Markets Update - 7/2/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

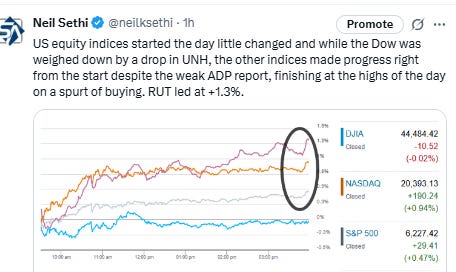

Major US equity indices started the day little changed despite the first negative read on the ADP employment report since March 2023 (and only second since July 2020), which comes ahead of Thursday’s NFP report, and with a key procedural vote on the OBBBA expected for today (which still hasn’t happened yet as Pres Trump and Speaker Johnson look to corral recalcatent Republicans). While the Dow was weighed down today by a drop in UNH, the other indices made progress right from the start, boosted by Pres Trump announcing a trade deal with Vietnam, with markets finishing at the highs of the day on a spurt of buying. RUT led at +1.3%.

Elsewhere, Treasury yields edged higher as did the dollar from 3+ yr lows. Also rising were crude, gold, bitcoin, nat gas, and copper.

The market-cap weighted S&P 500 (SPX) was +0.5%, the equal weighted S&P 500 index (SPXEW) +0.3%, Nasdaq Composite +0.9% (and the top 100 Nasdaq stocks (NDX) +0.7%), the SOX semiconductor index +1.9%, and the Russell 2000 (RUT) +1.3%.

Morningstar style box was all green outside of large value, but small caps the clear outperformer.

Market commentary:

“We, frankly, have been seeing a weakening of the labor market for months and months now, and I always wondered if it would take a negative payrolls print to get the Fed to pay a little bit more attention to the labor market as opposed to the inflation picture,” Ross Mayfield, investment strategist at Baird, told CNBC. “This is, on that front, what will hopefully catch some attention.”

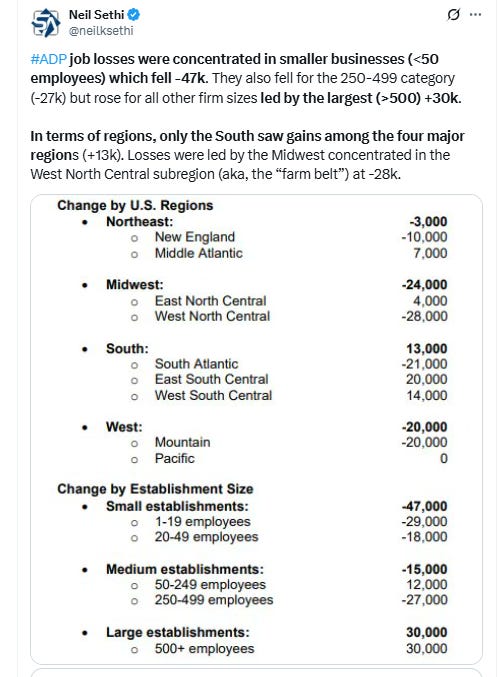

“A lot of the job loss was concentrated in small business, which is maybe not surprising given the given the economic backdrop, but I think it’s meaningful given just how many people are employed by small and private businesses,” the investment strategist said. “We focus so much on the stock market, but that’s the primary driver of employment in this country, so not ideal to see small businesses shutting jobs like that.”

“The ADP report increased the odds of a downside surprise in Thursday’s nonfarm payroll release,” said Jeff Roach at LPL Financial. “Investor jitters could be a catalyst for a drop in yields tomorrow if the jobs report is weaker than expected. I expect a weaker-than-consensus report, increasing the odds the Fed cuts three times this year.”

Any big surprise in Thursday's nonfarm-payrolls data for June that signals lower-than-expected job gains has the potential to recalibrate the way market participants think about the endpoint of the Fed's interest-rate policy.

This is according to strategists at TD Securities, who said in a note that a large downside surprise could push expectations for the Fed's terminal interest-rate level to below 3%. That's another way of saying that expectations may turn out to be that the central bank ends up cutting rates over the long run by more than officials indicated in June.

