Markets Update - 7/10/25

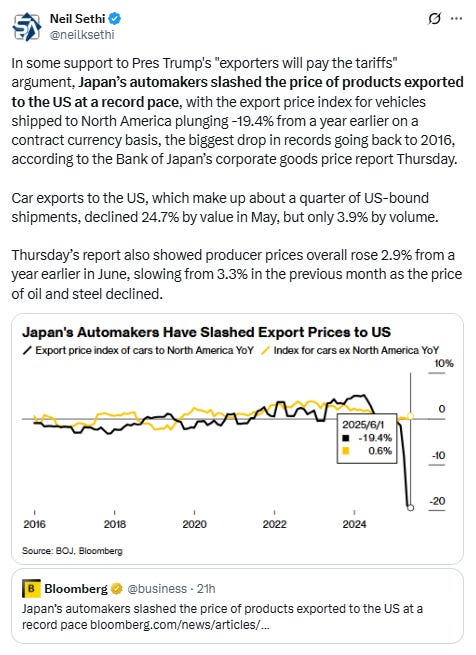

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

Major US equity indices started the day little changed as they digested the latest broadside from President Trump in a 50% threatened tariff rate on top 20 trading partner Brazil. For the most part they also ended that way, although the Russell 2000 was able to manage a +0.5% advance, the best of the bunch. All finished off the highs though with no large systematic buying today (if anything it was selling) as stocks fell in the last half hour. Still it was enough for a new all-time high for the S&P 500.

Elsewhere, Treasury yields were little changed as was the dollar and gold. Copper, bitcoin, and nat gas were up, crude was down.

The market-cap weighted S&P 500 (SPX) was +0.3%, the equal weighted S&P 500 index (SPXEW) +0.6%, Nasdaq Composite +0.1% (and the top 100 Nasdaq stocks (NDX) -0.2%), the SOX semiconductor index +0.8%, and the Russell 2000 (RUT) +0.5%.

Morningstar style box showed the stronger relative performance in growth today.

Market commentary:

“The market’s sensitivity toward tariffs has diminished,” said Marija Veitmane, senior multi-asset strategist at State Street Global Markets. “The key driver of equity returns for us has been and remain corporate earnings, particularly in the IT sector, and here policy and trade uncertainty have not caused too much damage.”

“It is wild to think that valuations are above where we started the year considering all the uncertainties with tariffs, and we now have a new deadline. The market’s been extremely desensitized to all of this back and forth, and I think for good reason,” said Mike Dickson, head of research and quantitative strategies at Horizon Investment.

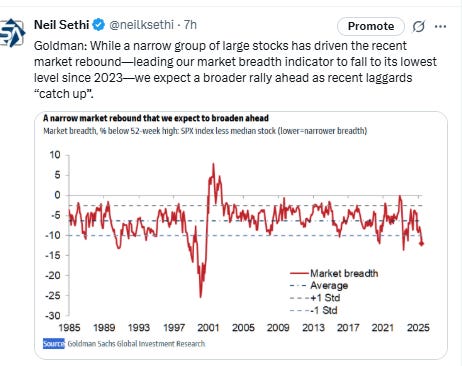

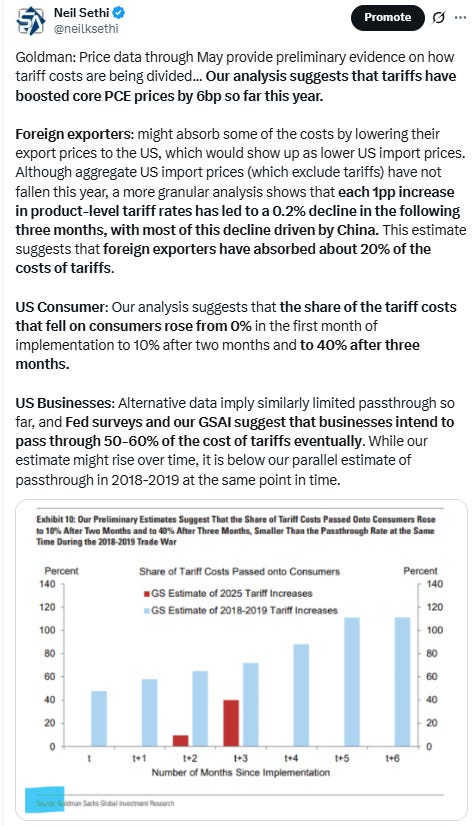

Although equity markets remain upbeat on the US economic outlook, Goldman Sachs Group Inc. strategists cautioned against leaning too heavily toward either defensive or cyclical stocks. “The equity market appears to be pricing an optimistic outlook for the US economy, but we believe there are risks in both directions and investors should not be clearly cyclical or defensive,” strategists including Ryan Hammond said.

