Morning Update - March 29, 2022

Morning Update - March 29, 2022

SPX = S&P 500

Naz = Nasdaq Composite

NDX = Nasdaq 100 (100 largest stocks in the Naz)

RUT = Russell 2000 (smaller stocks)

DMA = Daily Moving Average (the moving average over the given time period (20, 50, 100, 200 days normally)).

MACD = Moving Average Convergence Divergence (basically a trend indicator)

RSI = 14-day Relative Strength Index (basically what it sounds like)

Also, on my charts, the lines are 20-DMA (green), 21-DEMA (red), 50-DMA (purple), 100-DMA (blue), 200-DMA (brown)

Source abbreviations: BBG = Bloomberg; WSJ = Wall Street Journal; RTRS = Reuters; SA = Seeking Alpha; HR = Heisenberg Report

_______________________________________________________________________

Global stocks are moving higher this morning on constructive statements from both parties in the Ukraine peace talks. In summary, Ukraine says there's ground for a meeting between leaders, Russia confirmed that meeting is possible, and Russia says they'll cut military operations near Kyiv calling the talks “constructive”. Bonds continue their volatility recovering from earlier losses, and the dollar, oil, and gold are all getting hit on the more positive tone. In the US, around 9am ET, futures have the SPX, NDX and RUT +0.8, 1.1, and 0.9% respectively.

Here's the SPX futures this morning around 9 ET. Now at highest since mid-January. Seems to have clear sailing to the 4700 area.

In U.S. corporate news (Argus):

FedEx (FDX 234.75, +4.70): +2.0% after announcing that Frederick Smith, Chairman and CEO, will become Executive Chairman, and COO Raj Subramaniam will be promoted to CEO on June 1. Nielsen (NLSN 26.85, +4.64): +20.9% after agreeing to be acquired by a private equity consortium led by Evergreen and Brookfield (BAM 57.00, -0.18, -0.3%) for $16 billion in cash, including debt. L HC Group (LHCG 168.94, +11.71): +7.5% after agreeing to combine with UnitedHealth's (UNH 514.01, +0.81, +0.2%) Optum group for $170 per share, or about $5.4 billion, in cash. Dave & Buster's (PLAY 40.80, -2.32): -5.4% after missing revenue estimates

Asia

Major equity indices in the Asia-Pacific region ended Tuesday on a mostly higher note. Japan's Nikkei: +1.1% Hong Kong's Hang Seng: +1.0% China's Shanghai Composite: -0.3% India's Sensex: +0.6% South Korea's Kospi: +0.4% Australia's ASX All Ordinaries: +0.8%.

In news: The Bank of Japan conducted another emergency buying operation, receiving more demand than what was seen on Monday. Japan's Prime Minister Kishida ordered the compilation of the next stimulus package by the end of Apri l. The Bank of Japan expects the country's CPI to accelerate in April. South Korea is expected to announce an extra budget. China Securities Journal speculated that the reserve requirement ratio may be cut in Q2.

In economic data:

Japan's February Unemployment Rate 2.7% (expected 2.8%; last 2.8%)South Korea's March Consumer Confidence 103.2 (last 103.1)

Australia's February Retail Sales 1.8% m/m (expected 1.0%; last 1.8%)

