The Week Ahead - 12/28/25

A comprehensive look at the upcoming week for US economics, equities and fixed income

If you're a new reader or maybe one who doesn’t make it to the end feel free to take a second to subscribe now. It’s free!

Or please take a moment to invite others who might be interested to check it out.

Please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

As a reminder, some things I leave in from prior weeks for reference purposes, because it’s in-between updates, it provides background information, etc.. Anything not updated this week is in italics. As always apologize for typos, errors, etc., as there’s a lot here, and I don’t really have time to do a thorough double-check.

For new subscribers, this is a relatively long post. The intent is to cover the same areas each week. Sometimes the various areas are more interesting, sometimes less, but it’s easier just to go through them all, so you can expect this format (with things in the same places) each week.

The main sections are intended to cover 1) what’s upcoming next week, 2) what the Fed and rates markets are up to, 3) what’s going on with earnings (which along with valuations and positioning are the determinants to stock prices over the long term), 4) what’s going on with the economy (both because of its impact on our daily lives (I am a business investor in my “real” job) but also because it impacts earnings), 5) valuations, 6) breadth (which gets into sector/style performance), 7) positioning/flows (this is the most important determinant to asset price changes in the short term), 8) sentiment (really only matters at extremes but interesting to track), 9) seasonality (gives you an idea of what normally happens), 10) “Final Thoughts” (remember you get what you pay for there, and it’s the last thing I do, so it often is a bit rushed), and 11) my portfolio (to be transparent about where my money is in the market (but note first it is most definitely not intended as financial advice, and second as I mentioned earlier my main job (and investing assets) are in private industries (RE & venture capital)) so my portfolio is built with that in mind (i.e., it’s not how I pay the day-to-day bills) plus see note about MLP’s in that section).

The Week Ahead

As noted last week we’re in that time of year when weekly previews get more and more scarce until we flip the calendar into next year, so there will be fewer updates again this week than is typical (remember, anything in italics is old material that is left in). In that regard, news flow and trading volumes will again likely be very light next week as well (with Thursday a holiday).

And that goes for the US with another very light week (although we will have an extra half-session as New Year’s Eve is a full trading day (as is Jan 2nd)). New Year’s Day of course is a full global holiday.

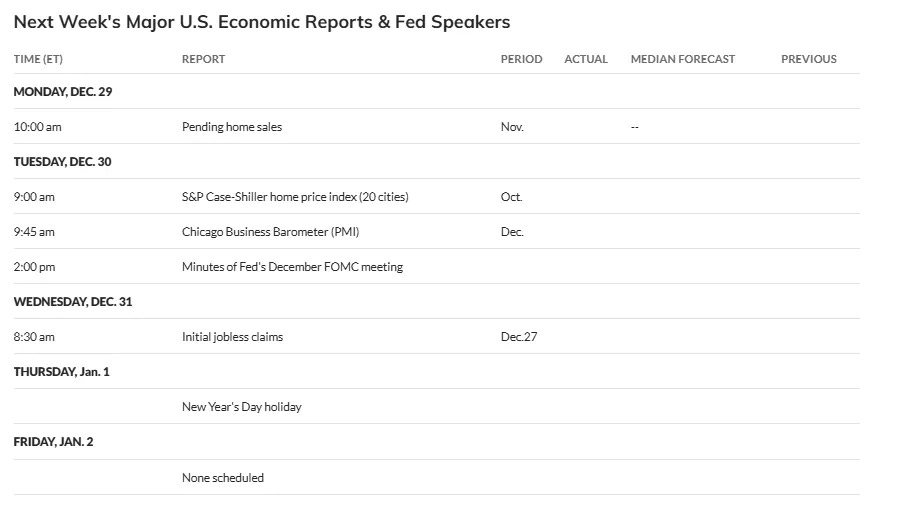

There is some US economic data though in Dec final manufacturing PMI from S&P Global (Fri, not listed; ISM though will be Jan 5th), Nov pending home sales, Oct repeat home price indices plus weekly jobless claims (Wed due to the holiday), ADP employment change, mortgage applications, and EIA petroleum inventories.

No Fed speakers on the calendar, but there could be media interviews. More importantly, we’ll get the FOMC minutes from the Dec meeting which may shed some light on where the committee’s collective mind is around the expected path for rates in 2026.

Non-Bill Treasury auctions (>1yr in duration) are done for the year.