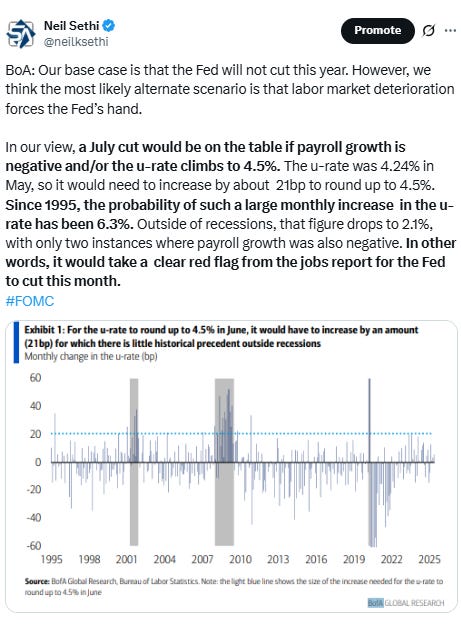

“The release of June’s nonfarm payrolls report stands to be a pivotal moment for near-term monetary policy expectations and the tone in the Treasury market for the next several weeks,” said Vail Hartman at BMO Capital Markets. “The path to a July cut would require not only disappointment on the employment front, but also another benign inflation print for June as well as an increase in growth/consumption worries.”

“One of the reasons the Fed has been able to be patient before cutting rates was because the job market was holding up so well, so if that were to change then the Fed may be forced to move earlier than they would like,” said Chris Zaccarelli at Northlight Asset Management.

“If we end up having a fairly weak employment report, then that could allow the Fed to be cutting rates,” said Sam Stovall, chief investment strategist at CFRA Research. He also pointed out that Fed Chair Jerome Powell recently confirmed that the central bank would have cut rates by now if it weren’t for Trump’s tariff plans announced earlier this year. “If that were the case then, it could be the case now, especially if we have weaker-than-expected employment data,” Stovall added.

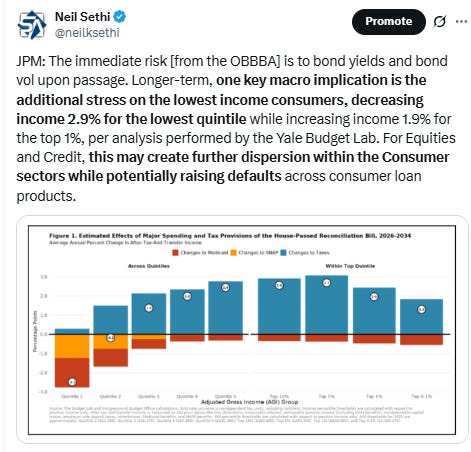

“We expect to see more volatility in fixed income, even once they get the bill passed, whatever that looks like,” said Jose Rasco, HSBC Global Private Banking and Wealth Management Americas CIO on “Closing Bell: Overtime.” “That’s going to bleed over into the equity markets.” Still, this turbulence is likely to be short-lived, he said. “Once these things get resolved and once the [Federal Reserve] gets back in gear, there’s a lot of upside here,” Rasco said.

The momentum that drove the S&P 500 and Nasdaq Composite to record closing highs on Monday remains in tact, according to Mark Hackett, chief market strategist at Nationwide. Investors "are holding a ‘glass half full’ view, continuing to favor equities despite near-term uncertainties," Hackett said in an email. "At 22x earnings, the market is clearly pricing in a strong dose of optimism." That confidence "can be a sign of resilience, but it also leaves little room for disappointment," he added. "Investors should remain constructive, but disciplined, as markets navigate a tightrope between high expectations and potential volatility."

Sentiment has been supportive of the rebound in US stocks, but the outlook for valuations and earnings suggests the rally is getting overbought from a fundamental perspective, according to RBC Capital Markets strategists led by Lori Calvasina. “Overall conditions in US equities didn’t seem frothy quite yet but were headed down that path,” they wrote. “If we do end up getting some inflation pressure or broader economic potholes from tariffs or the Fed doesn’t cut after all, we think it will come as a negative surprise to many investors.”

“Just when a bit of panic set into the minds of some investors, stocks turned seemingly on a dime and gained back all that was lost and then some,” said Scott Wren at Wells Fargo Investment Institute. “Our feel is that stocks are ahead of themselves, and we are looking to trim positions in overvalued markets and sectors.”

Trump’s warning to Japan “is a non-event,” said Karen Georges, equity fund manager at Ecofi in Paris. “The next two possible catalysts for the markets will be the jobless claims and the deadline for tariff negotiations.”