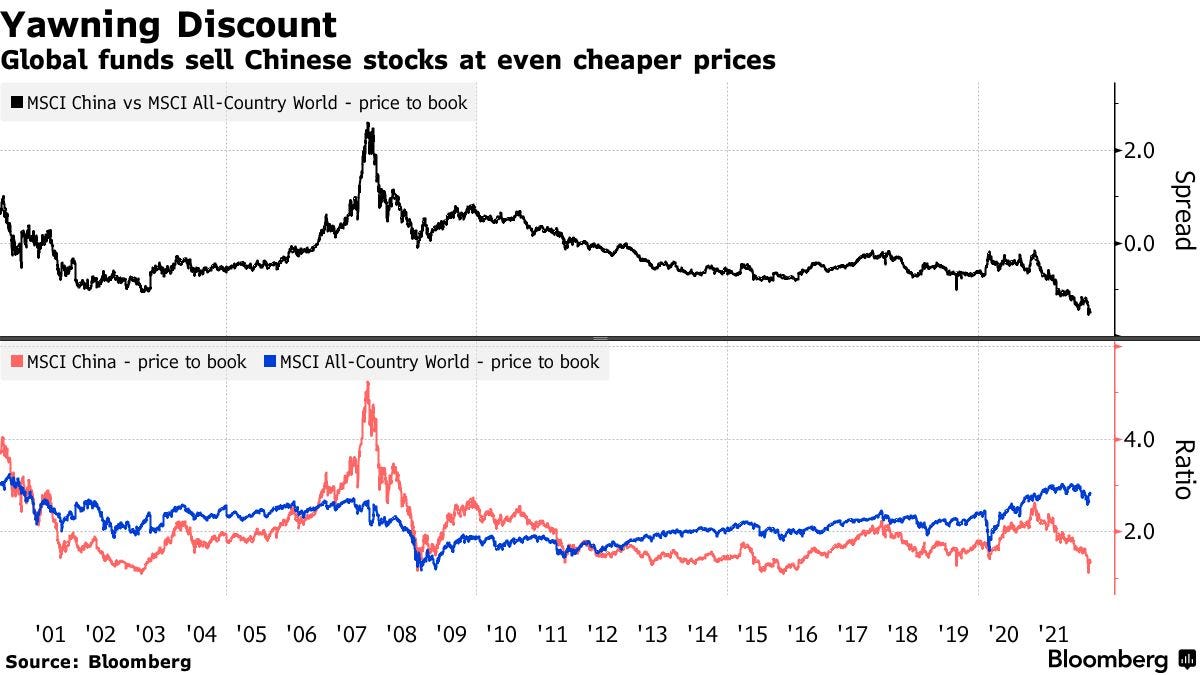

As many are saying it will take some doing for President Xi to overcome investor hesitancy. As we know from the change in tone in recent weeks, this is something that matters to the Chinese government, so I am more constructive on China stocks than I was a couple of months ago. The cheap prices don’t hurt. BBG.

While there’s little doubt Chinese assets are cheap -- the MSCI China Index of stocks trades near the biggest discount to global peers in more than two decades -- for many investors, the downsides of China exposure outweigh the potential upside. The trauma of investing in Russia, where sanctions and capital controls made internationally-held assets effectively worthless, has prompted investors to look at China in a different light.

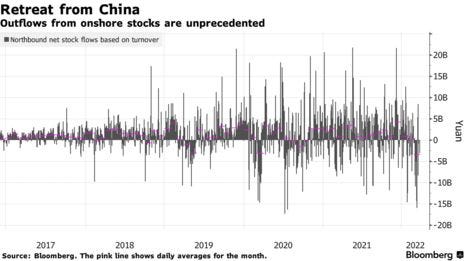

Capital flight is a growing concern. The Institute of International Finance reported an “unprecedented” surge in outflows from China starting in late February, when Russia’s invasion of Ukraine began. In the third week of March, redemptions from China equity funds were the highest since early 2021, while outflows from Chinese bond funds exceeded $1 billion for the first time ever, according to data provider EPFR Global. Foreign selling of the nation’s sovereign bonds last month totaled $5.5 billion, the most on record and ending 11 months of inflows.

Chinese exchange-traded funds saw $3.7 billion in redemptions last week even as Asian markets like Taiwan and South Korea attracted foreign inflows, according to Citigroup Inc. Long-only investors with a global equity mandate now allocate just 2% of their portfolios to stocks in China and Hong Kong, Morgan Stanley’s quantitative strategy team wrote in a March 24 note.

Attracting foreign capital has long been one of Xi’s priorities as he sought to make China’s financial markets more efficient and boost the international usage of the yuan. Since he became president in 2013, the government opened stock and bond trading links with the rest of the world via Hong Kong and successfully pushed for the inclusion of yuan-denominated assets in major global benchmarks.

Europe

As of 8 am Eastern, major European indices trade on a firmly higher note with auto and consumer stocks outperforming. STOXX Europe 600: +1.6% Germany's DAX: +1.9% U.K.'s FTSE 100: +1.3% France's CAC 40: +2.5% Italy's FTSE MIB: +1.9% Spain's IBEX 35: +1.7%. Among individual moves, Barclays Plc fell as a shareholder sold about 900 million pounds ($1.2 billion) of stock, a day after the lender revealed a costly blunder in how it sold billions of dollars in secies.

