Update - June 13, 2022

Update - June 13, 2022

Short glossary:

SPX = S&P 500

Naz = Nasdaq Composite

NDX = Nasdaq 100 (100 largest stocks in the Naz)

RUT = Russell 2000 (smaller stocks)

DMA = Daily Moving Average (the moving average over the given time period (20, 50, 100, 200 days normally)).

MACD = Moving Average Convergence Divergence (basically a trend indicator)

RSI = 14-day Relative Strength Index (basically what it sounds like)

On my charts, the lines are 20-DMA (green), 21-DEMA (red), 50-DMA (purple), 100-DMA (blue), 200-DMA (brown)

Source abbreviations: BBG = Bloomberg; WSJ = Wall Street Journal; RTRS = Reuters; SA = Seeking Alpha; HR = Heisenberg Report

If you missed the weekend update, it always has a more complete summary of my thoughts for this week, as I don’t have time during the week anymore to do more than an update on the day’s events (although I spent extra time today given what happened), and I will also be relying on a lot of the concepts covered in that note. As to today’s events, again it was quite a show. After an eventful Friday in terms of data and markets, we followed it up with more market fireworks which was basically just a continuation of Friday’s action just on a bigger scale. Bonds and stocks fell sharply with huge curve flattening which at one point saw the 2/10 spread back in negative territory. 2-year yields were up 34 more basis points on top of the 23 on Friday. So 57 basis points in tightening in two days. On the stock side, it was just complete liquidation as you’ll see. Just lots and lots of selling. And we officially ended the pandemic bull market closing down over -20% from the January highs. At day’s end the SPX, NDX, Naz, and RUT were down -3.8, -4.6, -4.7, and -4.8% respectively. We’ve basically had a correction (-10% drawdown) in these indices since Wednesday. The Nasdaq 100 is now down about -30% from its peak last year.

Also as if things weren’t busy enough this week, I forgot to mention yesterday this week is a quadruple-witching options expiration week (so stock index futures, stock index options, stock options, and single stock futures (although single stock futures don’t really trade anymore so that’s why many call it triple witching) which will likely influence markets. I’ll have more on that when I get data on it (size of expirations, where the “gamma pin” is, etc.).

Argus - Last week ended on a bad note, and the new week started on an even worse note. There were myriad concerns in today's trading mix that drove the Dow, Nasdaq, and S&P 500 to new 52-week lows and the S&P 500 back into bear market territory. The troubling writing was on the wall for both the Treasury market and the stock market. The former got clobbered on rate-hike concerns while the latter got clobbered on a combination of rate-hike concerns and growth concerns. Massive losses for cryptocurrencies coinciding with news that crypto lender Celsius has paused customer withdrawals and transfers due to "extreme market conditions." As of this writing, Bitcoin was down 15.5% to $23,212.40 while Ethereum was down 17.2% to $1228.22.

BBG - US stocks entered a bear market, Treasury yields spiked to levels not seen in a decade and the dollar rallied as the fallout from a hot inflation reading continued to rattle global trading already shaken by worries the Federal Reserve will plunge the economy into a recession. Another brutal bout of selling sent the S&P 500 to the lowest since January 2021 and down more than 20% from its January peak. Highly valued tech shares bore the brunt of the rout, with the Nasdaq 100 slumping about 4.5%. The Cboe Volatility Index jumped above 30 and the futures curve inverted in a rare instance of traders pricing in more uncertainty in the here-and-now than in three months. Speculative areas of the market inflated by years of government largesse buckled. Profitless software firms, newly public companies and blank-check entities sold off. Bitcoin plummeted below $24,000 after a lending platform ceased operations. Credit markets continued their historic repricing of rate trajectories. Treasury 10-year yields climbed to the highest since 2011, while two-year rates jumped to levels last seen before the 2008 financial crisis. The cost to protect investment-grade debt from default soared as a closely watched segment of the US bond curve inverted. Only the dollar provided a respite from the selloff, rallying to a two-year high.

Some quotes from BBG (as you might imagine people were rather dour today):

“It’s going to get a little uglier,” said Victoria Greene, chief investment officer at G Squared Private Wealth. “It’s going to be very hard for stocks to rally when the Fed continues to put hawkish pressure. There’s no way they can slam on the brakes with inflation without slamming on the brakes economically speaking. It’s funny we still have recession deniers.”

“Everyone’s crystal ball is so cloudy right now,” said Ted Mortonson, a technology strategist at Robert W. Baird & Co. “I don’t think we’ll get to a bottom until the Fed absolutely annihilates inflation and can pause, but no one knows when that will be.”

And another very weak Morningstar style box with every box down at least around -3% and growth just hammered.

There was a firehose of analysis given today’s events, so I’ll try to hit the highlights this week.

To start with, Blackrock’s not buying the dip.

U.S. stocks have suffered the biggest year-to-date losses since at least the 1960s. That’s ignited calls to “buy the dip.” We pass, for now. Valuations aren’t much cheaper given rising interest rates and a weaker earnings outlook, in our view. A higher path of policy rates justifies lower equity prices. We also see a risk the Fed will lift rates too high – or that markets believe it will. Plus, margin pressures are a risk to earnings. That’s why we’re neutral on stocks on a six- to 12-month horizon.

And Mike Wilson says no bear market rally but we’re headed for 3400.

But there were some positive notes.

And JPMorgan Chase & Co. strategist Marko Kolanovic who was the most accurate forecaster in past years, but has been constructive on equities the whole way down, is keeping the faith. As HR noted “For JPMorgan, equities can find support from light investor positioning, depressed sentiment and the corporate bid.” But they are underweight bonds and credit. On the below, I don’t see the Fed coming in less hawkish than expectations, at least not in the near term, and I’m not sure the market would react well to a dovish Fed anyway. BBG.

A surge in bond yields that has rattled global stock and currency markets has gone “too far,” leaving the door open for the Federal Reserve to stun investors with less hawkish policy and help engineer a soft landing for the economy, according to JPMorgan Chase & Co. strategist Marko Kolanovic. “Friday’s strong CPI print that led to a surge in yields, along with the sell-off in crypto over the weekend, are weighing on investor sentiment and driving the market lower,” Kolanovic and his team wrote in a note to clients on Monday. “However, we believe rates market repricing went too far and the Fed will surprise dovishly relative to what is now priced into the curve.”