Katharine Neiss, chief European economist at PGIM Fixed Income, warns that the average US tariff rate could ultimately exceed current expectations of “a shade above 10%.”

“There is still a huge amount of uncertainty and I don’t expect that it’s going to get resolved,” Neiss told Bloomberg TV. “These negotiations are going to drift, maybe by the time we get to the end of the year. That’s kind of bad news because the uncertainty itself is depressing decisions.”

“More tariff clarity should emerge as trade talks continue,” said Mark Haefele at UBS Global Wealth Management. “Declines in policy uncertainty have historically been positive for stocks, and we think US trade policy will move toward greater stability in the second half of the year.”

“While there will likely be no shortage of announcements coming out of the White House in the coming weeks, it’s unlikely the new August 1 deadline will be the end of the tariff story,” said Daniel Skelly, head of Morgan Stanley’s Wealth Management Market Research & Strategy Team.

“There’s zero chance we’ll have tariff clarity by Aug. 1, which makes a July rate cut impossible,” said Tom Essaye of The Sevens Report. “The practical impact of this consistently delayed tariff policy is to reduce the chances of a September rate cut, which could leave rates higher for longer and increase the chances of an economic slowdown.”

“AI might be exactly what is needed to counteract any price increases from the tariffs,” said Jeremy Siegel, Wharton School professor of finance and Wisdom Tree chief economist, on CNBC’s “Closing Bell” Wednesday. “If we don’t hear much bad effects, boy, this bull market certainly, I think, has further to run,” Siegel added. “If we begin to hear … there’s some hurdles that are harder to overcome, then we’re going to see choppiness, I think, this quarter.”

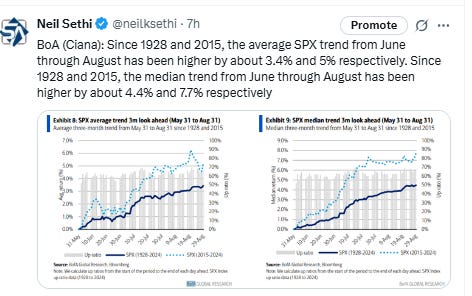

“While the overall technical trend remains positive for US equities, our proprietary cycle analysis currently implies a window of potential volatility to open beginning in late-July and lasting into October,” said Dan Wantrobski at Janney Montgomery Scott. Wantrobski also noted that bullish sentiment and positioning are elevated, charts are overbought, seasonality looms ahead in the coming weeks, and headline risk remains high in this environment.

"It is just putting aside the Trump threats for the moment and beginning to focus on upcoming earnings," said Peter Cardillo, chief market economist at Spartan Capital Securities, referring to the Trump administration's tariffs.

"Delta gave a good forecast," Cardillo said. "That's inspiring." The planned $3.1 billion takeover off WK Kellogg Co. also has been viewed positively. "Anytime you have M&A, that's a good indication that corporate America feels there are valuations out there which they can build upon."

“The remarkable resilience of the US consumer – and in turn US companies – was the hero of the first half,” said Kristy Akullian, head of iShares Investment Strategy, Americas. “Going into Q2 earnings season, stocks could get an added boost from low expectations.”

Risk assets are set to remain supported, with lower sensitivity to tariffs and the second-quarter reporting season as key catalysts, HSBC strategists led by Max Kettner said. They recommended increasing the overweight to equities further, now with a preference for the US. “Aside from still supportive investor positioning, we think the bearish narrative on the Q2 reporting season is misplaced,” they said. “The weaker USD, improved company guidance, and low expectations are more than sufficient for positive surprises. Following this week’s renewed tariff announcements, any cuts to these rates would likely be taken as positive too.”

