Markets Update - 7/16/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

Major US equity indices started the day modestly higher for a third session after a cooler than expected PPI report, which like yesterday’s CPI, saw cool services prices which offset strength in core goods. The market was also buoyed by another dose of positive bank earnings. They traded sideways until a little after noon when they dropped sharply on a bombshell headline that said Donald Trump was considering “firing” Chair Powell “soon” (from a WH official confirmed by those at a gathering with Trump the night before). Equities, bonds, and the dollar fell sharply, and Trump quickly walked back the comment saying it was “highly unlikely” he would fire Powell in the near future and he was only discussing it in “concept.” “No, we’re not planning on doing it,” Trump said, adding that he does not “rule out anything.” That was good enough for stocks and they climbed from there to finish around the highs of the day with mild gains led by the Russell 2000 (+1%).

Elsewhere, Treasury yields fell back as did the dollar and crude while bitcoin, gold, nat gas, and copper were higher.

The market-cap weighted S&P 500 (SPX) was +0.3%, the equal weighted S&P 500 index (SPXEW) +0.4%, Nasdaq Composite +0.3% (and the top 100 Nasdaq stocks (NDX) +0.1%), the SOX semiconductor index -0.4%, and the Russell 2000 (RUT) +1.0%.

Morningstar style box showed modest gains across all styles led by small caps.

Market commentary:

“The markets would not like it if Powell was fired,” said Larry Tentarelli, founder of the Blue Chip Daily Trend Report. “It’s obviously a political hotbed … but overall, most of the big market participants that I know of think Powell has done a very good job.”

“After the president’s subsequent backing off on remarks to remove Powell, the immediate crisis may have passed, though we doubt we are entirely done with this saga,” said Michael Feroli at JPMorgan Chase & Co.

Bank of America Corp.’s Chief Executive Officer Brian Moynihan and Goldman Sachs Group Inc.’s David Solomon joined JPMorgan’s CEO Jamie Dimon in stressing how critical the Fed’s autonomy is. Moynihan said in an interview with Bloomberg TV on Wednesday that the Fed was “set up to be independent.” The Fed’s continued independence is “absolutely critical,” Dimon at JPMorgan said on a conference call Tuesday. That just doesn’t mean under Powell, whom Dimon said he respects, but also for whomever eventually succeeds him. Meddling with the Fed “can often have adverse consequences,” Dimon noted.

To Chris Zaccarelli at Northlight Asset Management, a decision to fire the Fed chief would negatively impact markets as concerns around central bank independence would be at “the forefront of investors’ minds.”

“Markets are unlikely to look kindly on attempts to forcibly remove Chair Powell from office and threaten Fed independence,” said TD Securities strategists including Oscar Munoz and Gennadiy Goldberg. They view such an action as a low-probability, but high-impact event. “We would expect markets to price in higher long-run inflation, higher term premium, more near-term Fed rate cuts (and hence lower front-end rates), increased market volatility, and a steeper yield curve,” they added.

A Trump’s dismissal of Powell would be an underpriced risk that could trigger a selloff in the dollar and Treasuries, Deutsche Bank AG’s George Saravelos recently said. If Trump were to force Powell out, the subsequent 24 hours would probably see a drop of at least 3% to 4% in the trade-weighted dollar, as well as a 30 to 40 basis point fixed-income selloff, he said. “Investors would likely interpret such an event as a direct affront to Fed independence, putting the central bank under extreme institutional duress,” Saravelos said.

“Inflation has started a slow climb as signs of tariff-induced inflation are now evident within durable and nondurable imports,” said Joe Brusuelas, chief economist at RSM U.S. “That prompts an important question: Will service and housing inflation, which is easing but still elevated, cool further to offset what will be a more pronounced increase in durable and nondurable goods?”

“Our sense is that the Federal Reserve will continue to display patience as the direction of inflation evolves,” he added.

“There was no producer inflation in June, and the 0.3% May increase was offset by April’s 0.3% drop, not to mention a drop in March,” said Chris Low at FHN Financial. “Four months without producer price inflation would be unusual under any circumstances, but during the implementation of tariffs, it is remarkable.”

