Markets Update - 1/30/26

Update on US equity and bond markets, US economic data, the Fed, and select commodities with charts!

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out (sharing is caring!),

Link to posts - Neil Sethi (@neilksethi) / X

Note: links are to outside sources like Bloomberg, CNBC, etc., unless it specifically says they’re to the blog. Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

Finally, if you see an error (a chart or text wasn’t updated, etc.), PLEASE put a note in the comments section so I can fix it.

Note: This will be the last fully available Daily Update as I turn on the Subscription model Monday (the beginning part will remain unlocked). As a reminder, the subscription price per month will be the same as a quick service meal and all proceeds will go to charity.

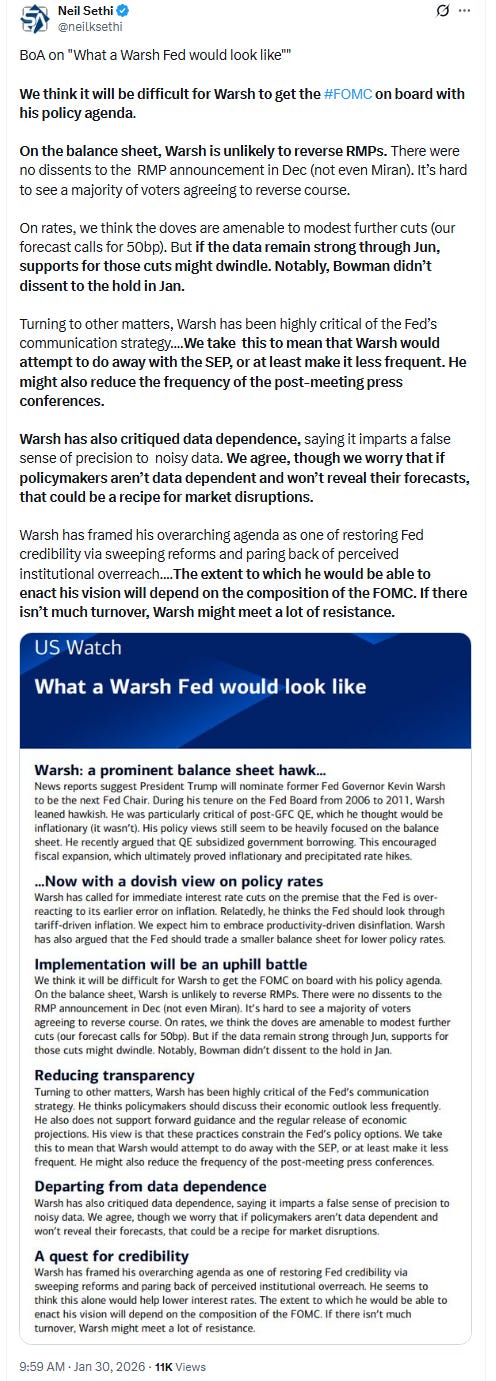

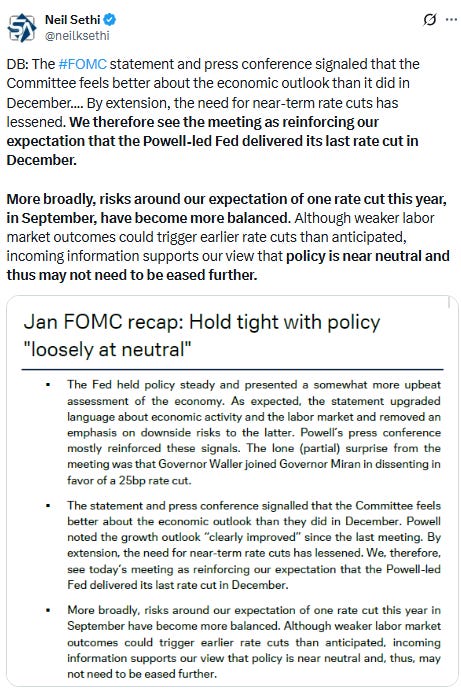

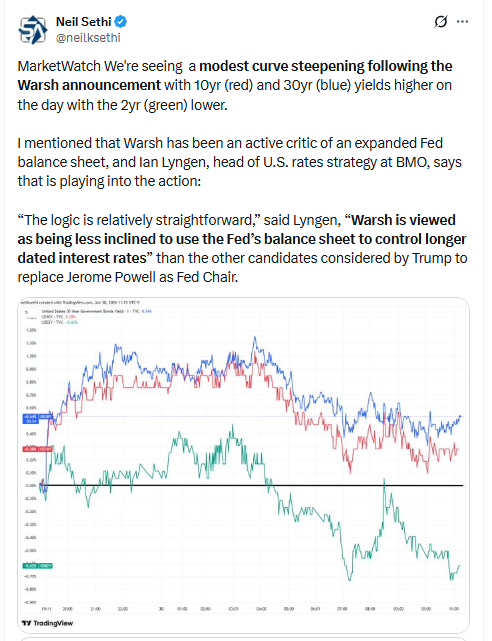

US equity indices opened today’s session modestly lower, not enthused by Pres Trump selecting former (hawkish historically) Governor Kevin Warsh as his pick for Fed Chair (although Warsh has been more constructive on rate cuts since he left the Fed). The selection was also putting upward pressure on bond yields given Warsh’s expressed desire for a smaller Fed balance sheet. Adding to that pressure ws December’s producer price index coming in hotter than anticipated (link is to CNBC article, I’ll have a breakdown by next week along with some other catch-ups from this week).

The heavy market weighed on Apple which was modestly lower despite beating fiscal first-quarter earnings and revenues expectations by a wide margin on the back of “blowout” iPhone sales as mentioned in more detail in last night’s update. Data storage stock Sandisk though popped 22% on the back of strong guidance, while KLA Corp lost 8% after guidance for non-GAAP gross margin in the fiscal third quarter came in light.

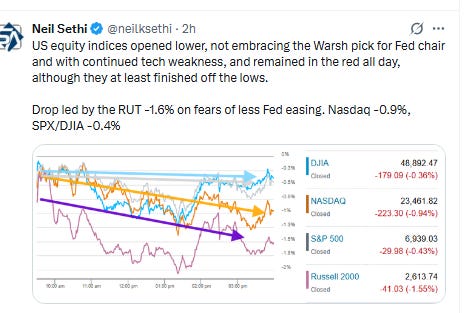

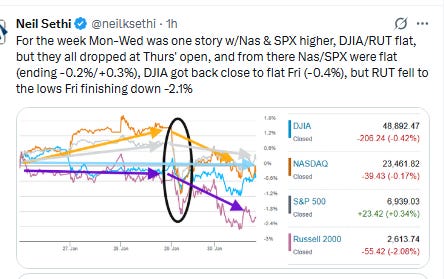

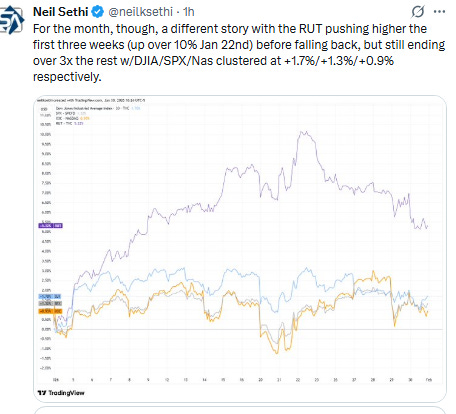

Indices remained in the red all day, with about the only positive that they finished off the lows. Declines were led by the Russell 2000 (RUT) -1.6%. Nasdaq was -0.9%, S&P 500 (SPX)/DJIA -0.4%. For the week the first half was one story with the Nasdaq and SPX higher, the DJIA and RUT flat, but they all dropped at Thursday’s open (see that link to the update above for more). With today’s declines, it saw the Nasdaq and SPX finish the week around unchanged (-0.2% and +0.3%), the DJIA -0.4%, but the RUT down -2.1%. For the month, though, a different story with the RUT pushing higher the first three weeks (up over 10% at one point Jan 22nd) before falling back, but still ending over 3x the rest w/DJIA/SPX/Nasdaq clustered at +1.7%/+1.3%/+0.9% respectively.

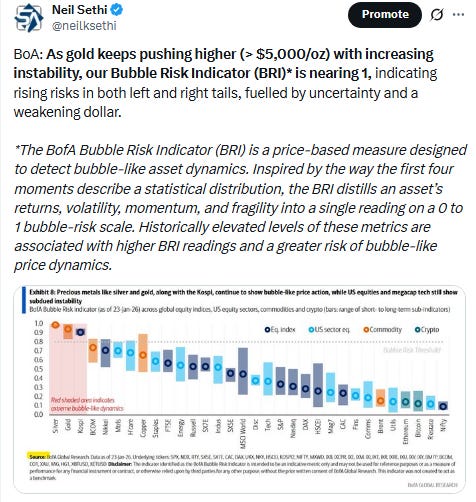

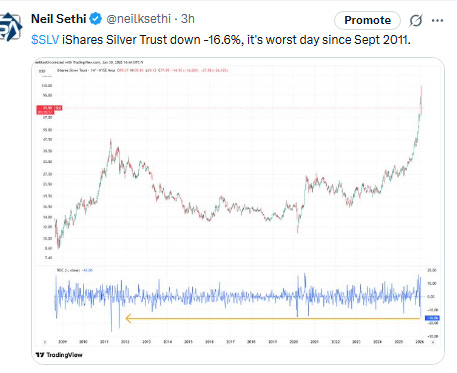

Elsewhere, bond yields were mixed, while the dollar had its best day since May. Natgas was up +11% and crude was up for a fourth session with its best week since June. Gold though had its worst day since 1983(!) and copper also saw a large drop (as did silver) as some of the air came out of that trade. Bitcoin fell to the lowest since April.

