Markets Update - 7/1/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

Major US equity indices started the day with modest losses following the close of the best quarter for the SPX since 2023. That index and the Nasdaq traded mostly sideways to close down for they day while the Russell 2000 and DJIA advanced to finish up around 1%, as investors fled recent winners with the Dow Jones U.S. Thematic Market Neutral Momentum Index dropping the most (-3.8%) since Jan '23. The BBG Mag-7 index was -1.5%. It was the largest outperformance of the RUT over the Nasdaq since April.

Elsewhere, Treasury yields edged higher but the dollar still fell to new 3+ yr lows. Also falling were nat gas and bitcoin while crude and gold advanced. Copper was little changed for a third day.

The market-cap weighted S&P 500 (SPX) was -0.1%, the equal weighted S&P 500 index (SPXEW) +1.1%, Nasdaq Composite -0.8% (and the top 100 Nasdaq stocks (NDX) -0.9%), the SOX semiconductor index -0.7%, and the Russell 2000 (RUT) +1.0%.

Morningstar style box was fairly strong outside of growth stocks, particularly for value and smaller caps.

Market commentary:

“If you’re long recent winners and are feeling the pain today, we would not be making any dramatic portfolio shifts just yet,” said Bespoke Investment Group strategists. “It could be the start of a longer-term shift that develops, but a one-day move is simply too soon to tell.”

“On balance, we see the environment as constructive for risky assets,” noted Mohit Kumar, chief European strategist at Jefferies International. “But with positioning moving to the long side, we do not see a sharp rally but a slow grind higher in risky assets.”

“For the last two months of the quarter, it was really risk on. It was about buying stocks that had these really strong secular growth drivers like AI and technology,” said Anthony Saglimbene, Ameriprise chief market strategist. “I think we’ve exhausted that trade.”

“There’s still some focus on July 9, but so many other factors are being watched these days, too,” said Michael Kantrowitz, chief investment strategist at Piper Sandler & Co. “Once again, investors are less worried. In the absence of a spike in rates, inflation or the unemployment rate, stocks will continue to grind higher.”

“We think this is going to be a broader recovery,” Mike Wilson, chief U.S. equity strategist and chief investment officer at Morgan Stanley, said Monday on CNBC’s “Closing Bell.” “I think with the Fed cutting in the second half of this year or next year, we can see a rolling recovery – because now there’s quite a bit of pent-up demand, particularly in those interest rate sensitive parts of the market,” he added. Those corners of the market include manufacturing and housing, the strategist said.

“While the hit to manufacturing activity from tariffs so far appears to have been limited, the further small rise in the prices paid index last month adds to evidence that firms are facing higher costs as a result,” said Thomas Ryan at Capital Economics.

“Trade deals of some kind are likely to come, and underneath, earnings estimates have stabilized after falling in the immediate aftermath of April,” Steven Chiavarone, senior portfolio manager and equity strategist at Federated Hermes, said in a Bloomberg Television interview on Monday. “What started out as just a relief rally is starting to become something real, and that what sucks those investors in — slowly and reluctantly.”

“We were pretty bullish for June on things that have nothing to do with Trump — this just has to do with the fact there’s other stuff going on that’s quite positive,” said Alexander Altmann, global head of equities tactical strategies at Barclays Plc. The strategist cited bank deregulation, big tech firms’ continued spending on artificial intelligence, and Trump’s $3.3 trillion tax and spending bill as factors bolstering the economy. “We’re still going to end up with high tariff rates and absorb that cost at some point in the future,” Altmann said. “This is a market where it’s very hard to look and trade more than four weeks ahead right now. And it’s very hard to have a strong opinion on events that could or could not happen six months from now.”

“We don’t have any significant trade deals — we have some memorandums of understanding, we have some agreement to move forward, but we don’t have anything concrete,” said Kate Moore, chief investment officer of Citigroup Inc.’s wealth unit. “I’ve been surprised, to be very honest with you, that the market seems to not care about it. It’s one of the reasons why this doesn’t feel like a fundamentally-driven market, despite the fact that we see a lot of strength in technology and artificial intelligence.”

