Markets Update - 8/16/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

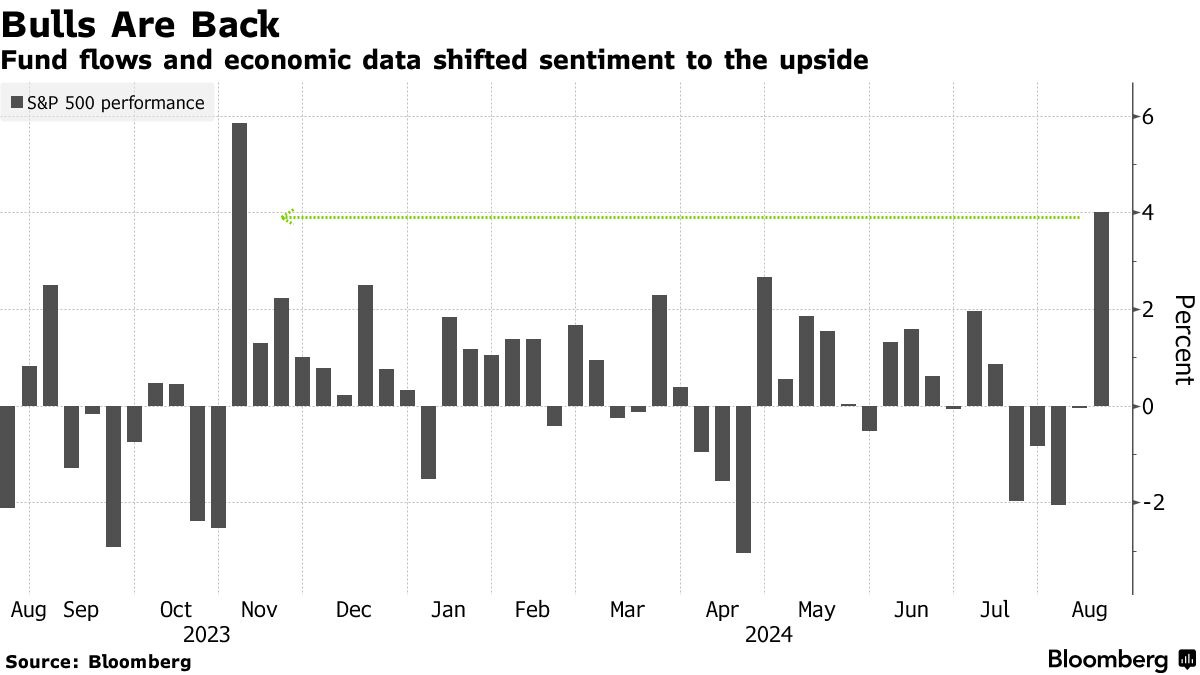

US equity markets saw more muted gains today after recovering from early losses, but it was enough to give the SPX and NDX their best weeks since November led by tech stocks which had their best week since Nov ‘22, emphatically halting a string of 4 weekly losses, and leaving the SPX just 2% from its record highs. If you look back into last week, the SPX had its best 7-day run since Oct ‘22. Smaller caps were not as impressive, but a 3% gain for the week for the RUT is certainly not bad.

Bond yields edged lower and the dollar fell as did crude and nat gas while gold and bitcoin advanced (the former to an ATH). Copper was little changed.

The market-cap weighted S&P 500 was +0.2%, the equal weighted S&P 500 index (SPXEW) +0.2%, Nasdaq Composite +0.2% (and the top 100 Nasdaq stocks (NDX) +0.1%), the SOX semiconductor index -0.1%, and the Russell 2000 +0.3%.

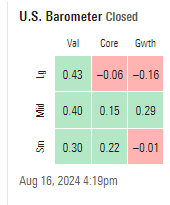

Morningstar style box shows most styles little changed but a tilt towards value for a change.

Market commentary:

“There is little in the data flow now to really derail sentiment in the immediate near-term,” said Chris Weston, head of research at Pepperstone Group Ltd.

“Investors have been looking for additional reasons to continue the road to recovery,” said Sam Stovall, chief investment strategist at CFRA Research. “With the recent, better-than-expected economic and employment data, now investors are picking up the pace.”

