Markets Update - 7/9/25

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

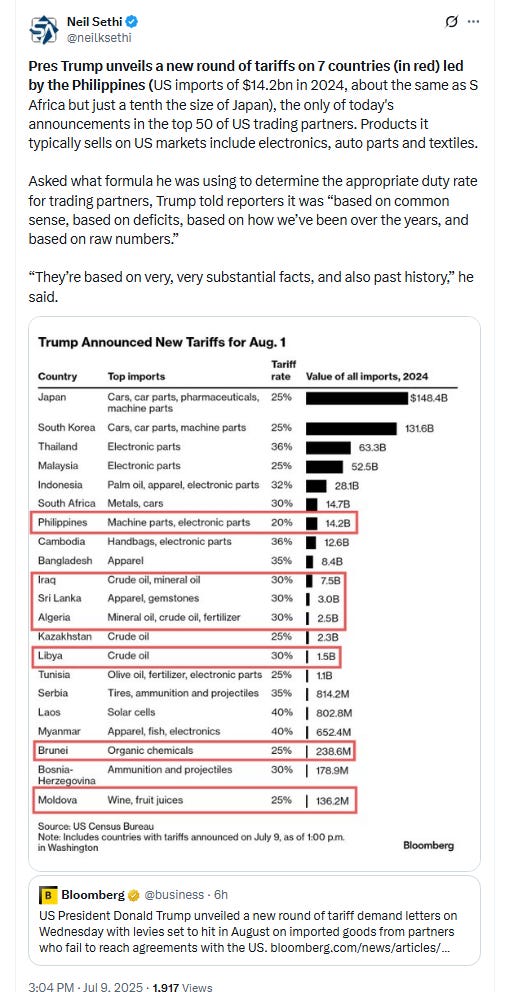

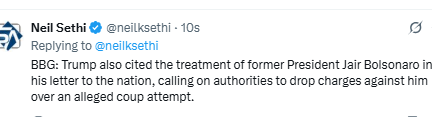

Major US equity indices started the day again modestly higher following a less newsy overnight with no new major developments on the trade front. After an initial dip the indices steadily climbed in the afternoon to end at the highs of the day with the DJIA & SPX around where they started (~+0.5%) while the Nasdaq & RUT made more progress (~+1%). During the session Trump sent letters dictating new U.S. tariff rates on goods imported from six more countries, including the Philippines (a top 50 trade partner). Markets shrugged that off with megacaps leading today’s gains as Nvidia hit the $4 trillion mark.

After the close Trump “lettered” Brazil with a surprising 50% tariff. SPX futures don’t seem all that concerned opening a touch higher.

Elsewhere, Treasury yields cooled for the first time in six sessions but the dollar was little changed as were gold and crude. Bitcoin and copper moved higher, nat gas lower.

The market-cap weighted S&P 500 (SPX) was +0.6%, the equal weighted S&P 500 index (SPXEW) +0.3%, Nasdaq Composite +0.9% (and the top 100 Nasdaq stocks (NDX) +0.7%), the SOX semiconductor index +0.4%, and the Russell 2000 (RUT) +1.1%.

Morningstar style box showed the stronger relative performance in growth today.

Market commentary:

Investors are likely better off ignoring Trump’s latest tariff announcements. "Our base case remains that, in aggregate, U.S. effective tariff rates will remain around their current levels," writes Jonas Goltermann, deputy chief markets economist for Capital Economics. "While continued noise around tariffs could well generate some volatility in the near term, we think the bar for another major sell-off remains quite high."

“The market has already overreacted in the past on Trump’s trade announcements, so I think investors are being prudent and cautious,” said Stéphane Deo, senior portfolio manager at Eleva Capital in Paris. “That being said, tariffs will end up being much higher in the fall than they were at the beginning of the year, so that’s likely to fuel inflation.”

“The tariff announcement was a reminder that markets are not out of the woods. The White House has not really achieved their goals on trade, and that could be a continued source of volatility,” said Scott Helfstein, Global X head of investment strategy.

