Markets Update - 7/7/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

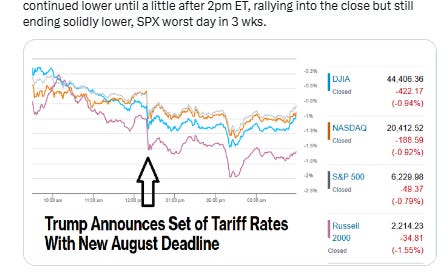

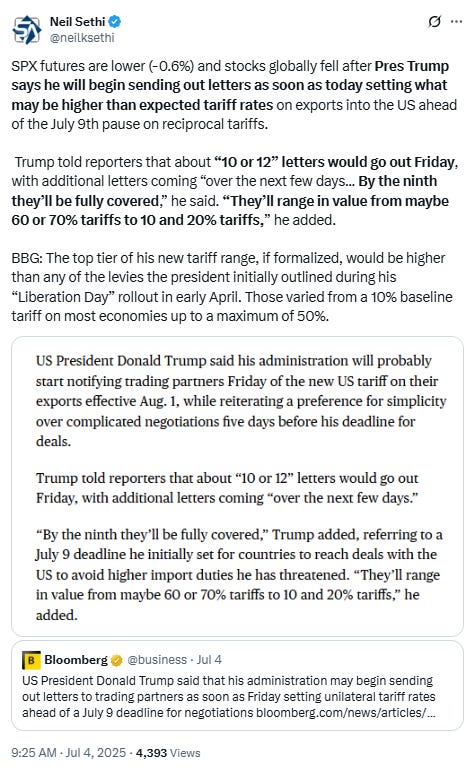

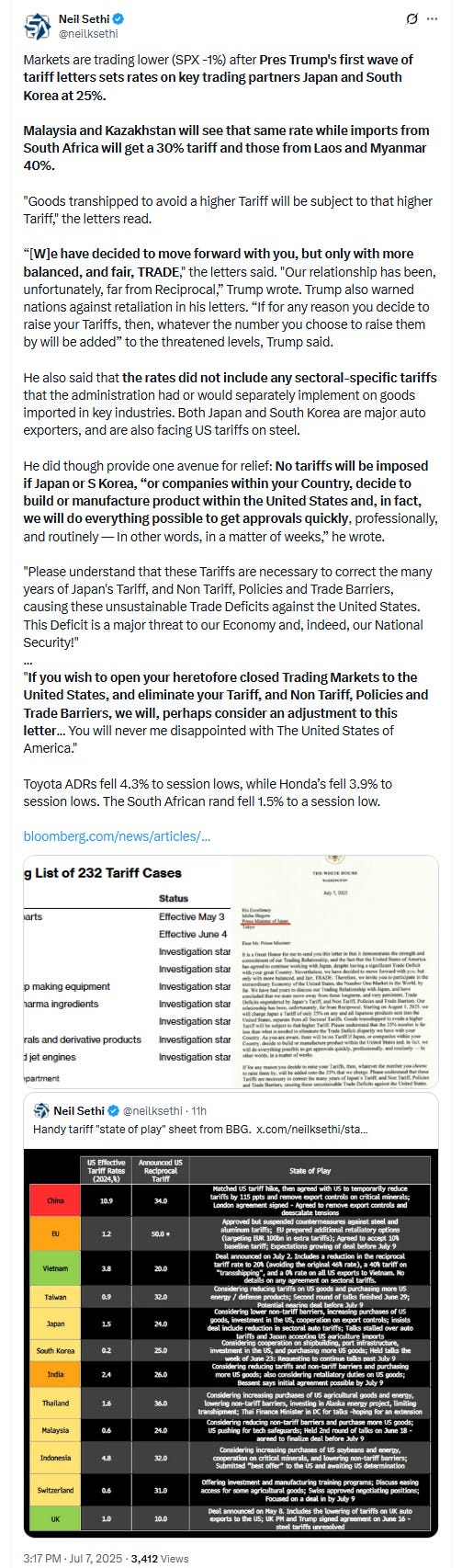

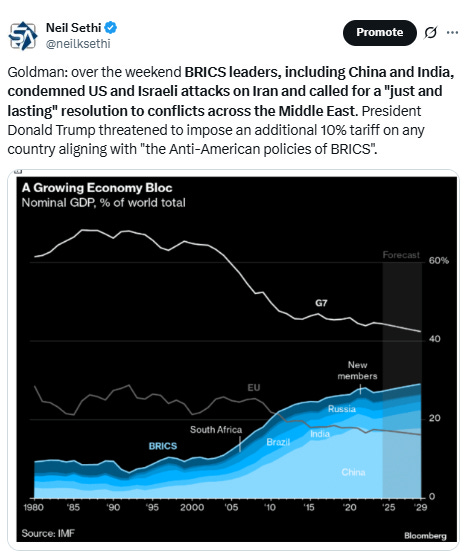

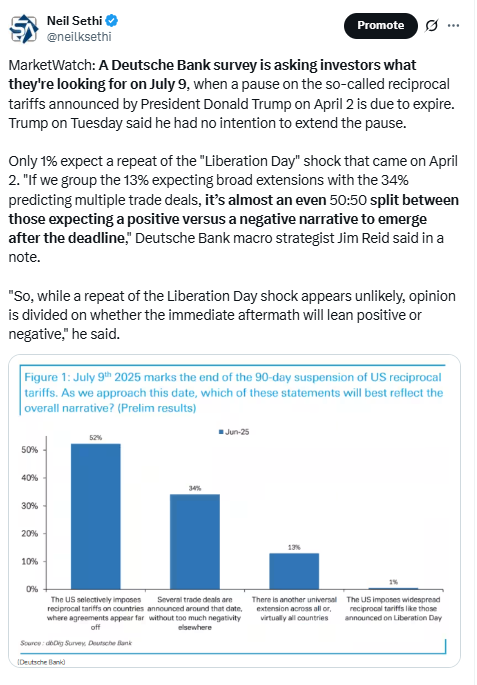

Major US equity indices started the day lower after Friday’s announcement (when the market was closed) by President Trump that he would unilaterally set rates this week on many countries to take effect Aug 1st (WH Press Sec Leavitt said 14 letters would go out today). Trump also threatened an additional 10% tariff on countries that align with the “Anti-American policies of BRICS,” which refers to emerging market countries including Brazil, Russia, India and China. Tesla also was pulling on markets, slumping -6%, after Elon Musk announced he will form a new political party.

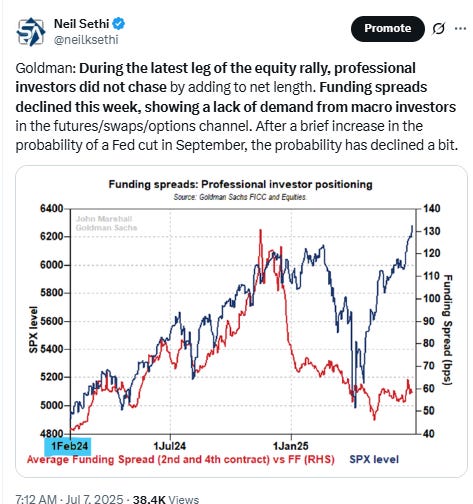

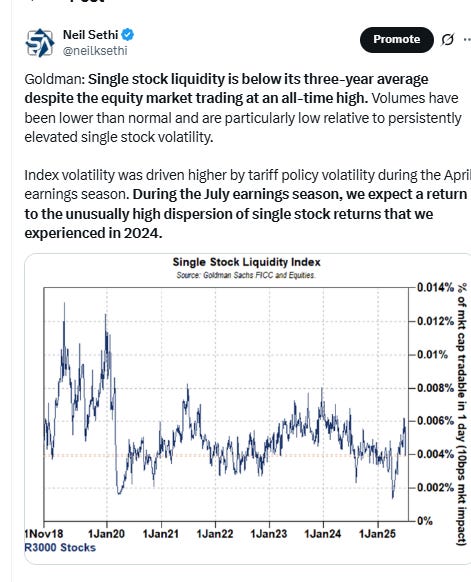

In terms of the tariffs, in classic Trump fashion the tentative rates on the seven countries whose letters were posted earlier today (including key trading partners Japan and South Korea) were worse than expected taking them back to around the levels set on Apr 2nd with sectoral tariffs layered on top of that. But with the knowledge that there are over 3 weeks until the Aug 1st effective date, and with the letters leaving open the possibility for adjustments based on actions by the tariffed countries, markets dropped just -0.5% initially (although they fell another half percent from those levels). Equity indices bottomed a little after 2pm ET and rallied into the close likely helped by the systematic buying that has been heavily flagged (see below and the Week Ahead blog post). The rally wasn’t enough to bring them close to initial levels though with the SPX finishing down -0.8%, its worst day since mid-June.

