Update - June 11, 2022

Update - June 11, 2022

Short glossary:

SPX = S&P 500

Naz = Nasdaq Composite

NDX = Nasdaq 100 (100 largest stocks in the Naz)

RUT = Russell 2000 (smaller stocks)

DMA = Daily Moving Average (the moving average over the given time period (20, 50, 100, 200 days normally)).

MACD = Moving Average Convergence Divergence (basically a trend indicator)

RSI = 14-day Relative Strength Index (basically what it sounds like)

On my charts, the lines are 20-DMA (green), 21-DEMA (red), 50-DMA (purple), 100-DMA (blue), 200-DMA (brown)

Source abbreviations: BBG = Bloomberg; WSJ = Wall Street Journal; RTRS = Reuters; SA = Seeking Alpha; HR = Heisenberg Report

So, a lot happened on Friday, so I tried to be a little more focused than some of the weekend efforts and didn’t get to quite a few things that I will try to work in during the week if I have the time. In terms of the market action Friday, I had said on Thursday

I think this tilts things to the downside for tomorrow, but we’ll see. A very cool CPI report and all bets are off. A very hot one, though, and it could get very ugly. Tomorrow will also be an important day in that any significant weakness really opens the door to a retest of the May lows, something I didn’t think would happen this quickly.

Well that CPI report was indeed very hot, and it did indeed get ugly (perhaps not “very”). I hadn’t even thought to mention on Thursday the UofM consumer sentiment report in terms of market impact. I mean we knew it would almost certainly be around decade lows, right? But all-time lows? That neither I, nor a single one of the economists surveyed by Bloomberg, thought that would happen. And long-term inflation expectations moving significantly higher? Oh boy. And on the back of that who wouldn’t expect a big spike in yields. And 22bps on the two-year qualifies as “big” for sure. Put it all together, and I would have been shocked if it wasn’t very ugly in the markets. Looks like Thursday’s sellers knew what they were doing. Anyway, at day’s end the SPX, NDX, Naz, and RUT were down -2.9, -3.6, -3.5, and -2.7% respectively.

Argus - The stock market ended the week on a disappointing note, pressured by hot inflation and weakening consumer sentiment. The S&P 500 fell 2.9%, surrendering 5.1% for the week while the Nasdaq (-3.5%) underperformed, losing 5.6% this week.

BBG - US stocks tumbled the most in three weeks and Treasury yields spiked higher after an unexpectedly hot reading in consumer prices fueled bets the Federal Reserve will have to step up its battle against inflation. The S&P 500 fell 2.9%, closing out the second worst week this year and the ninth weekly drop in the past 10, as fears mounted that efforts to combat inflation risk stifling growth. Tech shares bore the brunt of Friday’s rout, with the Nasdaq 100 tumbling more than 3%. Growth stocks from Cathie Wood’s flagship ETF to software developers and chipmakers plunged. A separate report showed US consumer sentiment dropped in early June to a record, adding to pressure on shares of airlines, casinos and hotels. In the Treasury market, two-year yields topped 3%, a level not seen since 2008, while the move in short rates left 30-year yields below those on five-year notes, signaling the risk that tightening will slow growth. Bitcoin slid back below $30,000, the Cboe Volatility Index surged to 29 and the dollar advanced.

Some quotes from BBG:

“The CPI report is another reminder that equity markets will no longer be coddled by monetary policy,” John Lynch, chief investment officer at Comerica Wealth Management, said in a note. “We look for volatility to continue until equity markets accept that the Fed’s target rate gets to at least 3.0%, and not obsess over the magnitude of incremental moves at the next several policy meetings.”

“At some point financial conditions will tighten enough and/or growth will weaken enough such that the Fed can pause from hiking,” Goldman Sachs Group Inc. strategists including Zach Pandl wrote in a note. “But we still seem far from that point, which suggests upside risks to bond yields, ongoing pressure on risky assets, and likely broad US dollar strength for now.”

And another very weak Morningstar style box on Friday again with broad based selling tilted a little more to growth.

As weekly fund flows saw investors going to cash according to Lipper with huge sales of bonds (other than junk) and some equities (other than large cap value).

Money market funds (+$24.3 billion) reported weekly inflows, while taxable bond funds (-$2.8 billion), tax-exempt bond funds (-$2.1 billion), and equity funds (-$274 million) suffered outflows.

June 10 (Reuters) - U.S. bond funds witnessed massive outflows in the week to June 8 after a weekly inflow. According to Refinitiv Lipper data, investors withdrew $7.61 billion out of U.S. bond funds after the purchases of $7.09 billion in the previous week, which was the only weekly inflow since Jan 5. U.S. investors offloaded taxable bond funds worth $5.21 billion and municipal funds worth $2.4 billion, which were the biggest weekly outflow in three weeks. U.S. short/intermediate investment-grade funds, and short/intermediate government and treasury funds witnessed outflows of $3.63 billion and $2.77 billion, respectively, but investors purchased high-yield funds worth $1.17 billion.

Which was confirmed by Bank of America Corp., which cited EPFR Global data but as noted there was some equity buying specifically US large-caps (but as noted above all value not growth or financials) to the tune of $14.5B. BBG.

Cash saw the biggest inflows in six weeks at about $54 billion, while exchange-traded funds led additions of about $12 billion into equities in the week through June 8, according to Bank of America Corp. note, which cited EPFR Global data. US stocks were the primary beneficiaries of inflows with about $13 billion, while bond fund outflows resumed, the data showed.

US large-caps saw inflows of $14.5 billion in the week through Wednesday, while outflows hit US small-caps, value and growth shares, according to BofA’s note. Among sectors, materials and health care had the biggest inflows, while financials, communication services, and technology saw the biggest outflows. Among regions, European stocks continued to face outflows for the seventeenth week, while emerging-market and Japanese equity funds also saw redemptions.

While in the same note, Bank of America’s Michael Hartnett who along with Mike Wilson at Morgan have been the most visible bears since last year, rubbed salt in the wound, asking “Where’s my bear market rally gone?” HR.

For Hartnett, stocks’ inability to hold gains is easy to explain. “In short, the inflation shock isn’t over and the rates shock is just starting,” he wrote, in the latest installment of his popular weekly “Flow Show” series. Hartnett’s contention that neither the inflation shock nor the rates shock are behind us proved prescient. His latest was published on Thursday evening, around 8:30 ET, 12 hours prior to Friday’s inflation data. “[There’s] no release valve from the peak in yields and the bear market rally is too consensus,” he said.

Hartnett also noted (from the BBG article).

The US economy is “a couple of bad data points away from ‘recession’.” “We’re in technical recession but just don’t realize it,” he wrote. “In short, inflation shock not over, rates shock just starting, growth shock coming, no release valve from peak in yields, bear market rally too consensus.”

I do have to admit a bear market rally had become fairly consensus (even Hartnett and Wilson were looking for one). Perhaps though now that it’s no longer consensus we actually get it? One can hope I guess.

As Robert Shiller says we may talk ourselves into a recession (which is not a new concept - if consumers and businesses retrench in anticipation of recession, that retrenchment can tip a growth slowdown into a recession). BBG.

Nobel laureate economist Robert Shiller sees a “good chance” of a US recession that’s at least in part the result of a “self-fulfilling prophecy” as investors, companies and consumers grow increasingly worried about a downturn. “The fear can lead to the actuality,” said Yale University professor Shiller, author of the 2019 book “Narrative Economics: How Stories Go Viral and Drive Major Economic Events.”

Concern about a potential contraction has mounted recently as inflation accelerated and the Federal Reserve stepped up efforts to control it. A number of corporate chieftains have sounded the alarm and stock prices have slumped. And an increasing number of US households say the economy is headed in the wrong direction. That all could lead consumers and companies to turn more cautious, planting the seeds of a downturn. Shiller puts the chances of a recession sometime over the next couple of years at a “much higher than normal” 50%. Shiller also said that Americans are more likely to succumb to a self-fulfilling prophecy of a downturn right now because the country is collectively suffering “post-traumatic stress disorder” from the pandemic. More than 1 million Americans have lost their lives to Covid-19.

Major Market Technicals

I said on Thursday

No good natural support below the May lows, so hopefully stocks will find their footing somewhere. The reaction to the CPI report tomorrow will obviously have a lot to say about that.

Well, you know the rest. Full retest with the SPX actually undercutting on a closing low basis (by a point) the May closing lows. Intraday low is another 100 points down. Do we test that? The chart says probably. But with this market who knows. Also MACD seems destined to crossover which is another headwind, but we do have an RSI positive divergence which you know I am a fan of. NDX, Naz and RUT look similar but did not make a lower closing low than May.

And we failed Mark’s test, which probably means not good things.

