Markets Update - 9/12/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

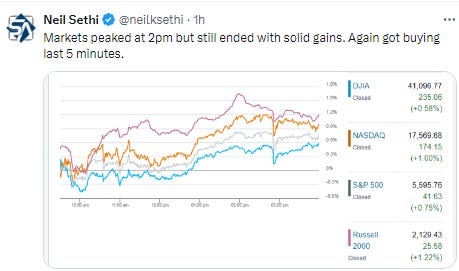

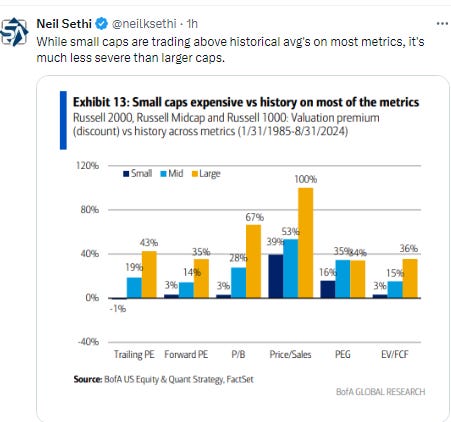

US equities kept the rally going today with the SPX and Nasdaq gaining for a 4th session on continued growth leadership, but today the ball was shared a little more equally particularly with small caps with the Russell 2000 up over 1%. Every sector though was in the green (even if some barely).

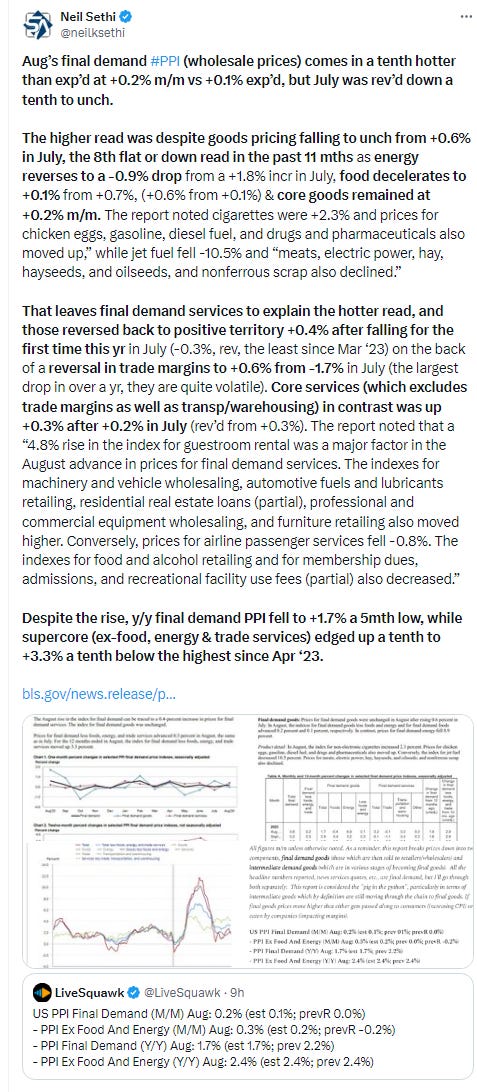

Bond yields edged higher following a slightly hotter than expected PPI report and weak 30yr Treasury auction. The dollar though fell back, helping gold move to an all-time high. Crude, copper, nat gas, and bitcoin also all advanced.

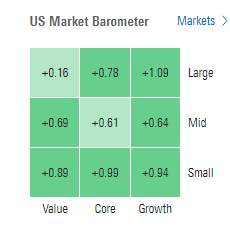

The market-cap weighted S&P 500 was +0.8%, the equal weighted S&P 500 index (SPXEW) +0.6%, Nasdaq Composite +1.0% (and the top 100 Nasdaq stocks (NDX) +1.0%), the SOX semiconductor index -0.2%, and the Russell 2000 +1.2%.

Morningstar style box shows the strength in large cap growth for a 4th day but every style was in the green.

Market commentary:

“The remarkable rebound rally yesterday stunned investors and left many wondering if it was just an ephemeral head fake or the start of a more sustained period of stability (we’re more in the latter camp as macro fundamentals remain supportive, but elevated valuations remain a huge obstacle),” said Adam Crisafulli of Vital Knowledge.