As are SPX earnings (done for the year).

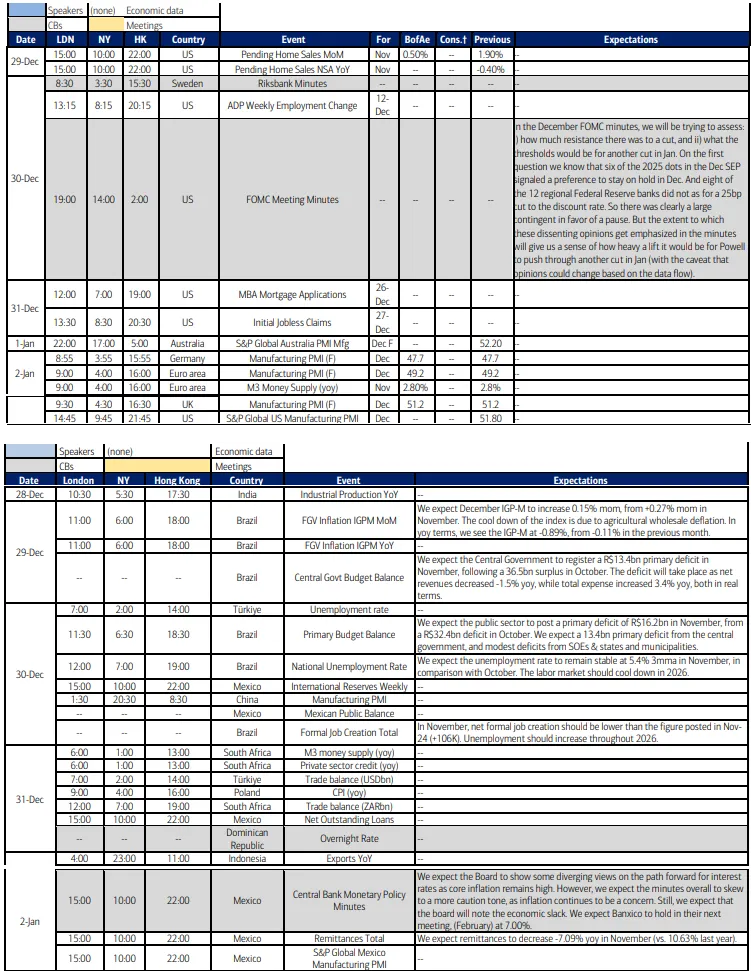

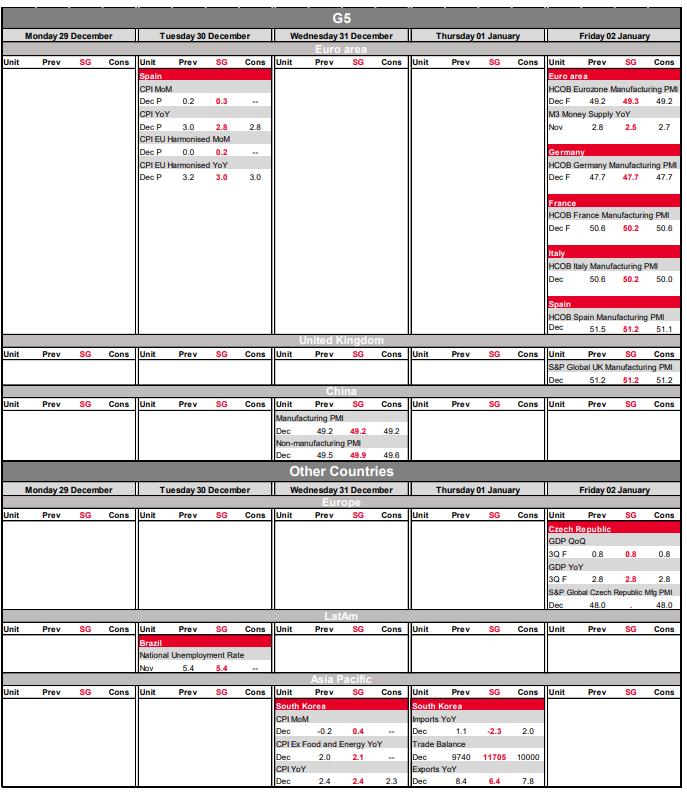

Ex-US it looks like BBG didn’t do their normal international update again this week, but based on the calendars below from BoA and SocGen it appears that there’s not much going on in DM next week, with the highlight the final manufacturing PMIs. A little more in EM with some inflation, employment, and economic production reports.