SPX Sector Flag

SPX sector flag Friday was similar looking to Thursday’s where every sector lost at least -1.5% with nine of eleven losing around -2% or more. On Friday two defensive sectors were able to finish better than -1.5% (but still down) and so seven instead of nine finished down at least -2% or more. So a tiny improvement, but I’d emphasize “tiny”.

And Jeff Currie makes an interesting point on the energy sector (and its impact on oil prices - if there’s no financial incentive to add production, producers won’t do it, keeping supplies tight). SA.

In January of this year, Goldman's chief commodities analyst Jeff Currie sat down with Grant Williams to discuss "mega trends" in commodity markets. At that time, Currie felt commodity capex would need to accelerate to meet the demands of an emerging low-carbon energy system. With companies largely sitting on their hands in 2022, Jeff reiterated Thursday that we are in the early-innings of the energy cycle.

In Jeff's view, Wall Street's rotation into natural resources has not yet begun, as share buybacks and the absence of sellers has driven shares higher. For capital to flow out of other sectors and into energy, Currie believes institutional investors will need to see three years of strong returns. Without institutional capital lifting share prices further, boards and management teams are faced with a dilemma; buyback shares or invest in new projects. Canadian Natural (CNQ) detailed this dilemma in its Q1 investor presentation. The company holds ~11b barrels of proved reserves. Even at today's $77b valuation ($91b including debt), the company is only "valued" at $7.00 / barrel of available resource ($8.27 including debt). With "finding and development" costs nearly double, the board is effectively forced to buyback shares rather than invest in production. In doing so, the board can increase resource per share at a cost of $7.00-$8.27 per barrel by reducing share count. Were Canadian Natural (CNQ) shares to double again, the board would be faced with a more balanced capital allocation decision - buyback shares valued at $14.00-$16.54 per barrel in the ground, or build new projects at a similar cost. In Currie's view, the process of rebalancing equity market valuations and development costs will take another three years. After which, companies will begin to allocate capital to new projects rather than buying back shares.

Jeff's bullish view raises a key question. Unlike prior cycles, energy companies have nearly no visibility into energy policy ten years forward. Just this Thursday, EU lawmakers voted to ban the sale of gasoline-powered cars from 2035. Canadian bitumen mines are expensive and long lived. Would a responsible management team be able to allocate capital to developing projects with a 30 to 50 year expected life, when policy makers are announcing new tax, carbon and pipeline policies weekly?

In the very near term, investors are likely to reap the benefits of historically elevated commodity prices. Energy companies in the US, Canada and Europe have universally committed to shareholder return frameworks that accelerate rapidly under the prevailing conditions. Policy measures have thus far proven ineffective in capping prices, and shifting policy is likely to discourage the investment needed to balance markets. Suggesting that record Q2 earnings could be just the start of an extended cycle, as Currie suggests.

Breadth

Interestingly, as bad as the action was, positive volume was slightly better than Thursday on NYSE but everything else deteriorated. On NYSE volume was 12% positive (it was 7% Thursday) and issues 15%. Naz was 21% positive volume, issues 19%. After a 90% down day on the NYSE on Thursday, an 88% down day is not a great follow-up. Just lots and lots of selling.

What does it mean? Well that’s the thing. Are you feeling lucky?

And we did have this positive divergence.

And this.

Commodities/Currencies/Bonds

Bonds -As noted bonds fell with yields moving higher. The 2-year yield was up 22 basis points to 3.06%, the highest since 2008, while the 10-year was up nine to 3.15%, the highest since it was 3.25% in 2018. If it gets over that, we’re going back to 2011 levels. So the 2-10 spread, which was 21 bps coming into Friday ended the day at just nine. And the 3-10, 5-10, and 7-10 curves are now all inverted. Meanwhile, five-year rates surged to the highest in more than a decade, exceeding their 30-year counterparts for the first time in a month.

In terms of the Fed, rates markets now have a 100% chance of a 50bps hike in September, and and now, understandably, 75bps chatter is starting to get more traction, with now 107bps of hikes priced in for the next two meetings and 155bps through September (so next three meetings). If that happens, once again Bullard will have been way ahead of the rest of the Fed. And Barclay’s officially called for a 75bps hike and increased their terminal rate by 25bps. In this era of not surprising markets, and as they are in a blackout period until the meeting, I don’t see that (75 in June) happening (although if they do feel they need to “surprise the markets” I guess that (or 100bps as Jeremy Siegel is suggesting) would do it), but I do think July or September could definitely be on the table if we get another hot print for June next month, and I would look for Powell to “set the table” for that next week:

“The US central bank now has good reason to surprise markets by hiking more aggressively than expected in June,” Barclays economists led by Jonathan Millar wrote in a note Friday. “We realize it is a close call and that it could play out in either June or July. But we are changing our forecast to call for a 75 basis point hike on June 15.”

Other comments:

“Even in these fast-moving times, the Fed is likely to be reluctant to surprise markets, which keeps the chance of a 75 basis-point surprise at next week’s meeting small,” said Sarah House, senior economist at Wells Fargo & Co. “However, we could see Chair Powell at the post-meeting press conference more clearly signal that 75 basis-point hikes are on the table for future meetings if we don’t see a let-up in inflation.”

“If these high month-on-month numbers continue, increments of 50 basis points beyond July become much more likely. And I wouldn’t exclude 75 basis-point increments either,” said Roberto Perli, head of global policy research at Piper Sandler & Co. “Powell said they were not under active consideration in May, but they may well be considered in the future if inflation does not show signs of abating.”

And I mentioned Mohammad El-Erian Thursday who said inflation wouldn’t peak until August or September, and Larry Summers (who I have to give credit to in terms of being right on inflation) had similar sentiments and piled on the Fed for missing the boat. BBG.

Former Treasury Secretary Lawrence Summers said the Federal Reserve has failed to account for its mistakes and to realize the damage to its credibility after the latest inflation data dashed hopes that a peak had been reached. Summers urged the Fed to investigate why officials’ forecasts were “so dramatically” and repeatedly wrong. He faulted the central bank for having a homogeneity in its forecasts, and criticized its main mathematical model. The Fed’s so-called FRB-US economic model “is not really fit for purpose in terms of inflation,” he said. The former Treasury chief cautioned that major components of the consumer price index could accelerate in the months ahead. Shelter costs could be rising by 8% later this year. Medical care is also still “looking low,” he said.

Given the lagged time periods it takes for Fed policy actions to take effect, “there’s some real disadvantages to delay” in tightening policy, said Summers, a Harvard University professor and paid contributor to Bloomberg TV. “The debate has been between 25 and 50 basis point moves a couple months from now,” Summers said. “I think a more fruitful deliberation would be between 50 and 75 basis points.”

While Ray Dalio was out last week looking for rate cuts in 2024 (something that would not be particularly surprising to me, especially if we follow the 1994 “soft landing” scenario). BBG.

Billionaire hedge fund founder Ray Dalio said central banks across the globe will be required to cut interest rates in 2024 after a period of stagflation constrains their economies, according to the Australian Financial Review. “We believe that we are in a tightening mode that can cause corrections or downward moves to many financial assets,” Dalio, the founder of Bridgewater Associates LP, said in an interview with the newspaper (see more on potential Australian rate cuts in Asia section). “The pain of that will become great and that will force the central banks to ease again probably somewhere close to the next presidential elections in 2024.”

Markets are pricing in rate cuts in the US in around two years time, and also in other developed economies including the UK, according to futures. For now, much of the focus is on the speed of the tightening as more than 60 monetary authorities have already raised borrowing costs in a bid to rein in accelerating inflation. “It is a structural inflation situation that is going to produce stagflation,” Dalio told the AFR. In my opinion, the speed of the rate hikes, while important, is less so than the terminal rate. In fact, I think the market might welcome a faster pace (“let’s just get it over with”). But the terminal rate moving significantly higher is a different story, as that is what many valuation metrics such as P/E’s, etc., are based off of. So that’s what I’ll be watching, and that did edge up by a quarter point, so if the market was at fair value on a P/E basis prior to the CPI report, then the selloff makes some sense (as the higher terminal rate should have moved P/E’s lower).

But in my opinion, the speed of the rate hikes, while important, is less so than the terminal rate. In fact, I think the market might welcome a faster pace (“let’s just get it over with”). But the terminal rate moving significantly higher is a different story, as that is what many valuation metrics such as P/E’s, etc., are based off of. So that’s what I’ll be watching, and that did edge up by a quarter point, so if the market was at fair value on a P/E basis prior to the CPI report, then the selloff makes some sense (as the higher terminal rate should have moved P/E’s lower).

Of course there’s some question as to whether current P/E’s are “fair value” (I know this is the Bonds section but it fits here). HR.