“The move in markets prices in more than enough recession risk, and we believe a near-term recession will ultimately be avoided thanks to consumer strength, Covid reopening/recovery, and policy stimulus in China,” Kolanovic and his team said.

Major Market Technicals

SPX, NDX, and Naz all broke to new 2022 lows. RUT a fraction of a percent away. No real technical support at this point until the 3400 level. Eesh. Below is a 3-year chart of the SPX.

And some technical callouts today.

SPX Sector Flag

An amazingly bad SPX sector flag today. Every sector down at least -2%. Only three sectors had any green stocks, and there were only a handful in the entire SPX. Wow.

And as bad as it’s been for tech this year, it’s been worse for retailers. BBG.

The MSCI World Retailing Index, which includes the likes of Target Corp., Zalando SE and Amazon.com Inc., is on track for its first negative year since 2008. The gauge was down about 29% in 2022 through Thursday, surpassing even the 24% decline of the MSCI World Information Technology Index. While such concerns have been reflected in reduced valuations this year, retail stocks still aren’t cheap. The MSCI World Index’s retailing subgroup remains more expensive than the main benchmark in terms of forward price-to-earnings ratios, due in large part to the presence of richly valued online merchants such as Amazon.com and Zalando.

To be sure, not everyone is tightening their purse strings with some consumers still prepared to spend lavishly. Airlines bookings are surging, while luxury spending hasn’t fallen in the same way it did in 2008. Retailers known for offering big discounts are also doing well as lower income households seek cheaper alternatives. T.J. Maxx owner TJX Cos.’ margin performance shone against peers, while discount-store operators Dollar Tree Inc., and Dollar General Corp. saw their shares rocket in one day after their sales both beat analyst expectations.

Breadth

My jaw dropped when I ran the math on this. On NYSE volume was 2% positive (yes two percent) and issues 5%. Naz was 14% positive volume, issues 12%. I don’t really know that I’ve seen a number that low (I think maybe during March 2020 but I don’t have the numbers from then). I said Friday “Just lots and lots of selling.” I guess now lots and lots and lots of selling.

And for my own purposes as well I’m going to keep this chart up.

Commodities/Currencies/Bonds

Bonds -As noted bonds fell with yields moving higher again. The 2-year yield as discussed was up 34 basis points to 3.40%, the highest since 2008, while the 10-year was up 28 to 3.43%, the highest since 2011. So the 2-10 spread, which was 21 bps coming into Friday ended the day at just three basis points. The 5/30 curve further inverted.

As traders at one point today were pricing in 175 basis points of Fed tightening by September, implying two half-point and one 75 basis points hike.

And the surge was given a late day boost by an article from the WSJ’s Nick Timiraos who I noted yesterday is a “Fed Whisperer” (meaning it’s thought that communications that the Fed wants to get out to the market sometimes flow through him). I hadn’t thought about that as a means of the Fed communicating during the blackout, so now I do think a 75bps hike is definitely on the table for Wednesday if not likely.

A string of troubling inflation reports in recent days is likely to lead Federal Reserve officials to consider surprising markets with a larger-than-expected 0.75-percentage-point interest rate increase at their meeting this week. Before officials began their pre-meeting quiet period on June 4, they had signaled they were prepared to raise interest rates by a half percentage point this week and again at their meeting in July. But they also had said their outlook depended on the economy evolving as they expected. Last week’s inflation report from the Labor Department showed a bigger jump in prices in May than officials had anticipated. Two consumer surveys have also shown households’ expectations of future inflation have increased in recent days. That data could alarm Fed officials because they believe such expectations can be self-fulfilling.

Fed Chairman Jerome Powell has avoided surprising markets on the day of policy meetings, instead arguing that the central bank can achieve its goals of tightening policy by shaping market expectations. But he also said in an interview last month that the Fed would be guided by the economic data to come. “What we need to see is clear and convincing evidence that inflation pressures are abating and inflation is coming down. And if we don’t see that, then we’ll have to consider moving more aggressively,” Mr. Powell said.

And with inflation breakevens remaining relatively contained, the bulk of the rate move the past week has been in real rates, which we have noted are like gravity to equity valuations (the higher real rates, the heavier the “gravity” on stock prices). They’re now up to +0.5%. Again, with a sharp spike in real yields, a fall in equity prices is completely expected.

And just as importantly, I discussed at length the importance of the terminal rate over the weekend. Well, that shot up to near 4% today, up 100bps in just a week. As I noted yesterday, that “should” cause a severe contraction in P/E ratios. The result is what we’re seeing today as stocks derate (given that earnings expectations didn’t change today).

BBG - Money markets now see the Federal Reserve terminal rate at 4% for the first time, and are pricing for it to get there by the middle of next year.

And I wrote this part yesterday evening, but I think it still holds up.

As we consider the Fed’s options for the upcoming meeting, as I noted in the weekend summary, perhaps the best resolution would be a “rip the band-aid off” outsized rate hike. HR had what I thought was a nice discussion on the pros and cons.

In my opinion, the Fed has a lot to lose and very little to gain from underwhelming. Equities are dying a slow, painful death. A coup de grâce may be the best outcome. The negative response to incremental evidence of economic overheating is a reflection of expectations for policy tightening, but the lack of outright capitulation in stocks isn’t just summer drudgery. It’s indicative of what Morgan Stanley called “a mixture of confusion and frustration” among investors and traders, who aren’t convinced of the Fed’s willingness, capacity or, more to the point, both, when it comes to doing what’s necessary in the face of highly corrosive inflation.

In effect, the Fed and markets are stringing one another along on the assumption of rate hikes just large enough for policymakers to claim they’re trying, but not large enough to risk triggering capitulation in risk assets or a rapid demolition of the pandemic housing bubble.

At this point, gradualism is bleeding both market and consumer sentiment. The fact that 50bps increments now count as “gradual” speaks to the urgency of the problem. You might argue that the Fed thus has a free pass to be dovish while being simultaneously hawkish (i.e., if “50 is the new 25,” and consecutive 50bps moves would count as highly aggressive in any other context, then the Fed has free rein to “dovishly” hike 50bps all the way up to neutral). But it still feels suspiciously like everyone is waiting, wishing and doubting. Waiting and wishing for signs of “peak inflation,” all the while doubting that any such evidence is forthcoming. Hence the tension.