After rising so far, so quickly, U.S. stocks will probably need a fresh catalyst to move higher, especially with so much uncertainty surrounding Trump's trade policies remaining, according to Fawad Razaqzada, a market analyst at City Index and FOREX.com. "But with uncertainty over the US trade policy lingering, the US markets are in need of a fresh catalyst for the next leg up, you’d feel. Consequently, don’t be surprised if we now see a bit of consolidation or a retracement after both the S&P 500 and Nasdaq 100 hit new highs recently," Razaqzada said.

There are a handful of key trends to look for when second-quarter earnings season starts next week, according to strategist Ed Clissold and Thanh Nguyen of Ned Davis Research. Those trends include how well companies have protected their gross margins, and whether a long-anticipated descent into earnings deceleration finally comes to fruition, Clissold and Nguyen wrote in a note on Thursday. At issue is whether there's been an impact on companies yet from the on-and-off-again maneuvers taken by President Donald Trump on reciprocal tariffs. "A dip in gross margins during Q2 would indicate that the initial reciprocal tariffs are impacting corporate profits, and that further deterioration should be expected as higher tariffs go into effect," Clissold and Nguyen said.

The key themes that have defined the market in the first half of the year will likely continue in the back half, and investors should look beyond traditional sector funds to play them, according to BlackRock’s iShares. “What the markets are sort of slow to fully appreciate right now is that the role that themes are playing in the market this year is almost akin to the role that sectors have previously played in the markets,” said Jay Jacobs, head of U.S. equity ETFs at BlackRock. The iShares team released an updated thematic outlook on Thursday. The ideas include the major themes of AI and geopolitical change, given ever-changing tariff picture and multiple conflicts. But Jacobs said the firm’s U.S. Thematic Rotation Active ETF (THRO)

is also finding success by focusing on consumer stocks with strong supply chains as a way to play defense, as opposed to toggling back and forth between consumer staples and consumer discretionary. “It’s a more nuanced take on the consumer space than what sectors are delivering,” Jacobs said. THRO is up nearly 7% year to date, slightly outperforming the S&P 500. The fund, which was launched in 2021, is now approaching $5 billion

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

In individual stock action:

Just a few days ahead of the unofficial start of the earnings season that will bring results from big banks, an upbeat forecast from Delta Air Lines Inc. lifted the industry. Tesla Inc. jumped on plans to expand its Robotaxi service to California and Arizona.

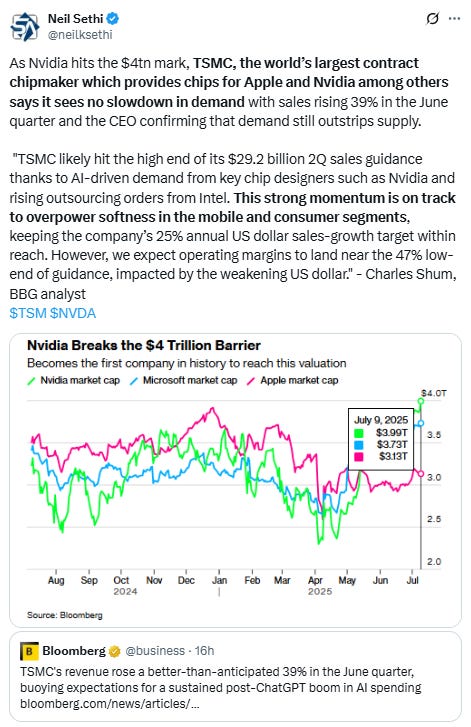

Spurred by optimism around the artificial intelligence trade, which sent Nvidia shares nearly 2% higher to become the first public company to be valued at $4 trillion. With shares up 0.8% on Thursday, the chip stock remained above that benchmark Thursday. The chipmaker’s chief Jensen Huang was said to meet with President Donald Trump before a planned trip to China.

Corporate Highlights from BBG:

Tesla Inc. will hold its annual shareholder meeting Nov. 6, the company said in a new filing with the Securities and Exchange Commission.

Elon Musk said his AI startup’s chatbot will be coming to Tesla vehicles.

Apple Inc. is planning an ambitious pipeline of new products for release during the first half of 2026, including a new low-end iPhone, multiple iPads and upgraded Macs.

Delta Air Lines Inc. reinstated a profit outlook for the year and said travelers are coming back, prompting its stock to surge amid a fresh sense of confidence in the beaten-down US consumer.