“We believe the setup for equity markets looks bullish, even in light of renewed trade-war jitters,” said Craig Johnson at Piper Sandler. “While equities may come under some near-term pressure, investors are increasingly becoming numb to the tariff headlines and instead focusing on the trendlines.”

“If the script goes as planned and economic activity remains firm, corporate profitability remains solid (especially across tech), and the inevitable unexpected speed bumps in the road don’t throw the market off track too much, stocks have an opportunity to grind higher through year-end,” said Anthony Saglimbene at Ameriprise. Yet Saglimbene remarks there’s now an elevated risk of disappointment, “especially after seeing how quickly the overall investment narrative can change based on the constant barrage of White House announcements.”

In a Wednesday note to clients, UBS wrote that most investors appear to be sitting on large cash piles and ready to buy the dip in the case of renewed tariff-induced volatility. “Investors who were ahead of their performance targets largely remained on the sidelines, conserving cash to capitalize on potential dislocations around macro events such as the tariff deadlines,” the bank said. “These accounts appear poised to ‘buy the dip’ should volatility resurface.”

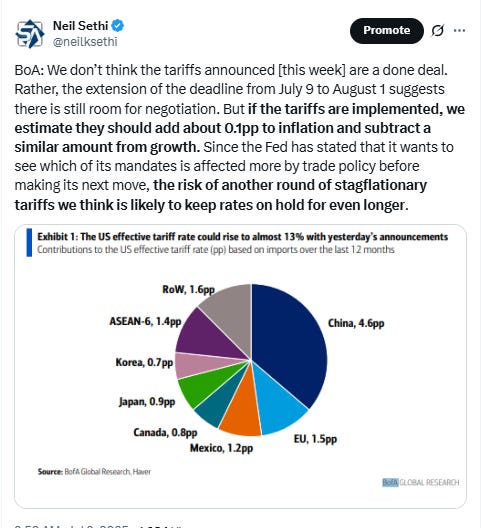

With the S&P 500 back at cycle-high valuations and the CNN Fear & Greed Index signaling extreme greed, the market seems to be signaling a robust appetite for risk, according to Mark Hackett at Nationwide. This heightened sentiment likely reflects positive interpretation of recent data as supportive, he said. “As we move forward, the technical tailwinds will likely begin to fade and fundamental narratives will be crucial in determining the sustainability of this bullish trend,” Hackett noted. “As the market reaction to the ebb and flow of tariff news has become muted, the next catalyst is earnings season. This handoff may come with some choppiness.”

To Jeff Roach at LPL Financial, the FOMC is comfortable remaining in wait-and-see mode. “Despite headwinds, the economy continues to trudge along, giving policymakers time to assess the projected impact from tariffs,” he said. “Ever since last week’s payroll release, markets do not expect the FOMC will cut rates later this month. Next week’s inflation data will likely show a reacceleration, giving the Fed more reason to keep rates elevated. We don’t expect inflation readings will improve until later this year.”

Link to posts - Neil Sethi (@neilksethi) / X for more details/access to charts.

In individual stock action:

Nvidia shares added 1.8% and the chip giant briefly hit a market capitalization of $4 trillion, becoming the first company to do so. Other major tech names also rose — including Meta Platforms, Microsoft and Alphabet — nodding to a rekindling in appetite for the artificial intelligence theme.

Corporate Highlights from BBG:

Microsoft Corp. was upgraded at Oppenheimer on Wednesday, adding to a growing consensus on Wall Street that the software giant is in a strong position within artificial intelligence.

Apple Inc. thinks it is “too big to tariff, in some sense, and it’s used that line,” White House trade counselor Peter Navarro told Fox Business.

France’s antitrust regulator said it notified Meta Platforms Inc. of a potential violation of competition rules relating to the online advertising sector.

Merck & Co. agreed to buy respiratory drugmaker Verona Pharma Plc for around $10 billion as part of its ongoing search for ways to fill the Keytruda-sized hole that will emerge over the next few years.

Meta Platforms Inc. bought a minority stake in the world’s largest eyewear manufacturer, EssilorLuxottica SA, deepening the US tech giant’s commitment to the fast-growing smart glasses industry, according to people familiar with the matter.