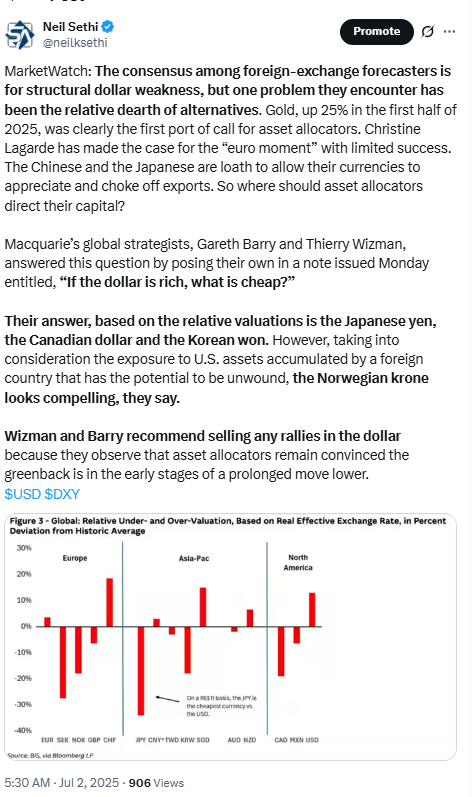

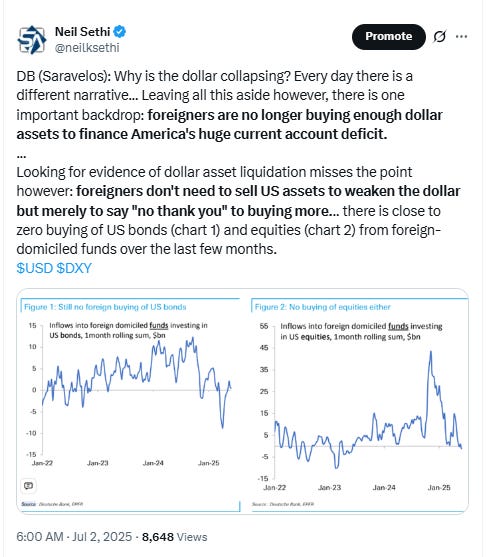

“The dollar usually loses value when the global economy is in decent shape and the Fed is cutting rates,” noted Nicholas Colas, co-founder of DataTrek Research. “Both factors are relevant now.”

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

In individual stock action:

Stocks with exposure to Vietnam including Nike initially popped after President Donald Trump announced a trade deal with the country. Most later gave back most those gains following more details that Vietnam will pay a 20% levy on goods to the U.S., and 40% on goods that originated from another country, but Nike shares held theirs finishing up over 4%.

Shares of Robinhood jumped more than 7% on Wednesday as investors bet that the brokerage stock could soon join the S&P 500.

Centene shares headed for their worst day on record after the health care company pulled its full-year guidance.

The company announced Tuesday afternoon that it was withdrawing its previously announced outlook for GAAP and adjusted diluted earnings per share in 2025. Shares tumbled more than 39% in midday trading Wednesday, making it the worst performer in the S&P 500.

Corporate Highlights from BBG:

Apple Inc. climbed after Jefferies raised its recommendation on the tech giant to hold from underperform.

Intel Corp. slid after Reuters reported CEO Lip-Bu Tan is exploring a potential strategy shift in its foundry business that would entail no longer marketing certain chipmaking technology to external customers, citing people familiar.

OpenAI has agreed to rent a massive amount of computing power from Oracle Corp. data centers as part of its Stargate initiative, underscoring the intense requirements for cutting-edge artificial intelligence products.

Microsoft Corp. began job cuts that will impact about 9,000 workers, its second major wave of layoffs this year as it seeks to control costs while ramping up on artificial intelligence spending.

Wall Street’s largest lenders boosted their dividends after passing this year’s Federal Reserve stress tests, a hurdle that regulators made easier to clear by softening some of the requirements laid out in previous years.

Health insurer Centene Corp. shocked investors when it withdrew its profit outlook on precipitously rising risks from Affordable Care Act plans, sending shares plummeting.

The US Justice Department urged a judge in Texas to accept a proposed settlement agreement reached with Boeing Co. that would allow the planemaker to avoid a criminal charge in a longstanding case over two fatal crashes of its 737 Max jets.

Bombardier Inc. jumped after the Quebec-based private jet-maker announced a $1.7 billion aircraft order with an anonymous client.

Rivian Automotive Inc. produced about half as many electric vehicles as Wall Street expected in the second quarter prior to the launch of 2026 model year vehicles later this month.