Elsewhere, Treasury yields were up for a fourth day and the dollar also gained. Crude was also higher but gold, bitcoin, copper, and nat gas all fell.

The market-cap weighted S&P 500 (SPX) was -0.8%, the equal weighted S&P 500 index (SPXEW) -0.9%, Nasdaq Composite -0.9% (and the top 100 Nasdaq stocks (NDX) -0.8%), the SOX semiconductor index -1.9%, and the Russell 2000 (RUT) -1.6%.

Morningstar style box was all green with growth back to outperforming.

Market commentary:

“Given that we’ve got this optimistic view — the markets are at record highs — tariff talk is not going to be helpful,” Jed Ellerbroek, portfolio manager at Argent Capital Management, told CNBC in an interview. “The more we’re talking about tariffs, the less happy the market is.”

“Ultimately, trade negotiations usually take a long time to negotiate; free trade arrangements the U.S. negotiated have taken an average of 3 years,” Rajeev Sibal, senior global economist at Morgan Stanley, wrote last week. “While the negotiations that are currently taking place are likely to be narrower than a full fledged free trade agreement, the historical precedent remains informative.”

The deadline “will create near-term uncertainty,” noted Mohit Kumar, chief European strategist at Jefferies International. “But the letters are meant as an incentive for other countries to agree to come to a deal quickly. Any dips in risky assets should be used as a buying opportunity.”

“It’s likely Trump will seek to escalate his threats against trade partners over the coming days to increase leverage in talks, as he did with Japan.”

—BBG’s Adam Farrar and Maeva Cousin.

“Investors should be alert to headline risk over the next 48 hours,” said Fawad Razaqzada at City Index and Forex.com. “The scope for last-minute deals is high, but so too is the possibility of renewed trade tensions.”

“Short-term ‘deals’ are limited in scope and leave several questions unanswered,” said Seth Carpenter at Morgan Stanley. “Comprehensive trade deals that reduce trade uncertainty will take much longer to finalize, and will require clarity on ongoing investigations and legal challenges.”

“With the trade war returning to the limelight, Treasuries bear-steepened on Monday – a move that was consistent with the forward reflationary implications associated with higher tariffs,” said Ian Lyngen and Vail Hartman at BMO Capital Markets. The strategists said that one positive to be taken away from the latest trade developments was that the higher tariffs won’t be in place during July. That means “an indirect extension” of the original 90-day pause that would expire on Wednesday. “The outcome could certainly have been more dire for the economic outlook had the additional window of relief not been included in the latest trade-war salvo,” they noted.

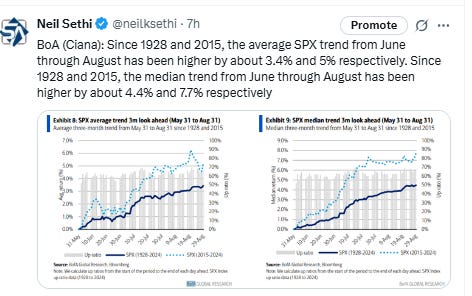

Chris Larkin, managing director of trading and investing at E-Trade by Morgan Stanley, warned that bullish catalysts might prove elusive in the days ahead — despite the tendency of the first half of July to be the strongest period of the month for stocks. "The market went into the holiday weekend on a roll, but with the jobs report surprise and the big, beautiful bill in the rearview mirror, bullish catalysts may be more elusive this week. Early July has, historically, tended to be the most bullish portion of the month, but as of Thursday, the [S&P 500] had already rallied more than 2% since it hit a new record high on June 26. Given this week’s light economic calendar, tariffs may once again become the front-and-center issue for the markets," Larkin said via email.

Charlie Ripley, senior investment strategist at Allianz Investment Management.

“If I'm on the equity market, I don't like two things. One, the uncertainty around inflation and the higher interest rates that come along with that. Two, uncertainty around what tariffs are going to look like,” Ripley said in a call. Investors are concerned that higher tariffs could lead to reheating inflation.

Still, stocks are unlikely to fall as sharply as in early April, when President Donald Trump announced his “liberation day” tariffs, Ripley noted.

“We've seen this used as a negotiation tactic from this administration, and I think we'll continue to see that as progress is made,” he said.