BoA’s cheat sheet for the upcoming week.

International calendar from SocGen:

Market Drivers

So let’s go through the list of items that I think are most important to the direction of equity markets:

Fed/Bonds

As noted previously this was one of the sections that had grown unwieldy, so I’ve really pared it down (I know, it’s still really long). Given I provide daily updates on Fed expectations, Fedspeak, and analyst thoughts on the Fed, it’s duplicative (and time consuming) to regather it all, so, again, I encourage you to look at those (the daily posts) for updates. I will just give more of a quick summary.

I’ve taken out the background information from how we got to where we were from the start of the year through the end of March, but if you’re interested you can find that in this section from the March 23rd update. And I had left in the background from March the August as I had said it was “still relevant in terms of ‘how we got here,’ and it reflects the continued slow evolution of the Fed away from worries about tariff impacts on inflation towards the need for rate cuts (remembering that absent those tariff worries the Fed would already be cutting at this point).” But I had “[a]t some point the hawks will become less hawkish and then I’ll reset all of this…. Powell this week could seal the pivot, but remains to be seen.” Well that’s exactly what Powell did, so if you’d like that background, you can find it at the August 17th update. In addition, I have taken out the “next phase” in the Fed’s evolution (from the August meeting leading up to the October meeting). You can find that material at the October 19th update.

With the relatively light data and and Fed speaking schedule there’s not to update, but we’ll be getting the FOMC minutes this week which I’m go over in the Wednesday update and again next Sunday. The biggest piece of economic data we got was the 3Q GDP data which confirms what Powell and other Fed members have already acknowledged which is we went into the shutdown on relatively strong footing. It’s what has happened since that they are more concerned with and that data has been more mixed (but on balance still showing underlying economic strength).

I noted last week that “notably the SEP showed only one Fed member with unemployment above 4.5% next year. With it almost rounding up to that in Sept, we could be at 4.6% in no time, which would open the door to more cuts.” And it wasn’t even a week, and here we are (with a rounded 4.6% in the Nov household report). This clearly gives more ammunition to the doves (as does the highly questionable but very constructive if taken at face value CPI report).

That said, we seem to be at a place where Fed members are seeing what they want to see in the data, with the hawks discounting the NFP and CPI (and most all reports that aren’t hawkish) due to what are likely distortions, and the doves not pressing their case too strongly for the same reason (and after they got their way in December). So at this point it seems everyone, whether hawks of doves, are waiting to see what comes out in January (December data) which it is hoped will be less distorted. Here’s hoping.

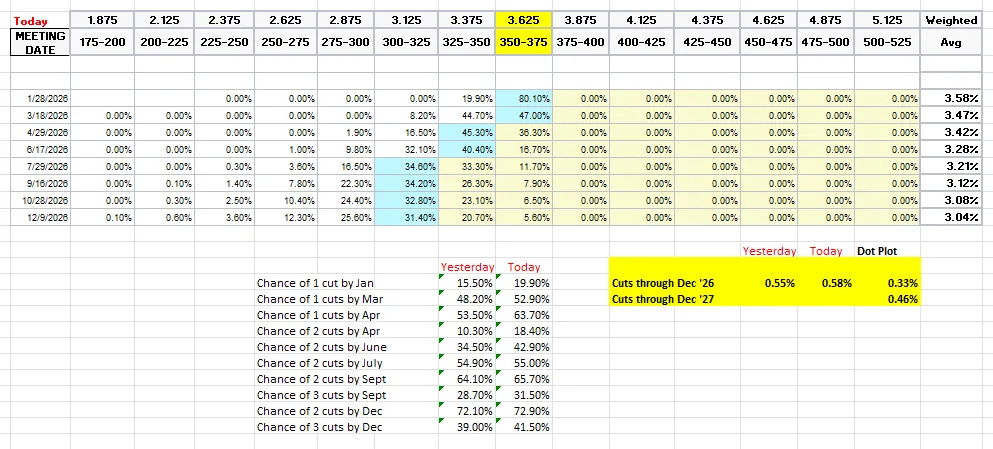

We did see 2026 rate cut expectations fall to the least since pre-Dec FOMC after the strong GDP report but they recovered some of that the rest of the week. So for now markets continue to see little chance of a Jan cut but 2 (maybe 3) more cuts next year, with one around March/April and one July/Sept (and potentially a third in December).