“We’ve had a strong quarter, but there’s still too much on the table,” said Haris Khurshid, chief investment officer at Karobaar Capital. “If the trade talks drag or the tax bill stalls, we’ll see how much conviction these bulls really have.”

“The bulk of the market sees July as a live meeting, that’s limiting the dollar,” Geoffrey Yu, a strategist at Bank of New York Mellon Corp., told Bloomberg TV. “Going back to the other asset classes, the fact that July is live and we may get two cuts at least this year, that is underpinning risk sentiment as well.”

“Federal Reserve interest rate policy is likely on hold for now,” said Josh Hirt at Vanguard. “If the labor market remains on the trajectory we expect, the Fed can afford to be patient. We anticipate the Fed will be able to make two more rate cuts later this year in this environment.”

“As long as the labor market remains solid, the US economy can continue to chug ahead, while helping reduce the risk of stagflation” said Bret Kenwell at eToro. “It would also buy the Fed more breathing room when it comes to interest rates.”

"As for Thursday’s nonfarm payrolls report, investors should be attentive to structural factors influencing the data. For instance, stepped-up deportations and stricter immigration enforcement are impacting both the size of the labor force and the number of employed persons. These dynamics could distort conventional readings of the unemployment rate — making it essential to examine both sides of the equation: the numerator (unemployed) and the denominator (participation)." Lauren Goodwin, chief market strategist at New York Life Investments, said in a note.

Traders are hoping for deals between the U.S. and its trading partners, as Trump’s 90-day reprieve on his steepest tariffs is set to expire next week. While Zachary Hill, head of portfolio management at Horizon Investments, doesn’t believe the market expects “very much,” volatility could still be on the horizon.

“If you did see some reimposition of the reciprocal tariff rates that were announced on ‘liberation day,’ I don’t think that would be well received by investors in the near term. Is it a catastrophe or something that’s going to cause a reaction of similar magnitude of what we saw in early April? No, I don’t think so, but we are pretty fully valued here,” he said. “Investors have definitely increased positioning over the last couple of weeks, so I do think that’s a potential vulnerability.”

Despite today's stock moves, UBS wrote that artificial-intelligence adoption could still push the tech sector higher in the long run.

“While near-term risks remain, we believe the robust secular trend of AI will continue to drive the longer-term gains in the tech sector. We favor a balanced and diversified positioning across the AI value chain, and recommend investors consider structured strategies to navigate volatility ahead,” Ulrike Hoffmann-Burchardi, global head of equities at UBS Global Wealth Management, wrote in a note.

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

In individual stock action:

Traders dropped tech giants, such as Nvidia and Microsoft, and opted to snap up shares of health-care companies instead. Amgen and UnitedHealth jumped more than 4%, while Merck and Johnson & Johnson rose more than 3% and about 2%, respectively, lifting the 30-stock Dow. It’s a turnaround from the market’s tech-driven recovery in the second quarter: The Technology Select Sector SPDR Fund (XLK) jumped nearly 23% in that period but was off 0.9% to start the third quarter.

Elsewhere, electric vehicle maker Tesla fell 5% after Trump suggested in a post on Truth Social that the Department of Government Efficiency (DOGE) should look into the government subsidies that CEO Elon Musk’s companies have received.

Corporate Highlights from BBG:

Sweeping tax legislation passed by the Senate would make it cheaper for semiconductor manufacturers to build plants in the US, delivering a win to chipmakers and boosting US efforts to expand the industry domestically.

Tesla Inc. sank as Trump threatened to withdraw subsidies from Elon Musk’s companies and examine the billionaire’s immigration status.

Boeing Co. said Stephen Parker will oversee the defense, space and security unit on a permanent basis, as Chief Executive Officer Kelly Ortberg molds his top leadership team, including the appointment of a new chief financial officer.

Ford Motor Co.’s electric vehicle sales plunged 31.4% in the second quarter after the automaker ordered dealers not to sell its battery-powered Mustang Mach-e model due to a safety flaw that could lock occupants in the car.