“Despite the 18% YTD decline, equity valuations remain far from depressed,” Goldman’s David Kostin said. Consider that the median S&P stock still trades on an 18 multiple, in the 87th%ile since 1976. “Valuations appear more attractive in the context of interest rates, but still do not look ‘cheap,'” Kostin went on to say, noting that the 540bps gap between the median stock’s earnings yield and 10-year US reals is middling. Note that IG yields are on the brink of eclipsing the S&P’s payout rate. That hasn’t happened since 2009.

And Jurrien Timmer notes that at 3% (now 3.25%) terminal rate and 17x forward P/E it makes a lot of upside tough to see from here.

And high yield issuance continues to be challenged by the risk off environment.

Dollar (DXY) - After breaking through resistance Thursday I noted “Seems it has a clear path to move higher. This has been a headwind to stocks lately.” Well it did move higher, and I’m sure that didn’t help stocks (although it almost certainly was a minor factor). “The Bloomberg Dollar Spot Index jumped 0.8%, buoyed by its haven appeal amid a stock selloff, climbing against most Group-of-10 and emerging-market peers.” Daily technicals have also turned supportive.

VIX - I said on Thursday “Tomorrow will be a function of market reaction to the CPI report”, and it was with the VIX pushing to the top of its wedge before falling back (interesting that it fell back despite equities closing at the lows of the day). Not sure where this goes next week.

Crude (/CL) - Ended little changed again, but remains in its sharp uptrend. Daily technicals remain supportive for now although starting to show signs of peaking.

As gas prices hit $5 on average for the first time in the U.S.

And last week at least no demand destruction. Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd., said at a conference in Calgary: “Even with high prices, demand is continuing because people, they want to travel, they want to get out. And the second thing is that governments around the world are subsidizing prices.”

As money managers didn’t do much trading week through Wednesday in WTI.

But they were a little more active in Brent adding over 8% to net length.

As US looks to mend ties with the Saudi’s.

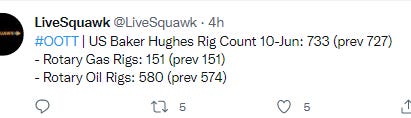

And oil rig count increases by six (gas rigs flat).

As European inventories continue to fall.

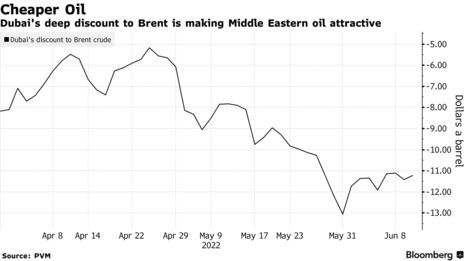

And it appears even with the price hike (although at a discount to Brent due to the Russian situation), already high prices, and Chinese demand severely depressed, the Saudi’s can’t fulfill all the requested commitments for July. Saudi crude is often sought after due to its purity versus many other producers. BBG.

Saudi Arabia will provide some Chinese buyers with less crude than they asked for next month, while fulfilling requests from many other customers in Asia after OPEC+ pledged to speed up production hikes. Japan, South Korea, Thailand and India will get the oil volumes they had sought, with some even getting extra supplies, according to refinery officials who asked not to be identified as the information is private. State-run marketer Saudi Aramco typically doesn’t provide buyers with a reason why volumes are cut. July supplies of Saudi oil were especially sought-after by many in Asia due to strong refining margins.

And in that regard as of now there appears to be no problem for Russia finding customers as Russia's Rosneft is holding back on signing new crude oil deals with two Indian state refiners, three sources with knowledge of the matter said, as it has committed sales to other customers. It looks like this will continue at least until the insurance ban takes effect in six months. RTRS.

Drawn to the discounts offered, three Indian state refiners - Indian Oil Corp (IOC.NS), Bharat Petroleum Corp (BPCL.NS) and Hindustan Petroleum - opened negotiations with Rosneft earlier this year for six-month supply deals. So far only IOC, the country's top refiner, has signed a deal with Rosneft, which will see it buy 6 million barrels of Russian oil every month, with an option to buy 3 million barrels more. The other two refiners' requests have since been turned down by the Russian producer, the sources said. "Rosneft is non-committal in signing a contract with HPCL and BPCL. They are saying they don't have volumes," said one of the sources. Russia is ramping up oil exports from its major eastern port of Kozmino by about a fifth to meet surging demand from Asian buyers and offset the impact of European Union sanctions. China has also boosted its purchases from Russia. Rosneft has awarded 900,000 tonnes (6.66 million barrels) of ESPO Blend crude oil loading in June to Unipec, the trading arm of Asia's top refiner Sinopec Corp, according to four traders.

Indian sources said Russian oil is no longer available at deep discounts and they get fewer offers for sale on a Delivered At Port (DAP) basis, an international commercial term in which the seller pays for insurance and freight and ownership is transferred to the buyer only after the cargo is discharged. "Earlier the companies were offering good discounts but that is not available now. Offers have been reduced and discounts are not as good as before, as insurance and freight rates have gone up," another source said.

And more bad news on supply from Libya.

And the positive correlation between the dollar and crude this year is unusual to say the least.

And as a side note, I think it’s worth noting that when we force marginal suppliers to produce, they’re almost guaranteed to be less environmentally friendly than US or European companies would be. Somebody needs to produce natural gas, crude, etc., shouldn’t it be the most responsible companies? I don’t even want to think about what’s going on in places like Nigeria. As an example, experts have made the case that Europe's shift from Russian gas to other gas supplies stands to be a net climate benefit because of the greater emissions profile associated with Russian gas. (from S&P).

Nat Gas (/NG) - Fell back but was able to hold the 20-DMA and uptrend line running back to March again. This is impressive as it’s kept its uptrend despite relatively weak technicals and in the face of the temporary closure of the Freeport facility which accounts for 16% of LNG exports.

Gold (/GC) - After moving to the bottom of its two-week range Thursday, moved to the top on Friday. Daily technicals remain supportive. Needs to clear the 1890 area to get more constructive.

And David Einhorn says gold price may go `much higher'. SA.

Hedge fund titan David Einhorn said believes that gold (GLD) is a buy now and it may go "much higher." "When countries don't trust each other over bonds and currencies, gold becomes the ultimate reserve asset," Greenlight's Einhorn said at the 2022 Sohn Investment Conference. "And I say gold rather than crypto because gold is already recognized as a globally acceptable central bank reserve asset."

"Gold as a percentage of total reserves remains staggeringly low," Einhorn continued. "The question is whether there is enough gold to back the currency reserves. The answer is for the price of gold to go higher, perhaps much higher."

Asia

Equity indices in the Asia-Pacific region ended the week on a mostly lower note. Japan's Nikkei -1.5%; Hong Kong's Hang Seng -0.3%; China's Shanghai Composite +1.4%; India's Sensex -1.8%; South Korea's Kospi -1.1%: and Australia's All Ordinaries -1.3%.

As Russia was able to cut its key rate by another 150bps to 9.5%, 50bps below estimates as the economy is holding up better than expected in no small part due to the deft handling of a very difficult situation by the head of its central bank Elvira Nabiullina. As a reminder, she had tried to resign after the start of the Ukraine incursion but Putin wisely refused her “offer”. As HR noted “When Putin refuses to accept your offer, that’s an offer you can’t refuse.” Still inflation is running 17% above year ago levels, so double what we’re seeing in the U.S. And much of the budget surplus is due to a collapse in imports (by 81% in some estimates) as Russians are deprived of many key (and many not key but nice to have (like burgers and cars)) items due to sanctions, while the economy is in a deep recession. BBG.

Russia’s central bank lowered interest rates to their level before the invasion of Ukraine but said the path of monetary policy will increasingly depend on how inflation fares while the economy adapts to sanctions. Following a large cut at an extraordinary meeting two weeks ago, policy makers used their scheduled session on Friday to reduce the benchmark again, this time to 9.5% from 11%. A majority in a Bloomberg survey of 23 economists predicted a smaller reduction of 100 basis points. “To the extent that inflation falls in a sustainable way, the key rate will gradually be cut further,” Governor Elvira Nabiullina told reporters after the decision in Moscow. “The effects of sanctions so far are less acute than we feared.” The benchmark is on average forecast to be in the range of 8.5% to 9.5% from June 14 through the end of 2022. The Bank of Russia said it expects this year’s economic contraction to be smaller than it had forecast in April “It shows the ability of companies to adapt,” Nabiullina said. “But it’s premature to say that the full effect of the sanctions has materialized.”

“The decline in headline inflation is largely due to a correction in prices for a small group of goods and services, after they went up sharply in March. This comes as a result of ruble exchange rate movements and the tailing-off of the surge in consumer demand in the context of a marked decline in inflation expectations of households and businesses,” the Bank of Russia said in the statement accompanying the policy decision.

