Markets Update - 12/17/24

Update on US equity and bond markets, US economic reports, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com)

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog.

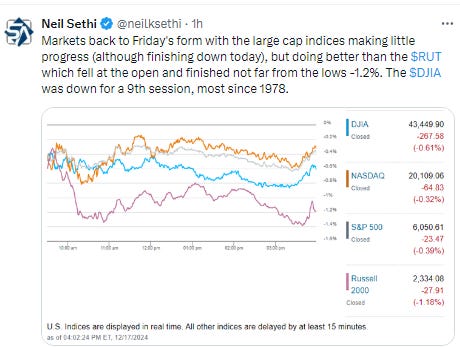

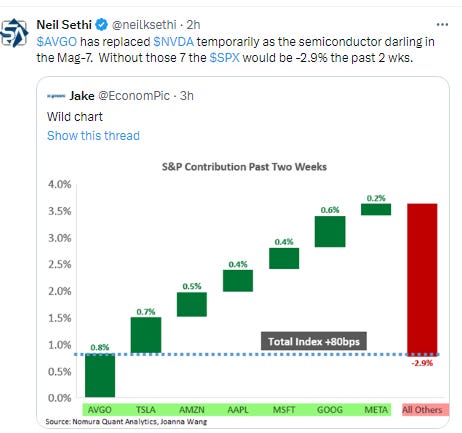

US equities fell back on Tuesday with traders not making big bets ahead of the FOMC decision tomorrow and following a strong retail sales report on the back of a jump in auto sales. Today’s story was at least a little different in that megacap growth stocks didn’t outperform. But what remained the same was weakness in small caps which fell for the 3rd session in 4. Also, notably, the Dow Jones Industrial Avg declined for a 9th straight session for the first time since 1978.

Treasury yields and the dollar were again little changed. Bitcoin hit another ATH and nat gas saw a healthy gain, but oil, gold and copper fell back.

The market-cap weighted S&P 500 was -0.4%, the equal weighted S&P 500 index (SPXEW) -0.8%, Nasdaq Composite -0.3% (and the top 100 Nasdaq stocks (NDX) -0.4%), the SOX semiconductor index -1.6%, and the Russell 2000 -1.2%.

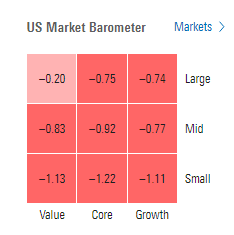

Morningstar style box consistent with every style down led by small caps.

Market commentary:

“There is nothing within the [retail sales] report that will alter expectations for tomorrow’s FOMC as a quarter-point cut remains the consensus, alongside the understanding that Powell will prepare the market for a pause in early 2025,” said Ian Lyngen of BMO Capital Markets.

“Whether tomorrow’s Fed decision is positive, negative or neutral for stocks and bonds likely won’t be determined by any actual rate cut, but instead by what the FOMC says about cuts in 2025,” wrote Tom Essaye, president and founder of Sevens Report and a former Merrill Lynch trader.

“Wall Street is waking up to the fact that a Trump presidency might not be as great for stocks as some people hoped,” said David Russell, global head of market strategy at TradeStation. “Financials and industrials jumped on his win but now may have to face higher rates and trade uncertainties, and healthcare faces its greatest political risks in recent memory.”

“The Mag 7 performance chasers are taking one last sprint towards 2024 year-end so far in December, leaving the rest of the S&P 500 stocks on the sidelines and kicking the Dow to the curb,” said Jeff Kilburg, CEO of KKM Financial.

“The market does like to climb a wall of worry,” CFRA’s chief investment strategist Sam Stovall said Monday on CNBC’s “Closing Bell: Overtime.” “Historically, following an up year in the S&P 500, you want to let your winners ride.” Since 1990, he noted that the top three sectors in a given calendar year tend to outperform in the next year by about 300 basis points on average 75% of the time. But the potential of tariffs under President-elect Donald Trump’s new administration could be a reason for some concern heading into 2025.

“If you are going to worry about something, it is that the tariffs are not just talk but truisms, and that we will actually be putting up barriers to trade,” Stovall said. “If that is an actuality, I think that could be a very big problem.”

“Is a 6% 10‑year Treasury yield possible? Why not? But we can consider that when we move through 5%,” Arif Husain, chief investment officer of fixed-income, wrote in a report. “The transition period in US politics is an opportunity to position for increasing longer‑term Treasury yields and a steeper yield curve.”

