Q3 Productivity

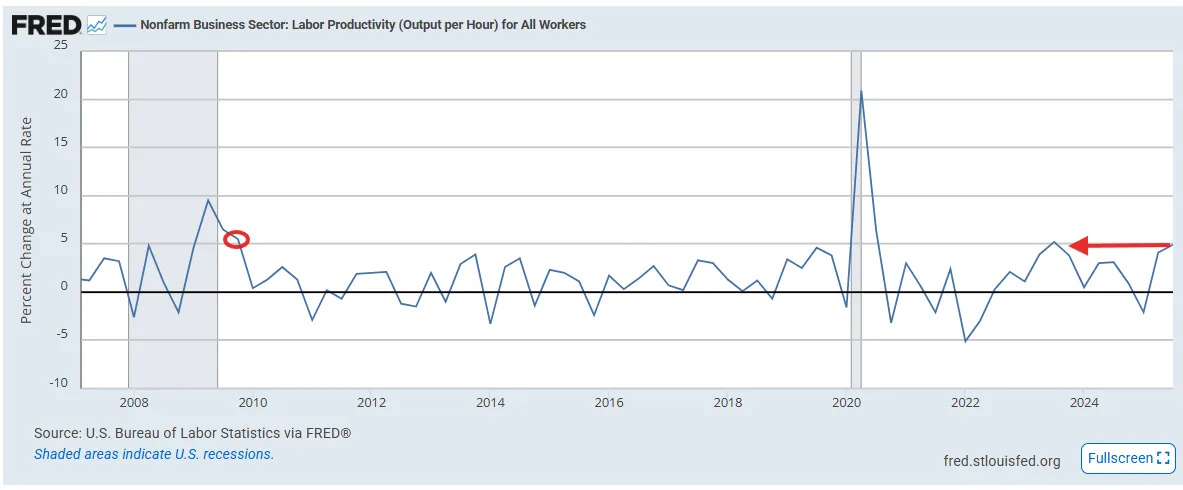

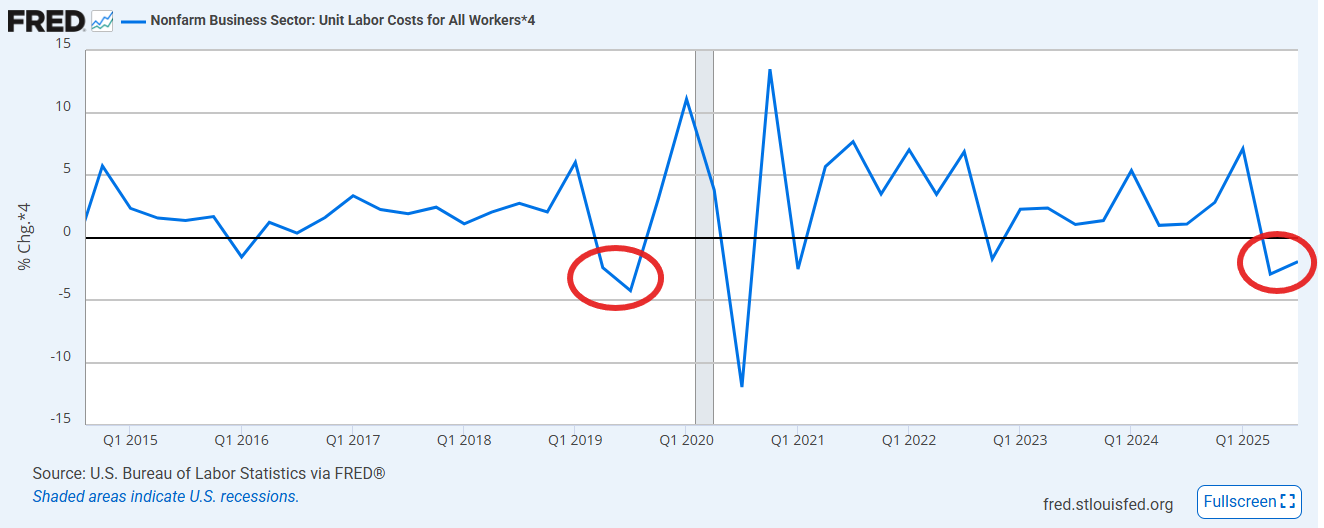

Q3 productivity the strongest since Q3 '23 (and before that 2020) pushing unit labor costs negative for a second quarter for the first time since 2019