“I agree with anybody who says that, ‘Look, we’ve reshaped some of the economic flows around tariffs,’ but that’s an upside story because if it plays out better, that’s an earnings surprise,” Tom Lee, head of research at Fundstrat Global Advisors, told CNBC’s “Closing Bell” on Thursday. He added: “This is the most hated V-shaped rally.”

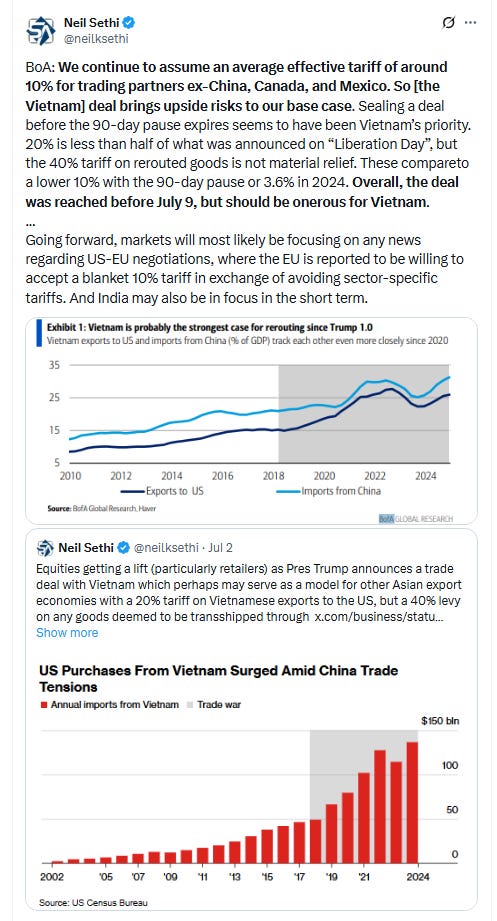

“The reality is that tariffs are already coming in higher than markets expected and much higher than anything in decades,” Tom Essaye, founder and president of Sevens Report Research, said in a note Monday. “Vietnam signed a trade deal with 20% baseline tariffs and 40% tariffs on goods shipped to Vietnam (mostly from China),” he wrote. “That joins 30% Chinese tariffs, 10% UK tariffs and a soon-to-be host of other countries with tariffs.”

“After being convinced of a tariff-induced slowdown earlier this year, investors are now dismissing that risk,” said Essaye. “But I want to stress that while the path of least resistance is higher (thanks to better-than-feared news and momentum), there are real risks building in the distance.”

Apart from tariffs, the passage of the tax and spending bill into law will provide “some fiscal stimulus to the economy in the short term,” he said, “but it also will increase deficits in the coming years.”

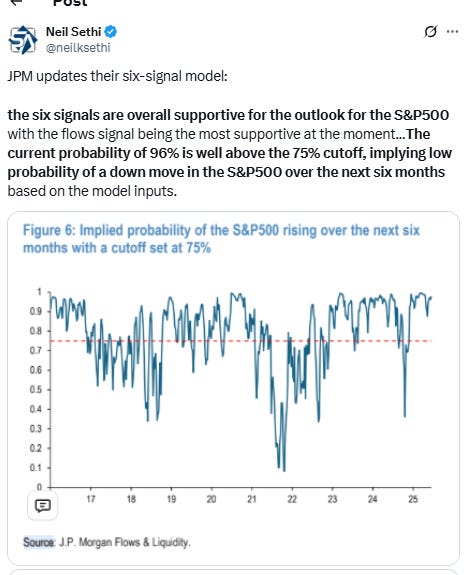

JPMorgan's equity strategists led by Mislav Matejka argue that the so-called "pain trade" -- the market move most against current positioning-- is still higher. "Fundamentally, though, will the Goldilocks narrative that was in force in the past few weeks get a confirmation during summer, or will it potentially give way to stagflationary risks increasing," the strategists ask in a note published Monday. They clearly suggest the latter: "The U.S. could see a stagflationary backdrop over the next months, which could constrain its performance during the summer. Having said that, there could be some growth supportive policies in the pipeline, and the U.S. is unlikely to be the only region experiencing growth scare. Trade uncertainty is in theory less of a headwind for the U.S., at least relatively. If markets relapse into weakness, the U.S. has typically held up better than other regions during risk-off periods, but this time around Tech and USD might not be the safe havens."

“So far, Fed Chair Powell’s wait and see approach has worked,” Dave Donabedian, co-chief investment officer of CIBC Private Wealth told me prior to the jobs report. “The economy has held up, and inflation has cooled a bit."