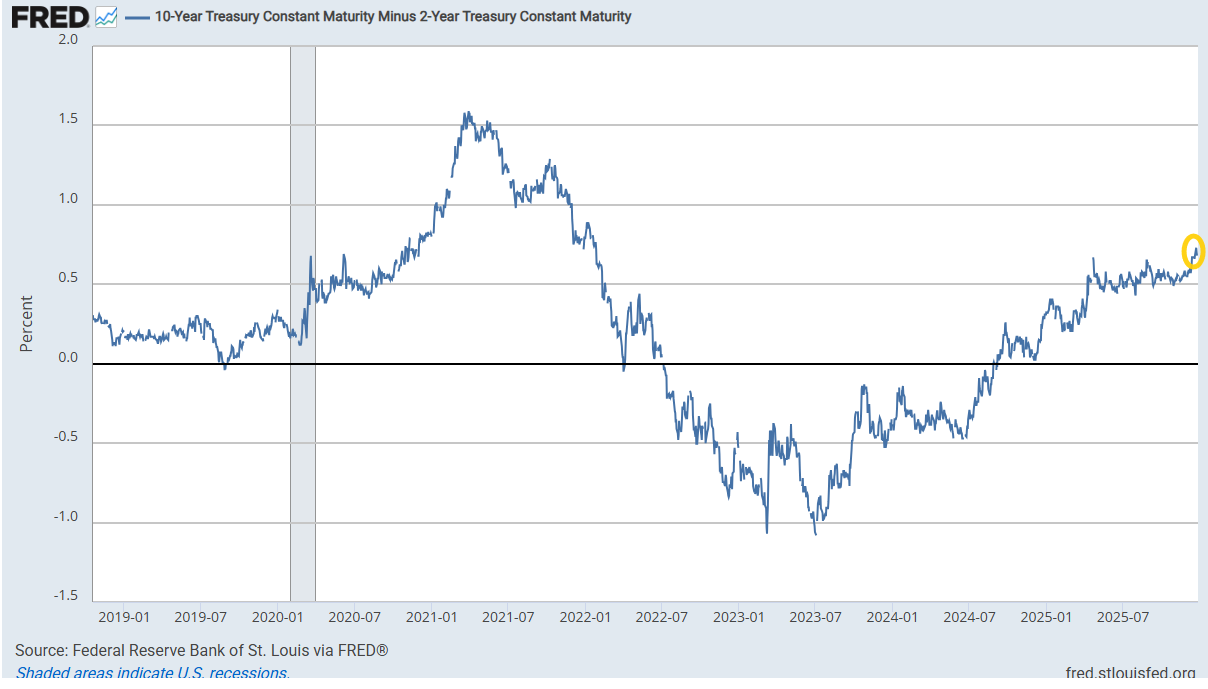

The 2/10 Treasury spread pushed up to +0.73% on Monday the highest since Jan ‘22 before falling back to +0.68% the same level as the prior Friday.

As a reminder, historically when the 2/10 curve uninverts following a long period of inversion the economy is either in a recession or within a few months of one. It uninverted in Sept, so I had said this looks officially like a “this time is different” situation as we’re now over a year. Anything that has a lead time that long is not really useful.

