Neil's Evening Summary - December 30, 2021 - Stocks Lose Some Ground

Neil's Evening Summary – December 30, 2021 - Stocks Lose Some Ground

Please excuse typos. Mornings are tilted more international, evenings more U.S. Continuing to try to make this more digestible for those who are not as familiar with the markets, lingo, etc. Feel free to leave your thoughts in the comments section, they are appreciated. Also, I don't discuss crypto extensively as I don't consider myself knowledgeable enough to talk intelligently on the subject (and there are plenty of other sources for that).

A small glossary. Feel free to inquire about any other terms used.

SPX = S&P 500

Naz = Nasdaq Composite

NDX = Nasdaq 100 (100 largest stocks in the Naz)

RUT = Russell 2000 (smaller stocks)

DMA = Daily Moving Average (the moving average over the given time period (20, 50, 100, 200 days normally))

MACD = Moving Average Convergence Divergence (basically a trend indicator)

RSI = Relative Strength Index (basically what it sounds like)

Also, on my charts, the lines are 20-DMA (green), 21-DEMA (red), 50-DMA (purple), 100-DMA (blue), 200-DMA (brown)

Source abbreviations: BBG = Bloomberg; WSJ = Wall Street Journal; RTRS = Reuters; SA = Seeking Alpha; HR = Heisenberg Report

__________________________________________________________________

Per my message this morning, looks like I'll be moving over to Substack for now. Nice thing is you can just subscribe (free), and you'll get full emails right in your inbox (don’t even have to click a link)!

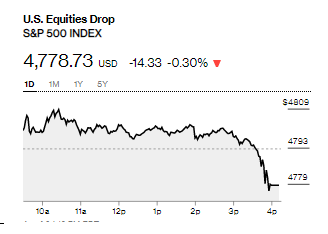

After consolidating for three days, stocks were doing more of the same today (with small gains that at one point pushed the SPX to a new all-time high), before a late-day sell off (last 40 minutes) dropped them into the red (although losses were minimal). Volumes remained light. At the index level, SPX and NDX were down around three tenths of a percent while the Naz was down little more than a tenth and the RUT was just under flat. After only having one day with less than +/-0.5% on the SPX since Thanksgiving coming into the week, we’ve moved less than that the last three days.

Commodities were mostly red, while longer bond yields gave back some of their gains yesterday flattening the yield curve.

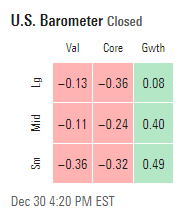

Style box shows a tilt to the left (growth) which is interesting as sector performance was more tilted to value.

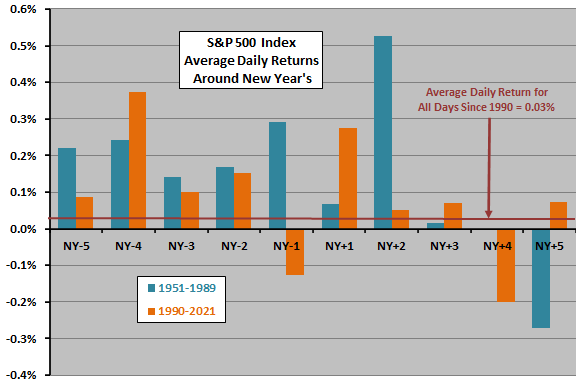

And CXO did a report this week also finding a “Santa effect” (week after Christmas and first two/three trading days of January). Interestingly though last trading day of the year has had a negative bias since 1990.

Major Market Technicals

Not much change on the charts again for the indices. SPX below. NDX and Naz look similar except they have yet to hit record highs this month.

RUT for the second time this week went over and fell back under 200-DMA.

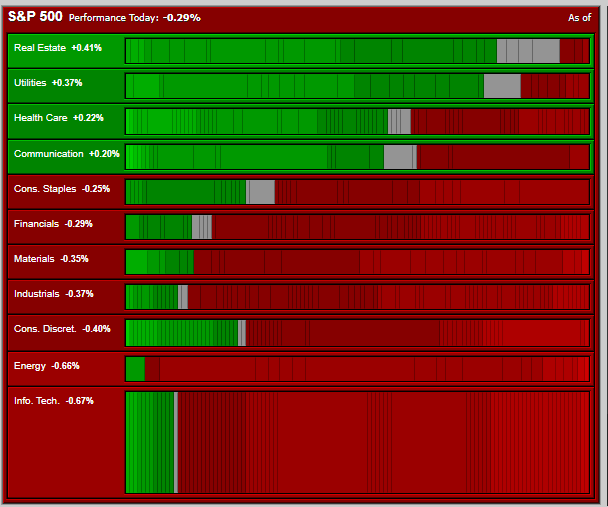

SPX Sector Flag

SPX sector flag deteriorated today, with the first day with more red than green sectors for over a week. Only four green sectors and three were defensives which have been leading the past few days. No sector up over half percent. That said, no sector down more than two thirds of a percent either.

