The Week Ahead - 3/9/25

A comprehensive look at the upcoming week for US economics, equities and fixed income

If you're a new reader or maybe one who doesn’t make it to the end feel free to take a second to subscribe now. It’s free!

Or please take a moment to invite others who might be interested to check it out.

Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

As a reminder, some things I leave in from prior weeks for reference purposes, because it’s in-between updates, it provides background information, etc.. Anything not updated this week is in italics. As always apologize for typos, errors, etc., as there’s a lot here, and I don’t really have time to do a real double-check.

For new subscribers, this is a relatively long post. The intent is to cover the same areas each week. Sometimes the various areas are more interesting, sometimes less (lately more), but it’s easier just to go through them all, so you can expect this format (with things in the same places) each week.

The main sections are intended to cover 1) what’s upcoming next week, 2) what the Fed and rates are up to, 3) what’s going on with earnings (which are the most important determinant to stock prices over the long term), 4) what’s going on with the economy (both because of its impact on our daily lives (I am a business investor in my “real” job) but also because it impacts earnings), 5) valuation, 6) breadth (which gets into sector/style performance), 7) positioning (this is the most important determinant to asset prices in the short term, particularly institutional/corporate flows), 8) sentiment (really only matters at extremes though), 9) seasonality (gives you an idea of what normally happens), 10) “Final Thoughts” (remember you get what you pay for there), and 11) my portfolio (to be transparent about where my money is in the market, although note that first I’m not the greatest at keeping it super-accurate (and it is most definitely not intended as financial advice) and second as I mentioned earlier my main job (and investing assets) are in private industries (RE & venture capital)).

The Week Ahead

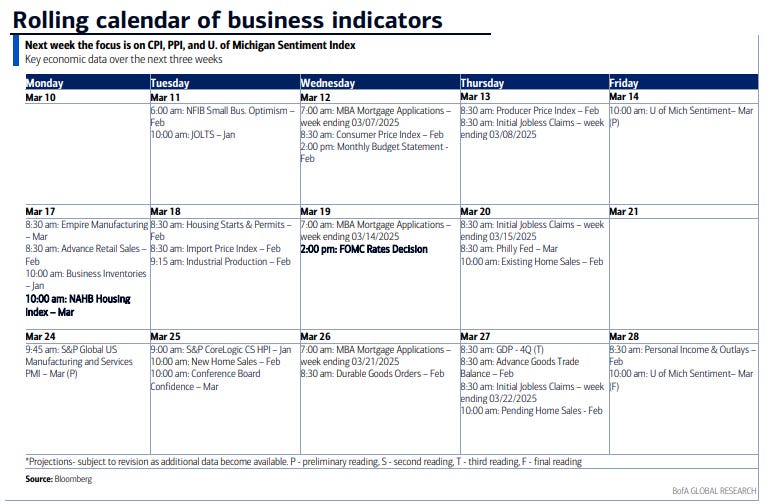

It’s the second week of the month and as is typical it’s inflation week in the US highlighted by the Feb CPI report Wed and PPI on Thurs. Don’t sleep on PPI. If you need a reminder, after yields shot up (and Fed rate cut bets were slashed) following last month’s hot CPI, that all reversed after PPI revealed the items which flow into PCE prices (the Fed’s preferred inflation metric) were cool.

Otherwise, it’s a relatively less busy week than the last couple. We do unusually get the Jan JOLTS report after the NFP this month. We also get two updates on consumer sentiment that contain both short and long term inflation expectations (in UMich on Friday and the NY Fed on Monday (which is the far superior report to me (almost 3x the number of consumers and it’s a rotating panel so there’s consistency))). If there’s anything we’ve learned from recent #Fed speakers, it’s that inflation expectations matter. A lot. Although notably consumers are just one piece of this (Powell mentioned also business and market measures Friday), he emphasized the importance of longer term exp's (5+ years), so pay particular attention to that metric (I’ll be sure to highlight in my posts). If you’re a long-time reader I don’t need to remind you Powell specifically referenced the jump in UMich inflation expectations in June 2022 as one reason for the 75bps hike at that meeting. A continued rise (it’s already the highest since 2009) in the 5-10yr in that survey could well influence the dot plot we get the following week.

We’ll also get NFIB this week and the standard weekly reports (jobless claims, mortgage applications, and petroleum inventories).

The #Fed is one thing we won’t have to specifically worry about this week. The blackout period has started, and there is zero chance outside of an economic calamity that they will be making a change to rates or any other major new item that needs to be tipped in advance.

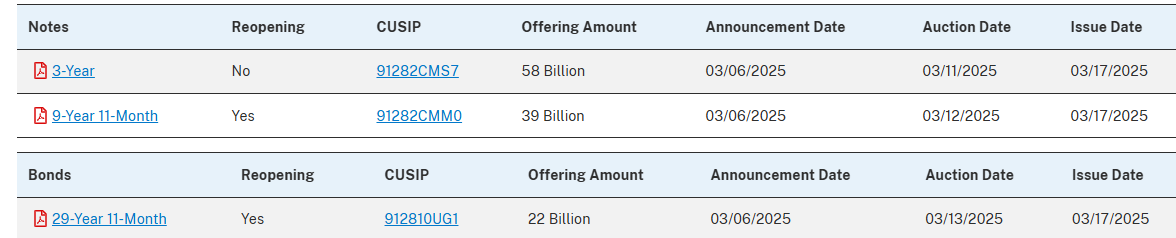

Treasury auctions pick back up with our normal start-of-the-month schedule of 3yr, 10yr (reopening) & 30yr (reopening) paper ($58bn, $39bn, & $22bn respectively Tues, Wed, Thurs).

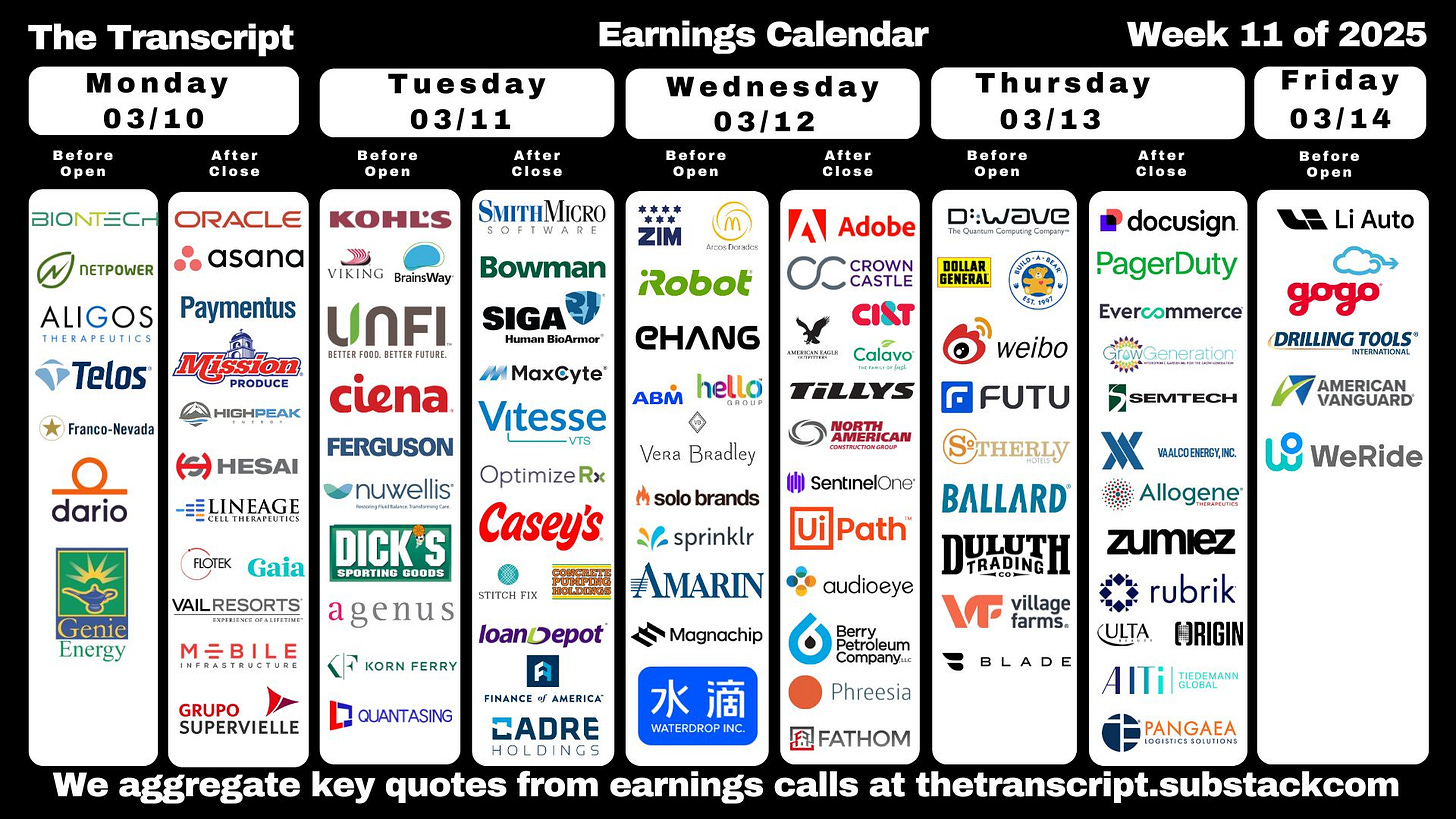

In terms of earnings in the upcoming week, we’re in that “middle ground” between quarters where we will get the tail end of the Q4 reports and the start of Q1 reports. This week we get 3 of the latter and 2 of the former for the SPX. But that doesn’t they're tiny names with two high profile reporters this week in Oracle and Adobe, our two >$100bn reporters this week.

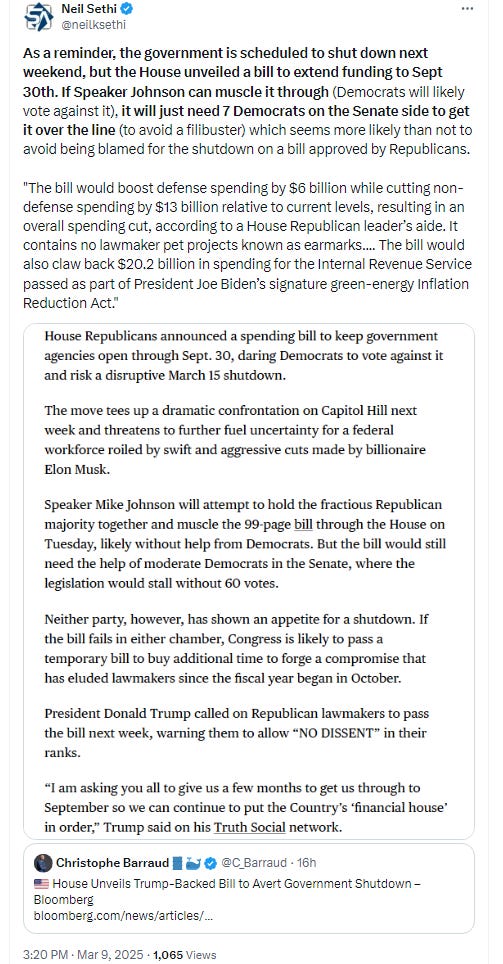

Finally, as a reminder, the government is scheduled to shut down next week, but over the weekend the House unveiled a bill to extend funding to Sept 30th. If Speaker Johnson can muscle it through (Democrats will likely vote against it), it will just need 7 Democrats on the Senate side to get it over the line which seems more likely than not to avoid being blamed for the shutdown.

From Seeking Alpha (links are to their website, see the full earnings calendar):

Earnings spotlight: Monday, March 10 - Oracle (ORCL), BioNTech (BNTX), Vail Resorts (MTN), Paymentus Holdings (PAY), Hesai Group (HSAI), and NET Power (NPWR).

Earnings spotlight: Tuesday, March 11 - Ferguson Enterprises (FERG), Viking Holdings (VIK), DICK’S Sporting Goods (DKS), Ciena (CIEN), and Kohl’s (KSS).

Earnings spotlight: Wednesday, March 12 - Adobe (ADBE), Crown Castle (CCI), UiPath (PATH), SentinelOne (S), and ABM Industries (ABM).

Earnings spotlight: Thursday, March 13 - Ulta Beauty (ULTA), DocuSign (DOCU), Dollar General (DG), Futu Holdings (FUTU), and Rubrik (RBRK). S

Earnings spotlight: Friday, March 14 - Li Auto (LI).