Donabedian expects inflation readings for June and July to be tame, which could pave the way for rate cuts as soon as September. “For all the policy imbalances, the U.S. stock market got more balanced,” Donabedian says. “The biggest challenge going forward is valuation. Earnings estimates are coming down, and the market is at new highs. The economy is decelerating.”

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

In individual stock action:

Shares of Toyota Motor dropped 4% and Honda Motor fell 3.9% following Trump’s posts. Nvidia was slightly lower, while Apple and Alphabet lost more than 1%. AMD shed over 2%.

Tesla shares also put pressure on the broader market. The EV maker shed nearly 7% after CEO Elon Musk announced his intention over the weekend to form a new political party called the “America Party.” Investors have been less than pleased with the billionaire’s foray into politics this year, which some say have damaged Tesla’s brands and sales.

Corporate Highlights from BBG:

CoreWeave Inc. is dropping $9 billion on the data-center operator Core Scientific Inc. in an effort to gain more direct control over the physical assets powering the artificial-intelligence boom.

Apple Inc. appealed a €500 million ($580 million) fine from the European Union, calling the penalty “unprecedented” and the regulator’s required changes to its App Store as “unlawful.”

Netflix Inc. was downgraded to neutral from buy at Seaport Global Securities, which cites valuation in the wake of strong gains at the streaming-video company.

Applied Materials Inc. was downgraded at Rothschild & Co Redburn to neutral from buy on growth risks.

Goldman Sachs Group Inc. initiated coverage of MGM Resorts International with a sell recommendation due to the volatile Las Vegas market.

Wells Fargo & Co. was downgraded to market perform from strong buy at Raymond James which says the stock’s “favorable fundamentals” are already reflected in its valuation.

Some tickers making moves at mid-day from CNBC:

In US economic data:

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

The SPX fell back from ATH’s but found some support at the 6200 level. Its daily MACD remains positive, although the RSI is starting to move from above to under 70 from the most overbought since last July which can be an indicator of a pullback/consolidation.

The Nasdaq Composite a similar setup.

RUT (Russell 2000) took a pause in its run per my note two weeks ago that “it has a clear path to move at least to the 2300 level”. MACD remains positive, although the RSI has the same over to under 70 phenomenon as the SPX. As mentioned last week, CTAs are modeled to be big buyers which should support a test of the 2300 level absent a larger down move.

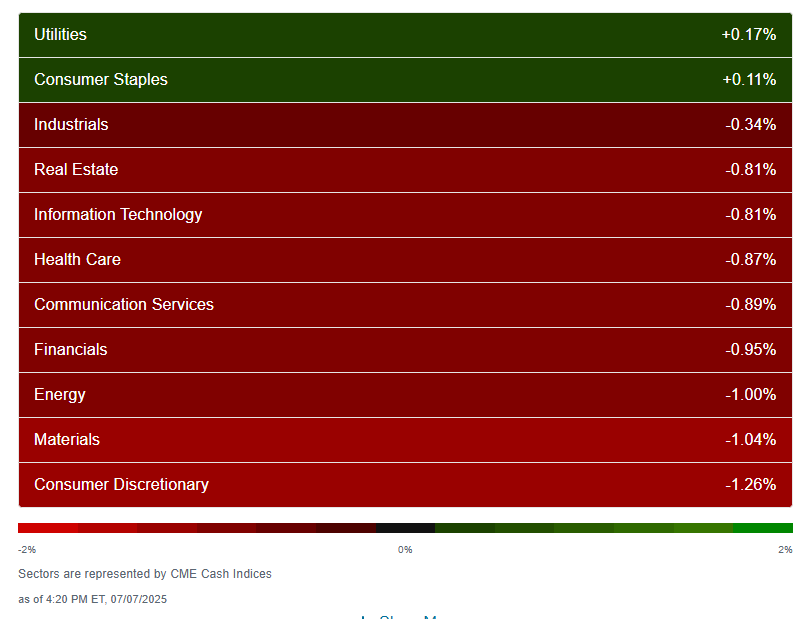

Sector breadth from CME Cash Indices unsurprisingly weakened considerably to 9 red sectors (from 9+ green sectors six of the previous seven sessions), and the only two green were up less than +0.2% (Utilities and Staples). Every red sector was down more than that with 8 of 11 down at least -0.8%.