“For much of the last three years now in a week with both CPI and PPI, these would easily be the most important reports of the week,” said Bespoke Investment Group strategists. “Now that the Fed has shifted focus from inflation to employment, though, yesterday’s CPI report had much less than normal fanfare, and most traders probably didn’t even know there was a PPI report today.”

“With PPI basically repeating yesterday’s CPI reading and jobless claims in line with expectations, the decks have been cleared for the Fed to kick off a rate-cutting cycle,” said Chris Larkin at E*Trade from Morgan Stanley. “The markets are anticipating an initial 25 basis-point cut, but the discussion will soon turn to how far and fast the Fed is likely to trim rates over time.

“Generally, folks are in wait-and-see mode ahead of the Fed next week,” Edward Jones senior investment strategist Mona Mahajan said, noting that markets have been volatile amid a seasonally weaker September and that she still expects “cooling, but not collapsing” economic growth. “We think this choppiness could continue,” Mahajan continued. “But if we are in this backdrop where the Fed is cutting rates and inflation is moderating gradually — and we can pull off a soft landing — then, historically, markets should continue to perform well in that backdrop. For us, that remains the base case.”

“Recognizing that the Fed can surprise ‘dovish’ right now, whereas it cannot surprise ‘hawkish’, we think PPI sustains a lingering possibility of a starter 50, which would take less risk with the soft landing,” said Krishna Guha at Evercore.

“Overall, we continue to think SPX can make a marginal new high into or around next week’s FOMC before a tougher period begins once again into October,” analyst Jonathan Krinsky said in a Thursday note, adding that mega-cap tech will likely seeing a consolidation as investors rotate into laggards.

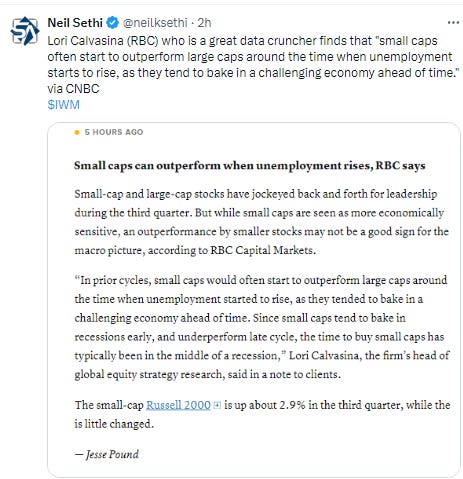

Eric Johnston at Cantor Fitzgerald says that going into the Fed decision, there’s a “very good” set-up for small caps. That’s the group considered to have the most-positive leverage to a policy easing cycle, he noted, citing the fact that the Russell 2000 has largely underperformed the S&P 500 in the past few weeks. “The consensus is that the Fed will cut 25 bps, but there is of course a chance that they end up cutting 50 bps,” Johnston said. Small caps “would get a significant rally if it was 50 and still rally with a very dovish 25,” he noted.

In individual stock action, shares of megacap tech and semiconductor names continued to rally on Thursday, including Nvidia (NVDA 119.14, +2.24, +1.9%), which is nearly 16% higher than Friday's close. Alphabet and Facebook parent Meta Platforms each gained more than 2%. A gauge of the “Magnificent Seven” megacaps climbed 1.4%, but Micron Technology Inc. sank on a downgrade, and Wells Fargo & Co. slid on news the US is seeking fixes to money-laundering controls.

