Neil's Morning Update - 3/4/22

Neil's Morning Update - 3/4/22

Please excuse typos. Mornings are tilted more international, evenings more U.S. Continuing to try to make this more digestible for those who are not as familiar with the markets, lingo, etc. Feel free to leave your thoughts in the comments section, they are appreciated. Also, I don't discuss crypto extensively as I don't consider myself knowledgeable enough to talk intelligently on the subject (and there are plenty of other sources for that). As are reminder, this is a free blog I put out to try to help people get information, so no editors, etc.

A small glossary.

SPX = S&P 500

Naz = Nasdaq Composite

NDX = Nasdaq 100 (100 largest stocks in the Naz)

RUT = Russell 2000 (smaller stocks)

DMA = Daily Moving Average (the moving average over the given time period (20, 50, 100, 200 days normally)).

MACD = Moving Average Convergence Divergence (basically a trend indicator)

RSI = 14-day Relative Strength Index (basically what it sounds like)

Also, on my charts, the lines are 20-DMA (green), 21-DEMA (red), 50-DMA (purple), 100-DMA (blue), 200-DMA (brown)

Source abbreviations: BBG = Bloomberg; WSJ = Wall Street Journal; RTRS = Reuters; SA = Seeking Alpha; HR = Heisenberg Report

_______________________________________________________________________

Quick note. The blog has morphed from a way to update friends and family on the markets into a quasi-job which was not the intent. As I have no illusions of becoming a full-time blogger, so I need to dial things back a bit in the interests of time. I am a “type-A” so I’ve been trying hard to be sure I include everything I can, but I’m going to move back to more of a “big picture” focus with fewer items and shorter snippets of articles. That said, feel free to make comments if there are particular things you miss or if you ever have any questions, and I’ll respond/take them into account.

As we approach the open of trade in NY, equities remain down although off the worst losses of the overnight session which occurred after headlines of a Russian attack on a nuclear power plant in Ukraine had them down -2%. The jobs report came in with a “goldilocks” feel with a better than expected headline number and participation rate but lower than expected wage growth number, but was completely ignored by the stock market (there was a one-minute pop which was immediately sold). European stocks are also off the lows but are still down sharply ending a terrible week (the Stoxx 600 is down -6.5% this week). Commodities, the dollar, and bonds are all higher (yields lower). Asian shares also finished down today and for the most part for the week.

In the US, around 8.45 am EST, futures have the SPX, NDX, and RUT down around -1%.

Here's the SPX futures this morning around 8.45 ET. Intermediate term downtrend remains in place. A lot of overhead resistance, and daily technicals more neutral.

In U.S. corporate news (Argus):

Broadcom (AVGO 595.50, +16.90): +2.9% after beating top and bottom-line estimates and guiding fiscal Q2 revenue above consensus. Costco (COST 523.50, -9.55): -1.8% despite beating top and bottom-line estimates. On a related note, Telsey Advisory Group raised its COST price target to $615 from $610.Gap (GPS 15.20, +0.95): +6.7% after beating EPS estimates and guiding FY23 EPS above consensus. Marvell (MRVL 63.37, -1.83): -2.8% despite beating top and bottom-line estimates and guiding Q1 revenue mostly above consensus. On a related note, MRVL was downgraded to Hold from Buy at Summit Insights

As Citi says buy the tech dip (I have been scaling in).

As margins continue to expand.

Asia

Major equity indices in the Asia-Pacific region ended the week on a lower note. Japan's Nikkei: -2.2% (-1.9% for the week) Hong Kong's Hang Seng: -2.5% (-3.8% for the week) China's Shanghai Composite: -1.0% (-0.1% for the week) India's Sensex: -1.4% (-2.7% for the week) South Korea's Kospi: -1.2% (+1.4% for the week) Australia's ASX All Ordinaries: -0.7% (+1.7% for the week).

In news, China's National People's Congress will convene tomorrow and continue through March 11. South Korea’s Finance minister, Hong Nam-ki, said on Friday the country will extend the tax cut in oil products by three months to minimise the impact of surging energy prices, pushed up by the Russia-Ukraine crisis. Amid worries that the Ukraine crisis may weigh on the chip industry, the finance ministry also said on Friday it is reviewing whether to apply a quota tariff on key items such as neon and krypton.