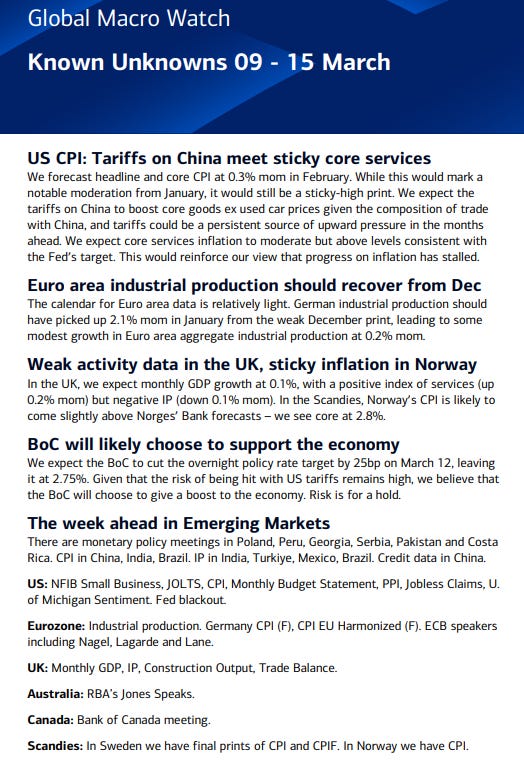

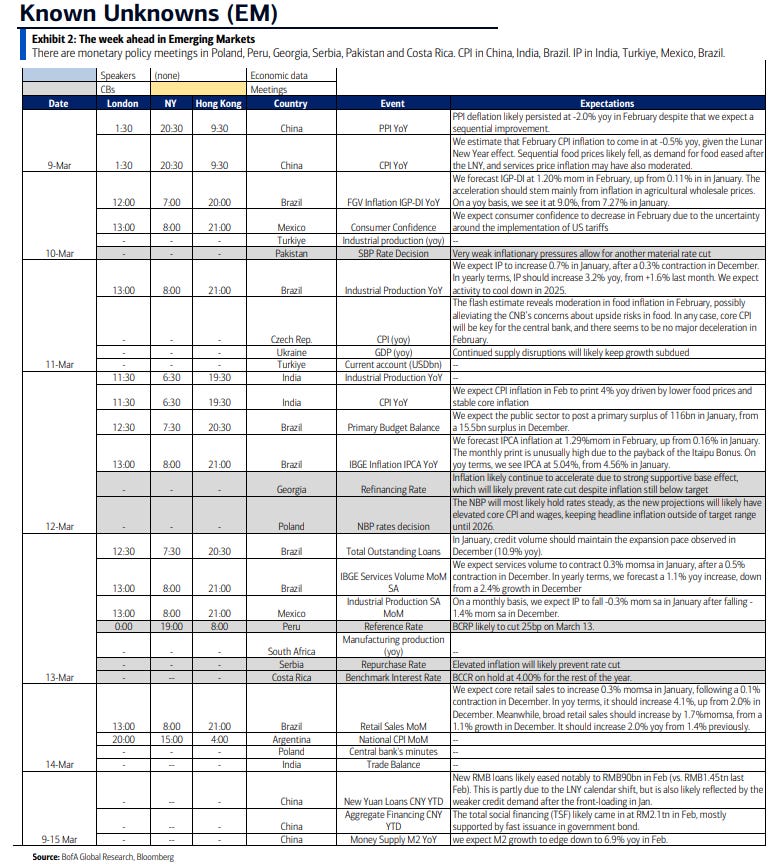

Ex-US, highlights will be the ECB’s leaders meeting (their version of the Fed’s Jackson Hole (although they also have the annual meeting in Sintra)) which will include an address from Christine Lagarde, a policy decision from the Bank of Canada (a cut is generally expected, but definitely not by all), inflation releases from a number of countries, growth data from the UK, industrial production from Germany, Japan wage data and GDP, growth and investment data from China, and a host of data points from Latin America.

The Bank of Canada is widely expected to cut rates by a further 25 basis points on Wednesday if President Donald Trump’s sweeping tariff push on Canadian goods persists. Previously, many economists had counted on a pause after recent data showed the economy bounced back strongly in the fourth quarter. It’s a challenging moment for Governor Tiff Macklem, who successfully wrestled inflation lower and put the country on track for a soft landing — only to face potential stagflation from a trade war instigated by an ally.

In Asia, investors will focus on Japan’s labor cost data after nominal wages in December rose at the fastest pace in nearly three decades. Japan will also release current account figures on the day amid increasingly uncertain prospects for global flow of investment and trade. The country’s current-account surplus hit a record high in 2024, with the yen’s weakness inflating the value of overseas investment returns. A renewed trade war between the US and China, Japan’s two biggest trading partners, hangs heavy over the outlook. Also on Monday, the State Bank of Pakistan is expected to cut rates to 11.5% to support growth after inflation eased to the lowest in seven years. On Tuesday, Japan will publish final gross domestic product estimates for the fourth quarter. A strong report may pave the way for further monetary policy tightening.

Australia releases a private survey for businesses which is likely to show the impact on sentiment of the country’s first rate cut in four years. Australia and Indonesia also report consumer confidence data. On Wednesday, South Korea’s unemployment rate will be closely watched after a steeper-than-expected drop in January. India’s consumer price growth likely cooled slightly in February which could spur bets for further monetary policy easing. Japan releases fourth-quarter economic and business conditions as well as producer prices, while New Zealand has card spending data. Malaysia and India report industrial output. Friday will see trade data from South Korea and New Zealand’s food prices. Also during the week, China publishes credit data as well as foreign direct investment figures which will be closed watched after the country in January recorded the weakest start for inbound investment in four years.

A packed week of policymaker appearances is in store for the euro zone following the ECB decision on Thursday to cut rates and avoid giving a clear signal of its next move. Officials on the schedule include President Christine Lagarde, who’ll make a key speech to a major conference in Frankfurt on euro-zone monetary policy. Chief economist Philip Lane and governors from the region’s four largest economies are on the calendar too. Among data in the region, euro-zone industrial production on Thursday will give a signal on growth at the start of the year. Prior to those figures, numbers from Germany will reveal how the country’s sickly manufacturing businesses were faring before Friedrich Merz won the Feb. 23 election. He’s working on a fiscal package that could prove a massive support to the country’s crippled industrial backbone. show a third monthly increase, albeit much slower than the spurt seen at the end of last year. Sweden, meanwhile, will release its monthly GDP indicator on Monday, and Riksbank officials will testify to lawmakers the following day. Norway and Denmark will publish inflation numbers during the week, as will Poland. The Polish central bank is likely to keep borrowing costs steady at a decision on Wednesday. The National Bank of Serbia, meanwhile, may extend its pause in monetary easing for a sixth month.

Turning south, Egypt’s inflation is expected to show a sharp drop in February from 24% a month earlier, paving the way for several rate cuts this year. Ghana’s finance minister, Cassiel Ato Forson, will present the Mahama administration’s first budget on Tuesday, outlining plans to revive the ailing economy. He may also provide details on International Monetary Fund talks to alter the terms of a $3 billion program that ends next year. In South Africa, Finance Minister Enoch Godongwana will present his own budget in Cape Town on Wednesday, a month after delaying plans because of a coalition disagreement over a proposal to raise taxes. Investors will watch for how far he sticks with fiscal consolidation while holding few options to raise revenue and reduce spending. Russia will publish inflation figures for February on Wednesday, just over a week before its next rate decision. Bloomberg Economics sees annual price growth reaching 10% before trending lower through the rest of the year. In Israel, meanwhile, inflation is expected to have eased slightly to 3.7% from 3.8% a month earlier. That report is due on Friday.

In Latin America, central bank surveys of economists are on tap in Argentina, where inflation expectations are drifting ever lower, and in Brazil, where they’ve leveled off after a protracted run-up. Brazil’s February inflation report will likely show a roughly 60 basis-point jump in the year-on-year print to well over 5%, the highest since September 2023. Brazil also reports industrial production, retail sales, budget and lending data in the coming week. While tighter financial conditions — Brazil’s central bank has tipped a third-straight 100 basis-point rate hike at its March 19 meeting — have yet to bring inflation and expectations to heel, retail sales and industry finished off 2024 on the defensive. In Peru, the central bank is likely quite close to drawing a line under its post-pandemic easing cycle. Inflation in February slowed to 1.48%, below the 2% mid-point off the central bank’s 1%-to-3% target range, although policymakers led by President Julio Velarde may still opt to hold at 4.75%. Industrial production, wage data, consumer confidence and same-store sales are on tap in Mexico. Argentina’s national inflation all but certainly slowed for 10th month, possibly sinking below 70% — down from 289.4% last April. The monthly reading may cool from January’s 2.2% print and local analysts see further disinflation ahead: they forecast 23.2% for year-end 2025 and 9.4% by 2027.

And here’s BoA’s cheat sheets.

And here’s calendars of 2025 major central bank meetings.

Market Drivers

So let’s go through the list of items that I think are most important to the direction of equity markets:

Fed/Bonds

As noted previously this was one of the sections that had grown unwieldy, so I’ve really pared it down. Given I provide daily updates on Fed expectations, Fedspeak, and analyst thoughts on the Fed, it’s duplicative (and time consuming) to gather it all again so, again, I encourage you to look at those (the daily posts) for updates. I will just give more of a quick summary.

I noted in late December,

Markets have taken 2025 pricing down to less than two cuts with just around a 50/50 chance of a cut in the first half of the year. After 100bps of cuts so far, just a few cuts before a prolonged hold would be consistent with the 90’s “soft landing” experience (where there were 75bps of cuts before a prolonged hold), and it’s certainly not implausible that inflation gets “stuck” around current levels and growth and labor markets remain in good enough shape that the Fed does have just one or two (or even no) cuts in 2025, but I think it’s also not unlikely that we see continued softening in labor markets and the economy, and with just 18% of investors expecting a recession in 2025, it feels like a growth scare and a quicker path of Fed rate cuts is underpriced.

But as longer term readers know the first six weeks of the year markets moved towards the “inflation gets stuck” mindset particularly following the better than expected Jan NFP report (when considering the revisions) and then the hot CPI and PPI. On CPI day the CME Fedwatch tool was pricing just over once cut. But then as noted two weeks ago,

on Friday we did get a whiff of that “growth scare” in the weak flash services PMI (along with the drop in business and consumer confidence). That was enough to get us back to basically where we were at the start of the month before the strong NFP, jump in inflation expectations, and hot CPI in terms of Fed rate cut expectations. The big item this week is PCE prices numbers (core, supercore, etc.), but we generally have a pretty good idea how those will come out…What could though have as much of an impact is the personal spending number. If that comes in under expectations, it could add to the “growth scare” bets.

And as noted last week, after a weak personal spending number, consumer confidence, home sales, and a jump in initial jobless claims we saw rate cut bets push to the highs of the year despite the chorus of Fed speakers talking about their concerns regarding inflation and that very same consumer confidence report validating the UMich jump in inflation expectations. As I said, “[s]o the market has clearly become concerned about growth, in line with my thoughts coming into the year that the growth risk was underpriced.”

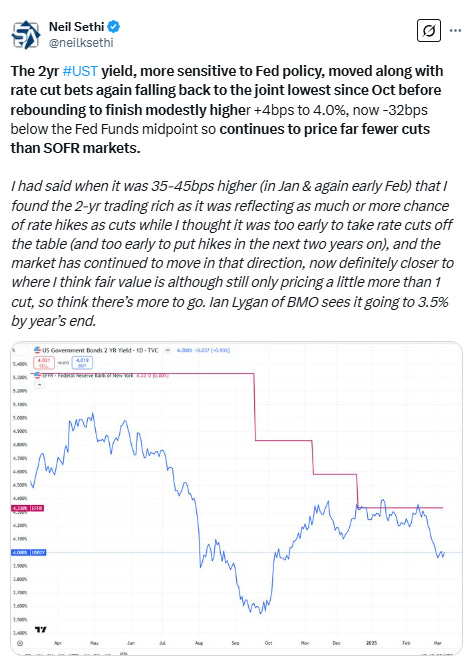

And this week saw the above continue particularly following the broad weakness in the household survey of NFP. While Fed speakers (including Powell himself Friday) continued to preach “caution,’ “uncertainty,” a “solid” economy and labor markets, etc., the markets pushed rate cut pricing to new highs for the year, now pricing in almost three full cuts for 2025. The Trump administration talking about "a little disturbance," "short-term pain," and "a detox period," as new economic policies though are clearly not helping.

What the Fed and markets agree on though is that there will be no cut in March. That makes the focus on the Summary of Economic Projections (SEP) which includes the “dot plot”. BMO’s Ian Lygan (a wonderful rates specialist) noted in his weekly podcast that the tendency has been for the dot plot to move in the direction of market pricing, which would be more cuts. We’ll see. Of course, the press conference will be must watch, but after a Powell interview Friday, I’m doubtful on any new ground being broken less than two weeks later. We do of course, get CPI this week, so that could push things one way or the other at the margin (a very hot or cool CPI as the Fed members are finalizing their dot plot projections could definitely make a difference given the current “extreme data dependency” of the FOMC as Mohammad El-Erian has noted.

