The Week Ahead - 2/8/26

A comprehensive look at the upcoming week for US economics, equities and fixed income

If you're a new reader or maybe one who doesn’t make it to the end feel free to take a second to subscribe now.

Or please take a moment to invite others who might be interested to check it out.

Please note that I do sometimes add to or tweak items after first publishing, so it’s usually safest to read it from the website where it will have any updates.

As a reminder, some things I leave in from prior weeks for reference purposes, because it’s in-between updates, it provides background information, etc.. Anything not updated this week is in italics. As always apologize for typos, errors, etc., as there’s a lot here.

As a reminder, some things I leave in from prior weeks for reference purposes, because it’s in-between updates, it provides background information, etc.. Anything not updated this week is in italics. As always apologize for typos, errors, etc., as there’s a lot here, and I don’t really have time to do a thorough double-check.

For new subscribers, this is a relatively long post. The intent is to cover the same areas each week. Sometimes the various areas are more interesting, sometimes less, but it’s easier just to go through them all, so you can expect this format (with things in the same places) each week.

The main sections are intended to cover 1) what’s upcoming next week, 2) what the Fed and rates markets are up to, 3) what’s going on with earnings (which along with valuations and positioning are the determinants to stock prices over the long term), 4) what’s going on with the economy (both because of its impact on our daily lives but also because it impacts earnings), 5) valuations, 6) breadth (which gets into sector/style performance), 7) positioning/flows (this is the most important determinant to asset price changes in the short term), 8) sentiment (really only matters at extremes but interesting to track), 9) seasonality (gives you an idea of what normally happens), 10) “Final Thoughts” and 11) my portfolio (to be transparent about where my money is in the market (but note first it is most definitely not intended as financial advice, and second my portfolio is invested with the intention of wealth building not daily income, etc., so my portfolio is built with that in mind plus see note about MLP’s in that section).