SPX Sector Technicals Rankings

These are NOT necessarily in the order that I like them for investment but how their underlying technical fundamentals stack up with a focus on resistance levels, MACD, and RSI. I do often buy calls though when I upgrade a sector. Going to keep playing with the groupings so bear with me. Changes are in bold.

Not much change again today. Defensives continue to lead.

- Sectors with good/ok technicals, above most resistance.

XLRE - Real Estate - MACD go long, RSI negative divergence, above all MA's. ATH.

XLP - Staples - MACD go long, RSI negative divergence, above all MA's. ATH intraday.

XLU - Utilities - MACD go long, RSI negative divergence, above all MA's. ATH (closing)

XLV - Health care - MACD go long, RSI negative divergence, overbought, above all MA's. ATH.

XLB - Materials - MACD go long, RSI negative divergence, above all MA's. ATH intraday.

XLK - Tech - MACD go long, RSI negative divergence, above all MA's.

XLI - Industrials - MACD go long, RSI positive, above all MA's.

XLY - Discretionary - MACD go long, RSI positive divergence, above all MA's.

- Sectors with mediocre to poor technicals but above all/most resistance.

- Sectors that look to have bottomed with positive technicals but below significant resistance.

XLC - Communications - MACD cover shorts, RSI positive, under 50, 100, 200-DMAs.

XLF - Financials - MACD cover shorts, RSI positive, under 50-DMA.

XLE - Energy - MACD cover shorts, RSI neutral, under 50-DMA.

- Sectors regrouping (negative technicals, short-term downtrend, long-term still positive/uptrend).

- Sectors in poor shape (negative technicals in intermediate or long term downtrends (so expect further weakness for a while (bear market))).

None.

Key Subsectors - SOX (semis), IYT (transp), XBI/IBB (smaller/larger bios (smaller are more a general "tell" on speculative activity as opposed to health care)), XHB (homebuilders), XRT (retail)

Retail was up over 1%, semi’s down over -1%. Homebuilders and transports were down less than a percent and bios up less than that much.

Breadth

Good news is breadth improved despite the worse equity performance. On NYSE volume was 61% positive and issues 53%. Naz was 72% positive volume, issues 56%. Those volume numbers are very good especially the Naz (72% positive on a down day is outstanding).

Commodities/Currencies/Bonds

Bonds - Yields moved lower in a bull flattener. 2-year yields were down two basis points to 0.73% (0.76% is post-pandemic closing high), 5-year yields down two to 1.27% (1.38% is post-pandemic high), 10-year yields were down three to 1.44% (1.76% is post-pandemic high), and 30-year yields down three to 1.93% which remains in the middle of the range of this year (low is 1.64%, high was 2.52%). The inversion with the 20-year at four basis points (remains below the high of the year of nine).

Dollar (DXY) - Dollar was able to bounce a bit despite the deteriorating technical condition, but couldn’t get through the 20-DMA. Finished at $95.98. Remains in intermediate-term uptrend. Daily technicals negative.

VIX - Finished little changed at 17.33. Remains near one-month lows.

Crude (/CL) - Spent another day testing the 50-DMA, again getting over and falling back. Finished the after-hours session at $76.36 WTI. Daily technicals positive. But it did close the regular session higher which gave it a seventh day of gains, the longest streak in 10 months. Crude is on course for the biggest annual advance in more than a decade. Earlier in the session, crude was under pressure as China cut the amount of import quota awarded to private refiners and favored complex processors as it seeks to reform the sector (detailed in the morning summary).

The market’s lack of reaction to omicron “bodes well for demand to start 2022,” according to Jens Pedersen, a senior analyst at Danske Bank A/S. “It further suggests OPEC+ made the right call to stick to its plans of further normalizing production.”

As XOM will take another 2mb (in addition to the 4.3mb they took previously) under the exchange program. Total is now 7mb for the three approved exchanges.

WASHINGTON, D.C. — Today, the U.S. Department of Energy (DOE) approved a third exchange of two million barrels of crude oil for release to ExxonMobil from the Strategic Petroleum Reserve (SPR). This release falls under the authorization published in the DOE announcement on November 23, 2021.