And Japan unveiled on Friday a raft of measures to help small and midsize firms cope with surging global fuel prices amid the Ukraine crisis, with an increased subsidy ceiling on oil and the extension of corporate funding, ministers said on Friday. Prime Minister Fumio Kishida’s cabinet approved the measures including lifting a subsidy ceiling on gasoline, diesel and kerosene to 25 yen a litre to help companies cope with rising energy prices, Chief Cabinet Secretary Hirokazu Matsuno said. The government also announced a package of measures aimed at reviewing funding support for small firms hit by the COVID-19 fallout, helping them become profitable and revive business.

In economic data, South Korea's February CPI remained above the 2.0% target for the 11th consecutive month, as a continued rise in food and energy prices pushed prices higher.

Japan's January Unemployment Rate 2.8% (expected 2.7%; last 2.7%)

South Korea's February CPI 0.6% m/m (expected 0.4%; last 0.6%); 3.7% yr/yr (expected 3.5%; last 3.6%)

India's February Nikkei Services PMI 51.8 (expected 53.0; last 51.5)

Australia's January Retail Sales 1.8% m/m, as expected (last -4.4%)

Singapore's January Retail Sales -2.5% m/m (las t 1.3%); 11.8% yr/yr (last 6.7%)

Hong Kong's January Retail Sales 4.1% yr/yr (last 6.2%)

The Russian stock market will be closed to trading until at least next Wednesday, marking a record in the country’s modern history. China’s central bank will increase financial support for rental housing and tailor its property policies to conditions in different cities as it largely affirms its stance since late year.The PBOC will continue to implement its prudential management system for property financing and insist the principle that “housing is for living in, not speculation,” according to the statement. The PBOC will boost financial support for the service sector suffering from the pandemic, according to the statement. It will prevent and resolve default risks in the bond market, continue to crack down on cryptocurrency trading and push for the rectification of online platforms, it said.

As JPM warns of 1998-style collapse. BBG.

JPMorgan Chase & Co.’s economists told clients in a report on Friday that they expect a 7% contraction in gross domestic product this year, while Bloomberg Economics forecasts a fall of about 9%. The economy shrank 5.3% in 1998 amid the debt crisis.Still, investors said while the human and geopolitical aftershocks of Russia’s invasion are greater than what was witnessed in 1998, in the short-term the ruble’s decline has proved smaller and the country now has a greater ability to stave off defaulting on its debt, especially if other nations continue to resist imposing sanctions on its energy exports. “It is the long-term that is more troubling,” said Tim Graf, head of EMEA macro strategy at State Street Global Markets. “The longer that sanctions are upheld, and especially if they are expanded to include gas and oil exports, the more likely Russia is to become an untouchable capital market for years to come.”

“The currency weakness we see now will inevitably be inflationary, particularly if the economy remains closed off from the rest of the world,” he said. “It is not hard to envision extreme scenarios similar to the post-1998 period in this case.”

As Russians increasingly turn to the yuan. I don’t see any risk of dollar supremacy but it will continue to weaken over time. Now if there’s ever a global crypto-currency backed by governments, that will be the end of the dollar most likely.

SHANGHAI, March 3 (Reuters) - The Moscow branch of a Chinese state bank has seen a surge in enquiries from Russian firms wanting to open new accounts, a person familiar with the matter said, as the country's businesses struggle with international sanctions after its invasion of Ukraine. "Over the past few days, 200-300 companies have approached us, wanting to open new accounts," the person, who works at the Moscow branch of a Chinese state bank and has direct knowledge of its operations, told Reuters.

As China looks to loosen it’s Covid-zero policies (which I posted a note on months ago so this is nothing particularly new). I still don’t see them really getting “loose” until after the Party Congress later this year, but it looks like they’re getting ready for that. WSJ.

