Markets Update - 7/8/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

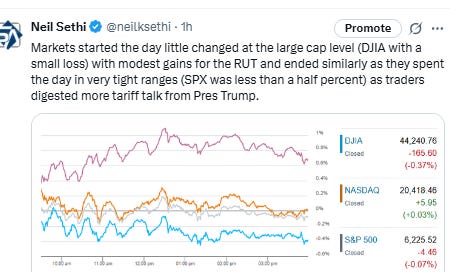

Major US equity indices started the day modestly higher (small caps with larger gains) as they digested the most recent “escalate to [hopefully] de-escalate” moves from President Trump regarding tariffs. Those continued throughout the day as he indicated that the Aug 1st date was firm with no extensions (although he also said that about the July 9th date) and talked about a range of new tariffs from copper (which saw futures shoot to record highs) to pharma products to a potential EU “letter” to an extra 10% charge on India for being part of the BRICS collective of nations. The jawboning seemed to keep a lid on equities which traded in a very tight range finishing close to where they started.

Elsewhere, Treasury yields were up for a fifth day and the dollar also gained. Copper shot to a record high, and crude and bitcoin were also higher while gold and nat gas fell.

The market-cap weighted S&P 500 (SPX) was -0.1%, the equal weighted S&P 500 index (SPXEW) +0.3%, Nasdaq Composite UNCH (and the top 100 Nasdaq stocks (NDX) +0.1%), the SOX semiconductor index +1.8%, and the Russell 2000 (RUT) +0.7%.

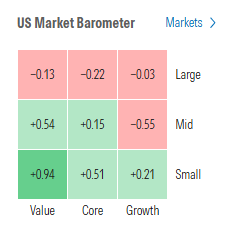

Morningstar style box showed the weaker relative performance in larger caps.

Market commentary:

Of course, investors should have been braced for this, and perhaps that explains a less precipitous drop for markets after they raced to new highs last week. "The Trump administration appears to retain its escalate-to-deescalate approach,” Ulrike Hoffmann-Burchardi, UBS’s chief investment officer for global equities, has noted, warning further trade volatility seems inevitable, if not terribly significant. “Trump has demonstrated a willingness to shock the market with tariff demands that he later modifies.”

"If you go through the details, I don't even know if anybody understands the difference between what was announced today, what was there previously, and if it will actually be implemented, and which companies it actually impacts," Trivariate Research CEO Adam Parker said Monday on CNBC's "Closing Bell."

"So, I think it's just a little bit of selling as we got the highs, and kind of recalibrating before July earnings season," Parker added. "But I don't think this is the sign of a new regime at all."

“Equity markets are focused on the positive news,” said Wolf von Rotberg, equity strategist at Bank J. Safra Sarasin. “Europe is working toward securing a framework agreement with the US and the July 9th deadline was pushed out by another month. The market has learned to focus on the facts more than following the talk.”

“What we’ve seen since April has really been the markets getting past the idea that tariffs would have a particularly detrimental impact on growth, earnings, inflation, etc.,” said Bill Merz, head of capital markets research at U.S. Bank Wealth Management. “Investor sentiment has shifted a lot in a very short period of time and become more optimistic, as we can see in equity market pricing and how we’re right around all time highs across multiple indices.”

“The fact that higher tariffs have become the default if no deal is reached does introduce a layer of risk that markets will have to price in,” said Daniela Sabin Hathorn, senior market analyst at Capital.com. “The dollar could struggle as this would have a negative impact on the growth outlook in the US.”

"Nothing that happened yesterday should be taken to mean that we're near the end to the U.S. tariff story of 2025. Leaving aside that 'reciprocal tariffs' still need to be resolved, there are also new 'strategic tariffs' to look forward to this year," Thierry Wizman, Macquarie Group’s global foreign exchange and rates strategist, wrote in a note.

In an email, Scott Helfstein, head of investment strategy for ETF provider Global X, wrote that "markets are not out of the woods. The White House has not really achieved [its] goals on trade, and that could be a continued source of volatility."