“This week’s reassuring inflation data has bolstered investor confidence, leading to a notable surge in market optimism,” said Mark Hackett at Nationwide. “The persistent ‘buy-the-dip’ mentality remains in play, as investors who had moved to the sidelines over the last month raced to get back in.”

“We’ll get some more data on the consumer,” said Matt Maley at Miller Tabak + Co., LLC. “These numbers could be disappointing. Let’s face it, it’s not like the consumer is suddenly booming again. In other words, the positive news from this week has been that the concerns over a recession have been alleviated to a certain degree. But there’s no question that the economy is still slowing.”

“The week was essentially a ‘one way’ week, harshly punishing pessimistic outlooks,” said Florian Ielpo at Lombard Odier Investment Managers. “Nonetheless, the economic data still comes with contradictions. Significant uncertainties persist, warranting caution against excessive optimism.”

JPMorgan believes the recent jarring market meltdown was a practice for possibly similar scenarios down the road. “Many market participants are dismissing the recent blowup of various crowded trades as a fluke or flash cash, but we see it as more of a dress rehearsal for what’s to come,” JPMorgan strategists said in a note. Earlier in August, the Nikkei 225 index, a benchmark for Japanese stocks, plunged 12.4% in one day, its worst day since “Black Monday” in 1987, triggering a domino effect globally. The sell-off was triggered by a small rate hike by the Bank of Japan, lifting rates to their highest in 15 years and the unwinding of the yen “carry trade.” The Wall Street firm believes that the carry trades could become a problem again, but with investors getting burned, they shouldn’t trigger another market meltdown. However, JPMorgan said concerns about an economic slowdown could resurface. “Looking ahead, until the Sharpe ratios on the carry trades get high, we would not think these would be the catalyst for the next major correction,” the firm said. “Instead, we see the reemergence growth risk as the likely trigger.”

Strategist Kamakshya Trivedi said in a note to clients that “We again think it makes sense to lean against extreme concerns and keep the faith in the modal view of continued expansion and decelerating inflation, rather than imminent recession,” stated the note. “Keep fading the extremes.”

“We see value in selectively fading the most acute mispricing across assets, and positioning for the ‘right tail’ that the economy and markets respond quite quickly to a bout of policy easing,” wrote Trivedi.“Nothing has changed in the underlying AI trade, [but] I’m surprised that people came back as fast as they did,” Deepwater Asset Management managing director Gene Munster told CNBC on Friday. “Investors needed this mental reset.”

Positioning and macro factors shift the market skew to positive, but investors should still focus on buying high-quality assets, according to Tony Pasquariello, global head of hedge funds coverage at Goldman Sachs Group Inc. “The speculative community has cleaned up a decent amount of length since the July highs,” Pasquariello wrote in note to clients Friday, referring to Goldman’s prime brokerage data that tracks hedge funds’ positioning and the latest update from the Commodity Futures Trading Commission. Corporate America also emerged as big dip-buyers following the chaos, with Goldman’s unit that executes share buybacks for clients seeing record orders last week. It’s running about $5 billion a day, Pasquariello noted. The biggest risks he sees right now? Increased volatility amid August’s low liquidity, and uncertainty around the US presidential election. “The trading environment will remain choppy, so I’d sit tight with a portfolio that’s reduced to the highest quality assets,” he wrote.

"My flow of funds framework flips to the buy side next week and systematic supply pressure will ease. At the end of the week, CTA supply will completely fade and there is a more fair fight. We have also entered the second best two-month period for corporate repurchases, which are tracking $5 billion per day until September 6. As volatility resets back lower, we should see additional demand from the vol control community. Buyers live higher and investors will re-gross above 5400." -- Scott Rubner, Goldman

"With volatility calming down, investors are tempted by various degrees to re-enter various momentum and carry trades. In the absence of a catalyst, vols will likely go lower and risk assets and carry trades could grind higher." -- Thomas Salopek, JPMorgan