Autodesk Inc. is weighing an acquisition of rival engineering-software provider PTC Inc., according to people familiar with the matter. PTC rose as much as 19% on the news.

UnitedHealth Group Inc. promoted a new leader for the company’s Medicaid insurance segment, filling a role that was vacant after recent executive changes.

Starbucks Corp. has received proposals from prospective investors in its China business, most of whom are eyeing a controlling stake in the operation, said people familiar with the matter.

AES Corp., which provides renewable power to tech giants such as Microsoft Corp., is exploring options including a potential sale amid takeover interest, people with knowledge of the matter said.

Samsung Electronics Co. introduced three new foldable smartphones in an effort to cement its grip on the category and broaden mainstream appeal before Apple Inc. debuts its first version next year.

Some tickers making moves at mid-day from CNBC:

In US economic data:

May consumer credit comes in at +$5.1bn less than half the +$10.6bn expected and less than a third of the +$16.9bn in April (+1.2% on a percentage basis), as revolving (credit card) debt fell -$3.5bn (-3.2%), the first decrease since November.

Link to posts for more details/access to charts (all free) - Neil Sethi (@neilksethi) / X

The SPX remained just below ATH’s for a third day. Its daily MACD remains positive, and the RSI is starting to move back over 70.

The Nasdaq Composite a similar setup but made it to a new high.

RUT (Russell 2000) like Nasdaq over Friday’s highs remaining with “a clear path to move at least to the 2300 level” per my note two weeks ago. MACD remains positive, although the RSI has the same over to under 70 phenomenon as the SPX (a little more so). As mentioned last week, CTAs are modeled to be big buyers which should support a test of the 2300 level absent a larger down move.

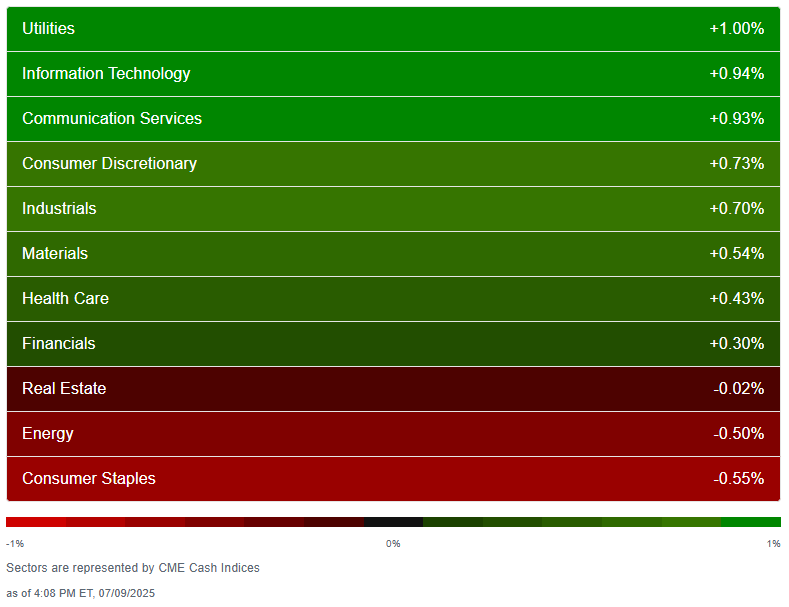

Sector breadth from CME Cash Indices improved for a third day to 8 green sectors with six up >0.5% (vs one Tues) led by Utilities followed by the three megacap growth sectors. Only the former was +1% though. Only two sectors were down a half percent or more, Energy and Staples.

SPX stock-by-stock flag from FINVIZ_com relatively consistent with much more green today and with very few stocks moving more than 3%.

NYSE positive volume (percent of total volume that was in advancing stocks), which has been relatively strong of late, not so much today falling to 52.9%, weak for the +0.3% gain in the index.

Compare that to Tuesday when it was 60.9% on a small loss.

Nasdaq positive volume in contrast was relatively solid coming in at 74.3%, in-line with the +0.94% gain in the index.

Positive issues (percent of stocks trading higher for the day) were mixed at 62 & 64% respectively.