“Investors betting on the TACO trade might gradually face some disappointment,” said Raphael Thuin, head of capital markets strategies at Tikehau Capital in Paris. “There’s a real possibility that tariffs are here to stay beyond Trump’s mandate as a permanent fiscal tool to fund growing deficits.”

According to Raphael Olsyzna-Marzys, international economist at J. Safra Sarasin Sustainable Asset Management, forecasting amid the current unpredictability is a challenge — but he said he now expects the U.S. to end up with an effective tariff rate closer to 20%, up from 15% today and 2.5% at the end of last year. “What’s clear is that Trump wants to have tariffs of 10%, that was always the bare minimum ... but what’s quite clear is at least on Asian countries such as Vietnam, the tariff rate is going to be quite high because the administration feels these countries have too high of a trade surplus, they need to be corrected,” he told CNBC’s “Squawk Box Europe.”

"While trade tension may be on the rise again, investors should remember that we’re just one session removed from record highs in the S&P 500 and Nasdaq. Mild profit-taking is actually healthy after the powerful rally we had in the second quarter and the holiday-shortened trading week to start July," Bret Kenwell, U.S. investment analyst at eToro, wrote in an email. Investors may be wondering if this new batch of tariff news could lead to a market decline like the one seen in April. Kenwell said that this isn't guaranteed, but if the tariffs do come with "more bite than bark" another pullback is possible. "Trade-war headlines are regaining momentum, but that doesn’t mean we’re in for a repeat of late March and early April. If there is confidence that negotiations will continue or deadlines will be extended, markets may continue to shake off the headlines," Kenwell said.

“While tariffs will likely remain high — compared with levels at the start of the year — as will the headline risk, we think the US effective tariff rate should end the year at around 15%,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. “This would be a headwind to growth but not enough to trigger a recession.” She continue to recommend phasing into global equities or diversified portfolios to navigate volatility ahead.

It remains tough to foresee the economic impact from tariffs and other government policies, even six months into 2025, according to National Retail Federation Chief Economist Jack Kleinhenz. “Anxiety and confusion have taken center stage in the economy and financial markets as uncertainty over public policy has intensified. It was difficult to judge how policy changes would impact the economy in early 2025 and it remains so now,” he said in a statement. “Economic fundamentals appear solid at this juncture, but uncertainty is pervasive,” Kleinhenz said. “There are many crosscurrents surrounding tariffs, immigration and deregulation, and everyone is sorting through what the tariff rates are going to be, how they will impact inflation for retail products and, importantly, how long they will be in place.”

Consumers are going to have to absorb some of the costs from higher tariffs, according to Mark Mahaney, head of internet research at Evercore ISI.

Mahaney said he expects that price increases from tariffs can still come. He noted that a spike in costs that can be weathered by larger retailers such as Walmart, Home Depot and Amazon will be more challenging for smaller companies. “10%, 20%, 30% — those are big increases. Retail is a thin margin business. So if you’re going to increase your cost of inputs, that’s going to be passed along, and those companies can only eat so much of that,” Mahaney told CNBC’s “Power Lunch” on Tuesday. “Consumer is going to have to eat some of this,” he added. “We’re still in a wait and see mode. But this is more risk than we had a year ago. There’s more price risk here than we had a year ago.”

Deutsche Bank sees a lower likelihood of a summer crisis arising this year.

“In the current climate, as long as markets believe that policymakers are willing and able to adjust in response to turmoil, then that in itself should limit the extent to which markets can sell off aggressively,” wrote strategist Henry Allen. “That means for a summer crisis to prove longer-lasting, and for the current resilience to end, it would take something that affects the macro fundamentals, but policymakers can’t easily fix.” Several factors that could trigger turmoil this summer include U.S. tariffs snapping back higher on Aug. 1, the market pricing out rate cuts due to the inflationary impact of tariffs, economic growth beginning to falter and oil prices spiking due to a geopolitical shock, the bank added.