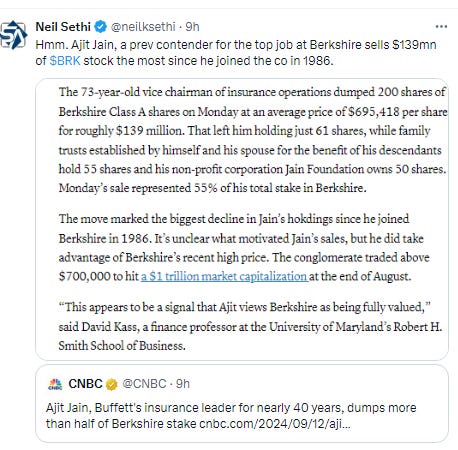

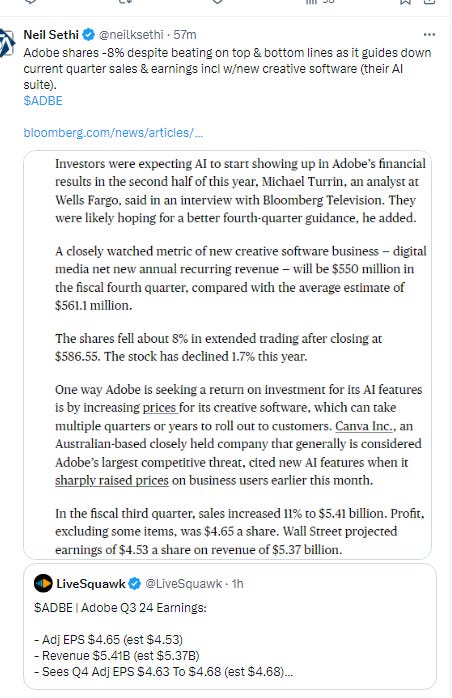

After hours Adobe Inc. tumbled on a disappointing revenue outlook, while Oracle advanced nearly 6% after raising its revenue guidance.

BBG’s Corporate Highlights:

Verizon Communications Inc. will take a pre-tax charge of as much as $1.9 billion in the third quarter tied to 4,800 planned job cuts.

Delta Air Lines Inc. said profit this year could reach the high end of its prior guidance – if investors ignore the financial blow from this summer’s system meltdown.

Alaska Air Group Inc. boosted its outlook for third-quarter profit on strong summer demand and lower-than-expected fuel costs.

American Airlines Group Inc. flight attendants approved a contract that will immediately raise wages as much as 20% and increase pay and benefits by $4.2 billion over the deal’s five-year term.

Kroger Co. lifted its full-year sales guidance as the grocery-store operator benefits from consumers prioritizing spending on groceries and other essentials.

Some tickers making moves at mid-day from CNBC.