Authorities now need to revive domestic demand to balance out surging exports of commodities that have powered the currency’s rebound to near the strongest in four years. Besides rate cuts, the central bank has also been loosening capital controls to relieve pressure on the ruble. It also revised down its baseline scenario for inflation and now sees it at 14%–17% by the end of 2022. Monthly inflation came in at just 0.1% in May.

“The statement sounds more balanced and a bit less dovish than the previous ones,” said Tatiana Orlova at Oxford Economics. “So it seems that the time of large rate cuts has ended. The next rate cut will probably be much more modest.” The central bank on Friday improved its outlook for the economy and inflation relative to its most recent projections. Nabiullina said that Russian exports haven’t declined as much as expected.

In news: Movement of shipping containers at South Korea's Ulsan port has been halted due to a strike by truckers. Representatives from South Korea's government met with the truckers, but the meeting did not produce a solution. The two sides will meet again tomorrow.

Some coronavirus restrictions will be reimposed in Shanghai, according to reports, and Beijing’s local government said a Covid-19 outbreak linked to a popular bar is proving more difficult to control than previous clusters. Authorities delayed the reopening for most schools in the capital planned for Monday, while most districts in Shanghai suspended dine-in services at restaurants. The quick rebound in cases once restrictions were eased shows the difficulties of fully stamping out more contagious virus variants, and explains why only China is still engaged in the effort of eliminating transmission. Defense Minister Wei Fenghe on Sunday praised China’s virus policy, saying the country is one of the safest in the world with the lowest Covid-19 induced death rate. In a speech to Asia’s biggest security conference in Singapore, Wei called China’s Covid response a miracle and said its success is a major contribution to the global fight against the pandemic.

And apropos to Ray Dalio’s thoughts noted above, Australia’s largest lender expects rate cuts, but in this case in 2023. BBG.

Australia’s largest lender expects current aggressive monetary policy tightening to weigh heavily on the economy and force the Reserve Bank to reverse course and cut interest rates in the second half of 2023. Commonwealth Bank of Australia on Thursday downgraded its GDP growth forecasts and now predicts the A$2.2 trillion ($1.6 trillion) economy will expand 3.5% this year, down from a previous 4.7%, and then slow to a “below‑trend” 2.1% in 2023, compared with 3.1% seen previously. The RBA “looks very intent on dropping the inflation rate quickly,” said Gareth Aird, head of Australian Economics at CBA. “But this will come at the expense of growth in aggregate demand, particularly household consumption.” Money markets are pricing in outsized hikes from the RBA in coming months and see the cash rate above 3% by December. “Our central bank appears to now be first and foremost inflation fighters,” Aird said. “Their objective of ‘the economic prosperity and welfare of the people of Australia’ has taken a back seat to their desire to drop the rate of inflation.”

“Were the RBA to tighten as much as markets project, it would trigger a recession -- forcing it to reverse course and cut rates as soon as 2H 2023. We doubt it will go that far” - James McIntyre, Economist.

In economic data: China reported cooler than expected inflation figures for May. Also, credit picked up more than expected in May.

China's May CPI -0.2% m/m (expected -0.3%; last 0.4%); 2.1% yr /yr (expected 2.2%; last 2.1%). May PPI 6.4% yr/yr, as expected (last 8.0%). May New Loans CNY1.89 trln (expected CNY1.30 trln; last CNY645.40 bln) and May total social financing CNY2.79 trln (expected CNY2.015 trln; last CNY910.20 bln)

BBG - China’s inflation moderated in May as global commodity prices cooled and consumer demand weakened, leaving room for authorities to ease monetary policy and add stimulus to shore up the economy. The producer price index rose 6.4% last month from a year earlier, the weakest pace since March 2021, National Bureau of Statistics data showed Friday. That compares to 8% growth in April, and it was in line with economists’ expectations. Consumer prices, meanwhile, rose 2.1%, just under the median forecast of a 2.2% increase in a Bloomberg survey of economists, and unchanged from April. Core inflation, which removes the more volatile food and energy prices, rose 0.9%, unchanged from April.

Global commodity prices aren’t as high as they were earlier this year when the war in Ukraine broke out, contributing to the moderation in factory-gate inflation. Pork prices, a key component in China’s CPI basket, fell 21.1%, dragging the headline number down by 0.34 percentage point. Fresh vegetable prices rose by 11.6% year-on-year in May, while fresh fruit prices increased by 19% during that time, driving CPI up by a combined 0.58 percentage point. Fuel prices for vehicles climbed by 27.1% from a year earlier.

“This is not an economy where the central bank really has to worry about inflation,” Michael Spencer, chief economist and head of research at Deutsche Bank AG, said in an interview on Bloomberg Television. “Even if we get a bounce-back in the third quarter as hopefully these lockdowns come to an end, it’s going to bounce back to a very moderate inflation rate, modestly below trend of growth in China.”

China’s slack inflation data for May underline weakness in the economy and add to the case for the People’s Bank of China to increase stimulus further. A drop in the CPI from April tracked weak demand from households whose sentiment has been battered by Covid restrictions. David Qu, China economist

China’s credit picked up more than expected in May, although that was largely attributed to a jump in government bond sales and a rise in short-term lending, suggesting borrowing by consumers and businesses remains subdued. Aggregate financing was 2.79 trillion yuan ($417 billion), the People’s Bank of China said Friday, up from 910 billion in April. Financial institutions offered 1.89 trillion yuan of new loans in the month, but more than 60% of those loans were short-term, indicating that companies and households are still reluctant to boost borrowing to buy houses or invest. While the worst of the current economic fallout may be coming to an end and the central bank is urging banks to “go all out” to boost lending, there’s little sign in Friday’s data of a strong rebound in demand for money which would propel growth in coming months.

Lenders struggling to find enough people to borrow money were swapping bills with each other in May just to meet regulatory requirements for corporate lending. Household loans came in at 288.8 billion yuan in May, less than half the level of a year earlier. Almost 105 billion yuan of that was medium to long-term loans, which are a proxy for home mortgages, while the other 184 billion yuan was in short-term loans. The growth in the stock of loans was 10.9% in May, slightly higher than the level in April, which had been the slowest since at least 2003.

“In the next three to six months, the government has no choice but to push banks to extend credit to the real economy,” as companies remain starved of cash, said Larry Hu, head of China economics at Macquarie Securities. “We will see pretty strong credit data in the next few months due to the government’s strong incentive to push lending.”

Japan's May PPI 0.0% m/m (expected 0.5%; last 1.3%); 9.1% yr/yr (expected 9.8%; last 9.8%)

South Korea's April Current Account deficit $80 mln (last surplus of $7.06 bln)

New Zealand's May Electronic Card Retail Sales 1.9% m/m (last 7.1%); 0.7% yr/yr (last 2.1%). Q1 Manufacturing Sales Volume -3.5% qtr/qtr (last 8.2%).

Europe

Major European indices ended sharply lower with Italy's MIB pacing the retreat after Italy's 10-yr yield hit its highest level since early 2014 in the wake of yesterday's ECB decision, fueling concerns about funding costs.

As economists are rushing to revise their forecasts for the path of euro-area interest rates, but disagree over how fast and far the European Central Bank will ultimately increase borrowing costs. BBG.

Credit Suisse Group AG - A 25 basis-point increase in July followed by double that amount in September and 75 basis points over the fourth quarter. The rate to reach 2% by end-2023

Deutsche Bank AG - A 25 basis-point increase in July followed by 50 basis-point hikes in September and October and 25 again in December. A terminal rate of 2% to be reached in June 2023 via 25 basis-point hikes

Goldman Sachs Group Inc. - Liftoff with 25 basis points followed by 50 in September and October before another 25 basis-point move in December. Three more increases of that amount in 2023 to a terminal rate of 1.75%

JPMorgan Chase & Co. - A 25 basis-point hike in July and then 50 in September, with additional quarter-point increases in October and December and the risk of more aggression

Barclays Plc - 25 basis points in July, 50 in September and 25 in October. The ECB will ultimately stop with a deposit rate at 0.5%

Morgan Stanley - Sees a quarter-point hike in July, a half-point in September and two more 25 basis-point increases in October and December

BNP Paribas - A 25 basis-point hike in July followed by moves of twice that size in September and October and a quarter-point increase in December

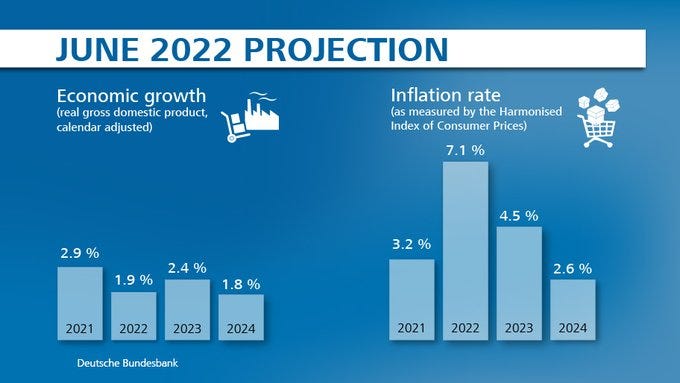

In news: Bank of England's Resolvability Assessment concluded that major British banks have overcome "Too Big to Fail" and that they shouldn't require a public bailout if a crisis hits. The Bundesbank raised Germany's 2022 inflation forecast to 7.1% from 3.6% while cutting the growth forecast to 1.9% from 4.2%.