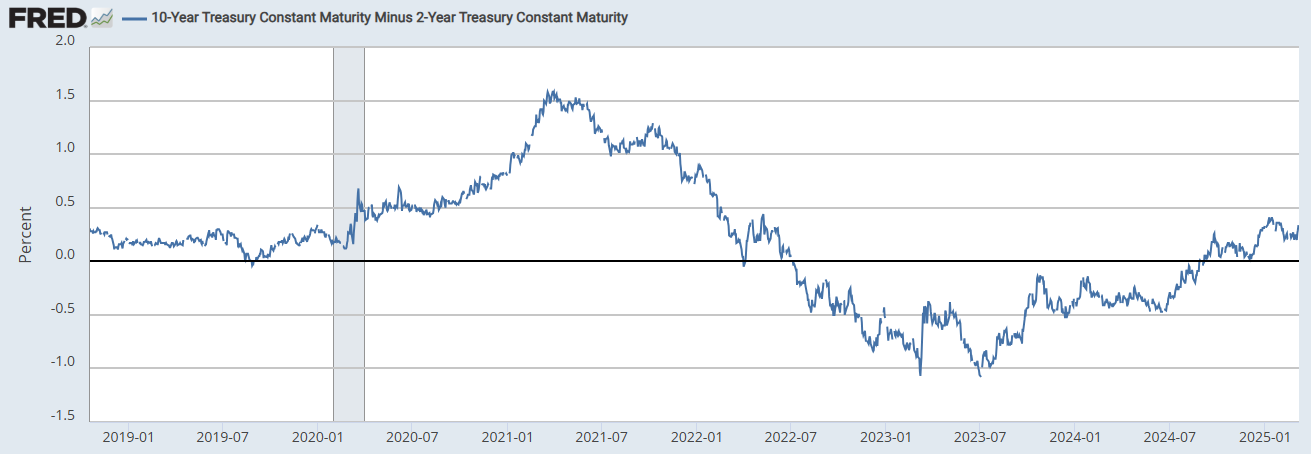

The 2/10 curve saw a relatively sharp +13bps move w/w to +0.33% now down just -8bps from Jan 14th when it hit the steepest since May ‘22. It started the year at +0.33%, so we are back to those levels. BMO’s Lygan thinks this will continue to steepen as the 2-yr “catches up” to market pricing on rate cuts (as discussed in Friday’s blog in the discussion on 2yr yields).

As a reminder, historically when the 2/10 curve uninverts following a long period of inversion the economy is either in a recession or within a few months of one. It uninverted in Sept, so this looks officially like a "this time is different" situation.

The 3mos/10yr yield curve (considered a better recession signal than 2/10’s w/the last four recessions on average coming a few months after the curve uninverted (prior to that it generally uninverted after a recession had already started)) remained inverted although steepening to -2bps from -8bps. As noted last week, this (reinverting) is something that it did prior to (or just after) the last two recessions and it also dipped (but didn’t reinvert) in the two recessions prior to that.

As noted last week, not sure if the reinversion “restarts the clock” on the recession watch. If so the longest it went in those previous four instances before recession after reinverting is 6 months (2007).

And the 10yr Treasury yield remains a little below the Fed Funds rate which as you can see is a very unusual situation historically, happening only a handful of time in the past 40 years, often before recessions.

Long term inflation expectations as measured by the 5-yr, 5-yr forward rate (exp'd inflation starting in 5 yrs over the following 5 yrs), specifically mentioned by Powell at the Nov FOMC press conference (he said the metric was “right where it’s been, consistent with 2% PCE inflation”), dropped to the least since March ‘23 this week (following the banking failures), finishing just off those levels -4bps w/w to 2.14%. They are now -15bps since the Nov FOMC.

10-yr breakevens fell back -5bps w/w to 2.33%, the lows of the year.

With nominal 10yr Treasury yields falling more than inflation expectations, 10yr real rates fell back -12bps to +1.80%, the least since October on Monday before rebounding along with yields the rest of the week and ending higher w/w at 1.95% on Thursday.

They’re still -39bps from the +2.34% on Jan 13th which was the highest since Oct ‘23 (and before that 2007), though still well above the 2010-2020 peak of 1% (but down from the post-pandemic peak Oct ‘23 of 2.5%).

As with 10yr rates implied from market pricing, backing into 10yr real rates using 5-yr, 5-yr forward inflation expectations (subtracted from the 10yr nominal yield) similarly saw them fall on Monday to 2.03%, the least since December, before rebounding to finish at 2.14% Thursday.

Still -31bps from 2.45% on Jan 13th which was the highest since Oct ‘23 (and before that 2007)), but also well above the 2013-2020 average of around 0.5% (but down slightly from the post-pandemic peak of 2.5% in October '23).

And as a reminder according to BoA the importance of real rates on equity returns has seen the largest increase in the factors they track over the past 5 yrs and explains a larger proportion of stock returns (83% correlation) in their data (to 2006), with the dollar close behind the most correlated (76%) since 2015.

Short-term real yields (Fed Funds - core PCE) edged higher to 1.68% in January from 1.61% in December, which was the least since Sep ‘23, down from 2.70% in June. That though was the highest since 2007. [this gets updated at the end of the month].

No relief for small businesses or HELOC borrowers as the real prime rate (inflation adjusted using core PCE) increased for the first time since last June to 4.85% from 4.78% in December, although still down over around a percent from the 5.87% in June, which was the highest since Sep 2007. It remains more than double the 10yr pre-pandemic avg. [this gets updated at the end of the month].

And looking out longer term, one thing to note is the FOMC’s long run projection for the endpoint of the Fed Funds rate (the “neutral rate”) is now the highest since Sep 2018 at 3.0% (and not unlikely to go higher as I said earlier this yr). [This will be updated after the March FOMC].

The ACM model of the 10yr term premium (which is solely based on interest rates), like real rates, fell to the lows of the year Monday at 0.21% before rebounding to 0.37% on Thursday +13bps w/w, still off the +0.66% it hit Jan 13th (which was the highest on this model since May 2015), and now up ~+51bps since the FOMC did the 50bps cut in Sept.

The extended discussion on term premium (what it is, why it’s important, etc.), can be found in this section in the Feb 4th Week Ahead.

I said two weeks ago that “volatility goes both ways,” and we again saw the MOVE index of expected 30-day Treasury note/bond volatility continue its relatively sharp move up from the lows of the year three weeks ago (which were not far from the lows of 2024 hit in December (which were the lowest since 2022)) to the highest since early-November on Tuesday, but fell back a touch by the end of the week.

30yr mortgage spreads followed the MOVE index this week, rising to the highs of the year on Tuesday before edging lower finishing down -3bps w/w at 2.39%, remaining just +12bps from the lowest since June ‘22 (2.27%) hit Dec 19th, and well off the 3.1% peak in June ‘23. But they are still around +65 bps above the 2010-2020 avg level.

Chicago Fed National Financial Conditions Index and its adjusted counterpart (the latter attempts to remove the correlation between the various indicators due to broad changes in economic conditions), both of which are very comprehensive each w/105 indicators, in the week through Feb 28th (so a little lagged), saw both increase for a 3rd week, the first 3-wk rise since Oct ‘23 although still remaining not far from the least tight since late 2021.

https://www.chicagofed.org/research/data/nfci/current-data

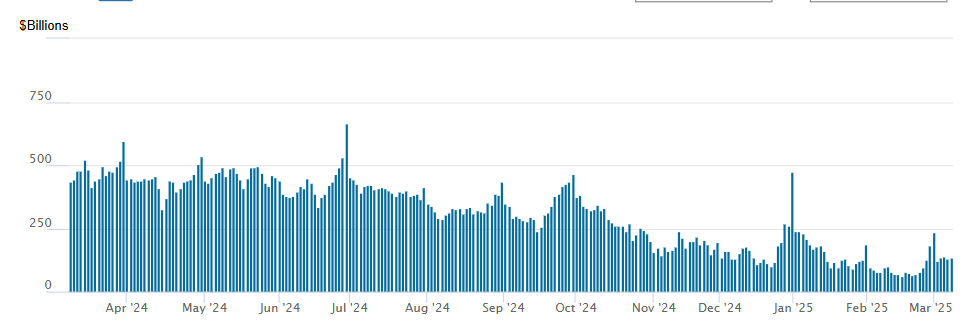

As the Fed continues to drain liquidity from the system via QT, I think it’s important to watch for stresses which give an early warning signal that they are perhaps going to far as they did in 2018 which led to a near bear market. One area I am monitoring is reverse repos (which is an overnight secured place institutions (mostly money markets and banks) can park excess funds to accrue some interest designed by the Fed originally to keep excess liquidity from pulling down rates too much in other short term markets). RRP grew rapidly in 2021 & 2022 as money was pumped into the system but since May ‘23 has been steadily drained down by the Fed’s QT program and higher bond issuance with banks discouraged by regulatory rules from taking up the increased Treasury supply.

In particular, the continued sizeable issuance of T-bills (<1 yr duration) of around $800bn/month (accentuated by the $60bn in balance sheet runoff (meaning the Fed has reduced its buying of maturing Treasuries by that amount which the private market has to fill)) drained ~$1.75 trillion from RRP in the year through March 1st. From then until early July RRP levels had remained relatively stable in the $375-$500bn range, but since early July they resumed their decline (in fits and starts), hitting new lows on Dec 20th at $98bn, the least since Apr ‘21 on the back of the Fed cutting RRP rates to the low end of the Fed Funds band which made parking funds there (versus lending overnight to other institutions or buying T-Bills) less attractive in line with their desire to sop up most of this “excess liquidity” (as they have described it).

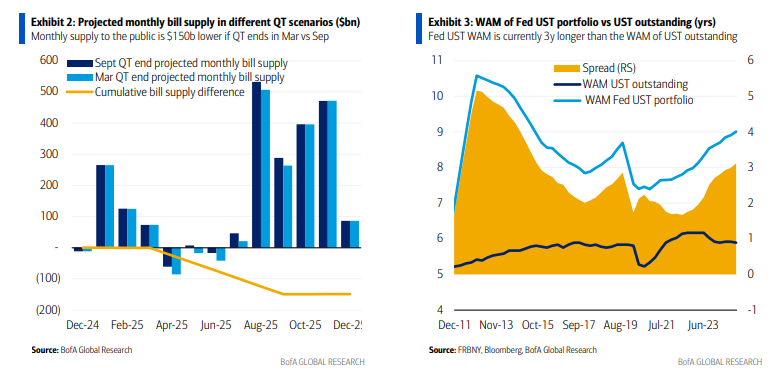

RRP last week fell back from the elevated month-end level the prior week but only -$29bn to +$136bn, keeping it over double the lows of the year ($63bn) which were the least since Apr ‘21. As noted previously, the higher RRP levels are a function of the Fed cutting its T-Bill issuance as it is up against the debt limit and so money markets need another home for their big balances.

Expectations are for RRP to continue to slowly build until the debt ceiling is raised (BOA sees it going to $585bn in July), at which time (when the debt ceiling is raised) it is predicted to drop quickly and force the end of QT (if it hasn’t already stopped as it expected to be announced at the March FOMC).

So, for now, liquidity is being injected into the system from the Treasury drawing down the TGA as a source of funds versus the markets (via T-Bill buying).

And as noted in previous weeks it appears the Fed has decided they’re not going to make the same mistake twice noting in the FOMC minutes this week that they were considering reducing or pausing QT. As the Jan Fed minutes are “managed” (i.e., not a verbatim transcript which we get years later but what the Fed wants to be communicated) this I think was a signal to the markets. BoA agrees, and they this week adjusted their call to QT pausing in March with an April implementation with “QT stop after debt limit (DL) resolution (most likely in July / August)”. They also see a return to QE in Q4.

The reason monitoring RRP is important is that once it’s gone (and the debt ceiling is raised) it’s expected to begin to pressure bank reserves (absent some other buyer shall as stablecoins which have been a buyer of T-Bills) to absorb any extra debt issuance, etc., that is not sold to foreign and domestic buyers unless/until the Fed pauses/stops QT (which actually may come soon).

That (stopping QT before it unduly pressures bank reserves) will be important as banks have been loathe to part with reserves beyond the $3tn level (which is where we saw indigestion in the credit markets in March ‘23 (which contributed to the banking issues (SVB, etc.)).

But for now with the Treasury drawing down the TGA, reserves remain comfortably above that stress level at $3.38bn, up marginally w/w through Wed due to the same factors driving up RRP levels (the lower T-Bill issuance from the Treasury due to the debt ceiling means there are fewer for banks to buy leading them to leave more on deposit with the Fed).

Overall, bank reserves are now above June 1, 2022 levels ($3.36tn), when the Fed started QT, but that will reverse quickly once the debt ceiling is lifted.

For background on various estimates of when reserves will be “too low” see the Feb 4th Week Ahead.

Getting back to rates, I said back in April 2-year Treasuries were a good buy at 5%, and as I noted once the Fed started its cutting cycle thereafter the ship has likely sailed on seeing those yields anytime soon (meaning years). In terms of 10-yr’s I had advised then grabbing some at 4.7% which I later had thought seemed like something we wouldn’t see anytime soon, but as I noted after the Dec FOMC with the Fed saying the ‘recalibration phase has ended’ along with concerns about sticky inflation cropping back up and now questions about the inflationary impact of some of Donald Trump’s policies, if inflation concerns resurface, we could get back there.