Some tickers making moves at mid-day from CNBC:

In US economic data:

June US light vehicle sales increased +3.8% YoY (selling day adjusted) for a SAAR of 15.3mm, a decline from 15.6mm in May. This was slightly above our mid-month estimate of 15.2mm and just below the Bloomberg consensus of 15.4mm.

Challenger June job cuts fall back -49% from May and -2% y/y to 48.0k (after rising +47% in May to 93.8k), but the second quarter as a whole saw 247k the most since 2020 (although well under the 1.2mn announced then). That is up 39% from the 177k a year ago.

June #ADP gives us our first negative read since Mar ‘23 (and second since July 2020) at -33k well under every BBG estimate for a third month (98k was the estimate) led by declines in major service sectors education and health, professional and business services (both 2024 leaders but both lower for a third month). Financial activities also saw a decline while goods sectors reaccelerated. May was also revised down -8k to 29k. While the ADP report saw weak hiring, “the slowdown in hiring has yet to disrupt pay growth,” they said, although the median salary change y/y for job stayers fell to 4.4%, the least since June ‘21. Pay growth for job changers eased to 6.8%, but still up from 6.6% last September.

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

The SPX pushed back over the 6200 level to a new ATH. Its daily MACD remains positive, and the RSI is just in overbought territory which as noted Tuesday is actually not a bad place to be (it’s when it falls out that you have to be more cautious).

The Nasdaq Composite bounced from its breakout level to just shy of an ATH. Otherwise a similar setup.

RUT (Russell 2000) Tuesday was “finally able to get going,” and that continued Wed. As I have been noting since Friday “it has a clear path to move at least to the 2300 level”. MACD is positive, RSI not yet overbought. As mentioned, CTAs are modeled to be big buyers if it can continue to move higher.

Sector breadth from CME Cash Indices a little weaker today with 7 green sectors after 5/6 days of at least 9, but still had three sectors >1% (just two Tuesday). No sector down that much. Today it was defensive’s turn at the bottom taking three of the bottom four spots.

SPX stock-by-stock flag from FINVIZ_com relatively consistent with more red than we’ve seen the past few sessions. Insurance (including health insurers) hit particularly hard and software, utilities, and telecom/media were weak, while semiconductors, banks, and energy were very strong.

NYSE positive volume (percent of total volume that was in advancing stocks) which has been better this week remained so Wednesday pushing up to 70.9%, an excellent result considering the index was up just +0.27% (which is oddly low given the SPX, Nasdaq, and RUT all finished up more than that).

In comparison, it was 69% Tuesday on double the index gain.

Nasdaq positive volume was solid at 74.1% but that was on a much bigger gain of +0.94% in the index.

In comparison it was 63.7% on June 23rd on the same gain in the index.

Positive issues (percent of stocks trading higher for the day) were mixed today at 72 & 65% respectively.

New 52-wk highs-new lows (red-black dotted lines) also improved with the NYSE up to 110, the best since January, while the Nasdaq got back to 124, still down from the 172 on Monday which was the best since December.

Fed rate cut bets were little changed despite the weak ADP report with pricing for 2025 #FOMC rate cuts unchanged at 64bps according to CME’s #Fedwatch tool, (down from 92bps on May 1st; and the peak this year at 103bps on Apr 8th (the low was 36bps Feb 11th)).

The probability of a cut at the July meeting remains low at 23% (although up from 10% on FOMC Day (but it was 78% at the start of May)) while a cut by the following meeting (Sept) is at 94% (up from 68% on FOMC Day, and now almost to the 95% May 1st).

Chances of 2 cuts this year is 90% (up from 62% on FOMC Day which was around the least we’d seen since Feb also closing in on the 99% at the start of May), three is 55% (so over 50-50), and four is 10%. The chance of no cuts has fallen to 0.6% (down from 8% FOMC Day and almost the least since May 1st).

2026 cuts though edged down -2bps to 66bps (still seeing over 2 cuts next year), with total cuts through Dec '26 at 130bps (over 5 cuts), +20bps from FOMC Day but -19bps from the start of May.

I said after the big pricing out of cuts in January (and again in February) that the market had pivoted too aggressively away from cuts, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 80 “maybe actually going a little too far” which is back to where we probably were Apr 20th (a little too far) at 102bps). Seems like we’re getting back to “fairly priced,” and as of May 14th at 48bps perhaps starting to go a little too far in the other direction, but as I’ve said all year “It’s a long time until December.”