“Disinflation remains, but the Fed will be undeterred in keeping rates steady until September,” said Jamie Cox at Harris Financial Group. “As long as the labor market remains strong and resilient, rates aren’t likely to move meaningfully lower.”

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

In individual stock action:

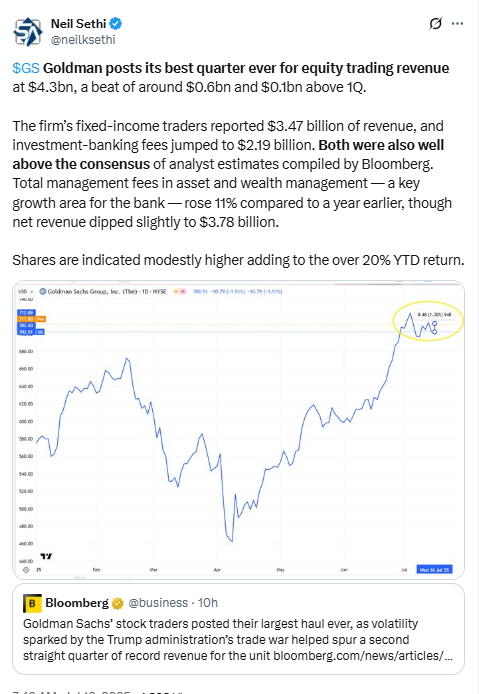

Bank earnings continued for a second day. Despite posting better-than-expected earnings results, Bank of America and Morgan Stanley each ended the session modestly lower. Goldman Sachs also topped estimates, and shares rose nearly 1%.

ASML — The stock dropped about 10% after the semiconductor company warned it may see no growth in 2026, citing macroeconomics and geopolitics. The news sent chip stocks such as Broadcom and AMD lower.

Companies making the biggest moves after-hours from CNBC.

Corporate Highlights from BBG:

United Airlines Holdings Inc. refined its profit outlook for this year after travel rebounded from flight disruptions, trade tensions and fighting in the Middle East conflict.

Goldman Sachs Group Inc.’s stock traders posted the largest revenue haul in Wall Street history, as volatility sparked by the Trump administration’s trade war spurred a second straight record quarter for the unit.

Morgan Stanley’s stock traders scored their best second quarter on record as the biggest US banks continue to reap the benefits of market volatility tied to President Trump’s policy moves.

Bank of America Corp.’s traders posted a record second quarter as the company reaped the benefits of volatile markets and net interest income topped analysts’ estimates.

PNC Financial Services Group beat expectations for second-quarter net interest income, helped by an increase in loan growth.

ASML Holding NV Chief Executive Officer Christophe Fouquet walked back his forecast that sales will grow next year, blaming trade disputes and global tensions.

Tesla Inc. is preparing to launch a longer, six-seat version of its Model Y sport utility vehicle in China, where the carmaker has been losing ground to domestic manufacturers with fresher lineups.

Elon Musk’s artificial intelligence startup, xAI, is in discussions to lease data center capacity in Saudi Arabia, according to people familiar with the matter, part of an effort to expand its infrastructure in regions offering cheap energy and political goodwill.

Nvidia Corp. boss Jensen Huang anticipates getting the first batch of US licenses to export H20 AI chips to China soon, formally allowing the company to resume sales of a much sought-after component to the world’s top semiconductor arena.

Alphabet Inc.’s Google will debut new Pixel-branded hardware at an event on Aug. 20 in New York, with the lineup expected to include several smartphones and a smartwatch, all powered by the company’s artificial intelligence technology.

Hewlett Packard Enterprise Co. is creating a new strategy committee and agreed to work with Elliott Investment Management on ways to help the software company boost value.

Johnson & Johnson beat Wall Street’s quarterly sales expectations and raised its full-year outlook, a show of confidence as the pharmaceutical industry faces the dual threats of tariffs and a crackdown on drug pricing.

