Markets Update - 9/6/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

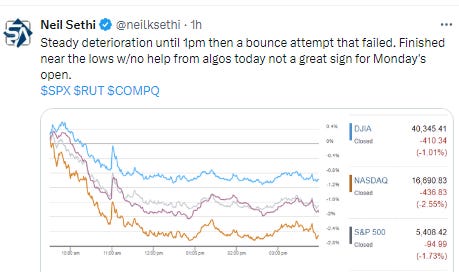

US equities closed out the week with another big drop which left the SPX with its worst week since March ‘23 and Nasdaq since 2022 following a Rorschach test of a nonfarm payrolls report (it had something to support basically any narrative you wanted it to, making the chance of a 50bps FOMC cut in Sept smaller, but still not off the table (and making next week’s CPI print all the more important (a hot print likely doesn’t change anything but a very cool print may tip the scales for a 50bps cut, so prepare for another “biggest data point yet” sort of day))).

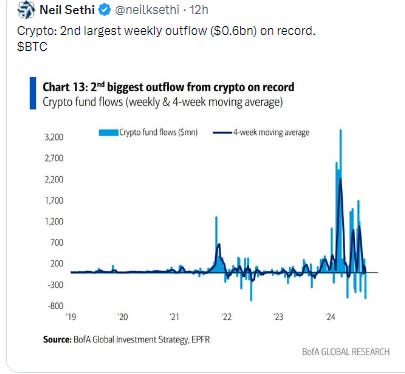

Bonds seemed to focus on the weakness in the report with yields dropping again to 52wk lows as Fed rate cut expectations were mixed (less chance of a 50bps in Sept but more overall rate cuts priced over the next year). The dollar was nevertheless able to rally from steep losses to finish little changed. Nat gas was able to continue its rally but crude, gold, copper, and bitcoin all fell, the first to the lows of the year.

The market-cap weighted S&P 500 was -1.7%, the equal weighted S&P 500 index (SPXEW) -1.2%, Nasdaq Composite -2.6% (and the top 100 Nasdaq stocks (NDX) -2.7%), the SOX semiconductor index -4.5%, and the Russell 2000 -1.9%.

Morningstar style box shows again overall broad weakness today led by large growth.

Market commentary:

“It’s a sentiment-driven move that’s largely driven by growth concerns,” said Emily Roland, John Hancock Investment Management co-chief investment strategist. “The market’s oscillating between this idea of is bad news bad news, or is bad news good news and the sense that it may revive hopes that the Fed moves more aggressively than markets anticipate.”

“Markets have turned their attention toward how much the Fed will ease and how fast the economy is slowing,” said Scott Wren at Wells Fargo Investment Institute. “Expect the near-term volatility.”

“August employment data continue the portrayal of an economy running out the string, nearing an inflection point,” according to Steven Blitz at TS Lombard. “Whether inflection turns into recession, or something less negative, depends upon how aggressive the Fed counters current negative momentum. Does the Fed go 25 or 50?”

To Krishna Guha at Evercore, Fed Governor Waller’s remarks today [noted below in the FOMC section] expressed a clear preference for getting started with 25 basis-point cut in September and be ready to accelerate to 50 basis points in November or any subsequent meeting if risks to employment increase. “This is not the worst possible approach,” Guha said. “But in our view, it is still not sufficiently forward-leaning in terms of risk management, and as such ‘not risk-friendly’ for markets.”

While Fed Chair Jerome Powell has said the Fed does not welcome further cooling in the labor market, the numbers are trending in that direction (with revisions), according to Don Rissmiller at Strategas. “For insurance against downward downward revisions, the Fed should cut by 50 basis points in September,” he said. “They look behind the curve currently.”

Amid all the discussion about the size of the Fed reduction, “it strikes us” that the market is readying for a “photo finish” based on the August inflation profile — although employment will undoubtedly be weighted more heavily by officials at this stage in the cycle, according to Ian Lyngen at BMO Capital Markets. “Perhaps it will be more akin to a game-time decision? Either way, many have thrown in the towel and will be sitting on the sidelines as the debate moves into overtime. It goes without saying that the Fed is running down the clock on terminal and rate cuts are at the starting blocks. Powell needs a slam dunk to stick the landing,” he noted.

