Markets Update - 11/05/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

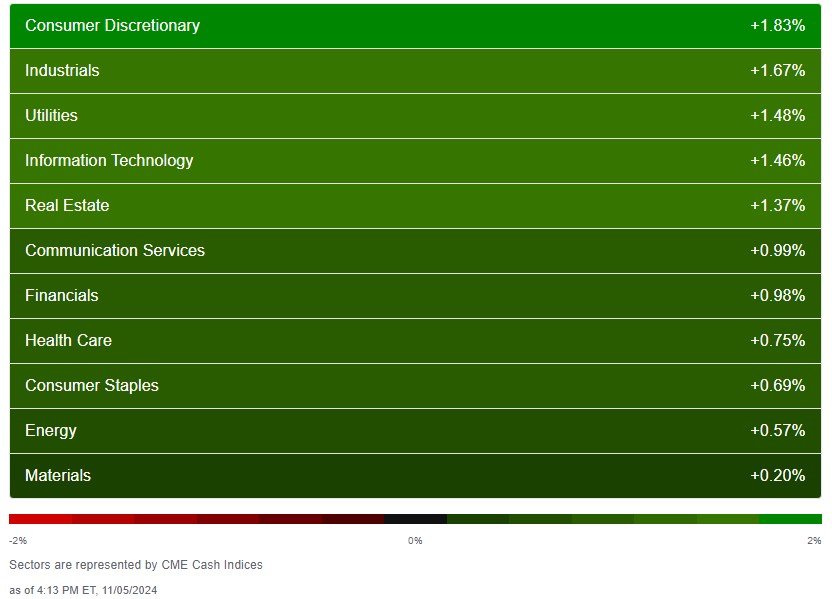

US equities started the Election Day (also my birthday (hence the picture)) session moving higher and never looked back finishing at or near the highs of the day with every sector closing in the green, something we haven’t seen in a while (at least at the broad level). It was the 6th straight Election Day gain for the SPX & Nasdaq, although it was small & mid-caps which led today.

Treasury yields were little changed giving up early gains, while the dollar fell to a 2 wk low. Nat gas also fell but crude, copper, bitcoin, and gold all rose (the fall in the dollar probably didn’t hurt).

The market-cap weighted S&P 500 was +1.2%, the equal weighted S&P 500 index (SPXEW) +1.2%, Nasdaq Composite +1.4% (and the top 100 Nasdaq stocks (NDX) +1.3%), the SOX semiconductor index +1.7%, and the Russell 2000 +1.9%.

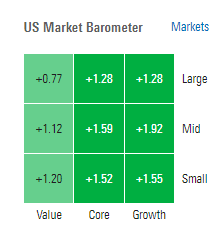

Morningstar style box shows every style in the green led by growth and small and mid-caps (large caps lagged for a 2nd day).

Market commentary:

"Today is the most important Election Day ever, until the next one. We think the Warren Buffett logic of investing in stocks you would want to own if the stock market was closed for the next decade is the optimal approach to such an environment." -- Mike O'Rourke, JonesTrading

"The relevance of the election is difficult to overstate, particularly as it pertains to investors’ perception of the reflationary risks over the next few years and any of the associated implications for monetary policy. We maintain that although Tuesday’s vote won’t derail the Fed’s agenda for the next few meetings, the occupant of the White House could become a more relevant policy input beginning in the second half of next year. The path to reflationary pressures that slow the FOMC’s normalization schedule is relatively straightforward, and involves a Trump victory that translates into a series of higher tariffs." -- Ian Lyngen and Vail Hartman, BMO

History says that Wednesday’s market moves will be a strong indicator of how Wall Street will react to the election results in the weeks ahead, according to Bank of America. In the past seven elections, the direction of Wednesday’s S&P 500 move matched the direction of the index in the two weeks directly after the election, according to a trading desk note from the bank.

The tight nature of the 2024 presidential race could mean that traders are less certain than normal of the election outcome during Wednesday’s trading session.

“Investors need to look through lingering election risks,” Anwiti Bahuguna, chief investment officer of global asset allocation at Northern Trust Asset Management, said in an interview. “Traders can’t even position at this point since it’s so speculative, and traders don’t know what policy proposals would actually get passed from either candidate through Congress.”

“There’s been a lot of hedging against potential uncertainty, potential drama out of Washington. We’ve seen that. And now as we’re at Election Day, we kind of are optimistic that maybe some of that can unwind,” said Ryan Detrick, chief market strategist at Carson Group. “The reality is whoever is given the keys to the White House, if you will, is going to be taking on a car that’s in pretty good shape — an economy that’s in pretty darn good shape,” Detrick added.

“We’re positive on the market regardless of what happens tonight, today. We think Congress will be a divided Congress. That’s going to be the most positive thing of all,” said Alicia Levine, head of investment strategy and equities, on “Squawk Box.”

“Interest rates are still restrictive and increasing volatility is more likely through the end of the year, so a more conservative approach is appropriate,” said Brian Mulberry, client portfolio manager at Zacks Investment Management.

“What you can see across markets now is that no one is ready to take clear investment positions on the election,” said Alexandre Hezez, chief investment officer at Groupe Banque Richelieu in Paris. “The uncertainty is palpable across all asset classes. There’s such a massive gap between the program of the two candidates that caution is of the essence.”

“What you can see across markets now is that no one is ready to take clear investment positions on the election,” said Alexandre Hezez, chief investment officer at Groupe Banque Richelieu in Paris. “The uncertainty is palpable across all asset classes. There’s such a massive gap between the program of the two candidates that caution is of the essence.”

“Regardless of who wins tonight or whenever we get those results, it effectively is going to be a surprise,” Cameron Dawson at NewEdge Wealth told Bloomberg Television. “Those polls are so very tight, which means that it could be volatility-inducing event.”

“What you can see across markets now is that no one is ready to take clear investment positions on the election,” said Alexandre Hezez, chief investment officer at Groupe Banque Richelieu in Paris. “The uncertainty is palpable across all asset classes. There’s such a massive gap between the program of the two candidates that caution is of the essence.”

“If it was a cleaner call, it would be baked into the market and there would be little left to exploit,” said Mark Luschini, chief investment strategist at Janney Montgomery Scott. “But in something this tight it is better to look over the horizon and maintain your thoughts on what the macroeconomic condition will look like six to 18 months from now, rather than just on the outcome on that day.”

“The market is longing for the election to be over so that the focus can return to earnings and monetary policy,” said Susana Cruz, a strategist at Panmure Liberum.

Goldman Sachs Group Inc. strategists said there’s a possibility of a burst of volatility in the aftermath of the election, but also pointed to the resilient US economic backdrop as likely to support equities in the long run. The team of strategists led by Andrea Ferrario said there’s just an 18% chance of a bear market in the next 12 months — even when taking into account the risks posed by Tuesday’s presidential election. “Equities should be able to digest higher bond yields as long as they are driven by better growth,” the Goldman strategists wrote in a note.

“The setup is still skewed to the positive and the bull cases is still intact, unless we get a new policy from a new political regime that looks like it’s going to be more austere,” Trivariate Research founder Adam Parker said Monday on CNBC’s “Closing Bell.”

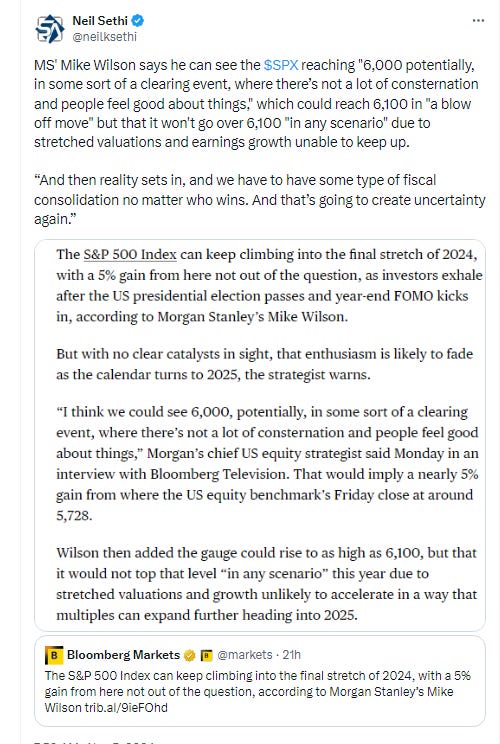

Investors should use any outsized market moves in the coming days to build better long-term positions in their portfolios, according to UBS. The firm sees opportunities in U.S. and Chinese equities, bonds and gold. “We believe that U.S. equities are attractive and should be supported by benign growth, lower rates, and structural support from AI, regardless of the election result,” Solita Marcelli, chief investment officer Americas for UBS Global, said in a Tuesday note. “We expect these market drivers to remain in place regardless of who wins the U.S. election.” At the sector level with equities, Marcelli prefers U.S. technology, utilities and financials. Near-term volatility has not shaken the firm’s 2025 target of 6,600 for the S&P 500, which is a roughly 15% price return from current levels, per the note. With bonds, the firm expects them to see positive returns over the next 12 months as inflation moves downward. “We recommend deploying cash to lock in yields while attaining a strong portfolio diversifier,” Marcelli said, while still noting that yields are currently “too high, regardless of who secures the presidency.”

A volatile near-term market could benefit some major consumer staples names, Fairlead Strategies founder Katie Stockton told CNBC on Tuesday.

“Oftentimes the market would undergo a corrective phase ahead of the actual election day. We have not really had that if we reference the S&P 500, and that would suggest that maybe it’s a bit more of a proof point for the market this time around in terms of its reaction,” Stockton said. “Our anticipation is that we’ll get this sort of positive near-term action, but it could just be a knee jerk that gives way to some corrective price action into year-end.”

Staples noted that if the market sees a correction, defensive properties behind consumer staples stocks could make them “do better in a more tenuous market environment.” Many of the constituents in the Consumer Staples Select Sector SPDR Fund, including Coca Cola, Procter and Gamble and General Mills, have become oversold, she said. “We feel at least that this would be a natural place for a rebound for the sector … and at the same time, the relative performance, which has really suffered, should rebound — especially if we do see some corrective action ensue for the S&P 500,” Stockton said.

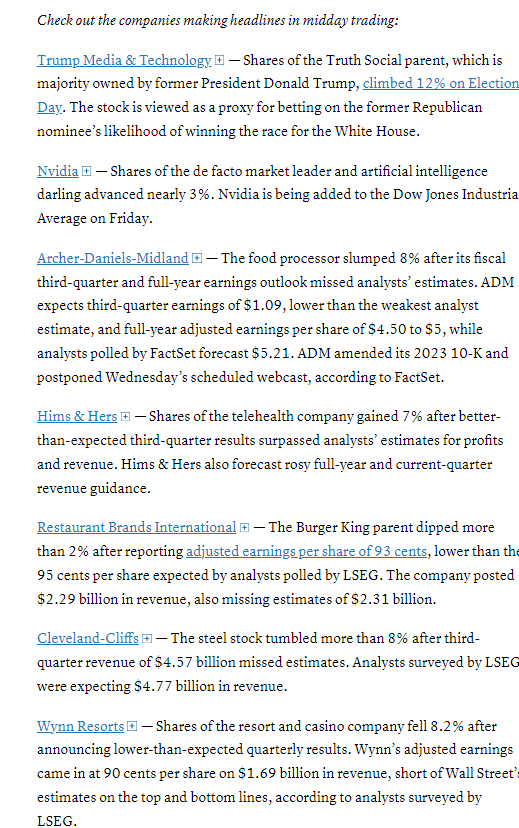

In individual stock action, the world’s largest tech companies supported gains with a measure of the “Magnificent Seven” megacaps climbing 1.8%. The rally was partly fueled by a surge in Palantir Technologies Inc. after the company signaled “unwavering demand” for artificial intelligence. Palantir Technologies (PLTR 51.13, +9.72, +23.5%), DuPont (DD 85.67, +3.82, +4.7%), GlobalFoundries (GFS 41.37, +5.36, +14.9%) registered big gains in response to earnings.

Some tickers making moves at mid-day from CNBC.

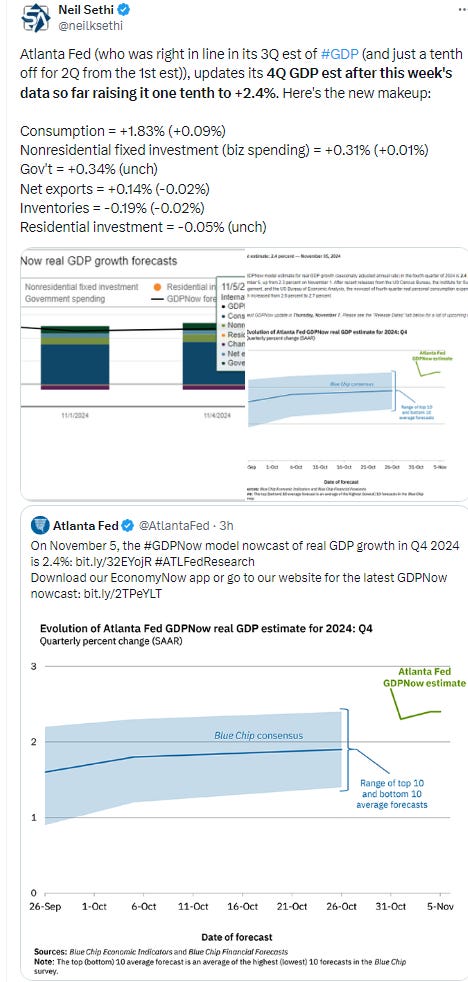

In US economic data today:

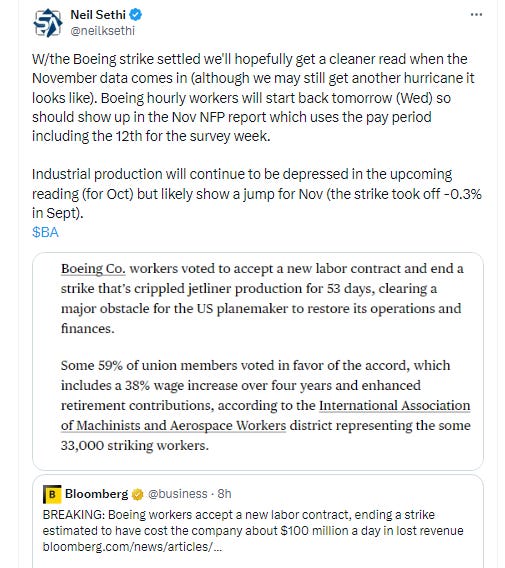

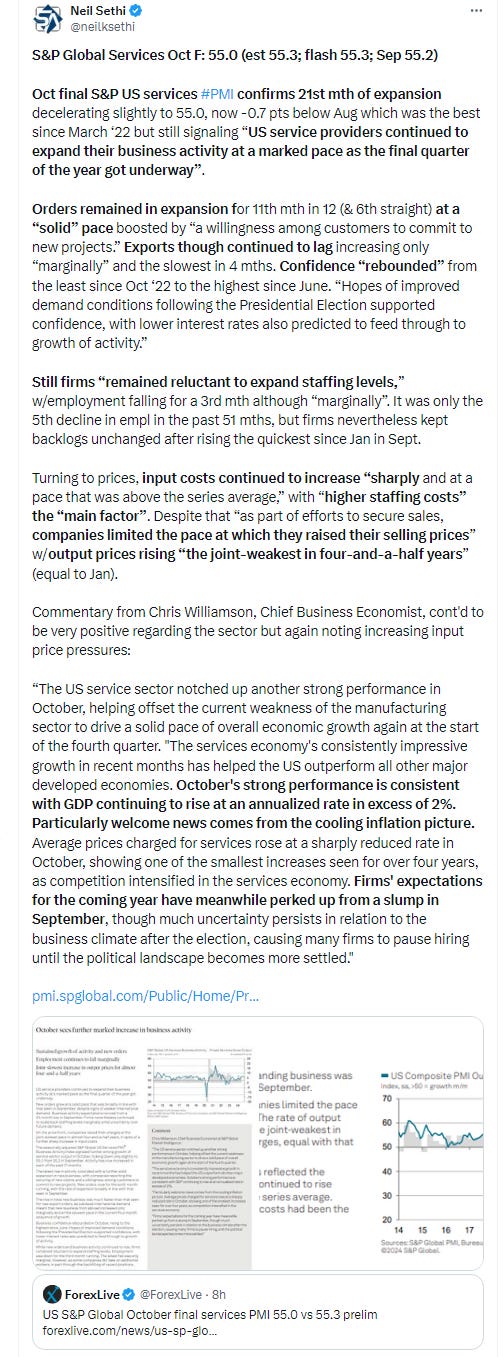

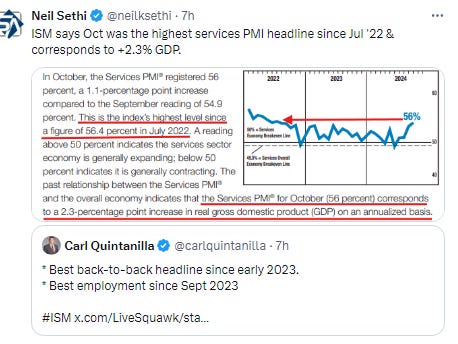

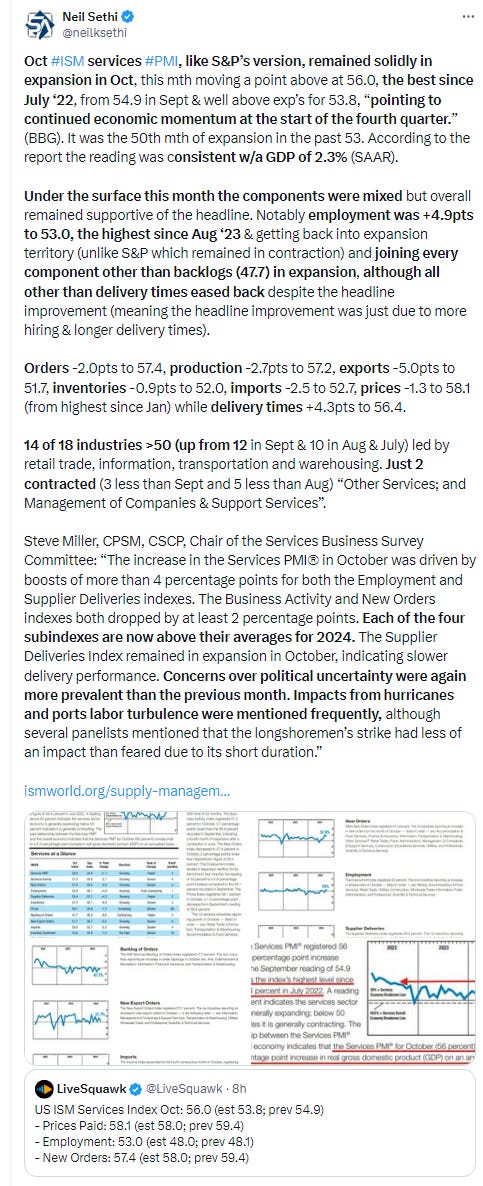

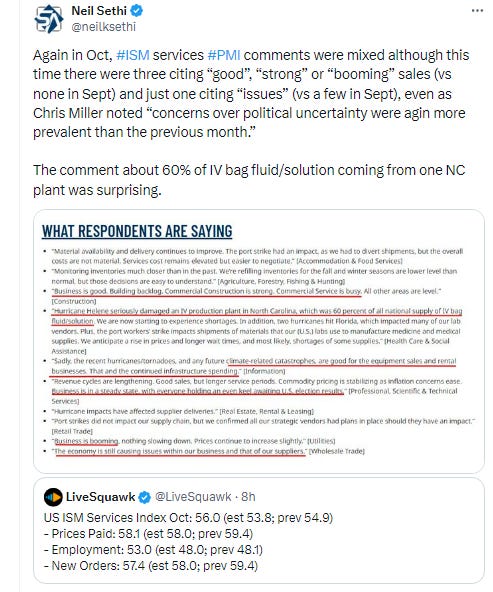

Global services PMIs were very solid w/the S&P’s just off the highest since Mar ‘22 & the ISM moving to the highest since July ‘22 well above expectations (although the internals were a bit more mixed). Notably though the ISM saw employment back in expansion.

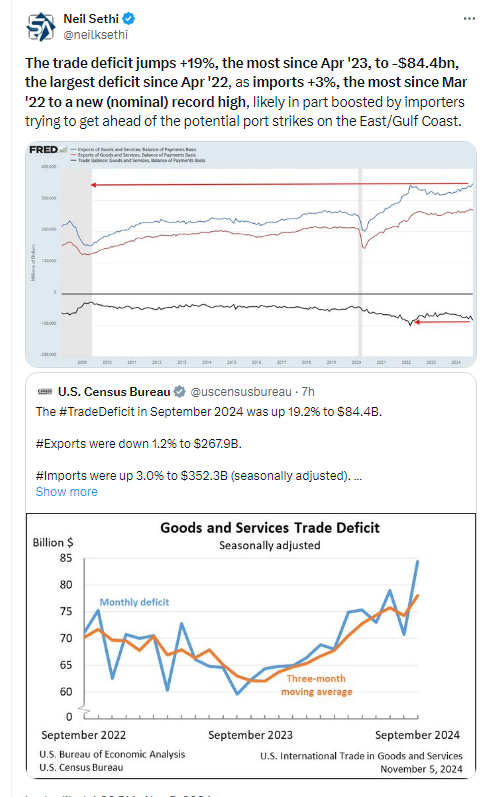

The Sept trade balance jumped the most since Apr ‘23 on the biggest increase in imports since Mar ‘22 as importers tried to get ahead of the looming port strikes.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

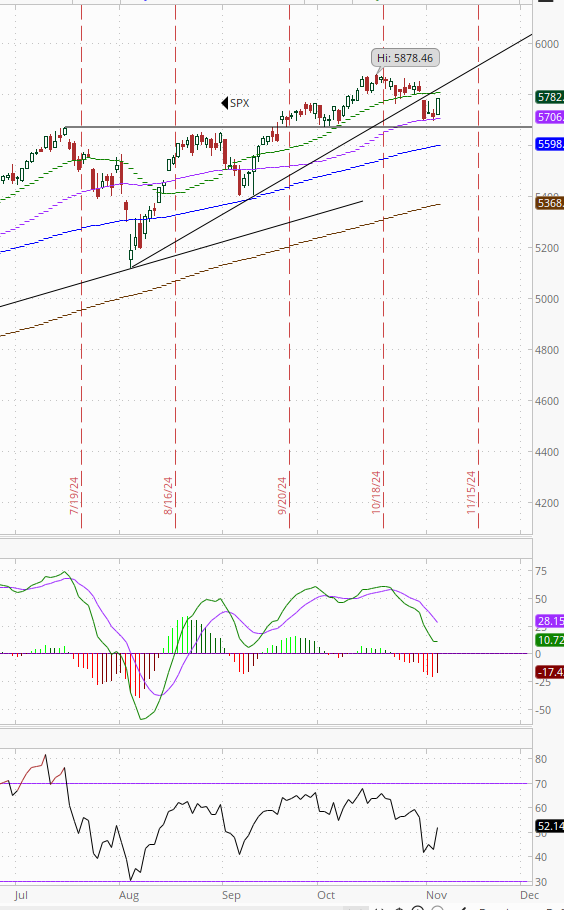

The SPX moved off its 50-DMA but remains below the 20. Daily MACD and RSI though as noted Thursday remain weak.

The Nasdaq Composite able to bounce back over its 20-DMA (green line) into the gap from Halloween. The daily MACD & RSI remain weak though.

RUT (Russell 2000) a good day up to the highest close since Oct 18th back above its 20-DMA. Its daily MACD & RSI are turning more positive.

Equity sector breadth from CME Indices gave us our first 11/11 green day in a while. 10/11 were up at least a half percent & 7/11 up ~1% or more (& made up of a good mix of sectors (3 megacap growth sectors, 2 cyclicals & 2 defensives)). Materials lagged (+0.25%).

Stock-by-stock SPX chart from Finviz consistent with very little red (have to pick it out).

Positive volume which had alternated good and bad days for the past week+ broke the streak Tuesday with a very solid session following Monday’s relatively good day, coming in at 80 & 78% on the NYSE & Nasdaq respectively. That’s the best combined since late August I believe. Issues were 80 & 71%.

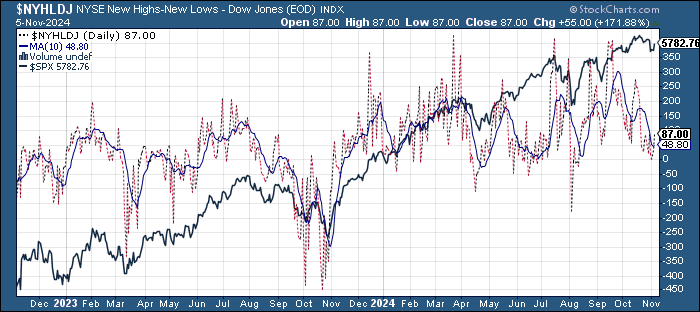

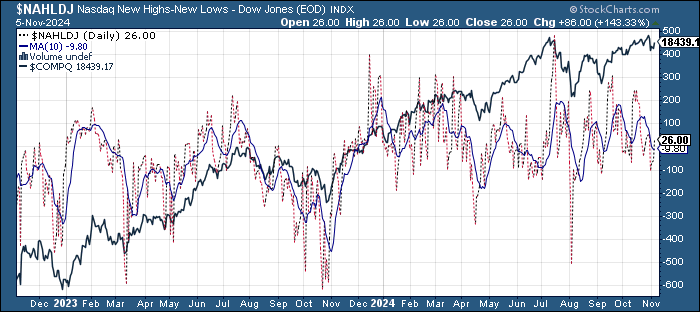

New highs-new lows also improved to 87 & 23 respectively from 33 & -62 Monday. That has them back above the 10-DMAs (more bullish), but the DMA’s are still heading lower for now with the NYSE’s the least since Aug and the Nasdaq since early Sept.

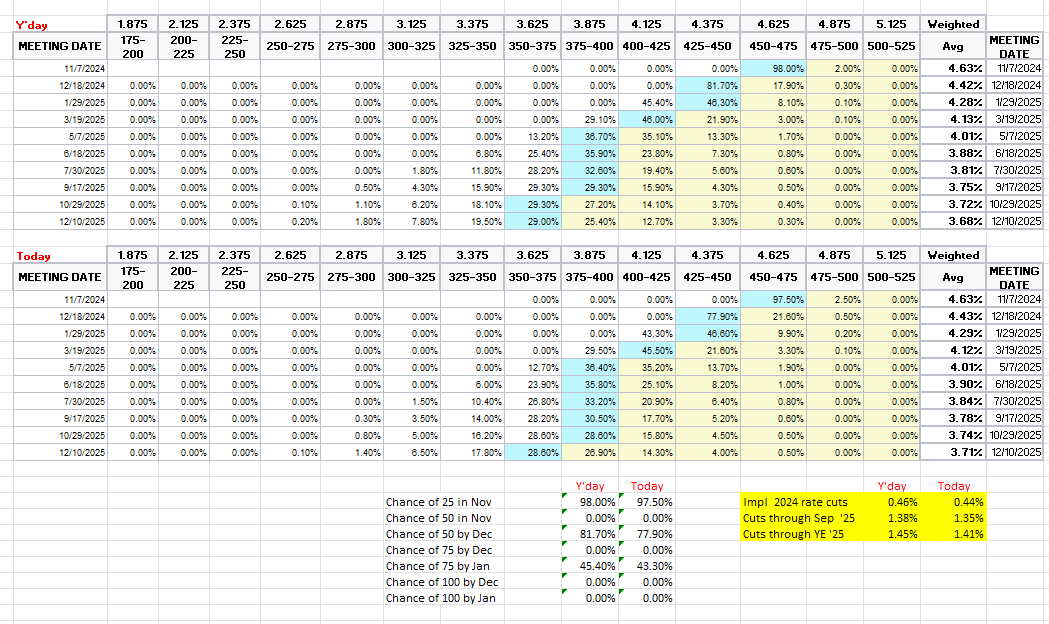

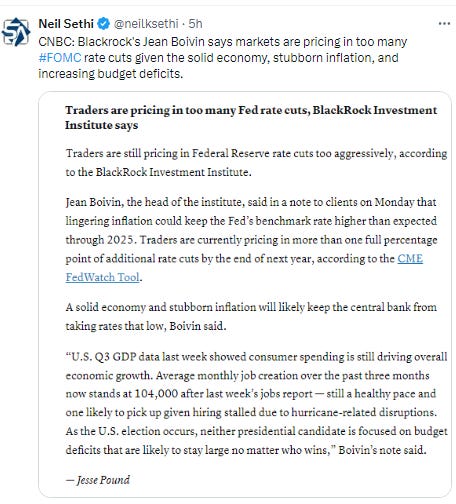

FOMC rate cut probabilities from CME’s Fedwatch saw some movement after the strong services PMI’s although the chance of 25bps in Nov remained near a virtual certainty at 97.5%, but the chance of 50bps through the end of year edged to 78% from 82%. The chance of 75bps after Jan’s meeting fell to 43% from 45%.

Still 44bps of cuts priced this yr (from 46), 135bps through Sep ‘25 (from 138) & 141bps through YE ‘25 (from 145), but those were lower earlier in the session.

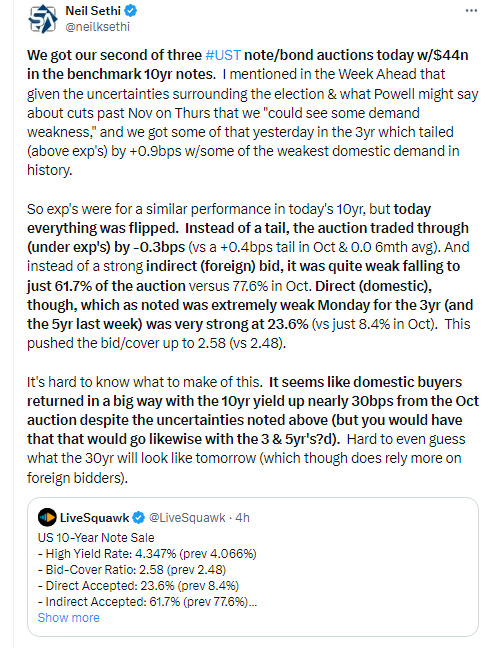

Treasury yields initially pushed higher after the services PMIs but fell back as the day progressed with the 10yr yield ending lower -3 basis points to 4.28% following a strong 10yr Treasury auction, still up +54bps since the start of October, while the 2yr yield finished +1bps at 4.19%, the highest close since July, but it had been up +6 bps earlier in the day. It’s up +56bps since the start of October.

Dollar ($DXY) set a lower low for a 5th session, but this time it wasn’t able to rally, closing under the 200-DMA (brown line) for the first time in 2 weeks, what I called last week “a key level with the daily MACD crossing over to ‘sell longs’ & RSI falling to a 1 mth low which raises the chances for a consolidation.”

It is also back under the downtrend line running to the Sep ‘22 highs that outside of 8 or so days in June has capped all rallies (it was over for 10 days this time). As noted Monday, “given the stretched positioning it could fall sharply if it gets going.”

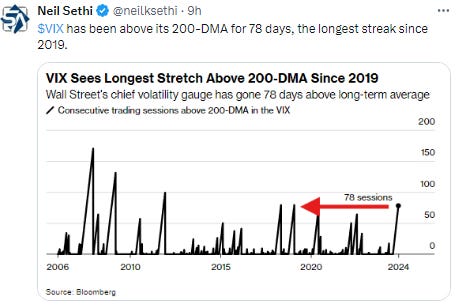

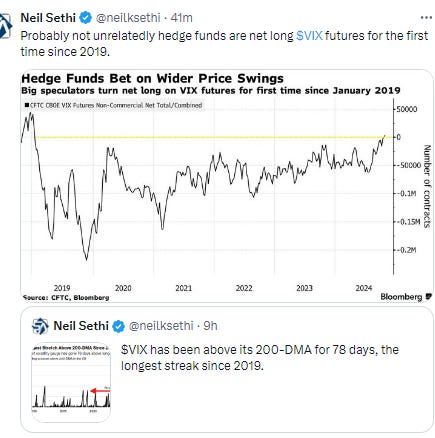

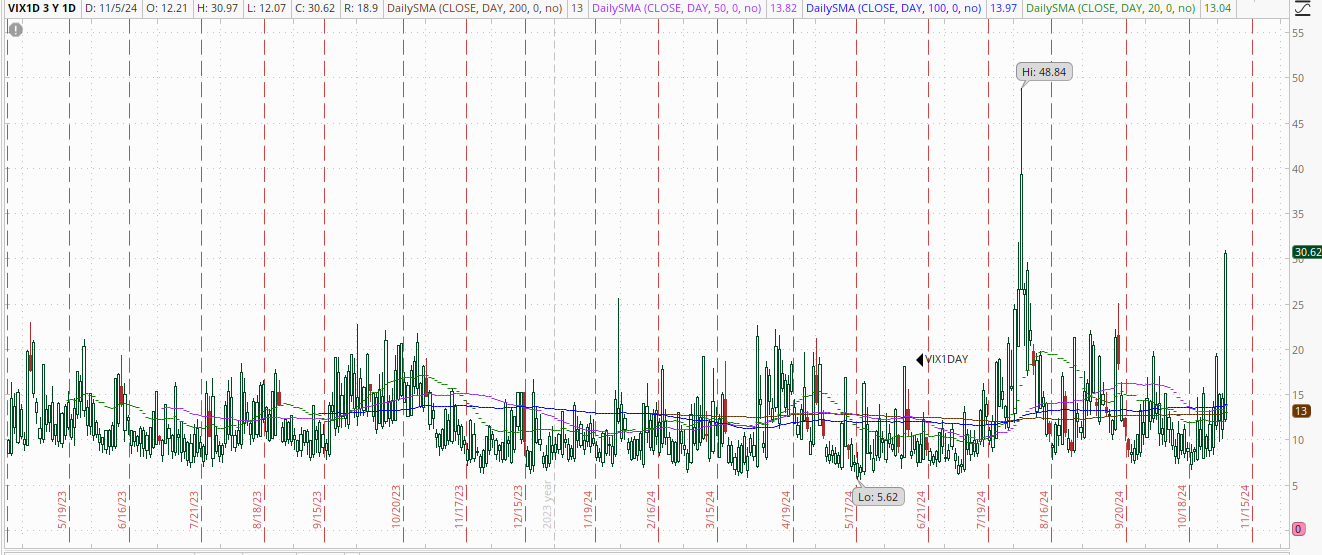

The VIX & VVIX (VIX of the VIX) fell back today (a day earlier than I thought they would) still elevated with the former at 20.5, (consistent w/1.25% daily moves over the next 30 days) & the latter to 114 (consistent w/“elevated” daily moves in the VIX over the next 30 days).

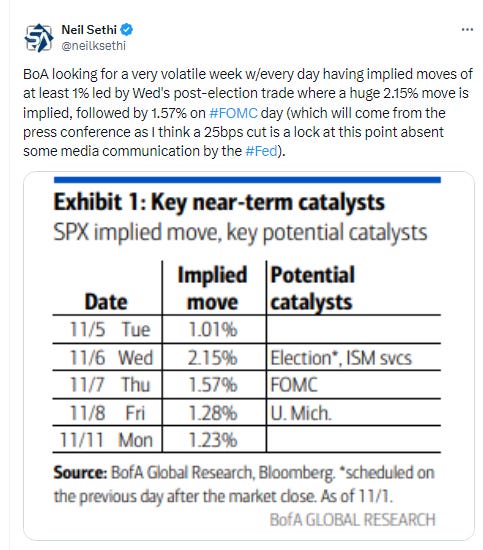

1-Day VIX, as predicted by BoA, spiked today, closing over 30 for just the 2nd time in its history (to Apr ‘22), looking for a move of ~2% Wednesday similar to BoA’s estimate (2.15%).

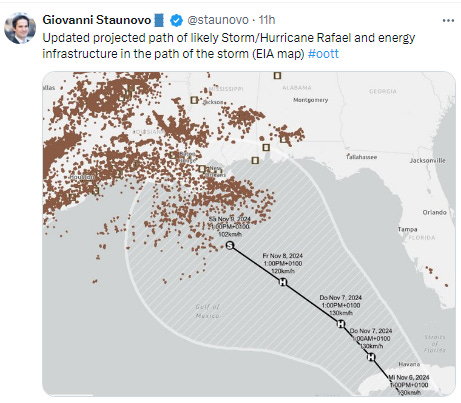

WTI up for 4th day in 5 as it’s probably seeing some short covering, able to finally close just over the $71.60 level consistent w/yesterday’s note that “with the daily MACD & RSI moving into more supportive positioning perhaps it’s coming?”. If it can stay over tomorrow a run to the $78 area is not unlikely.

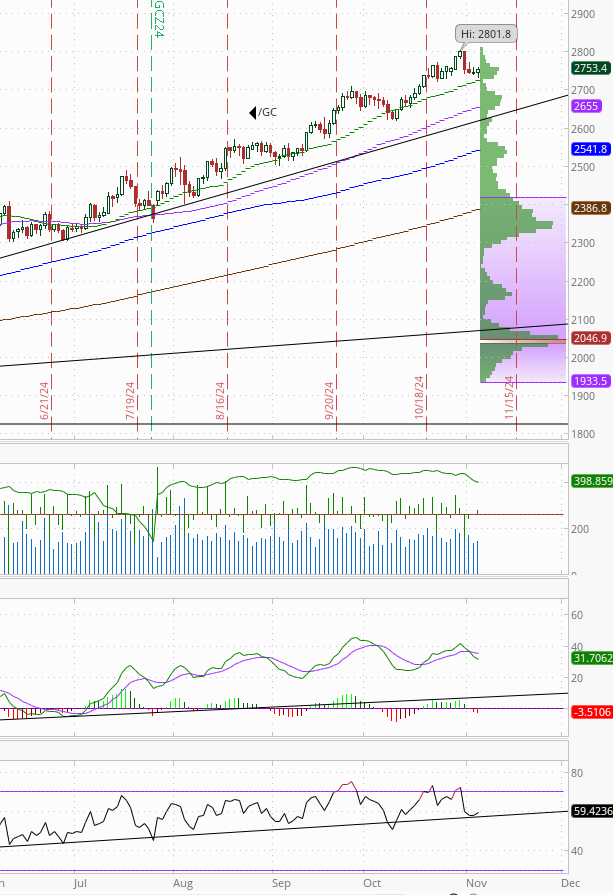

Gold broke the 3-day losing streak with a mild gain remaining just above its 20-DMA as I mentioned 2 weeks ago as a possibility. As noted last week, the daily MACD has also now crossed over to “sell longs” something that has seen mild weakness previously (see Friday’s chart). That said, we haven’t seen it dip below the 20-DMA (green line) for long since July.

Copper continued to move higher after Monday finally breaking out of the nearly 3-week period of remarkable calm (closing w/in a 10-cent range for 13 sessions) pushing to the highest close since Oct 11th. The daily MACD (circle) & RSI (arrow) are also now supportive, so things are set up for a run higher. As noted 3 weeks ago not much resistance until the Oct closing highs near $4.70.

Nat gas (/NG) fell back after yesterday’s big reversal, again seeming to have trouble with the area of the downtrend line from the Nov ‘23 highs. The MACD & RSI remain positive because of the jump in price on the roll.

Bitcoin futures bounced for the first session in 4 although remain under the $70k mark. Daily MACD & RSI still just tilt positive.

The Day Ahead

News tomorrow will obviously continue to be dominated by the election (hopefully we have some certainty (a guy can dream right?)). And unlike today there won’t be much economic data to distract beyond weekly mortgage applications and EIA petroleum inventories (maybe I’ll actually catch up on the pile of reports from last week (like I said a guy can dream)).

No Fed speakers with the blackout, but we will get our last Treasury auction of the week in $25bn in the long bond (30yrs).

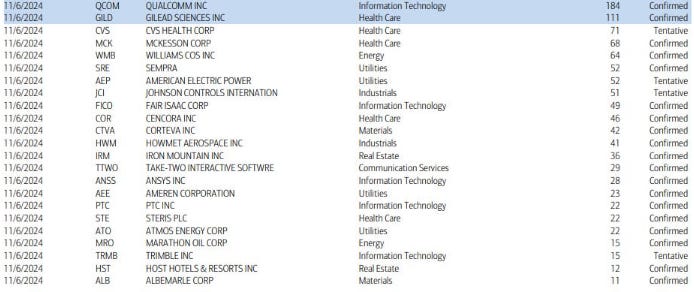

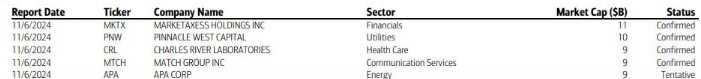

Earnings will remain heavy with 28 SPX components with two >$100bn in market cap: Qualcomm (QCOM) (our largest reporter of the week) & Gilead Sciences (GILD) (see the full earnings calendar from Seeking Alpha).

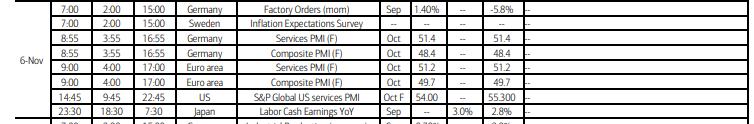

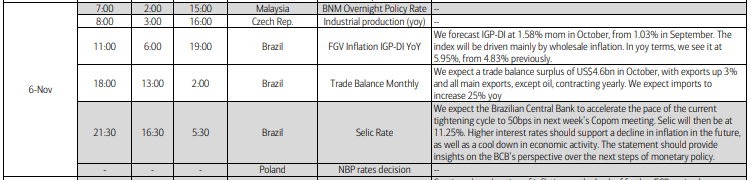

Ex-US we’ll get the remaining services PMI's we didn’t get today along with Reuters’ monthly estimate of the closely watched Tankan survey in Japan, minutes from the BoJ’s last meeting, and Germany’s Sept factory orders. In EM we’ll get policy decisions from Brazil (where a 50bps rate hike is expected) and Poland along with Brazil inflation and trade data.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,