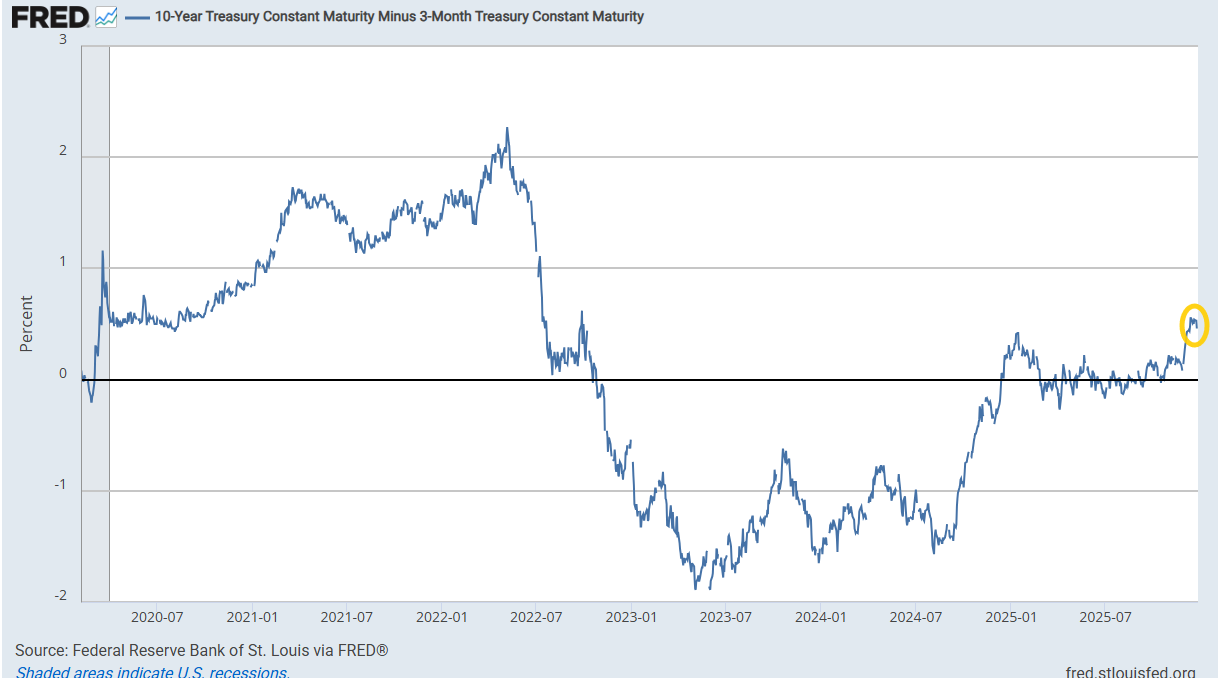

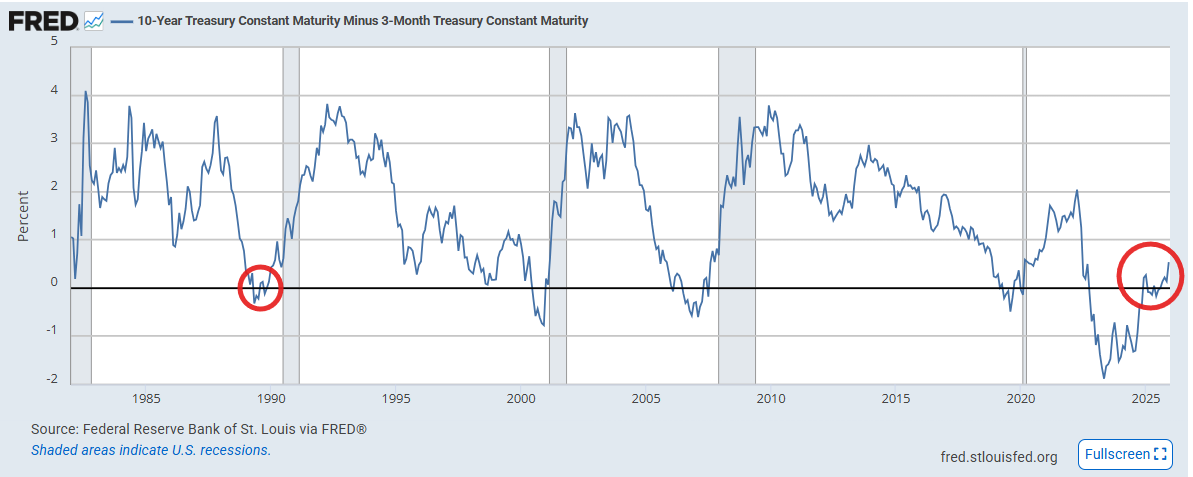

Similarly the 3mos/10yr yield curve eased back for a second week to +0.50% from the +0.56% on Dec 12th, the highest since Sept ‘22 still calling for more rate cuts or a move higher in 10yr yields (this is historically around +1.25%).

Note this curve is considered a better recession signal than 2/10’s w/the last four recessions on average coming a few months after the curve uninverted (prior to that it generally uninverted after a recession had already started)).

It had spent nearly a year within a quarter point of 0%. The only other comparable period (inversion followed by a long stretch around 0%) was 1989 when it spent the year within a slightly larger band (but after a much smaller inversion). When it finally lifted after that instance a recession followed six months later. This is NOT to say I think we’ll see recession in 6 months (quite the opposite).