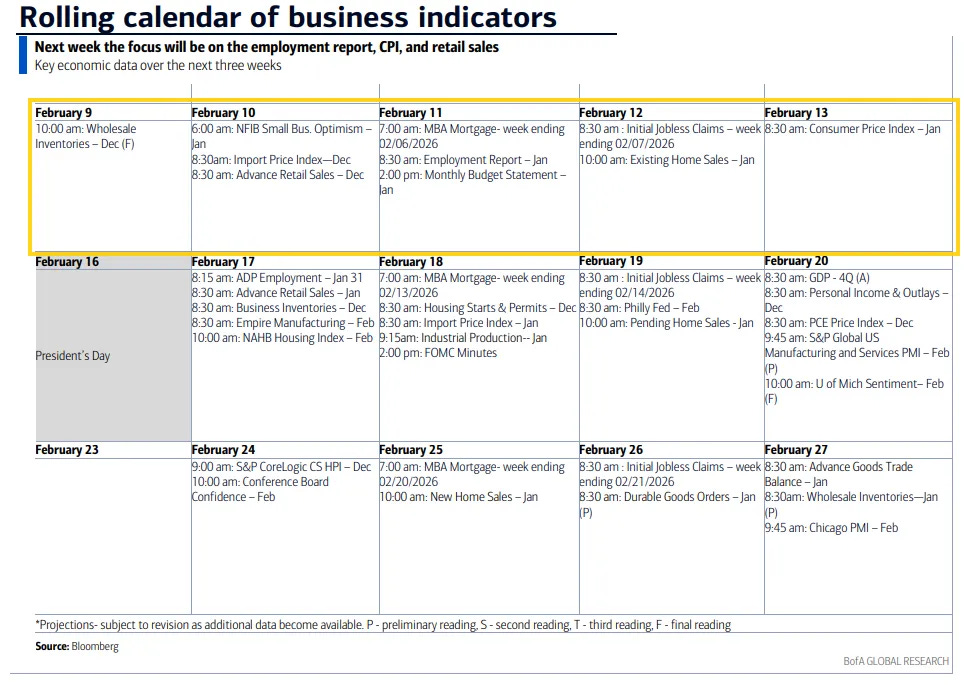

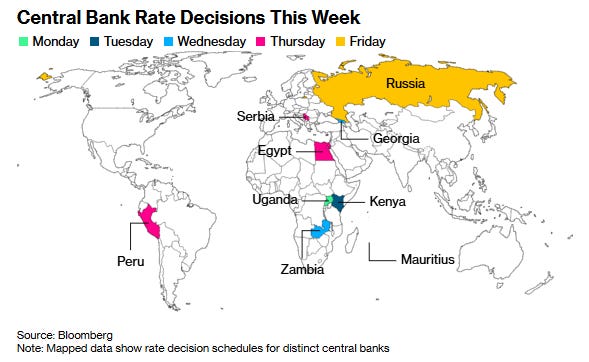

The Week Ahead

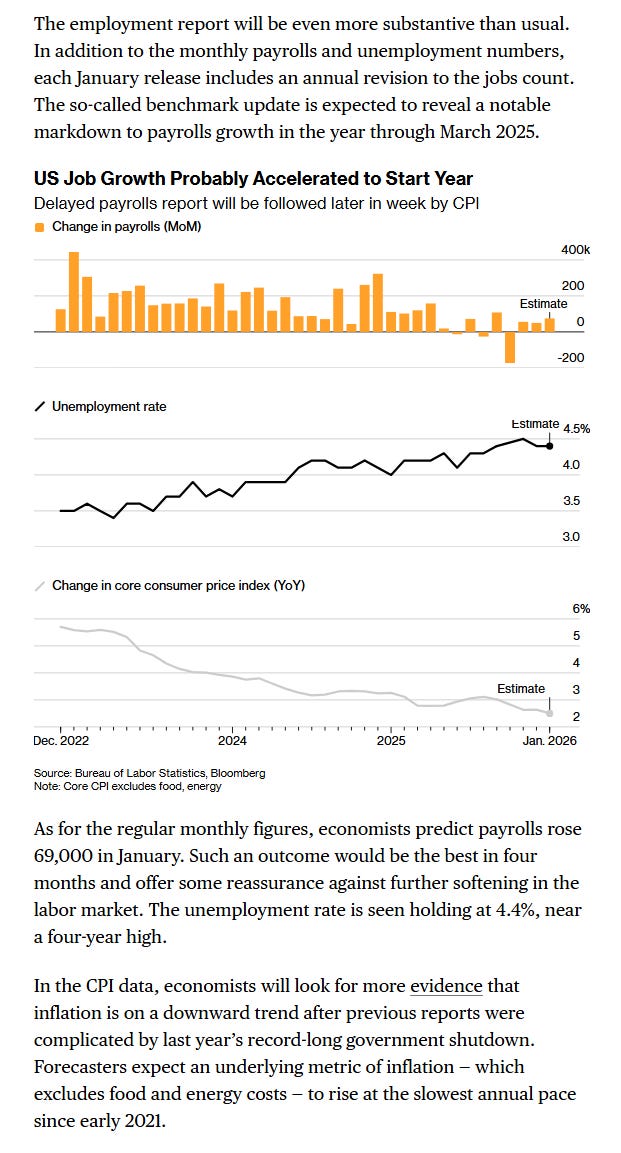

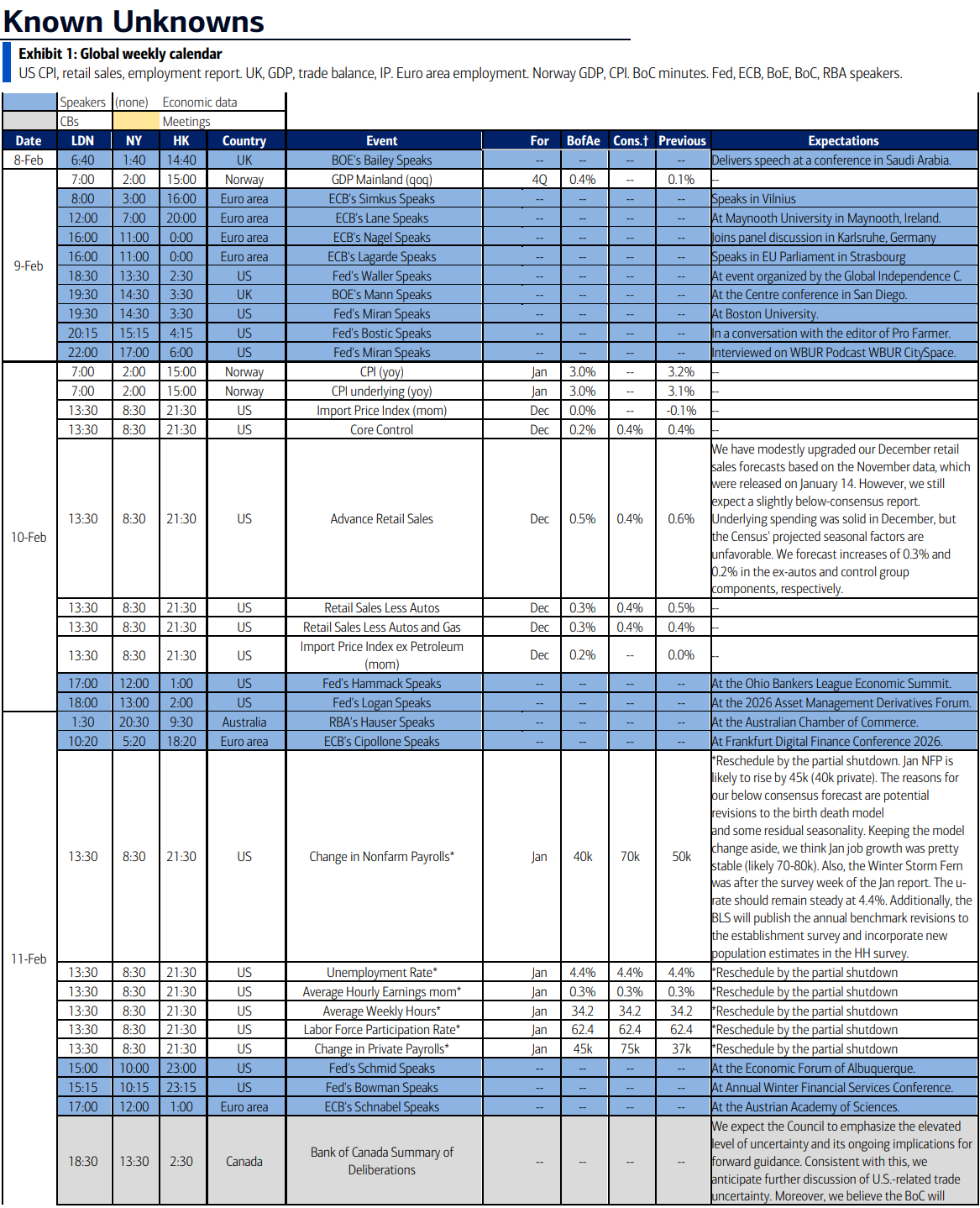

For the second month in a row (and hopefully the last month for a while) we’ll get a jobs report (NFP on Wednesday) in our inflation week (CPI on Friday). This will be a messy jobs report starting with the second-half of the QCEW revisions (which adjusts estimated employer payrolls to the actual best estimate we have - state unemployment insurance fund contributions). We got the first half (through March 2025) of that last year. This will revise the rest of 2025 (Apr-Dec). Last year that resulted in a more than 900k downward revision to 2024 job growth. While that large of an adjustment is not expected, if it’s anything close it will garner plenty of headlines (Jerome Powell for what it’s worth insinuated at one point he’s expecting something like -700k (-60k a month)).

But we will also get an updated birth-death model (which extrapolates the numbers from the employer sample to all employers). Many think a faulty birth-death model (which resulted in many more businesses assumed to exist than actually do) is responsible for the large QCEW revisions. That will mean the January payrolls number (which is not part of the QCEW revisions) will also likely be on the weaker side.

But don’t sleep on CPI either. January is traditionally a month when companies push through price increases, and it has been more pronounced since the pandemic which has created a “residual seasonality” issue (the BLS attempts to adjust for such seasonal price increases but the adjustments have been slow to catch up to this), and as a result we have generally seen hot CPI prints in the first quarter. A strong NFP and a hot CPI could see some fireworks in the bond markets.