New 52-wk highs-new lows (red-black dotted lines) were similar with the NYSE continuing to deteriorate now down to 72, a two-week low, while the Nasdaq improved to 127 (still down from 265 Friday).

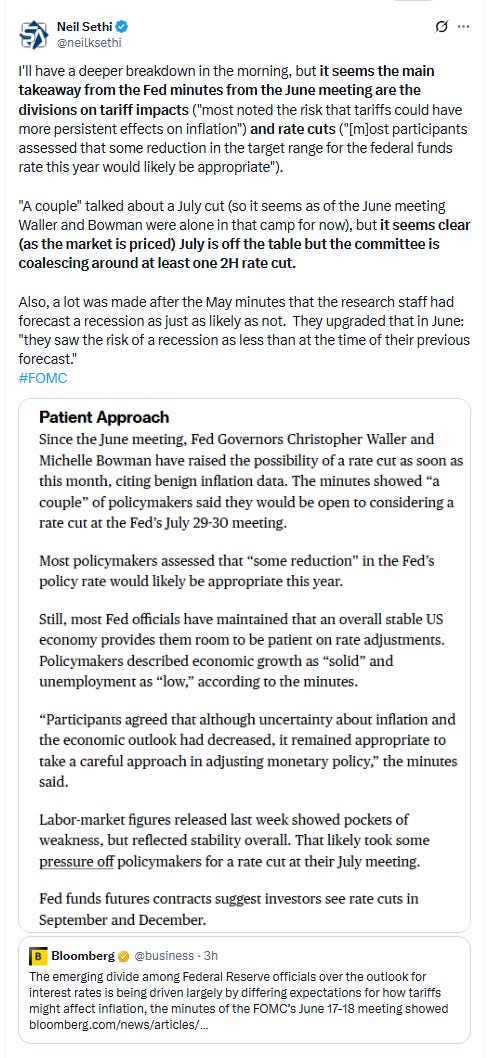

Fed rate cut bets were boosted modestly following the Fed minutes but remained below where they were pre-NFP with pricing for 2025 #FOMC rate cuts +3bps to 52bps according to CME’s #Fedwatch tool, (down from 64bps last Wed & 92bps on May 1st (and the peak this year at 103bps on Apr 8th) (the low was 36bps Feb 11th)).

The probability of a cut at the July meeting edged to 7% but down from 23% on Wednesday (and from 78% at the start of May) while a cut by the following meeting (Sept) up to 70% but from 94% Wednesday.

Chances of 2 cuts this year is 77% (down from 90% Wed although still up from 62% on FOMC Day), three is 34% (down from 55%), and four is 2% (from 10%). The chance of no cuts fell to 3% but still up from 0.6% last Wed (but down from 8% FOMC Day).

2026 cuts edged +3bps to 70bps, seeing total cuts through Dec '26 at 122bps (edging back towards 5 cuts), +12bps from FOMC Day but -27bps from the start of May.

I said after the big pricing out of cuts in January (and again in February) that the market had pivoted too aggressively away from cuts, and that I continued to think cuts were more likely than no cuts, and as I said when they hit 60 bps “I think we’re getting back to fairly priced (and at 80 “maybe actually going a little too far” which is back to where we probably were Apr 20th (a little too far) at 102bps). Seems like we’re getting back to “fairly priced,” and as of May 14th at 48bps perhaps starting to go a little too far in the other direction, but as I’ve said all year “It’s a long time until December.”

Also remember that these are the construct of probabilities. While some are bets on exactly two, three, or four cuts much of it is bets on a lot of cuts (5+) or just one or none.