Some tickers making moves at mid-day from CNBC:

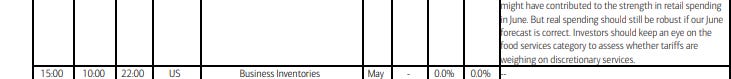

In US economic data:

Very quick look at June final demand PPI (wholesale prices) show them coming in two tenths below expectations at unchanged after a +0.3% m/m increase in May (revised from +0.1%), the deceleration all due though to services which fell -0.1% on a -4.1% drop in lodging (hotels, etc.). In contrast goods prices were +0.3%, the most since Feb, with core goods (ex-food & energy) +0.3% as well for the 4th month in 5 after not seeing that level of above the last half of 2024. Prices for communications equipment led the gains. Food was +0.2% m/m and energy +0.6%. While goods prices are just up y/y just 1.7%, core goods are now +2.5%, the highest since May '23.

June industrial production, our most holistic look at the manufacturing sector, comes in better than expected at +0.3% m/m (+0.33% unrounded) after falling -0.03% in May (but revised up from -0.22%) above expectations for +0.1% on the back of a +2.8% increase in utilities. Manufacturing (~75% of industrial production) though was also better than exp’d at +0.12% vs an exp’d flat read and after +0.31% in May (also revised higher from +0.12%), the third increase in four months despite a continued drag from autos (ex-autos manufacturing was +0.3%, the most in three months) as gains in other areas were broad based led by commercial aircraft, machinery, furniture and primary metals.

to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

The SPX fell to again test the 6200 level before bouncing back to finish up slightly as it continues to trade mostly sideways over the past nine sessions. Its daily MACD has turned negative, and the RSI is starting to deteriorate.

The Nasdaq Composite a little more favorable picture.

RUT’s (Russell 2000) “clear path to move at least to the 2300 level” per my note three weeks ago has gone from “gotten choppy,” as I noted Friday, to “in jeopardy” as I noted Tuesday as it fell under its trendline but bounced at the 20-DMA to recover it. Daily MACD has crossed to “sell longs” and the RSI is also deteriorating.

Sector breadth from CME Cash Indices big improvement back to 8 of 11 sectors in the green (from just one Tuesday, the worst in weeks), with two up over 1% (Health Care and RE). No sector down that much and just Energy (-0.8%) was down more than -0.2%. Megacap growth sectors relatively laggards today taking two of the bottom three spots with Energy.

SPX stock-by-stock flag from @FINVIZ_com relatively consistent with a lot more green today. Still only 12 stocks up over 3%. Some notables were JNJ, TSLA, and asset managers APO, KKR, BX, & BLK.

Fewer stocks down that much but there were nine in the SPX, the largest being Micron (MU).

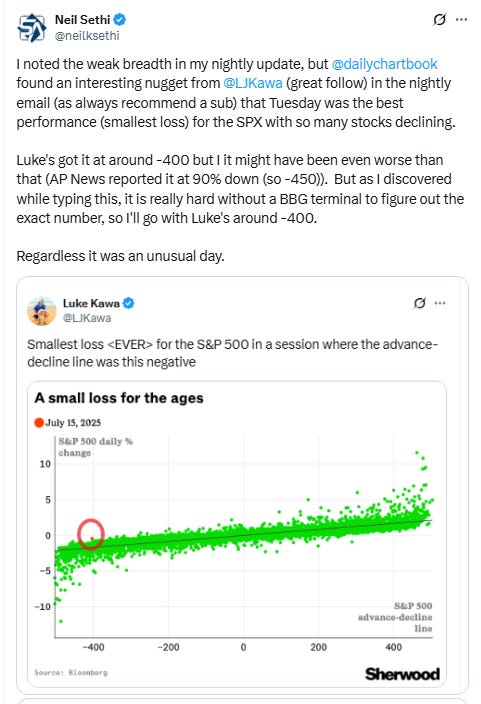

NYSE positive volume (percent of total volume that was in advancing stocks), which had been relatively strong the last couple of weeks but weaker since Friday, remained so Wed at 61.2%. Not a terrible result for the +0.55% gain in the index, but compare that to July 1st when it was 69.1% on the same gain (circle).

Nasdaq positive volume also improved but more so and remaining more elevated than the NYSE at 75.5%, excellent considering the +0.25% gain in the Nasdaq index. Compare that to Monday when it was just 61.7% on a +0.27% gain in the index (circled).

And interestingly the difference isn’t due to penny stock volumes (which I treat as sub $2) which accounted for 7 of the top 13 stocks by volume (the same as Tuesday and down from 9 Monday and 12 Friday) while the total volume in those stocks came in at 1.4bn or 17.6% of total Nasdaq volume up just slightly from 16% Monday (and 14% Tuesday).