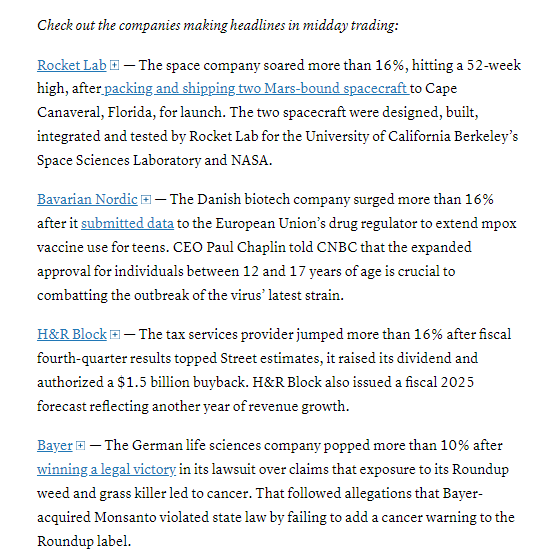

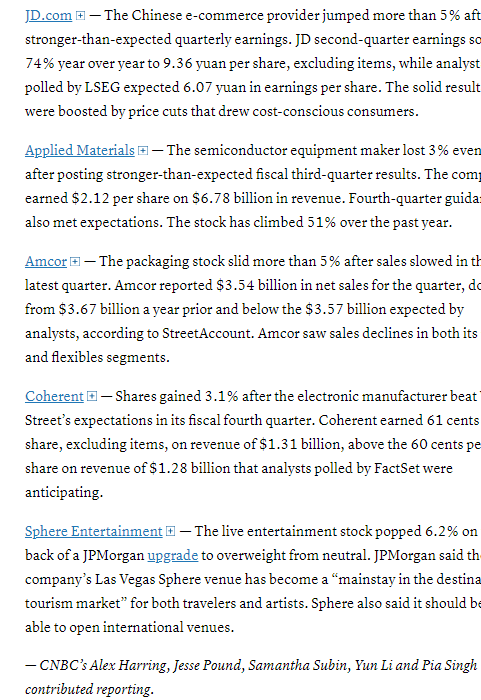

Corporate news light. Applied Materials Inc. (AMAT 207.90, -3.93, -1.9%) sank after a sales forecast that disappointed investors looking for a bigger payoff from artificial-intelligence spending. Nike Inc. saw its longest winning streak in more than eight years. Even at the individual level, movement was relatively muted in stocks. The best -- Dexcom (DXCM 74.65, +2.29, +3.2%) -- and worst -- Amcor (AMCR 10.45, -0.40, -3.7%) -- performing stocks in the S&P 500 moved less than 4.0% in either direction.

BBG’s Corporate Highlights:

Mastercard Inc. is cutting 3% of staff worldwide, according to a spokesperson for the payments network.

Boeing Co. Chief Executive Officer Kelly Ortberg met with union representatives during his first week on the job and said he’s “committed to reset” the relationship the company’s relationship with workers as the US planemaker heads into crucial labor negotiations next month.

Fox Corp., Warner Bros. Discovery Inc. and Walt Disney Co. were blocked by a judge from launching their streaming sports service one week before its rollout, taking a blow from their smaller rival FuboTV Inc.

Texas Instruments Inc. is set to receive $1.6 billion in Chips Act grants and $3 billion in loans, the Biden administration announced Friday, marking the latest major award from a program designed to boost American semiconductor manufacturing.

Rivian Automotive Inc. has paused production of the electric commercial van it makes for Amazon.com Inc. due to a parts shortage in the latest supply chain snafu for the EV maker.

Bayer AG shares jumped following a significant win for the German company in the long-running cancer litigation over its Roundup weedkiller.

A combination Covid-flu vaccination developed by Pfizer Inc. and BioNTech SE missed on one of its goals in a final-stage trial, a setback for the companies as they search for lucrative new uses of a technology that succeeded in the pandemic.

Some tickers making moves at mid-day from CNBC:

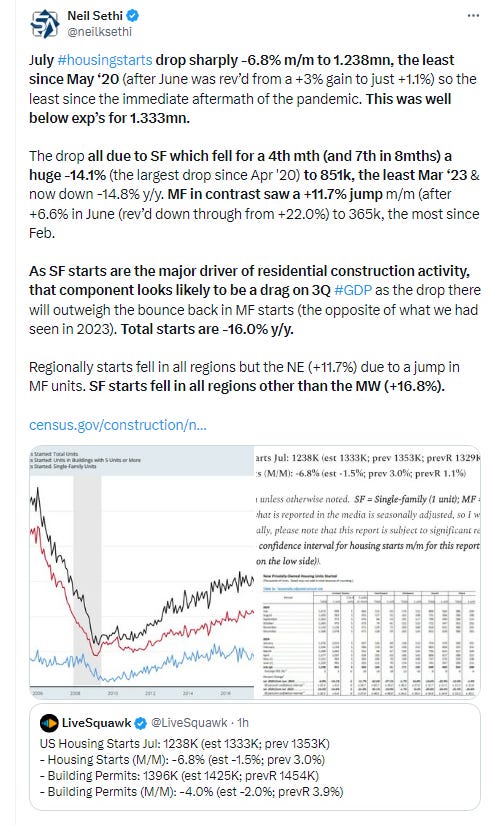

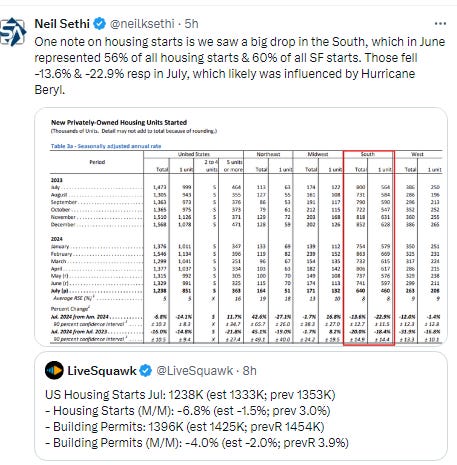

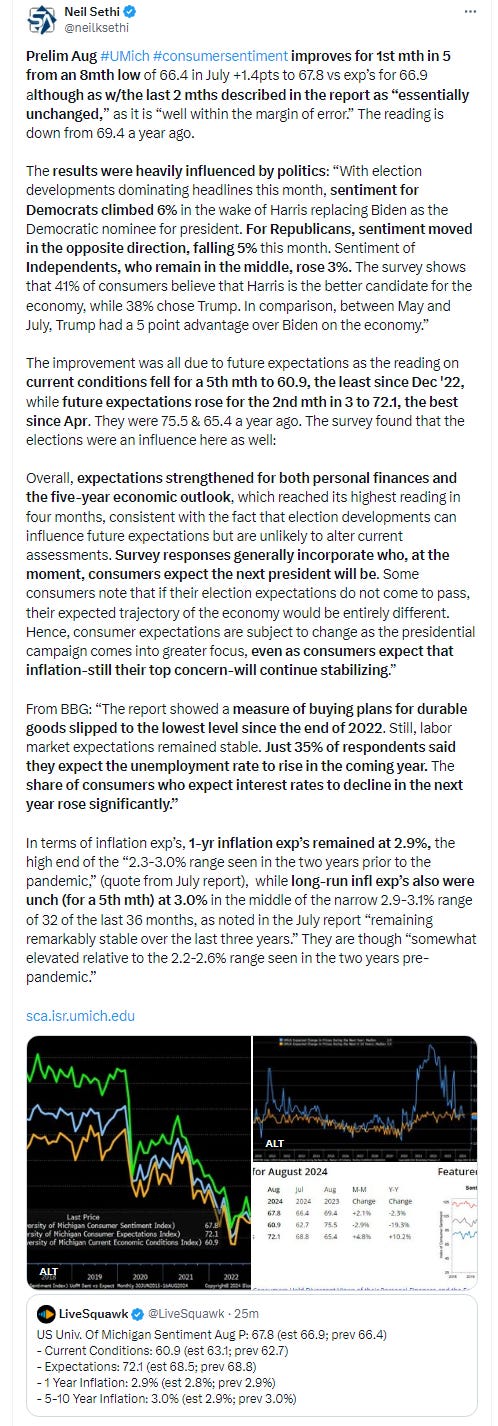

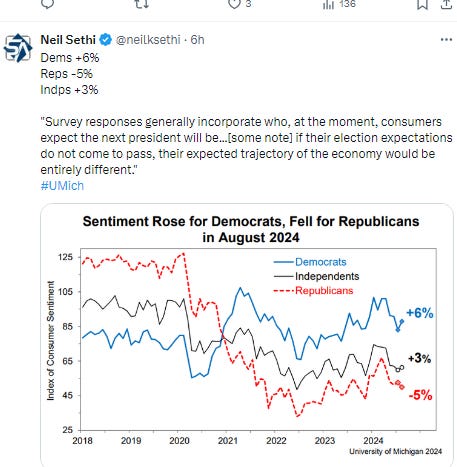

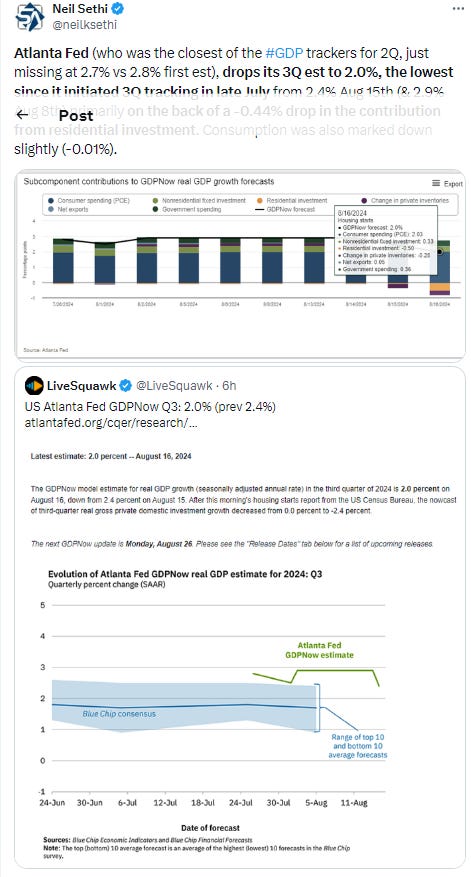

Economic data was a little lighter. We got housing starts and building permits, the first of which fell sharply with single-family starts falling the most since the early days of the pandemic to the lowest levels since that time. However, with the over half of housing starts in the South, they very well might have been weather distorted (Hurricane Beryl). Permits though also fell back to least since June 2020, so Hurricane or not, residential construction is in a recession. This dragged down the Atlanta Fed 3Q GDP estimate by four tenths to 2.0%. We also got U of Michigan consumer sentiment which improved for the 1st mth in 5 driven by independents and Democrats as Republican sentiment fell back. Inflation expectations remained unchanged near or at the post-pandemic lows. Buying plans for durable goods though fell to the lowest since 2022.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX edged a little higher to best close since July 22nd, now just 2% off its ATH. As noted Thursday, it’s now well over the 50-DMA and with the MACD "cover shorts" crossover & RSI pushing over 50, so this could really run at least into next week. I had said CPI could have a lot to say about whether we revisit the lows. As I said Wednesday “I still don’t think we’re out of the woods (as I said normally it’s not right away, but when people have gotten comfortable that we won’t revisit the lows), but these are good indicators that those lows should hold.” As I noted Thursday, I’m now one of those starting to wonder if we do come back down as is historically normal.

The Nasdaq Composite a very similar story to highest close since July 23rd (day of Alphabet earnings) and edging over its 50-DMA.

RUT as I noted has a relatively clear path to test the 2180 level, and it got a little closer today. Its MACD and RSI are quickly turning but remain negative for now.