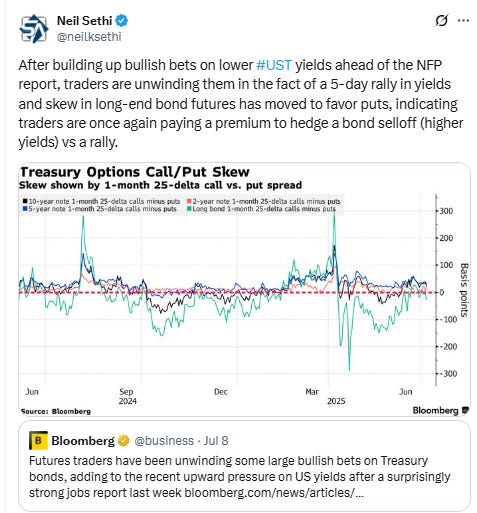

10yr #UST yields fell for the first time in six sessions -8bps to 4.34% back to some support. If they fall much below this we could be looking at a deeper decline. As noted Monday next resistance to the upside is 4.5%.

The 2yr yield, more sensitive to #FOMC policy, also fell back -5bps to 3.85%. It is -48bps below the Fed Funds midpoint, so still calling for rate cuts but also up +13bps this month.

I had said when it was around 4.35% (in Jan & again early Feb) that I found the 2-yr trading rich as it was reflecting as much or more chance of rate hikes as cuts while I thought it was too early to take rate cuts off the table (and too early to put hikes in the next two years on), but then the 2yr fell to 3.65% past where I thought we’d see it, so I took some exposure off there. We got back there but I never added back what I sold, so I stuck tight. Ian Lygan of BMO saw it going to 3.5% by year’s end before all this tariff business but now thinks it’s at fair value here. I will probably take some more off this week.

$DXY dollar index (which as a reminder is very euro heavy (over 50%) and not trade weighted) was little changed for a second day as it remains capped for now by the trendline from the Feb highs that it hasn’t closed over since then.

The daily MACD as noted Monday crossed over to “cover shorts” while the RSI is improving after having moved from under to over 30, which can be a signal of a reversal of a downtrend. I asked Monday “Does it have enough to get/stay over this time?” Not so far.

VIX falls to 15.9, its first sub-16 close since Feb 20th. That level is consistent w/~1% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) unlike the VIX didn’t fall to new lows but remained in the area it’s traded in the past ten sessions at 92, still under Nomura’s Charlie McElligott’s “stress level” of 100 (consistent with “moderate” daily moves in the VIX over the next 30 days (normal is 80-100)).

The 1-Day VIX fell for a fifth session with a new lowest close since Feb 19th at 9.6, consistent with traders implying a ~0.59% move in the SPX next session.

#WTI futures little changed as they struggle with the 200-DMA resistance again shrugging off bad headlines, today in the form of a much larger than expected inventory build. The daily MACD remains in “sell longs” positioning but is improving while the RSI is over 50.

#oott

Gold futures (/GC) also little changed as they edge through the bottom of the uptrend channel from January for a second time, below the 50-DMA. Daily MACD remains negative as noted two weeks ago, while the RSI fluctuates around 50.

Copper (/HG) futures a little less volatile Wed after Tues’s record gain but did edge up a half percent to a new record close.

Nat gas futures (/NG) fell to the bottom of the short-term falling wedge they’ve been trading in the past month starting to break away from the 200-DMA, which as noted two weeks ago has for the most part held since last August. Overall they remain in their range this year. Daily MACD and RSI tilt negative.

Bitcoin futures up 2% but it was enough for an intraday record high. They closed just under record levels as they look to break away from the top of the larger flag formation. The daily MACD and RSI tilt positive.

As a reminder the last time daily RSI went from well over to well under 70 there was a a six-month period of consolidation (November), so we’ll see if this time is different (it needs to make and sustain a new high). So far it’s been 4 weeks.

The Day Ahead

Thursday US economic data will be limited to weekly jobless claims.

We do get our only scheduled Fed speakers of the week in Gov Waller as well as regional Fed Presidents Musalem (2025 voter) and Daly (2027 voter). We also get our third Treasury non-Bill auction of the week in 30-yr bonds. Hopefully it goes at least as well as today’s 10-yr.

Earnings pick up a bit with two SPX reports in Conagra (CAG) and Delta (DAL).

Ex-US DM we’ll get Japan PPI and Norway CPI among other reports.

In EM, we’ll get Brazil inflation, Banxico minutes, Chile economist survey, and S Africa manufacturing among other reports, as well as rates decisions from S Korea, Peru & Serbia.

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,