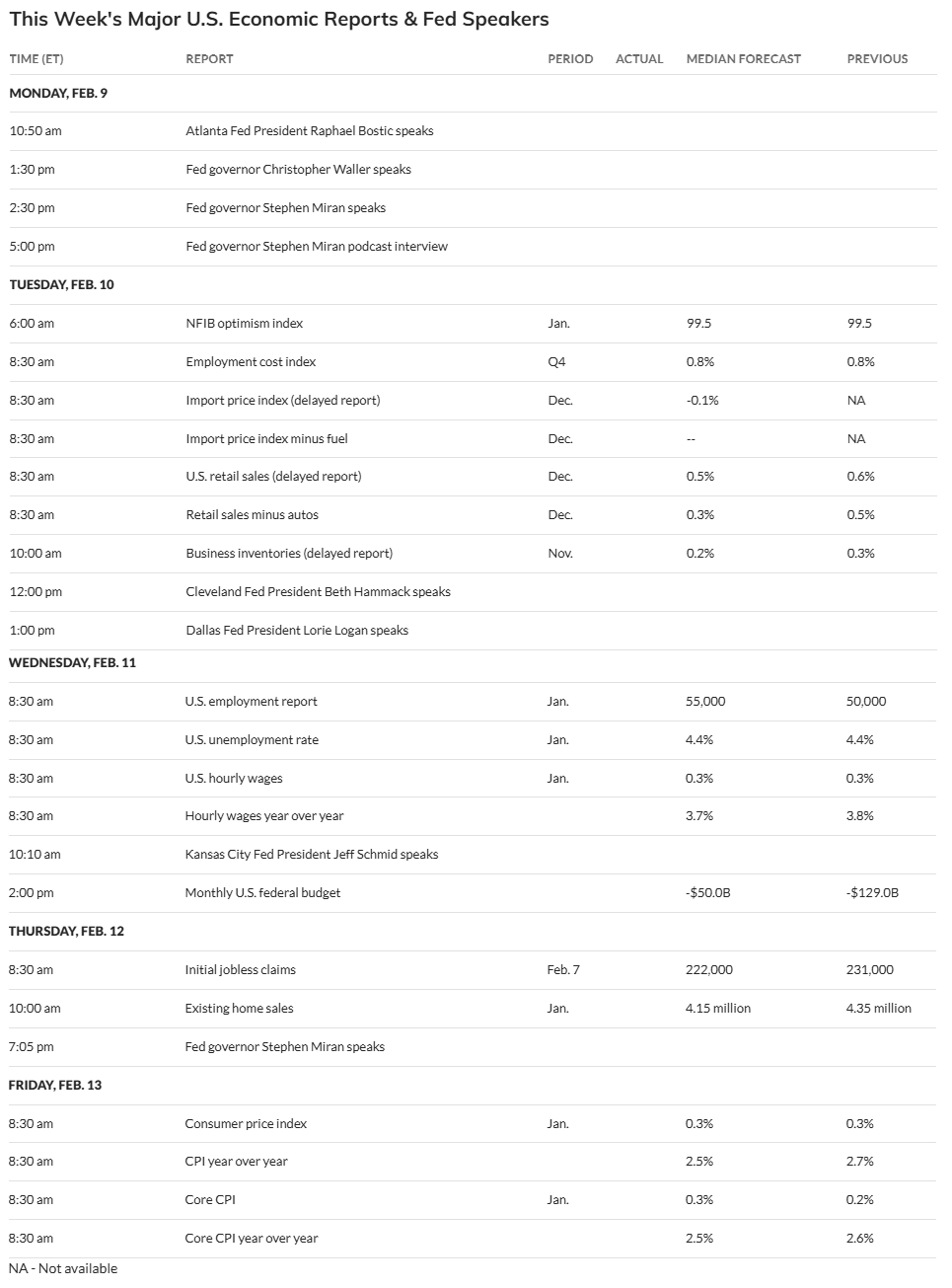

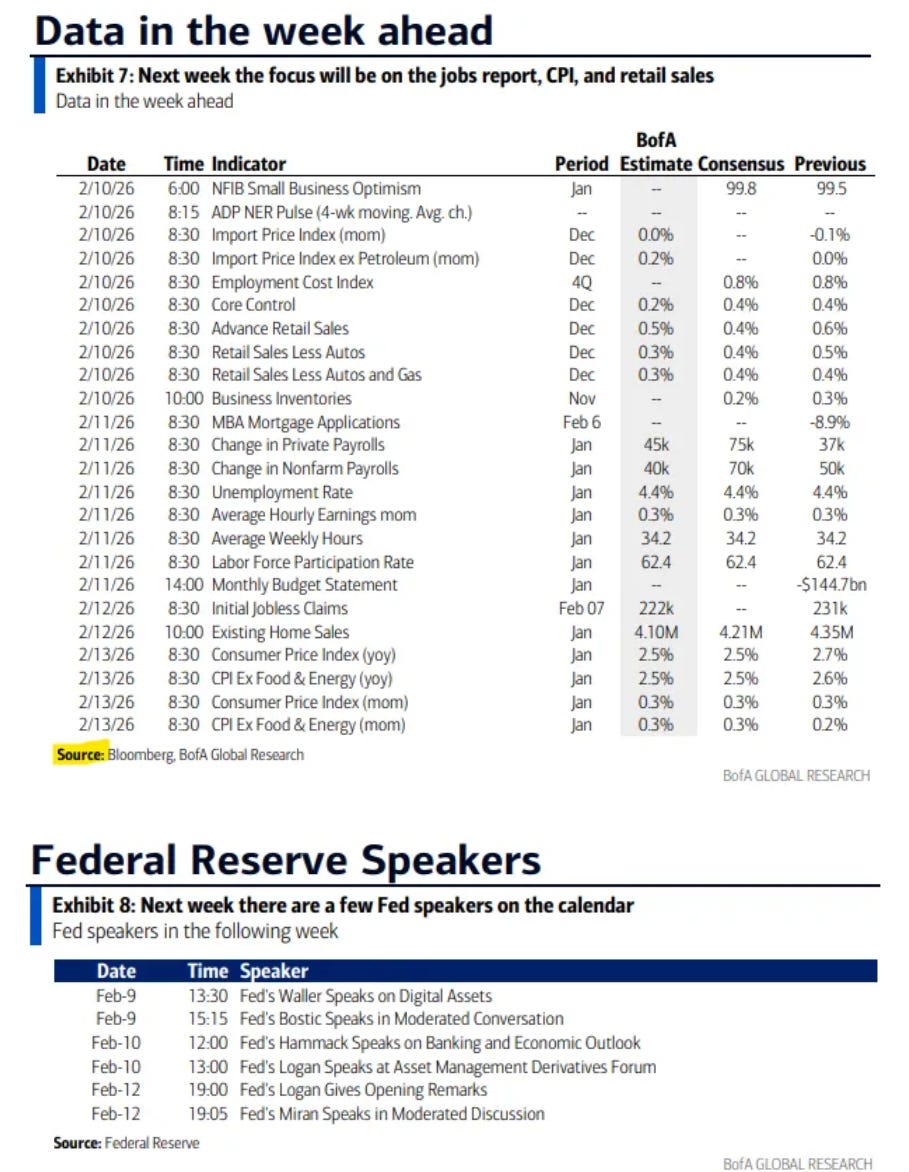

And it’s also retail sales week (Tuesday). All for December. Also Tuesday we’ll get the Fed’s favorite wage metric, the Employment Cost Index for Q4 along with Dec import prices and NFIB small business optimism. Thursday gives us initial jobless claims and Jan existing home sales, while Monday has the NY Fed’s consumer survey (not on the below calendars). All in addition to the normal weekly reports (ADP, mortgage applications, EIA inventories, etc.).