UnitedHealth Group Inc. and Memorial Sloan Kettering Cancer Center resolved a contract dispute that threatened to interrupt treatment for thousands of cancer patients in the New York City area.

AMC Entertainment Holdings Inc. said it reached an agreement with a majority of bondholders to end litigation that resulted from the movie theater chain’s debt restructuring last year.

Wolfspeed Inc., a chipmaker caught in President Donald Trump’s push to reshape Biden-era tech subsidies, filed bankruptcy to enact a creditor-backed plan to slash $4.6 billion in debt.

Macau’s monthly gaming revenue rose 19% in June, exceeding analyst expectations as visitors poured in to the world’s biggest gambling hub for Cantonese pop concerts and other entertainment offerings.

Some tickers making moves at mid-day from CNBC:

In US economic data:

S&P final June manufacturing PMI up +0.9pts from May (and the flash read) to 52.9, a three-year high and pushing further into expansion which it entered at the start of the year, and “indicative of a solid rate of expansion.”

ISM’s June manufacturing PMI, unlike its S&P counterpart (generally smaller companies more domestic focus) which accelerated further into expansion (52.9) to a 3-yr high, remained in contraction following its brief 2-mth period of expansion in Jan & Feb (the first since Sep ‘22), although did improve +0.5pts to 49.0 from a 6-mth low in May, slightly above exp’s for 48.8. The PMI reading is still indicative of expanding economic growth according to the report: “A Manufacturing PMI above 42.5, over a period of time, generally indicates an expansion of the overall economy.”

May JOLTS job openings (SA) unexpectedly jump +374k, the most since Nov (after +194k in April), to 7.769mn, the highest since Nov and well above exp’s for a decline to 7.300mn. Still these as a reminder are down from a peak in Mar ‘22 at 12.2mb. The level Jan 2020 was 7.124mn (so we remain around +650k above). The increase in openings though was concentrated in the accommodation/food services category which were +314k (three quarters of the increase) and perhaps might be related to seasonal adjustment issues related to summer hiring.

JOLTS hires though fell the most since October -112k (after +211k in Apr (rev’d from +169k) the largest increase since Sep ‘24 in Apr) to 5.503mn (now -500k below Feb ‘20 levels (6.0mn)) on a broad based decline

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

The SPX fell just under the 6200 level. Its daily MACD remains positive, and the RSI is just in overbought territory which is actually not a bad place to be (it’s when it falls out that you have to be more cautious).

The Nasdaq Composite tested its breakout level which just held. Also its RSI has fallen back under 70, which could evidence a loss of momentum.

RUT (Russell 2000) finally able to get going. I have been noting since Friday “it has a clear path to move at least to the 2300 level”. MACD is positive, RSI not yet overbought. CTAs are modeled to be big buyers if it can continue to move higher.