In economic data:

U.K.'s Inflation Expectations 4.6% (last 4.3%)

Italy's April Industrial Production 1.6% m/m (expected -1.1%; prior 0.0%); 4.2% yr/yr (expected -0.2%; last 3.2%)

Spain's May CPI 0.8% m/m, as expected (last -0.2%); 8.7% yr/yr, as expected (last 8.3%)

And British employers added staff in May at the slowest pace since early 2021, according to a survey that adds to signs that the labor market is losing some of its heat. RTRS.

A measure of permanent staff hiring by accountants KPMG and the Recruitment and Employment Confederation (REC) fell for a sixth month to 59.2 from 59.8 in April, but remained well above the 50 threshold for growth. The survey's gauge of temporary staff hiring in May also fell to its lowest since early last year.

And the LNG terminal fire in the US is pushing up European nat gas prices. Luckily it’s at a time of less usage, and they are ahead of schedule on restocking. BBG.

Benchmark futures traded in Amsterdam snapped a six-day falling streak, while UK prices soared as much as 39% before paring gains. The Freeport liquefied natural gas facility in Texas -- which makes up about a fifth of all US exports of the fuel -- will remain closed for a minimum of three weeks, resulting in at least 10 missed cargoes. The closure comes as pipeline supplies from Europe’s top providers are also capped. Key facilities in Norway are undergoing annual maintenance this week, while Russia’s supplies are below capacity after several European buyers were cut off for refusing to meet Moscow’s demands to be ultimately paid in rubles for its pipeline fuel.

“The event highlights Europe’s precarious situation, and it would likely signal an end for now to the calm trading seen in recent weeks,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. “An export halt during the high-demand winter months would have triggered a much bigger reaction.”

Europe’s underground facilities were about 50% full as of June 7 after active refilling in recent weeks, which moved the storage level closer to historic averages, data from Gas Infrastructure Europe show. The continent’s electricity prices also rose, with German contracts for next month adding as much as 11% to 194.50 euros per megawatt-hour before retreating to 187.25 euros.

Other Int’l

As Canadian employers continued hiring at a strong pace last month in an increasingly tight labor market, driving down the unemployment rate to a record low and fueling a sharp acceleration in wage gains. The wage gains in May were some of the strongest in records going back to the 1990s.

BBG - The economy added 39,800 jobs in May, Statistics Canada reported Friday, surpassing the 27,500 gain anticipated by economists. The nation’s jobless rate fell to 5.1%, from 5.2%, bringing it to the lowest in data going back to 1976. Masking the overall gain in net new jobs was a massive shift of part-time employment to full-time -- another sign of a tight labor market. Full-time employment jumped by 135,400, with part-time jobs down 95,800. The average hourly wage rate was up 3.9% from a year ago, an acceleration from 3.3% in April. The bulk of the new job gains came from the unemployment ranks, with the labor force growing by just 11,800 during the month. Canada’s economy has added more than 1 million jobs over the past year, with employment nearly half a million above February 2020 levels.

Officials led by Governor Tiff Macklem have increased the main policy rate to 1.5%, from 0.25% earlier this year, and are expected to rapidly hike borrowing costs to 3% by October. “The solid data and standout wage figure may have investors once again increasing the odds of a 75 basis point move by the Bank at its next meeting,” Andrew Grantham, an economist at Canadian Imperial Bank of Commerce, said in a report to investors.

U.S. Data

Did reports on CPI and the UofM consumer sentiment index. They weren’t pretty.

And some reaction to the CPI report.

“One concerning development we’ve been seeing in prior inflation readings is that the stickier core components were beginning to catch fire - and we saw this accelerate with the latest core print,” said Max Gokhman, chief investment officer for AlphaTrAI. “That means Fed firefighters have to fight harder and that means stock bulls might get burned.”

“Today’s report should extinguish any pretense that a ‘pause’ in rate hikes will likely be appropriate by the end of summer,” Jason Pride, chief investment officer of private wealth at Glenmede, said in a note. “Investors should expect the Federal Reserve to continue on its 50-bp rate hike path next week and beyond until inflation shows meaningful signs of decelerating toward the Fed’s 2–3% target range.”

“With the next CPI report likely tracking at about the same monthly pace, the chance for a new peak in year-over-year inflation is high. That will likely keep the Fed on a trajectory of 50-basis-point hikes beyond July, even though the economy is cooling.” -- Anna Wong and Andrew Husby, BBG economists

“Demand continues to outpace the supply capacity of the US economy and with supply factors showing little sign of near-term improvement, the onus is on the Fed to dampen the demand side of the equation with ongoing rate hikes,” ING’s James Knightley wrote.

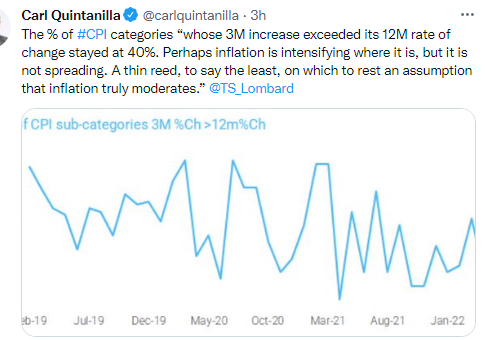

And we also got the Cleveland Fed which wasn’t much better with the median CPI moving to 0.6% and the 16% trimmed-mean CPI doubling to 0.8% m/m from 0.4% in April.