SPX stock-by-stock flag from FINVIZ_com relatively consistent with much more red today, although not many names down more than -3%. TSLA was a standout in that regard -6.8%.

NYSE positive volume (percent of total volume that was in advancing stocks) which was pretty good last week softened considerably as would be expected given the -0.87% loss in the index to 25.6%.

Still compare that to June 25th when it was 23.1% on a -0.64% loss in the index.

Nasdaq positive volume a similar story coming in at 39.7%, with a -0.97% loss in the index (actually pretty good given that loss).

In comparison it was 38.6% on June 17th on a slightly smaller -0.91% loss in the index.

Positive issues (percent of stocks trading higher for the day) were weaker today at 20& 26% respectively.

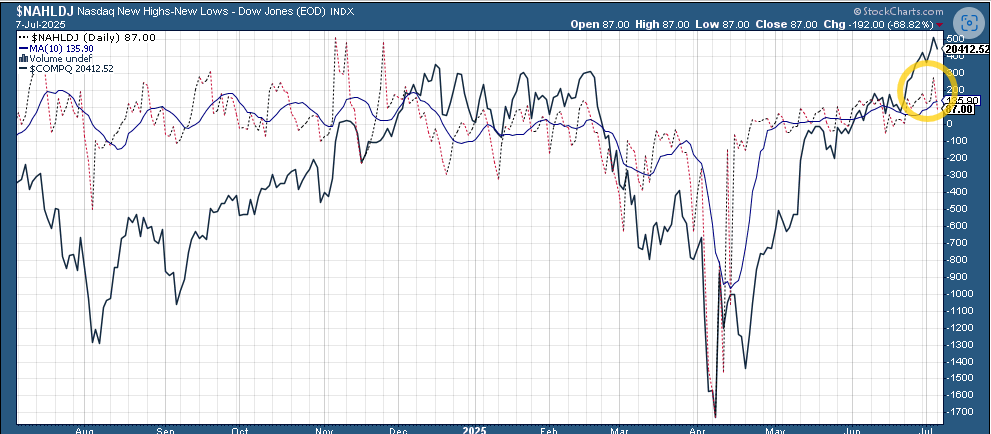

New 52-wk highs-new lows (red-black dotted lines) also fell back from the best since December & November on the NYSE & Nasdaq respectively at 179 & 265 to 97 & just 82 today. 10-DMAs on both though improved to at or near the highs of the year.