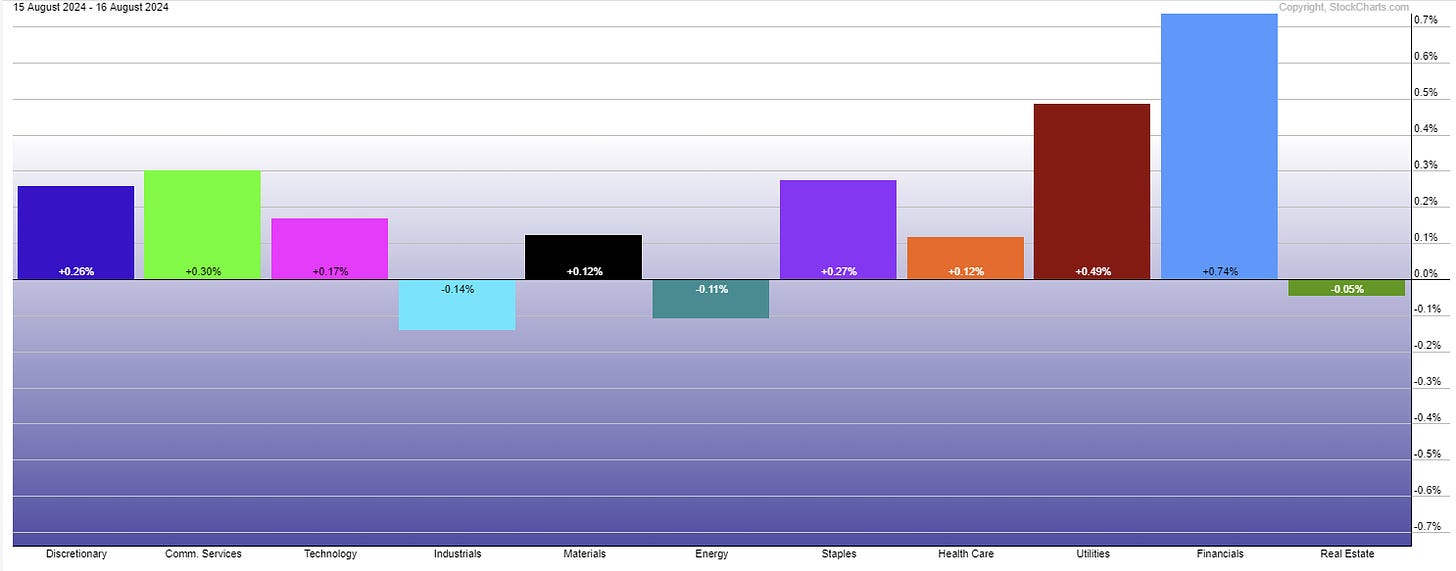

SPX sector breadth pretty good for a mildly up day with 8 sectors advancing although only two were up more than +0.3% and none up over +0.75%. Still no sector down more than -0.14%.

Stock-by-stock SPX chart from Finviz overall consistent with a little more green than red.

Positive volume which was very good Thursday for the NYSE (best of the year) was pretty good Friday at 59%. Nasdaq though was excellent at 69%. While down from 76% Thursday, the index was up 402pts Thursday but just 37 pts Friday, so huge relative outperformance. Issues were 63 & 59% resp, so breadth was strong 3 of the 5 days this week.

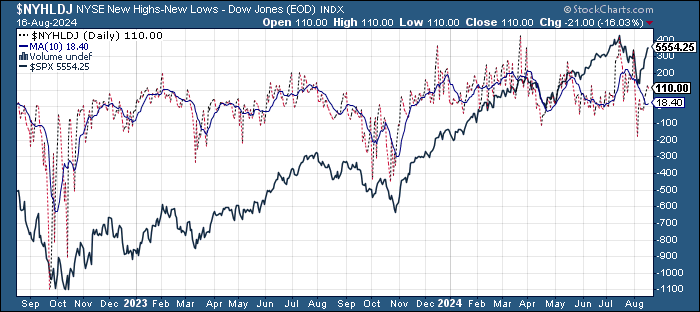

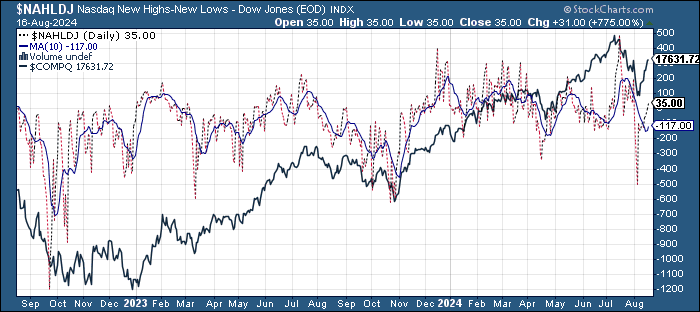

New highs-new lows (charts) though were mixed w/NYSE falling back to 110 from 131 while Nasdaq improved to 33 from 3. Both though are helping the 10-DMAs start to turn higher.