Going forward, investor Keith Lerner believes that the market “deserves the benefit of the doubt.”

“This bull market has earned the benefit of the doubt, and even if it’s a slower trajectory higher and with some hiccups along the way, I still think the trend is one that moves up over the duration of the year,” the Truist Wealth co-chief investment officer said on CNBC’s “Squawk on the Street” Tuesday morning.

Lerner pointed to strong corporate earnings as a driving force behind the market’s current resilience.

President Donald Trump’s latest moves on tariffs could be a catalyst for stocks to lose steam in the near-term, according to Wolfe Research. “Investors seem to be dismissing the upside risk to inflation. But someone ultimately has to pay the tariffs—likely showing up in CPI, profit margins, or (realistically) a combination of both,” Wolfe Research chief economist Stephanie Roth wrote in a Tuesday note. “While we still expect the economy to hold up, this raises near-term risks to the equity rally so far and reinforces our base case that the Fed stays on hold this year given the looming inflationary impact,” she added.

Oppenheimer Asset Management remains bullish on U.S. equities at this time, the firm’s chief investment strategist John Stoltzfus wrote in a Monday note.

Specifically, the firm prefers cyclical stocks over their more defensive counterparts. These cyclical sectors include information technology, consumer discretionary, communication services, industrials and financials.

“We anticipate continued positive corporate earnings growth, a key driver of equity valuations,” Stoltzfus wrote. “Our intermediate- and longer-term outlook for the U.S. economy and the stock market remains decidedly bullish. We believe U.S. economic fundamentals remain on solid footing. As the drag of tight monetary policy eases, job growth and consumption and business fixed investment demand should continue to exhibit resilience. In addition, should the economy appear to falter, the Federal Reserve has the ability to move swiftly to cut rates further to provide economic stimulus and reinvigorate demand.”

"This last policy meeting probably was a bit more contentious than the prior meeting in May," said Bob Lang, chief options analyst at Explosive Options. "There probably was a lot of discussion about when the next rate cut is going to be, so that's going to be important to help move markets along."

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

In individual stock action:

Copper producer Freeport-McMoran Inc. rallied along with copper. A gauge of drugmakers whipsawed as Trump indicated he could offer pharmaceutical manufacturers at least a year before applying a 200% tariff on foreign-made products. In megacaps, Tesla Inc. climbed while Amazon.com Inc. fell at the start of its Prime Day sales event.

Nvidia nudged higher, closing in on a $4 trillion market cap. But banks helped weigh down the market, after HSBC adopted a “more cautious stance” on larger banks. Shares of JPMorgan and Bank of America shed 3%, while Goldman Sachs slipped 2%.

Corporate Highlights from BBG:

Amazon.com Inc.’s Prime Day sales fell almost 14% in the first four hours of the event compared with the start of last year’s sale, according to Momentum Commerce, which manages 50 brands in a variety of product categories.

Boeing Co. said it delivered 60 aircraft in June, its best showing in 18 months that reflects improvements in its factories and the resumption of US jet exports to China.

HSBC is turning cautious on three of the biggest US bank stocks following a record rally that’s brought the group within shouting distance of an all-time high.

President Donald Trump called for new rules that would restrict access to tax incentives for solar and wind projects that already had been pared back by his $3.4 trillion budget bill designed to end green energy incentives.

SpaceX is discussing plans to raise money and sell insider shares in a deal that would value Elon Musk’s rocket and satellite maker around $400 billion, people familiar with the matter said.

Ciena Corp. was cut to underweight from equal-weight citing at Morgan Stanley, which cited a lack of margin upside in the near term.

Hershey Co. appointed Kirk Tanner to be the chocolate maker’s next president and chief executive officer.

Walt Disney Co. and Hearst Corp. are considering a sale of their A+E Global Media joint venture, which includes cable-TV channels such as History and Lifetime, according to a person familiar with the discussions.