Conagra Brands Inc. pointed to rising costs from US tariffs as the packaged food company forecast profit for this fiscal year below Wall Street’s expectations.

Levi Strauss & Co. raised its revenue outlook, with the maker of 501 jeans expecting sales growth to outweigh the impact of President Donald Trump’s tariffs.

Ralph Lauren Corp. Chief Executive Officer Patrice Louvet said demand for its signature clothing such as cable-knit sweaters remains strong, even as the fashion industry is buffeted by tariffs and an economic slowdown.

Helen of Troy Ltd. tumbled after the consumer-products company reported net sales for the first quarter that missed the average analyst estimate, and issued a weaker-than-expected forecast for the second quarter.

Ferrero International SA agreed to acquire WK Kellogg Co. for an enterprise value of $3.1 billion, pushing the Italian family-owned candy business further into the lucrative US market.

US regulators approved Moderna Inc.’s Covid vaccine for children, but for a narrower group than before.

Autodesk Inc. is weighing an acquisition of rival engineering-software provider PTC Inc., according to people familiar with the matter.

Taiwan Semiconductor Manufacturing Co.’s revenue rose a better-than-anticipated 39% in the June quarter, buoying expectations for a sustained post-ChatGPT boom in AI spending.

Some tickers making moves at mid-day from CNBC:

In US economic data:

Initial jobless claims (SA) continue to remain tame in wk through July 5th edging back another -5k to 227k now down -23k from the highest level since October hit four weeks ago, overall remaining in the range over the past yr, just +40k above the 50-yr lows in Oct '23 (187k). Four-wk moving avg edges -6k to 236k (+3k y/y), down -11k from the highest since Aug ‘23 from three weeks ago. This is consistent with the note four weeks ago that there have been modest moves higher in initial claims in early summer the past two years which eventually subsided. Continuing claims (SA) in wk through June 28th (1-wk lagged) though remained the highest since Nov ‘21 at 1.965mn +10kw/w (after a -9k revision to the prior week), remaining over the 1.8-1.9mn range it had been in since June for a fifth week. The 4wk moving avg up +4k to 1.955mn, also the highest since Nov ‘21, +106k y/y, evidencing that while layoffs have remained very low, workers are having a little harder time finding a new job.

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

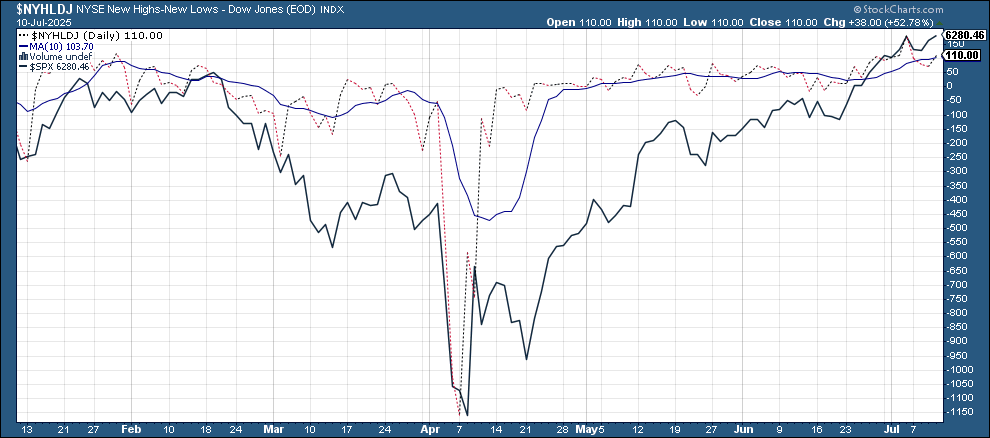

The SPX edged to a new ATH. Its daily MACD remains positive, and the RSI is starting to move back over 70.

The Nasdaq Composite a similar setup.

RUT (Russell 2000) continues on its “clear path to move at least to the 2300 level” per my note two weeks ago. MACD remains positive, although the RSI has the same over to under 70 phenomenon as the SPX (a little more so). As mentioned last week, CTAs are modeled to be big buyers which should support a test of the 2300 level absent a larger down move.

