Retail Sales - December

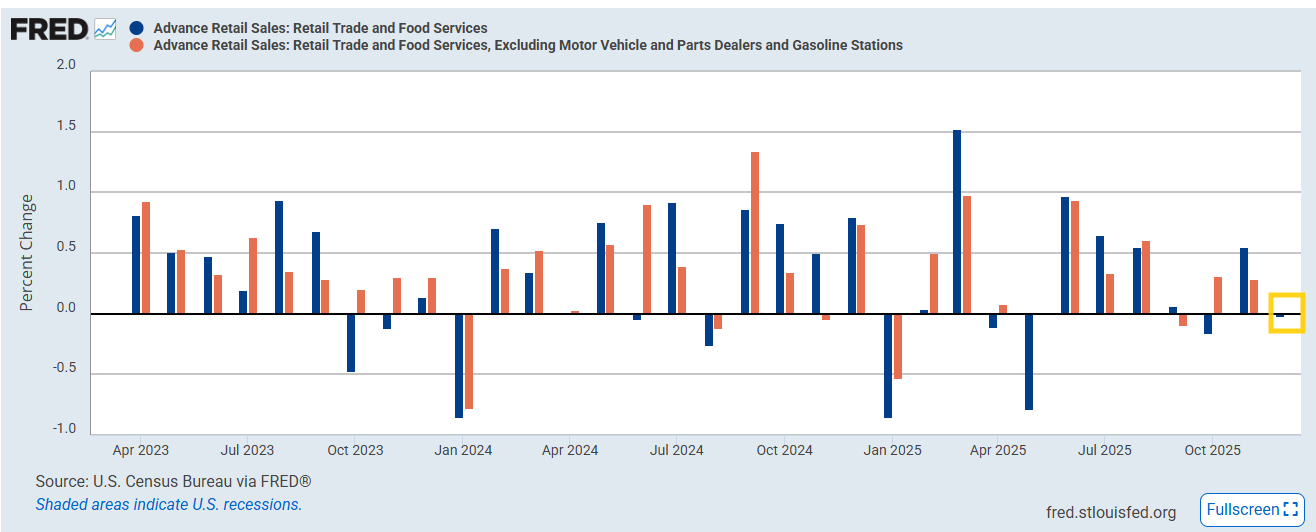

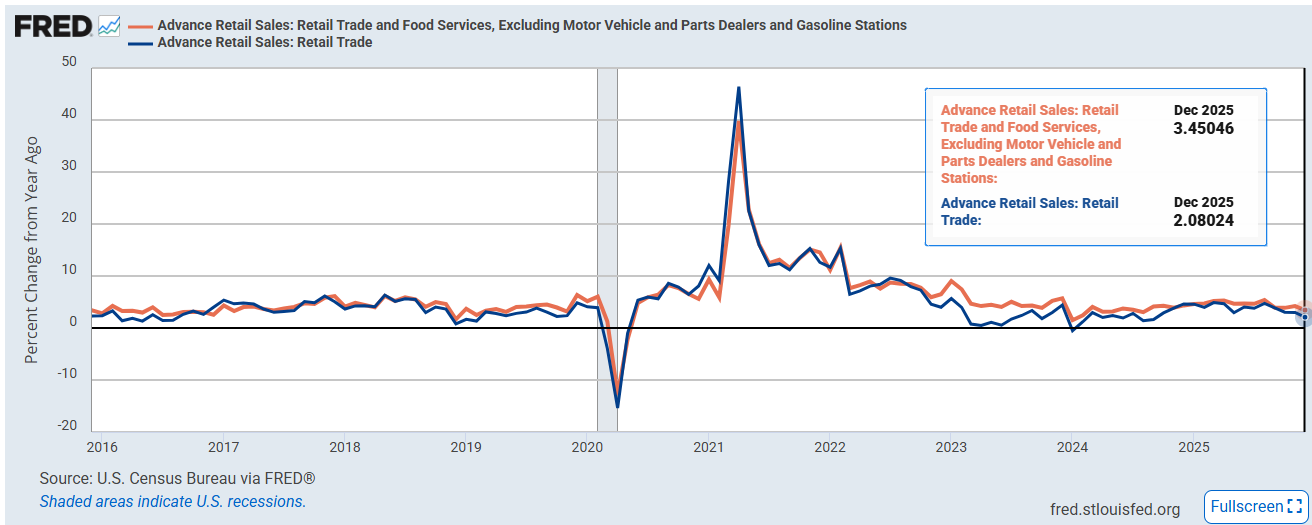

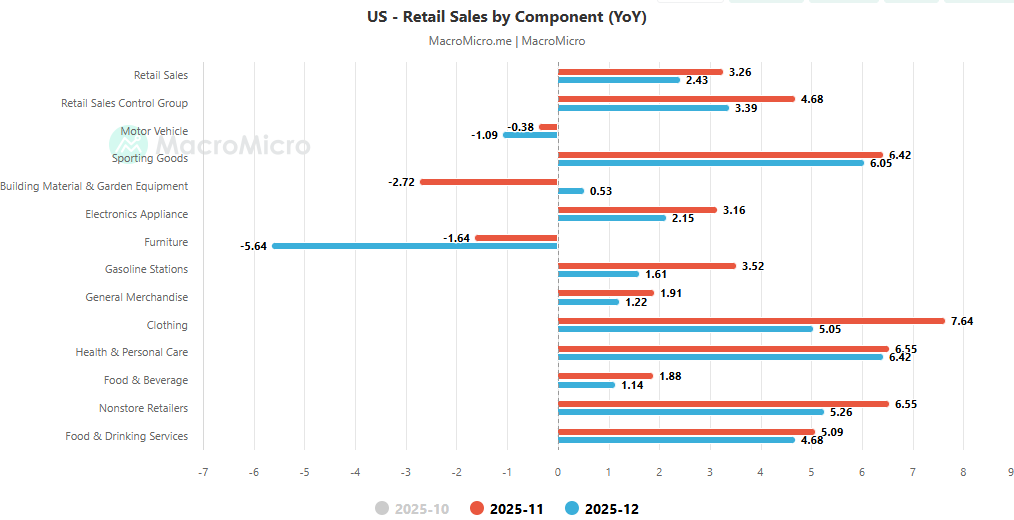

Headline, core, and control group retail sales all come in much weaker than expected with y/y the least since 2024.

US Retail Sales Advance (M/M): Dec: 0.0% (est 0.4%; prev 0.6%)

