US Univ. Of Michigan Sentiment Jun P: 50.2 (est 58.1; prev 58.4)

UofM sentiment falls to an all-time low driven by inflation concerns

US Univ. Of Michigan Sentiment Jun P: 50.2 (est 58.1; prev 58.4)

- Current Conditions: 55.4 (est 62.9; prev 63.3)

- Expectations: 46.8 (est 55.3; prev 55.2)

- 1-Year Inflation: 5.4% (est 5.3%; prev 5.3%)

- 5-10 Year Inflation: 3.3% (prev 3.0%)

Surveys of Consumers (umich.edu)

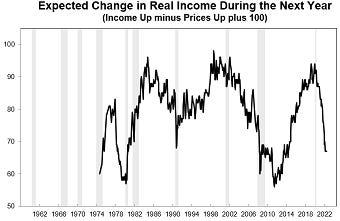

After falling to a new decade low (since 2011) on a broad based decline in sentiment in May, the University of Michigan’s preliminary June sentiment index fell sharply from those already depressed levels, moving from 58.4 to 50.2, a record low reading “comparable to the trough reached in the middle of the 1980 recession.” The figure was weaker than all estimates in a Bloomberg survey of economists which had a median forecast of 58.1. The headline read was 85.5 a year ago. Adding insult to injury, inflation expectations, which the Federal Reserve watches closely, also moved higher, as detailed below.

Both indexes (current conditions and future expectations) declined with present conditions, which was already at a 13-year low, falling to a new record low of 55.4 (from 63.3), and future expectations fell from 55.2 to 46.8. These compare with 88.6 (current conditions) and 83.5 (expectations) a year ago. “All components of the sentiment index fell this month, with the steepest decline in the year-ahead outlook in business conditions, down 24% from May.” (my emphasis). That index of expected business conditions over the next year fell to the second-lowest since 1980, while a gauge of durable goods buying conditions fell to a fresh record low.

As noted, the one-year ahead inflation expectations moved to new four-decade highs at 5.4% while 5-10 year inflation expectations pushed up three tenths to 3.3%, the highest since 2008. “Throughout the survey, consumers signaled strong concerns that inflation will continue to erode their incomes, and the factors they cited are unlikely to abate soon,” Joanne Hsu, director of the survey, said in a statement. “Forty-six percent of consumers attributed their negative views to inflation, up from 38% in May; this share has only been exceeded once since 1981, during the Great Recession.”

Here were the comments from Ms. Hsu who as I noted last month is replacing Dr. Curtin, and has kept it short and to the point in her commentary so far.

Consumer sentiment declined by 14% from May, continuing a downward trend over the last year and reaching its lowest recorded value, comparable to the trough reached in the middle of the 1980 recession. All components of the sentiment index fell this month, with the steepest decline in the year-ahead outlook in business conditions, down 24% from May. Consumers' assessments of their personal financial situation worsened about 20%. Forty-six percent of consumers attributed their negative views to inflation, up from 38% in May; this share has only been exceeded once since 1981, during the Great Recession. Overall, gas prices weighed heavily on consumers, which was no surprise given the 65 cent increase in national gas prices from last month (AAA). Half of all consumers spontaneously mentioned gas during their interviews, compared with 30% in May and only 13% a year ago. Consumers expect gas prices to continue to rise a median of 25 cents over the next year, more than double the May reading and the second highest since 2015. In addition, a majority of consumers spontaneously mentioned supply shortages for the ninth consecutive month

To subscribe to these summaries, click below.

To invite others to check it out,

To see more content, including summaries of most major U.S. economic reports and my morning and nightly updates go to Neil’s Newsletter Substack for newer posts or https://sethiassociates.blogspot.com for the full history.