While index gains were marginal, sector breadth from CME Cash Indices improved for a fourth day back to 9 green sectors with again six up >0.5% but again no sector up over 1%. No sectors though down more than a half percent, from two Wed.

Interestingly the megacap growth sectors took the bottom two spots as well as the top spot.

SPX stock-by-stock flag from relatively consistent although a lot more stocks down 3% or more today. Some notables on the downside were NFLX, PANW, CRWD, NOW, WDAY, ACN, DASH.

Also more on the upside today as well though (TSLA, AMD, BX, VLO, MGM, MGM, CZR, FCX, EXPE, NCLH and the airlines some notable upside standouts).

NYSE positive volume (percent of total volume that was in advancing stocks), which had been relatively strong of late but weaker Wedback to strong Thurs at 67.2%, very good for the +0.34% gain in the index. That was the same gain as Wed when positive volume was 52.9%.

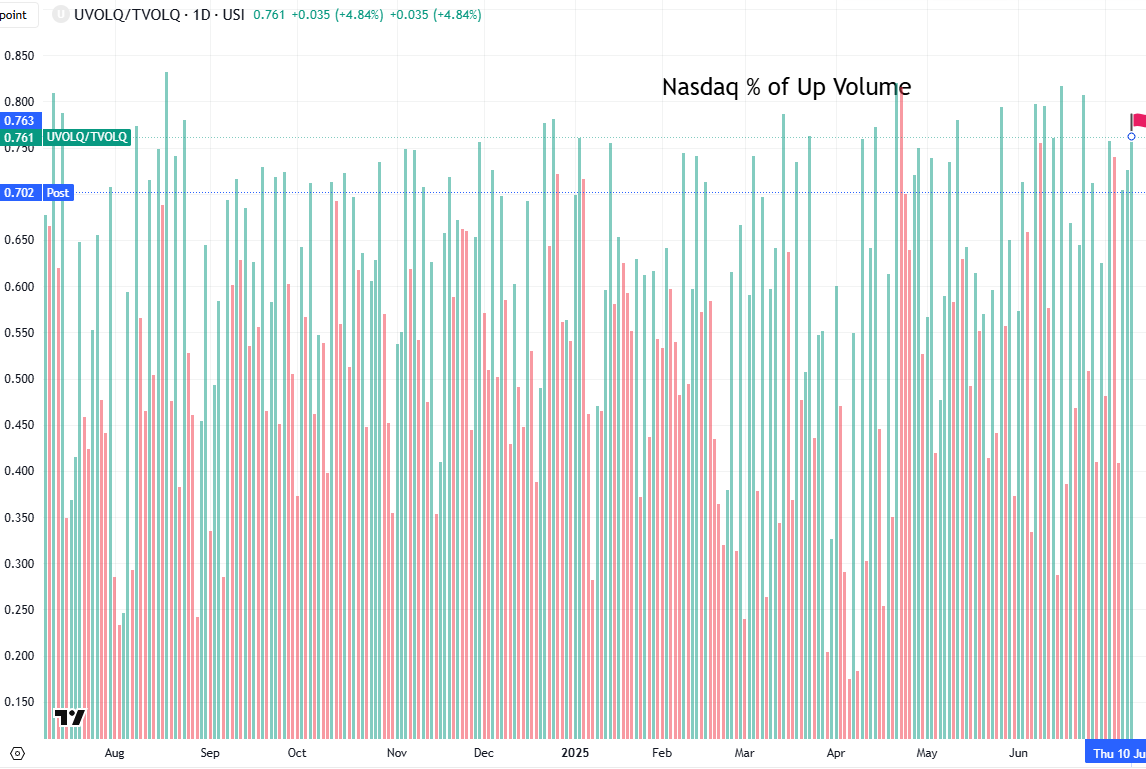

Nasdaq positive volume even better at 76.1%, although we are again seeing the issue of penny stocks pushing the numbers up (these are total volume not dollar volume statistics), so take it with a grain of salt. Does show that risk appetite is very much back.

Positive issues (percent of stocks trading higher for the day) were mixed at 66 & 56% respectively.

New 52-wk highs-new lows (red-black dotted lines) though also improved with the NYSE increasing for the first time this week to 110 from a two-week low, while the Nasdaq improved to 169 (still down from 265 Friday).