Fed speakers will continue with Gov’s Waller and Miran (multiple times), and regional bank presidents Bostic (who already appeared three times this week (I guess since he’s retiring he’s practicing the speaking circuit)), and, more interestingly, new 2026 voters Hammack and Logan who we haven’t heard from recently. Hammack has been the most hawkish Fed member and Logan has been close, so it will be interesting to see if they see any scope for rate cuts in 2026 (both said they wouldn’t have cut in Oct or Dec).

Non-Bill Treasury auctions (>1yr in duration) pick back up with 3, 10, and 30-yrs on their “normal” days (Tues, Wed, Thurs respectively).

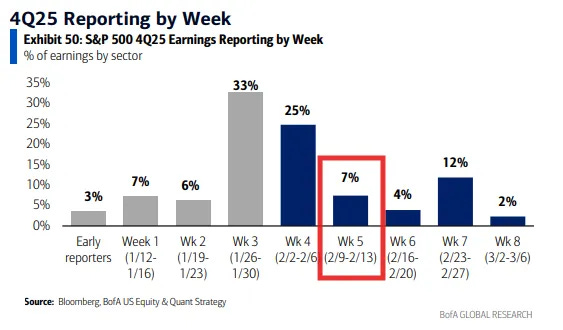

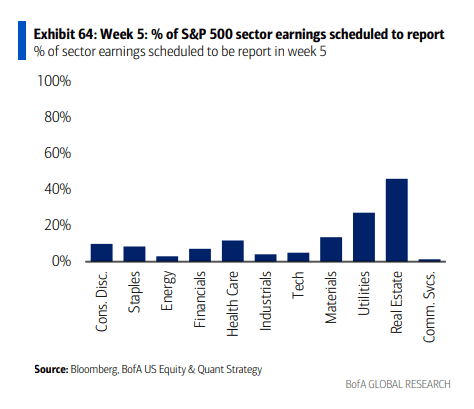

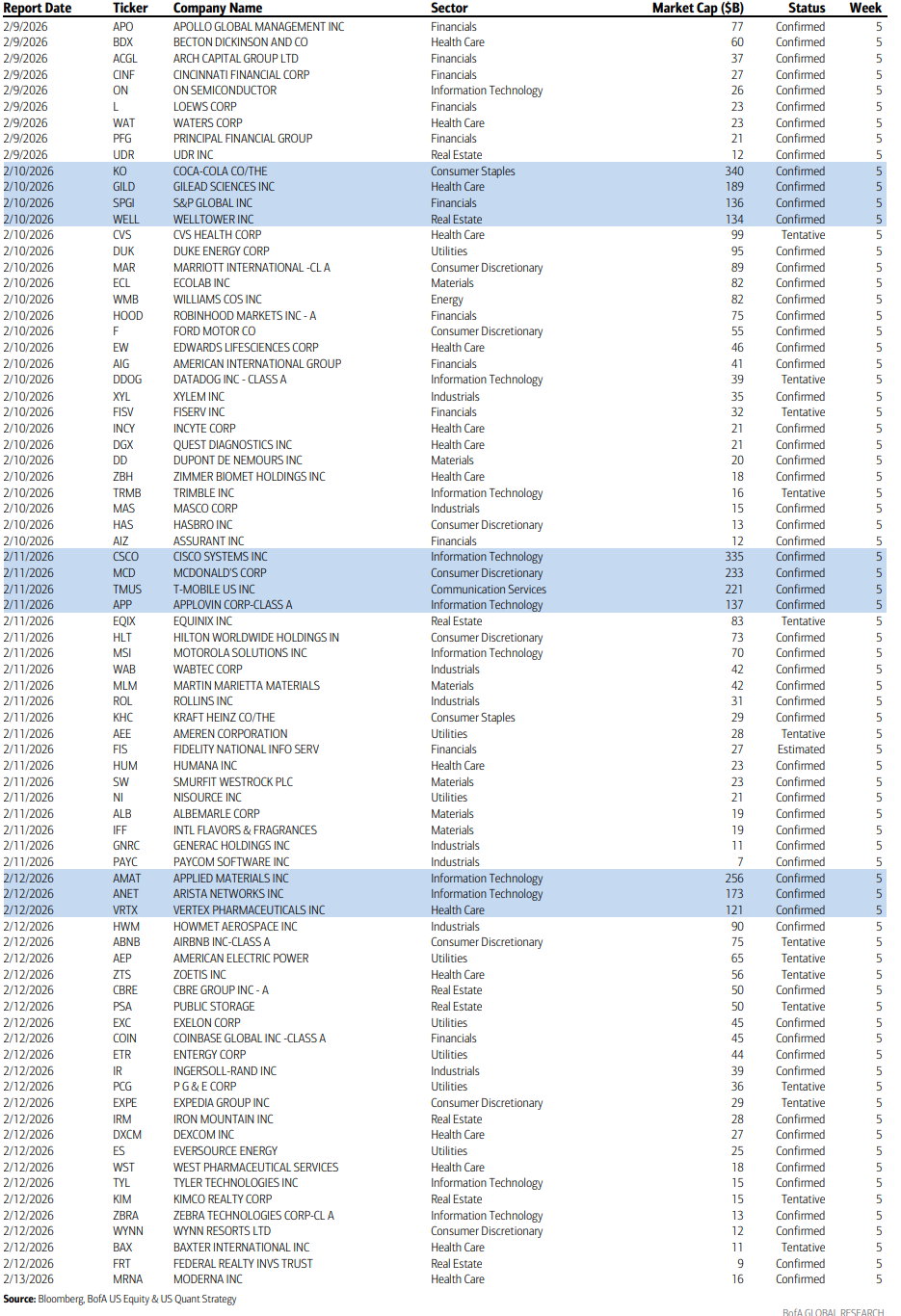

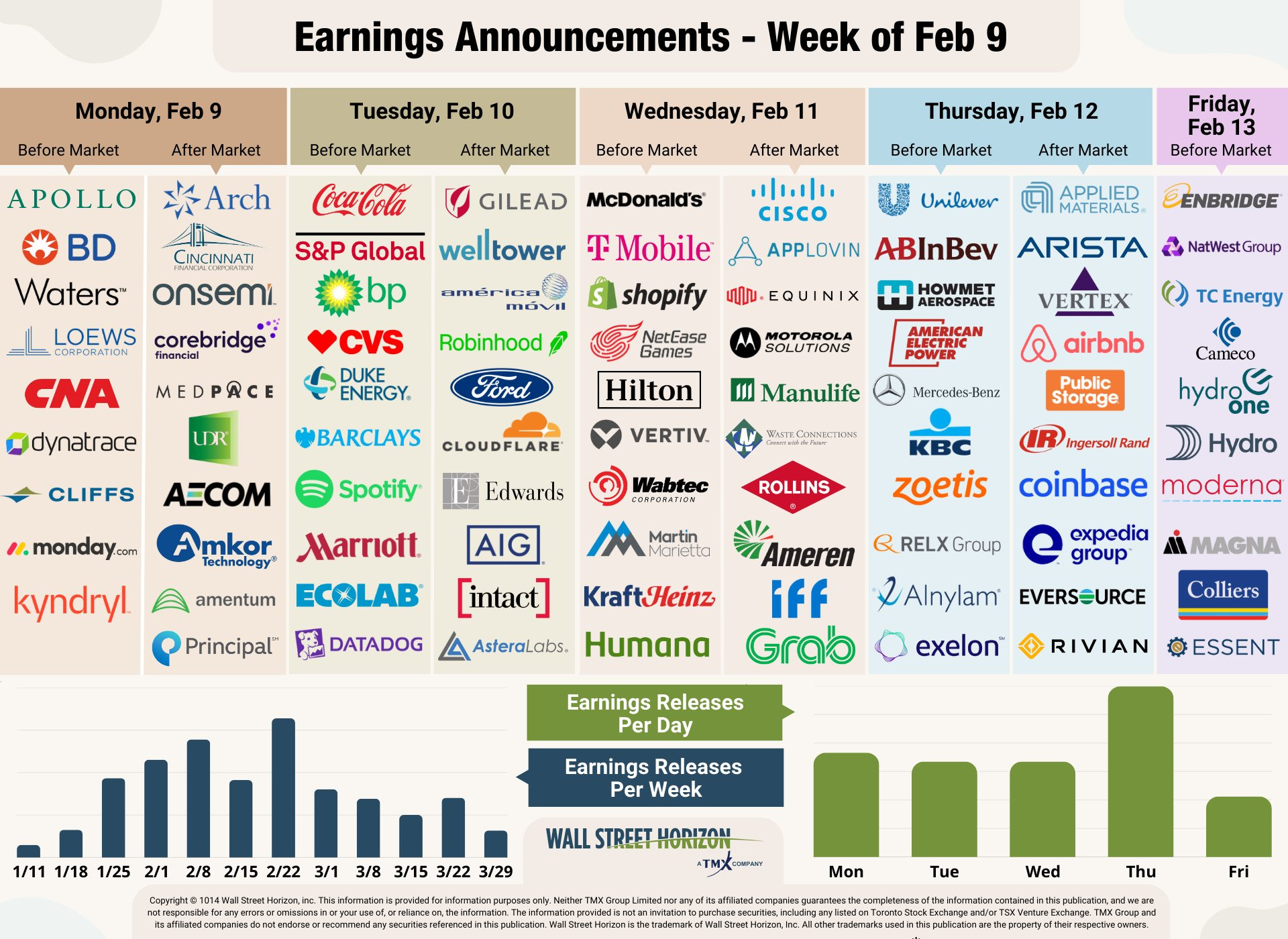

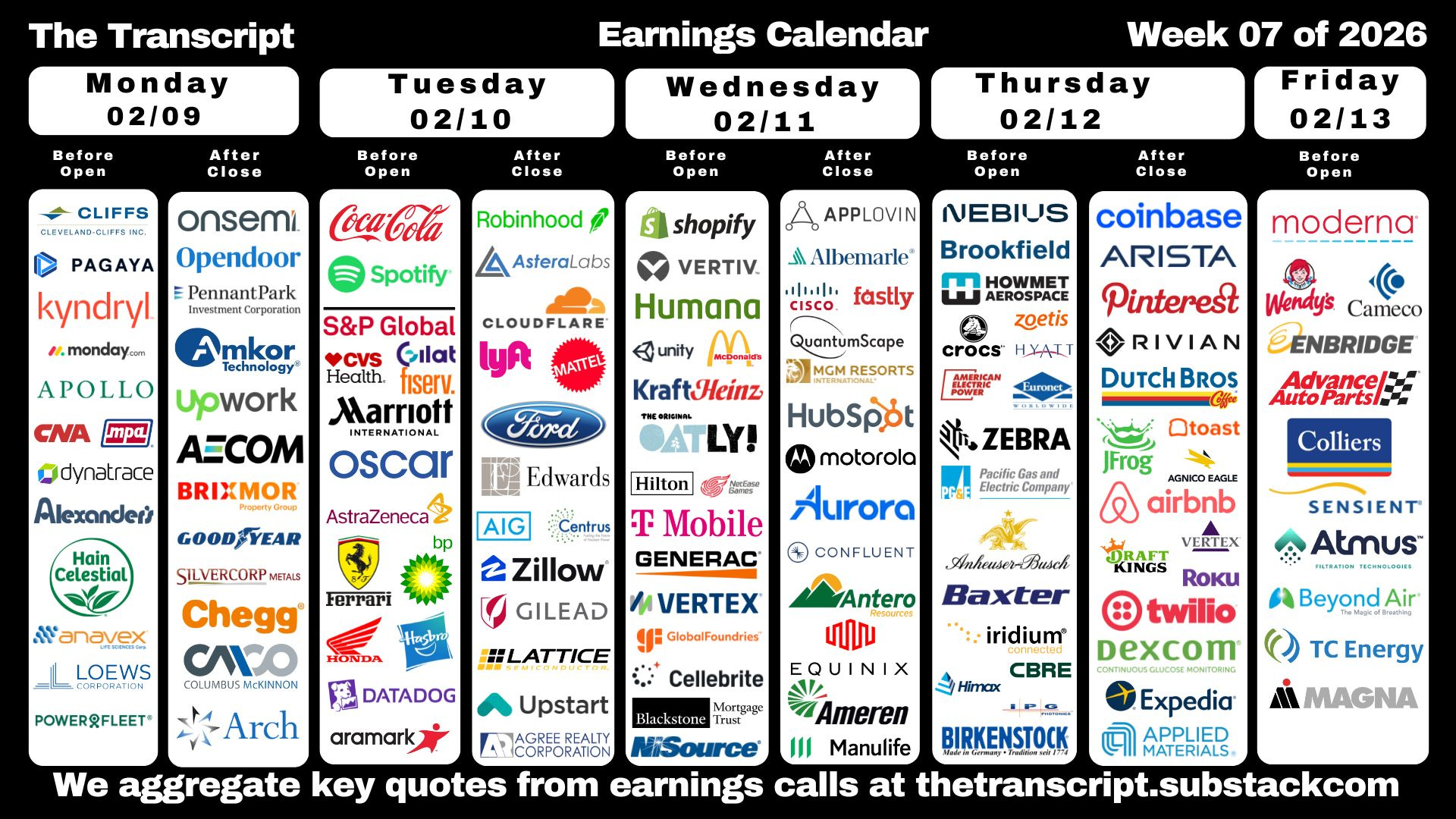

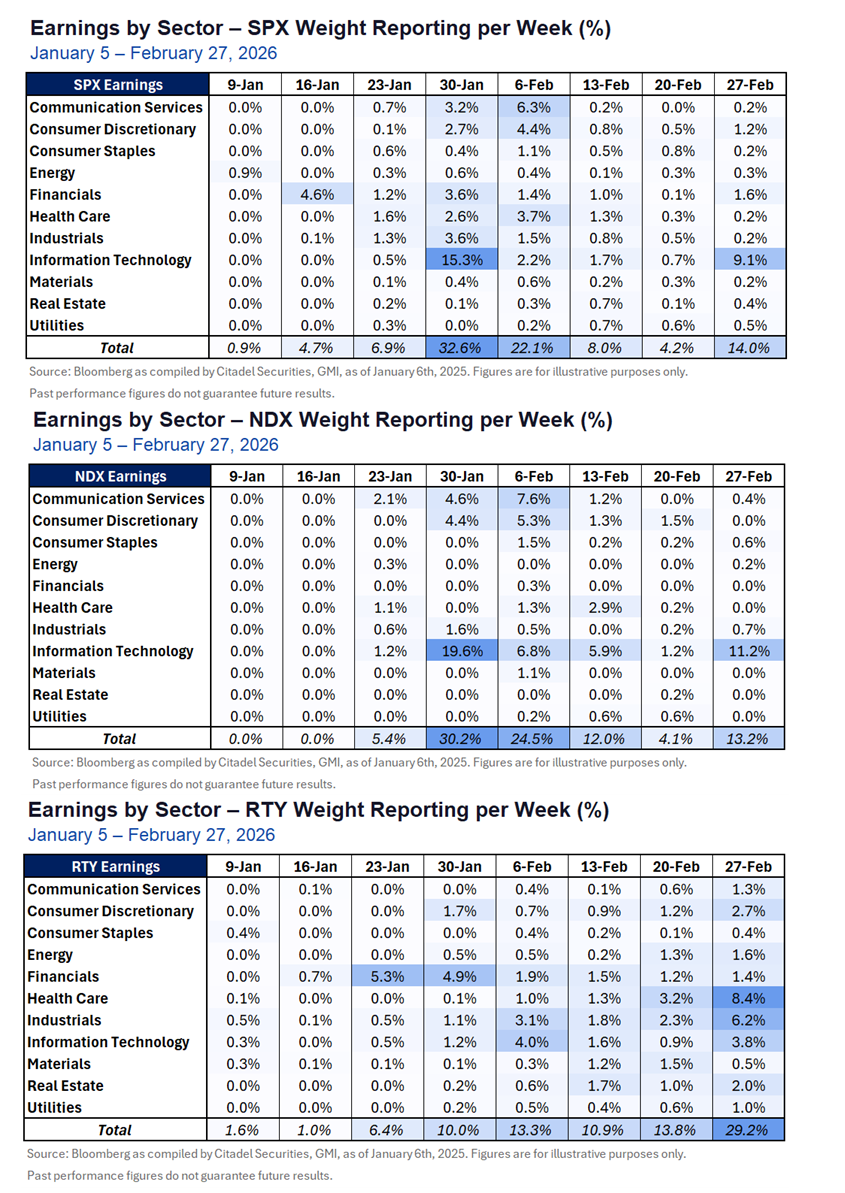

In terms of earnings, for the SPX we are on the downslope (at least until Nvidia at the end of the month) but we’ll still get 7% of the SPX reporting Q4 earnings next week comprising ~85 SPX components but just 10 >$100bn in market cap in GILD, SPGI, KO, APP, TMUS, MCD, CSCO, VRTX, ANET, AMAT (in order of reporting date). And outside of the SPX it’s the second busiest week of the season according to @WallStHorizon with over 1,800 companies reporting.