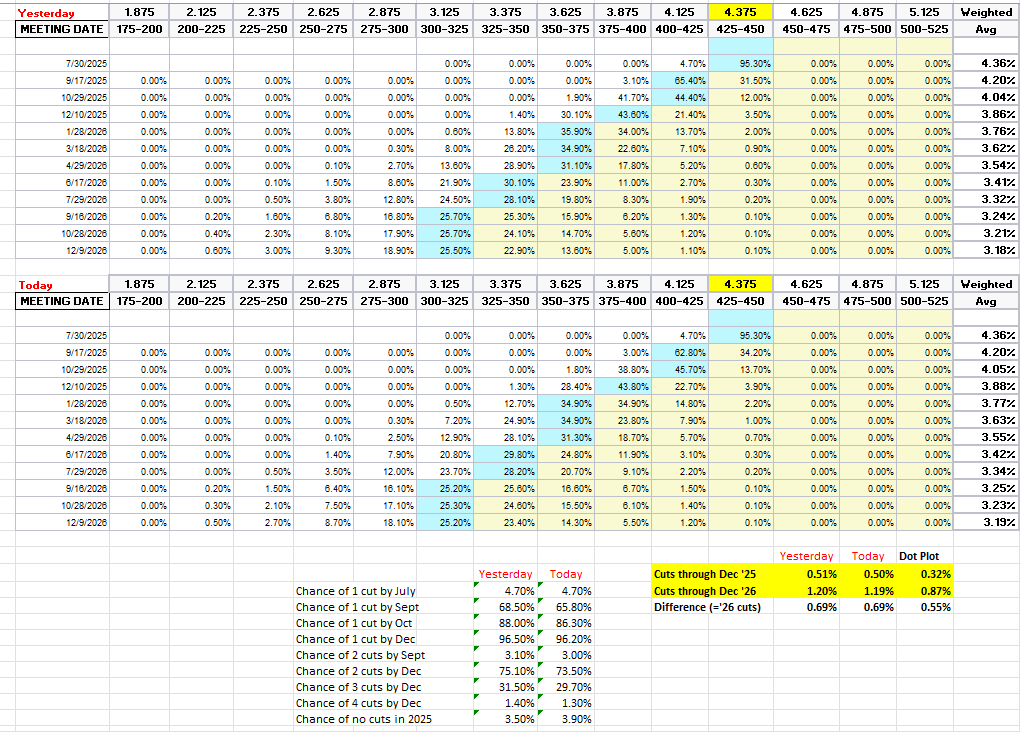

Fed rate cut bets were little changed after being cut sharply Thursday following the beat on headline payrolls with pricing for 2025 #FOMC rate cuts -1bps (after falling -13bps Thursday) to 50bps according to CME’s #Fedwatch tool, (down from 92bps on May 1st; and the peak this year at 103bps on Apr 8th (the low was 36bps Feb 11th)).

The probability of a cut at the July meeting remained at 5% from 23% on Wednesday (now below where it was following the June FOMC meeting, and from 78% at the start of May)) while a cut by the following meeting (Sept) now at just 66% from 94% Wednesday (also now below where it was on FOMC Day).

Chances of 2 cuts this year is 74% (down from 90% Wed although still up from 62% on FOMC Day), three is 30% (down from 55%), and four is 1% (from 10%). The chance of no cuts rose to 4% from 0.6% (still down from 8% FOMC Day).

2026 cuts were unchanged at 69bps (still seeing close to 3 cuts), with total cuts through Dec '26 at 119bps (now under 5 cuts), still +9bps from FOMC Day but -30bps from the start of May.

I said after the big pricing out of cuts in January (and again in February) that the market had pivoted too aggressively away from cuts, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 80 “maybe actually going a little too far” which is back to where we probably were Apr 20th (a little too far) at 102bps). Seems like we’re getting back to “fairly priced,” and as of May 14th at 48bps perhaps starting to go a little too far in the other direction, but as I’ve said all year “It’s a long time until December.”

Also remember that these are the construct of probabilities. While some are bets on exactly two, three, or four cuts much of it is bets on a lot of cuts (5+) or just one or none.

10yr #UST yields up for a fourth day Monday +6bps to 4.40% as they continue to rebound from the lowest close since April last Monday now through my target of the downtrend line from the May peak. Next resistance is 4.5%.

The 2yr yield, more sensitive to #FOMC policy, also rose for a fourth day Monday +3bps to 3.90%. It is still -43bps below the Fed Funds midpoint, so still calling for rate cuts, but now up +18bps in a week.

I had said when it was around 4.35% (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), but then the 2yr fell to 3.65% past where I thought we’d see it, so I took some exposure off there. We got back there but I never added back what I sold, so I stuck tight. Ian Lygan of BMO saw it going to 3.5% by year’s end before all this tariff business but now thinks it’s at fair value here. I will probably take some more off this week.

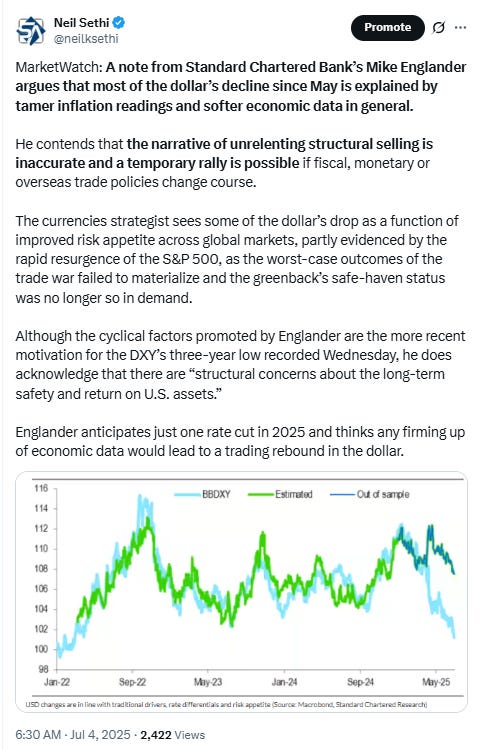

$DXY dollar index (which as a reminder is very euro heavy (over 50%) and not trade weighted) up for third day in four now back at the trendline from the Feb highs that it hasn’t closed over since.

The daily MACD also crossed over to “cover shorts” while the RSI is improving after having moved from under to over 30, which can be a signal of a reversal of a downtrend. Does it have enough to get/stay over this time?