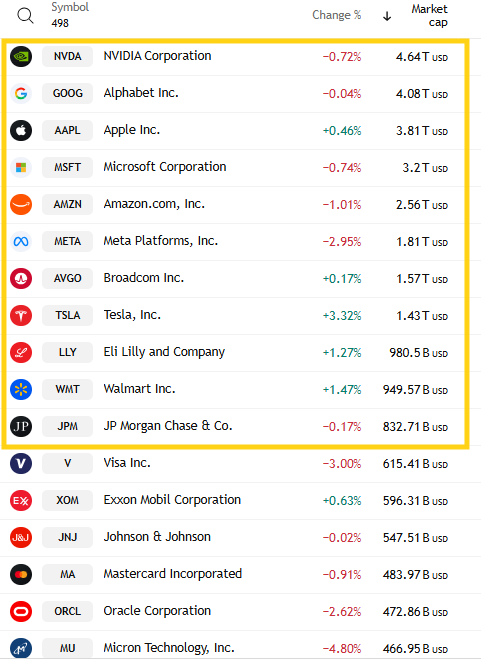

The market-cap weighted S&P 500 (SPX) was -0.4%, the equal weighted S&P 500 index (SPXEW) -0.3%, Nasdaq Composite -0.9% (and the top 100 Nasdaq stocks (NDX) -01.3%), the SOXX semiconductor index -3.9%, and the Russell 2000 (RUT) -1.6%.

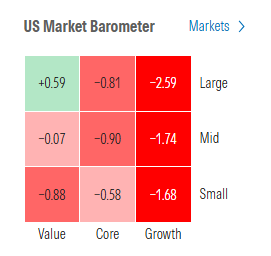

Morningstar style box saw just large value escaping the red which was concentrated in the growth styles.

Market commentary:

“Markets may see volatility as investors become accustomed to a new Chair’s voice and messaging for markets,” Saperstein said. “It’s common to see volatility during a Fed Chair transition.” Saperstein said President Donald Trump’s selection of Warsh doesn’t change his outlook for the stock market. Stocks should “perform positively” in 2026 due in part to economic growth and strong earnings, he said.

Kevin Warsh is a “credible” pick as the next chair of the Federal Reserve, and he probably won’t deviate too much from the Federal Open Market Committee on monetary policy, according to Angelo Kourkafas, senior global strategist at Edward Jones. Warsh may have a bias toward rate cuts, but he is likely to be a “pragmatist” when it comes to setting interest-rate policy, Kourkafas said in a phone interview. Kourkafas expects the Fed may cut rates twice this year as it continues to monitor upside risks for inflation.

“Markets may price in a modest acceleration of rate cuts, but an aggressive easing cycle appears unlikely,” said Jason Pride at Glenmede.

“While President Trump has been clear in his desire to have the federal funds target rate moved lower, and we would view Kevin Warsh as being hand-picked for that role, we still believe that the actual likelihood of the FOMC moving rates significantly out of sync with economic fundamentals is unlikely,” Doug Beath, global equity strategist at Wells Fargo Investment Institute, said in emailed comments Friday. “If Warsh is confirmed, we believe he will advocate to push the federal funds rate to a ‘neutral’ level, which most Fed members project is near 3.00%.”

“Instead of a focus on lower rates, we believe that Kevin Warsh, if confirmed for the chair, will focus on his history of advocating for a reduced Fed balance sheet, which may lead to closer cooperation with the Treasury,” Beath said.While some market participants may be interpreting Trump’s pick for the Fed as a shift toward a more hawkish policy stance, that reaction may be “overly simplistic,” according to Seema Shah at Principal Asset Management. “It is unlikely he would have been selected without signaling a willingness to consider additional rate cuts this year,” she said. Shah also notes that his background suggests a strong respect for Fed independence, which makes him far less susceptible to political pressure for aggressive rate cuts when inflation dynamics do not warrant it. “That commitment to independence should help limit the risk of a selloff at the long end of the Treasury curve and support financial stability,” said Shah. “In the longer run, Warsh’s nomination reinforces the likelihood of policy continuity and institutional credibility. For markets, that steadiness should matter far more than the knee-jerk reaction we’re seeing today.”

If Warsh is confirmed as Fed chair, Brian Levitt and Benjamin Jones at Invesco don’t think he would prove as hawkish as markets seem to expect. “Warsh’s policymaking background and prior experience at the Fed should lend support to central bank independence and financial system stability,” they said. “This may help inflation expectations and US borrowing costs, which remain contained. Also, his private-sector experience could result in further banking deregulation, providing a tailwind to credit expansion and US growth.”

“We perceive room for eventual agreement at the Fed on reducing the size of its balance sheet and moving it to a Treasury-only portfolio,” said Calvin Tse and James Egelhof at BNP Paribas. “However, these changes will probably take some time to implement.” A twist-steepening of the Treasury curve based on Warsh’s past comments makes sense for now, they said, while a focus on AI-driven productivity and disinflation may further boost steepener trades.

Warsh brings an unusual combination of hawkish instincts, openness to innovation, and deep respect for Fed independence, according to Dan Siluk at Janus Henderson. His nomination suggests a policy regime that is more flexible on rates, more disciplined on the balance sheet and less communicative in its forward signaling. “Markets should prepare for a Fed that is simultaneously more unpredictable and more orthodox, a blend that marks a genuine shift in the post‑crisis monetary landscape,” Siluk noted.

For markets, Siluk says the reaction reflects the duality of Warsh’s stance.

Front‑end yields have drifted lower on expectations that rate cuts may come sooner than previously projected. Longer‑dated yields have risen, as investors anticipate less willingness to use the balance sheet to suppress term premiums, producing a “bear steepening dynamic.”

“The Warsh nomination should be good for markets in general, but there is one area worth watching,” said Scott Helfstein at Global X ETFs. “Warsh has expressed interest in shrinking the Fed balance sheet as a means to ensure the bank’s independence from policymakers. That could drive some volatility in the rates market that spills into equities and credit spreads.”

There is a sense that a Warsh Fed technically leans more hawkish with an unwillingness to utilize the balance sheet to cap long-term rates, according to Charlie Ripley at Allianz Investment Management. “With inflation risks continuing to loom on the horizon, balancing political pressures to reduce policy rates will remain a challenge,” he said. “On balance, we see Warsh’s nomination ultimately leads to higher risk premiums on long-term rates and the dollar. Momentum towards a directionally steeper yield curve puts duration buyers on notice, with more potential to underperform.”

If Warsh is confirmed, Wells Fargo Investment Institute strategists bet he’ll likely advocate to push the federal funds rate to a “neutral” level, which most Fed members project is near 3%. “This expectation is consistent with our outlook for two quarter-point rate cuts in the second half of 2026,” they said.

The Warsh pick should help stabilize the dollar some and reduce, though not eliminate, the asymmetric risk of deep extended dollar weakness by challenging “debasement” trades — which is also why gold and silver are sharply lower, according to Krishna Guha at Evercore. “But, we advise against overdoing the Warsh hawkish trade across asset markets – and even see some risk of a whipsaw. We see Warsh as a pragmatist, not an ideological hawk in the tradition of the independent conservative central banker,” he said.

With five years of history on the Board of Governors under the “Ben Bernanke Fed”, Warsh was known as the “bridge to Wall Street,” according to Jeffrey Roach at LPL Financial. “Warsh is a safe pick. He’s forthright, willing to rethink convention, and not necessarily a ‘yes-man’,” Roach said. “Investors should be thankful.”

Markets don’t need “a friendly Fed,” but a central bank that is predictable, transparent, and willing to take short-term heat to preserve long-term stability, according to Mark Malek at Siebert Financial. “So yes, today feels messy. Yes, the plot has thickened. And yes, my perfectly teed-up earnings season just got hijacked by central banking politics. But if this leads us toward a world where fundamentals reclaim the spotlight and capital is priced a little more honestly, that is not a bad trade-off at all. In fact, it might be exactly what the market needs,” Malek concluded.

Trump’s nomination of Warsh to be the next Fed Chair is “a relatively safe choice for investors,” with his prior hawkish views counteracting concerns he might morph into a full-blown stooge, according to Stephen Brown at Capital Economics. “Nonetheless, his desire for the Fed to operate with a smaller balance sheet still presents upside risks to long-term yields,” Brown said. “Moreover, his views downplaying the link between inflation and the pace of economic growth as well as his conviction that AI and the Trump administration’s deregulatory push will hold down inflation means there is a risk of the Fed falling behind the curve in the future.”

The selection of Warsh for the Fed should calm concern about the erosion of independence of the central bank, according to Eric Teal at Comerica Wealth Management. “His candidacy included prior experience as a Fed Governor and as an investor,” Teal said. “He has been flexible on monetary policy in the past and will likely take the most strategic approach toward the role of the Federal Reserve mission going forward.” Further deregulation, reducing the balance sheet, and additional rate cuts if inflation continues to moderate should be stimulative for the economy and markets including more value-oriented sectors of the market in the intermediate term, Teal concluded.

“Kevin Warsh as the nominee for Fed Chair means we could actually end up with a Fed that tilts hawkish at the margin,” said Sonu Varghese at Carson Group. “Warsh has historically been a hawk, even though he’s been talking rate cuts lately. If he walks into the Fed with aggressive cuts as his baseline, he may not have a lot of credibility selling others on the need for further rate cuts, Varghese said. And we may even end up with a deeply divided committee that doesn’t cut at all, he concluded.