And we were well on our way until a more constructive than expected Powell at the Jan FOMC and comments from Treas Sec Bessent about his focus on keeping the 10yr yield low (and perhaps more importantly committing to the auction schedule set up by Sec Yellen for the next few quarters), started to exert pressure on 10yr yields which the recent growth scare has just added to, now seeing them trade down towards the lower end of my “2025 likely trading range of between 4.1 and 5%.”

I had said “the 2yr will likely not see a lot of movement unless we get some big movement in Fed rate cut (hike?) expectations,” and with projected cuts going from around one CPI day to now around three, that is starting to move lower as well, but I still think trades above where it should.

But in terms of much lower yields, as I said in September, we have probably seen the lows until we get a recession:

“while we didn’t quite see 3.5%, I think 3.6% is close enough, and I think we might have been at or near the lows at this point, particularly as the Fed has been raising their neutral rate estimate. If the endpoint for Fed Funds is around 3% (or higher) then it’s hard to see the 10yr trading much lower [than 3.5%] absent a recession. Similarly 2yrs at 3.6% seem to be very rich and almost certainly too low absent a recession consistent with my statement last week.”

For all the old “final hike” and “first cut” materials, you can reference the Feb 4th blog post.

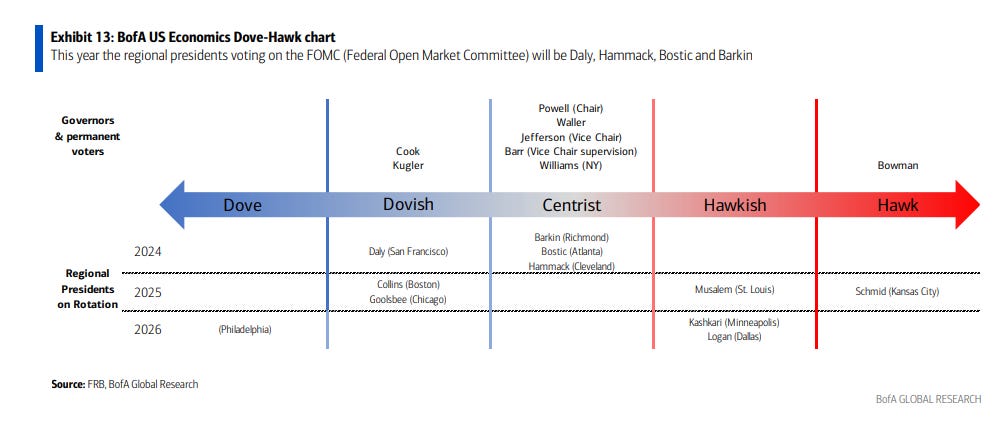

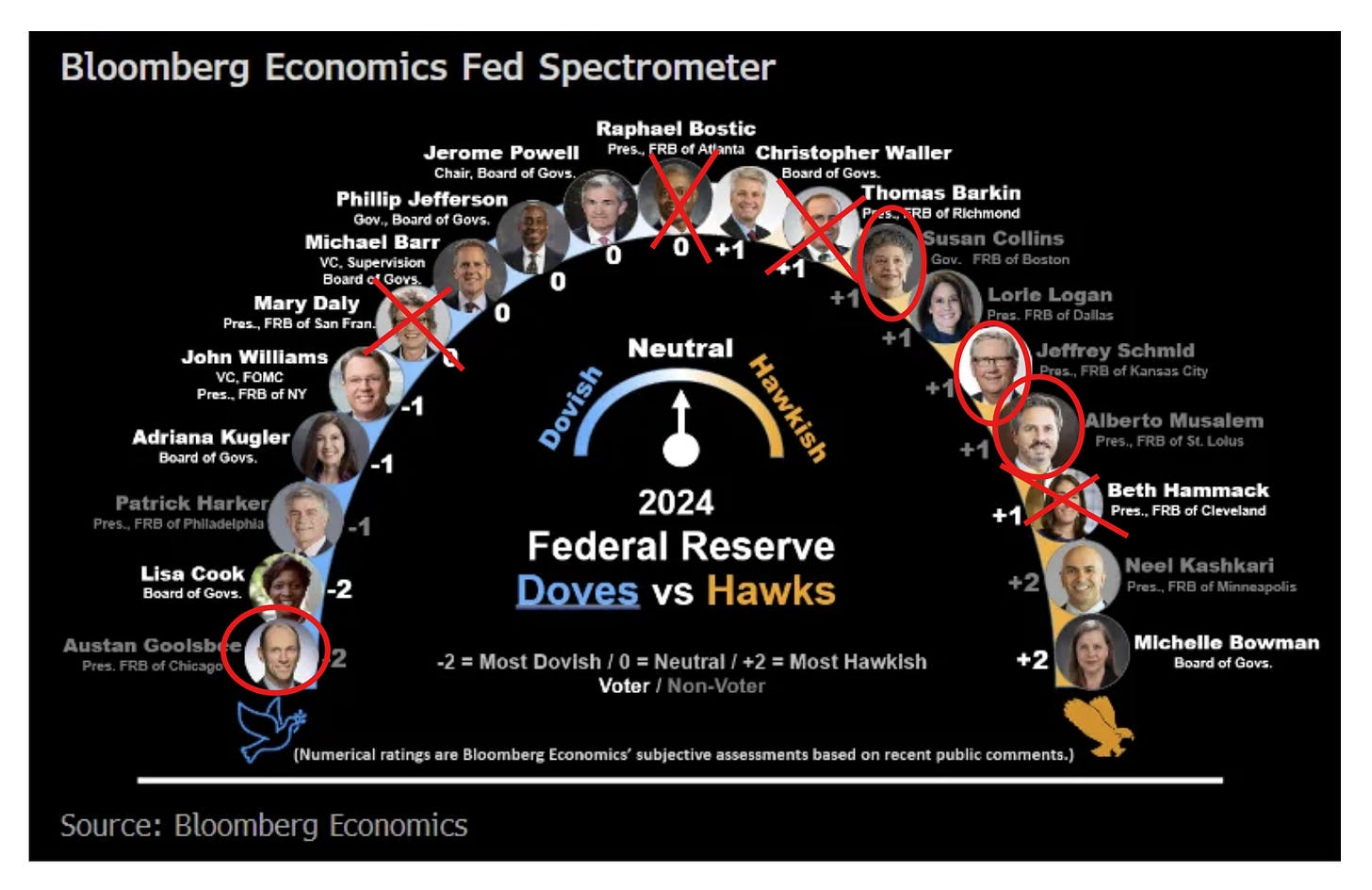

BoA updated their FOMC Dove-Hawk Chart. Note it’s missing Hammack in ‘26 (Cleveland and Chicago vote every 2 yrs), but otherwise looks right. Also note that Philadelphia Fed Pres' Harker’s term is up this year (which is why they don’t have a name for Philadelphia), something I didn't realize.

I think this now needs some dramatic changes with Hammack (who dissented voting for no cut in Dec) clearly one of the most hawkish members, Daly at best a Centrist as she sees only 2 cuts in 2025, and perhaps Collins as well. Goolsbee is clearly the most dovish of the members currently.

And I came across one from BBG. I think it’s pretty accurate except Kashkari is definitely not that hawkish (he was calling for a December cut in early November):

And here who is rotating off and on for 2025.

Earnings

As a reminder, I have removed most of the background material, which you can get in the Feb 4th blog post. As you know I’ve moved on to 4Q and beyond. You can reference this post from 12/1/24 for stats on 3Q.

As I noted last week:

This will be the last update on Q4 earnings, as they won’t change materially from here. I will continue to give up dates on 2025 and 2026 though as those come through.

I will though leave up the Q4 numbers for reference (in italics), but as noted I will continue to update 2025 and 2026 expectations as those evolve.

With 97% of SPX earnings in for Q4, Factset says 75% have beaten exp's (-1% w/w), below the 5-yr avg of 77% but equal to the 10-yr avg of 75%. Those beats though edged up to +7.5% above exp’s (from +7.3% two weeks ago) below the 5-yr avg of +8.5% but above the 10-yr avg of +6.7%.

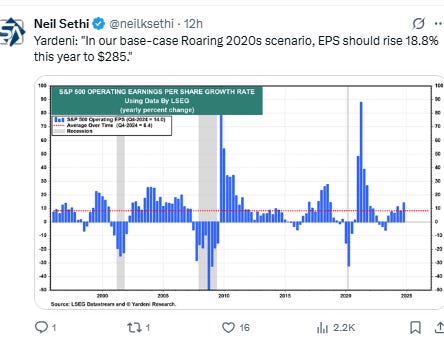

With the higher beat amount, earnings estimates were up to a blazing +18.2% growth (from +16.9% two weeks ago, up +6.5% the past seven weeks), up from +11.8% at the end of the 4th quarter. This is the most growth in three years and would mark the 6th consec quarter of earnings growth.

Cons Discr had the most surprises (13.2%), RE the least (1.5%).

As I’ve written each week, it’s normal for there to be a “beat” which sees actual earnings surpass estimates as of the end of the quarter (only 3 times in the past 40 quarters has that not happened (Q1 ‘20, Q3 ‘22, Q4 ‘22) according to Factset. The estimate at the start of the quarter was +11.7%, so that means we’re going to get a beat of +6.5%, better than the 10-yr avg of +5.4%, but worse than the 5-yr of +7.1%.

In terms of Q4 revenues, 63% of SPX reporters have beaten est's (+1% w/w), below the 5-yr avg of 69% and 10yr avg of 64%, and they are just +0.8% above est’s (-0.1% w/w) well below the 5-yr avg of +2.1% and 10yr avg of +1.4%. Still, Factset says SPX co’s are expected to see revenue growth of 5.3% y/y (unch w/w), up slightly from the +5.2% on Sept 30 and from +4.6% at the end of the 4th quarter. It marks the 17th consecutive quarter of revenue growth for the index.

In terms of profit margins, Factset says SPX co’s reported net profit margins of 12.6% for Q4 (+0.1% w/w), above the previous quarter’s net profit margin of 12.2%, the year-ago net profit margin of 11.3% and the 5-year average of 11.6%.

“Six sectors are reporting (or have reported) net profit margins in Q4 2024 that are above their 5-year averages, led by the Financials (19.5% vs. 16.6%) and Information Technology (26.7% vs. 24.0%) sectors.”

2025 quarter-by-quarter earnings continued to fall this past week according to Factset particularly for Q3.

Q1 ‘25 fell another -0.3% w/w +7.3% (-6.8% last 18 wks), Q2 ‘25 a tenth to +9.7% (-3.4% last 18 wks), Q3 down a big -2.2% to +12.1% (-3.1% the past 6 wks), while Q4 was unch at +11.6% (-5.0% in the past 6 wks).

Factset notes that the drop in Q1 earnings YTD of -3.7% is more than both the 5 yr & 10 yr avgs (-3.3 & -3.2% respectively). Every sector has seen its expectations cut led by materials.

Q1 revenue growth is now exp’d at +4.3%, down from 5.1% at the start of the year.

FY ‘24 earnings according to Factset will end over $242, representing +10.7% growth. It will end down just around -1.2% from July 1, 2023, much better than the typical -6% or so drop we historically see.

2025 earnings expectations fell back slightly to $271.20 (-$0.08 w/w, down ~-$2.88 the past five weeks), but the y/y growth rate (with 2024 earnings rising) fell more significantly to +11.6% (-0.5% w/w and down ~-5.2% since Sept 1st and -3.5% since Dec 31st).

Factset also notes that the -1% drop in FY 2025 earnings the first two months of the year is more than is typical in the past 5, 10, and 15 yrs (+0.1%, -0.6%, and -0.4% respectively), but less than the 20-yr average of -1.5%. Only financials hasn’t seen their expectations cut.

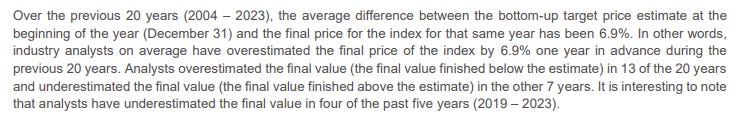

In terms of the earnings growth exp’d for 2025 Factset notes it will be a record, although also notes that there is on average over the past 25 yrs a -6.3% deterioration from where it starts the year ($275.05) w/analysts overestimating in 17 of those yrs (which would equate to $257.72 based on the average deterioration). But it should be noted that average includes 4 outlier years (2001, 2008, 2009 & 2020) where the overestimation was b/w 27-43% due to recessions. Excluding those, the difference is just -1.1% (which would equate to $272.02 (a little below where we are now)).

2025 revenues are expected to grow +5.4% down -0.3% since Dec 31st.