It’s not quite as simple as suggesting Jerome Powell should resort to draconian rate hikes. Monetary policy acts on a lag. So, there’s an argument to made that policymakers need time to assess the impact of the tightening already delivered (and the 100bps of guaranteed tightening over the June and July meetings) before it makes sense to go all-in with a hawkish “Whatever it takes” moment.

“This year’s monetary policy action is to combat next year’s inflation, and despite the higher-than-expected May CPI data, we are skeptical that the benefit of a more aggressive tone from Powell outweighs the costs associated with a renewed round of surging volatility,” BMO’s Ian Lyngen and Ben Jeffery said, speaking to that point and calling Friday’s stock rout an example of “precisely this risk as the selloff in Treasurys and higher rates once again pushed the S&P 500 below 4,000.” That “feedback loop,” Lyngen and Jeffery said, “will continue to define trading as summer liquidity conditions become more pronounced.”

It’s possible, though, that both bonds and stocks would rally if the Fed resorted to draconian measures now. Obviously, the first few sessions following such a broadside would be rough, and maybe even the first couple of weeks. But at some point, the Fed needs to end the speculation. Every, single day someone, somewhere writes an editorial questioning the Fed’s resolve. In many cases, those editorials emanate from former officials, monetary or otherwise. They’re not all attention seekers, nor do they all have ulterior motives. Some of them are genuinely concerned. And you could (easily) argue that short-end selloffs like Friday’s are evidence of a market that’s prodding (begging, even) the Fed for clarity, even if that means a decisive, heavy-handed rate hike.

“The Fed’s trying to erase any perception that they’re behind the curve,” said Steven Englander, global head of G-10 FX research at Standard Chartered Bank. “Fifty was the big round number six months ago. Meanwhile, 75 is a very middling type of hike. So the Fed might say: ‘Look, if we want to show commitment, let’s just do 100.’” Englander predicts there’s a 10% chance of a 100-basis-point increase at the Wednesday meeting, with his baseline still a half-percentage point increase.

Yet to some economists, the odds that the Fed opts for an 100- basis-point hike remain very low. “I’d say even a 1% chance might be generous,” said Jonathan Millar, an economist for Barclays, who is on the team of the bank’s strategists who revised his forecast to 75 points on Friday.

Dollar (DXY) - Shot higher to a new 19-year high on the back of the move in yields. Daily technicals remain supportive but already starting to get overbought.

VIX - While we didn’t get above 40 we got to 35 today as the VIX broke conclusively above its downtrend line. Could definitely see it going higher tomorrow.

And the VIX is closing the much discussed discount to realized volatility. BBG.

A furious bout of options hedging is tightening up a much-watched gauge of market sentiment: the VIX’s discount to realized volatility in the S&P 500. After sitting below the S&P 500’s historical volatility for four weeks, the VIX has quickly popped back up to match it. After sitting below the S&P 500’s historical volatility for four weeks, the VIX has quickly popped back up to match it. The SPDR S&P 500 ETF Trust (ticker SPY) saw volume of bearish put contracts outpacing bullish calls by a ratio of 1.78-to-1. That’s the highest ratio in almost three months.

Crude (/CL) - Ended little changed again today, but continues to hold its sharp uptrend. Daily technicals remain supportive for now although showing signs of peaking.

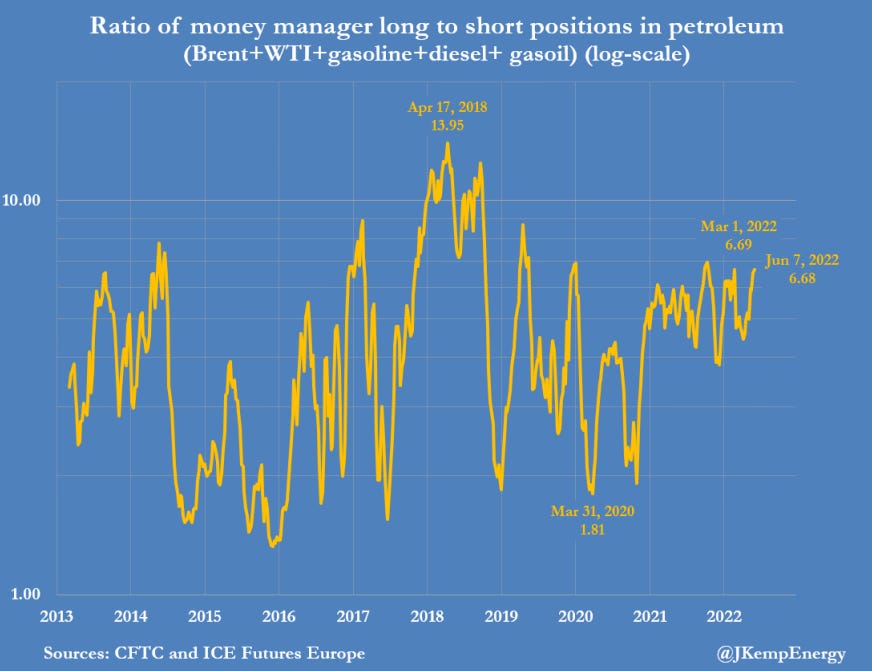

As John Kemp updates on petroleum market positioning noting increasing bullishness, although in the most recent week it was all Brent (I had noted the big Brent buying yesterday). With net positioning near the highs of the year, some softness like we saw today might make some sense this week.

LONDON, June 13 (Reuters) - EU sanctions on Russia’s petroleum exports and easing lockdowns in China have encouraged portfolio investors to become more bullish on oil prices despite the steadily darkening outlook for the major economies. Hedge funds and other money managers purchased the equivalent of 16 million barrels in the six most important petroleum-related futures and options contracts in the week to June 7.

Funds have been net buyers in three of the last four weeks, increasing their position by a total of 99 million barrels since May 10. The combined position has risen to 647 million barrels, the highest since the start of March, though still only in the 56th percentile for all weeks since 2013.

In the most recent week, buying was entirely concentrated in Brent (+18 million barrels) with inconsequential changes in NYMEX and ICE WTI (-2 million), U.S. gasoline (-1 million) and U.S. diesel (+1 million) and no change in European gas oil.