Combined, DOE has provided over seven million barrels of SPR crude oil to boost the nation’s fuel supply, including the two previous exchanges awarded earlier in the month. As with all exchanges, companies that receive SPR crude oil through the exchange agree to return the amount of crude oil received, as well as an additional amount, dependent upon the length of time in which they hold the oil.

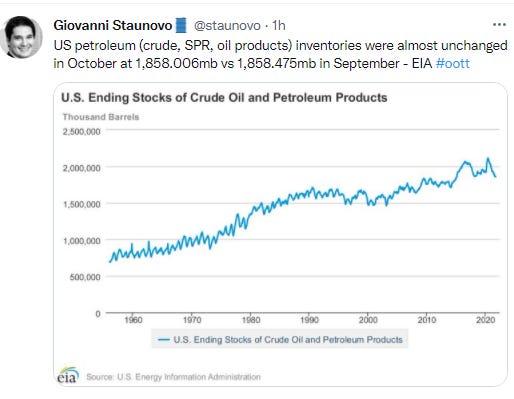

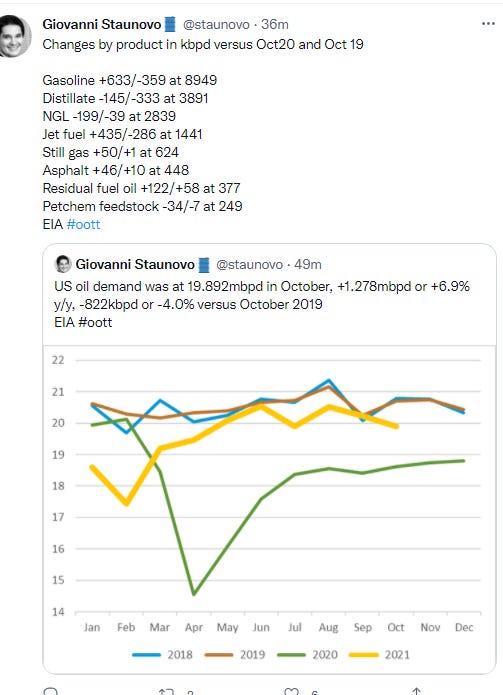

As EIA released their report for October. Total inventories continued to fall (first chart) while demand didn’t see the normal bounce it did in 2018 and 19.

As Iran negotiations take a break.

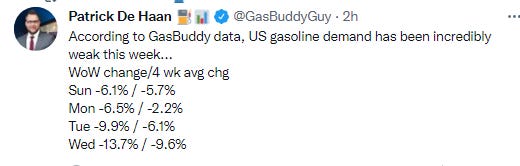

And gasoline demand has been very weak this week (worst first four days since 5/30).

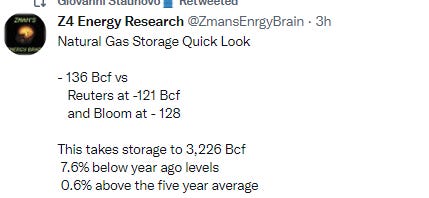

Nat Gas (/NG) - Fell sharply today to a 5-month low despite a bullish storage report, finding some support at $3.50. Finished at $3.60. Daily technicals positive.

More on storage draw that came in above expectations.

Gold (/GC) - Moved a little higher to highest close of the week. Finished at $1816. Daily technicals remain positive.

Copper (/HG) - Pulled back to the 50-DMA finishing down for a third day. Daily technicals remain positive.

U.S. Data

Did report on jobless claims. Link below.

Next 24

In the US no data because of the “holiday” (I put in quotes because the markets are open full day).

Overseas, will be very light. Markets in Germany, Italy, and Spain will be closed while markets in France and the U.K. will close early. In Asia, Japan's Nikkei will be closed while markets in Australia and Hong Kong will close early. That said, I believe we get final read on Chinese PMI’s and S Korean CPI for December.

Overall

Nothing much to add here to the message of this week - "I continue to feel that as long as the market can look through the Omicron spike, I am optimistic due to company and insider buying, sentiment coming off lows, the general "washed out" conditions we saw two weeks ago, seasonality, and the likely reengagement of systematic flows. And you can add to that a big improvement in both index and sector charts."

My big quibble this week has been breadth but even that improved today. Of course, as we saw above, seasonality isn’t great for tomorrow. But otherwise I don’t see anything to change my relatively positive view for at least the next few trading sessions.

Misc.

Other random stuff.