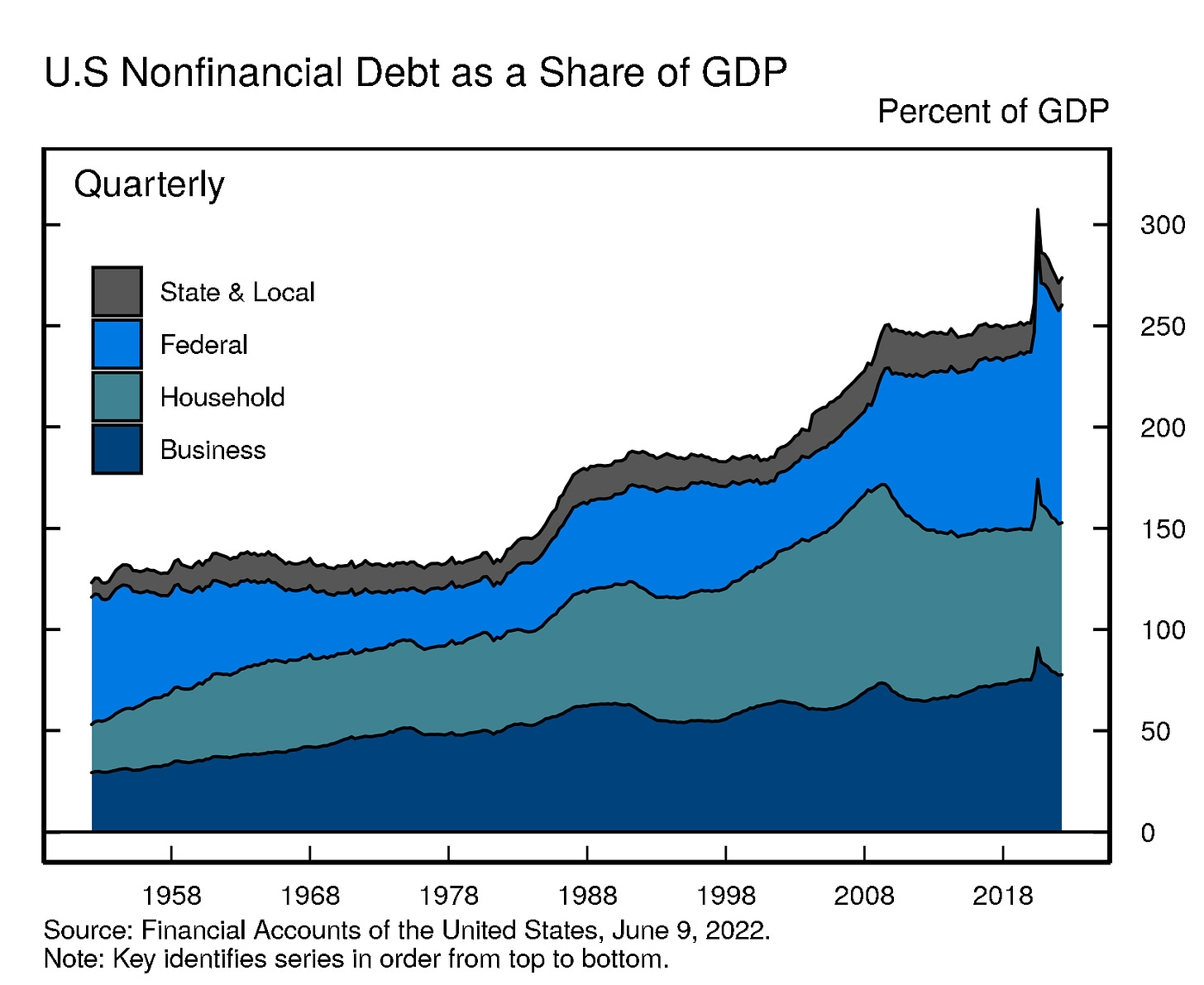

And we got the Fed’s quarterly Financial Accounts of the United States which goes through transactions and levels of financial assets and liabilities. Overall, balance sheets remain in good shape. Overall net worth took a small hit from the 1Q22 market slide (it fell by -$544B after increasing $39.1T since Q220 - $3T of equity holdings were offset by $1.7T of increase in real estate (it was the sixth consecutive quarter during which property prices logged a gain of $1 trillion or more), coupled with debt continuing to increase (as is normal in a growing economy)). Non-mortgage debt is increasing at a more rapid rate for households then previously though. Interestingly, state and local debt fell and remains below 2021 levels. Here was some of the summary.

The recent developments discussed below refer to data through March 31, 2022.

Household net worth decreased by $0.5 trillion in the first quarter, primarily driven by a drop in stock prices and robust gains in house prices.

Household debt grew at an annual pace of 8.3%, reflecting strong growth in both home mortgages and consumer credit.

Nonfinancial business debt increased at an annual rate of 8.0%, boosted by a rapid expansion in loans at depository institutions and at nondepository institutions.

Directly and indirectly held corporate equities ($46.3 trillion) and household real estate ($39.7 trillion) were among the largest components of household net worth. Household debt (seasonally adjusted) was $18.3 trillion.

Household debt grew by 8.3% in the first quarter at a seasonally adjusted annual rate, a bit higher than in the previous quarter. Home mortgages increased by 8.6%, and nonmortgage consumer credit increased by 8.7%, buoyed by rapid growth in credit card borrowing and auto loans. Nonfinancial business debt grew at a rate of 8.0%, reflecting strong growth in loans, both from depository institutions and from nondepository institutions, and modest net issuance of corporate bonds. Federal debt increased by 14.9%. State and local debt decreased by 3.0%.

Looking at the various components of nonfinancial business debt, nonmortgage depository loans to nonfinancial business increased by $79 billion in the first quarter. Loans from nondepository institutions also increased, as did commercial mortgages and corporate bonds outstanding. Overall, outstanding nonfinancial corporate debt was $12.2 trillion. Corporate bonds, at roughly $6.7 trillion, accounted for 55% of the total. Nonmortgage depository loans were about $1.2 trillion. Other types of debt include loans from nonbank institutions, loans from the federal government, and commercial paper. The nonfinancial noncorporate business sector consists mostly of smaller businesses, which are typically not incorporated. Nonfinancial noncorporate business debt was $6.8 trillion, of which $4.8 trillion were mortgage loans and $1.5 trillion were nonmortgage depository loans.

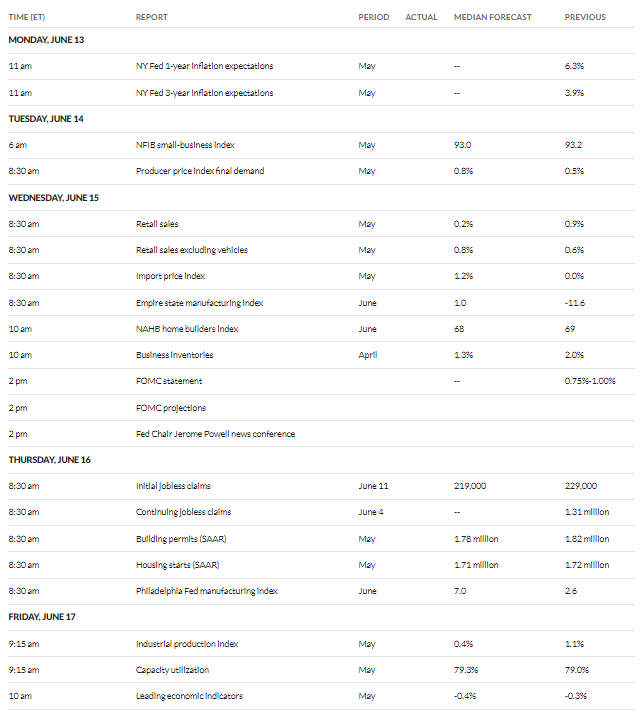

Next Week

After the light week this week, another busy week coming up. In terms of economic data we get key reports in retail sales and industrial production. We also get the PPI report which will be closely watched given the current focus on inflation and more housing data, but I think it’s a pretty good bet the housing reports will show further softening. The highlight of the week of course will be the FOMC meeting. This was supposed to be a boring recitation of past information following an in-line CPI print, but after the hot print, this will likely be not so boring. The press conference in particular will have the potential to move markets.

Internationally, from LiveSquawk:

Sunday 12 June - French Elections

Citi analysts note that the two-round legislative election set for the 12 and 19 June will determine whether the President Emmanuel Macron and his Prime Minister can: rely on a stable majority, or will have to make compromises to secure support from the left or right in a coalition or minority government, or whether France will return to “cohabitation” between a President and Prime Minister from different political camps.

For Macron to govern efficiently, experts say he needs to get an absolute majority in the coming legislative elections. i.e. at least 289 seats out of 577 in the National Assembly. Recent polls point to Ensemble (the bloc of parties supporting Macron) and NUPES (the coalition of left-wing parties mainly led by La France insoumise, the party of Jean-Luc Mélenchon) putting little between the factions, in terms of voting intentions for the first round.

Monday 13 June

UK Apr Monthly GDP (06:00) - Consensus: M/M 0.1% (prev -0.1%)

Investec’s best prediction is that GDP held up well at the start of Q2, but that it could be May’s release that could well show more of an impact from the spike in utility bills on activity.

Tuesday 14 June

UK Apr ILO unemployment rate (06:00) - Consensus: 3M/3M 3.6% (prev 3.7%)

“The UK labour market likely tightened further in three months ending in April, with the unemployment rate improving to a record low of 3.6%,” TD Securities noted.

German ZEW Jun Investor Expectations (09:00) - Consensus: M/M -27.5 (prev -34.3)

“In June, we expect both the current situation and the ZEW expectations index to increase as the general mood on financial markets has improved over the course of the last couple of weeks, mirrored by a significant rebound in equity markets," HSBC wrote. “We forecast ZEW expectations to rise from -34.3pts to -25.0pts while ZEW current conditions could move up from -36.5pts to -31.0pts.”

Wednesday 15 June

Mainland China May Industrial production (02:00) - Consensus: -0.5% (prev 2.9%)

"On the production front, high-frequency data showed a mixed picture," HSBC observed. "Semi-steel tyre operating rate saw a narrower y-o-y contraction, likely thanks to production resuming in Shanghai, where some major automobile manufacturing plants are located."

Mainland China May Retail sales (02:00) - Consensus: Y/Y -7.3% (-11.1%)

The slowdown in Omicron infections has led to hopes retail sales growth experienced partial recovery in May. SocGen’s Asia Pacific desk wrote, “Passenger car sales, which account for one-tenth of total retail sales, contracted 17% in May. However, this was a much better showing than the steep decline of close to 50% in April. Nevertheless, the contraction seen in sales of other goods and catering likely deepened. As a case in point, tourism revenues during the early May holiday were down 43% vs. that of 2021.”

US May Retail sales advance (12:30) - Consensus: 0.2% (prev 0.9%)

ING predicts that retail sales headline growth will be depressed by weaker auto sales in May. But the banks posits that there should be decent strength in other parts of the report given strong readings for people movement and firm chain store sales numbers that will leave a positive figure overall.