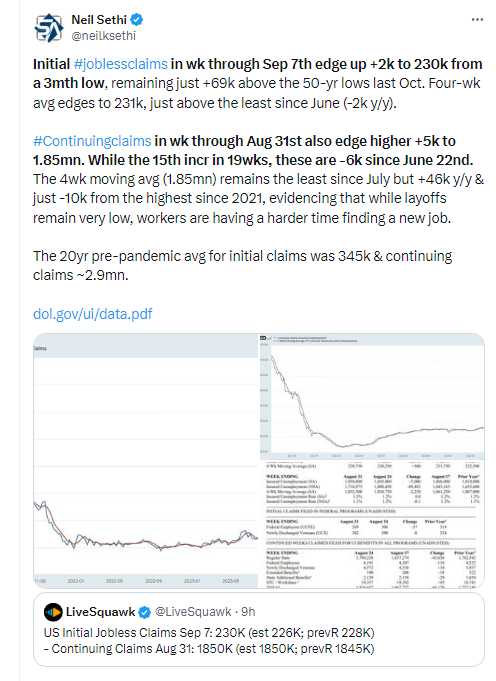

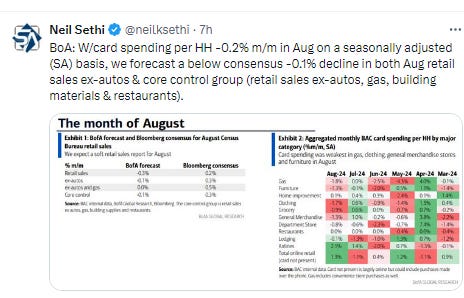

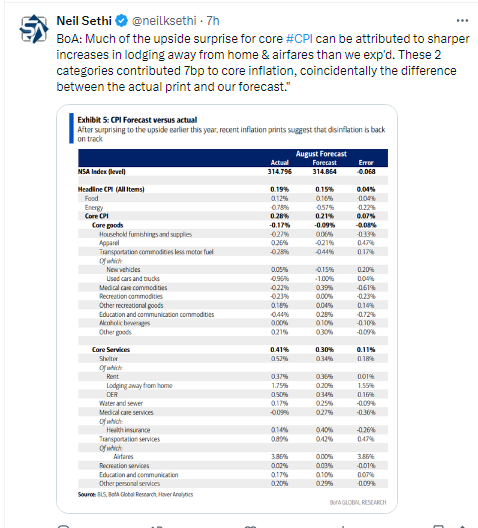

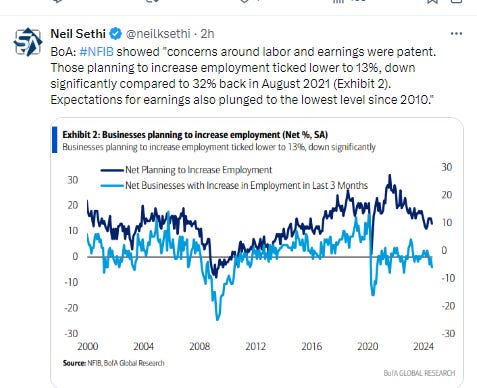

US economic data highlighted by the Aug PPI report which came in a tenth hot (but July was revised lower by a tenth offsetting that) as services priced remained sticky. Jobless claims remained little changed.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX keeps moving through resistance, today the 20-DMA, now with just the modest resistance of the downtrend line from the highs standing between it and a retest of those highs. The daily MACD & RSI have turned more neutral and are close to flipping positive.

The Nasdaq Composite made it through its 50-DMA. It has a little more resistance to work through but its daily MACD & RSI are also turning more positive.

RUT remains under even more resistance now up to its 50 & 20-DMAs. Its daily MACD & RSI are less positive but also turning.

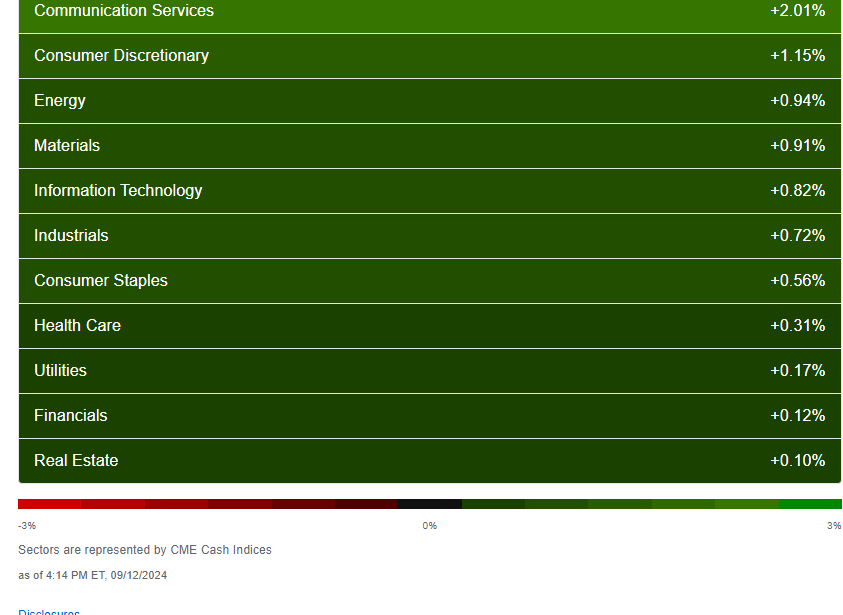

Equity sector breadth improved notably despite weaker index gains at the large cap level than yesterday with smaller caps much stronger. Every sector was up led again today by growth stocks (growth heavy comm’s & discr top 2 sectors & tech was 5th all up at least +0.8%). 6 sectors up at least +0.5%. Defensives lagged.

Stock-by-stock SPX chart from Finviz confirms with a lot more green today.

Positive volume Tuesday improved on the NYSE as might be expected from the strong day for the RUT which was weaker yesterday. That came in at 71% while Nasdaq fell to 64% from 71% Wed. That remains fairly (weak in fact both are pretty weak given the index gains). Issues were 75 & 60% resp.