As the revision to productivity had literally no changes (I assume because it was so delayed, but still don’t think I’ve ever seen that before) I thought I would shoot out my notes that I posted on X at the time as this is an important report:

US Unit Labour Costs Q3: -1.9% (est -0.1%; prev 1.0%; prevR -2.9%)

- Nonfarm Productivity: 4.9% (est 5.0%; prev 3.3%; prevR 4.1%)

3Q productivity, a metric closely followed by the Fed, and one which has heightened importance given the avowed feeling from several Fed members (including Powell) that like the 1990’s, productivity may be the key to allowing for rate cuts even while maintaining strong growth and a relatively healthy labor market, while also continuing to see inflation moderate, gave some evidence of that coming in at a very strong +4.9% Q/Q SAAR, up from an upwardly revised +4.1% in 2Q (from +3.3%). So with the revision it exceeded expectations for +5% growth from the lower base.

That’s the strongest read since Q3 ‘23 and before that 2020. Pre-pandemic we didn’t have a quarter this strong since 2009, and that strength saw unit labor costs, a key component of wage pressures, decline for a second quarter -1.9% (after an even bigger -2.9% in 2Q which was revised from a plus +1.0%, giving us our first back-to-back declines in unit labor costs since 2019) as the strong productivity was paired with real (inflation-adjusted) compensation falling -0.2% (in 2Q real compensation was -0.5% revised from +2.6%).

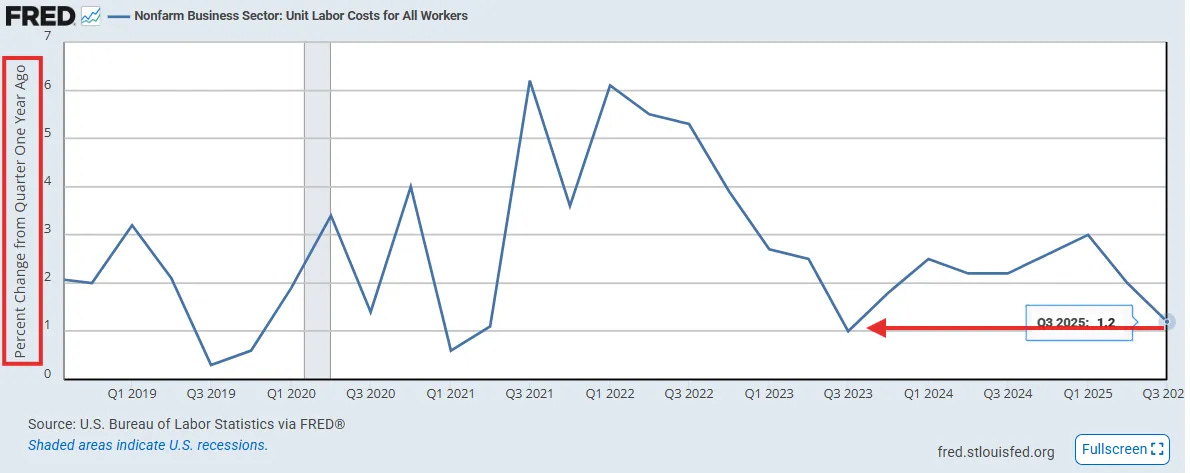

“The yearly rise in unit labor costs is easily consistent with the 2% inflation target: It is very clear from these figures that labor costs are not what is driving price increases above target,” Carl Weinberg, chief economist at High Frequency Economics, said in a note.

The gains in productivity were fairly broad based with services +5.0% Q/Q SAAR and manufacturing +3.3% led by durable manufacturing +4.7% (non-durable +1.2%). The fall in unit labor costs though was just in services -2.0% where real compensation fell -0.3% while manufacturing unit labor costs rose +1.5% (still very contained) with a +0.6% in real compensation.

On a y/y basis unit labor costs came in at +1.2%, the least since Q3 ‘23.

https://www.bls.gov/news.release/prod2.toc.htm

To subscribe to these summaries, click below.

To invite others to check it out,