- Retail Sales Ex Auto (M/M): 0.0% (est 0.4%; prev 0.5%; prev R 0.4%)

- Retail Sales Ex Auto and Gas (M/M): 0.0% (est 0.4%; prev 0.4%; prev R 0.3%)

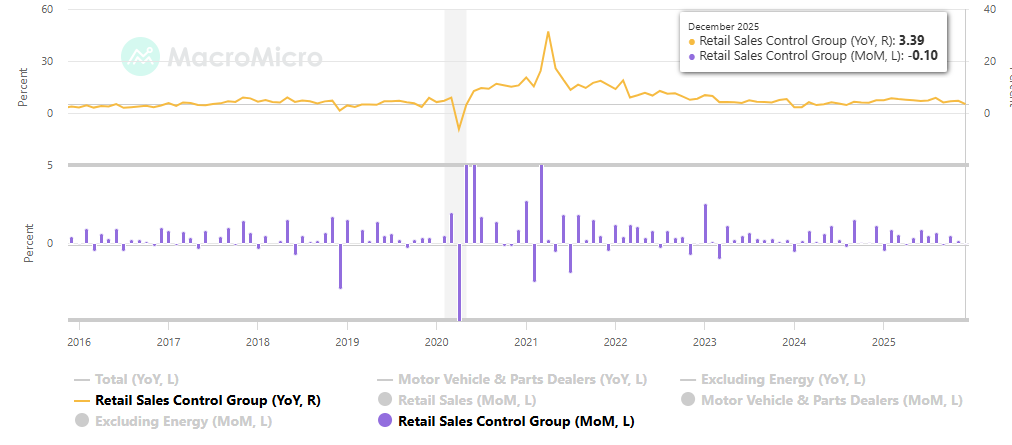

- Retail Sales Control Group (M/M): -0.1% (est 0.4%; prev 0.4%; prev R 0.2%)