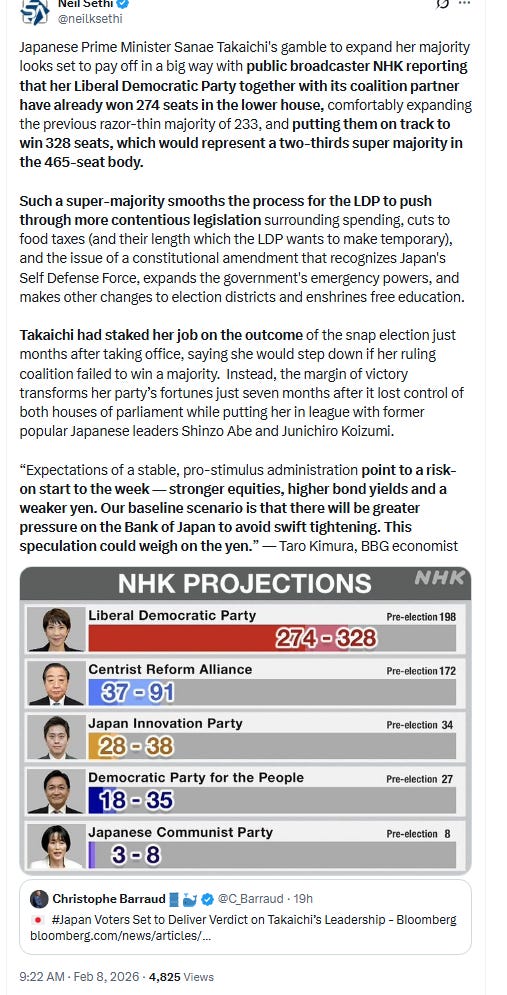

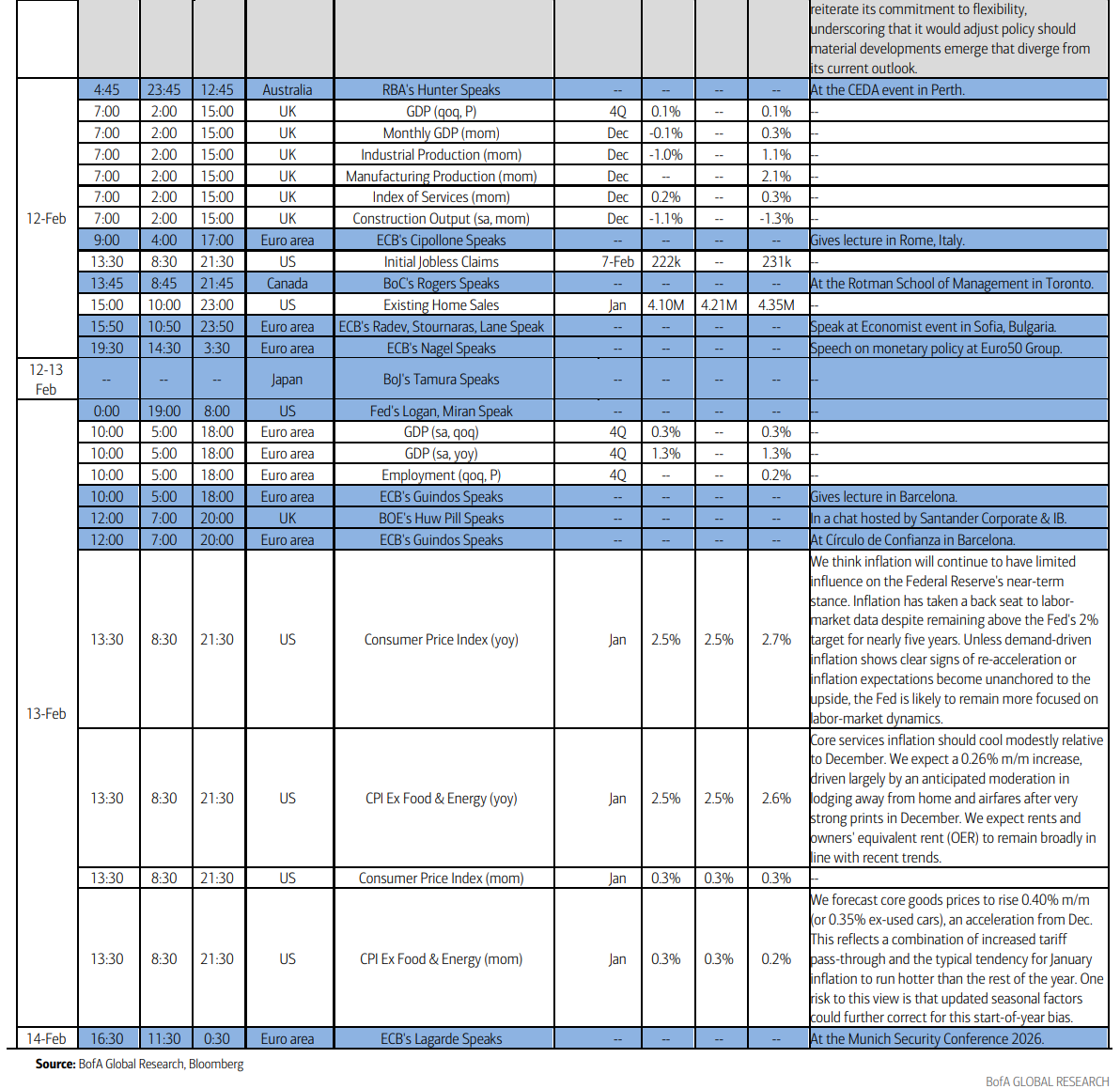

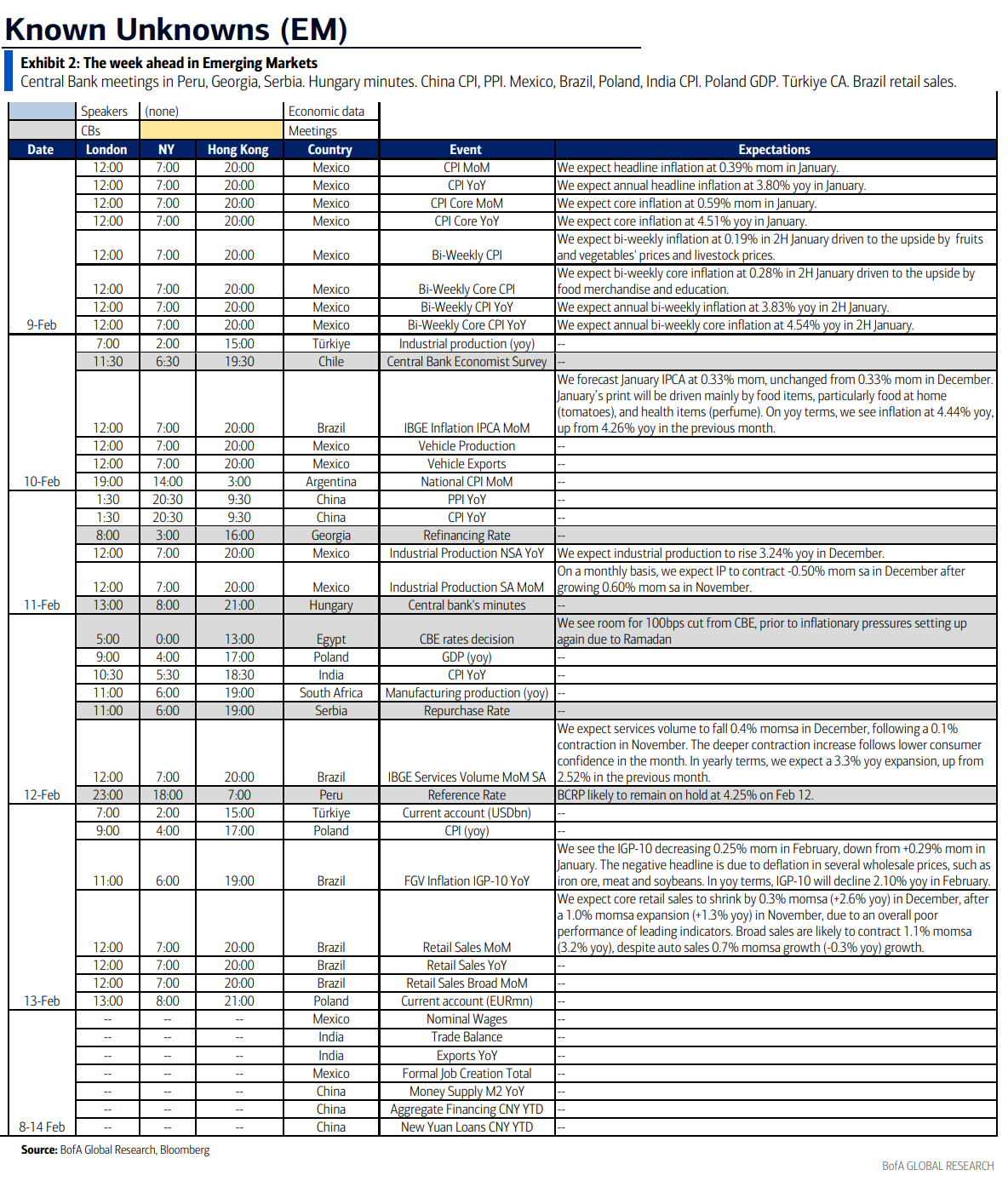

Ex-US a lighter week highlighted by the fallout from the smashing victory by Japan PM Takaichi’s LDP party in snap elections, inflation data from China to Switzerland to Brazil, gross domestic product in the UK, China credit data, Japan wage data, and rate decisions from Russia to Peru may focus investors.

Canada

the Bank of Canada’s summary of deliberations will offer insight into its decision to hold rates steady for a second consecutive meeting, while warning that heightened uncertainty made its next move hard to predict. Senior Deputy Governor Carolyn Rogers will speak on Thursday about how artificial intelligence is impacting the economy.

Asia

China sets the tone early with January credit data, including new yuan loans, aggregate financing, and money supply figures. Investors want to see whether easier policy is translating into stronger economic momentum. Inflation readings later in the week, including producer and consumer prices due Wednesday, should help clarify whether deflationary pressures are easing or becoming more entrenched.

Fresh off a national election — with Prime Minister Sanae Takaichi poised for a resounding victory — Japan gets a big batch of data on Monday, with cash earnings and real wage data for December expected to shed light on whether income growth is fueling prices. Balance-of-payments figures are released the same day, while machinery orders later in the week will offer an update on capital spending momentum.

In Australia, attention turns to domestic demand indicators arriving Tuesday, including household spending for December and consumer confidence readings. The figures land a week after the Reserve Bank’s hawkish pivot. South Korea has January unemployment data on Wednesday. In Southeast Asia, the spotlight turns to growth. Malaysia releases fourth-quarter GDP on Friday, alongside current-account figures, offering insight into domestic demand.

India publishes January inflation on Thursday, a key test for the Reserve Bank of India as it weighs the scope for easing later this year. Food prices remain a swing factor, and any upside surprise could complicate the policy outlook. In sum, the week’s data will help determine whether Asia’s cooling inflation narrative is intact — or whether, as Australia’s experience shows, central banks risk being pushed into a more stop-start policy path as growth and prices diverge across the region.

Europe, Middle East, Africa

Following the Bank of England’s close vote against a rate cut — and Governor Andrew Bailey’s apparent endorsement of bets on a 50% chance of a March move — data in the coming week will reveal the strength of the economy in the fourth quarter. Most analysts predict only a slight acceleration to growth of 0.2% from the prior three months. Officials scheduled to speak include key voters including Bailey himself on Sunday and Catherine Mann on Monday. Chief economist Huw Pill is on the diary for Friday.

In the euro zone, following the European Central Bank’s decision to keep borrowing costs unchanged, an appearance on Monday in the European Parliament by President Christine Lagarde is among several by policymakers in the coming days. Any comments on the euro will be in particular focus, with Executive Board member Piero Cipollone telling Cyprus News Agency in an interview published Sunday that the ECB will assess the effects of the currency’s recent rally on consumer-price growth in its quarterly forecasts due in March, but recent moves have been rather limited. Data on euro-area trade and a second reading of GDP are due on Friday.