Positive issues (percent of stocks trading higher for the day) were similar at 58 & 66% respectively.

New 52-wk highs-new lows (red-black dotted lines) though deteriorated to 1-mth lows with the NYSE falling down to 8 while the Nasdaq fell to 49.

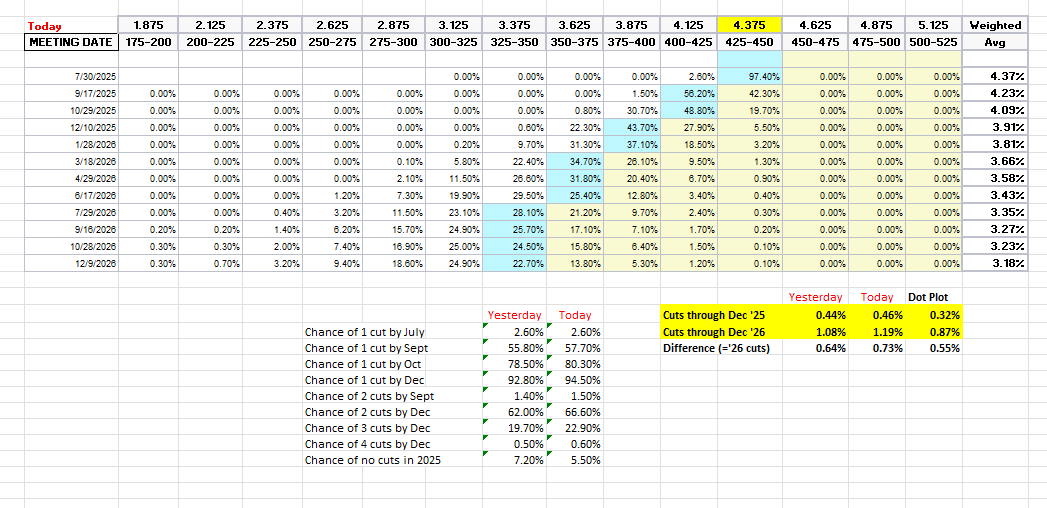

Fed rate cut bets edged higher, particularly for 2026, with pricing for 2025 #FOMC +2bps to 46bps according to CME’s #Fedwatch tool, up from the least since Feb (but still down from 64bps July 2nd before the June NFP & from 92bps on May 1st (the peak this year was at 103bps on Apr 8th, the low was 36bps Feb 11th)).

The probability of a cut at the July meeting is 3% down from 23% pre-NFP (and from 78% at the start of May) while a cut by the following meeting (Sept) remains just 58% from 94% pre-NFP and just off the lowest since February hit Tuesday (56%).

Chances of 2 cuts this year is 67% (down from 90% pre-NFP and also just off the lowest since February (62%)), three is 23% (down from 55%), and four is 0.6% (from 10%). The chance of no cuts low at 5.5% but still up from 0.6% pre-NFP (almost to the highest since February).

2026 cuts though +9bps to 73bps, seeing total cuts through Dec '26 at 119bps, up from the least since February (108) still -27bps from the start of May.

I said after the big pricing out of cuts in January (and again in February) that the market had pivoted too aggressively away from cuts, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 80 “maybe actually going a little too far” which is back to where we probably were Apr 20th (a little too far) at 102bps). Seems like we’re getting back to “fairly priced,” and as of May 14th at 48bps perhaps starting to go a little too far in the other direction, but as I’ve said all year “It’s a long time until December.”

Also remember that these are the construct of probabilities. While some are bets on exactly two, three, or four cuts much of it is bets on a lot of cuts (5+) or just one or none.

10yr #UST yields fell back from the 4.5% target/resistance -3bps Friday to 4.46% from the highest close since June 6th.

The 2yr yield, more sensitive to #FOMC policy, -6bps to 3.89% from near a 1-mth high. It is -44bps below the Fed Funds midpoint, so still calling for rate cuts but also up +17bps this month.

I had said when it was around 4.35% (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), but then the 2yr fell to 3.65% past where I thought we’d see it, so I took some exposure off there. We got back there but I never added back what I sold, so I stuck tight. Ian Lygan of BMO saw it going to 3.5% by year’s end before all this tariff business but now thinks it’s at fair value at around 3.75% so I took some more off at the end of June.