Brazil Jun Selic Rate Decision (21:30) - Consensus: 50bps Rate Hike (prev 12.75%)

“We expect the Central Bank of Brazil (BCB) to hike 50bp in June (vs 100bp in May), bringing the Selic rate to 13.25%. BCB signalled in the previous meeting statement that it would deliver another hike “of smaller magnitude” at its June meeting,” HSBC wrote. “We anticipate BCB will keep a data-dependent tone given that inflation expectations for 2022 and 2023 continue to rise.”

Thursday 16 June

Australia May Employment change (01:30) - Consensus: M/M 25.0K

“Following its latest rate hike, the Reserve Bank of Australia (RBA) made it clear that policymakers would be watching the labour market closely for signs of additional inflationary pressure,” ING wrote. “The surge in full-time employment last month and dive in part-time employment should give way to flatter figures for both in May. But there is still a good chance that the unemployment rate will fall to a new all-time low.”

SNB Jun Policy Rate Decision (07:30) - Consensus No Change

Consensus:

The expectation is for the Swiss National Bank (SNB) to keep its policy rate on hold at -0.75%. However, UBS posits that the SNB should be ready to end its negative rate regime, “a step that might trigger strong flows in the Swiss money market. Learning the lessons from other central banks, the SNB is likely to act cautiously and gradually.”

BoE Jun Rate Decision (11:00) - Consensus: 25bps Rate Hike (prev 1.0%)

Citi does not expect the BoE to pause yet. “The MPC is caught in an interesting state of economic equipoise. On the one hand, demand is showing signs of softening in line with their expectations – with business expectations now falling,” analysts wrote. “However, the labour market remains tight and wage pressures are still intense. We think the MPC will therefore conclude the risk of a more persistent inflationary surge still justify some preventative tightening via a fifth back-to-back 25bps move.”

Friday 17 June

BoJ Rate Decision (N/A) - Consensus: Rate Hold

"The Bank of Japan (BoJ) is scheduled to hold a rate decision meeting next Friday, and no change is expected," ING noted. "Governor Kuroda and other members have publicly stated on several occasions that the BoJ will retain its current accommodative monetary policy stance, as the recent cost-push inflation will be temporary and that a weak yen benefits the economy as a whole."

UK May Retail sales (06:00) - Consensus: 0.0% (prev 1.4%)

Nomura’s George Buckley forecast a 0.5% month-on-month fall in May. He said, “Further falls might relate to underlying weakness (due to the cost-of-living crisis and weak confidence) or it could reflect a rotation from goods to services spending.”

And 1Q22 earnings season continues to wind down.

Earnings spotlight: Monday, June 13 - Oracle (NYSE:ORCL).

Earnings spotlight: Wednesday, June 15 - John Wiley & Sons (WLY).

Earnings spotlight: Thursday, June 16 - Adobe (ADBE), Kroger (KR), and Jabil (JBL).

And Brian Gilmartin updates us on earnings estimates. He will be doing an Ironman in Wisconsin (hope it went well Brian!) so won’t be able to do the normal update, but did note that the quarterly estimates (which are released by Refinitiv each Friday) continue to show no degradation in earnings (in fact they were moved higher for most quarters. As I’ve noted numerous times, unless/until earnings crack, I am not looking for another leg substantially lower in the market.

And, I know I’ve beat this to death, but just another example of why earnings are so important.

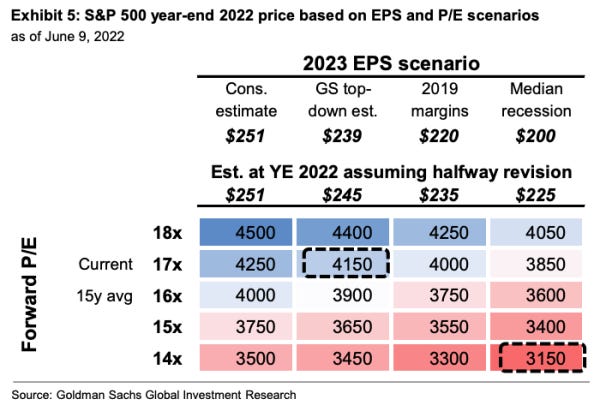

And here was Goldman’s analysis on the subject as informed by HR’s clarifications. It’s a bit dour, but I think it reinforces how precarious the situation is for equities at this juncture, and how important earnings are.

For their part, Goldman doesn’t think the inventory overhang will be as vexing for most companies as it appears to be for some of America’s largest retailers, but Kostin conceded that “slowing growth and still-elevated input costs will pressure margins and revenues.” When you throw in the FX headwind (Microsoft won’t be the last multinational to guide lower on a stronger dollar), you’re left to ponder a very challenging calculus. The figure (below) shows just how challenging.

Goldman’s top-down, base case for 2023 EPS is $239. Consensus bottom-up is at $251. The table assumes that by year-end, consensus 2023 EPS forecasts move halfway towards the various scenarios mentioned at the top. So, if the consensus 2023 EPS estimate moves halfway to Goldman’s top-down forecast and multiples stay at current levels, the S&P would trade around 4,150. If, by contrast, consensus moves halfway to a recession scenario, and multiples contract to 14x, you’re left with the S&P at 3,150.

It’s easy to get lost in the math, so let me clarify something. The $225 figure Goldman uses under “median recession” assumes consensus moves halfway to the median, post-War, LTM S&P earnings decline during recessions (figure below).

But a more granular look at profits during recessions shows the median trough, on a quarterly, YoY basis, was a decline of more than 20% (figure below). The point isn’t to goal seek the worst possible outcome. Rather, I just want to emphasize that no recession is exactly alike, and there’s a good argument to be made that the next recession, assuming it’s catalyzed by a combination of Fed hikes, consumer retrenchment in the face of generationally high inflation and gale-force margin headwinds, will be uniquely, if not singularly, painful. You can do the math for yourself. 2021 S&P EPS was $209. It’s not terribly difficult to get to an index level below 3,000. There are any number of plausible permutations that suggest US equities could easily shed another 25% under what might count as a benign scenario considering the macro and policy circumstances. And that’s to say nothing of the distinct possibility that the Fed is actually angling to push stocks below pre-pandemic levels in order to kneecap inflation by bleeding the wealth effect. Forgetting all of that, and sticking with Goldman’s scenario analysis (as shown above), note that only a handful of permutations result in meaningful upside for US equities. Just two of them result in appreciable upside.

Overall

As I’ve done previously on the weekends, I want to look at different timeframes here. In the very long term (12-18 months) I think we’ll be higher than present levels. But I’ll save that discussion for another day, because I don’t think there’s any rush to buy, as I’ll discuss. Looking next several months, I think we’re at best stuck in a trading range as discussed by several above (Jurrien Timmer, etc.). Unfortunately, I am starting to think that we’re near the top of what may become a new range depending on the action next week (for the reasons noted by some above).

While I have discussed many of these concerns previously, I tried to hit them again from multiple angles in this update. In short, the key components of equity valuations, earnings and the discount rate, don’t appear to have meaningful room for improvement, and both are at risk of moving negatively (earnings down, rates higher). I had been hopeful previously that May’s CPI report would continue the steady deceleration in core CPI prints which would allow for a Fed pivot in the Fall (which could relieve pressure on both areas). But with the increase, it “resets the clock” on the “series” of decelerating prints that the Fed has said is a requisite condition for such a pivot. That means even if the June, July, and August core CPI prints are notably softer (a questionable assumption) to go along with what might be softening PCE (due to the index construction), it won’t be until September/October that they’ll even be countenancing the possibility of taking their foot off the brakes. So rates should stay supported, and the Fed will continue to look to cool the economy (pressuring earnings).

And for that reason and others noted in this update, earnings appear to be on shaky ground as well. Any significant softening in earnings expectations can be expected to see commensurate declines in equities. And this is to say nothing of the fact that equity gains loosen financial conditions, something the Fed clearly doesn’t want right now (they’ve gone out of their way to not make a big deal out of the near 20% drawdown in equities in terms of levels). Seasonality also is no help. So to say the road to higher prices over the next several months is precarious would be an understatement.

But that doesn’t mean that I think equities will necessarily fall precipitously from current levels. And it certainly doesn’t mean we can’t have rallies. I’ve discussed at length the very low exposure hedge funds and systematic strategies have. That is dry kindling for a strong rally if they do reengage at some point.

And buybacks continue given that while equity upside may be limited, corporates remain in excellent financial health, as do consumers for the most part with a continuing very strong jobs market. In that regard we’re seeing very little stress in credit markets. So the good news is while earnings may come down some, we will not have to question the financial health of companies as we did in the GFC. As a side note, that’s why I like strong dividend payers.