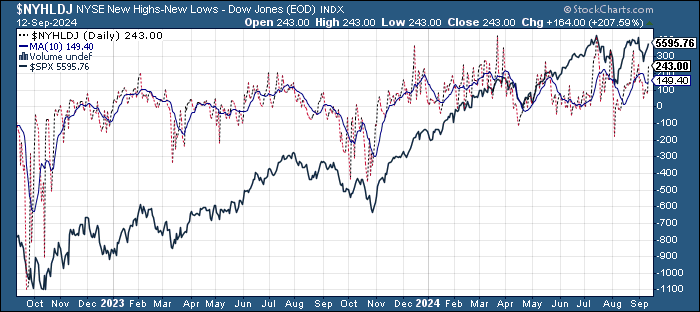

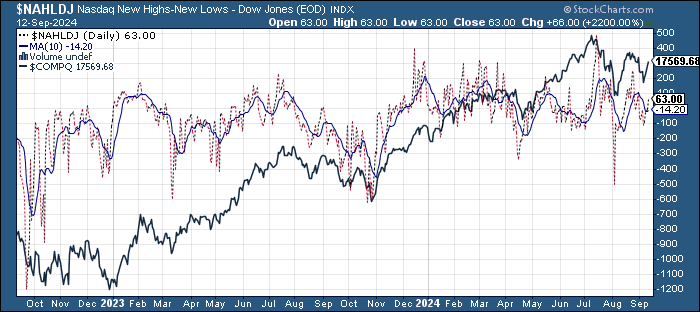

New highs-new lows (charts) though were much improved at 243 NYSE, 59 Nasdaq. That’s the best for both this month and has the 10-DMAs starting to curl up (more bullish).