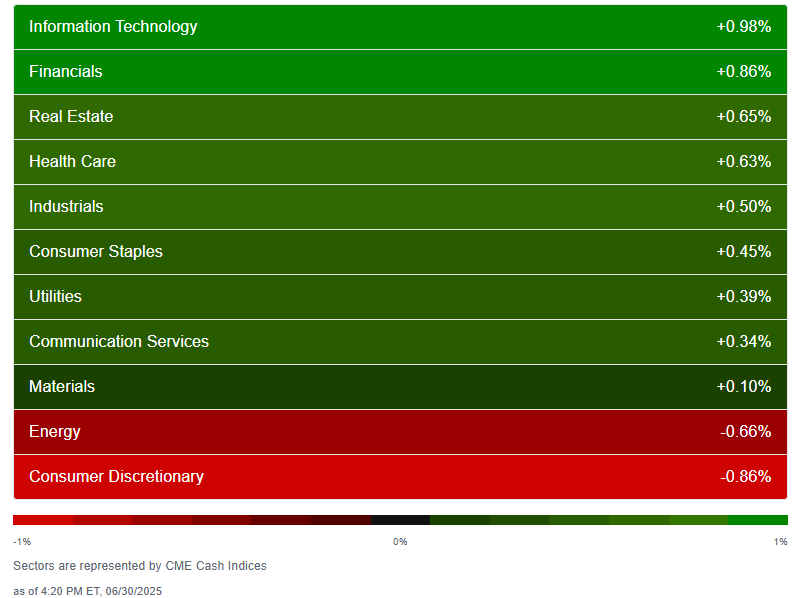

Sector breadth from CME Cash Indices remained very good with the fifth day in six of at least 9 green sectors (we had 9 again) but today it was megacap growth’s turn to underperform with those three sectors taking the bottom three spots. Every other sector up at least +0.3% with two up over 1% (Materials and Health Care).

SPX stock-by-stock flag from @FINVIZ_com relatively consistent. As with the past three days, plenty of stocks up over 2%, and today more up over 3%, particularly in health care and many consumer names (SBUX, NKE, LOW, CMG, LEN, DHI, TGT, etc.).

Also though more down that much including heavyweights NVDA, META, TSLA, AVGO, PLTR, NFLX, AMD, PANW, CRWD, GE, GEV, PM, CEG, all down at least -2.5%.

NYSE positive volume (percent of total volume that was in advancing stocks) which has been mixed the last couple of weeks but a little better this week remained so Tuesday improving to 69.1%, a very solid result.

In comparison it was 70% on June 24th but that was on a 1.05% increase in the NYSE Composite Index vs 0.55% today.

Nasdaq positive volume was understandably weaker given the -0.82% loss in the index but given that loss the 49.2% result was very respectable.

In comparison it was just 43.1% on June 20th despite a lower -0.51% loss in the index.

Positive issues (percent of stocks trading higher for the day) were stronger today at 73 & 55% respectively, a rare occurrence this year.

New 52-wk highs-new lows (red-black dotted lines) saw similar action improving 104 on the NYSE just off from the best since January, but on the Nasdaq they fell back to 109 from the best since December.

[charts not updated yet]

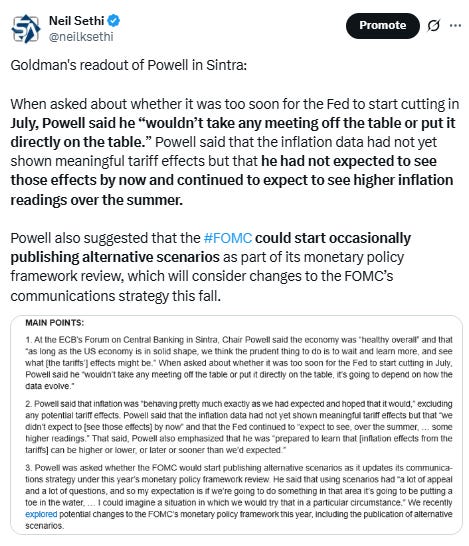

Fed rate cut bets were little changed following Powell basically reiterating his Congressional testimony from last week at an ECB panel discussion, edging just off the highest since the start of May with pricing for 2025 #FOMC rate cuts -2bps to 64bps according to CME’s #Fedwatch tool, (down from 92bps on May 1st; and the peak this year at 103bps on Apr 8th (the low was 36bps Feb 11th)).

The probability of a cut at the July meeting remains low at 21% (although up from 10% on FOMC Day (but it was 78% at the start of May)) while a cut by the following meeting (Sept) is at 93% (up from 68% on FOMC Day, and now almost to the 95% May 1st).

Chances of 2 cuts this year is 91% (up from 62% on FOMC Day which was around the least we’d seen since Feb also closing in on the 99% at the start of May), three is 56% (so well over 50-50), and four is 10%. The chance of no cuts has fallen to 0.4% (down from 8% FOMC Day and almost the least since May 1st).

2026 cuts also edged down -1bps to 68bps (still seeing almost 3 cuts next year), with total cuts through Dec '26 at 132bps (over 5 cuts), +22bps from FOMC Day but -17bps from the start of May.