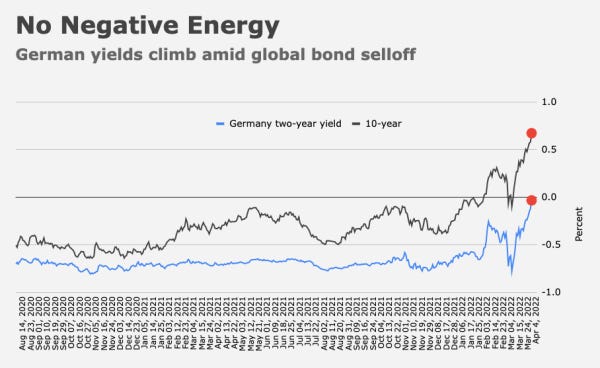

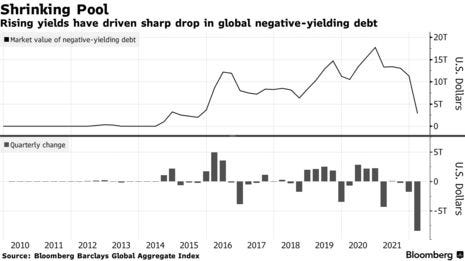

As European yields continue to push higher, which you have to remember are tied to American yields. They all move together to some extent.

In news: Recent reports suggest that Ukraine may be allowed to join the EU if it doesn't join NATO. European Central Bank policymaker De Cos said that the governing council sees inflation stabilizing around target in 2024 under all scenarios.

In economic data: More plummeting confidence surveys, but UK consumer credit comes in well above expectations (although mortgages were below).

Germany's February Import Price Index 1.3% m/m (expected 1.8%; last 4.3%); 26.3% yr/yr (expected 26.9%; last 26.9%). April GfK Consumer Climate -15.5 (expected -14.0; last -8.5)

U.K.'s February Mortgage Lending GBP4.67 bln (expected GBP6.00 bln; last GBP5.93 bln). February BoE Consumer Credit GBP1.876 bln (expected GBP843 mln; last GBP143 mln)

France's March Consumer Confidence 91 (expected 94; last 97)

Spain's February Retail Sales 0.9% yr/yr (last 4.1%)

Commodities/Currencies/Bonds

Bonds - More volatility in bond markets with bonds going from more losses back to close to unchanged levels. At one point the yield curve was down to single digits. I still think we could be getting close to at least some short term relief in the bond selloff. 2-year yields are flat at 2.39%, and 10-year yields are flat at 2.48%. (these levels can be a little different from the evening update). The 3/10 curve and higher is inverted. 2/10 is at 11 basis points.

Dollar (DXY) - A little surprisingly is sharply lower after breaking higher yesterday giving back all of last week’s minor gains as they yen and pound are bouncing back. Not really sure where it’s going from here. Technicals say lower.

VIX - Is moving lower. As I noted last night, now that it’s broken below the 200-DMA it will take a catalyst to move higher. Getting oversold though, so a bounce makes sense. Interestingly it’s at another trendline.

Crude (/CL) - Down again today on the more positive news on war talks along with demand cutbacks from China. Down over -5% again this morning, and now testing he $100 support level I thought we’d see if we broke the 20-DMA, but think this is area is more solid support. 50-DMA is at $98. Daily technicals weak though.

As there does appear to be some impact from the CPC port closures, but far less than the worst case 2mbd.

As Russia’s Transneft shows there’s definitely a slowing of Russian exports as they’re out of storage.

March 29 (Reuters) - Russia's Transneft, operator of the world's largest oil pipeline network, has set caps on oil received by it as storage filled up amid weak demand for Russian fuel, hit by Western sanctions, five sources familiar with the matter said on Tuesday.

But Chinese demand has clearly plummeted.