In a note titled “Warshing and Waiting,” TD Securities strategists say markets may struggle to pin down Warsh’s view given his notable shift in policy priorities after espousing a very hawkish stance over the last decade. “Warsh will likely be a proponent of rate cuts in 2026, but the main question is whether his former hawkish persona makes a comeback down the road,” said the TD strategists.

“The market shouldn’t be impacted greatly by the news,” said Jay Woods, chief market strategist at Freedom Capital Markets. “While he had been somewhat critical of Jerome Powell for being too late to cut rates, he should understand the importance of the independence of the Fed.”

Apollo Global Management’s Chief Economist Torsten Slok praised Trump’s Fed chair pick Kevin Warsh in an appearance on CNBC’s “Squawk on the Street” Friday. “He will be really a great Fed chair,” Slok said. “He understands the institution, he understands this committee, the 12 voting members. He absolutely also understands the importance of guiding the committee and figuring out the consensus opinion of, ‘what can we do, what can we not do?’”

He called Warsh “pragmatic,” and an “outstanding” choice that understands the Fed is not about one individual, but rather a variety of voices on the FOMC.

Slok acknowledged that Warsh has had at times contradictory views with the consensus of the rest of the FOMC members, but reiterated he believes Warsh understands he won’t be able to completely change the views of the committee overnight. “This whole idea that he will come in and guide the committee in a completely different direction from where we are today,” Slok said, “I think that’s completely misguided.”

Link to X posts - Neil Sethi (@neilksethi) / X for full posts/access to charts.

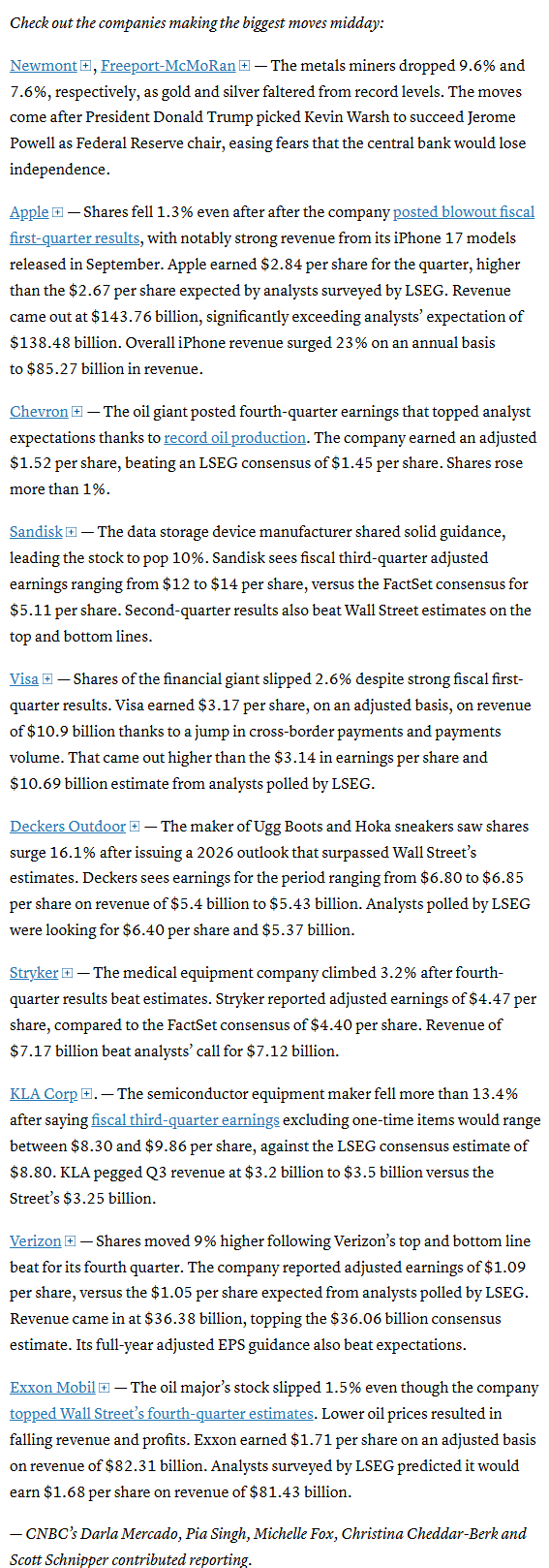

In individual stock action:

Apple ticked lower despite beating fiscal first-quarter expectations and reporting a significant surge in iPhone sales. That slide follows Microsoft’s 10% post-earnings drop on Thursday, marking its worst day since 2020 and wiping out more than $350 billion in market cap. KLA Corp lost 13% on Friday after its forecast suggested a deceleration in growth.

But outside of tech, Verizon shares surged more than 11%, on track for their best day since 2008. The telecommunications giant beat analyst expectations and providing a strong full-year outlook for earnings.

Companies making the biggest moves after-hours from CNBC.

None today.

Corporate Highlights from BBG:

Apple Inc. rose after delivering record quarterly sales and a better-than-anticipated forecast for the current period, even as the company warned that rising component costs are threatening to squeeze margins.

Jeff Bezos’ Blue Origin will pause tourist flights to space for “no less than two years” in order to shift resources to accelerating the development of its moon lander and other lunar technologies, the company announced.

Digital storage company Sandisk Corp.’s strong revenue and earnings outlook is extending a blistering rally in the top performing stock in the S&P 500.

Exxon Mobil Corp. and Chevron Corp. surpassed profit expectations as higher oil production helped offset the blow from lower crude prices.

American Express Co. fell after the company’s Platinum card refresh boosted expenses more than expected and profit fell short of analysts’ estimates.

Verizon Communications Inc. reported its biggest gain in mobile phone subscribers since 2019 and announced plans to buy back as much as $25 billion in shares, signaling turnaround efforts under new Chief Executive Officer Dan Schulman are starting to bear fruit.

Charter Communications Inc. reported something the cable provider hasn’t seen in a while — a gain in pay-TV customers, its first increase in more than five years.

Eli Lilly & Co. failed to win backing from the European Union’s medicines regulator for the use of its weight-loss drug Mounjaro to treat a certain kind of heart failure in adults with obesity.

Rio Tinto Group and Glencore Plc are poised to seek more time to work on a deal to create the world’s biggest miner as they wrangle over the premium that Rio would need to pay, people familiar with the matter said.

Costco Wholesale Corp. will use Instacart’s technology to power online grocery ordering in Spain and France, extending their partnership beyond North America for the first time as the delivery company looks overseas for growth.

Deutsche Lufthansa AG will retrofit its largest aircraft with better business-class seats and put them into service starting in April — a quick turnaround that contrasts with the delays plaguing its new Boeing Co. 787 premium cabin.

China Vanke Co. reported its losses widened by two-thirds to a record last year, citing a sharp decline in its property developments and additional provisions.

Mid-day movers from CNBC:

In US economic data:

As noted, I’ll be catching up on these next week.

Substack articles:

Forgot yesterday to post the jobless claims link.

Link to posts for more details/access to charts - Neil Sethi (@neilksethi) / X

The SPX fell for a third session finishing on the 20-DMA. The daily MACD is now neutral as is the RSI but for now continues to remain in divergence.

The Nasdaq Composite a similar story.

RUT (Russell 2000) remains the weakest. The MACD remains in “sell longs” positioning and the RSI is falling under 50.

With it being the end of the month, doing monthly charts today. On a monthly basis all three look very good, in their channels with “go long” MACD’s and RSI’s well above 50 although at 76 SPX is the most overbought since Aug ‘21.

We’re starting to see more instances of weak sector breadth according to CME Cash Indices with just 4 of 11 sectors in the green (less than 6 sectors for the second time this week after only happening twice previously in the month (Jan 20th and 7th)), although two were up around 1% or more in Staples and Energy. Health Care and RE the other two in the green.

Only two sectors down more than -0.3%, but both more than -1.3% in Tech and Materials (so a little less dispersion at 3.2% after 4.8% Thurs (but 1.7% Wed)).

Tech was after leading to the downside -1.9% Thurs.

While the sector chart looked a lot different from Thurs, the stock-by-stock flag from

more incremental with Tech remaining quite red (although more in semiconductors and less in software Fri) and just incremental changes elsewhere.

Five of the largest 11 SPX components were higher (from 6 or 7 the rest of the week) led by TSLA +3.3%. META led to the downside -3.0%, giving back a little of Thurs’ +10% gain.

Mag-7 -0.4% and that was also the loss for the week after finishing the prior week +1.1%.

~18 SPX components were up 3% or more (after 35 Thurs, 22 Wed, 23 Tues, 12 Mon), led by Deckers DECK +19.5%. VZ also up +10%.

9 of those 18 were >$100bn in market cap in VZ, SYK, T (again), TMUS, MO, CVX, TSLA, PEP, ABT (in descending order of percentage gains).

~35 SPX components down -3% or more (after 45 Thurs, 22 Wed, 26 Tues, 12 Mon) led by Applovin APP -16.9% (leading to the downside I think for the third time this year, the 5th time it’s been down at least -5% this year). KLAC, NEM, WDC also down -10% or more.

12 of the 45 down -3% or more were >$100bn in market cap in APP, KLAC, NEM (again), AMD, LRCX, AMAT, MU, INTC (again), ANET, APH, PLTR (again), V (in order of percentage losses).