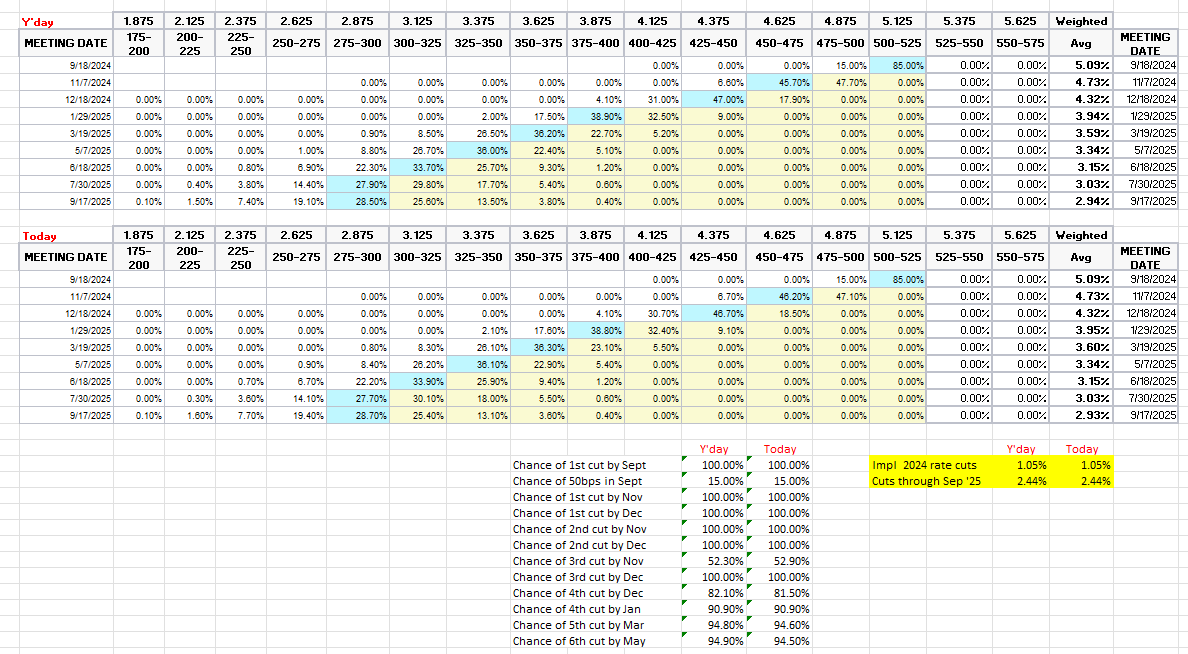

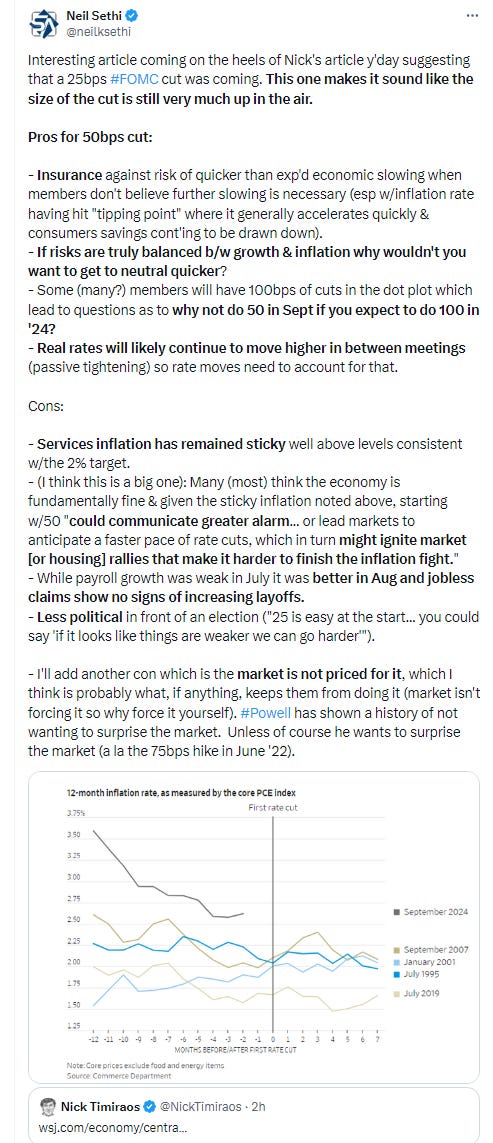

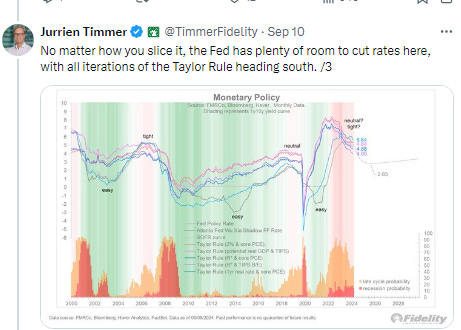

FOMC rate cut probabilities got back much of what was priced out yesterday following a Nick Timiraos article that breathed life back into chances for a 50bps Sept cut. That moved back to a 28% probability (& 50bps by Nov to 66%). Now 109bps of cuts are expected this yr. Cuts through Sep '25 though curiously fell 3bps to 241.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

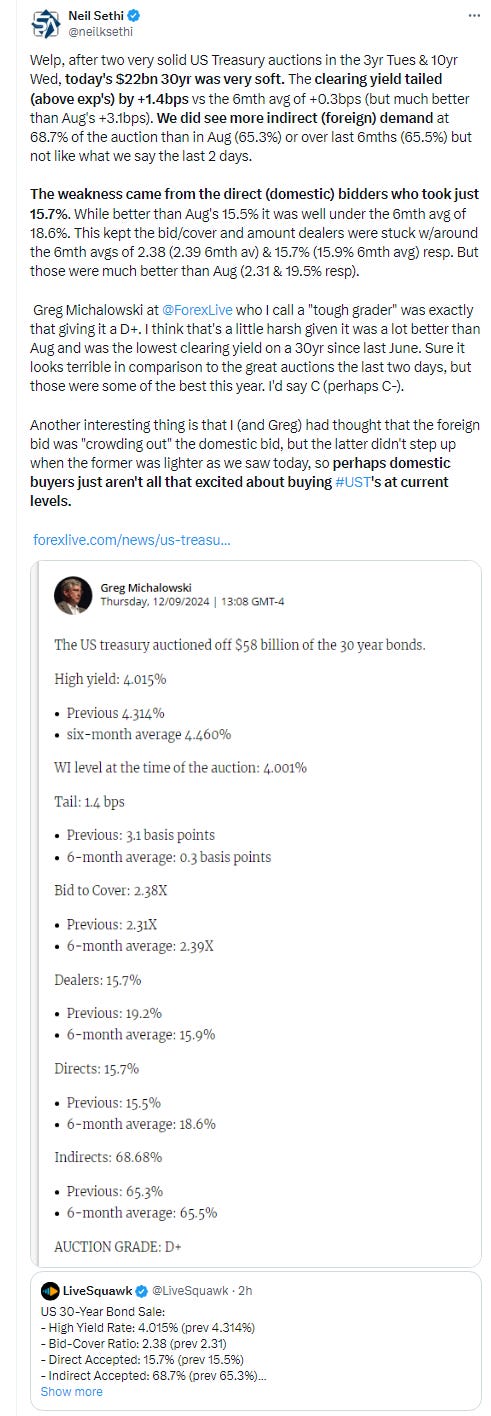

Treasury yields rose again following the hotter than expected Aug PPI report as well as a poor 30-yr Treasury auction although the moves remained modest. The 10-yr note yield ended up 3 basis points at 3.68%, 4bps off the least since May ‘23 and still down 23 basis points since the start of last week. The 2-yr note yield settled 1 basis point higher at 3.65%, still down 28 basis points since the start of last week and just off the lowest close since Sep ‘22.