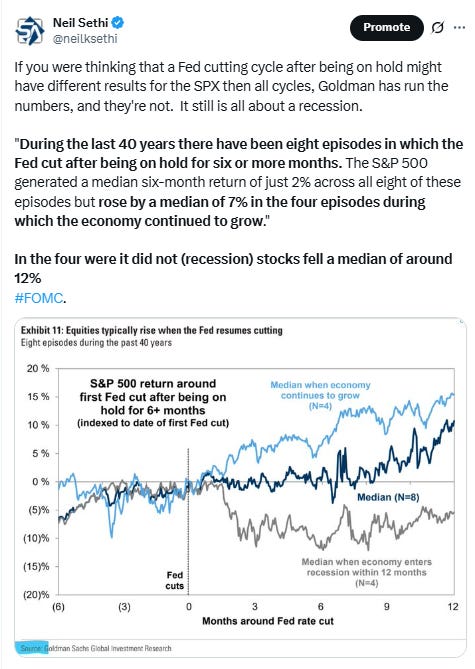

Fed rate cut bets were little changed with the mixed slate of Fed speakers with pricing for 2025 #FOMC rate cuts +1bps to 53bps according to CME’s #Fedwatch tool, (down from 64bps last Wed & 92bps on May 1st (and the peak this year at 103bps on Apr 8th) (the low was 36bps Feb 11th)).

The probability of a cut at the July meeting at 7% down from 23% pre-NFP(and from 78% at the start of May) while a cut by the following meeting (Sept) is 68% from 94% pre-NFP.

Chances of 2 cuts this year is 76% (down from 90% pre-NFP although still up from 62% on FOMC Day), three is 33% (down from 55%), and four is 2% (from 10%). The chance of no cuts at 3% but still up from 0.6% pre-NFP (but down from 8% FOMC Day).

2026 cuts -4bps to 66bps, seeing total cuts through Dec '26 at 119bps, +9bps from FOMC Day but -30bps from the start of May.

I said after the big pricing out of cuts in January (and again in February) that the market had pivoted too aggressively away from cuts, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 80 “maybe actually going a little too far” which is back to where we probably were Apr 20th (a little too far) at 102bps). Seems like we’re getting back to “fairly priced,” and as of May 14th at 48bps perhaps starting to go a little too far in the other direction, but as I’ve said all year “It’s a long time until December.”

Also remember that these are the construct of probabilities. While some are bets on exactly two, three, or four cuts much of it is bets on a lot of cuts (5+) or just one or none.

10yr #UST yields also little changed at 4.35% sitting on the 200-DMA. As I said Wed “if they fall much below this we could be looking at a deeper decline.” As noted Monday next resistance to the upside is 4.5%.

The 2yr yield, more sensitive to #FOMC policy, +25bps to 3.87%. It is -46bps below the Fed Funds midpoint, so still calling for rate cuts but also up +15bps this month.

I had said when it was around 4.35% (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), but then the 2yr fell to 3.65% past where I thought we’d see it, so I took some exposure off there. We got back there but I never added back what I sold, so I stuck tight. Ian Lygan of BMO saw it going to 3.5% by year’s end before all this tariff business but now thinks it’s at fair value here. I will probably take some more off this week.

$DXY dollar index (which as a reminder is very euro heavy (over 50%) and not trade weighted) was little changed for a third day but the sideways action has it moving “around” the downtrend line from the Feb highs closing over for the first time since then but still needs to get over the 20-DMA.

The daily MACD as noted Monday crossed over to “cover shorts” while the RSI is improving after having moved from under to over 30, which can be a signal of a reversal of a downtrend. I asked Monday “Does it have enough to get/stay over this time?” Starting to feel like it might.