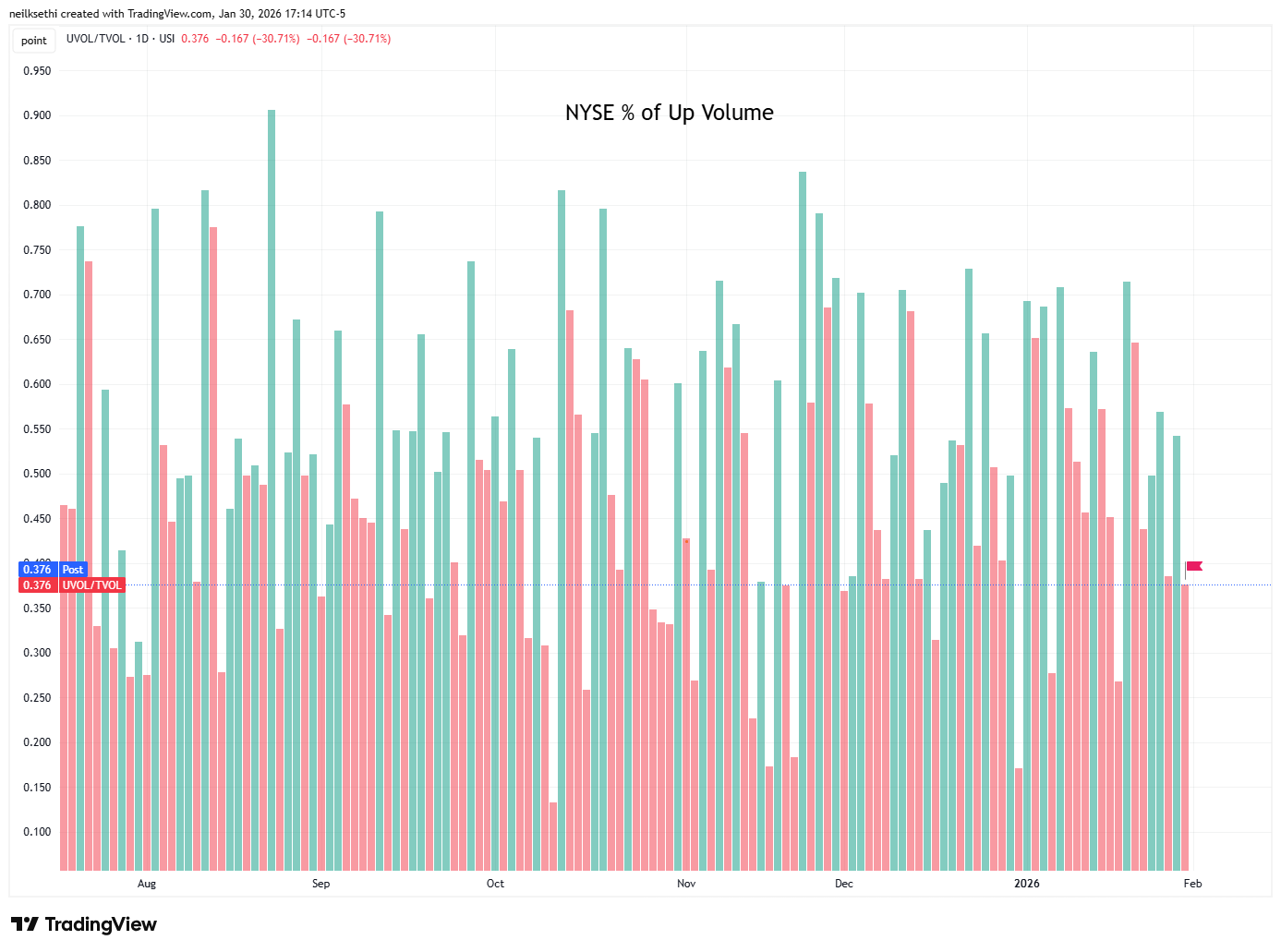

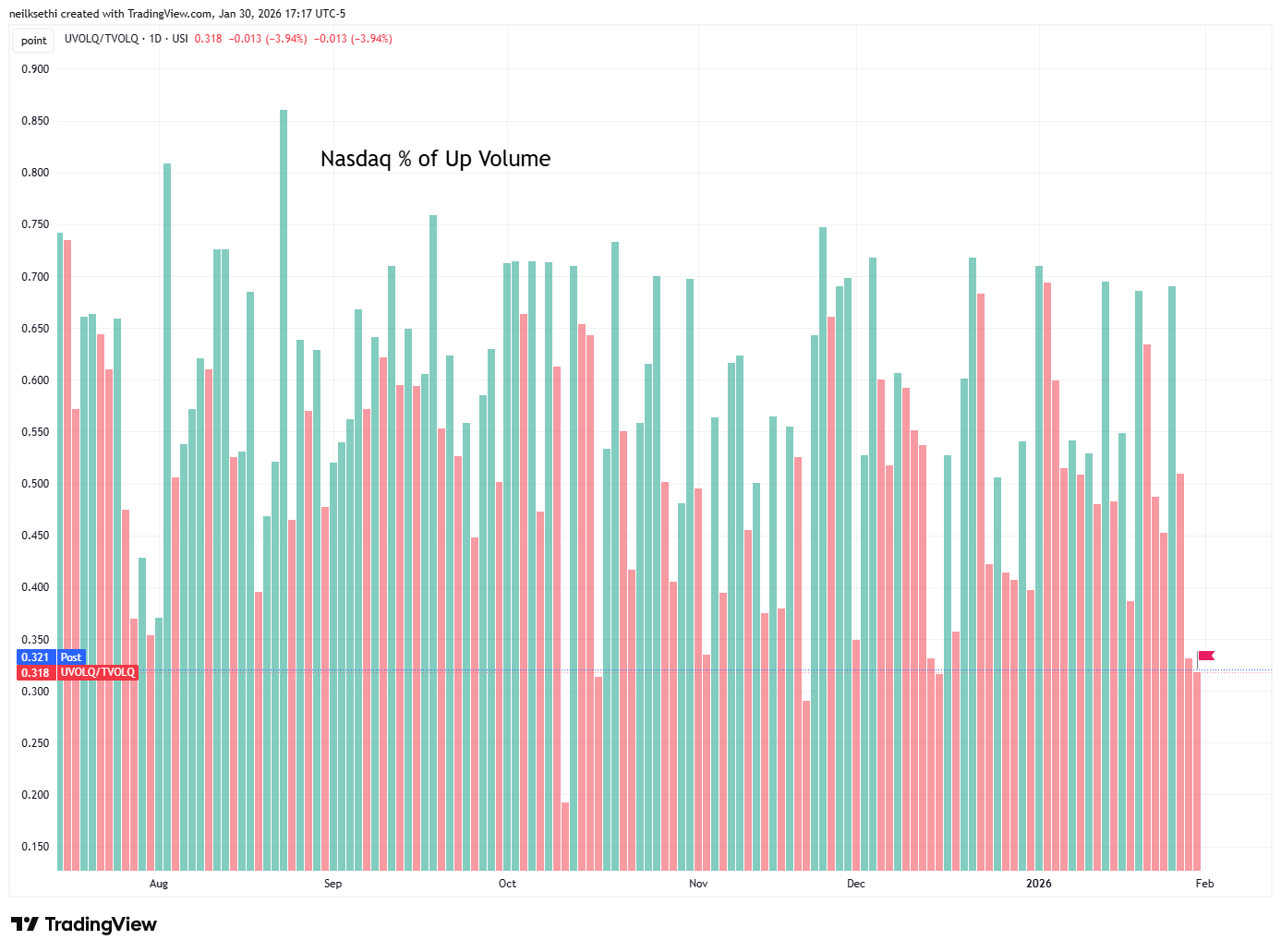

NYSE positive volume (percent of total volume that was in advancing stocks (these also use futures)) fell back to 37.6% not bad for the -0.68% loss in the index although it’s been a while since we were around this loss (it’s either been much smaller or much bigger).

Nasdaq positive volume (% of total volume that was in advancing stocks) also fell to 31.8% but that was just a touch below Thurs even as the loss grew to -0.94% from -0.72% (with the usual caveat that positive volume on the Nasdaq is all over the place due to the speculative volumes).

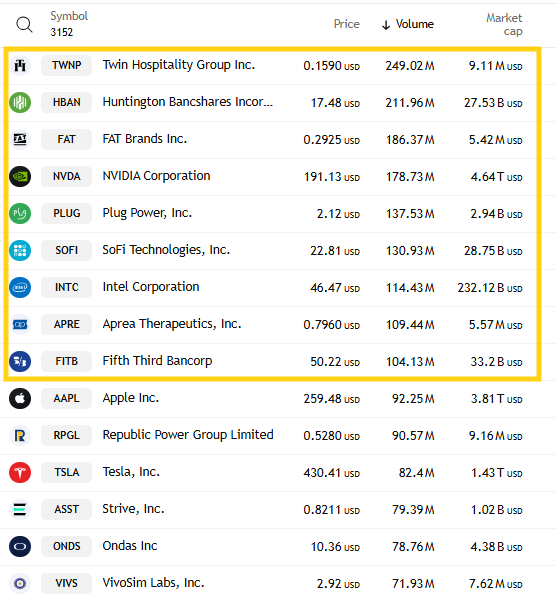

Speculative volumes explain some of the more supported positive volume picking up from one of the weakest days we’ve seen in months on Thurs with the top 3 stocks by volume (which interestingly included a regional bank in HBAN and another regional FITB was in the top 10) collectively trading 650mn shares, up from just 450mn Mon. Still that’s down from ~900mn Wed/Tues.

But six other stocks traded over 100mn shares (up from three Thurs, five Tues/Wed) and another two over 90mn.

Positive issues (percent of stocks trading higher for the day), which are not inflated by high speculative volumes, were still higher on the Nasdaq at 32%, and 41% on the NYSE.