In individual stock action, Nvidia (NVDA 130.39, -1.61, -1.2%) underperformed again along with other chipmakers such as Broadcom (AVGO 240.23, -9.77, -3.9%) leading to a -1.6% fall in the PHLX Semiconductor Index (SOX). Gains in Apple (AAPL 253.48, +2.44, +1.0%), Microsoft (MSFT 454.46, +2.87, +0.6%), and Tesla (TSLA 479.86, +16.84, +3.6%), which constitute 16% of the S&P 500, provided some offsetting support to the broader market. UnitedHealth (UNH 485.52, -12.98, -2.6%) was another influential laggard, along with managed care stocks with pharmacy benefit manager divisions like CVS (CVS 44.04, -2.56, -5.5%). This selling followed comments from President-elect Trump yesterday that he wants to "knock out the drug industry middle man" contributing to higher drug prices.

Shares of Teva Pharmaceuticals and Sanofi rose more than 23% and 6%, respectively, after the companies announced positive Phase 2b results for duvakitug, their joint treatment of moderate-to-severe inflammatory bowel disease. That’s the best day for Teva in 2 years.

Some tickers making moves at mid-day from CNBC.

In US economic data:

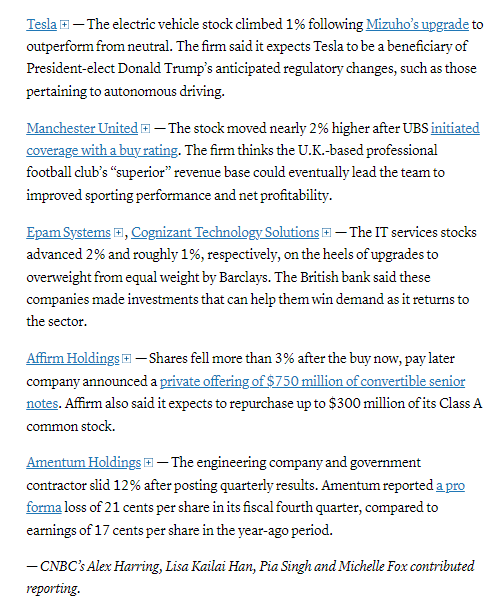

Nov retail sales were a robust +0.7% m/m due for a 2nd month to strong auto sales +2.6%, the most in 3 yrs, after +1.8% in Oct likely at least in part due to front-running potential tariffs and the elimination of EV tax credits by the incoming administration. YE discounting also likely helped. Ex-autos though was two tenths light at +0.2% and core (ex-autos & gas) was the same (+0.2% vs +0.4%). Control group sales (which feed into GDP (they exclude food services, auto dealers, building materials stores and gasoline stations)) were stronger though bouncing back +0.4% as exp’d after falling -0.1% in Oct. Over the past three months, control-group sales increased an annualized 5.6%, boding well for fourth-quarter GDP.

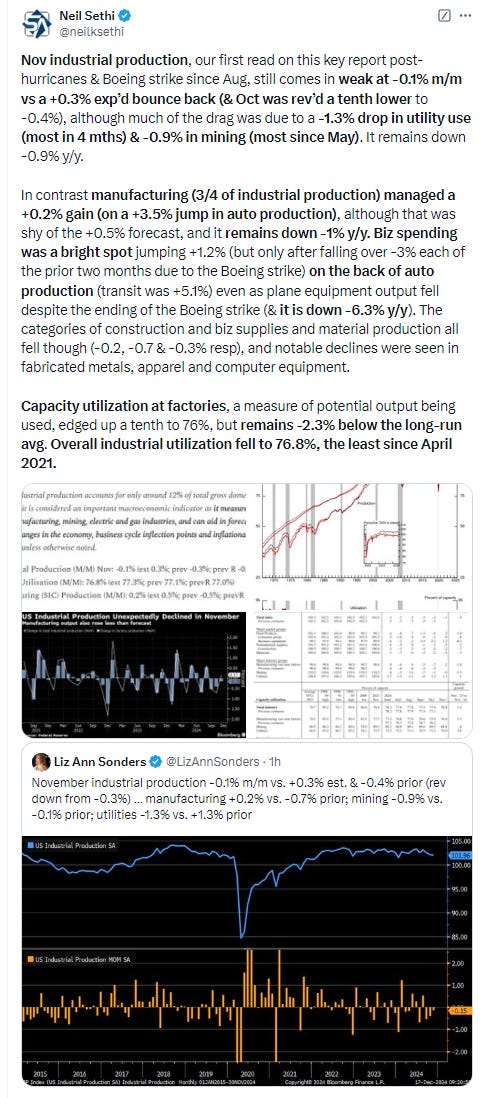

Nov industrial production, our first read since Aug on this key report post-hurricanes & Boeing strike, still comes in weak at -0.1% m/m vs a +0.3% exp’d bounce back (& Oct was rev’d a tenth lower to -0.4%), although much of the drag was due to a -1.3% drop in utility use (most in 4 mths) & -0.9% drop in mining production (most since May). Headline production remains down -0.9% y/y.

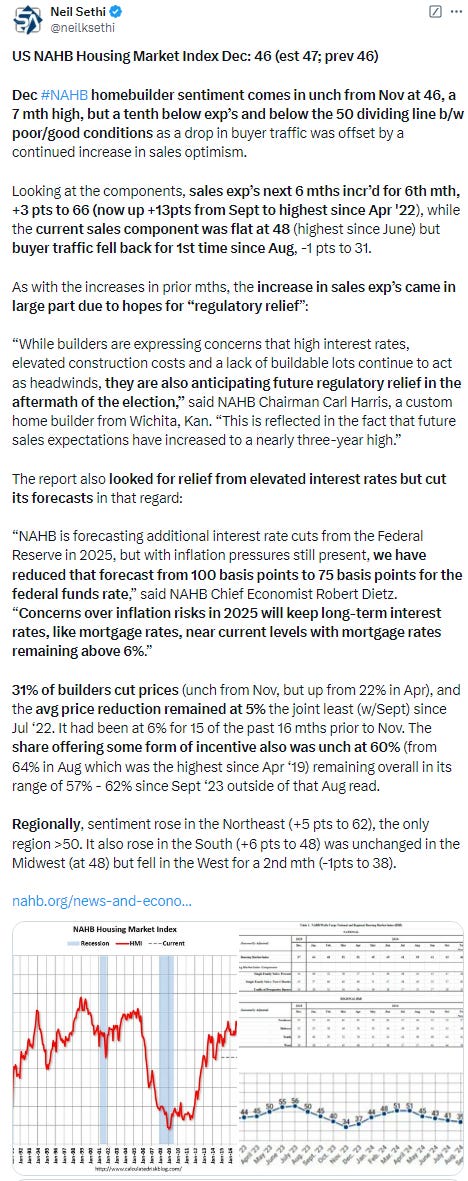

Dec NAHB homebuilder sentiment was unch from Nov at 46, a 7 mth high, but below the 50 dividing line b/w poor/good conditions as a drop in buyer traffic was offset by a continued increase in sales optimism.

Link to posts - Neil Sethi (@neilksethi) / X (twitter.com) for more details.

The SPX fell back finally getting close to its 20-DMA which it hasn’t closed under since Oct. RSI is weakest in nearly a month & MACD is deteriorating.

The Nasdaq Composite a different story from the SPX remaining well above its 20-DMA continuing though to be capped by the top of its channel since Aug. Its daily MACD & RSI also remain much more constructive although the RSI continues to have a negative divergence not yet making a higher high.

RUT (Russell 2000) down for 3rd day in 4 (& 7th in 11) coming up on my target from last week of its 50-DMA (purple line). Daily MACD continues to deteriorate & RSI now the softest since early Sept.

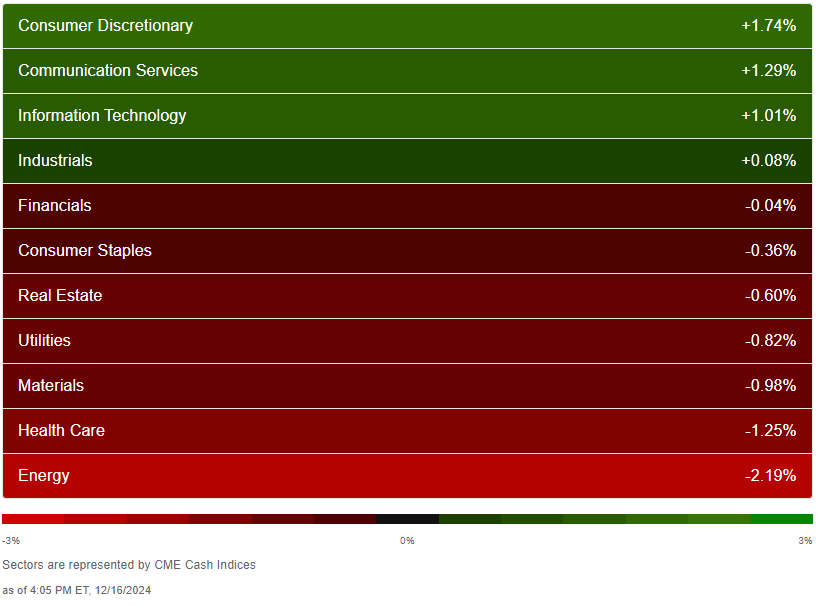

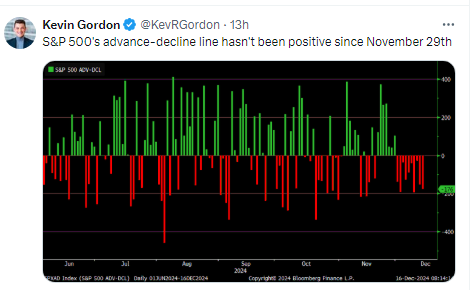

Equity sector breadth from CME Indices back to very weak from just weak with only Cons Discr managing a small gain +0.3%. Eight sectors down more than that, although none at least done >-1%. Cyclicals took the bottom 3 spots. Growth more evenly distributed as defensives took 3 of the top 4 spots.

Stock-by-stock SPX chart from Finviz consistent with a lot more red today. Just some pockets of green here and there (health care outperformed ex-insurance which was sold heavily). Still plenty of “bright” red today indicative of -3%+ drops.

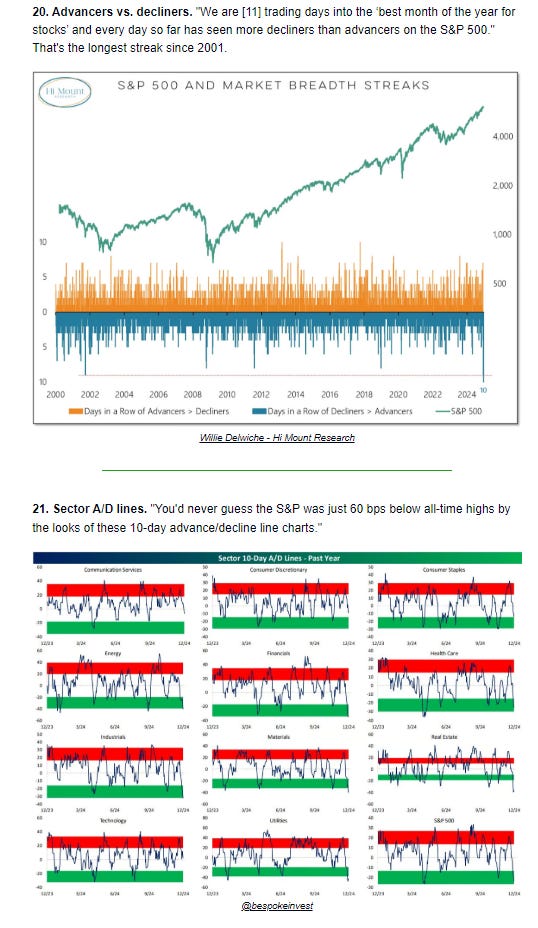

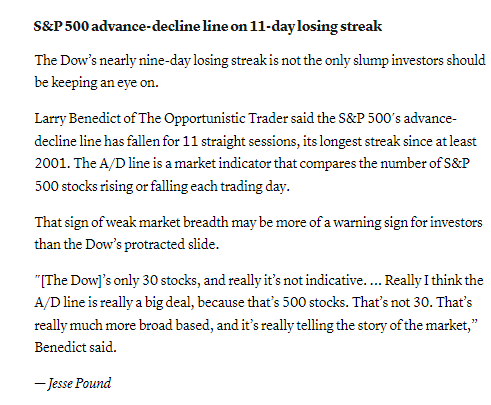

Positive volume continued to be bifurcated Monday with the NYSE remaining weak at 39.8% (the 5th session in 6 with positive volume below 40% (and that other day was 48%)), while Nasdaq was stronger at 54% (pretty good for a negative day on the index). Positive issues (stocks trading higher for the day) were again weaker at 27 & 35% respectively continuing the unusually weak number of stocks advancing as posted on Friday.

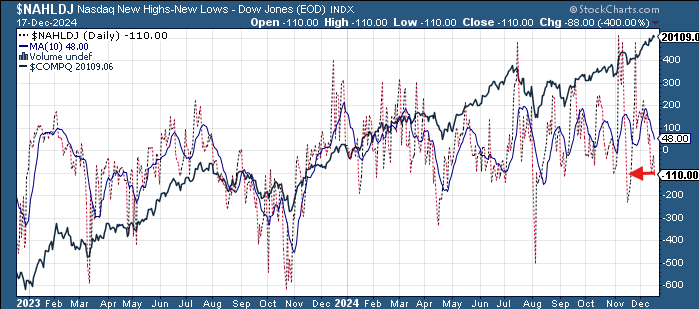

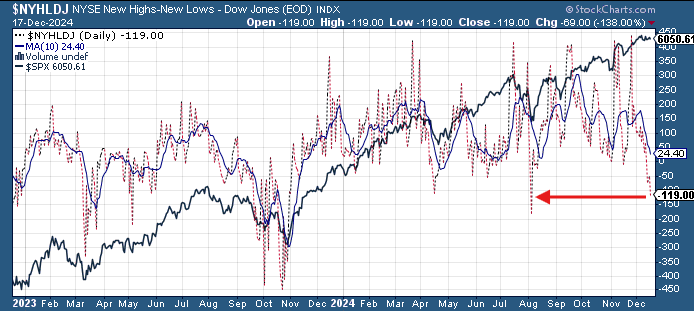

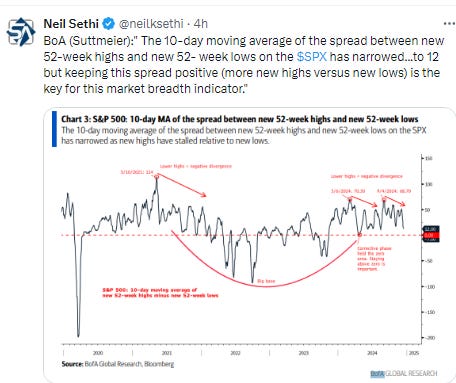

New highs-new lows were similar with the NYSE falling to -119 (the weakest since Aug), while the Nasdaq moved to -114 (the least since 11/19). Both remain below the respective 10-DMAs which are heading lower (more bearish).

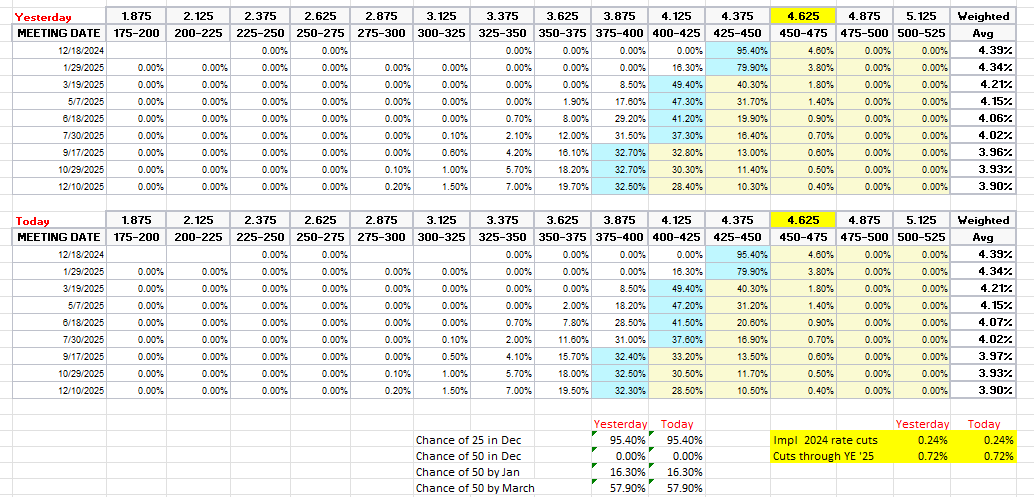

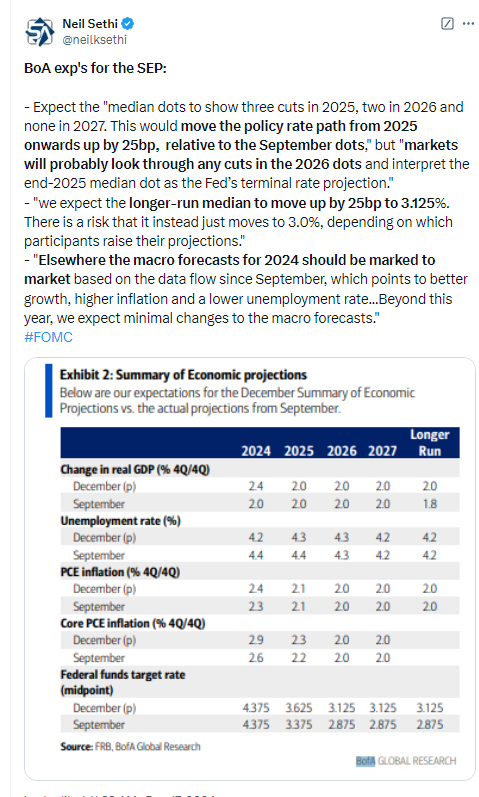

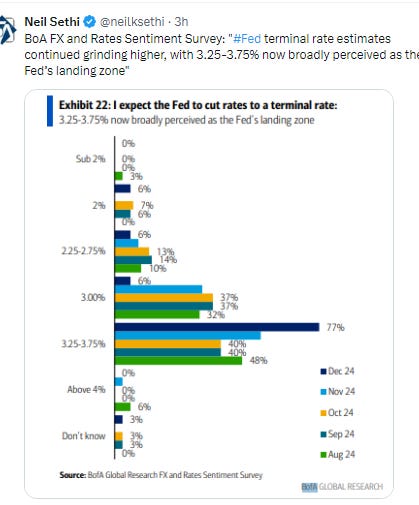

FOMC rate cut probabilities from CME’s #Fedwatch tool are almost exactly where they were yesterday with a December cut remaining almost fully priced at 95% (meaning the Fed is almost certainly cutting tomorrow). A January pause is 84% priced, and a further cut in March is a toss-up at 58%. Total cuts through YE 2025 are 72bps (the least in two weeks, although they fell to 70bps earlier in the day) meaning we’ve priced out almost a full cut since last week, remaining under 2 full cuts next year.

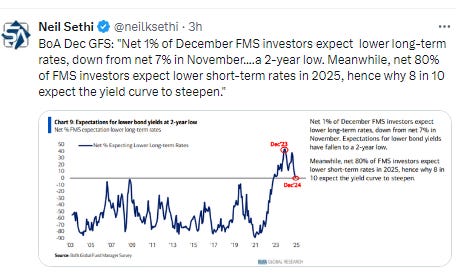

Treasury yields edged back after initially pushing higher following the better than expected headline on the retail sales report. Still they remain near 3-wk highs with the 10yr yield -2bps to 4.38%, still up +26bps from the low a week ago Friday when it bounced off what is now a decent uptrend line, remaining right on what has been a strong downtrend line. The 2yr yield, more sensitive to Fed policy, was -1bps to 4.24%, from the highest since 11/26. I’d expect these to see more movement tomorrow.

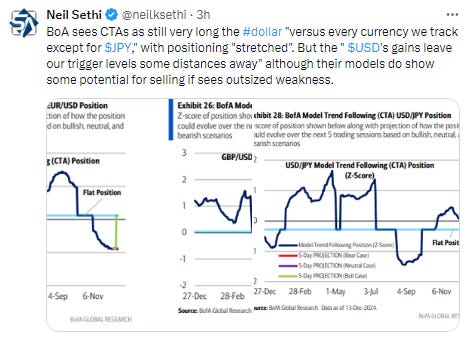

Dollar ($DXY) little changed for a 3rd day ahead of the FOMC tomorrow. It remains less than a percent from a 2-yr high. As noted last Wed, just minor resistance now between it and the prior high. Daily MACD is starting to turn more neutral (from negative) while the RSI remains constructive.

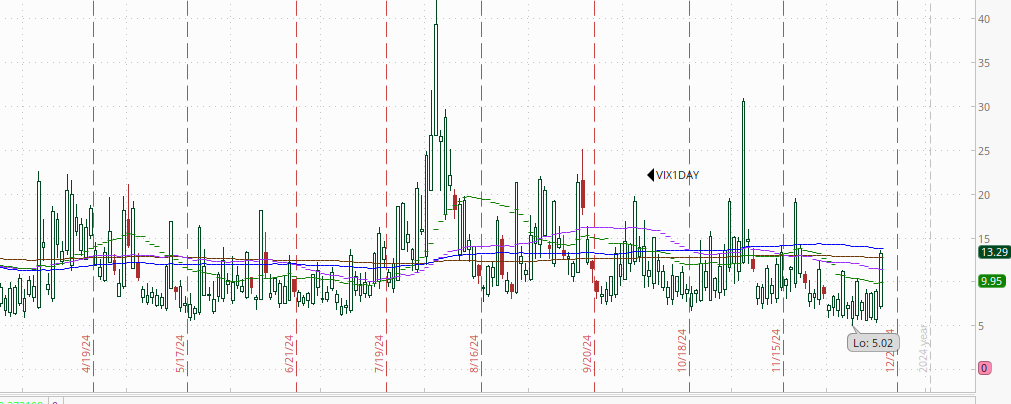

The VIX rose another point to 15.8 (consistent w/0.98% daily moves over the next 30 days) while the VVIX (VIX of the VIX) moved just over 100 (consistent with “elevated” daily moves in the VIX over the next 30 days).

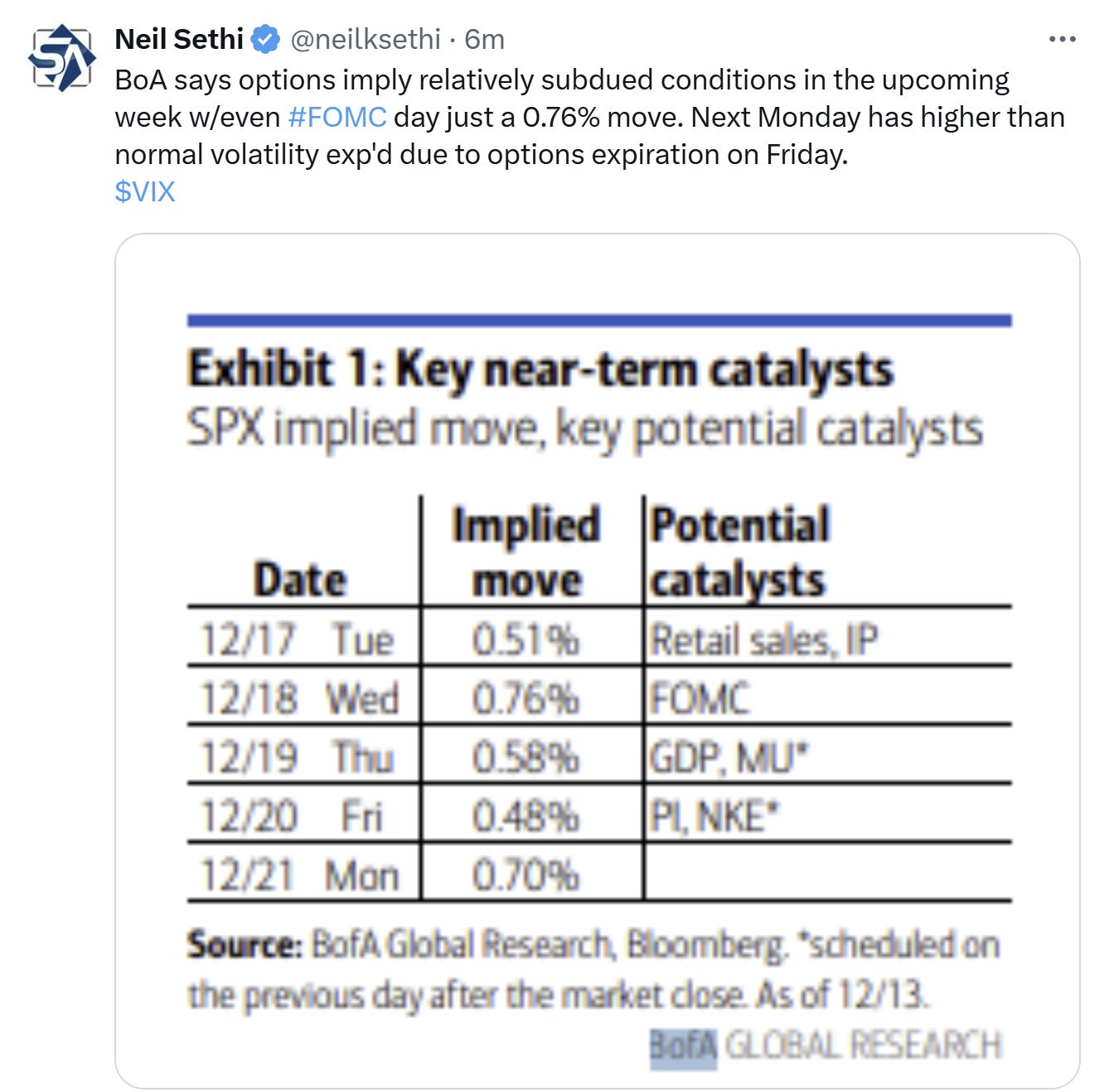

1-Day VIX nearly doubled to 13.3, but that’s still the lowest reading ahead of an FOMC decision day this year, just looking for a move of +0.84% Wednesday, a little above the +0.76% BoA said was implied by options coming into the week.

WTI fell back for a 2nd day after getting to the point last week that I had to mention it was “threatening to break the series of lower highs the past 2 months.”. Still for now the $67 bottom has held consistent with the note two weeks ago that “it’s been able to bottom in this area every previous time this year.” Daily MACD & RSI remain relatively positive. As noted previously we “could see a big short covering rally if it [ever] gets over $72.”

Gold little changed as it continues to sit just below its 50-DMA on an uptrend line from Feb. Its “clear path to test its ATH” is now less clear as I put it Friday. Its MACD has also turned less supportive to join its RSI.

Copper (/HG) fell for a 4th session in 5, now back to the uptrend line running back to Oct ‘23. It’s RSI remains weak while the MACD is turning more neutral.

Nat gas (/NG) saw a nearly 10% rebound today after falling almost -4% before reversing and finishing up over +5% keeping it over support of the 20-DMA. Daily MACD and RSI remain neutral.

Bitcoin futures continued their breakout pushing near $109k at one point. The daily MACD has started to move more positive as well. RSI remains positive but as noted Monday is at a lower high while price is at a higher high which is a bearish divergence.

The Day Ahead

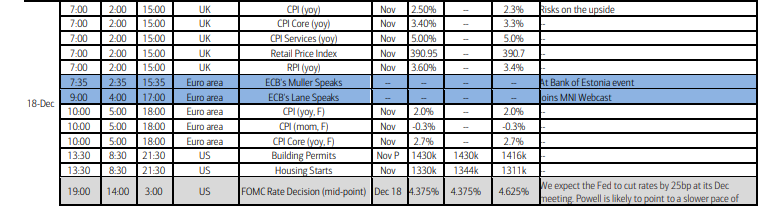

In US economic data we’ll get Nov housing starts and permits along with weekly mortgage applications and EIA petroleum inventories.

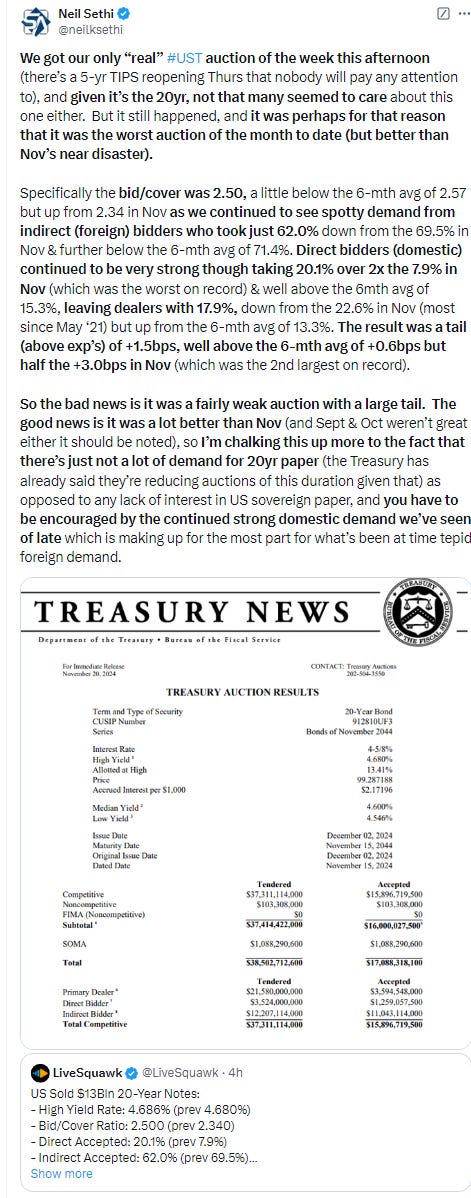

The highlight of the day of course will be the FOMC at 2pm ET. A rate cut is basically a lock at this point given market pricing, so the attention will mostly be on the dot plot and press conference. No Treasury note or bond auctions.

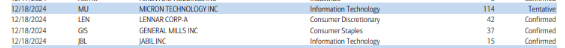

In earnings we’ll get 4 SPX components with one >$100bn in Micron Technology (MU). Lennar (LEN), General Mills (GIS), and Jabil (NYSE:JBL) are the others (see the full earnings calendar from Seeking Alpha).

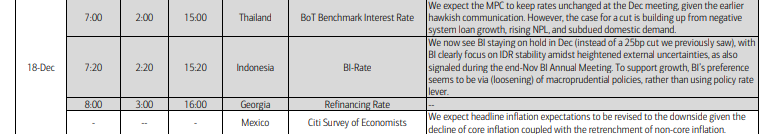

Ex-US highlights are Nov UK CPI, PPI and retail prices, EU final CPI, and Japan Exports. In EM we’ll get policy decisions from Thailand, Indonesia, and Georgia and Mexico inflation expectations.

Link to X posts - Neil Sethi (@neilksethi) / X (twitter.com)

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,