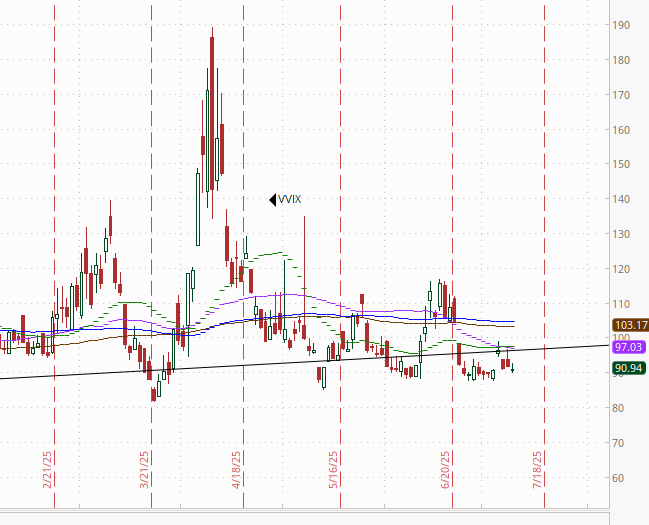

VIX edged to 15.8, after its first sub-16 close Wed since Feb 20th. The current level is consistent w/~0.98% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) unlike the VIX didn’t fall to new lows but remained in the area it’s traded in the past eleven sessions at 91, still under Nomura’s Charlie McElligott’s “stress level” of 100 (consistent with “moderate” daily moves in the VIX over the next 30 days (normal is 80-100)).

The 1-Day VIX fell for a sixth session (albeit very mildly) with a new lowest close since Feb 19th at 9.5, consistent with traders implying a ~0.58% move in the SPX next session.

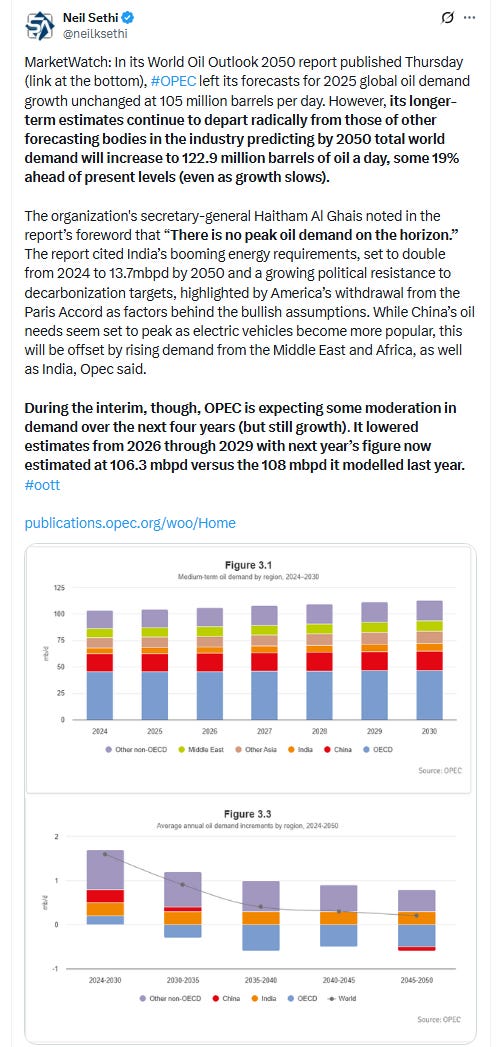

#WTI futures fell back after spending three sessions struggling with the 200-DMA resistance. The daily MACD remains in “sell longs” positioning but has improved while the RSI is just over 50.

#oott

Gold futures (/GC) also little changed as they remain around the bottom of the uptrend channel from January right on the 50-DMA. Daily MACD remains negative as noted two weeks ago, while the RSI fluctuates around 50.

Copper (/HG) futures another record closing high.

Nat gas futures (/NG) rose to the top of the short-term falling wedge they’ve been trading in the past month moving back towards the 200-DMA, which as noted two weeks ago has for the most part held since last August. Overall they remain in their range this year. Daily MACD and RSI tilt negative.

Bitcoin futures up 2.5% to a new ATH and looking to push out of the congestion zone they’ve been in the past two months. The daily MACD and RSI tilt positive.

As a reminder the last time daily RSI went from well over to well under 70 there was a a six-month period of consolidation (November), so we’ll see if this time is different (it needs to make and sustain a new high). So far it’s been 4 weeks.

The Day Ahead

No major US economic data Friday.

Also no scheduled Fed speakers and no Treasury auctions.

Also no SPX earnings.

Ex-US DM we’ll get UK GDP and Canada employment among other reports.

In EM, we’ll get Mexico industrial production among other reports, as well as a policy decision from Kazakhstan. On Saturday China will release trade statistics.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,