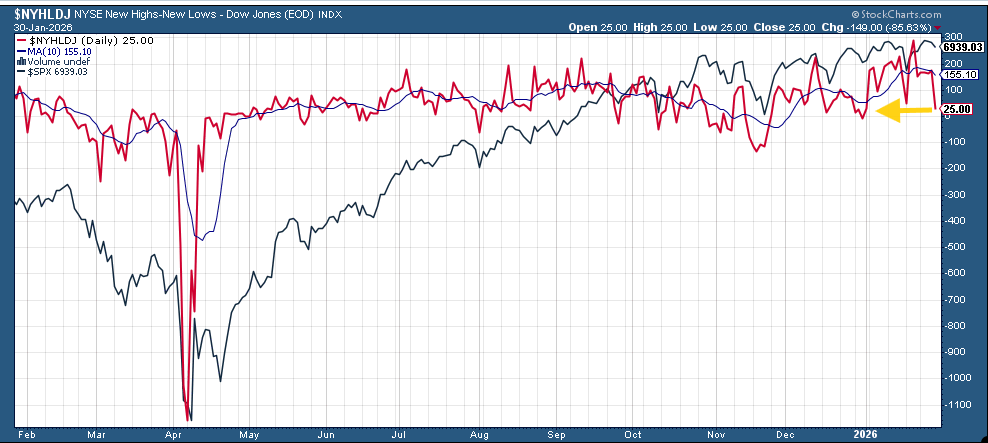

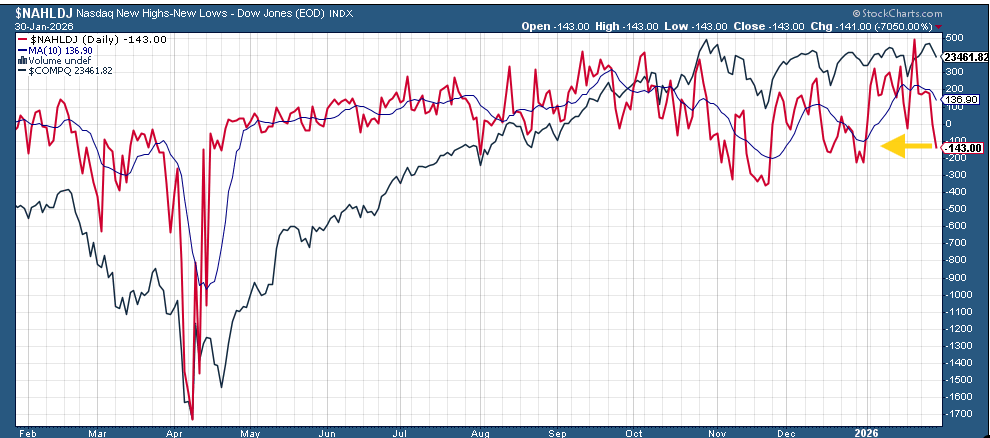

New 52-wk highs minus new 52-wk lows (red lines) finally cracked on the NYSE falling to 24 from 174 (and down from 288 Jan 22nd, the best since Nov ‘24 ), and fell to -148 on the Nasdaq from 177 Wed (and down from 490 Jan 22nd, also the best since Nov ‘24). Both the lows of the year.

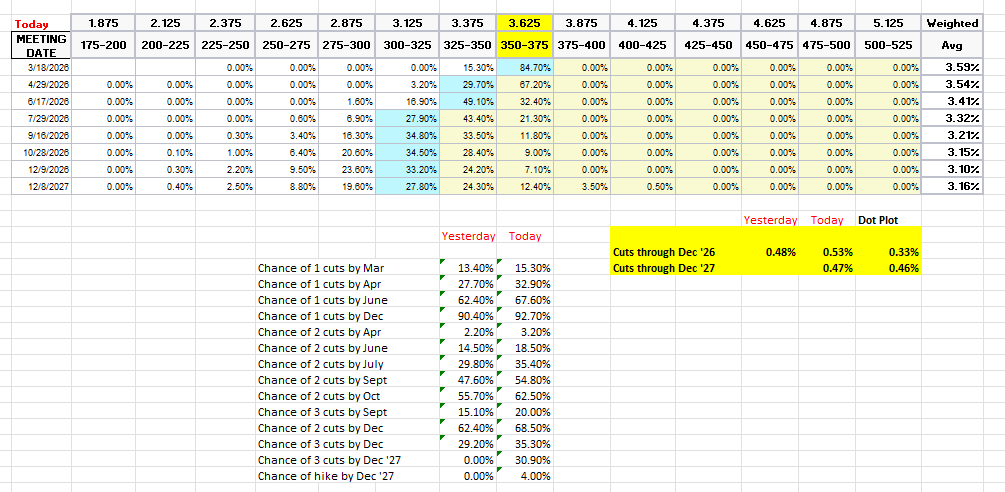

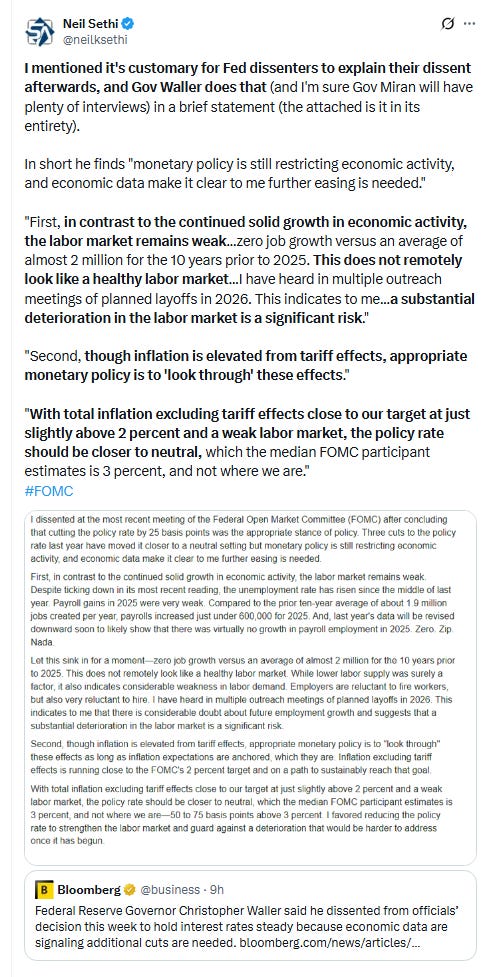

Despite concerns about Warsh not being a strong advocate for rate cuts, FOMC 2026 rate cut pricing did move to more cuts (which you’d think means markets now expects more cuts than before he was nominated knowing someone was going to be nominated) although just incrementally at 53bps from 48 at Thurs' close.

No cut is expected under Powell still with March at 13% (down from 51% Jan 6th), April 33% (from 63%), with the first cut in June which will be Warsh’s first meeting (67%). A second cut is now back into Sept (at 55%, but as compared to a a 55% chance of a July cut on Jan 6th).

Pricing for 2026 as noted +5bps to 53bps (it had fallen as low as 44bps Jan 21st), with pricing for one cut 93%, two cuts 69% and three cuts 35% (down from 68bps Dec 3rd (and 80bps mid-Nov which was highest we’d been for 2026 cuts)).

Note, I also added YE 2027 which is slightly higher than YE 2026 (by 6bps) meaning the market on net expects 6bps of hikes between Dec 2026 and Dec 2027.

The dot plot as a reminder has 33bps in cuts for the average dot for 2026 with another 13bps expected in 2027 so the market is in alignment with the dot plot as to YE 2027.

Remember that these are the construct of probabilities. While some are bets on exactly one, two, etc., cuts some of it is bets on a lot of cuts (3+) or none (and may include a hike at some point).

The 10yr #UST yield rose a few basis points before settling back to finish little changed at 4.24% but remaining in somewhat of a short term uptrend.

Here’s the monthly chart.

The 2yr yield, more sensitive to FOMC rate cut pricing, fell for a sixth session from the highs of the year to 3.52% (down -9bps over that time) now back into the channel it had been in since the start of 2024 before breaking out two weeks ago (which makes me happy as it is a good channel).

It is -12bps below the Fed Funds midpoint. Outside of recessions it is normally above by around +50bps on average, so back to calling for a couple of rate cuts.

The Effective Fed Funds Rate (red line) remained at 3.64%.

This seems like a fairly rich yield at these levels unless we really aren’t going to get any more rate cuts (then it’s a bit expensive (i.e., yield should be higher)). That said I just don’t know that I want to buy 2-years at what is basically the 1-month yield., but I’m starting to get tempted.

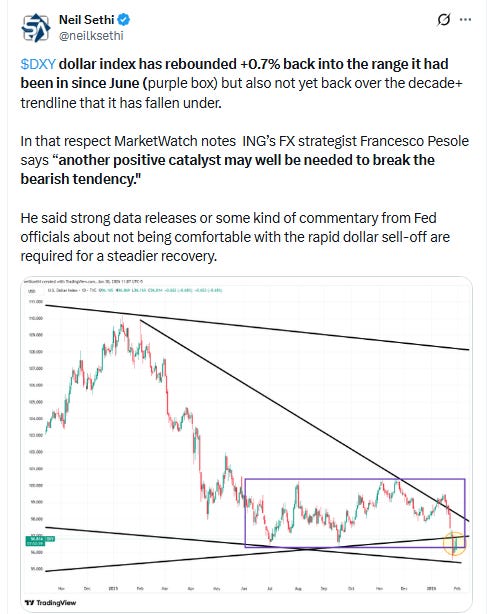

The $DXY dollar index (which as a reminder is very euro heavy (57%) and not trade weighted) saw a strong bounce gaining a full percent following the Warsh nomination given his clear past of being an inflation hawk. That took it back into its range from June and just over the decade+ uptrend line (and at the bottom of the channel it’s been in since the Sep ‘22 peak).

The technicals remain titled negative with the daily MACD in “go short” territory, although the 14-day RSI has bounced from under 30 to now over 40 which can indicate a reversal consistent with my question Thurs “an oversold bounce coming?”. This clearly is more fundamental in nature though.

Monthly chart less constructive but holding the trendline is important.

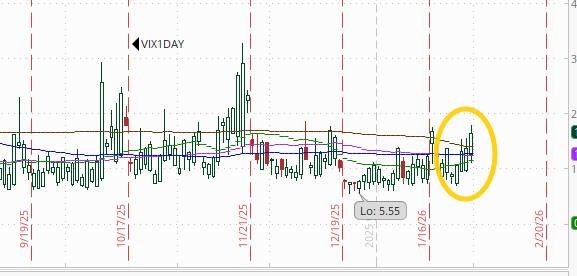

VIX got up to 19 before pulling back to 17.4 still the highest close in a week. That level is consistent w/~1.09% average daily moves in the SPX over the next 30 days.

The VVIX (VIX of the VIX) also moved higher but kept its gains at 108.9 perhaps signaling the coast is not quite clear. The current level is consistent with “moderately elevated” daily moves in the VIX over the next 30 days (historically normal is 80-100, but we’ve been above 90 almost the entire time since July ‘24)). 100 is the level flagged by Charlie McElligott as one to watch.

With a weekend upcoming, as noted last week, the weekend premium is back, but the 1-Day VIX moved past the level of last Friday to 13.7. The current reading implies a ~0.86% move in the SPX next session.

#WTI futures continued to run higher up for a fourth session on continued uncertainty surrounding potential Iran strikes still though trapped in the $65-67 target area I noted Tues.

Daily MACD remains in “go long” positioning while the RSI is now the strongest since June (over 70) providing support.

Monthly chart is firming up but not quite there.

I have been saying “I have no words for what’s going on with gold futures (/GC)”, and that remains the case as they give back the entire rally of the past 8 sessions falling -11%, the worst drop since 1983.

Daily MACD somehow still remains in “go long” positioning, but the RSI has dropped from nearly 90, a level we haven’t seen in the past 20 years, to 50 a massive drop which would normally indicate a lengthy consolidation, but when we saw something similar in late December, it got right back on track (circle) so we’ll see.

It did take it down the top of the channel it had been in since Nov’24

Nothing wrong with the monthly chart, and it looks just like it has a long wick on the Jan candle.

US copper futures (/HG) saw a sizeable but not as great drop of -4.5% falling back from a record high and also putting them back in their channel. The daily MACD is still in ‘sell longs’ positioning, but the RSI is over 50.

Longer term, copper futures remain in the grinding uptrend since August (and longer than that in the uptrend started in March 2020).

Monthly.

With the continued frigid temperatures (I guess Miami, FL is going to be the coldest since 1908 Saturday), natural gas futures (/NG) took a bigger step towards filling the enormous “roll gap” following the roll to the March contract Wed which saw the price drop nearly in half, gaining another +11%, now up +16% the past two sessions.

As I said Monday, given the upcoming roll, I’m not going to bother looking at the technicals until we get some stabilization in the chart.

Bitcoin futures fell to a new “since April” low although down just -0.4%. The daily MACD as mentioned Thurs is now “go short,” while the RSI is under 40.

Monthly chart doesn’t give a lot to be optimistic about.

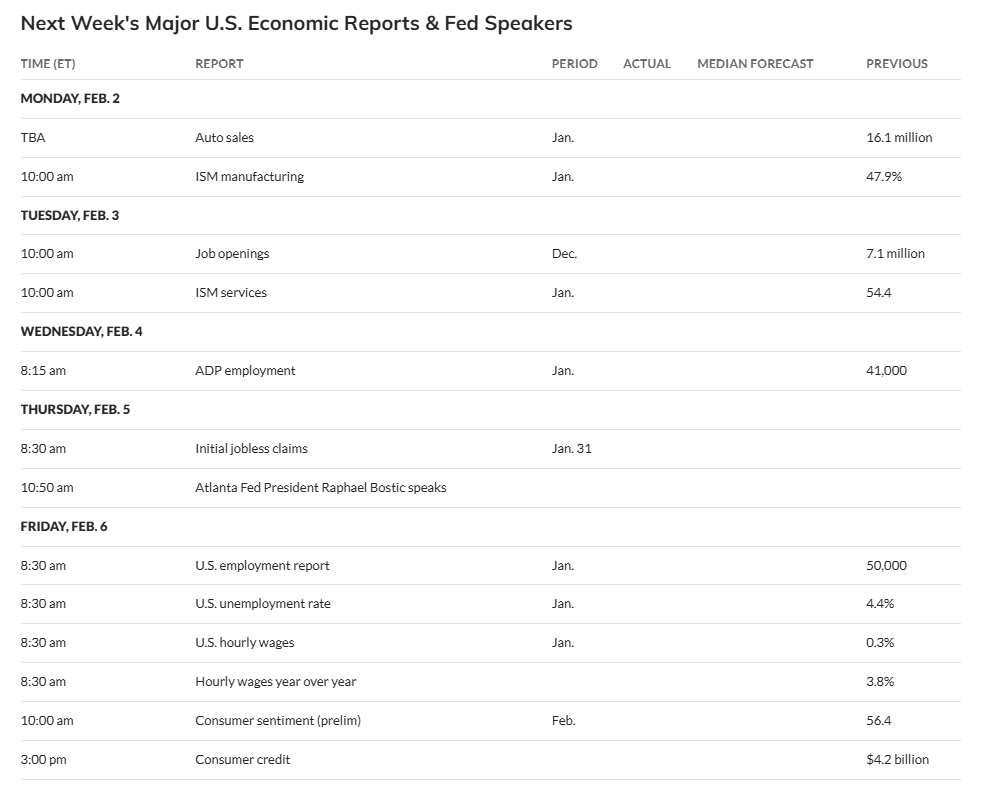

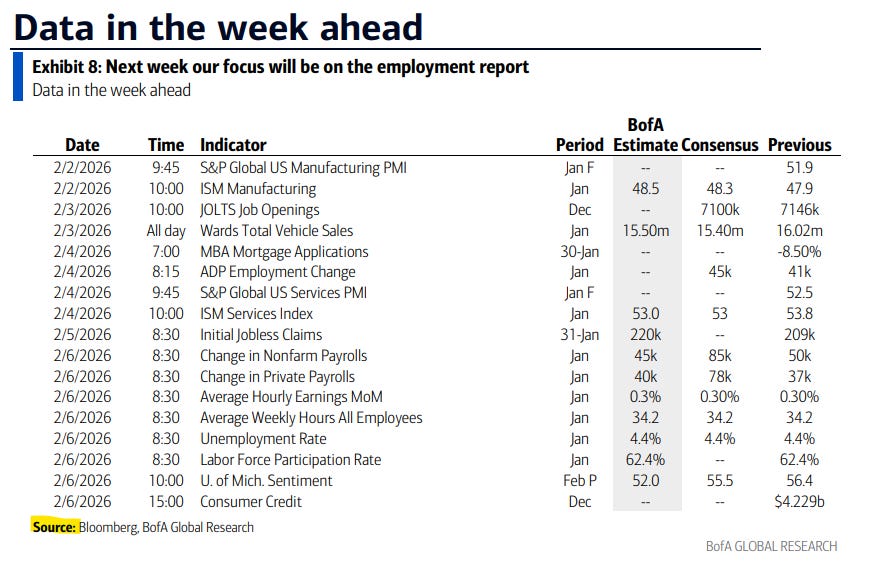

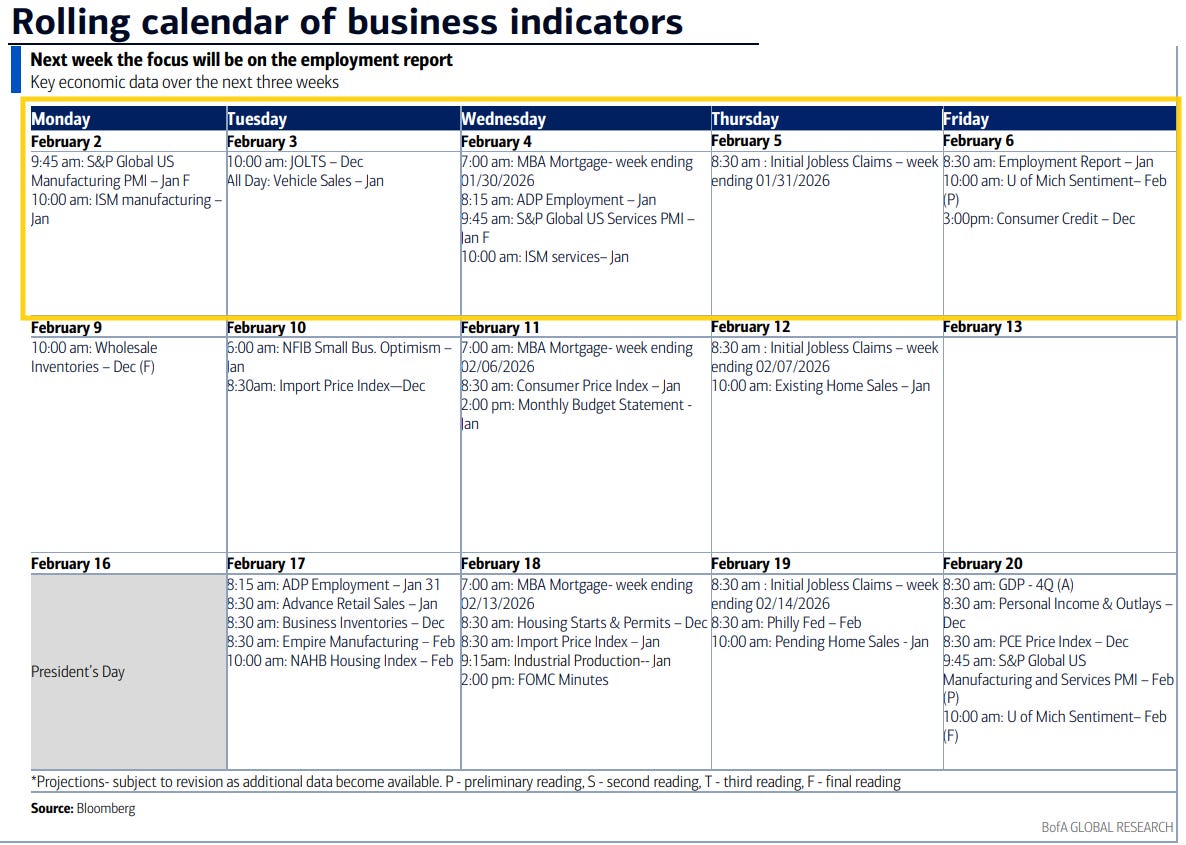

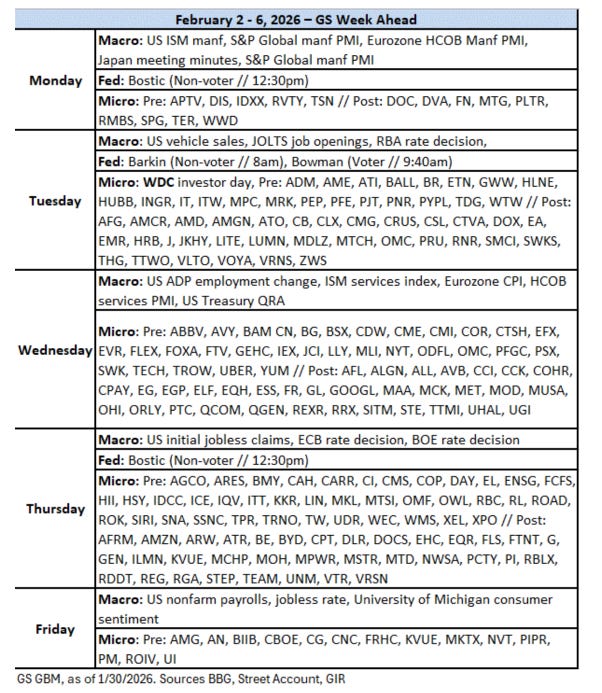

The Week Ahead

Next week is the first week of the month, and we’ll get most of our normal first week of the month US economic reports with a focus on the labor market leading up to “jobs Friday” (all assuming no shutdown). But as usual, before we get to Friday, we’ll get Jan ADP and Challenger job layoff/hiring announcements, Dec JOLTS, and weekly jobless claims. And, as usual, we’ll get the Jan ISM and final S&P PMIs, auto sales, and as we sometimes do, we’ll get Dec consumer credit and the preliminary Feb UMich consumer survey.

Fed monetary policy speaking blackout is over, and it will be back to the circuit for Fed members, although formally there’s just a few speaking next week, and one is outgoing Atlanta Fed Pres Bostic (twice). Another is Richmond Fed Pres Barkin who speaks quite a bit (and is not a voter). Gov Bowman might be interesting if she details why she didn’t dissent despite saying she wanted lower rates ahead of the the meeting. That said, I’m sure there will be (a lot) more than what’s listed now.

No non-Bill Treasury auctions (>1yr in duration) until they pick back up the following week.

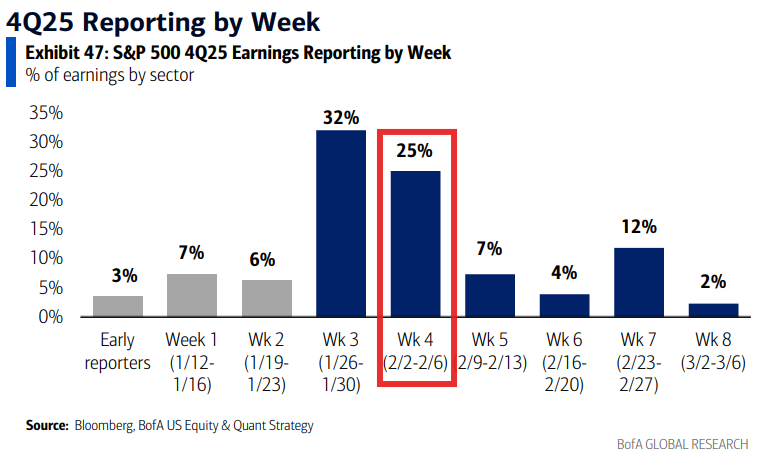

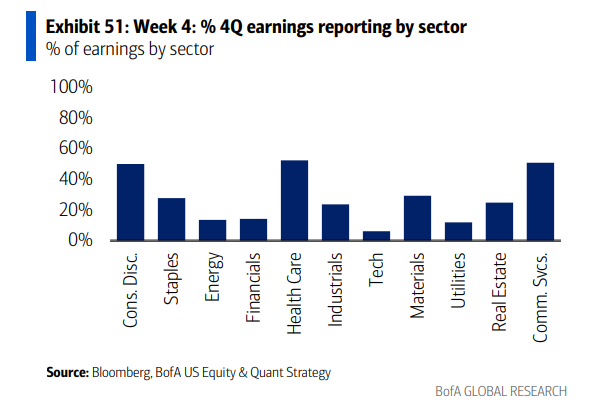

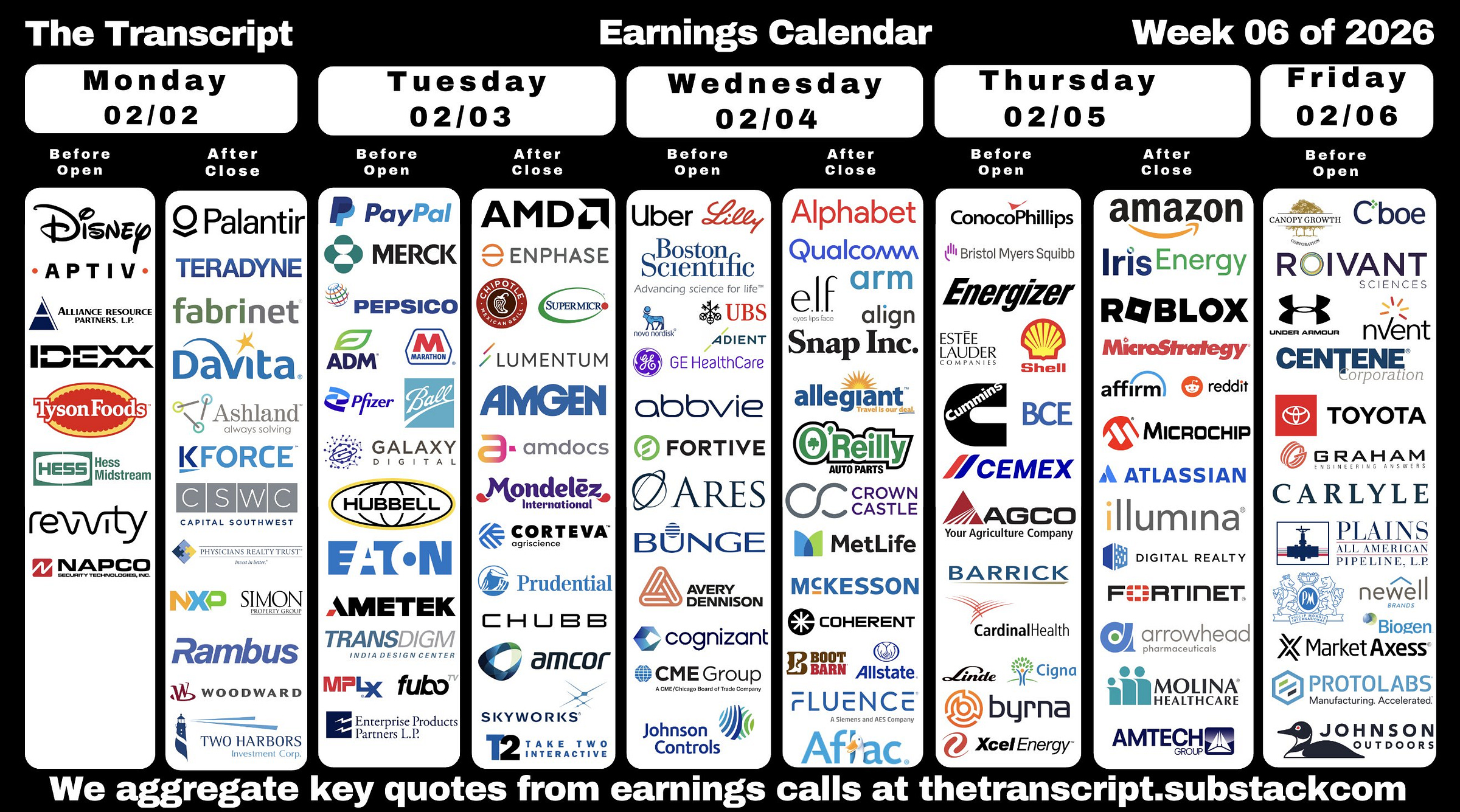

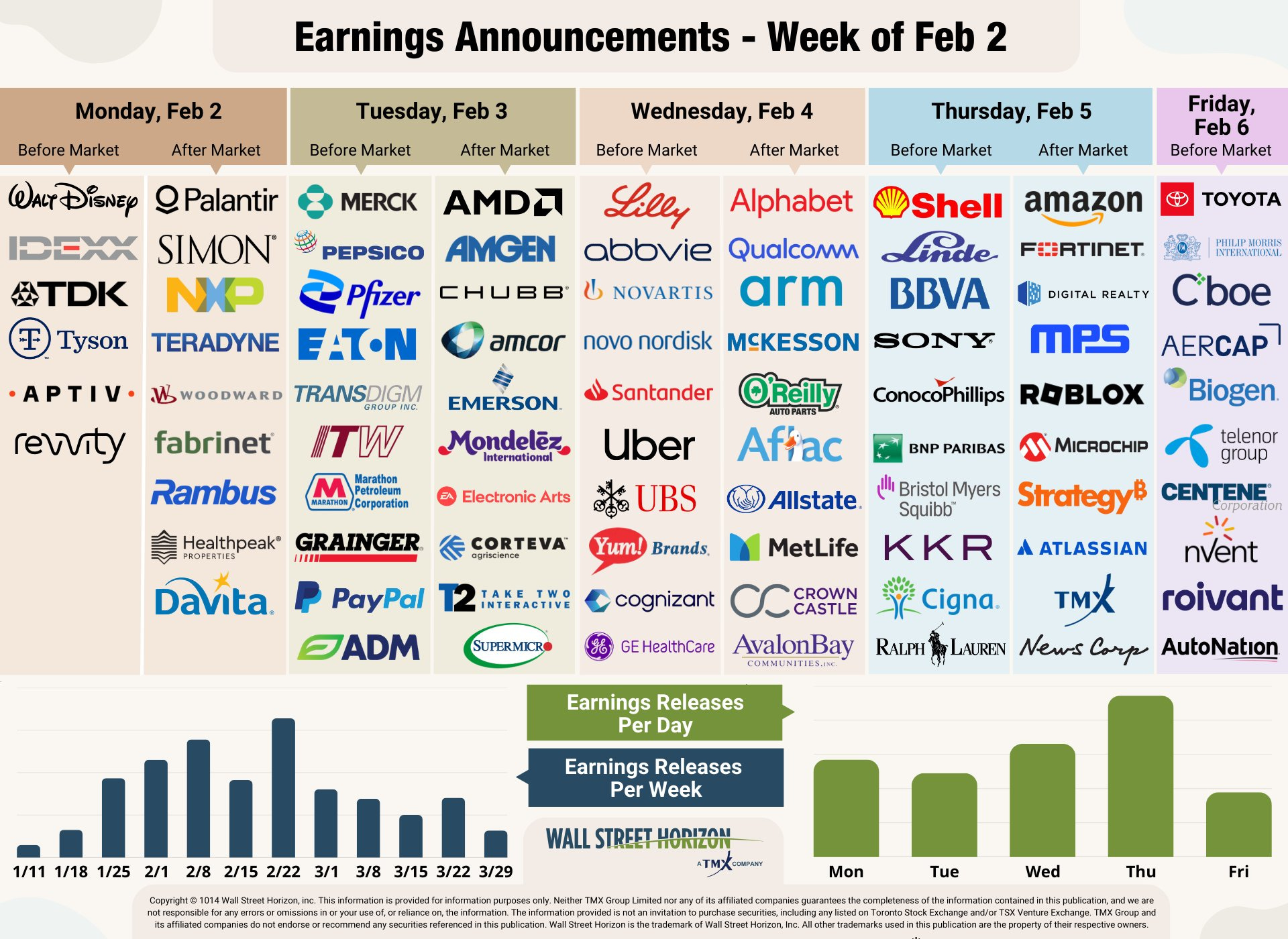

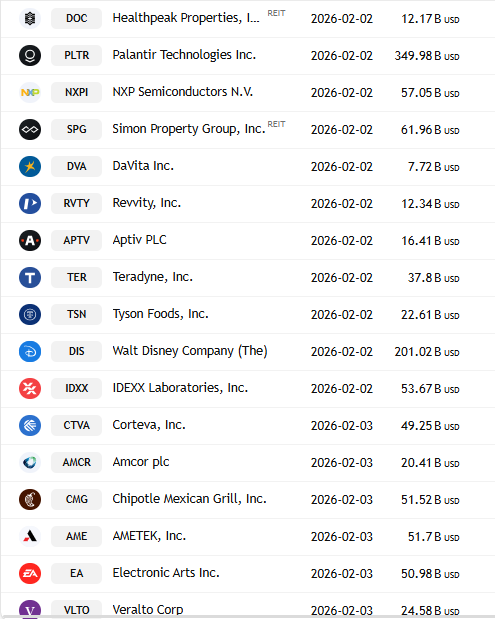

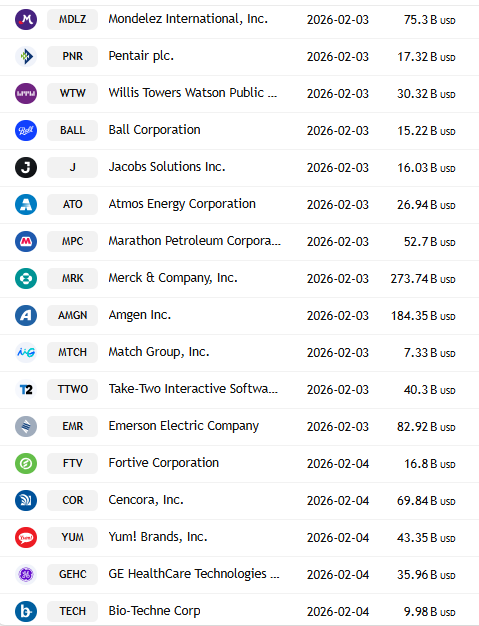

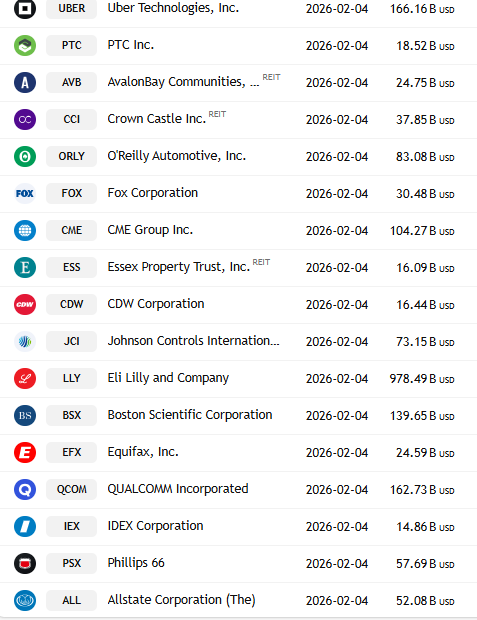

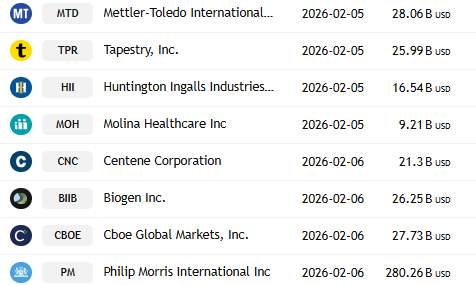

While we’re past the peak of SPX earnings, it’s still a huge week with 25% of the SPX by earnings weight reporting consisting of around 155 SPX components, with two more Mag-7s in GOOG & AMZN and another ~20 >$100bn in market cap in DIS, PLTR, AMGN, AMD, MRK, CB, PEP, ETN, PFE, BSX, CME, MCK, QCOM, ABBV, UBER, BMY, LIN, COP, KKR, PM (by reporting date). Full list below from TradingView.

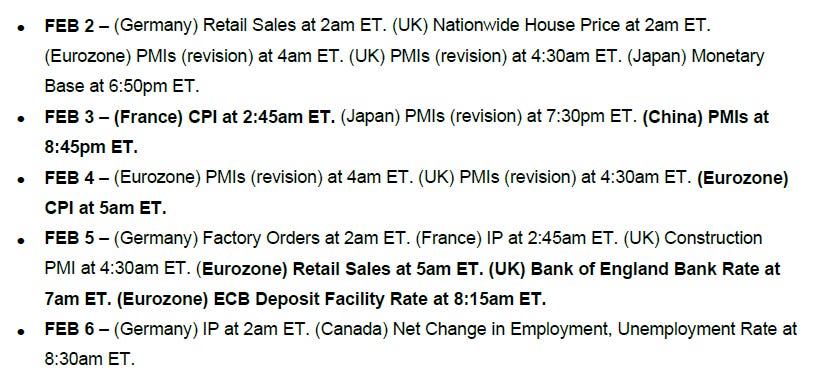

Ex-US highlights are a policy decisions from the BoE, ECB, and RBA (England, EU, and Australia) as well as BoJ (Japan) minutes, global PMIs, EU CPI (along with individual countries) and retail sales, and Germany retail sales, factory orders, and IP (more details Sunday).

SPX Components reporting next week:

Link to X posts - Neil Sethi (@nelksethi) / X

To subscribe to these summaries, click below (it’s free!).

To invite others to check it out,