$DXY dollar index (which as a reminder is very euro heavy (over 50%) and not trade weighted) at one point was up for a 5th day (and 9th in 11) and pushing over the 50-DMA before the Trump/Powell news sent it plummeting over -1%. While it rebounded it still finished lower for the session.

The daily MACD as noted last Monday crossed over to “cover shorts” while the RSI is just off the highest in nearly two months and over 50 after having moved from under to over 30, which can be a signal of a reversal of a downtrend, “so it’s got a lot of boxes checked for a move higher,” as I noted Monday. We’ll see if it can get back on track or if Trump quashed the rally.

VIX jumped to 20 before falling back to settle slightly lower on the day at 17.2, overall remaining in the same narrow range it’s been in for three weeks. The current level is consistent w/~1.06% average daily moves in the SPX over the next 30 days.

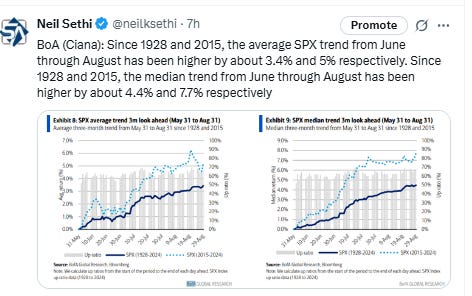

Remember, though, we’re in a seasonally strong period for the VIX. Chart from July 9th.

The VVIX (VIX of the VIX) also jumped before falling back and like the VIX remained in the area it’s traded in the past 15 sessions at 95.6, still under Nomura’s Charlie McElligott’s “stress level” of 100 (consistent with “moderate” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX also jumped to near the highs of the month before settling back to 10.9 actually down on the day, and consistent with traders implying a ~0.68% move in the SPX next session.

#WTI futures fell through the uptrend line from the May lows all the way to test the $65 level before bouncing. Now they have that to contend with before they can try again at the 200-DMA resistance they spent a week trying to clear. The daily MACD remains in “sell longs” positioning while the RSI fluctuates around 50.

#oott

Gold futures (/GC) edged up ~half percent Wednesday as they drift in the same range over the past two weeks. They remain around the bottom of the uptrend channel from January right on the 50-DMA. Daily MACD remains negative as noted two weeks ago but is very close to flipping positive, while the RSI fluctuates around 50.

Copper (/HG) futures little changed after three down sessions since spiking higher last week on the Trump tariff threat, but remaining well into record territory pre-last week.

Nat gas futures (/NG) continued to move higher after breaking out of the short-term falling wedge they’ve been trading in the past month, which as I noted “would commonly be associated with more good things to come for the bulls,” now back over the 200-DMA, which as noted three weeks ago has for the most part held since last August.

Overall they remain in their range this year. Daily MACD and RSI have also turned more positive.

Bitcoin futures got back Tues’s decline as the crypto legislation which failed to advance in Congress moved forward today. The daily MACD and RSI remain positive, and the latter though going from over to under 70.

The Day Ahead

US economic data Thurs gives us another piece to our economic puzzle with the June retail sales report. We’ll also get import prices, weekly jobless claims, biz inventories, and homebuilder sentiment.

And of course more Fed speakers ahead of the blackout. In terms of Fed Governors (generally considered more influential with 14-yr terms who vote every year) we’ll get Kugler, Cook and Waller. In terms of regional Fed Presidents (who serve 5-yr terms (up to 10 yrs) and vote on a rotating schedule (except the NY Fed Pres (Williams) who votes every year) we’ll get Daly (not a voter this year).

And 2Q earnings season will roll on with another 12 SPX reports (five >$100bn in market cap (NFLX, GE, ABT, PEP, MMC (in order of market cap)).

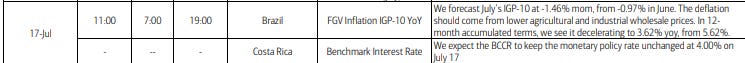

Ex-US DM we’ll get Japan exports, Australia and UK unemployment and wages, and EU final June CPI, among other reports.

In EM, we’ll get Brazil inflation among other reports.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,