Dollar fell back today to under its 20-DMA (green line). It has some support in the 101 area. But it could just as easily run up to 102 as I mentioned Tuesday.

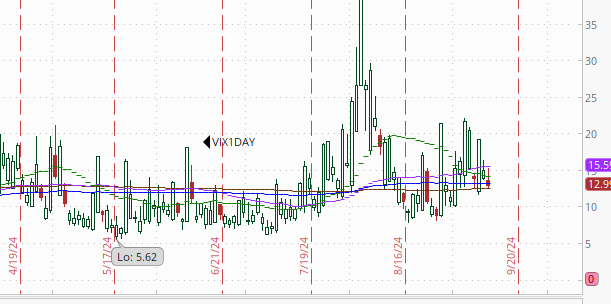

VIX edged a little lower still though with a 17 handle (consistent with 1.1% daily moves), while VVIX refused to fall under the 100 level flagged by Charlie McElligott on the Odd Lots podcast.

1-Day VIX falls back to the 13 area but remains above the single digits it normally trades at without a major catalyst in the coming day.

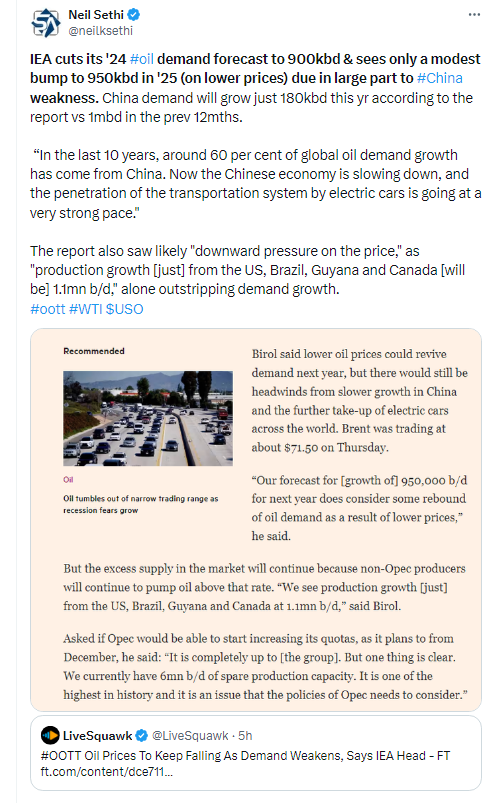

WTI remained very volatile continuing its rebound from 16mth lows Wed with shut-ins in the Gulf taking some supply offline. I’d hazard that much of the rebound today was short covering, so we’ll see how much further it can go, but for now it’s back above the $68 level I targeted yesterday. Next key resistance levels are $70 & $71. If it can get through those, it could run right back to the $77 area. Daily MACD & RSI remain very weak but are starting to improve.

Gold finally broke out of its month-long consolidation moving to an all-time high, now threatening the $2600 level. That has the RSI now more positive & daily MACD looking to turn up as well.

Copper another 1wk high, finally moving over its 200-DMA to the 50-DMA and downtrend line from the July highs. A sustained break of the 50-DMA (meaning two closes over) would be the first since early June. With the daily MACD & RSI turning more positive, maybe we’ll get another little run like we did in early Aug.