On Thursday, European Union leaders will gather for a meeting focused on improving the bloc’s single market — for which the ECB has provided a checklist of desired measures. Switzerland’s inflation number on Friday may draw attention, with a result of just 0.1% — at the lower end of the Swiss National Bank’s target range — predicted by economists. Some even forecast a return to zero price growth, while the central bank chief, Martin Schlegel, has acknowledged that more negative readings are possible this year. Both Norway and Denmark will release inflation numbers on Tuesday following Norway’s GDP reading the previous day.

The diary features a number of central bank decisions around Africa and Eastern Europe: Uganda on Monday and Mauritius on Wednesday are expected to leave their rates steady at 9.75% and 4.5% respectively, as policymakers assess the inflation trajectory. Kenya on Tuesday and Zambia on Wednesday are likely to reduce borrowing costs. Kenya’s central bank is seen cutting its rate by 25 basis points to 8.75%, with inflation likely to stay within its target band in the near term. Zambia is expected to deliver a 50 basis-point cut, to 13.75%, anticipating price growth to slow. On Thursday, the National Bank of Serbia may extend its long streak of unchanged rates amid slowing inflation and early signs of a pickup in growth. The Bank of Russia will likely choose between a third consecutive modest 50 basis-point cut or a hold at 16% at its first meeting of the year on Friday, as policymakers wonder if the inflation effects of a hike in value-added tax could persist. Consumer-price data later that day may show an acceleration.

Latin America

Mexico-watchers on Monday get both mid- and full-month consumer price reports as a follow-up to the central bank’s decision to pause at 7%. Inflation picked up in early January, which to some analysts may push Banxico to the sidelines until the second quarter, when pressures related to newly enacted tariffs and excise tax hikes, along with a minimum wage increase, subside. Analysts in Citi’s latest Mexico Expectations Survey see annual prints creeping higher in January and February.

Brazil will also post its January inflation report, which is likely to show some uptick after ending 2025 within the central bank’s target range. Consumer price increases overshot the top of the target range in three of the previous four years. Banco Central do Brasil stands poised to finally begin whittling away at its 15% key rate next month, but how fast and how far remain open questions. Argentina’s inflation ended 2025 moving in the wrong direction, with the annual reading posting slight increases in November and December while the monthly rate rose for four straight months. Economy Minister Luis Caputo sees January’s monthly result likely coming in near December’s 2.8%, which implies a year-on-year figure of 32.2%. Analysts in the central bank’s most recent survey marked up their 2026 inflation forecast to 22.4% from 20.1% previously.

Peru’s central bank board meets Thursday, with the country’s economy in no need of stimulus and inflation running below the 2% midpoint of its 1% to 3% target range. A fifth straight hold at 4.25% looks nearly certain there.

DB one pager:

BoA’s cheat sheets: