Markets Update - 11/04/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

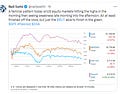

US equities started the Monday session little changed ahead of tomorrow's pivotal election with some softening in the "Trump trades" (stronger dollar, yields, equities) following reports of encouraging signs for the Harris campaign over the weekend. In familiar fashion, equities hit their highs in the morning before falling into the afternoon with large caps finishing lower but smaller caps in the green.

Treasury yields as noted fell back, as did the dollar. Gold also fell for a 3rd day as did bitcoin, while crude, nat gas, and copper all saw healthy gains.

The market-cap weighted S&P 500 was -0.3%, the equal weighted S&P 500 index (SPXEW) +0.1%, Nasdaq Composite -0.3% (and the top 100 Nasdaq stocks (NDX) -0.4%), the SOX semiconductor index -0.6%, and the Russell 2000 +0.4%.

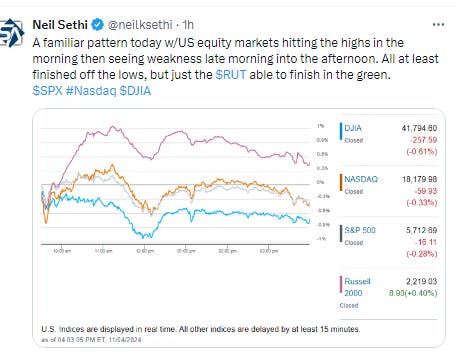

Morningstar style box saw all of the large cap styles down but others in the green.

Market commentary:

“Somehow markets persuaded themselves that Trump was well ahead and had been priced as if it was quite a clear victory for him, which seems crazy,” Erik Nielsen, group chief economics advisor at UniCredit SpA, told Bloomberg TV. “What you’re seeing now is a realization that we got ahead of ourselves.”

“The US election is incredibly important, but the process is likely to be incredibly noisy. Some patience, and a plan, can make the difference between navigating the noise and getting lost in it,” Morgan Stanley strategist Michael Zezas said in a note to clients.

Lauren Goodwin, economist and chief market strategist at New York Life Investments, said investors appear to be trying to price in the relatively small changes in the perception of who is likely to win the election.

“This election is too close to call. Neither I nor anyone else has any real edge on what’s likely to happen. So that makes the market’s moves kind of binary,” Goodwin said.

The sustainability of any upward move in equities if Trump wins the election is likely to depend on the magnitude of bond yields’ response, according to JPMorgan strategists led by Mislav Matejka. A Trump win and a positive market reaction are widely expected at this point, and investors are already long equities “which could lead to travel and arrive at some point,” they said. If Harris wins, the uncertainty over the path of corporate taxes would increase near term. Over the medium term, equities might see some support from the reduced tariffs risk, the strategists noted.

“Normally, the Fed rate announcement would dominate the week’s discussion, but this isn’t just any week,” said Chris Larkin at E*Trade from Morgan Stanley. “Traders and investors who have been waiting for the outcome of the election have to prepare themselves for the possibility of a delayed outcome, and the potential impact of that.”

CFRA Research’s Sam Stovall noted that according to data since 1944, a prematurely strong performance in election years often translates to “further improvement” in November and December. “I think we have some volatility into next week,” he told CNBC’s “Closing Bell” on Friday. “We’ve got a lot going on, but I think that once we get through it, we rally in November and December.”

To Dan Wantrobski at Janney Montgomery Scott, US equities remain largely in consolidation mode ahead of this potentially historic week. Investors should expect “more choppy trading in sessions ahead, he noted. “Depending on how things develop, the markets themselves are teed up for either new highs (the primary trend is still bullish) or bigger drawdowns (overbought conditions remain, with some recent support levels broken),” Wantrobski said.

US equity markets performed relatively well during the past month in comparison to steeper declines during the period just ahead of past presidential races. That suggests optimism about the economy and further Fed rate cuts is outweighing worry about the US election, according to strategists at Citigroup Inc. “Of course, the US election will play a prominent role in moving financial markets around this week,” said Anthony Saglimbene at Ameriprise. “However, a Federal Reserve policy decision on Wednesday, some light economic releases throughout the week, and roughly 20% of the S&P 500 scheduled to report third quarter results should also have their fair share of sway on directing stock traffic.”

Any risks that the U.S. presidential election poses to the market may actually be overstated, according to Citi. “For the lead-up to the U.S. election, equity market behavior has not been in line with previous elections,” analyst Chris Montagu wrote in a Monday note, pointing to October’s “relatively strong” market performance, a lower CBOE Volatility Index (VIX) and a lack of de-risking among investors through the selling of expensive stocks. “Overall, this suggests that other risks, such as U.S. macro, reporting season etc., are having a bigger influence than any perceived election risks,” he continued.

“Investor sentiment could take a turn for the worse over the very short-term, especially if there is uncertainty over the winner of the presidential election or if it takes longer-than-expected to declare a winner,” said Carol Schleif at BMO Family Office. “Sooner or later, the election result will be finalized, and any volatility from this is an opportunity in our view.”

JPMorgan Chase & Co. strategist Dubravko Lakos-Bujas expects US equities will climb into the final stretch of 2024 once the results of the US presidential election are declared, particularly if the outcome is political gridlock.

“Under either gridlock scenario, we think equities reprice higher as we clear the uncertainty, volatility decreases and hedges unwind, with investors refocusing on the Federal Reserve at a time when the economy and corporate earnings remain resilient,” he wrote.

The S&P 500 can keep climbing into the final stretch of 2024 as investors exhale after the US presidential election passes and year-end FOMO kicks in, according to Morgan Stanley’s Mike Wilson. But with no clear catalysts in sight, that enthusiasm is likely to fade as the calendar turns to 2025, the strategist warns. “I think we could see 6,000, potentially, in some sort of a clearing event, where there’s not a lot of consternation and people feel good about things,” Morgan’s chief US equity strategist said Monday in an interview with Bloomberg Television. The gauge closed at 5,712.69 Monday.

Against the uncertain electoral backdrop, it might make sense to look at areas that have bipartisan support rather than industries that benefit from one party or the other, according to Scott Helfstein at Global X. “For example, themes tied to U.S. competitiveness like infrastructure, defense technology, and nuclear energy are central to both party platforms,” he said. “Private investment in areas like AI, data centers, and robotics is likely to remain elevated as US companies look to sustain high margins in an environment with either higher tariffs or taxes.”

Financial markets are starting their final sprint into year-end and conditions are aligning for the normal seasonal rally, though one is far from assured, according to Jason Draho at UBS Global Wealth Management. “The election should be a risk-clearing event, while economic fundamentals, policy, and investor positioning lean in favor of markets grinding higher,” he said. “For equities, this could also mean a further broadening out of performance that began earlier in the fall. Even if such a year-end rally doesn’t materialize, these conditions, along with the AI theme, give us confidence that the markets will move higher over the next year.”

The year-to-date gains through October are the strongest for any election year going back to at least the 1950s, according to Keith Lerner at Truist Advisory Services Inc. These gains are supported by an economy that remains resilient and forward earnings that reached yet another record high, he said. “Two pillars of this market also remain intact: 1) Don’t fight the trend, and 2) Don’t fight the Fed,” Lerner noted.

Raymond James strategist Javed Mirza said in a note to clients that the stock market appears to be in the early stages of a pullback. “Ongoing deterioration in Market Breadth and the Percentage of Stocks with Bullish Patterns, in conjunction with weakening Investor Sentiment is consistent with a new intermediate-term (1-3 month) equity market corrective phase getting underway,” wrote Mirza. “Equity markets have reached our time target for the intermediate-term equity market rally that began in August, which further reinforces our view that the reward/risk ratio at current levels is poor.”

Weak economic data over the past week suggests that the market won’t necessarily once the election is decided, according to Andrew Smith, chief investment strategist at Delos Capital Advisors in Dallas. “This volatility I think is going to be around for awhile even after the election outcome, because there just needs to be more market clearing events for investors to get that green light to move forward,” Smith said. Additionally, the market’s movement over the past few weeks does not point to a clear election winner, Smith said.

“I think the market is very confused right now. They’re holding back,” he added.

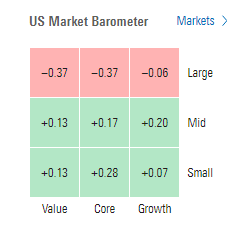

With both US presidential candidates at a “dead heat” heading into next week’s election, markets are bracing for a result that could lead to a wide range of policy outcomes. Yet, it is notable that, since 1933, equities have almost always risen by double-digits by the end of a president’s term, regardless of their party affiliatio according to Seema Shah at Principal Asset Management.

“Investors should take caution. Those who allow their political opinions to cloud their investing decisions could miss out on the potential rewards that come with staying invested in the market over the long-term,” she noted.

In individual stock action, losses in mega caps and chipmakers were a drag on index performance. Apple (AAPL 222.01, -0.90, -0.4%), Microsoft (MSFT 408.46, -1.91, -0.5%), Amazon.com (AMZN 195.78, -2.15, -1.1%), Alphabet (GOOG 170.68, -1.97, -1.1%), Meta Platforms (META 560.68, -6.48, -1.1%), Broadcom (AVGO 168.64, -0.27, -0.2%), and Tesla (TSLA 242.84, -6.14, -2.5%) were notables. NVIDIA (NVDA 136.05, +0.65, +0.5%) and Sherwin-Williams (SHW 374.40, +16.43, +4.6%) though were higher on news they will be replacing Intel (INTC 22.52, -0.68, -2.9%) and Dow Inc. (DOW 47.95, -1.02, -2.1%) in the Dow Jones Industrial Average effective prior to the open of trading on Friday, November 8.

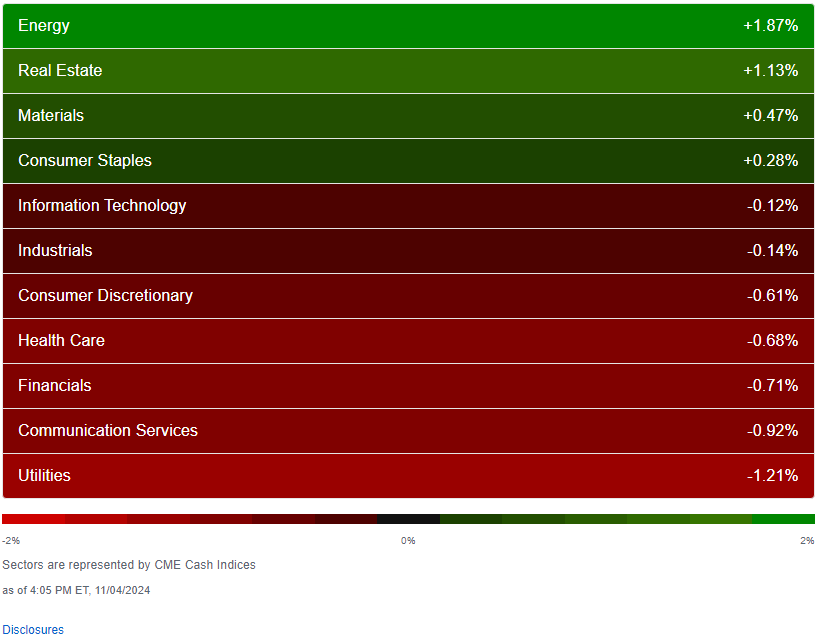

Utility stocks weighed on the market after federal regulators rejected a Talen Energy request to increase nuclear power at a plant in Pennsylvania to provide more electricity for an Amazon data center. Financials and health-care stocks were also weak areas of the market, as Goldman Sachs and UnitedHealth Group fell 1.5% and 1.7%, respectively, dragging down the Dow.

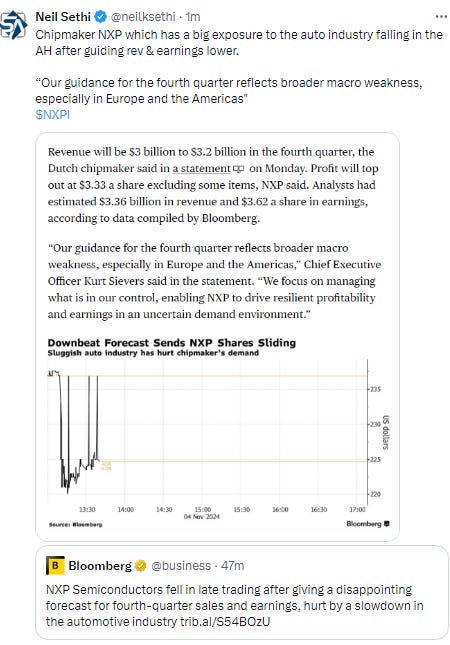

In late hours, Palantir Technologies Inc. rallied on an earnings beat, while citing “unwavering” artificial-intelligence demand. NXP Semiconductors NV tumbled after giving a disappointing forecast.

Corporate Highlights from BBG:

Shares of nursing home operator PACS Group Inc. tumbled after Hindenburg Research released a short report alleging that the company has been — among other things — “systematically scamming taxpayers.”

Franklin Resources Inc. sank on news that the Commodity Futures Trading Commission is investigating trades at Western Asset Management Co., and that $18 billion of long-term cash had flowed out of that unit last month.

Obesity pill data released by Viking Therapeutics Inc. and AstraZeneca Plc at a big conference foreshadowed an increasingly competitive landscape for weight-loss therapies, sending down shares of drugmakers in the field.

Peloton Interactive Inc. picked up rare buy rating Monday as Bank of America Corp. upgraded the fitness company by two notches, touting its profit outlook and a positive view of its new chief executive.

French grocer Carrefour SA is in the early stages of studying ways to boost its valuation, more than three years after talks to sell itself to an industry rival fell apart, people with knowledge of the matter said.

Commerzbank AG Chief Executive Officer Bettina Orlopp is seeking to unlock more capital to pay out or invest, as she makes the case for an independent bank in the face of a potential takeover by rival UniCredit SpA.

Some tickers making moves at mid-day from CNBC.

In US economic data today we got Sept factory orders which fell -0.5% m/m (after -0.8% in Aug) mostly due to weak Boeing orders. Ex-transportation things were a little better rising +0.1% (but still falling -0.2% in Aug). Didn’t get to do a summary today.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX continued to hold above its 50-DMA. Daily MACD and RSI though as noted Thursday have deteriorated to the worst since September.

The Nasdaq Composite fell back towards its 3-wk low remaining beneath its 20-DMA (green line). The daily MACD & RSI are also starting to materially deteriorate.

RUT (Russell 2000) continued to find support at its 50-DMA, but as noted Friday, “that’s been about it.” Its daily MACD & RSI remain weak.

Equity sector breadth from CME Indices continued its streak of weakness into Mon with just 4 green sectors (down from 5 Fri (although up from 2 Thurs)), but we did have 2 up >1% (energy & RE) vs just 1 Fri, and only one sector down >-1% (utilities which finished in last place for a 2nd day) down from 2 Fri (and 7 Thurs).

Communications (due to Alphabet’s big day last week) only sectur up last 5 sessions.

Stock-by-stock SPX chart from Finviz consistent with another very mixed performance outside of RE, energy, and some other yield sensitive areas like home improvement/specialty retailers and homebuilders. Berkshire -2.3% after reporting earnings Saturday.

Positive volume which has alternated good and bad days for the past week continued to do so with a relatively good day (given the index performances) at 54 & 55% on the NYSE & Nasdaq respectively. Compare that to Friday’s 41 & 53% when the SPX and Nasdaq both were up for the day. Issues were 58 and 49%.

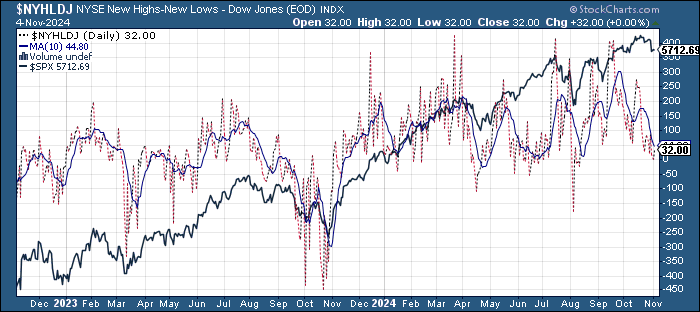

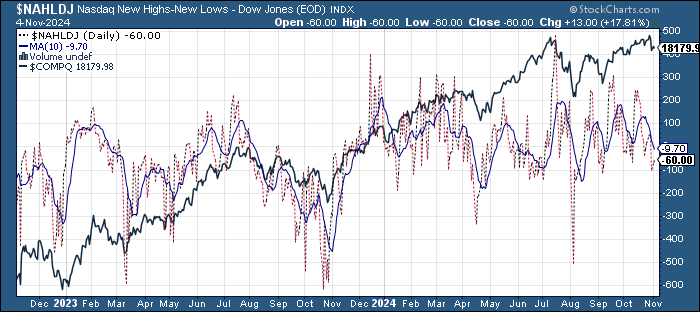

New highs-new lows saw some improvement as well w/the NYSE up to 33 from the least since Aug 12th while the Nasdaq moved to -66 from the least since Sept. They’re also still below the 10-DMAs (less bullish), and so the DMA’s continue to head lower with the NYSE’s the least since Aug.

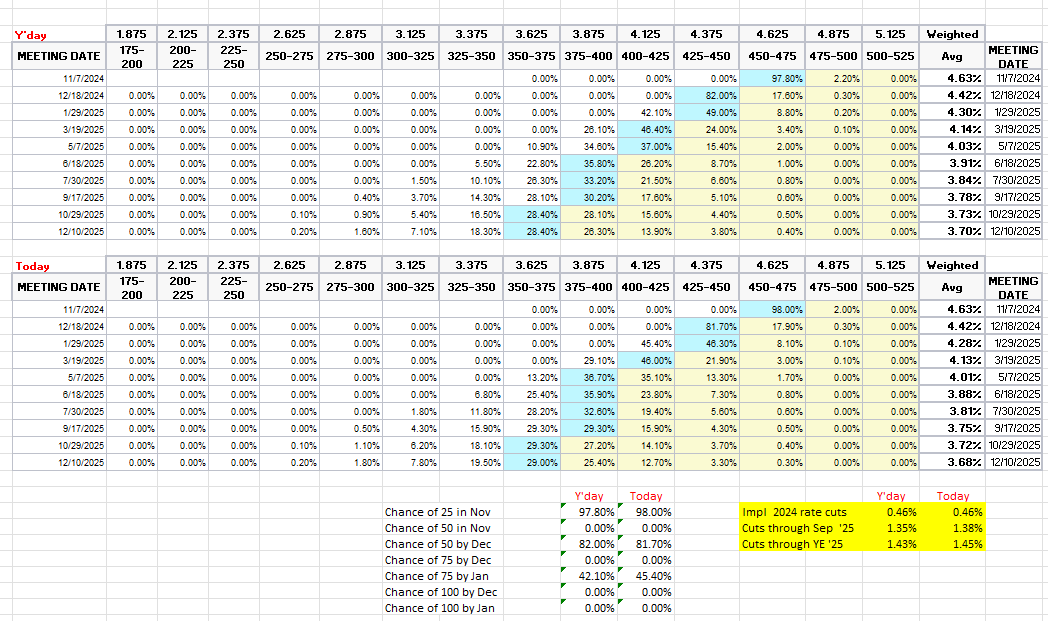

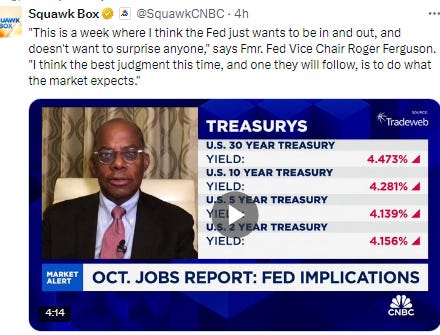

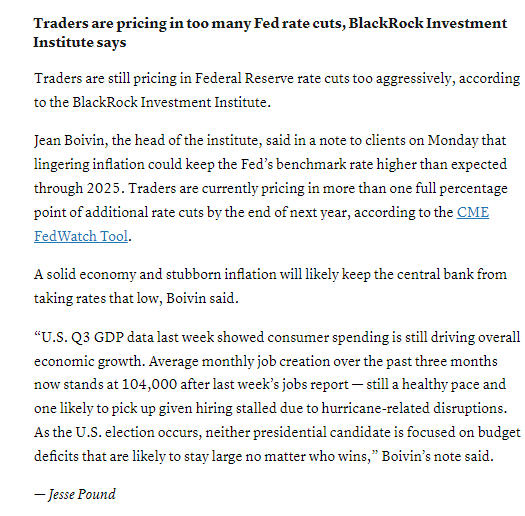

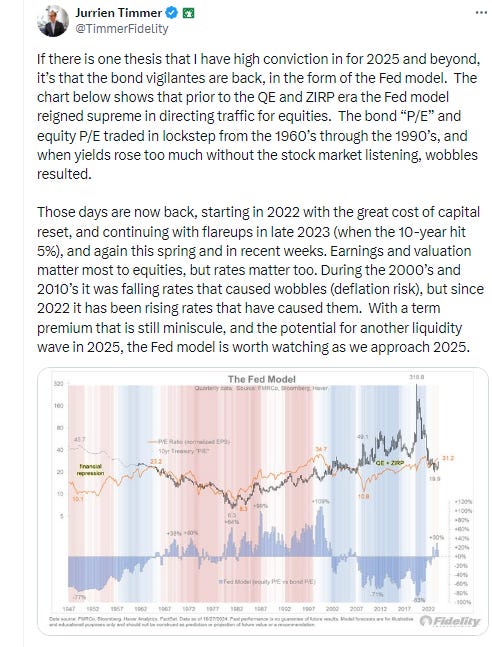

FOMC rate cut probabilities from CME’s Fedwatch were little changed with the chance of 25bps in Nov remaining near a virtual certainty at 98%. The chance of 50bps through the end of year is 82% (w/ 0.3% chance of no cuts this yr). The chance of 75bps after Jan’s meeting back up to 45%.

Still 46bps of cuts priced this yr, now 138bps through Sep ‘25 (from 135) & 145bps through YE ‘25 (from 143).

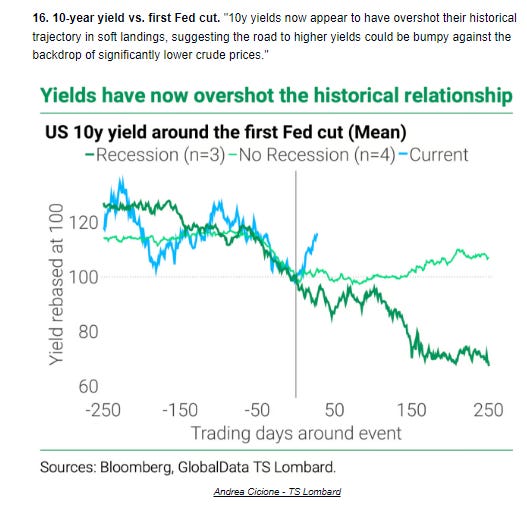

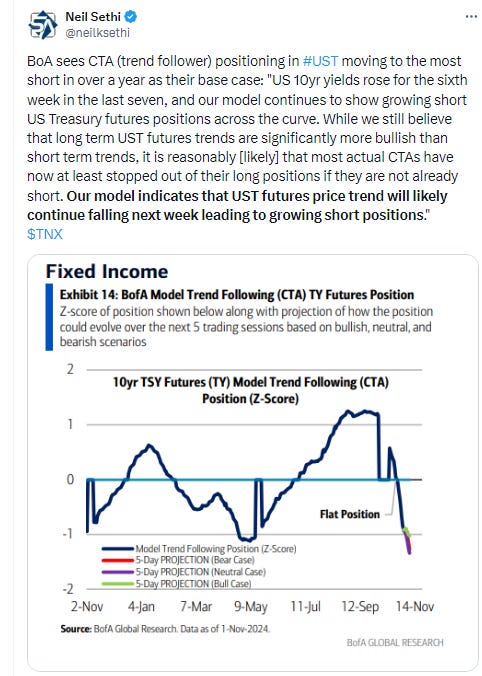

Treasury yields fell back and unlike Friday didn’t turn losses into gains although did finish well off the lows on some unwind of the “Trump trades” today. The 10yr yield was -5 basis points to 4.31%, from the highest since July, still up +57bps since the start of October, but breaking its steep ascent. The 2yr yield was -3bps to 4.18% also from the highest close since July, still up +55bps since the start of October.

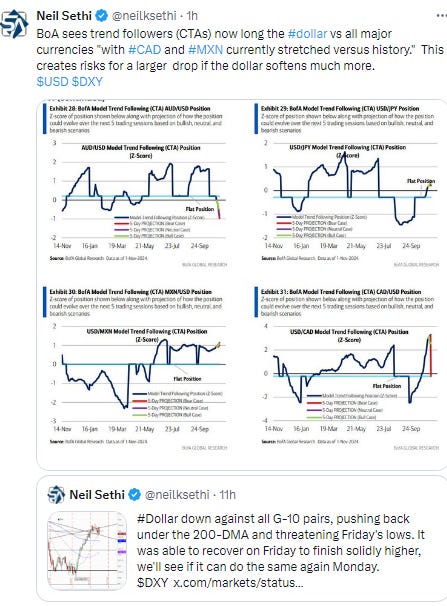

Dollar ($DXY) followed yields lower at one point falling to the least since Oct 21st, again breaking under the 200-DMA (brown line) what I called last week “a key level with the daily MACD crossing over to ‘sell longs’ & RSI falling to a 3wk low which raises the chances for a consolidation.’” But like yields it was able to finish off the lows just below the 104 level, remaining above the uptrend line running back to the Sep ‘22 highs that outside of 8 or so days in June has capped all rallies (it’s been over for 10 days so far).

As noted Monday, it broke a lot of resistance the prior, and if it can stay over it opens up a run all the way to 106, but the flagging momentum is becoming more evident. Given the stretched positioning it could fall sharply if it gets going.

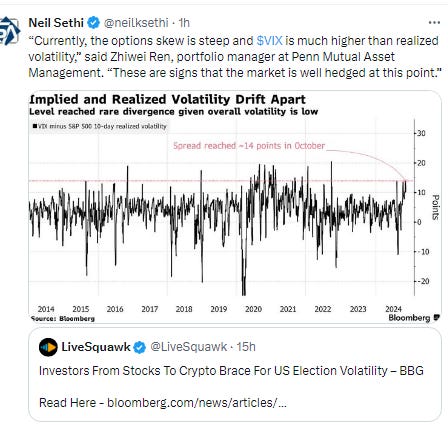

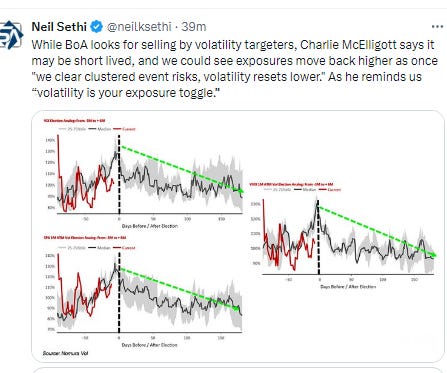

The VIX & VVIX (VIX of the VIX) edged higher with the former to 22, (consistent w/1.4% daily moves over the next 30 days) & the latter to 122 (consistent w/“elevated” daily moves in the VIX over the next 30 days). As noted 4 weeks ago, though, these are 30-day volatility measures and incorporate the election, so will likely remain more elevated until that passes (just another few days (hopefully)!).

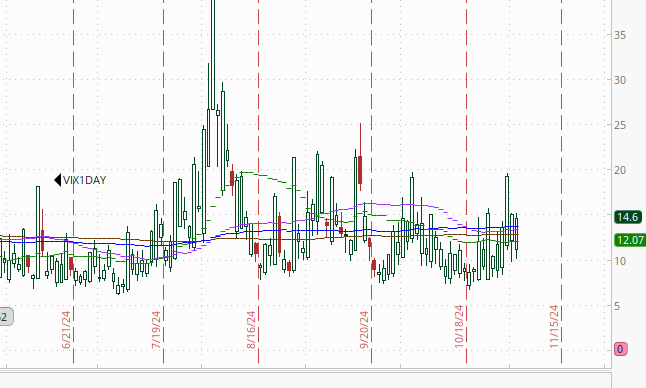

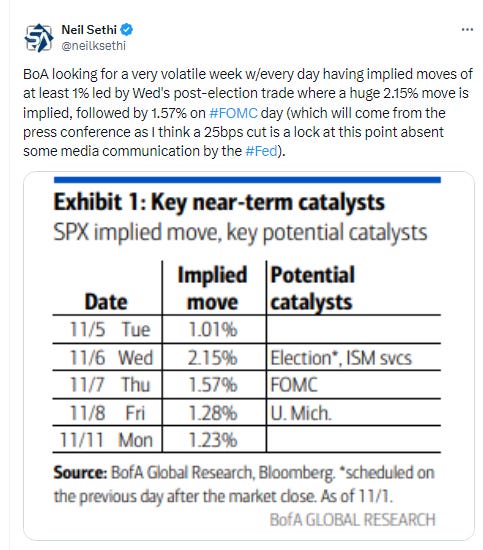

1-Day VIX, which will be a better near term indicator of expected volatility until the election, remained relatively low (as not much volatility is expected tomorrow) at 14.6, looking for a move of ~0.9% Tuesday similar to BoA’s estimate (1.0%). BoA though says this should spike to 34 tomorrow.

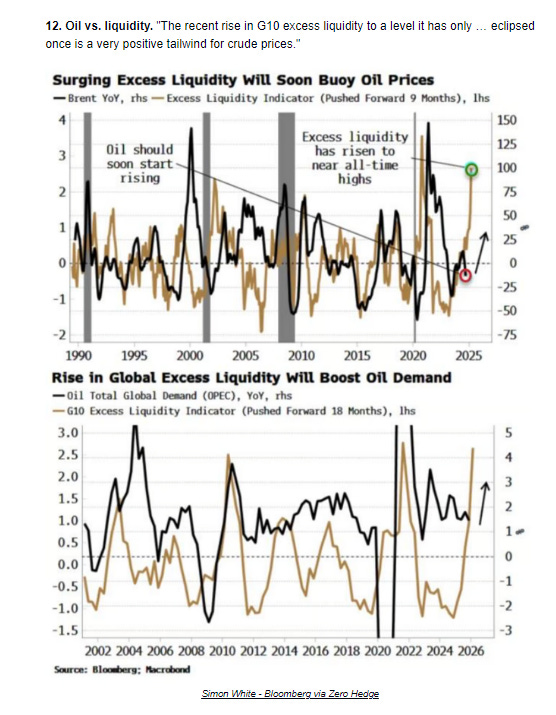

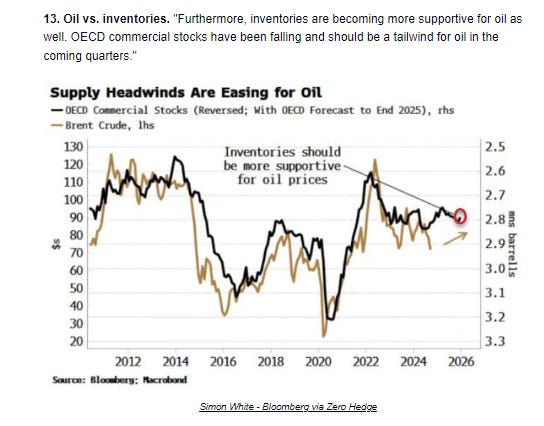

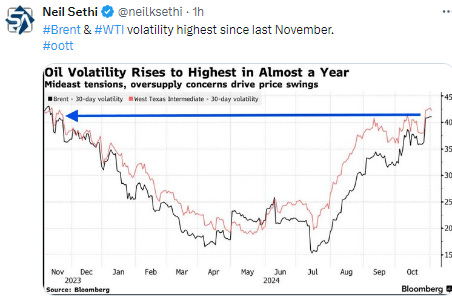

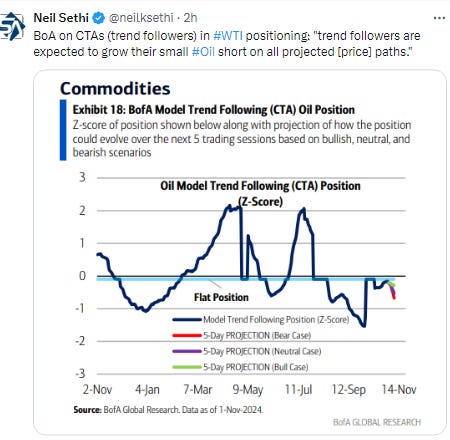

WTI up for 3rd day in 4 after news that OPEC+ will push off the start of unwinding voluntary cuts to the new year and continued saber-rattling from Iran. It wasn’t able to conclusively clear the $71.60 level (which I said would “change the picture and could take us up to the $78 level quickly if we got a sufficient catalyst”), but the daily MACD (circle) & RSI (arrow) have moved into more supportive positioning so perhaps it’s coming?

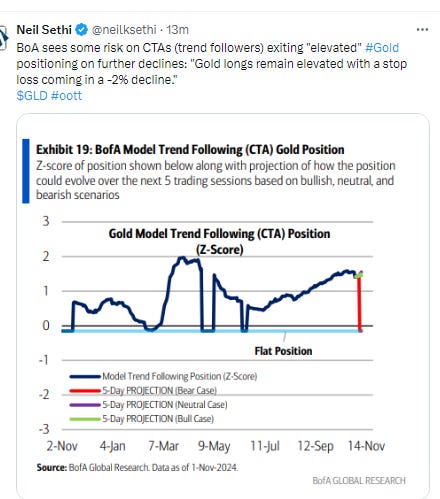

Gold fell for a 3rd day back towards its 20-DMA as I mentioned 2 weeks ago as a possibility. As noted last week, the daily MACD has also now crossed over to “sell longs” something that has seen mild weakness previously (see Friday’s chart).

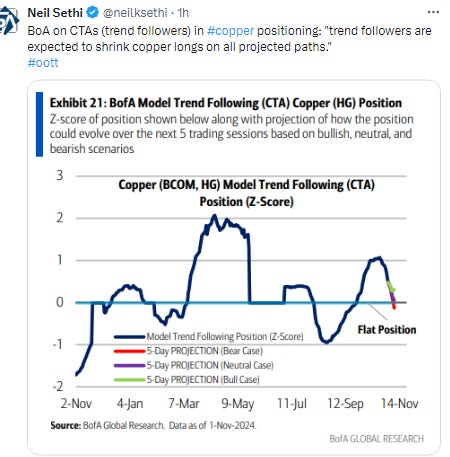

Copper finally broke out of the nearly 3-week period of remarkable calm (closing w/in a 10-cent range for 13 sessions) with its best day in a month pushing to the highest close since Oct 11th. The daily MACD & RSI are not quite yet supportive, but they’ll confirm any further gains. As noted 3 weeks ago not much resistance higher until the Oct closing highs near $4.70.

Nat gas (/NG) with a volatile session, continuing to fall into the gap created from the “roll jump” to the December contract, but once it filled that gap it shot higher finishing the day up over 4%. Still remains under the downtrend line from the Nov ‘23 highs. The MACD & RSI remain positive because of the jump in price on the roll.

Bitcoin futures fell back for a 3rd session making it to the 20-DMA after coming oh so close to an ATH close last Wednesday. Daily MACD & RSI are on the verge of crossing negative as well.

The Day Ahead

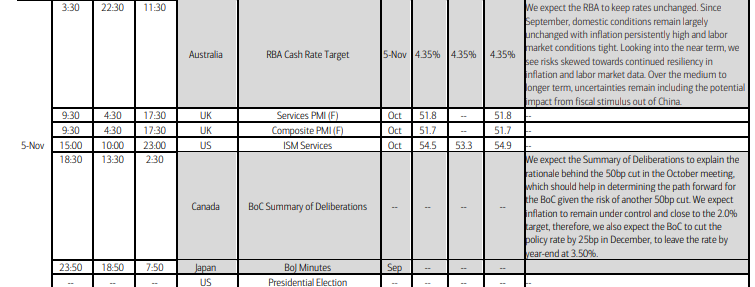

News tomorrow will obviously be dominated by the election. But if you, like me, are not going to spend your day following every twist and turn of exit polling there’s some US economic data you can peruse including the Sept trade balance and Oct final services PMIs.

No Fed speakers with the blackout, but we will get another Treasury auction in $42bn of the benchmark 10yr note (we’ll see if we get a little better domestic bid than today’s).

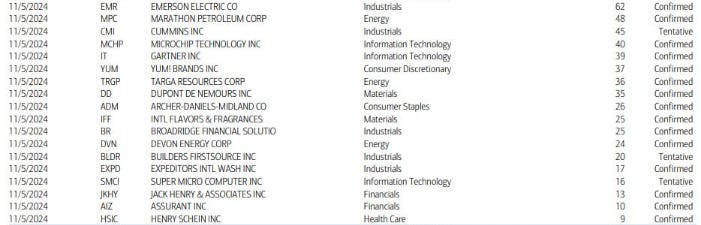

Earnings will remain heavy with 18 SPX components but none >$100bn in market cap. (see the full earnings calendar from Seeking Alpha).

Ex-US the highlight is a policy decision by the Royal Bank of Australia (no change is expected). We’ll also get the minutes from the last meetings of the BoC & BoJ which might be interesting. Otherwise we’ll get final Oct services PMIs.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,