In preparation for a potential opening, Chinese officials are looking into the use of travel bubbles modeled on measures taken during the Winter Olympics, collecting data on new antiviral drugs and scouting sites abroad for future production of homegrown Chinese mRNA vaccines, according to people familiar with the matter. Covid-19 controls likely won’t be eased before next spring, according to two of the people, but experimental opening measures could arrive in select cities as early as this summer.In response to a request for comment, China’s National Health Commission pointed to an interview last month in which Liang Wannian, head of the commission’s Covid-19 task force, said that “dynamic clearing”—Beijing’s preferred term for its current Covid-19 control strategy—is “definitely not something that will continue forever.” A potential pitfall for China, currently vividly on display in Hong Kong, is the public’s attitude toward infections, said Mengji Lu, a virologist at the University of Essen-Duisburg in Germany.University research into Chinese citizens’ views of the virus and attitudes toward social controls suggests the country hasn’t built up a strong enough psychological tolerance for the virus to open the country’s borders, according to people familiar with the discussions.

Europe

As of 8 am EST, major European indices trade on a sharply lower note to end a very harsh week. STOXX Europe 600: -3.0% (-6.5% week-to-date) Germany's DAX: -3.7% (-9.4% week-to-date) U.K.'s FTSE 100: -3.5% (-6.7% week-to-date) France's CAC 40: -3.7% (-9.1% week-to-date) Italy's FTSE MIB: -4.9% (-11.6% week-to-date) Spain's IBEX 35: -3.2% (-8.6% week-to-date). The Stoxx Europe 600 index has fallen about 13% from its January record

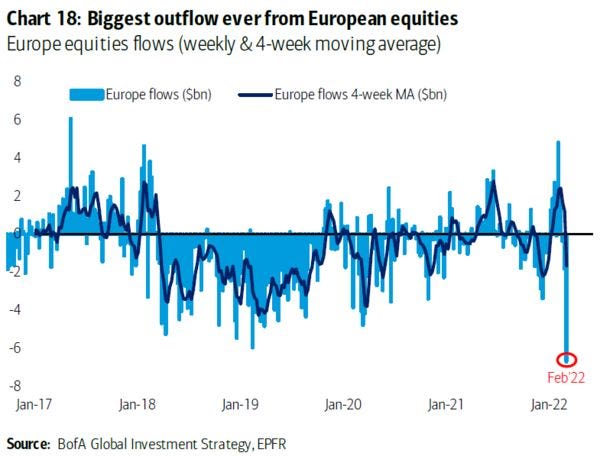

And probably no surprise that BofA saw unprecedented outflows from European stocks. BBG.

European equities had their largest outflows on record at $6.7 billion in the week to March 2, the strategists wrote, citing EPFR Global data. The redemptions from the region caused the first outflow in 10 weeks for global stocks to the tune of $5 billion. “Financial market accidents threaten global recession,” strategists led by Michael Hartnett wrote in a note. The war in Ukraine implies a bigger “inflation shock” as commodity prices surge, and investors should be “maximum defensive” in the absence of de-escalation, they said.

In news, European Central Bank policymaker Rehn said that the medium-term inflation outlook is being assessed carefully and that the central bank will do whatever is necessary. The Czech and the Polish central banks stepped in to protect their currencies, which are among the hardest hit by the market impact of Russia’s invasion of Ukraine. Also just saw a headline that NordStream2 operator will be filing for bankruptcy.

In economic data, EU retail sales were well under expectations while French IP and German and UK February construction PMI beat. It’s unfortunate that the economies there were really gaining momentum into the Ukraine situation.

Eurozone's January Retail Sales 0.2% m/m (expected 1. 5%; last -2.7%); 7.8% yr/yr (expected 9.5%; last 2.1%)

Germany's February IHS Markit Construction PMI 54.9 (last 54.4). January trade surplus EUR9.40 bln (expected surplus of EUR7.10 bln; last surplus of EUR8.1 bln). January Imports -4.2% m/m (last 4.0%) and Exports -2.8% m/m (last 1.2%)

U.K.'s February Construction PMI 59.1 (expected 54.3; last 56.3)

France's January Industrial Production 1.6% m/m (expected 0.5%; last -0.1%)

Italy's Q4 GDP 0.6% qtr/qtr, as expected (last 2.6%); 6.2% yr/yr (expected 6.4%; last 3.9%)

As Swedes and Finns are increasingly in favor of joining the NATO defense bloc after Russia’s invasion of Ukraine, adding pressure on the countries’ leaders to change long-standing policies of military non-alignment. BBG. I can’t imagine Russia would take kindly to this.