SINGAPORE, March 29 (Reuters) - Anti-COVID lockdowns have dampened consumption of transportation fuels in China to a point where some independent refiners have resorted to trying to resell crude purchased for delivery over the next two months, traders and analysts said. The current lockdowns in Shanghai, China’s most populous city with 26 million people, and the northeastern province of Jilin have reduced demand in the world’s No. 2 oil consumer and largest crude importer, putting downward pressure on global oil prices that had surged after Russia invaded Ukraine.

Gasoline consumption has clearly been hit by the lockdown in Shanghai, which according to London-based consultancy Energy Aspects, accounts for 3.6% of China’s consumption of the motor fuel. Shanghai’s lockdown has also crimped jet fuel demand, though there are other factors at play in the aviation sector, including an air disaster last week that was China’s worst in 28 years. Energy Aspects has twice lowered its forecasts for second quarter demand for gasoline and jet fuel, reducing them by 131,000 bpd and 155,000 bpd respectively.

As the missile strike from Iran into Iraq appears to have been about more than just Israel.

BAGHDAD/ANKARA, March 28 (Reuters) - A nascent plan for Iraq's Kurdistan region to supply gas to Turkey and Europe - with Israeli help - is part of what angered Iran into striking the Kurdish capital Erbil with ballistic missiles this month, Iraqi and Turkish officials say. Iraqi and Turkish officials who spoke to Reuters on condition of anonymity this week said they believe the attack was meant as a multi-pronged message to U.S. allies in the region - but that a key trigger was a plan to pump Kurdish gas into Turkey and Europe, with Israel's involvement. "There had been two recent meetings between Israeli and U.S. energy officials and specialists at the villa to discuss shipping Kurdistan gas to Turkey via a new pipeline," an Iraqi security official said.

The Iraqi, Turkish and Western sources spoke mostly on condition of anonymity because they are not allowed to give statements to the media. They said the move comes as a politically sensitive time for Iran and the region: the gas export plan could threaten Iran's place as a major supplier of gas to Iraq and Turkey while its economy is still reeling from international sanctions.

As Bolsanaro replaces another Petrobras CEO.

Nat Gas (/NG) - Continues to fall back after struggling at the February highs. Said last night 20-DMA seems a natural place for it to trade down to.

Gold (/GC) - Falling sharply, testing the 50-DMA. Not sure that holds.

Other Commodities -

U.S. Data.

Later this morning we’ll get the Conference Board's Consumer Confidence Index for March, the JOLTS - Job Openings report for February, the FHFA Housing Price Index for January, and the S&P Case-Shiller Home Price Index for February.

Misc.

Random stuff:

And some updates on Ukraine (big news I noted above regarding talks, here’s what BBG noted). This seems consistent with my thoughts over the weekend that Russia will scale back its ambitions to the Donbass, a Crimea land bridge, and a non-NATO Ukraine. BBG.

Moscow said it would sharply cut military operations near the Ukrainian capital of Kyiv and Chernihiv after negotiators from Ukraine and Russia held discussions in Turkey on Tuesday aimed at de-escalating the war.

A Ukrainian negotiator said the country is seeking international security guarantees for territory that doesn’t include the separatist-controlled areas of Donbas and Crimea. Russia indicated the talks could pave the way for a meeting between Russian President Vladimir Putin and his Ukrainian counterpart Volodymyr Zelenskiy

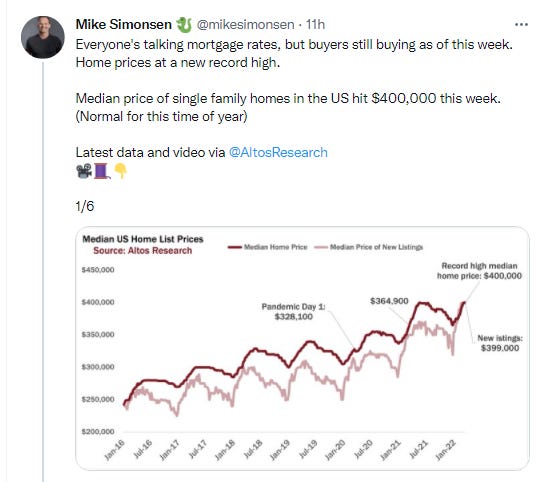

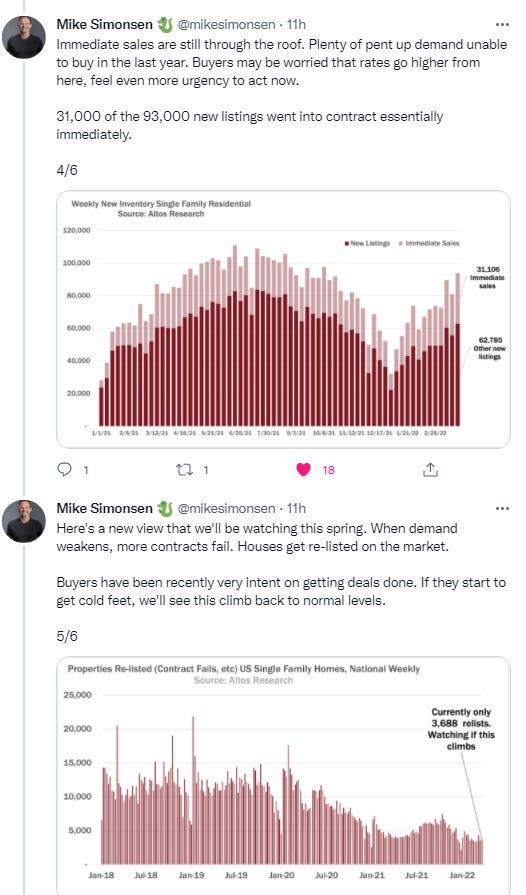

As housing market remains very hot.

And I missed it yesterday but obviously a big topic was the WH releasing the proposed 2023 budget. As the President has no say in the actual budget (other than either signing or vetoing the final legislation) this is more of a “wish list” for Congress (budget bills start in the House). WSJ.

WASHINGTON—President Biden called for the largest-ever level of military spending and increased funding for law enforcement in a $5.8 trillion budget, playing down his proposals for expanding social programs in favor of backing initiatives generally favored by centrist lawmakers. The budget, released Monday, also seeks higher taxes on businesses and the wealthiest Americans, part of an emphasis on reducing the federal deficit that departs from last year’s budget that laid out ambitious spending increases.

But it looks like some pieces didn’t survive even 24 hours. BBG.

President Joe Biden’s plan to tax unrealized capital gains ran into opposition from key Democratic Senator Joe Manchin, likely dooming it just hours after it was sent to Congress. The West Virginia senator also said he doesn’t support Biden’s proposal to end fossil fuel tax breaks. Still, Manchin said he would like to re-engage with the White House on a legislation focused on climate incentives, prescription drug cost reductions and other tax increases on the wealthy and corporations, if the package also reduces the deficit. But he’s had no discussions with the Biden administration.

“So we’re looking to see if anybody wants to talk,” he said. Manchin said he has heard talk about trying to get a deal done by July 4 but the key now is to agree on “parameters” of a package.

And no surprise what’s worrying Americans, but it does depend somewhat on who you voted for. It’s why I don’t put that much stock in sentiment surveys, preferring to watch the hard data. BBG.

The share of Americans who rate inflation as the top issue facing the country is at the highest in nearly 40 years, according to a Gallup poll released Tuesday. About one in five Americans, or 17%, surveyed March 1-18 cited inflation as the nation’s most important problem. That’s up from 10% in February, and compares with 4% who pointed to fuel prices in particular. Among those polled -- a little over 1,000 U.S. adults -- 22% say the government is the top problem outside of the economy, while 9% cited the war in Ukraine. The share citing the coronavirus fell to the lowest level since the pandemic began.

Similar to a University of Michigan survey -- which showed U.S. consumer sentiment remained at a decade low in March -- inflation concerns diverge sharply from a political perspective. Nearly 80% of Republicans are worried about inflation, more than double the proportion of Democrats, according to Gallup. Still, the overall share rating inflation as the biggest problem in the U.S. is far below the 52% proportion recorded in the early 1980s.

Looking ahead, the poll found Americans are increasingly pessimistic about the economy: 75% said conditions are getting worse, about tied with the most negative it’s been since April 2020.

To see more content, including summaries of most major U.S. economic reports and my morning and nightly updates go to Neil’s Newsletter |l Sethi | Substack for newer posts or https://sethiassociates.blogspot.com for the full history.