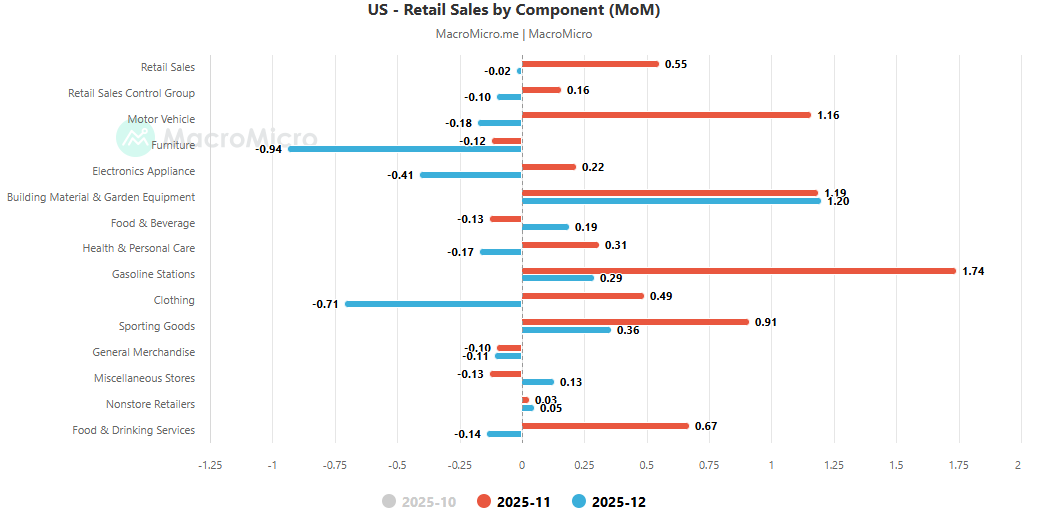

Dec retail sales come in worse than expected at the headline level decelerating back into negative territory -0.02% for the second time in three months (but after a solid +055% in Nov (revised from +0.61%)), coming in well below the +0.4% estimate with 8 of the 13 major categories falling back (more details below).

Gasoline stations remained positive +0.3% (after +1.7% in Nov), but autos fell for the third month in four -0.2% (after +1.2% in Nov (but -1.6% in Oct)). Stripping those out still saw core sales in negative territory (but barely at -0.003%) down from +0.28% in Nov (but revised down from +0.43%).

The key control group sales (which feed into GDP as the goods consumption component) came in at -0.10% vs +0.40% expected, and after Nov was revised down to +0.16% from +0.40%. That should overall see a healthy cut to 4Q GDP estimates.

As noted just 5 of the 13 main categories were higher (after 11 in Nov, 8 in Oct/Sept) led by increases (on a percentage basis) in building materials/garden +1.20% (after +1.19% in Nov), sporting goods +0.36% (after +0.91% in Nov), and gas stations as noted.

Online sales were +0.05% (after +0.03% in Nov revised from +0.36% (but after +1.0% in Oct), while bars/restaurants (the only service in the report) turned negative -0.14% (after +0.67% in Nov revised from +0.58%). Groceries and Misc Stores also advanced +0.19% and +0.13% respectively.

Leading decliners were home furnishing for a second month -0.94% (after -0.12% in Nov), apparel -0.71% (after +0.49%), and electronics -0.41% (after +0.22%).

The control group y/y decelerated to +3.39%, the least since Aug ‘24, from +4.68% (revised from 5.06%), a decent but much less solid pace, and down from 5.80% in Aug which was the highest since Feb ‘23.

Y/y headline retail sales also decelerated to +2.43%, the least since Sep ‘24, from +3.26% (revised from +3.09%) remaining at the least since Sep ‘24, while core fell to +3.45%, the least since Aug ‘24, from +4.21% also down from the 5.40% in Aug which was the best since Dec ‘23).

Note: All changes m/m unless otherwise noted. Usual caveats - First, these are not adjusted for prices so that also should be taken into account. Second, this report is more of a goods report with only one main services category (bars and restaurants) so it is not a complete picture of consumer spending, representing only around 35% of the total. Data on inflation-adjusted personal spending and overall services spending will be out later this month, offering a more full picture of consumer outlays in the month. Finally this report is seasonally adjusted which can always cause distortions, particularly for retail sales which are very lumpy throughout the year. #retailsales

https://www.census.gov/retail/sales.html

To subscribe to these summaries, click below.

To invite others to check it out,