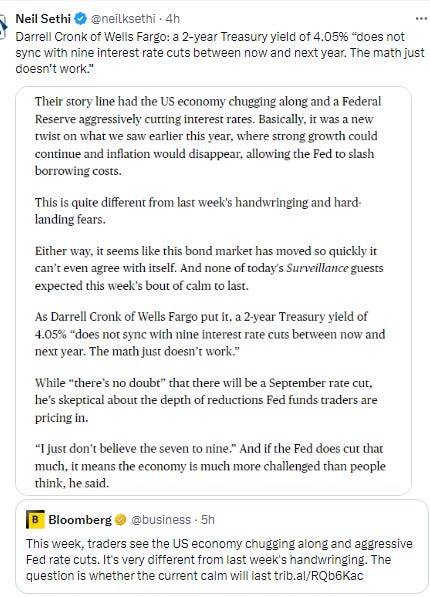

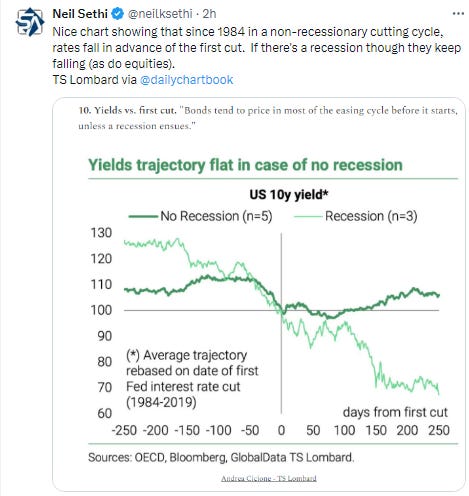

Treasury yields edged lower after Thursday’s jump. The 2-yr and 10-yr note yields both settled four basis points lower at 4.06% and 3.89%. For the week, while it traveled in a 20bps range, 2-yr yields were unch while 10yr yields finished 6 basis points lower.

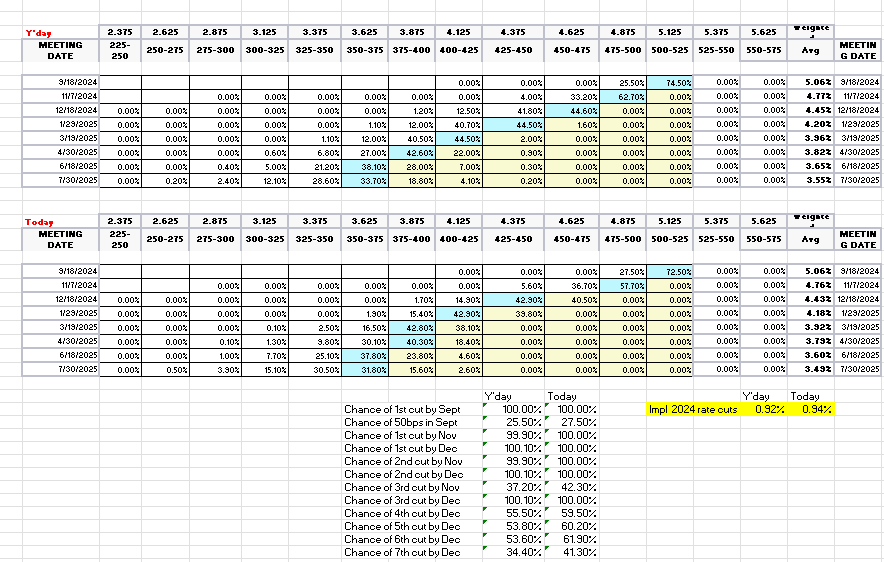

FOMC rate cut probabilities were little changed after shifting notably during the week. 94bps of cuts (so under 4) priced for this yr (from 102 a week ago) w/a 4th cut at 60% from 75% a week ago. A 50bps cut in Sept at 26% from 50% a week ago

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Dollar fell back to the lowest close since Jan 11th, just holding on to the support of the March intraday low. The daily MACD & RSI remain negative.