Brent buying mostly came in the form of new bullish long positions (+16 million barrels) rather than the closure of old bearish shorts (-2 million) suggesting changing circumstances have drawn in fresh fund money.

Until a couple of weeks ago, funds had been more bearish about Brent than any other part of the petroleum complex, anticipating a slowing global economy and China’s lockdowns would cut oil consumption. But the EU’s sixth sanctions package, which targets Russia’s marine insurance as well as oil sales, has convinced at least some of them that the expected loss of consumption will be matched by a loss of production and sales.

And I guess they’re getting it in while they can.

While China and India take in half of Russia’s overseas exports.

As North Sea barrels, sought after due to their closeness to Europe and good refining characteristics are flying.

And with respect to Libya they’re down to 100kbd. They were producing 1.2mbd not a couple of months ago. BBG.

Libya’s oil production has almost fully halted as a political crisis leads to more shutdowns of ports and fields. The OPEC member’s daily output -- which averaged 1.2 million barrels last year -- is down by about 1.1 million barrels, Oil Minister Mohamed Oun told Bloomberg on Monday. That suggests Libya is pumping only about 100,000 barrels a day. The latest decline comes after protesters forced workers to shut down the key eastern oil ports of Es Sider and Ras Lanuf. Libya exported roughly 380,000 barrels a day of crude from the two facilities in May, according to tanker-tracking data monitored by Bloomberg. Workers at Hariga, the second-largest port, were also urged to halt operations. That came as the 125,000 barrel-a-day Sarir field, oil from which flows to the port, was completely shut down, two people familiar with the situation said on Monday. The three ports together handle about 70% of Libya’s total production. The country’s output had already halved to 600,000 barrels a day in mid-April after groups closed the major Sharara and El Feel fields.

Nat Gas (/NG) - Continues to hold the 20-DMA and uptrend line running back to March but seems increasingly like its rolling over.

As unlike crude, US nat gas production is at a record high.

Gold (/GC) - After a good day Friday despite the rise in yields, reversed that today. I am wondering whether there wasn’t some raising cash for margin calls involved given it held up on Friday. Regardless it moves it to the lowest in a couple of weeks. Daily technicals starting to roll over.

Other commodities -

As nickel hits a 3-month low.

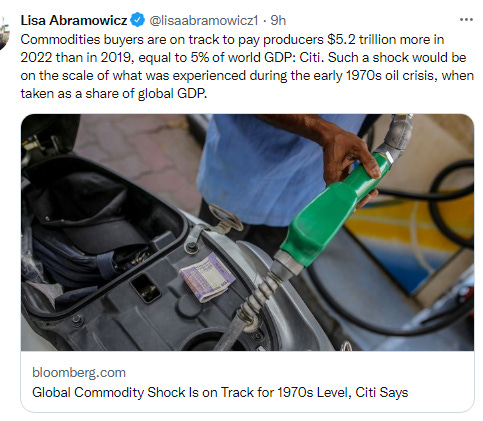

While Citi says the hit of higher commodities to GDP is on scale with 1970.

Asia

Equity indices in the Asia-Pacific began the week on a sharply lower note, some of which was “catch up” to Friday’s slide in the U.S.. Japan's Nikkei -3.0%; Hong Kong's Hang Seng -3.4%; China's Shanghai Composite -0.9%; India's Sensex -2.7%; South Korea's Kospi -3.5%; and Australia's All Ordinaries -1.3%.

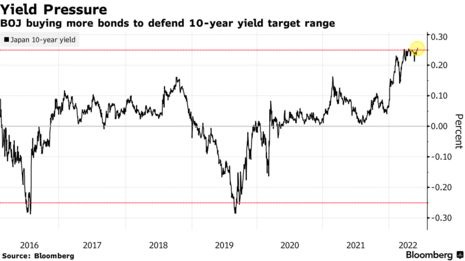

As continued weakness in the yen briefly sent the Japanese currency to its lowest level since 1998 against the dollar while Bank of Japan Governor Kuroda repeated that the BoJ will continue its ultra-loose policy. BBG.

With the yen at a 24-year low, Tokyo stocks down the most since March and bond yields hitting its ceiling, the Bank of Japan is under duress having to defend a policy the rest of the world is quickly moving on from. In his clearest warning yet on the yen’s weakness, BOJ Governor Haruhiko Kuroda, 77, said Monday that the recent abrupt slide of the currency is bad for the economy, while the central bank reinforced efforts to keep a lid on yields. Still, the yen fell 0.6% to 135.19 per dollar, the lowest since 1998.

The downward pressure on the yen and slide in Japanese government bonds was triggered by a new wave of selling in global debt markets, led by Treasuries, as investors shocked by Friday’s US inflation data priced in aggressive policy tightening by the Federal Reserve and sought refuge in the dollar. “While Japanese authorities have stepped up warnings, there are few tools available to stop this momentum,” said Akira Moroga, manager of currency products at Aozora Bank in Tokyo. “The environment remains ripe for speculators to drive dollar-yen higher.”

Earlier, the BOJ stepped up efforts to defend its easy stance, saying it would buy another 500 billion yen ($3.7 billion) worth of bonds on Tuesday to keep rates low. That’s after the 10-year bond yield rose above 0.25% -- the upper end of its accepted range -- for first time since January 2016. “The BOJ will now need to explain clearly what is the logic behind the 0.25% cap and whether that level is appropriate under the current environment,” said Mari Iwashita, chief market economist at Daiwa Securities Co. While Kuroda’s currency comments gave some support to the yen, stocks still lost the most since March 7, with the Topix Index down 2.2%. Even traditional weak-yen beneficiaries including electronics and automakers ended the day in the red.

While a recent survey of economists by Bloomberg showed that the BOJ is unlikely to adjust policy until the yen breaches the 140 level, the talk of close cooperation has prompted some BOJ watchers to flag the chance of adjustments or tweaks to policy guidance at the conclusion of Friday’s meeting.

In news: South Korean truckers remained on strike for the seventh day in a row.

In economic data: South Korea's exports through the first ten days of June were down 12.7% yr/yr while chip exports increased 0.8% yr/yr.