VIX little edged higher after holding just above the 16 level for seven sessions but still just at 17.8. That level is consistent w/~1.10% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) moved higher to 96 still though remaining under Nomura’s Charlie McElligott’s “stress level” of 100 (consistent now with “moderate” daily moves in the VIX over the next 30 days (normal is 80-100)).

Interestingly, the 1-Day VIX fell back from Thursday’s levels despite the down day in the indices closing at 11.8 from 14.6, consistent with traders implying a ~0.74% move in the SPX next session.

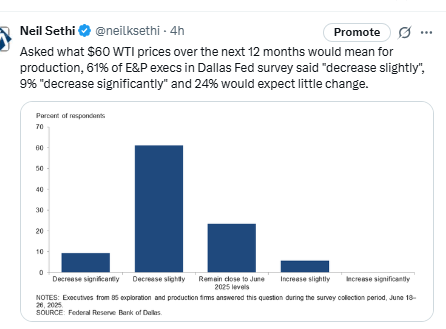

#WTI futures impressively bounced from early declines (and a test of the uptrend line from the May lows) to finish 1% higher despite the larger than expected return of idled production by OPEC. The daily MACD remains in “sell longs” positioning but is improving while the RSI is over 50.

#oott

Gold futures (/GC) remained at the bottom of the uptrend channel from January, just over the 50-DMA. Daily MACD remains negative as noted two weeks ago, while the RSI fluctuates around 50.

Copper (/HG) futures fell through the $5.10 resistance level it has never been able to hold over for more than six or seven sessions. It made it this time to five. The daily MACD and RSI are positive as noted last Thursday but are quickly softening.

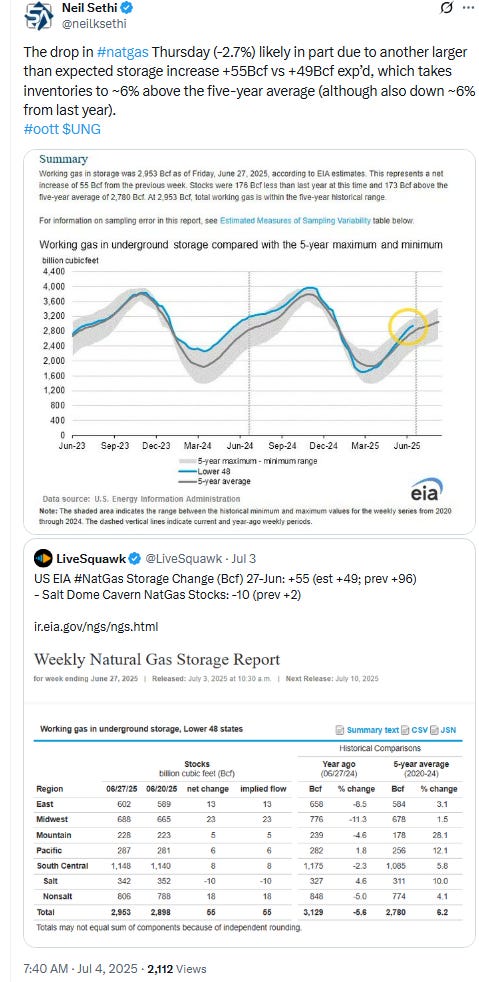

Nat gas futures (/NG) little changed ending right on the 200-DMA, which as noted two weeks ago has for the most part held since last August, overall remaining in the middle of its range this year. Daily MACD and RSI tilt negative.

Bitcoin futures fell back to the top of the larger flag formation. The daily MACD and RSI tilt positive.

As a reminder the last time daily RSI went from well over to well under 70 there was a a six-month period of consolidation (November), so we’ll see if this time is different (it needs to make and sustain a new high). So far it’s been 4 weeks.

The Day Ahead

It’s a light week for data, but Tuesday is probably the heaviest day with NFIB small business sentiment, the NY Fed’s consumer survey, and May consumer credit. The EIA will also release their monthly energy outlook.

No Fed speakers on the calendar, but we will get our first Treasury note auction of the week in 3-yrs.

Earnings are light with no SPX reports (actually no US companies I’ve heard of).

Ex-US DM the highlight is a policy decision from Australia (RBA). A 25bps cut is expected. We’ll also get German and French exports among other reports.

In EM, we’ll get Taiwan exports and Brazil retail sales among other reports, as well as a rates decision from Romania.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,