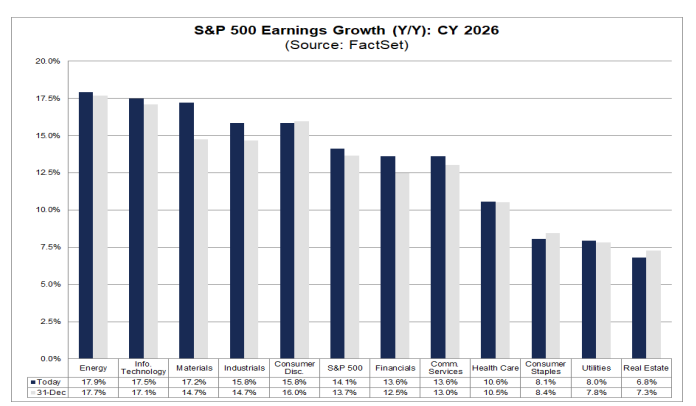

FWIW 2026 earnings are exp’d to grow 14.1% (up +0.1% w/w & +0.8% since Dec 31st).

In terms of how markets handled earnings beats & misses for 4Q, looking 2 days before to 2 days after an earnings release, Factset now says that beats have seen NO price change (+0.0%) compared to the 5yr avg of +1%, but misses are being punished slightly more than average at -2.6% vs 5yr avg of -2.3%.

Factset’s analysis of analyst bottom-up SPX price targets for the next 12 months as of Thursday was up +5pts w/w to 6,943 (which would be +21.0% from Thursday's close), now up ~2,010 points over the past 47 weeks.

Tech (+29.2% (up from +24.8% the prior week)) replaces Consumer Discr (+28.0% (but up from +24.7% the prior week) as the sector with the largest upside seen by analysts, while Consumer Staples remains as the sector expected to see the smallest price increase (+7.4% same as prior week).

As a reminder the last 20 yrs they have been on avg +6.3% too high, but note they underestimated it five of the past six years (including 2024).

In terms of analyst ratings, buy and hold ratings continue to dominate at 55.3% & 39.1% (from 55% & 39.1% respectively last wk (sell ratings fell to 5.6%)). That 55.3% in buy ratings though is down somewhat from 57.5% in Feb ‘22.

Energy (64%), Communication Services (63%), and Information Technology (62%) sectors have the highest percentages of Buy ratings, while Consumer Staples (41%) has the lowest percentage. Several sectors have 7% sell ratings (Cons Discr, Financials, Utilities, Industrials, Cons Staples).

And some other earnings stuff:

Economy

Over the past 2+ years part of my earnings optimism has been due to the economy holding up better than expected. While earnings only track the economy loosely (and markets look forward 6-12 months), there is a clear positive correlation between the economy and earnings (particularly a weak economy and weak earnings), and there is a very strong correlation between earnings and stock prices (although stock prices (being as noted forward looking) generally fall in advance of a recession and bottom 6-9 months before the end of one). So if you can see a recession coming it is quite helpful, although very difficult (especially ahead of the market). You can reference this Week Ahead (see the Economy section) for a lot of material on how every recession is preceded by talk of a “soft landing” as close as a month before the start. That report also has the notes about how small caps have shorter debt maturity profiles and more of it (debt).

As long time readers know the beginning of this section hasn’t changed much since I switched to the Week Ahead format in mid-2022, with the indicators to me during that period consistent with solid (which at times has been robust) economic growth, and I have been a broken record that I “certainly do not think we’re on the verge of a recession (although as noted above every recession starts out looking like just some economic softening).”

That said, as I’ve noted starting last month, the January data was much more mixed, but as I said last week

most of the weak data (outside of consumer confidence but particularly housing and spending data) can be explained by the unusually bad weather, particularly in the South which represents a huge amount of economic activity. And consistent with it being “mixed” data we saw strength in many areas such as labor markets, core capital goods orders (biz spending), exports (overshadowed by the surge in imports (which is not necessary a “bad” thing even as it drops GDP)), and personal incomes.

And as the February data is rolling in, it continues to be “mixed”. In that regard, last week, we saw weakness in the household survey from the NFP, auto sales, and in the S&P’s services PMI, but the ISM version was very solid, the manufacturing one remained in expansion, the payrolls survey was stronger (although remained heavily reliant on a few sectors) with, most importantly to me, aggregate take-home pay reaccelerating, and jobless claims remained low. Purchase mortgage applications also saw a healthy increase.

So while the picture is definitely more mixed, and there is almost certainly going to be further slowing in the economy given the uncertainty created by the volatility of economic policy from the Trump administration (it would be far more productive economically speaking for them to pick something and stick with it even it if caused short term dislocations), for now I don’t see any reason to change my overall takeaway on the economy from the start of October that “the situation continues to seem like manufacturing is subdued but trying to bottom [and perhaps “has bottomed” subject to economic policies], housing perhaps has inflected off the bottom, labor markets (and the services sector and construction in particular) remain for now solid with healthy wage growth, and productivity appears to remain robust (this can be a game changer in allowing the economy to expand without triggering inflation)…. I continue to feel that any softening does not appear to be morphing into a recession.”

And as I said at the start of September:

without question, the evidence is building that the days of >3% real GDP growth are behind us (although we got there in Q3), and we should be happy to settle into something more around trend (1-3% real (infl adjusted) growth). That though is far from a disaster. The important thing will be to see the softening level out (L-shape) rather than continue to fall turning the “soft landing” into a recession.

So far that’s what we’ve seen.

In line with my thinking that the data last week was on balance not bad, the Citi Economic Surprise Index rebounded last week +9.1pts to -7.4 from -16.5 Feb 28th, which was the weakest since September, still now -29.9 pts from the highs of the year (22.5) seven weeks ago (and still -50.7pts from the December highs (43.3)).

The 2024 high was 47.2 (in Feb) and the low -47.5 (in July).

https://yardeni.com/charts/citigroup-economic-surprise/

And GDP estimates are for now mostly consistent with a no recession call (again though remembering GDP going into recessions generally doesn’t look like one is coming (it was up around 2% in Q2 & Q3 2008 well after the recession had started)). After Q3 was revised up to 3.1%, Q4 decelerated but still above trend at 2.3%. While some Q1 trackers (most notably the Atlanta Fed’s) continue to be depressed due to the big jump in imports (which are subtracted from GDP as they are consumption produced elsewhere), that’s not really the same as a drop in exports (which were higher or spending or investment) so really isn’t consistent with a coming recession. Also,most of the other trackers though are clustered closer to 2% which is far from a terrible result.

Atlanta Fed (who was right in line in its 3Q & 4Q est’s of GDP (and just a tenth off for 2Q from the 1st est)), who saw its 1Q ‘25 GDP estimate drop -3.8% the prior week on the goods trade deficit (which we know should be faded) and then another -1.3% Monday to -2.8% gets a modest +0.4% improvement to -2.4% following the data since then (they list auto sales, services PMI, factory orders, trade balance, and wholesale inventories) on a further upgrade to nonresidential fixed investment (biz spending), which is now tracked to grow a very healthy 4.8% leading the GDP components (adding +0.55% to the GDP estimate), and personal consumption which though is only tracked to grow +0.4% (contribute +0.3%), which would be the least since the pandemic (Q2 ‘20) offset in part by a further downgrade to net exports.

BoA (who as a reminder was right on for 4Q GDP vs the 1st estimate and two tenths high for 3Q), dropped their 1Q tracking Friday morning (before NFP) four tenths to 1.9%, six tenths now below their “official forecast” of 2.5%.

NY Fed’s 1Q #GDP Nowcast (as a reminder, they had 2.56% for 4Q vs 2.3% 1st est (they were off a similar amount for 3Q)) fell back to 2.67% from 2.95% last week primarily on the employment reports (which subtracted -0.16%) and ISM manufacturing (-0.6%). Interestingly the trade balance resulted in a net addition of +0.03% (their model must have been assuming an even worse trade balance or is controlling somehow for the spike in imports).

As a reminder, the NY Fed’s model is dynamic and so adjusts in real time as data evolves, and “parameter revisions” subtracted -0.04%.

St. Louis Fed GDP tracker, which has often undershot actual real GDP since Q2 ‘22, but which was right on in Q1 & Q4 2024, jumped a full percent w/w to 2.49% from 1.49% the prior week (it unfortunately doesn’t give the inputs), a little below the NY Fed’s tracker.

Weekly Econ Index from the Dallas Fed (scaled as y/y rise for #GDP), which runs a week behind other GDP trackers, in the week through March 1st fell to 2.24% from 2.43% in the prior week (rev’d up from 2.37%) remaining towards the top of the 2024 range (1.49 - 2.66%) that it left only twice during 2024 but which it had been above again the last two weeks in January.

The 13-wk avg though continued its steady improvement now up to 2.51%, the best since 2022, evidencing overall economic momentum that is accelerating above trend, although the weekly read is now back below it.

https://www.dallasfed.org/research/wei

Other economy stuff:

Valuations

Like the other sections, I’ll just post current week items regarding the multiple. For the historical stuff, see the Feb 4th blog post.

With the declines in equities far outpacing the more marginal decline in 2025 earnings expectations, forward P/E’s fell back to the lows of the year (and in the case of the “Megacap-8” to the least since 2023).

-The SPX forward P/E down seven tenths to 20.8 (down -1.4pts the past three weeks). This chart has it the least since late 2024, but I’ve seen other charts that show the forward P/E the least since 1H 2024 and as low as Q3 2023.

-Mid-caps (S&P 400) fell six tenths to 15.0 also the least since late 2024 (down -2.1pt from the highest since early-’21 (17.1)).

-Small caps (S&P 600) fell four tenths to 14.9 as earnings expectations are being cut more significantly there still also the least since late 2024 (down -2.2pts from the highest since early-’21 (17.1)).

-Yardeni's “Megacap-8” (adds NFLX) P/E down for the sixth week in seven -1.1pts to 25.9, the least since last 2023. It’s now down -5.5 pts from the 31.5 it hit in 1H 2024 (which was the highest since Jan ‘22)).

https://yardeni.com/charts/stock-market-p-e-ratios/

Other valuation stuff:

Breadth

Breadth, which as I’ve noted in previous weeks has been weak continued to see some “green shoots” in terms of a rotation away from the Mag 7, etc., but the overall picture is pretty weak.

The McClellan Summation Index ("what the avg stock is doing") still heading lower after rolling over two weeks ago from a 2-mth high.

% of stocks over 200-DMAs fell to the lowest since Nov ‘23 last week.

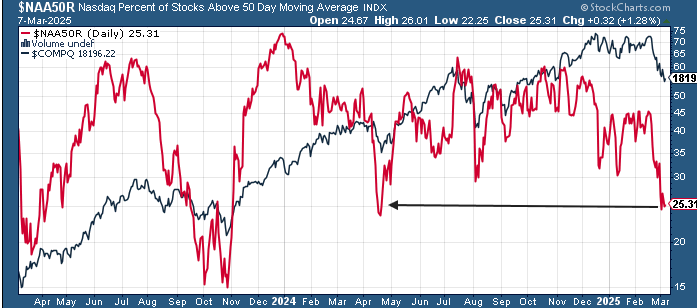

% of stocks above 50-DMAs has stabilized but at the lowest since mid-Jan for the NYSE but for the Nasdaq the least since August.

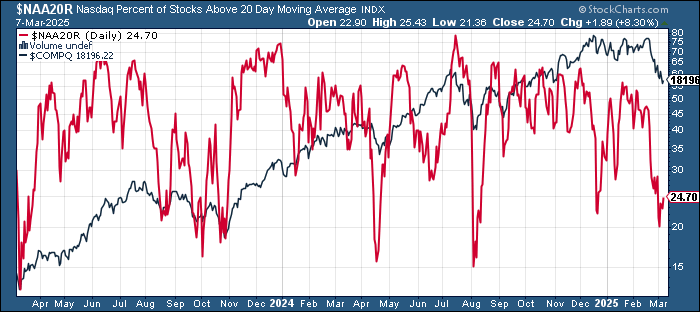

But in perhaps a positive sign, % of stocks above 20-DMAs rebounded to a 1-wk high on Friday after hitting the least since December for the NYSE and least since Aug for the Nasdaq.

Value/Growth continued its rebound from near the least since 2022 hitting the highest since late November.

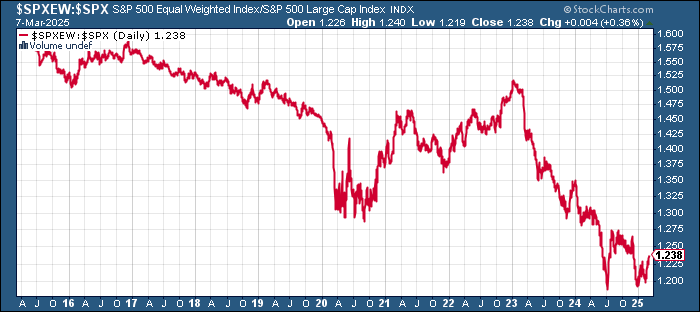

The equal-weighted SPX vs cap weighted ratio like value/growth continued its improvement from near the lowest since 2008 now the highest since early December.