Japan's Q2 BSI Large Manufacturing Conditions -9.9 (last -7.6)

New Zealand's April Permanent/Long-Term Migration -80 (last 926)

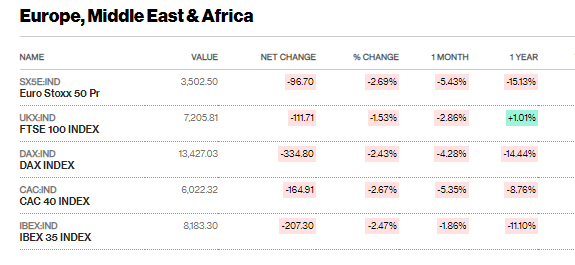

Europe

Major European indices ended sharply lower across the board, with the Stoxx 600 at the lowest close since March 2021.

As European government bonds also had sharp losses today as traders priced in a more aggressive pace of tightening from the European Central Bank, with traders now wagering on two half-point hikes by October. The yield on Germany’s two-year government debt -- the most sensitive to changes in policy -- rose above 1% for the first time in more than a decade. Benchmark Italian bond yields also pushed higher, touching the highest since 2014. The spread over German equivalents rose to as much as 235 basis points, the widest level since May 2020, reflecting growing worries about the region's economy. Money markets priced more than 125 basis points of ECB tightening over the next three scheduled decisions. That implies two half-point hikes and one quarter-point hike by October, and is the most hawkish positioning this cycle. It would bring the policy rate to 0.75%, up from minus 0.5% currently.

French bonds also fell Monday after polling suggested French President Emmanuel Macron may lose his outright parliamentary majority following Sunday’s first round of voting in the parliamentary elections. Ten-year bond yields rose as much as 10 basis points to 2.19%, the highest since March 2014. Germany’s two-year bond yield rose as much as 13 basis points to 1.10%, double the rate reached on June 1. The yield on Italian 10-year bonds surged 15 basis points to 3.91%.

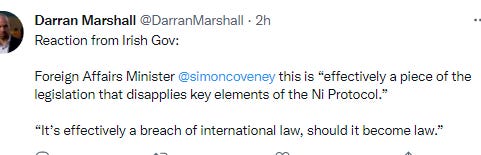

In news: Reuters reported that the Bank of England will raise its bank rate by 25 bps on Thursday and maintain a slow hiking pace in the coming months while FT speculated that the BoE will hike by 50 bps this week. Meanwhile ECB Governor Kazimir sees “clear need” for 50bps hike in September. French President Macron's party appears to have lost some parliamentary seats in yesterday's election and it remains unclear if the party will maintain its absolute majority. The U.K. will introduce legislation today to allow it to unilaterally amend the Northern Ireland Protocol amid controversy over whether the legislation will break international law. Boris Johnson insisted the plan to effectively override parts of the Brexit deal with Brussels was "not a big deal" as he was warned the move would "deeply damage" relations with the European Union and Ireland. Fitch affirmed the U.K.'s AA- rating wit h a Stable outlook.

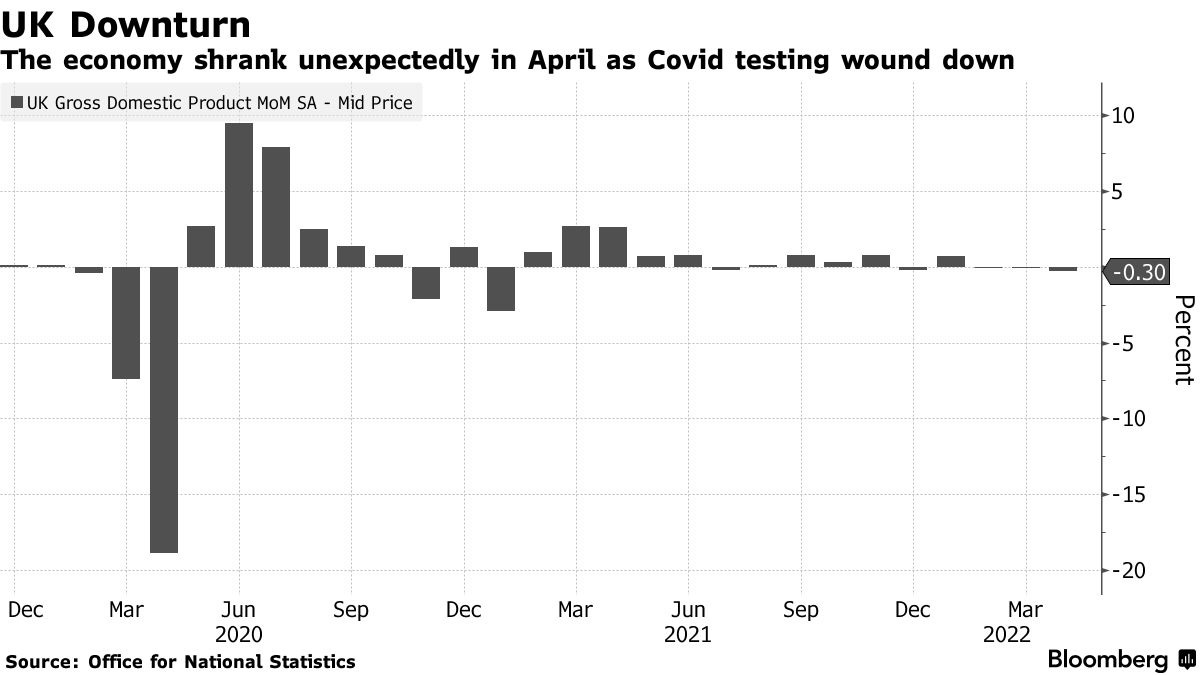

In economic data: The UK economy shrank in April at the sharpest pace in more than a year as the government wound down Covid testing, highlighting risks that a broader contraction is under way.

U.K.'s April GDP -0.3% m/m (expected 0.1%; last -0.1%); 3.4% yr/yr (expected 3.9%; last 6.4%). April Construction Output -0.4% m/m (expected -0.5%; last 1.7%); 3.9% yr/yr (expected 3.8%; last 4.7%). April Industrial Production -0.6% m/m (expected 0.2%; last -0.2%); 0.7% yr/yr (expected 1.7%; last 0.7%). April Manufacturing Production -1.0% m/m (expected 0.2%; last -0.2%); 0.5% yr/yr (expected 1.8%; last 1.9%)

Gross domestic product fell 0.3% from March when output declined 0.1%, the Office for National Statistics said Monday. A gain of 0.1% was predicted by economists. The figures underscore a dimming outlook for the UK economy, with manufacturing, services and construction all contracting together for the first time since January 2021. That may persuade the Bank of England to move cautiously in fighting inflation. It’s expected to deliver a quarter-point rate rise on Thursday. April marks the third month in which GDP hasn’t grown, a clear sign that the economy is weakening rapidly in the face of inflationary pressures. The pound slid as much as 0.6% to $1.2238, reaching the lowest level in about a month.