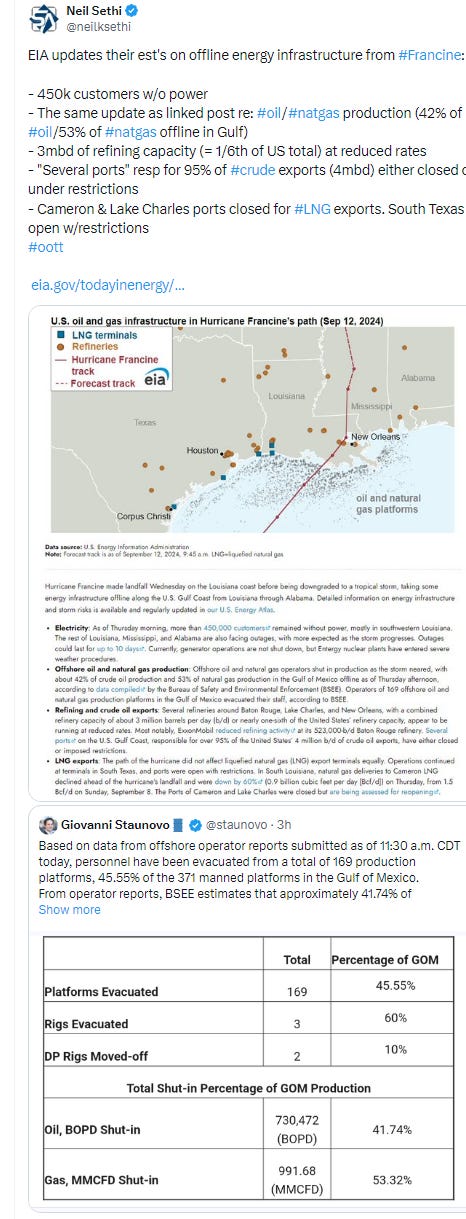

Nat gas moved to a 2mth high pushing further above that key $2.25 level following a bullish storage report despite TS Francine making landfall in Louisiana as a Cat 2 hurricane and putting 3 of the country’s 7 LNG export terminals on hold or under restriction and knocking out power to 450k. Daily MACD & RSI remain supportive so we’ll see if it can keep it going.

Bitcoin futures edged to a 1wk closing high right on the 200-DMA but with layers of resistance still to go (although bitcoin cuts through resistance/support quite easily). The daily MACD & RSI remain negative but are improving.

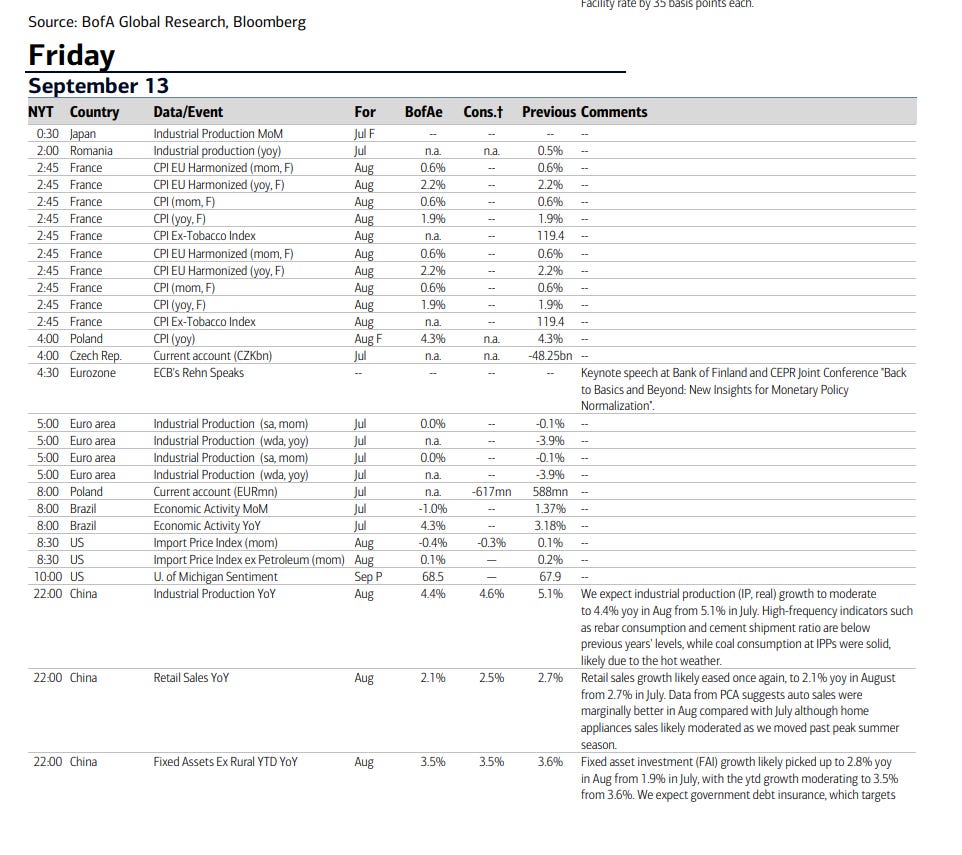

US econ data tomorrow are import prices and the preliminary Sept U of Michigan consumer sentiment survey. No Fed speakers and no Treasury auctions. Also the earnings calendar is literally empty for US reporters (maybe because it’s Friday the 13th?).

Ex-US the calendar is very light as well. We’ll get July industrial production from Japan & the EU. The China data listed below is over the weekend (Saturday).

Link to today’s posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,