I said after the big pricing out of cuts in January (and again in February) that the market had pivoted too aggressively away from cuts, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 80 “maybe actually going a little too far” which is back to where we probably were Apr 20th (a little too far) at 102bps). Seems like we’re getting back to “fairly priced,” and as of May 14th at 48bps perhaps starting to go a little too far in the other direction, but as I’ve said all year “It’s a long time until December.”

Also remember that these are the construct of probabilities. While some are bets on exactly two, three, or four cuts much of it is bets on a lot of cuts (5+) or just one or none.

10yr #UST yields rebounded from early losses after the tax and spending bill passed the Senate but just +2bps for the day to 4.25%, from the lowest close since April, remaining toward the bottom of the range this year.

The 2yr yield, more sensitive to #FOMC policy, saw a bigger move +5bps to 3.78% from just above the least since May 1st. It is still -54bps below the Fed Funds midpoint, so calling loudly for rate cuts.

I had said when it was around 4.35% (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), but then the 2yr fell to 3.65% past where I thought we’d see it, so I took some exposure off there. We got back there but I never added back what I sold, so I stuck tight. Ian Lygan of BMO saw it going to 3.5% by year’s end before all this tariff business but now thinks it’s at fair value here. I will probably take some more off this week.

$DXY dollar index (which as a reminder is very euro heavy (over 50%) and not trade weighted) fell to a new 3+ yr low and tested that long term trendline noted Monday that runs back to 2010. The daily MACD and RSI are starting to tilt more negative with the RSI now oversold.

VIX little changed at 16.8. That level is consistent w/~1.05% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) also little changed at 89.5 remaining under Nomura’s Charlie McElligott’s “stress level” of 100 (consistent now with “moderate” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX edged to the lowest close since Feb 19th at 9.7. It’s consistent with traders implying just a ~0.60% move in the SPX next session.

After seeing its most volatile two weeks since the Russian invasion of Ukraine, #WTI futures have been remarkably quiescent the past five sessions, trading mostly sideways just above the uptrend line from the May lows and in the $65 area which I said I thought would hold last Monday. So far it has. Today was the best day in the stretch up nearly 1%.

As noted Tuesday though the daily MACD has crossed to “sell longs” positioning and the RSI has plunged from over 70 to under 50 (but hasn’t fallen further).

#oott

Gold futures (/GC) continued their recovery after breaking under the bottom of the uptrend channel from January on Monday. Daily MACD remains negative as noted Wed, but the RSI rebounded off the lowest this year to 50.

Copper (/HG) futures tested again but couldn’t get over the $5.15 resistance level it has closed over only twice ever (in March). It has traded sideways now for three sessions just hanging there under that resistance. The daily MACD and RSI are positive as noted Thursday.

Nat gas futures (/NG) fell under the 200-DMA, which as noted last week has for the most part held since last August, before recovering overall remaining in the middle of its range this year. Daily MACD and RSI tilt negative.

Bitcoin futures another that has traded sideways the past few sessions, in its case at the top of what sort of looks like a larger flag formation forming than we’ve seen previously. We’ll see which way they break out, currently right at the top, but overall remaining in their range since late May. The daily MACD remains in “sell longs” positioning (but close to flipping), while the RSI is around 50.

As a reminder the last time daily RSI went from well over to well under 70 there was a a six-month period of consolidation (November), so we’ll see if this time is different (it needs to make and sustain a new high). So far it’s been 4 weeks.

The Day Ahead

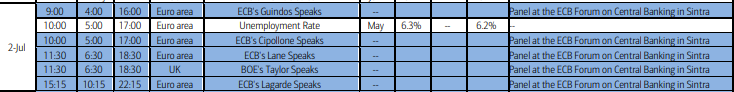

A little pause in US economic data before we get the main course Thursday, but not a tiny intermezzo with ADP, Challenger job cuts plus weekly EIA petroleum inventories and mortgage applications.

Fed calendar also lightens with no speakers on the schedule.

Earnings calendar almost empty (and it is empty Thursday).

Ex-US DM also a lighter day with just EU unemployment plus another round of ex-US central bank speakers.

In EM we’ll get a policy decision from Poland and Brazil industrial production among other reports.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,