Robinhood Markets Inc. Chief Executive Officer Vlad Tenev said the firm is in talks with regulators over its offering of tokenized equities in Europe, after the launch drew rebuke from companies including OpenAI.

Some tickers making moves at mid-day from CNBC:

In US economic data:

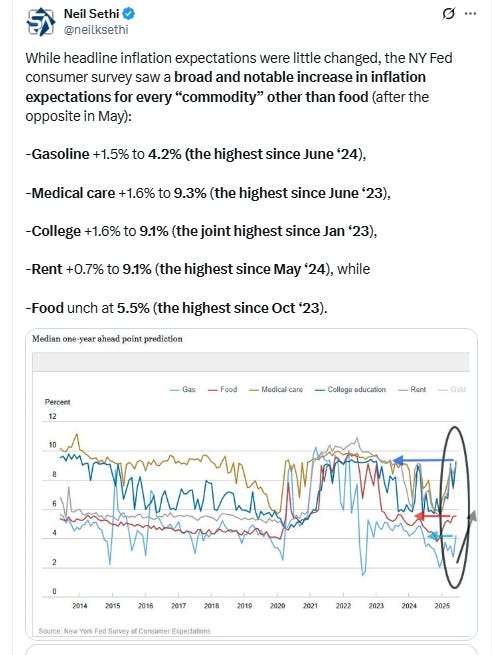

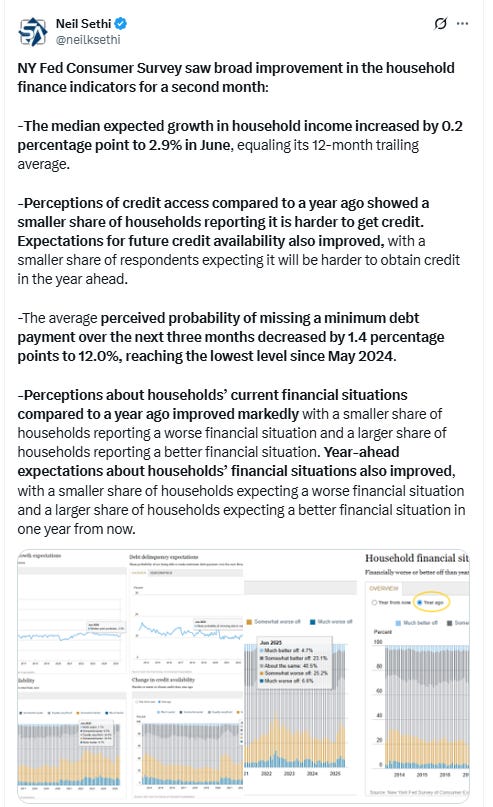

We got the NY Fed consumer survey. Some posts from that are below.

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

The SPX remained just below ATH’s for a second day. Its daily MACD remains positive, although the RSI is starting to move from above to under 70 from the most overbought since last July which can be an indicator of a pullback/consolidation.

The Nasdaq Composite a similar setup.

RUT (Russell 2000) also remains a bit below Friday’s levels still though with “a clear path to move at least to the 2300 level” per my note two weeks ago. MACD remains positive, although the RSI has the same over to under 70 phenomenon as the SPX (a little more so). As mentioned last week, CTAs are modeled to be big buyers which should support a test of the 2300 level absent a larger down move.