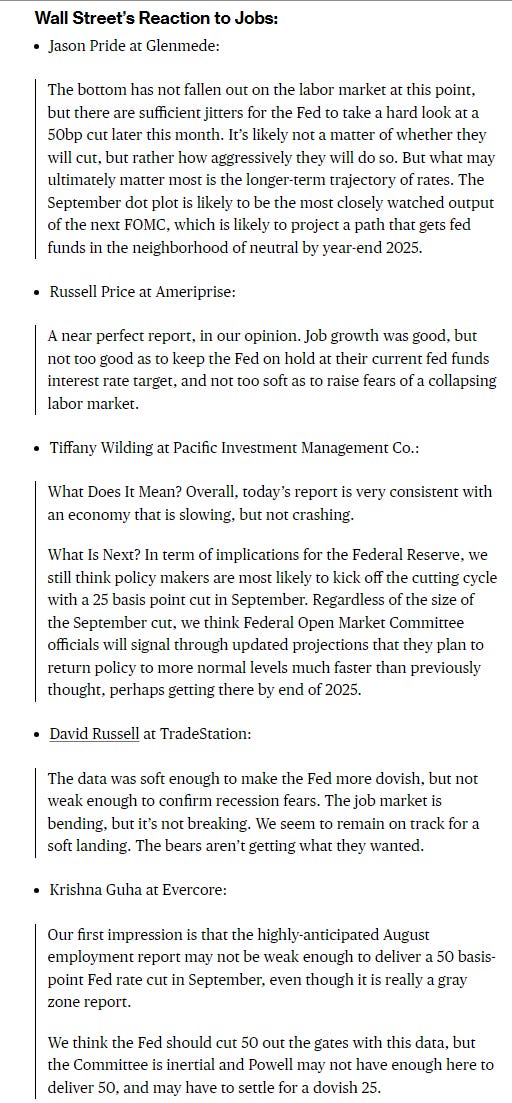

More Wall St reaction to the jobs report:

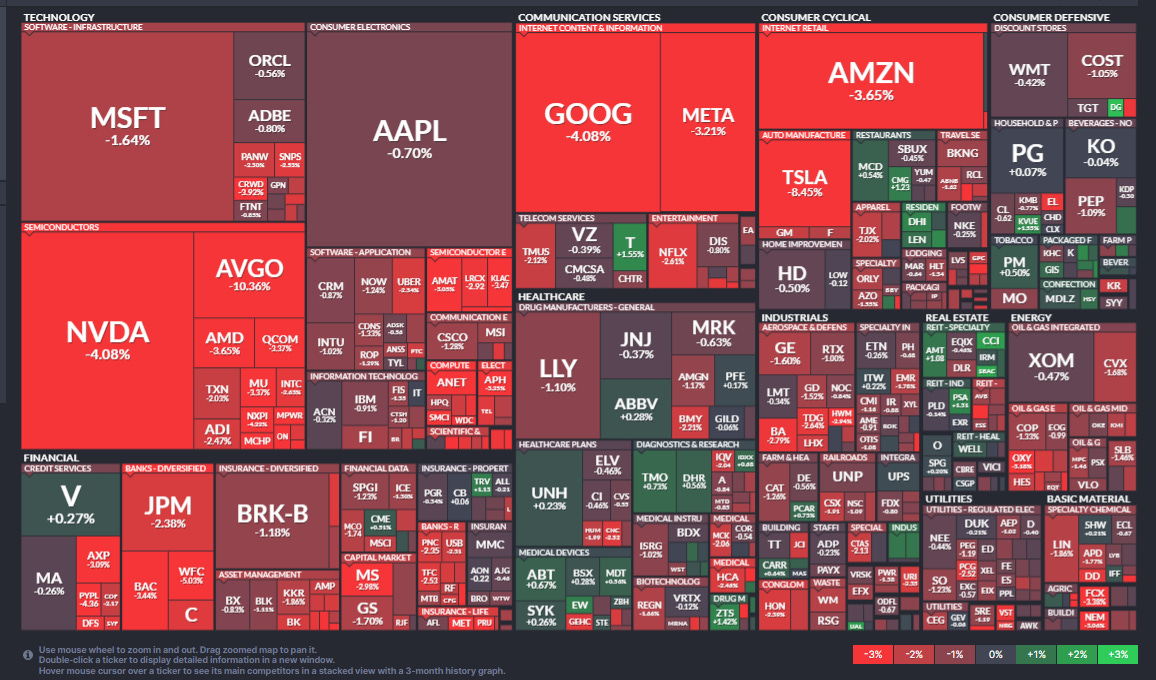

In individual stock action, Amazon and Alphabet slumped about -4% each, while Meta Platforms lost more than -3%. Broadcom shed -10% on lackluster current-quarter guidance. Other semiconductors fell in sympathy, with Nvidia and Advanced Micro Devices dropping about -4% each. The VanEck Semiconductor ETF declined -4%, and notched its worst week since March 2020.

For the week, tech declined more than -7%, making it the biggest underperformer in the S&P 500 with chipmakers Broadcom, Intel, KLA Corporation and Nvidia leading the sector’s declines with sell-offs of -14% and more. Energy was the 2nd worst-performing sector, declining nearly -6% for the week. APA Corporation dropped around -12%. Valero Energy and Occidental Petroleum shed more than -8% each.

Some tickers making moves at mid-day from CNBC.

In US economic data, it was all about that nonfarm payrolls report. As noted it was a bit of a Rorschach test. Overall my take is it was more evidence of “normalization” of things than a flashing red indicator of an oncoming recession, but it certainly I don’t think was consistent with big worries about inflation being an issue versus labor markets, meaning it did nothing to take a Sept rate cut off the table (even as it dialed back the chance of a 50bps cut). With everything going on today, I wasn’t able to do a full breakdown, so I’ll try to get that done in the next few days along with the other economic reports I didn’t get to this week.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX dropped through the 50-DMA on the open and made it almost to the 100-DMA (blue line) consistent with my thinking Wed that further declines were not unlikely given “the daily MACD & RSI have now turned more negative with the former crossing to ‘sell longs’ and the latter falling below 50.”

The Nasdaq Composite fell through its 100-DMA to the lowest close in nearly a month and like the SPX its daily MACD & RSI have flipped to negative.

RUT fell to its 100-DMA, and also has seen its daily MACD & RSI flip more negative.

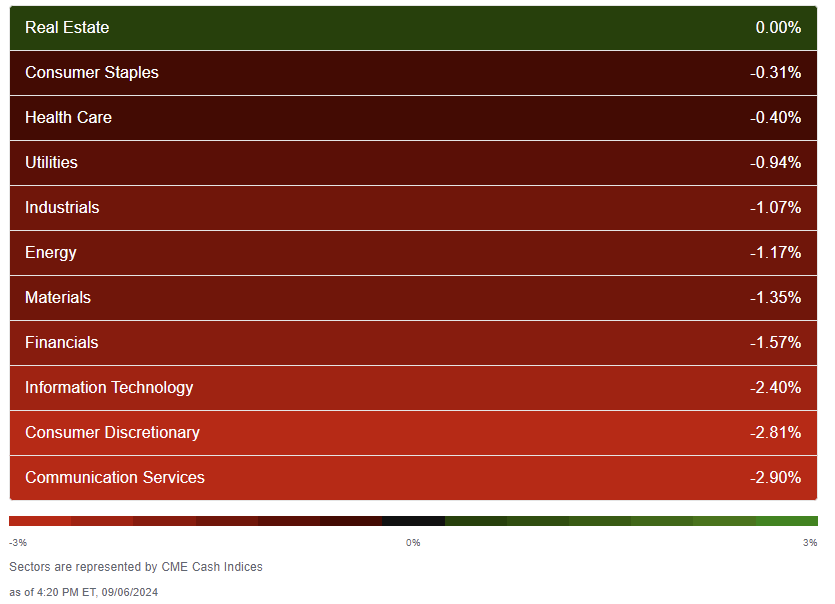

Equity sector breadth deteriorated as you’d expect w/no sector finishing in the green. RE was the closest finishing flat. 8 of 11 were down at least -0.9% w/the megacap growth sectors (tech, discr, comm servs) all down over -2%. As a reminder, the below is based on CME cash indices.