Polls released in the two Nordic countries on Friday showed 51% of Swedes and 48% of Finns now back joining the North Atlantic Treaty Organization. It’s the first time a Swedish majority favors the entry, while an earlier poll in Finland has also indicated majority support. Authorities have so far indicated no rush for the move that President Vladimir Putin’s administration has warned would result in “military and political” repercussions.

As EU member states will need to add 144TWh of extra supply to storage sites in March-September compared with a year earlier to meet the European Commission's proposed start-of-winter target. Argus.

Average EU inventories would have to reach 80pc of aggregate capacity by 1 October "to be well-prepared for the winter", based on a draft policy document. And the commission is considering implementing legal requirements for member states to ensure that this is reached. Aggregate EU inventories were 321TWh at the start of this month, meaning that a net 564TWh — around 2.64 TWh/d — would have to be added to sites in March-September. Net withdrawals typically persist in March and occasionally continue into April, before sites switch to net injections, which usually peak in the core summer months when demand is weakest. Cumulative net injections [in 2021] were 420TWh in March-September, meaning they would have to rise by 144TWh [in 2022, or 34%] to meet the commission's target. Inventories reached just 826TWh at the start of last winter, the lowest in recent years and almost 60TWh short of the proposed target. While net injections of 564TWh in March-September this year would be considerably quicker than in the past two years, they would still be far from a record for the period. The net stockbuild over the period was consistently quicker than 564TWh in 2017-19, peaking at 605TWh in 2019.

Commodities/Currencies/Bonds

Bonds - As noted bond yields are falling back this morning taking a leg lower on the cool wage print noted below in a bull flattener. 2-year yields down six basis points to 1.47%, and 10-year yields down eight at 1.77%. (these levels can be a little different from the evening update).

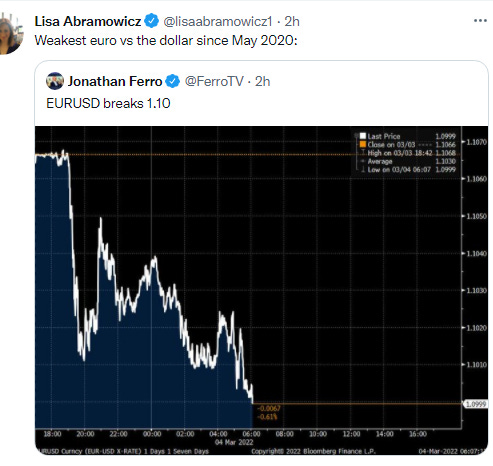

Dollar (DXY) - Strongly higher this morning moving to the highest level since May 2020. Currently at $98.59. Intermediate-term uptrend. Daily technicals positive. 3-yr chart below.

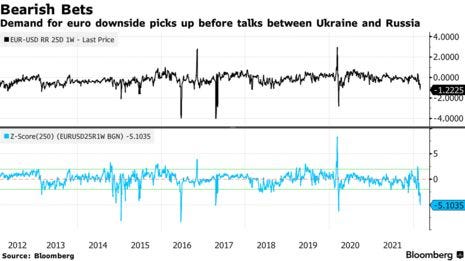

With the Euro testing key support. BBG.

Traders are focused once again on a key support level for the euro that dates back to the the currency’s inception more than two decades ago. According to options, there is a two-in-three chance that the currency trades at $1.10 within the next three months. The median forecast in a Bloomberg survey sees upside risks for the euro into year-end, while some analysts call a move to $1.09 by end-March. That would mean a trendline that has been in place since 1999 will be breached, opening further downside risks for the euro-dollar pair. The bearish sentiment may gain further traction should the latest repricing in the fixed income market remain in place. Rates traders are losing conviction that the European Central Bank will increase interest rates twice by year-end, with money markets now pricing 31 basis points of hikes. Still, strategists at Goldman Sachs Group Inc. recommend fading any delay in ECB tightening wagers given the significant upside shock to near-term inflation. And according to Stephen Gallo, European head of FX strategy at BMO Capital Markets, “the ECB may now seek to play a greater role as a stabilizing force for the EUR if events push EURUSD below 1.10.”