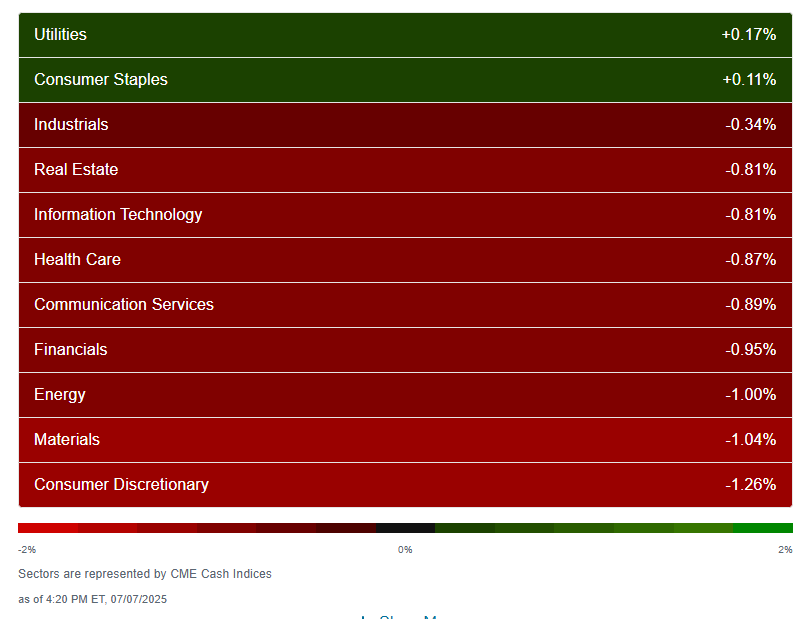

Sector breadth from CME Cash Indices improved somewhat but still just 5 green sectors and only one was up more than around a half percent (Energy). Five sectors were down by that much with bond proxies Utilities and Staples each losing more than -1% pressured by increasing interest rates.

SPX stock-by-stock flag from FINVIZ_com relatively consistent more mixed today, although again not many big movers. On the upside energy names saw nice gains as did MU and INTC along with some others. Banks on the other hand were fairly weak with JPM and BAC both down over -3% on downgrades.

NYSE positive volume (percent of total volume that was in advancing stocks) which has been relatively strong of late remained so Tuesday at 60.6%, pretty good for a flat day in the index.

Compare that to June 11th when it was 46.9% on a small gain.

Nasdaq positive volume an even better story coming in at 69.7%, with just a +0.03% gain in the index.

In comparison it was 65.0% on June 18th on a slightly larger +0.13% gain in the index.

Positive issues (percent of stocks trading higher for the day) were 60% on both.