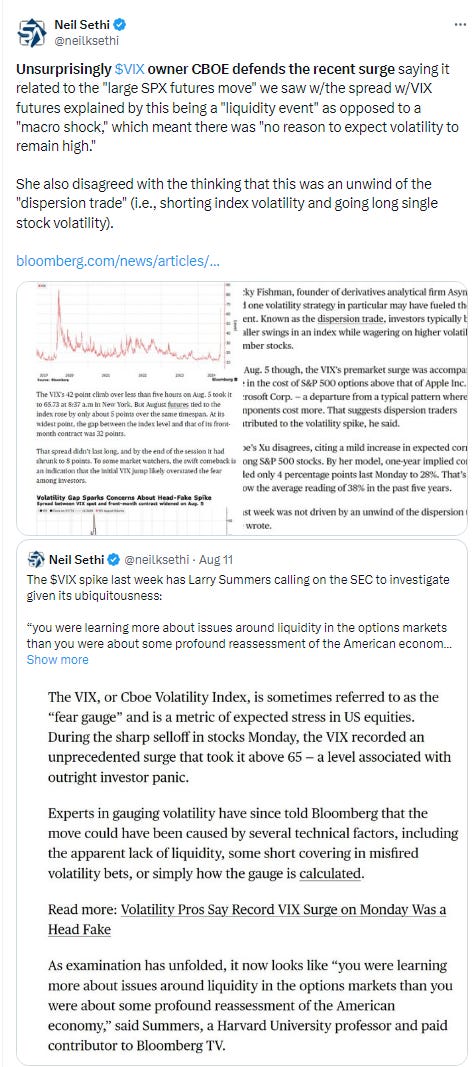

VIX continues to drift lower, now in the 14’s. Lowest close since July 23rd.

WTI fell for 3rd day in 4 as Mid-East peace efforts continue to gain traction. I had said last week I had my doubts about it getting over the $80 level absent a jump in hostilities in the Mid-East which isn’t resolved quickly, and as it looks like those are going the other way, so are oil prices. Daily technicals are softening as well.

Gold pushes higher all day with now clear break above $2500 to ATH. It's got its daily MACD & RSI breaking out to boot.

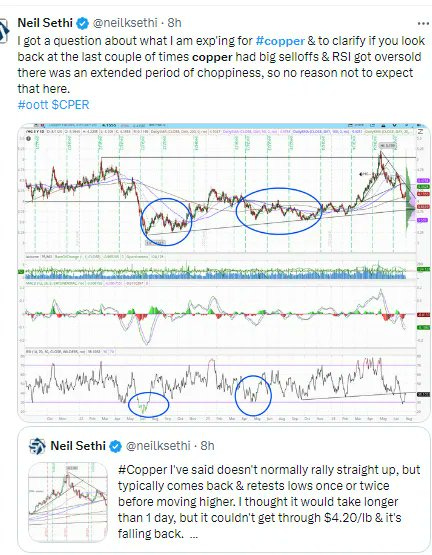

Copper held in despite the settling of a strike at a mine which is responsible for 5% of global supplies. As I said Monday, though, until/unless it closes over the downtrend line from the highs, I’m going to keep my expectations in check, but I also noted that the daily MACD and RSI have flipped more positive which may at least mark a bottom. As a reminder a sideways trade for weeks/months has been my expectation. If it broke out now and didn’t come back down that would be unusual.

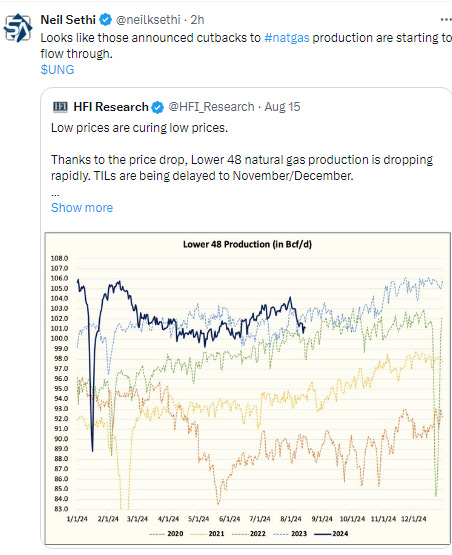

Nat gas fell back to a 1-week low taking a break from its daily tests of the $2.25 level. It’s starting to make me think it’s just not going to get through despite the favorable MACD & RSI which gave us that same setup that has seen bottoms in the past year.

Bitcoin continues to trade in its established range since late February. Daily MACD & RSI remain tilted negative for now.

More on Sunday.

Link to today’s posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,