Stock-by-stock SPX chart from Finviz consistent with just a smattering of green.

Positive volume Friday was the weakest since Aug 5th (which was the worst in over a year) but not “panic selling weak” at 22% NYSE, 27% Nasdaq. Issues were 23% for both.

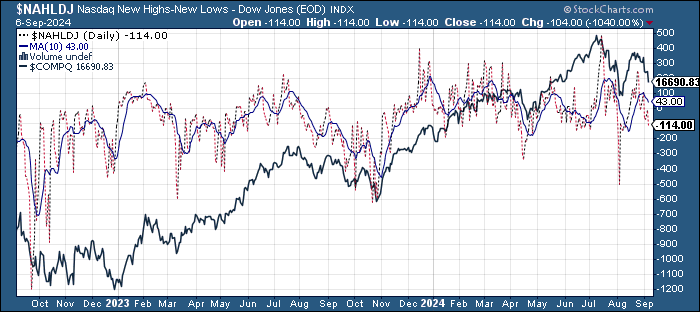

New highs-new lows (charts) also dropped to the least since Aug 12th at 53 & -117 resp. The 10-DMAs on both continue to roll over (less bullish, more severely on the Nasdaq).

Treasury yields fell again with the 10-yr note yield 2 basis points lower today, and 20 basis points lower this week, at 3.71%, the lowest close since June ‘23. The 2-yr note yield settled 10 basis points lower today, and 28 basis points lower this week, at 3.65%, the lowest close since Sep ‘22.

FOMC rate cut probabilities were volatile today but ended up with much less of a chance of a 50bps cut in Sept but more overall cuts expected this year and over the next year. Bets on a 50bps Sept cut ended the day at 31%, where they were coming into the week (but at one point today they were 50%). But there's still 114bps of cuts priced in for this yr (up from 103 last Fri) & 243bps through Sep '25 (up from 215).

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Dollar was volatile Friday, at one point falling near the 52wk lows of last week, before bouncing and finishing little changed. Still it remains under the downtrend line from the start of August. Daily MACD & RSI are mixed.

No huge surprise that the VIX pushed back over 20, a level implying a move of around 6% over the next mth & VVIX further over the 100 level flagged by Charlie McElligott on the Odd Lots podcast. Also notably 1-Day VIX remains elevated at over 20, prior to August around the highest since inception in Apr ‘23. That is something given there is no particular event risk on Monday (no major data reports, central bank meetings, etc.).

WTI selling picked back up Friday after Thursday’s respite taking it through the key $67.71 level (December lows) to a 14-mth low before it rebounded to close just over (some relief to bulls). Still it was WTI’s worst week since October down -8%. Brent was down even more (nearly -10%).We know from the COTC data that there was a lot of selling and shorting in the week through Wednesday, and that likely continued through today consistent with my thinking that there’s been heavy systematic selling. As noted Wednesday the “good” news of daily MACD & RSI having higher lows is starting to give way.

Gold gave back yesterday’s gains falling back to the 20-DMA, but overall continuing its sideways trade of the past three weeks just below ATH’s. As noted Thursday though the action has seen the daily MACD & RSI turn a bit negative.

Copper gave back yesterday’s bounce rejected by the 200-DMA. I noted Thursday “it needs to get back over that before we can really look higher”, so for now I’ll stick with my thinking on a continuation of the sideways trade. Daily MACD & RSI also have turned negative.

Nat gas I noted Thursday after it closed over $2.25 “with the favorable technical setup, it's got everything in its favor to take a run higher,” and it did put some breathing room between it and the $2.25 level. Good news is basically no resistance all the way up to $3, although I’d like to see a big up day to give me more confidence before betting on it. Daily MACD & RSI are supportive.

Bitcoin futures look like they’re not going to choose the quick bounce option after falling below the 200-DMA for the first time since Mar ‘23 on Thursday as it fell just below the key $53k level. Seems it might be setting up a test of the Aug 5th spike low at the $50k level which is even a more important level. The daily MACD & RSI have now flipped squarely negative though.

More on Sunday.

Link to today’s posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,