Also remember that these are the construct of probabilities. While some are bets on exactly two, three, or four cuts much of it is bets on a lot of cuts (5+) or just one or none.

10yr #UST yields up for a second day +4bps to 4.29% as they continue to rebound from the lowest close since April on Monday perhaps heading for a test of that downtrend line, remaining for now toward the bottom of the range this year.

The 2yr yield, more sensitive to #FOMC policy, also rose for a second day +1bps to 3.79%. It is still -54bps below the Fed Funds midpoint, so calling for rate cuts.

I had said when it was around 4.35% (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), but then the 2yr fell to 3.65% past where I thought we’d see it, so I took some exposure off there. We got back there but I never added back what I sold, so I stuck tight. Ian Lygan of BMO saw it going to 3.5% by year’s end before all this tariff business but now thinks it’s at fair value here. I will probably take some more off this week.

$DXY dollar index (which as a reminder is very euro heavy (over 50%) and not trade weighted) edged higher from a 3+ yr low as it continues to hold that long term trendline noted Monday that runs back to 2010. The daily MACD and RSI are starting to tilt more negative with the RSI now oversold.

VIX little changed at 16.6 remaining very calm the past week. That level is consistent w/~1.03% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) also little changed at 90 remaining under Nomura’s Charlie McElligott’s “stress level” of 100 (consistent now with “moderate” daily moves in the VIX over the next 30 days (normal is 80-100)).

1-Day VIX jumped up ahead of tomorrow’s NFP to 16.1, the highest close in over a week from the lowest close since Feb 19th. It’s consistent with traders implying a ~1% move in the SPX next session.

#WTI futures finally broke from their five-day slumber, jumping +3% despite a weak inventories report, appearing to get a lift from the announced US/Vietnam trade deal, and pushing away from the uptrend line from the May lows and $65 area which I said I thought would hold last Monday.

As noted Tuesday though the daily MACD has crossed to “sell longs” positioning but the RSI is back over 50.

#oott

Gold futures (/GC) continued their recovery after breaking under the bottom of the uptrend channel from January on Monday. Daily MACD remains negative as noted last Wed, but the RSI has rebounded off the lowest this year to 50.

Copper (/HG) futures pushed over the $5.15 resistance level for only the third close above ever after trading just under it for three sessions. The daily MACD and RSI are positive as noted last Thursday.

Nat gas futures (/NG) held the 200-DMA, which as noted last week has for the most part held since last August, overall remaining in the middle of its range this year. Daily MACD and RSI tilt negative.

Bitcoin futures another that moved out of its sideways pattern from the past few sessions, in its case over the top of what sort of looks like a larger flag formation forming than we’ve seen previously. We’ll see if it can continue the breakout tomorrow. The daily MACD remains in “sell longs” positioning (but close to flipping), but the RSI is over 50.

As a reminder the last time daily RSI went from well over to well under 70 there was a a six-month period of consolidation (November), so we’ll see if this time is different (it needs to make and sustain a new high). So far it’s been 4 weeks.

The Day Ahead

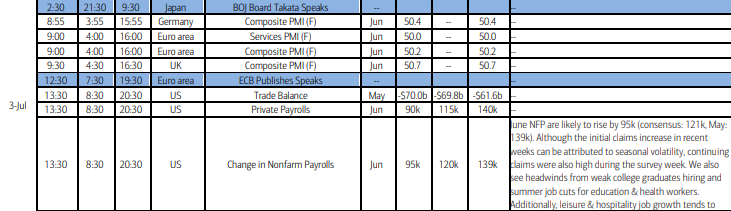

Now that the intermezzo is over, it’s on to the main course for US economic data with Nonfarm Payrolls. In a very unusual twist we’ll also get unemployment claims the same day as well as NFP, along with final June services PMIs and May trade balance and factory orders (so more than a full course, I won’t get through all of that tomorrow).

Fed calendar remains light with just Atlanta Fed Pres Bostic on the calendar (who we heard from earlier this week and isn’t an FOMC voter until 2027).

Earnings calendar is empty for US stocks.

Ex-US DM the highlights are services PMIs, Australia and Canada trade data among other reports, and more central bank speakers.

In EM we’ll get Mexico consumption and investment data and inflation from Turkey among other reports.

As a reminder, US markets close early Thursday (1 pm ET) and are closed Friday for Independence Day.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,