Unlike value/growth or the equal-weight/cap weight ratios, IWM:SPY (small caps to large caps), continued to deteriorate, the lowest since 2000.

Sector breadth deteriorated last week with just one green sector (Health Care and up less than +0.2%) while every other sector was down at least -1%, with six down -2% or more, four over -3% and two -5%(!) (Cons Discr & Financials). That said the prior week seven were down -1%, three more than -4%, so suffice to say the selling has been heavy.

Defensives outperformed again (third week in a row) taking four of the top seven spots.

SPX sector flag showing the details from last week. More red this week, but still not a small number of green stocks sprinkled in. Again huge losses in many big names (NVDA, TSLA, JPM, WFC, C, BAC, MS, GS COST, NFLX, COP, BA, ISRG, ANET, INTC, NOW all down over -8%(!) (many double digits)). ORCL, AMZN, META, DIS, WMT, BKNG all down at least -6%, V, MA, PANW, HD, CRM all down around -5% or more.

Some positives in VZ, CMCSA, AMGN, MCD, GD, LMT, NOC, CL, MDLZ all up over 4%.

Other breadth stuff:

Flows/Positioning

Overall global flows from BoA (EPFR data): : $53.1bn to cash, $22.9bn to stocks, $12.0bn to bonds, $1.0bn to gold, $0.8bn from crypto.

Here were some notables.

• Gold: big $1.0bn inflow…largest 4-week inflow on record ($9.9bn – Chart 12);

• Crypto: $0.8bn outflow…largest 4-week outflow on record ($3.6bn – Chart 13);

• Treasuries: biggest outflow in 11 weeks ($1.2bn); • TIPS: longest streak of inflows (8 weeks) since Dec'21 ($0.4bn last week);

• Europe: largest inflow since Feb'22 ($4.1bn)…largest 4-week inflow since Aug'15 ($12.0bn – Chart 14);

• EM: largest inflow in 3 months ($2.4bn);

• Tech: 1st inflow in 5 weeks ($2.6bn);

• Infrastructure: largest outflow on record ($0.9bn – Chart 15).

ICI data on money market flows saw a +$51.2bn inflow in the week through March 5th (+$115.7 the past 2 wks), in line with the +$53.1bn inflow EPFR saw.

Institutional added +$20.8bn after +$47.2bn the prior week while retail added +$30.4bn after +$12bn each of the prior two weeks. In terms of totals, 60% of MMF’s are held by institutions, 40% retail. Total MMF assets are at a record $7.03tn.

https://www.ici.org/research/stats/mmf

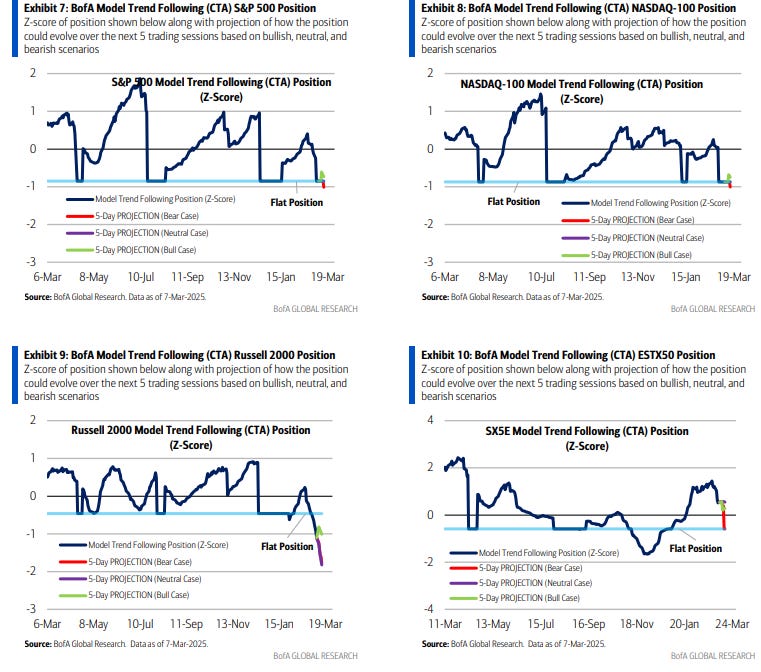

Looking at CTA (trend follower) US equity positioning, BoA says that according to their models “[t]hree straight weekly declines have left the NASDAQ-100 and S&P 500 near correction territory and by now we’d expect trend followers to have significantly reduced long positions in each. However, we don’t expect shorts at this point in either [ $SPX or $NDX] as CTAs tend to use moving average crosses (and not spot) to determine price trend. If so, then the one-month moving average would need to come in a bit more to cross below medium and longer-term moving averages. Should both indices decline further or stay at current levels, then we could see trend followers start building shorts in about a week’s time.”

So, it looks like we might get some relief from CTA selling in the upcoming week, but an inability to bounce this week could lead to more selling next week it seems. Of course, there's now much more room for buying if we can get a sufficient rally with positioning. It looks like they’re already short the RUT though, so the “base case” is that continues meaning likely more relative pain for small caps.

Price trend while weak across the board ex-Europe is now the strongest for the $NDX at 26% down from 48% last week while $SPX is down to 26% (from 49%), while the $RUT has fallen to -40% from -6%. #Japan’s #Nikkei225 also dropped to -19% from -4% while the Euro #Stoxx50 eased off last week’s 95% (and 99% the week before that) to 82%.

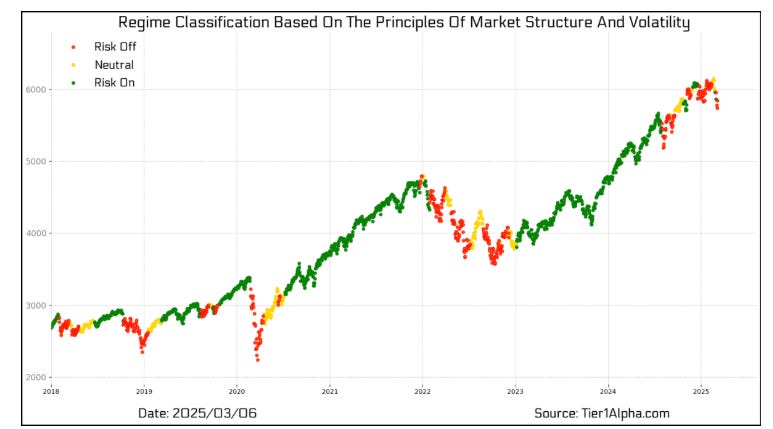

Tier 1 Alpha also sees systematic positioning down at the August lows “after a massive deleveraging from CTA strategies.”

In terms of gamma positioning, BoA says "SPX gamma has been minimal this week with a high of only $1.6bn and ending Thursday at +$0.2bn (7th 1y %ile). As it stands currently, the SPX gamma profile across spot levels is highly asymmetric owing largely to 1-week through 1-month options which are heavily skewed to the upside. The profile now suggests that if equities fall, then gamma may stay roughly flat. But if the S&P begins to rally, then gamma may slowly return (e.g., growing to ~$4bn near 6050). Given the volatility in markets, there is the potential for gamma to likewise change quickly due to new flows and/or large moves in spot.”

So like others BoA sees gamma very low (although not negative like many (although they rarely see it negative)), but at just the 7th%ile it provides basically no volatility dampening. Interestingly, though, they don’t see it changing much from here regardless of which direction the SPX goes until it gets over 5850 then it rebuilds rapidly.

Tier 1 Alpha who as of Wednesday also sees their Gamma Volatility Throttle Index remains deeply negative, but notes though "it could be worse. In fact, this is broadly true for realized volatility across the board, given we haven't actually seen a close break of the -2% mark so far during this decline as it's largest been a momentum event rather than a volatility event."

BoA sees risk parity funds continuing to push higher their (leveraged) overweight to bonds, adding some more to commodities which are at the highest since mid-2024, but leaving equities around the lows of the year.

#oott

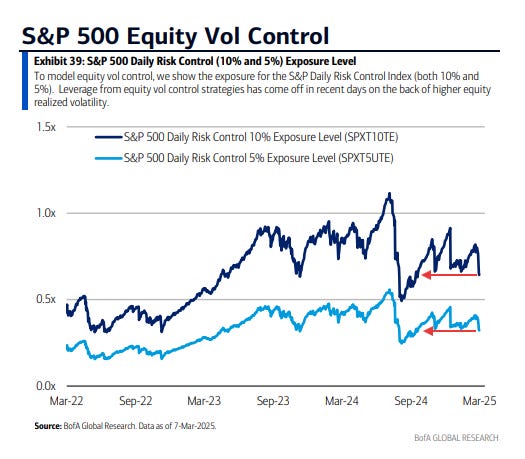

BoA agrees with other sources that, in line with the extreme volatility in equities the past couple of weeks, vol control (volatility targeting funds) continued to see selling taking their exposure to the least since August. Unsurprisingly given that only one session last week (Friday) saw a move under 1% they see it continuing in the upcoming week.

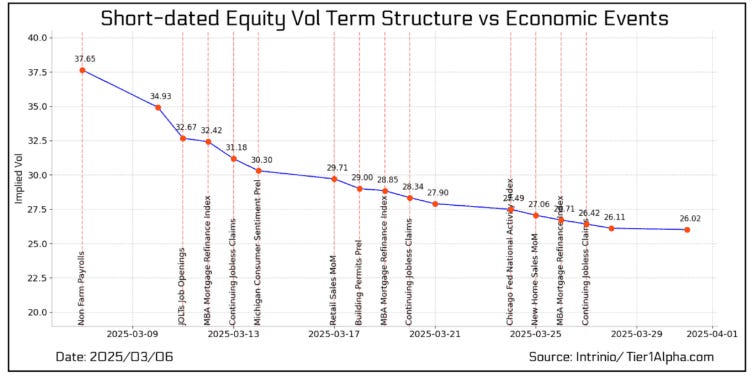

But Tier 1 Alpha says with the volatility event curve downward sloping and without “a significant increase in hedging activity [following the Friday jobs report”, there is a strong possibility that implied volatility will start to soften…next week, which should provide support for equities now that one more source of uncertainty is behind us.”

That said, their “strategic allocation model remains firmly in a Risk stance, so we plan to stay defensive until volatility shows a clear and lasting decline, but all else being equal, this could be the clearing event needed for markets to finally find some grounding.”

And I like to look at the notional value in leveraged ETF’s as a barometer of risk appetite. BoA says they hit the lowest since December and August for the SPX & NDX respectively before rebounding some end of week.

Leveraged ETF AUM in NVDA (the largest single-stock w/leveraged ETFs) also fell last week to the lowest of the year while TSLA (the second largest) fell to the least since around October.

And after buybacks ended 2024 at a record, BoA says they’ve started off the year even better (and Goldman sees the same) although last week they decelerated a bit.

And some other notes on positioning:

Sentiment

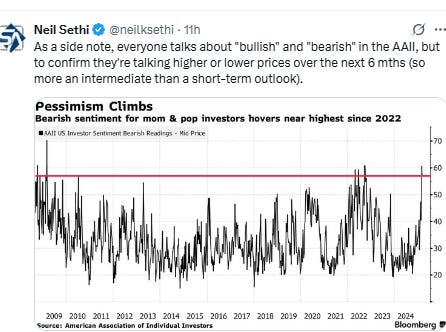

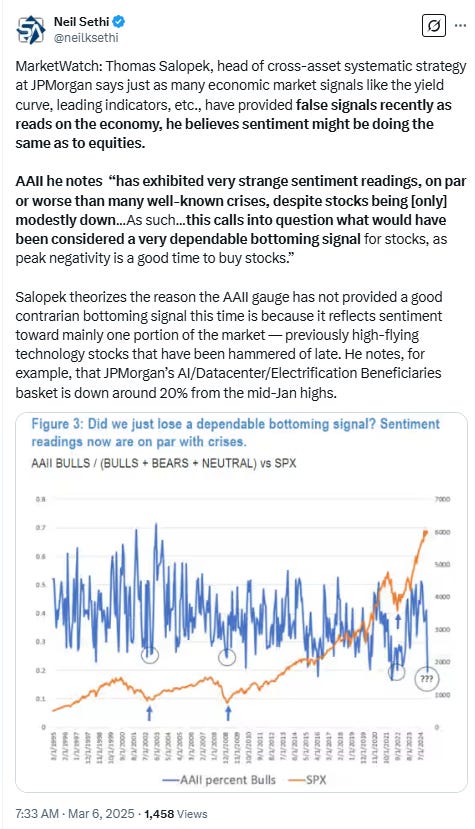

Sentiment (which I treat separately from positioning) is one of those things that is generally positive for equities when its above average (“it takes bulls to have a bull market”, etc.) but not extreme and when it’s at extreme lows. Sentiment measures were mixed again this week but generally again saw deterioration or those that were already very bearish (like the AAII survey and CNN Fear and Greed Index) remaining so. But it remains far from universal.

The 10-DMA of the equity put/call ratio (black/red line), after plummeting at the end of January to the lowest since July (which was the least since Apr ‘22), has since rebounded to the highest since Sept, consistent with investors continuing to start to look more seriously for downside protection but still well below “panic” levels.

When it’s increasing it normally equates to a consolidation in equities and increase in volatility and vice versa.

CNN Fear & Greed Index at one point last week fell to 17 which was the joint lowest since Oct ‘22 before rebounding slightly to 20 (so unch w/w), still remaining in “Extreme Fear”. As noted earlier, the last two times readings hit this level we saw bottoms in the SPX (although the Oct ‘22 one “double tapped” (up and then back down at a higher low). The index was at 73 (“Greed”) a year ago. Every component in Extreme Fear but junk bond demand.

Looking at the components:

Extreme Greed = junk bond demand (from Fear).

Greed =None

Neutral = None

Fear = None

Extreme Fear = market momentum (SPX vs 125-DMA); stock price strength (net new 52-week highs); stock price breadth (McClellan Volume Summation Index (from Fear) safe haven demand (20-day difference in stock/bond returns); 5-day put/call options; market volatility (VIX & its 50-DMA) (from Neutral)

https://www.cnn.com/markets/fear-and-greed

BofA’s Bull & Bear Indicator (a global metric), didn’t improve for the 1st time in 9 wks, remaining at 5.4 ("Neutral"), up 2.2pts from the 3.2 hit nine weeks ago which was nearly a 1-yr low, “as improving global stock index breath and inflows to risky assets (EM & HY) are offset by hedge funds increasing downside protection for S&P 500, US dollar, WTI oil.”

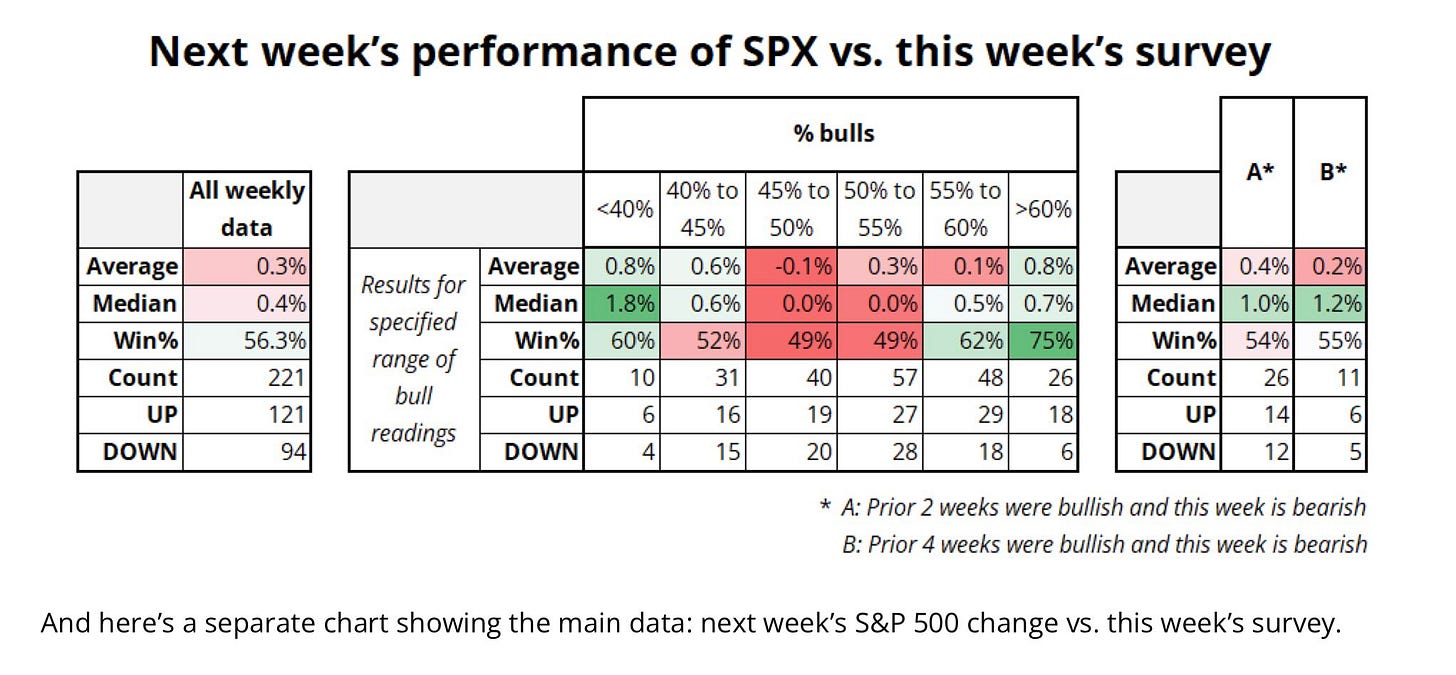

Helene Meisler's followers remain bullish for the 3rd wk in 4 with 62.7% voting next 100pts up, from 59.3% the prior week.

An analysis done by SPYSTSignals last month shows that <45% and >60% results have led to better than median returns in the SPX, although that hasn't panned out so far this year. Hopefully we get it this week. Median is +0.7% w/75% hit rate.

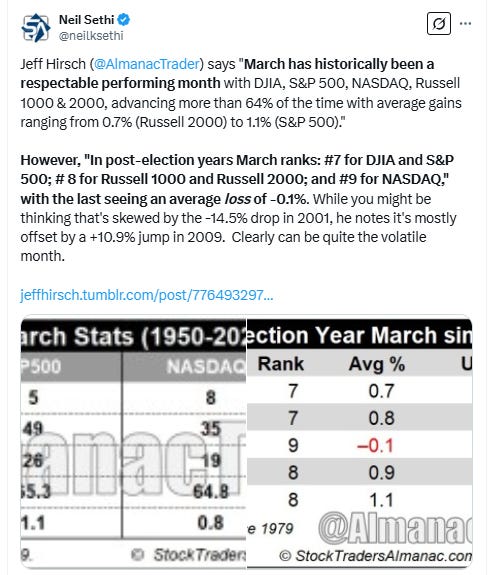

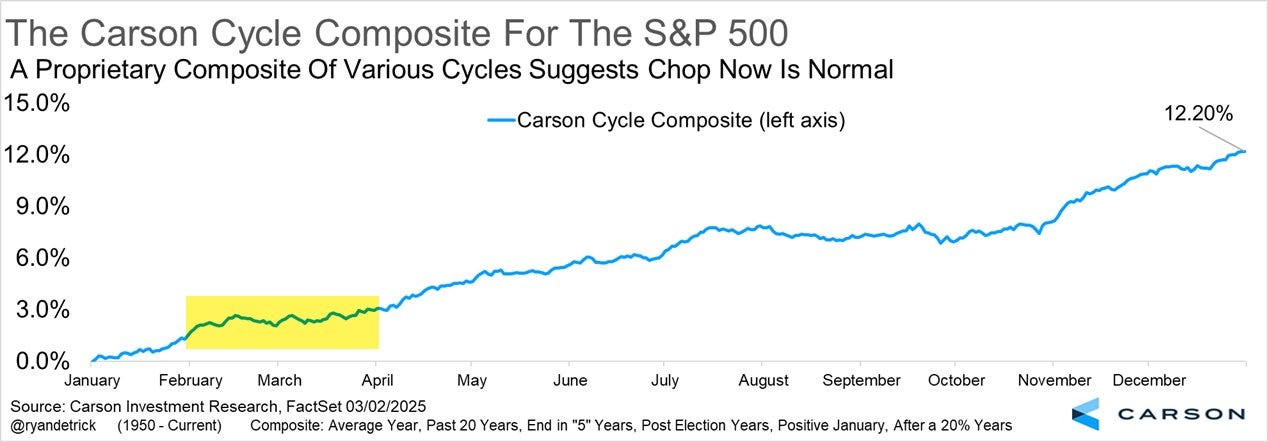

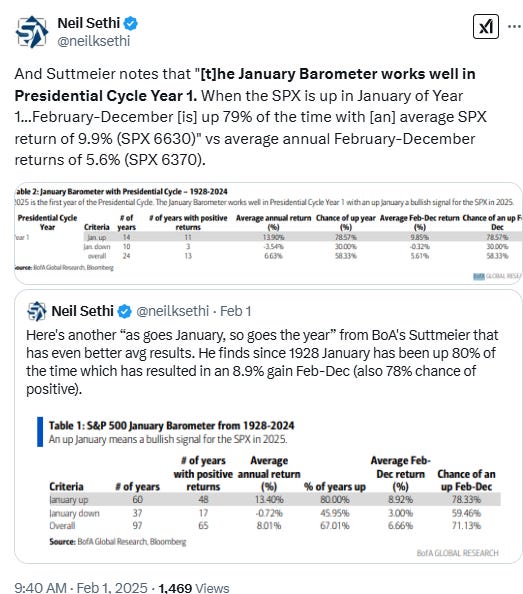

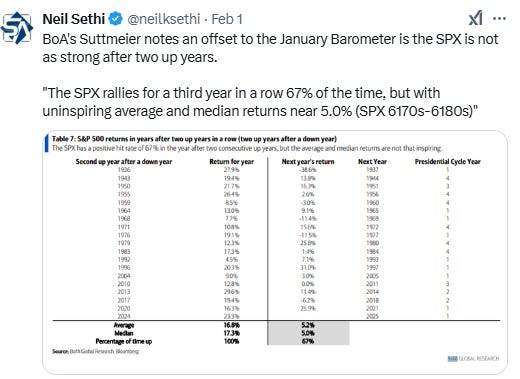

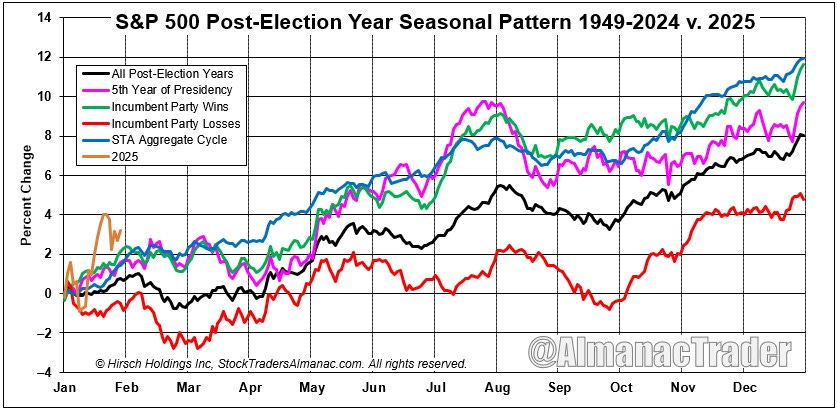

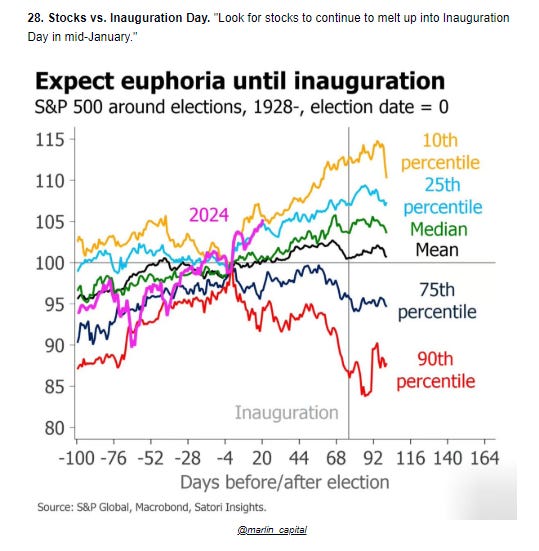

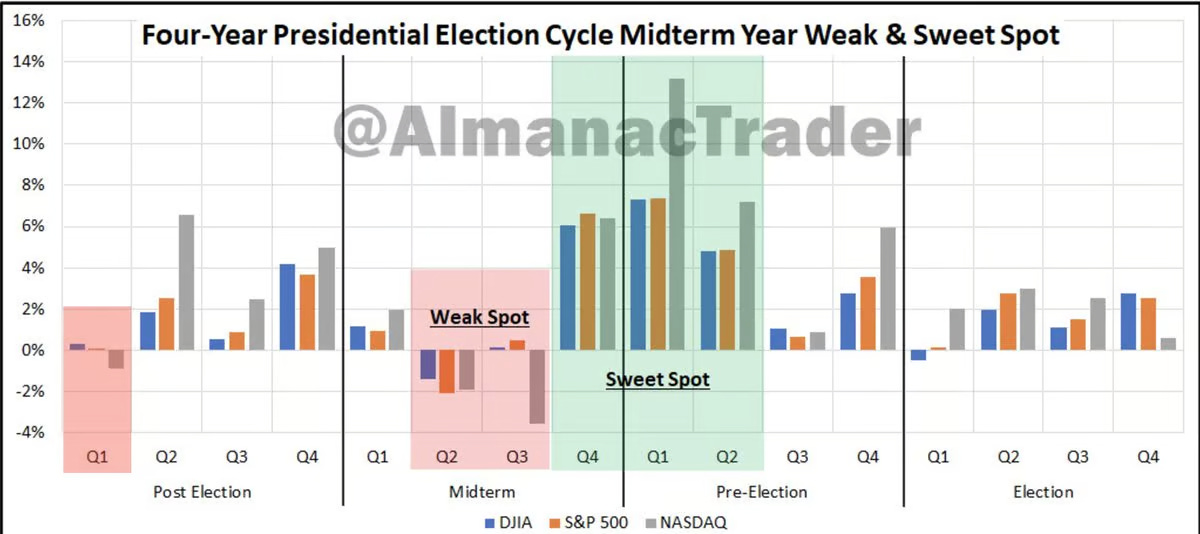

Seasonality

As noted last week, March is typically very good, particularly the first half. In fact since 1950 it’s the second best half month, although as the Almanac Trader noted, the month overall is not quite so strong in Pres Yr 1s. Also, the second half is weaker than the first half, particularly over the last 10 years where mid-March through mid-April have been down on average. So this week seasonality is ok, but moving into the end of the month not as much (which coincides with the start of the buyback blackout window).