And just because the markets overall don’t do well doesn’t mean individual companies won’t. It’s a tired phrase but this truly is a “stock picker’s market”. Focus on companies with secure market positions and strong fundamentals (as I’ve done to good effect with energy this year, which is a large proportion of my portfolio, and not so good buying too early into some high growth names like SHOP and TDOC), and pay attention to margins and valuations. This is not the time to be “reaching” for stocks. But if you have a 12+ month timeframe, it’s not a terrible time to be adding to names that are out of favor (as I have been doing with some names recently such as financials), but know it might be a while before they gain traction (which, again, is why I prefer strong dividend payers).

And while I am not particularly optimistic stocks can rally from here, there are some positives to hang our hat on. I noted several positive divergences above, and the selling has been so vicious the past couple of days that a bounce could certainly be in the cards.

And bearishness is definitely ramping back up.

While Helene’s twitter poll came in very bearish. In all of the cases she notes in the tweet, we were up for the week.

I know these are thin reeds to hang a bullish narrative on, but that’s unfortunately the situation we find ourselves in. So as Art Cashin likes to say “Keep your seatbelt fastened and try to stay safe.”

Misc.

Other random stuff.

Missed the reverse repo numbers from Friday, will update on Monday.

As low liquidity certainly isn’t helping anything.

And the Logistics Managers Index for May was released noting high inventory levels. Here was some analysis from Peter Bookvar:

Adding some color to the high level of inventory that many retailers hold of certain goods that consumers overbought over the past two years which in turn retailers continued to over order assuming a continuation in trend, the Logistics Managers Index for May fell to 67.1 from 69.7 in April.

LMI said, "The downward shift in the index continues to be driven by a loosening in the transportation market, as more capacity comes online and prices decrease...Warehousing and inventory continue to grow at a similar pace to the one we have observed over the last 18 months. Inventory levels are unseasonably high, packing warehouses to the gills and driving costs up for both inventory and warehousing." Bold is mine.LMI is also saying that the trucking spot market, where prices have fallen sharply over the past few months, is seeing some stabilization while the contract market still remains firm.

And here was Oxford Economics’ supply chain stressometer (my name) which also seems to have better news on supply chains.

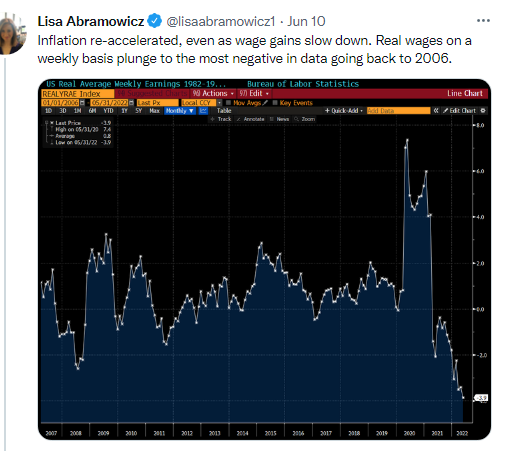

And while the lowest paid have seen the biggest increases on a percentage basis since the pandemic, there’s clearly a long way to go.

And with housing reports starting next week, mortgage rates push up to 5.85% according to Mortgage News Daily. Importantly, while rates may move a bit higher, even if they moved 1% higher it would be significantly less of an impact as compared to what we’ve already seen. If the market is able to absorb (after a period) the higher rates, that’s going to keep prices elevated until we get the new supply that’s under construction and not yet started.

Portfolio

Did pick a little on Friday. Added to CG, HBI, EVR, MELI, TTE, AMAT, MMM, SCHW, DFS, RHHBY, HBAN, BAC, WFC, SHEL, VNO, STT BUD, E, SNOW, TWLO ALGN. All small buys. Also started a new position in Airbus (EADSY).

Also bought back calls in CTRA (half), ENB (all), LUMN (all), EPD (20%), PAA (20%).

Cash = 30% (this is much higher than average pre-mid-2021, above average since then).

Positions (after around the top 20 I don’t keep track of their order on a frequent basis as they’re all less than 0.5% of my portfolio)

Core positions (each 5% or more of portfolio, total around 30%)

EPD, ET, MMP, PAA

Secondary core positions (each at least 1% of portfolio, total around 20%)

GOOGL, TTE, AMZN (FWIW I’m starting to wobble on my AMZN conviction), FANG, KMI, XOM, WFC, CTRA, MRK, MPLX

High conviction (each at least 0.75% of portfolio, total around 20%).

MSFT, PXD, MAC, C, FB, USB, VNOM, RHHBY, BLK, LAZ, CVE, ZBH, SHEL, BWA, HBI, LUMN, SWKS, GSK, CRM, BAYRY, LUMN, SLB, T, AGNC, HBAN, PARA

For the rest I’ll split based on how I think about them (these are all less than 0.75% of the portfolio each

High quality, high conviction

BWA, JWN, DAL, KHC, CI, BAC, SNY, ADNT, SKT, CURLF, BP, SU, WMB, CVS, CLB, PANW, NXPI, PLTR, BMWYY, CR, TYL, VTRX, SU, DD, CQP, SUGR, JPM, NCLH, AM, LEN, ING, BRK/B, DIS, NXPI, BUD, UBA, WCC, PANW, K, HON, INGR, ADBE, APD, CHKP, GM, TEN, STLA, CMP, TOL, LRCX, MMM, FRT, O, CSCO, TMHC, NOW, V, CG, SHOP, LUV, SAN, TWLO, TEF, BDX, SPG, KT, F, CTSH, E, UBS, DHI, VWAPY, NNN, EFX, TD, VEEV, LYG, CMCSA, SPLK, VMW, GTBIF, EVR, GS, PNW, FISV, MS, GWRE, WMT, ROP, CRWD, SOFI, SNOW, AMAT, SBUX, BMO, VICI, RY, CM, MELI, EADSY

High quality, less conviction due to valuation

STZ, DBA, DINO, LMT, PRU, NVS, EMR, TSLA, DVN, TEAM, PSX, AAPL, MDT

Higher risk due to business or sector issues; own due to depressed valuation or long term growth potential (secular tailwinds) so feel comfortable holding and waiting for value to be realized

GILD, TCNNF, VOD, GE, BABA, INCY, ORAN, TAP, TCEHY, SBH, BZH, NLY, NOV, EEMV, PK, VNM, QRVO, FIS, WYNN, RBLX, SHLX, INTC, EWQ, WPP, HT, PINS, ST, PYPL, CS, SABR, TDOC, NSANY, BTI, VNQI, UBER, SWN, , RLGY, ETRN, ACCO, ECL, ATVI, LVS, SAM, WBD, NLYpI, BA, LADR, BNS, PPLT, RNG, EWS, MCHP, APA, BIIB, CLDT, WBK, COLD, VTRS, TEVA, IDV, SNAP, DDAIF, BMRN, ASRV, QCOM, PVH, IJS, TPR, NOK, ALSN, SIL, WVFC, ALB, FUSB, LBTYK, DOCU, INDA, CHTR, OKTA, CCJ, YUMC, FDX, BBWI, EMR, AMD, DOC, QRTEA, TWTR, HSBC, BYND, GPN, ZM, LEN/B, CHWY, ASRV, CLR, SNA, JTKWY, CAL, HRTX, VTR, TRP, KKR, CPRI, SPOT, EWZ, PPC, URBN, UAL, THS, TSM, NVDA, DBX, ENR, CNC, WSM, ICPT, MAT, IVZ, TTWO, TFC, MSM, FCX, TLRY, WU, EA, CZR, MRNA, DOW, STOR, APO, NFLX, LAC, DDOG, NSTS, SONY, GNRC, MBUU

Note: CQP, EPD, ET, MMP, MPLX, PAA all issue K-1s (PAGP is the same as PAA but with a 1099).

Reminder: I am generally a long term investor (12+ month horizon) but about 20% of my portfolio is more short term oriented (just looking for a retracement of a big move for example). This is probably a little more given the current environment. I do like to get paid while I wait though so I am a sucker for a good well supported dividend. I also supplement that with selling calls and puts. When I sell a stock, I almost always use a 1-2% trailstop. If you don’t know what that is, you can look it up on investopedia. But that allows me to continue to participate in a move if it just keeps going. Sometimes those don’t sell for days. When I sell calls or puts I go out 30-60 days and look to buy back at half price. Rather than monitor them I just put in a GTC order at the half price mark.

To subscribe to these summaries, click below.

To invite others to check it out,

To see more content, including summaries of most major U.S. economic reports and my morning and nightly updates go to Neil’s Newsletter Substack for newer posts or https://sethiassociates.blogspot.com for the full history.