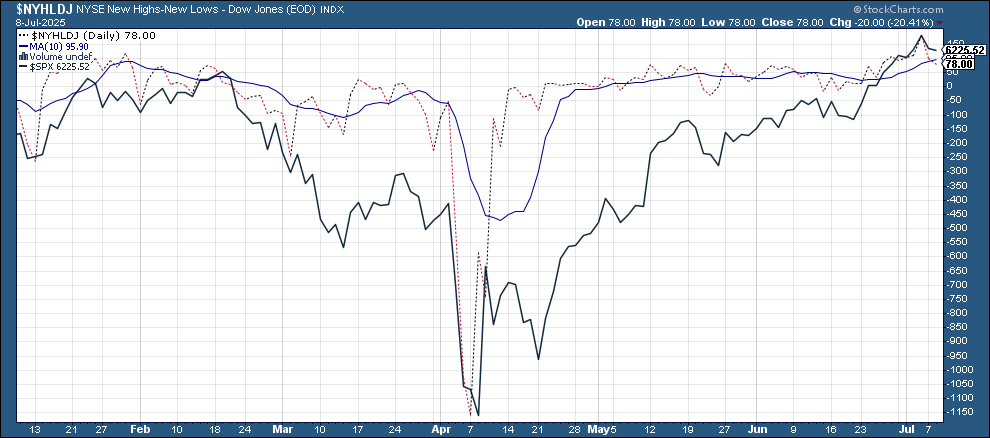

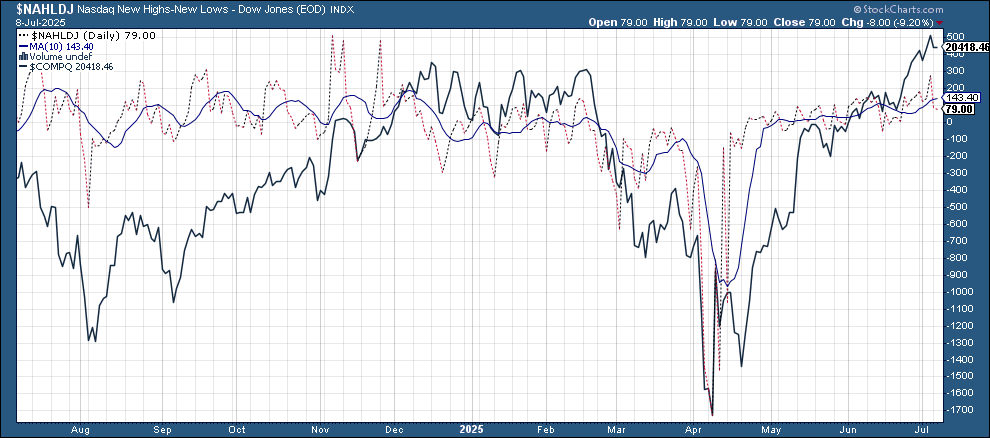

New 52-wk highs-new lows (red-black dotted lines) though continued to deteriorate now down to 78 & 72 on the NYSE & Nasdaq respectively from 179 & 265 Friday.

Fed rate cut bets were little changed after being cut sharply Thursday following the beat on headline payrolls with pricing for 2025 #FOMC rate cuts -1bps to 49bps according to CME’s #Fedwatch tool, (down from 92bps on May 1st; and the peak this year at 103bps on Apr 8th (the low was 36bps Feb 11th)).

The probability of a cut at the July meeting remained at 5% from 23% on Wednesday (now below where it was following the June FOMC meeting, and from 78% at the start of May)) while a cut by the following meeting (Sept) now at just 66% from 94% Wednesday (also now below where it was on FOMC Day).

Chances of 2 cuts this year is 72% (down from 90% Wed although still up from 62% on FOMC Day), three is 28% (down from 55%), and four is 1% (from 10%). The chance of no cuts rose to 4% from 0.6% (still down from 8% FOMC Day).

2026 cuts edged -2bps lower to 67bps, with total cuts through Dec '26 at 116bps (under 5 cuts), now just +6bps from FOMC Day but -33bps from the start of May.

I said after the big pricing out of cuts in January (and again in February) that the market had pivoted too aggressively away from cuts, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 80 “maybe actually going a little too far” which is back to where we probably were Apr 20th (a little too far) at 102bps). Seems like we’re getting back to “fairly priced,” and as of May 14th at 48bps perhaps starting to go a little too far in the other direction, but as I’ve said all year “It’s a long time until December.”

Also remember that these are the construct of probabilities. While some are bets on exactly two, three, or four cuts much of it is bets on a lot of cuts (5+) or just one or none.

10yr #UST yields up for a fifth day +2bps to 4.42% as they continue to rebound from the lowest close since April last Monday. As noted Monday next resistance is 4.5%.

The 2yr yield, more sensitive to #FOMC policy, was unchanged at 3.90%. It is still -43bps below the Fed Funds midpoint, so still calling for rate cuts, but now up +18bps in a week.

I had said when it was around 4.35% (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), but then the 2yr fell to 3.65% past where I thought we’d see it, so I took some exposure off there. We got back there but I never added back what I sold, so I stuck tight. Ian Lygan of BMO saw it going to 3.5% by year’s end before all this tariff business but now thinks it’s at fair value here. I will probably take some more off this week.

$DXY dollar index (which as a reminder is very euro heavy (over 50%) and not trade weighted) up for fourth day in five but very marginally as it remains capped for now by the trendline from the Feb highs that it hasn’t closed over since.

The daily MACD as noted Monday crossed over to “cover shorts” while the RSI is improving after having moved from under to over 30, which can be a signal of a reversal of a downtrend. I asked Monday “Does it have enough to get/stay over this time?”

VIX little edged lower as it continues to trade just above the 16 level for a ninth session at 16.8. That level is consistent w/~1.05% average daily moves in the SPX over the next 30 days.

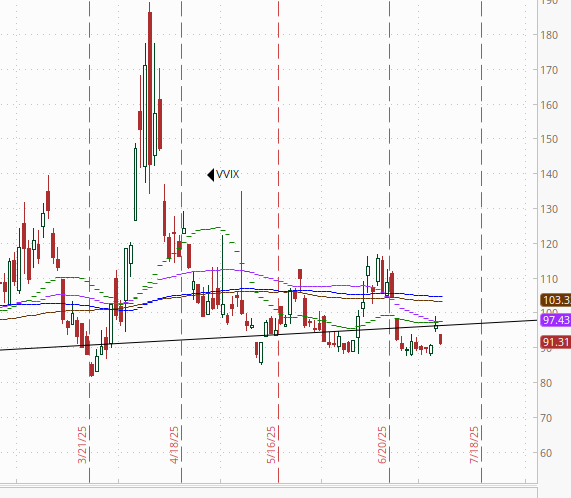

The VVIX (VIX of the VIX) also fell back to the area it’s traded in the past nine sessions at 91 remaining under Nomura’s Charlie McElligott’s “stress level” of 100 (consistent with “moderate” daily moves in the VIX over the next 30 days (normal is 80-100)).

The 1-Day VIX fell for a fourth session as it edges closer to the lows hit last week closing at 10.5, consistent with traders implying a ~0.65% move in the SPX next session.

#WTI futures continued to press higher despite the larger than expected return of idled production by OPEC over the weekend and the EIA remaining bearish on prices into 2026 (although slightly more bullish short-term due to “geopolitical risk premium”. The daily MACD remains in “sell longs” positioning but is improving while the RSI is over 50.

#oott

Gold futures (/GC) edged through the bottom of the uptrend channel from January for a second time, now below the 50-DMA. Daily MACD remains negative as noted two weeks ago, while the RSI fluctuates around 50.

Copper (/HG) futures had an exciting day shooting up nearly 20% after President Trump said there would be a 50% import tax applied to copper imports in coming weeks. As /HG is US traded copper (NY) it shot to a record $5.90 a pound before falling back. Still it finished at $5.50, up 10% and easily a new record close.

Nat gas futures (/NG) were little changed for a fifth session as they trade around the 200-DMA, which as noted two weeks ago has for the most part held since last August, overall remaining in the middle of its range this year. Daily MACD and RSI tilt negative.

Bitcoin futures also little changed sitting just above the top of the larger flag formation. The daily MACD and RSI tilt positive.

As a reminder the last time daily RSI went from well over to well under 70 there was a a six-month period of consolidation (November), so we’ll see if this time is different (it needs to make and sustain a new high). So far it’s been 4 weeks.

The Day Ahead

Wednesday US economic data will be limited to May wholesale inventories and weekly mortgage applications and EIA petroleum inventories.

No Fed speakers on the calendar, but we will get the June FOMC minutes which might be interesting as might be our second Treasury note auction of the week in benchmark 10-yrs. As I noted in the 3-yr recap, hopefully that auction goes better than today’s did. In terms of the Fed minutes here was what BoA will be looking at:

We will be focused on understanding the nature of the disagreement between the seven policymakers who don’t expect to cut rates this year, and the 10 who are forecasting 50bp or more of cuts. Is the latter group more concerned about the labor market, or less concerned about the magnitude/persistence of tariff related inflation? Or both? We will also be looking for any color on why the committee moved to a more stagflationary outlook for 2026

Earnings are light with no SPX reports.

Ex-US DM the highlight is a policy decision from New Zealand (RBNZ). A hold is expected. We’ll also get the BoE’s financial stability report among other reports.

In EM, we’ll get China and Mexico inflation among other reports, as well as a rates decision from Malaysia.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,