Of course, as always remember that seasonality is like climate. It gives you an idea of what generally happens, but it is not something to base your decision on whether to bring an umbrella (as the Santa Rally showed us).

And as we consider seasonality, a really nice post from Callie Cox about how you need to take historical analogies w/a grain of salt (unless you've dug into the history). Her chart on Presidential election yr performance w/ & w/o 2008 (when the SPX was -17% in Oct) is a wonderful example.

https://www.optimisticallie.com/p/a-history-lesson

Final Thoughts

I noted at the start of the year,

As we turn the page into the new year, we’re presented with a very different backdrop than what we saw for much of 2024 when the Fed was moving from hiking to cutting, bond yields were falling, seasonality was mostly favorable, systematic positioning was mostly a tailwind, political risk was low, valuations had room to grow, liquidity was very robust, the economy was firing on all cylinders, volatility (until early August) was more subdued, earnings were rebounding, etc.

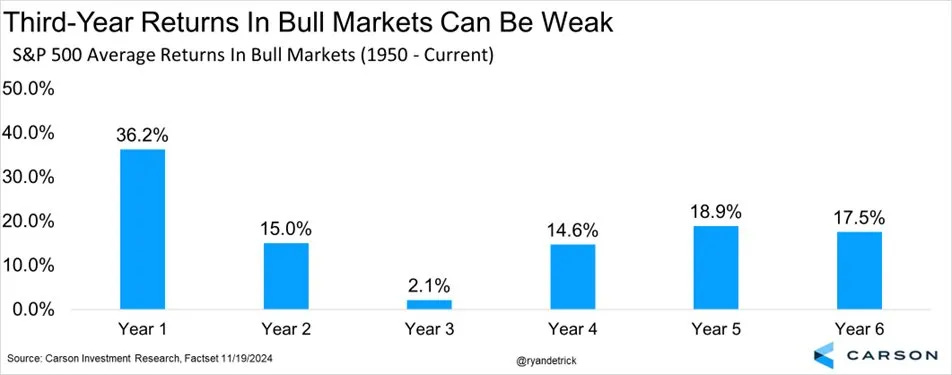

Now we’re in what is historically a more challenging year (1st year of a Presidential term and 3rd year of a bull market following two 20% years) with valuations well above where we started 2024, high expectations (judging from analyst SPX forecasts), higher volatility and political risk…higher bond yields (particularly real yields), a Fed talking more about fewer than more cuts and continuing to drain liquidity that is now hitting levels we’ve run into issues in the past, high earnings expectations, etc.

It doesn’t mean that we can’t have a good or even a great year. Balance sheets remain very solid as does the economy and labor markets (even if slowing), earnings are expected to be very good, buybacks are expected to be a continued tailwind, there’s a lot of scope for the Fed to become less hawkish, the upcoming administration may provide big tailwinds in tax cuts, deregulation, etc., etc. But we need to see at least some of those come through, and disappointments are not going to be welcomed given the set-up, so my expectation is for choppier markets more like we’ve seen since October than what we saw before.

And “choppier markets” is definitely what we’ve seen. Each week since the end of January seems full of news events, economic data, etc., that have injected a lot of uncertainty which is anathema to markets. They have responded as such. Added to that, we have seen some weakening in economic data which has resulted in the “growth scare” I indicated might be a possibility in January. Not helping things has been the Trump administration talking about a “detox period” and “short-term pain”. All of this has seen volatility move higher (which equals selling from volatility targeting funds as discussed above) and while systematic positioning was not extreme coming into the year, it was plenty long, and that has come off in a hurry the last couple of weeks (which is the biggest reason for the recent drawdown), although it appears that might be reaching a “pause point” needing further declines or volatility before paring positions further. Retail has likely also now started to sell, but those flows are relatively small compared to institutional.

The good news is that the economy remains in better shape than many give it credit for I think (even as some warning flags are forming), the selloff has brought valuations down, buybacks continue (at least for next week) to be robust, breadth seems to be expanding (at least as to sectors (small caps remain unloved) but it should be remembered that to extent it’s a rotation away from the largest stocks it will be a headwind for the market-cap indices), and the Fed remains on balance tilted towards rate cuts at some point (even if solidly on hold currently). Seasonality is mixed for the upcoming week, while sentiment is pretty bearish.

So given all of that, it’s hard to say where we go from here in the short term (or for that matter the intermediate term). There’s lots of good reasons we should bounce, but that doesn’t mean we will. And if we do, there’s at least a 50/50 chance we come right back down and test these levels again. So, in short, any guess I would have on the upcoming week (or two or three) would be just that at this point.

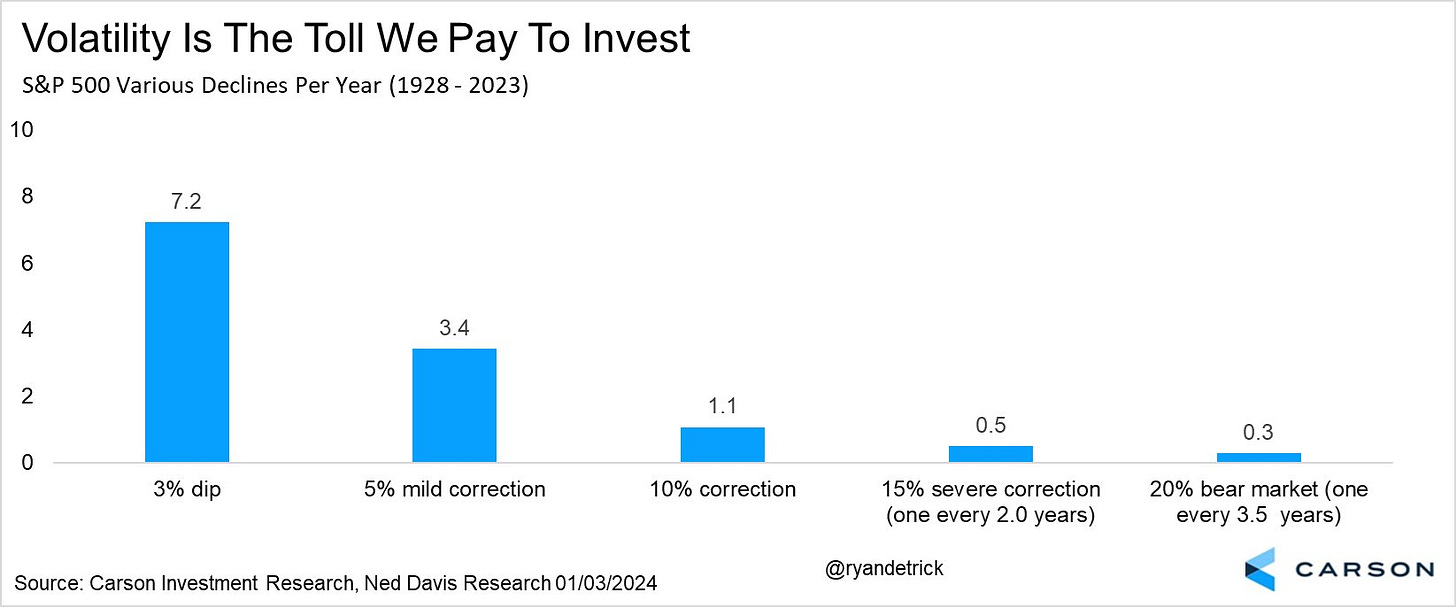

But in the long term, as always just remember pullbacks/corrections/bear markets are just part of the plan.

Portfolio Notes

I’ve decided to clean up the portfolio, trying to take it down to 50 (or hopefully fewer) positions to force me to stick with only my highest convictions (and make life simpler). I’ve had mixed success so far.

Sold out of RTX, ANET, W, ALB, EA, KEY, ON, , Trimmed TFC, AN,CFG, KIM, SNY, MAC, VFC, SNY, TCEHY, JWN, BBVA, ING, HD, CVX, SAN, NVDA, PYPL, BWA

Bought ARCC, OWL, AMZN, LMT, C, XOM, PLTR, EWJ, ET,

Cash = 25% (held mostly in SGOV & BOXX (BOXX mimics SGOV but no dividend, all capital appreciation so get long term capital gains if you hold for a year)

Bonds/Fixed Income (like MINT, SHY, etc.) = 20%

Positions (after around the top 20 I don’t keep track of their order on a frequent basis as they’re all less than 0.5% of my portfolio).

Core positions (each 5% or more of portfolio (first 2 around 10% each, total around 25%) Note the core of my portfolio is energy infrastructure, specifically petroleum focused pipelines (weighted towards MLP’s due to the tax advantages). If you want to know more about reasons to own pipeline companies here are a couple of starter articles, but I’m happy to answer questions or steer you in the right direction. https://finance.yahoo.com/news/pipeline-stocks-101-investor-guide-000940473.html; https://www.globalxetfs.com/energy-mlp-insights-u-s-midstream-pipelines-are-still-attractive-and-can-benefit-from-global-catalysts/)

EPD, ET, PAA, SHY, MINT

Secondary core positions (each at least 2% of portfolio)

ENB

For the rest I’ll split based on how I think about them (these are all less than 2% of the portfolio each)

High quality, high conviction (long term), roughly in order of sizing

ENB, CTRA, GILD, GOOGL, PYPL, SCHW, PFE, ARCC, AM, TRP, T, XOM, SHEL, JWN, CVS, TLH, FSK, TFC, NTR, GSK, EQNR, CMCSA, TLT, APA, DVN, OXY, RRC, JWN, RHHBY, E, ING, VZ, OWL, VSS, VNOM, SLB, MPLX, BTI, KMI, VOD, CVX, ING, O, KHC, ADNT, STLA, NEM, CCJ, HBAN, VICI, DGS, ADNT, WES, MPLX, CVE, BAYRY, SOFI, BEP, SAN, UPS, TEF, SCHD, KVUE, KT, KIM, F, MAC, GPN, LYG, ORCC, LVMUY, EMN, NVDA, BCE, OCSL, AES, BWA, GBDC, PLTR, SNOW, BAC, SIG, BUD, VALE, BAX, PZZA, STZ, C, BHP, RIO, MRVL, LMT

High quality, less conviction due to valuation

Higher risk due to business or sector issues; own due to depressed valuation or long term growth potential (secular tailwinds), but at this point I am looking to scale out of these names on strength. These are generally smaller positions.

FXI, LADR, AGNC, BBWI, URNM, URA, STWD, PARA, CFG, YUMC, ORAN, KSS, CHWY, ILMN, TIGO, TCNNF, TCEHY, JD, WBA, ACCO, KVUE, KLG, CLB, HBI, IBIT, UNG, EEMV, SABR, NSANY, VNQI, ST, SLV, WBD, BNS, EWS, IJS, NOK, SIL, CURLF, WVFC, VTRS, NYCB, ABEV, PEAK, LBTYK, RBGLY, LAC, CMP, CZR, , LAC, EWZ, CPER, MBUU, HRTX, MSOS, SIRI, M, CE,

Note: CQP, EPD, ET, MPLX, PAA, WES all issue K-1s (PAGP is the same as PAA but with a 1099).

Reminder: I am generally a long term investor (12+ month horizon) but about 20% of my portfolio is more short term oriented (just looking for a retracement of a big move for example). This is probably a little more given the current environment. I do like to get paid while I wait though so I am a sucker for a good well supported dividend. I also supplement that with selling calls and puts. When I sell a stock, I almost always use a 1-2% trailstop. If you don’t know what that is, you can look it up on investopedia. But that allows me to continue to participate in a move if it just keeps going. Sometimes those don’t sell for days. When I sell calls or puts I go out 30-60 days and look to buy back at half price. Rather than monitor them I just put in a GTC order at the half price mark.

To subscribe to these summaries, click below (it’s free).

To invite others to check it out,