US ADP Employment Change Nov: 127K (est 200K; prev 239K)

ADP misses with big drop in goods producing jobs offsetting gains in services; hiring very concentrated by sector and firm size; wage growth moderated but remained "elevated"

US ADP Employment Change Nov: 127K (est 200K; prev 239K)

ADP® Employment Reports | Home Page (adpemploymentreport.com)

ADP’s payroll data represent firms employing around 25 million workers in the US.

After coming in above expectations for two months, November ADP payroll data missed estimates decelerating from October’s 239k to 127k, slightly below the 132k in August, and the least added jobs in this report since January 2021. This was well below expectations for an increase of 200k.

As with last month, the hiring was very concentrated this month. Starting with firm size, last month the entirety of the hiring was concentrated in the smallest businesses (1-19 employees, who added 62k) and medium-sized businesses in the 50-249 employee category (who added 241k). The rest of the businesses lost employees. That was similar this month although the concentration was even higher in that 50-249 employee category which accounted for basically the entirety of the job gains.

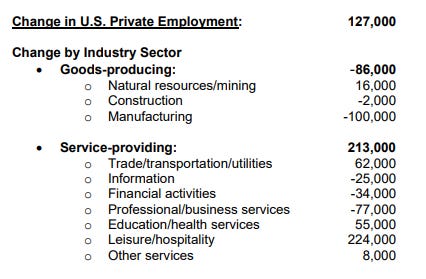

Similarly there was a big discrepancy in terms of sector composition, as for the third month in a row goods producing industries lost employees (-86k after -8k in October and -29k in September). Manufacturing led the losses again with a big -100k decline after -20k in October. So services industries added 213k (after 247k in October), but, again, that was “lumpy” with leisure and hospitality adding 224k of those, so 176% of the total number of jobs added, meaning without those jobs, the total job loss would have been nearly -100k. Leisure and hospitality was 88% of the total job gains in October. Trade and transportation (+62k), which added 84k in October, education/health services (+55k), and other services (+8k) were the only other categories to add jobs. Leading to the downside was business/professional services (-77k). IT shed jobs for a third consecutive month (-25k).

And finally, when you break it down by regions it was a similar story. Payroll gains were concentrated in the Northeast (last month it was the West). The West added 12,000 while the Midwest and South posted declines for a second month.

Also as you know if you’ve been reading these, the revamped report* has wage insights. In that regard, if accurate, it continues to have some potential good news (if you’re the Fed) on further moderation in wage increases.

Pay growth remained elevated even as it continued a modest but broad-based deceleration. Job changers notched their fifth straight slowdown and the smallest increase in pay since January. Pay growth for job stayers edged down, too, led by leisure and hospitality, which had a rapid run-up in 2021 but has been falling since March.

“Turning points can be hard to capture in the labor market, but our data suggest that Federal Reserve tightening is having an impact on job creation and pay gains,” said Nela Richardson, chief economist, ADP. “In addition, companies are no longer in hyper-replacement mode. Fewer people are quitting and the post-pandemic recovery is stabilizing.”

ADP hasn't always been a great predictor of the BLS employer’s report, but as I noted a few of months ago they’ve basically given up. “ADP has emphasized the new measure is an independent estimate of employment and not a forecast of BLS data.” That said, it has seemed to track better since they “gave up” so we’ll see if that continues this month.

*From Bloomberg on the revamped report:

[D]eveloped with the Stanford Digital Economy Lab, now includes figures on both jobs and pay. It will feature the monthly change in private employment as well as weekly payrolls data for the preceding month. Median annual pay growth by industry, company size, region, gender and age will also now be available each month. The ADP data often differed substantially from the government’s monthly private payrolls figure, frequently requiring significant revisions the following month to better align with the Bureau of Labor Statistics’ jobs report. ADP’s last report was for May, and it later said it was retooling its technique “to provide a more robust, high-frequency view of the labor market and trajectory of economic growth.”

One of the key differences in Wednesday’s report is the new methodology underpinning the private employment figure. Instead of its previous model-based approach, the figure will now be constructed from ADP payroll data and weighted with an expansive, quarterly BLS dataset to make it more nationally representative. While the ADP report is based on payroll transactions of over 25 million US workers, the government’s payrolls estimate reflects surveys of about 131,000 businesses and government agencies each month. ADP has emphasized the new measure is an independent estimate of employment and not a forecast of BLS data. “As the labor market evolves, methods for measuring employment dynamics also need to evolve,” Nela Richardson, ADP chief economist, said in the statement. “Combining job and pay data in one report, coupled with high-frequency releases, will give us a clearer picture of the labor market.”

To subscribe to these summaries, click below.

To invite others to check it out,

To see more content, including summaries of most major U.S. economic reports and my morning and nightly updates go to Neil’s Newsletter Substack for newer posts or https://sethiassociates.blogspot.com for the full history. Follow me on Twitter @NeilKSethi

Good info! As the poor economic data continues to worsen, lower lows in stocks are coming for Q1 2023 - monetary policy won't ease before great pain in markets. Keep up the good work Neil!