VIX - Up but in the range of this week at 33.06. This will continue to move around with the Ukraine situation.

Crude (/CL) - Back moving higher this morning ignoring the continuing chatter around a coming Iranian deal. Currently at $111.96 WTI. Daily technicals remain positive but very overbought. This will continue to move around on headlines about Russian oil availability it seems.

As Japan released details on their SPR release - TOKYO, March 4 (Reuters) - Japan will release 7.5 million barrels of oil from private reserves as a part of an International Energy Agency (IEA)-led coordinated release, industry minister Koichi Hagiuda said on Friday.

As Citi capitulates. Probably means we’re at the peak (although I do like Ed Morse a lot).

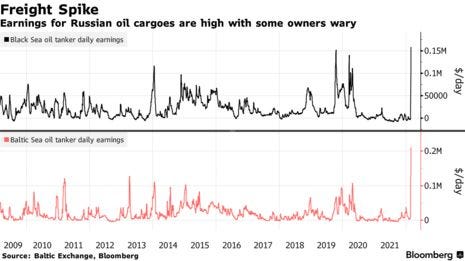

And much of the issue with getting Russian crude revolves around the difficulty in obtaining shipment. BBG.

It now costs about $3.5 million to hire a tanker to deliver a million barrels to Italy from Russia’s Black Sea port of Novorossiysk -- a voyage that should take no longer than a week. That’s a more-than 300% gain from before the invasion of Ukraine began. It also assumes traders can find an owner willing to risk letting their ship enter a region where five merchant ships have been blown up in the week since the attack started, and where NATO has warned of an increasing risk of collateral damage to vessels. Rates to ship Russian crude to Europe from the Black or Baltic seas, the nation’s two main western outlets, now cost about 291 and 516 industry-standard Worldscale points, according to the Baltic Exchange in London. Both were below 100 points before the attack. Energy Aspects Ltd. estimated earlier this week that 70% of Russia’s oil sales were “frozen” because of the shipping and trading logjam, a figure that could drop to 20% once there’s sanctions certainty. Even the lower level would deprive the global tanker market of a swath of cargoes.

And on Iranian deal.

VIENNA, March 3 (Reuters) - Talks on reviving the 2015 Iran nuclear deal appeared to near a climax with talk of an imminent ministerial meeting as a U.N. report on Thursday showed Iran is most of the way to amassing enough enriched uranium for one bomb if purified further. "We are close to a possible deal," Jalina Porter, the U.S. State Department's principal deputy spokesperson, told reporters but cautioned that unsolved issues remained and that time was of the essence given the pace of Iran's nuclear advances. An Iranian foreign ministry spokesperson said more work was needed, however, and a White House official said there was "no change" from Wednesday, when it had said all sides were working to clarify the most difficult issues.

Nat Gas (/NG) - Trading a little higher. Currently at $4.84. Remains over the 100-DMA. Daily technicals tilt positive. Continue to think this area is long-term fair value but natural gas is a very volatile commodity.

Gold (/GC) - Trading up towards the highs of the week. Currently at $1947. Daily technicals mixed with RSI negative divergence now. I remain more of a seller than a buyer at these prices.

Copper (/HG) - Up strongly for a fourth day firmly out of the wedge it’s been in for over a year. Pressing up to 1-yr high. Daily technicals positive but overbought.

Wheat -

US Data

Only data point today is what is normally the biggest report of the month (not now with others like CPI taking precedence this month) which came in better than expectations. Also, wage growth came in lower than expectations and labor force participation higher, which gave it a sort of “Goldilocks” feel. But as you can see the market has basically shrugged it off. I’ll have a report out later today with all the puts and takes.