The GDP report showed services dropped sharply due to a 5.6% decline in health spending. Test and trace activity fell almost 70% in April. Excluding test and trace and vaccines, the economy would have grown 0.1% in the month, the ONS said. Households showed signs of resilience in April, the month when energy bills jumped 54% and payroll taxes went up. Consumer-facing industries expanded 2.6%, led by a strong rise in retail sales and personal services such as hairdressing. However, more recent data show households cutting back on non-essentials items in response to the cost of living squeeze. Manufacturing fell 1%, with businesses reporting the impact of price increases and supply shortages. Construction fell by 0.4%.

“We expect momentum to remain subdued in the following months, with output to decline by a marked 0.4% in the second quarter as the real income squeeze starts to bite. Still, with inflation remaining stubbornly high and a red-hot labor market showing no signs of easing, it won’t be enough to prevent the Bank of England from hiking rates. Given the risks to the economy, a 50 basis point move this week looks highly unlikely -- we expect a 25-bp hike, with rates climbing to 2% by November.” --Ana Luis Andrade, Bloomberg Economics.

Other Int’l

U.S. Data

Did reports on May 2022 NY Fed Survey of Consumer Expectations.

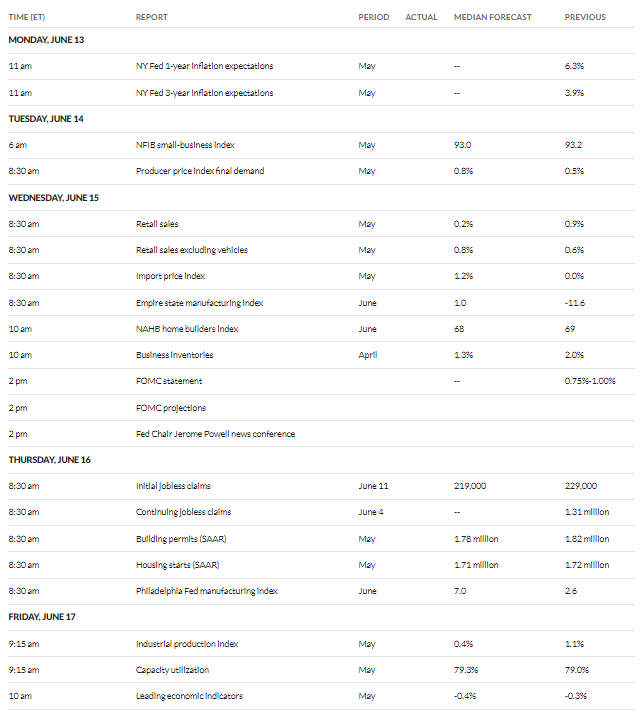

Next 24

In the US we’ll get NFIB Small Business Optimism Index (6:00 a.m. ET) and May Producer Price Index report (8:30 a.m. ET) on Tuesday.

Internationally, from LiveSquawk:

Tuesday 14 June

UK Apr ILO unemployment rate (06:00) - Consensus: 3M/3M 3.6% (prev 3.7%)

“The UK labour market likely tightened further in three months ending in April, with the unemployment rate improving to a record low of 3.6%,” TD Securities noted.

German ZEW Jun Investor Expectations (09:00) - Consensus: M/M -27.5 (prev -34.3)

“In June, we expect both the current situation and the ZEW expectations index to increase as the general mood on financial markets has improved over the course of the last couple of weeks, mirrored by a significant rebound in equity markets," HSBC wrote. “We forecast ZEW expectations to rise from -34.3pts to -25.0pts while ZEW current conditions could move up from -36.5pts to -31.0pts.”

Wednesday 15 June

Mainland China May Industrial production (02:00) - Consensus: -0.5% (prev 2.9%)

"On the production front, high-frequency data showed a mixed picture," HSBC observed. "Semi-steel tyre operating rate saw a narrower y-o-y contraction, likely thanks to production resuming in Shanghai, where some major automobile manufacturing plants are located."

Mainland China May Retail sales (02:00) - Consensus: Y/Y -7.3% (-11.1%)

The slowdown in Omicron infections has led to hopes retail sales growth experienced partial recovery in May. SocGen’s Asia Pacific desk wrote, “Passenger car sales, which account for one-tenth of total retail sales, contracted 17% in May. However, this was a much better showing than the steep decline of close to 50% in April. Nevertheless, the contraction seen in sales of other goods and catering likely deepened. As a case in point, tourism revenues during the early May holiday were down 43% vs. that of 2021.”

US May Retail sales advance (12:30) - Consensus: 0.2% (prev 0.9%)

ING predicts that retail sales headline growth will be depressed by weaker auto sales in May. But the banks posits that there should be decent strength in other parts of the report given strong readings for people movement and firm chain store sales numbers that will leave a positive figure overall.

Brazil Jun Selic Rate Decision (21:30) - Consensus: 50bps Rate Hike (prev 12.75%)

“We expect the Central Bank of Brazil (BCB) to hike 50bp in June (vs 100bp in May), bringing the Selic rate to 13.25%. BCB signalled in the previous meeting statement that it would deliver another hike “of smaller magnitude” at its June meeting,” HSBC wrote. “We anticipate BCB will keep a data-dependent tone given that inflation expectations for 2022 and 2023 continue to rise.”

Thursday 16 June

Australia May Employment change (01:30) - Consensus: M/M 25.0K

“Following its latest rate hike, the Reserve Bank of Australia (RBA) made it clear that policymakers would be watching the labour market closely for signs of additional inflationary pressure,” ING wrote. “The surge in full-time employment last month and dive in part-time employment should give way to flatter figures for both in May. But there is still a good chance that the unemployment rate will fall to a new all-time low.”

SNB Jun Policy Rate Decision (07:30) - Consensus No Change

Consensus:

The expectation is for the Swiss National Bank (SNB) to keep its policy rate on hold at -0.75%. However, UBS posits that the SNB should be ready to end its negative rate regime, “a step that might trigger strong flows in the Swiss money market. Learning the lessons from other central banks, the SNB is likely to act cautiously and gradually.”

BoE Jun Rate Decision (11:00) - Consensus: 25bps Rate Hike (prev 1.0%)

Citi does not expect the BoE to pause yet. “The MPC is caught in an interesting state of economic equipoise. On the one hand, demand is showing signs of softening in line with their expectations – with business expectations now falling,” analysts wrote. “However, the labour market remains tight and wage pressures are still intense. We think the MPC will therefore conclude the risk of a more persistent inflationary surge still justify some preventative tightening via a fifth back-to-back 25bps move.”

Friday 17 June

BoJ Rate Decision (N/A) - Consensus: Rate Hold

"The Bank of Japan (BoJ) is scheduled to hold a rate decision meeting next Friday, and no change is expected," ING noted. "Governor Kuroda and other members have publicly stated on several occasions that the BoJ will retain its current accommodative monetary policy stance, as the recent cost-push inflation will be temporary and that a weak yen benefits the economy as a whole."

UK May Retail sales (06:00) - Consensus: 0.0% (prev 1.4%)

Nomura’s George Buckley forecast a 0.5% month-on-month fall in May. He said, “Further falls might relate to underlying weakness (due to the cost-of-living crisis and weak confidence) or it could reflect a rotation from goods to services spending.”

And 1Q22 earnings season continues to wind down.

Earnings spotlight: Monday, June 13 - Oracle (NYSE:ORCL).

Earnings spotlight: Wednesday, June 15 - John Wiley & Sons (WLY).

Earnings spotlight: Thursday, June 16 - Adobe (ADBE), Kroger (KR), and Jabil (JBL).

Overall

So I noted yesterday that “Unfortunately, I am starting to think that we’re near the top of what may become a new range depending on the action next week.” With the break of support, if we don’t rebound pretty quickly, that looks more likely. The headwinds increased today. The jump in the terminal rate is very unhelpful, and we still haven’t seen earnings estimates fall. That is just another shoe to drop if/when it occurs that will keep many on the sidelines (a la Blackrock, Morgan Stanley, etc. noted above). And with the break of support we’ve now got CTA’s (trend followers) piling on, and the increased volatility the last three days has undone a lot of the good in realized volatility which had come down, so we’re “resetting the clock” on when they might get meaningfully engaged. It also doesn’t help that the daily technicals have rolled over.

That said we have seen a LOT of selling the past three days (I mean 2% up volume on the NYSE is an incredible number). At some point the sellers will be exhausted, and we can at least bounce.

And, as I noted this weekend, this is not a credit led drawdown, and companies enter this period in excellent financial health. So I will continue to take small bites of good companies that I don’t mind holding through a rocky few months.

Misc.

Other random stuff.

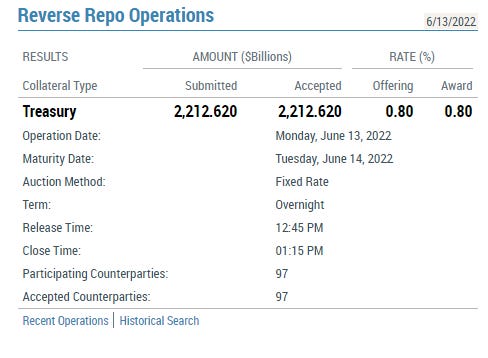

As reverse repos jump over $2.2T. This is just evidencing the flight to safety.

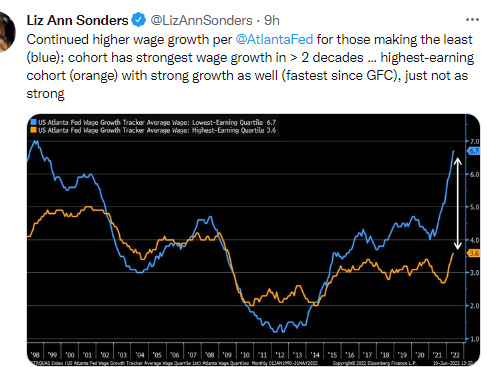

And the Atlanta wage tracker (which is superior to the average hourly pay because it tracks the same job while the monthly payroll report is whatever jobs were reported) shows continued strong wage gains (although short of inflation) particularly for the lowest paid.

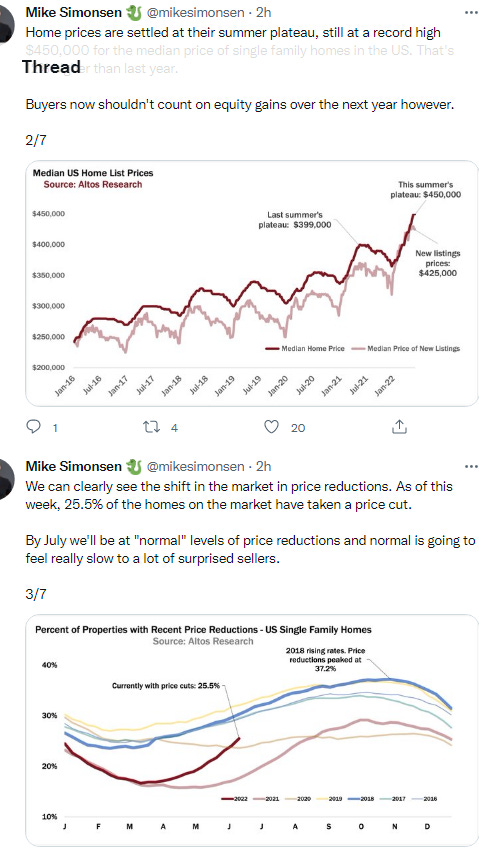

As Mike Simonsen notes the continued shift in housing market conditions which remain strong but clearly softer than where we started the year.

And the rapid rise in inventory is a big part of the story. Inventory bottomed seasonally at the beginning of March 2022 and is now up 64% since then.

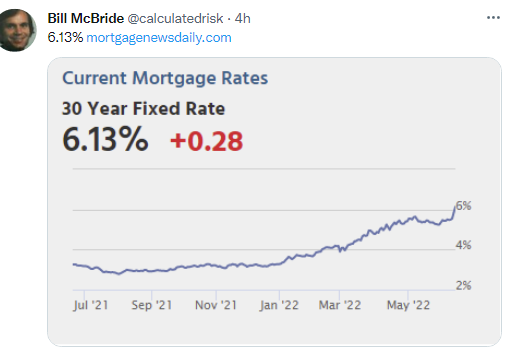

As mortgage rates breach 6%. Never imagined we’d get here so fast. That said, we’re well ahead of where the 10-year says we should be, so there’s a good amount of spread widening that can unwind.

And global flights hit a new post-pandemic high.

Portfolio

Did some picking today, but with the break of support, I am keeping the buys very small for now. I’d rather have dry powder and miss out on lower prices than vice versa.

Added to LUV, AGNC, JPM, LRCX, META, GPN, ADSK, CMP, ADBE, TTE, MAC, PVH, SHEL, C, TWLO, MRNA, TSM, FHB, FRT, BX, STLA, DAL, FISV, MELI, F, MSFT, TYL, TFC, SNOW, E, AMZN.

I started new positions in a few names also - D, MFC, V, FSK, ORCC, EXPE, APTV, JBL, EMN. All small buys just looking for a rebound next few months.

I also bought back all of the outstanding calls except for those in CVE, JWN, MMP, RTLR, VNOM, and XOM which didn’t fall far enough.

Cash = 30% (this is much higher than average pre-mid-2021, above average since then).

Positions (after around the top 20 I don’t keep track of their order on a frequent basis as they’re all less than 0.5% of my portfolio)

Core positions (each 5% or more of portfolio, total around 30%)

EPD, ET, MMP, PAA

Secondary core positions (each at least 1% of portfolio, total around 20%)

GOOGL, TTE, AMZN (FWIW I’m starting to wobble on my AMZN conviction), FANG, KMI, XOM, WFC, CTRA, MRK, MPLX

High conviction (each at least 0.75% of portfolio, total around 20%).

MSFT, PXD, MAC, C, FB, USB, VNOM, RHHBY, BLK, LAZ, CVE, ZBH, SHEL, BWA, HBI, LUMN, SWKS, GSK, CRM, BAYRY, LUMN, SLB, T, AGNC, HBAN, PARA

For the rest I’ll split based on how I think about them (these are all less than 0.75% of the portfolio each

High quality, high conviction (long term)

BWA, JWN, DAL, KHC, CI, BAC, SNY, ADNT, SKT, CURLF, BP, SU, WMB, CVS, CLB, PANW, NXPI, PLTR, BMWYY, CR, TYL, VTRX, SU, DD, CQP, SUGR, JPM, NCLH, AM, LEN, ING, BRK/B, DIS, NXPI, BUD, UBA, WCC, PANW, K, HON, INGR, ADBE, APD, CHKP, GM, TEN, STLA, CMP, TOL, LRCX, MMM, FRT, O, CSCO, TMHC, NOW, V, CG, SHOP, LUV, SAN, TWLO, TEF, BDX, SPG, KT, F, CTSH, E, UBS, DHI, VWAPY, NNN, EFX, TD, VEEV, LYG, CMCSA, SPLK, VMW, GTBIF, EVR, GS, PNW, FISV, MS, GWRE, WMT, ROP, CRWD, SOFI, SNOW, AMAT, SBUX, BMO, VICI, RY, CM, MELI, EADSY, D, MFC, V, FSK, ORCC, EXPE, APTV, JBL, EMN

High quality, less conviction due to valuation

STZ, DBA, DINO, LMT, PRU, NVS, EMR, TSLA, DVN, TEAM, PSX, AAPL, MDT

Higher risk due to business or sector issues; own due to depressed valuation or long term growth potential (secular tailwinds) so feel comfortable holding and waiting for value to be realized

GILD, TCNNF, VOD, GE, BABA, INCY, ORAN, TAP, TCEHY, SBH, BZH, NLY, NOV, EEMV, PK, VNM, QRVO, FIS, WYNN, RBLX, SHLX, INTC, EWQ, WPP, HT, PINS, ST, PYPL, CS, SABR, TDOC, NSANY, BTI, VNQI, UBER, SWN, , RLGY, ETRN, ACCO, ECL, ATVI, LVS, SAM, WBD, NLYpI, BA, LADR, BNS, PPLT, RNG, EWS, MCHP, APA, BIIB, CLDT, WBK, COLD, VTRS, TEVA, IDV, SNAP, DDAIF, BMRN, ASRV, QCOM, PVH, IJS, TPR, NOK, ALSN, SIL, WVFC, ALB, FUSB, LBTYK, DOCU, INDA, CHTR, OKTA, CCJ, YUMC, FDX, BBWI, EMR, AMD, DOC, QRTEA, TWTR, HSBC, BYND, GPN, ZM, LEN/B, CHWY, ASRV, CLR, SNA, JTKWY, CAL, HRTX, VTR, TRP, KKR, CPRI, SPOT, EWZ, PPC, URBN, UAL, THS, TSM, NVDA, DBX, ENR, CNC, WSM, ICPT, MAT, IVZ, TTWO, TFC, MSM, FCX, TLRY, WU, EA, CZR, MRNA, DOW, STOR, APO, NFLX, LAC, DDOG, NSTS, SONY, GNRC, MBUU

Note: CQP, EPD, ET, MMP, MPLX, PAA all issue K-1s (PAGP is the same as PAA but with a 1099).

Reminder: I am generally a long term investor (12+ month horizon) but about 20% of my portfolio is more short term oriented (just looking for a retracement of a big move for example). This is probably a little more given the current environment. I do like to get paid while I wait though so I am a sucker for a good well supported dividend. I also supplement that with selling calls and puts. When I sell a stock, I almost always use a 1-2% trailstop. If you don’t know what that is, you can look it up on investopedia. But that allows me to continue to participate in a move if it just keeps going. Sometimes those don’t sell for days. When I sell calls or puts I go out 30-60 days and look to buy back at half price. Rather than monitor them I just put in a GTC order at the half price mark.

To subscribe to these summaries, click below.

To invite others to check it out,

To see more content, including summaries of most major U.S. economic reports and my morning and nightly updates go to Neil’s Newsletter Substack for newer posts or https://sethiassociates.blogspot.com for the full history.