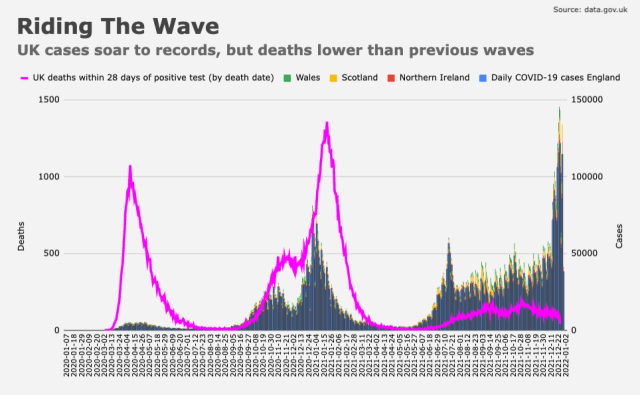

As link between Omicron and deaths continues to look much more positive than prior waves. HR.

John Bell, an Oxford immunologist, told BBC the strain isn’t “the same disease.” “The horrific scenes that we saw a year ago [are] now history in my view, and I think we should be reassured that that’s likely to continue,” he remarked.

Bell spoke as daily cases in the UK forced a recalibration of the y-axis (figure below). Deaths still haven’t moved up, though

And a study (don’t think peer reviewed) suggests breakthrough infections may provide “super immunity”.

Breakthrough infections greatly enhance immune response to variants of the virus that causes COVID-19, according to a newly published study from Oregon Health & Science University…

“You can’t get a better immune response than this,” said senior author Fikadu Tafesse, Ph.D., assistant professor of molecular microbiology and immunology in the OHSU School of Medicine. “These vaccines are very effective against severe disease. Our study suggests that individuals who are vaccinated and then exposed to a breakthrough infection have super immunity.”

The study found that antibodies measured in blood samples of breakthrough cases were both more abundant and much more effective – as much as 1,000% more effective – than antibodies generated two weeks following the second dose of the Pfizer vaccine.

The study suggests each exposure following vaccination actually serves to strengthen immune response to subsequent exposures even to new variants of the virus.

“I think this speaks to an eventual end game,” said co-author Marcel Curlin, M.D., associate professor of medicine (infectious diseases) in the OHSU School of Medicine who also serves as medical director of OHSU Occupational Health. “It doesn’t mean we’re at the end of the pandemic, but it points to where we’re likely to land: Once you’re vaccinated and then exposed to the virus, you’re probably going to be reasonably well-protected from future variants.

“Our study implies that the long-term outcome is going to be a tapering-off of the severity of the worldwide epidemic.”

As airlines cancel more flights. BBG.

Airline cancellations are already piling up in the U.S., with 1,125 flights scrubbed as rising coronavirus cases hobbled staffing. Winter storms meanwhile threatened to further disrupt travel over New Year’s weekend. More than 650 flights already have been canceled for Friday and about 400 are already scratched for Saturday.

JetBlue Airways Corp. scratched 175 flights, accounting for 17% of its schedule, by 4:20 p.m. Thursday in New York, according to FlightAware.com. Allegiant canceled 96 flights, or 19% of its service. United Airlines Holdings Inc. scrubbed 199 flights, representing 9% of its schedule.

The disruptions come after thousands of flights were canceled over the Christmas holiday weekend and into early this week as winter storms combined with staffing shortages caused by the spread of coronavirus cases from the omicron variant.

And CDC says even the vaccinated should avoid cruising. BBG.

Shares of cruise operators fell after U.S. health officials said travelers should avoid them even if they’re vaccinated.

The Centers for Disease Control and Prevention raised its travel alert on cruise ships Thursday to the highest-risk level, saying Covid-19 spreads easily between people aboard in close quarters. Even people who are fully vaccinated may be at risk of getting and spreading the virus, the agency said.

Shares of Carnival Corp., Royal Caribbean Cruises Ltd. and Norwegian Cruise Line Holdings Ltd. tumbled on the news. Covid cases have been reported on 94 cruise ships in U.S. waters, and nearly all of those outbreaks have met the threshold for a formal investigation by the CDC.

The Cruise Lines International Association trade group said in an email that the CDC recommendation “is particularly perplexing” since the number of cases identified on ships “make up a very slim minority of the total population onboard -- far fewer than on land.”

To see more content, including summaries of most major U.S. economic reports and my morning and nightly updates go to Neil’s Newsletter | Neil Sethi | Substack for newer posts or https://sethiassociates.blogspot.com for the full history.