US Change In Nonfarm Payrolls Feb: 678K (est 423K; prev 467K; prevR 481K)

- US Unemployment Rate Feb: 3.8% (est 3.9%; prev 4.0%)

US Average Hourly Earnings (Y/Y) Feb: 5.1% (est 5.8%; prev 5.7%; prevR 5.5%)

- US Average Hourly Earnings (M/M) Feb: 0.0% (est 0.5%; prev 0.7%; prevR 0.6%)

US Labor Force Participation Rate Feb: 62.3% (est 62.2%; prev 62.2%) - US Underemployment Rate Feb: 7.2% (prev 7.1%)

Misc.

Random stuff:

And on Ukraine/Russia.

A top nuclear official called for talks with Moscow and Kyiv after the government in Kyiv accused Vladimir Putin’s troops of triggering the fire with an attack on Europe’s largest atomic power complex. Russian forces now occupy the area. Ukraine’s nuclear regulator said its last check before it halted monitoring showed normal radiation levels. Russian shelling had caused a blaze at a training complex in the Zaporizhzhia plant in the east of the country overnight, Ukrainian officials said, but emergency services extinguished it and there were no casualties. Ukraine told the International Atomic Energy Agency the incident had “not affected ‘essential’ equipment,” and there had been no change reported in radiation levels.

Preparations continue for a possible landing of Russian assault troops near the Black Sea city of Odesa. Ukraine’s defense minister said the navy had sunk its own flagship frigate in port to avoid possible capture. Russian troops are encircling Ukraine’s capital, Kyiv, the general staff of the Ukrainian army said.

A global financial watchdog is discussing a coordinated approach to trace Russian money flows into several nations in an effort to curb sanctions evasion, people familiar with the matter said. The issue of money from Russia was a major concern raised by member states at the Paris-based Financial Action Task Force’s plenary this week, said the people, who requested anonymity as the matter is private. Efforts are underway to coordinate across the body to address the matter in a comprehensive way. The FATF has been talking about priority jurisdictions that will receive additional scrutiny to ensure Russian capital isn’t able to evade recent penalties, the people said.

And the UAE which drew heavy criticism for abstaining from a UN Security Council vote condemning the Russian advance, is set for inclusion on a global watchdog’s “gray list” after some of its members indicated that the Gulf nation hadn’t made enough progress in tackling illicit financial flows, according to people familiar with the matter. BBG.

A gray-list classification isn’t as punitive as the group’s highest-risk “black list,” and it suggests that UAE officials are taking steps to address the country’s current deficiencies, the people said. Still, the decision is potentially the most significant step to be taken by the FATF in its three-decade history, given the UAE’s position as a regional financial center. FATF, set up by the Group of Seven major economies, has some two dozen nations -- including Turkey, Zimbabwe and Albania -- on its gray list, with Iran and North Korea on the black list.

In practical terms, a gray-listing would force Wall Street banks, which use Dubai as their regional headquarters, to dedicate additional resources to compliance in order to avoid future penalties from international regulators. The decision could also have an impact on Abu Dhabi, the nation’s capital and home to sovereign wealth funds with more than $1 trillion of assets. A report by the International Monetary Fund last year found that gray-listed countries experienced “a large and statistically significant reduction in capital inflows.”

Since warnings by the FATF in 2020 as part of the group’s mutual-evaluation report, the UAE government has stepped up efforts to better align with global standards on anti-money laundering and countering terrorist financing.

As Libya’s crisis deepens.

BENGHAZI, Libya, March 3 (Reuters) - A standoff between two rival governments in Libya worsened on Thursday with the risk of fighting or territorial division as the parliament in the east swore in a new administration while the incumbent in Tripoli refused to cede power. Addressing the parliament after taking the oath of office, Fathi Bashagha said he was studying all options to take over in Tripoli. The present prime minister there, Abdulhamid al-Dbeibah, has said he will not hand over control. Armed groups affiliated with both sides have mobilised in the capital and foreign forces, including from Turkey and Russia, remain entrenched in Libya nearly 18 months after a ceasefire ended the last major bout of warfare. Groups located in the main oil producing regions have meanwhile warned they may block off Libya's energy exports, which amount to 1.3 million barrels per day.

To see more content, including summaries of most major U.S. economic reports and my morning and nightly updates go to Neil’s Newsletter | Neil Sethi | Substack for newer posts or https://sethiassociates.blogspot.com for the full history.y.