Also, as noted back in February, reinverting is something that it did prior to (or just after) the last two recessions and it also dipped (but didn’t reinvert) in the two recessions prior to that, although this one was much more mild than previous. Regardless, the longest it went in those previous four instances before recession after reinverting is 6 months (2007).

Also note that in 1989 and 2007 we saw similar periods of a recovery from inversion that stalled at the zero line for long periods of time which turned into recessions after they finally started to steepen again (but in 1989 it took six months (we’re beyond that now)), but see the note above about the length it spent around the zero line.

And the 10yr Treasury yield is now more comfortably above the Fed Funds midpoint (and the EFFR), at +49bps still though well under the typical non-recessionaly spread of around 1-1.25%, so calling for another ~50bps of rate cuts (or perhaps if one thinks the 10yr is mispriced, a higher 10yr yield (or some combination)).

The 2yr yield though remains below the Fed Funds midpoint (and EFFR) by -16bps. This is also well under the typical non-recession spread of ~50bps so also calling for 2-3 more rate cuts (or a higher 2-year yield).

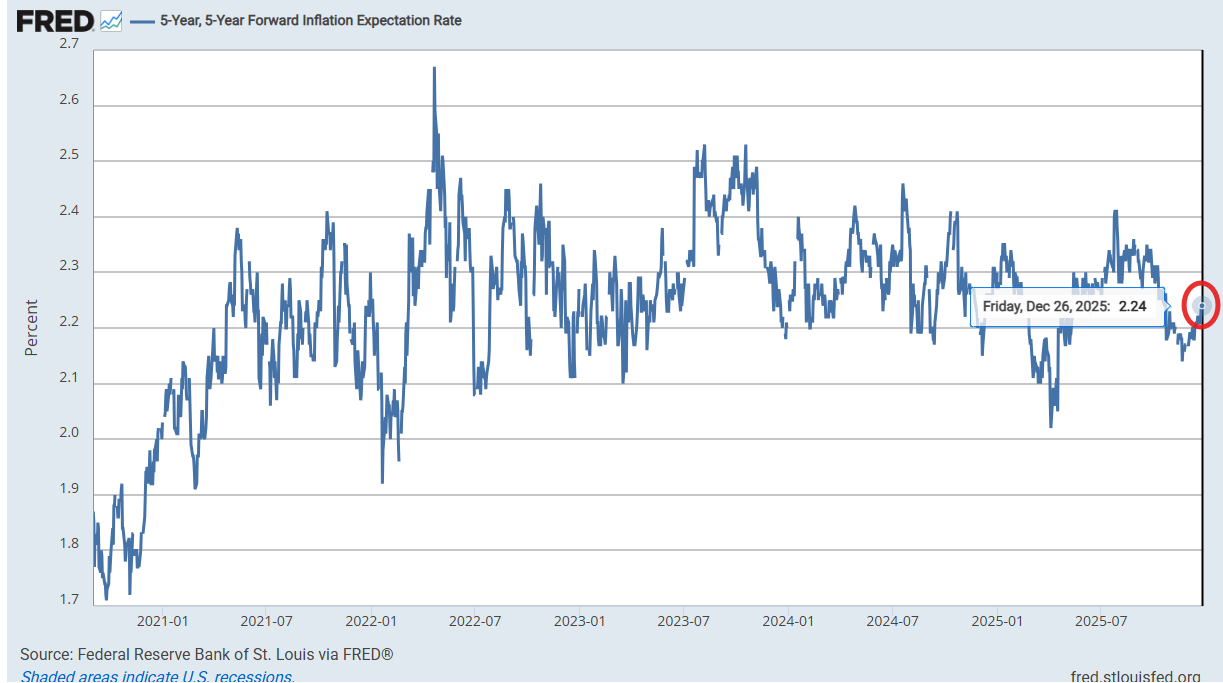

Long term inflation expectations as measured by the 5-yr, 5-yr forward rate (expected inflation starting in 5 yrs over the following 5 yrs) moved up to +2.24% a 3-month high but still just 10bps from the 2.14% Nov 20th which was the joint the least since April, and before that Mar ‘23, remaining near the bottom of the range since 2022. They’re also a touch below their 20-yr average (2.25%).

The peak this year was 2.41% July 28th which was the joint highest (with October) in a year) and 2.67% was the post-pandemic peak in Apr ‘22.

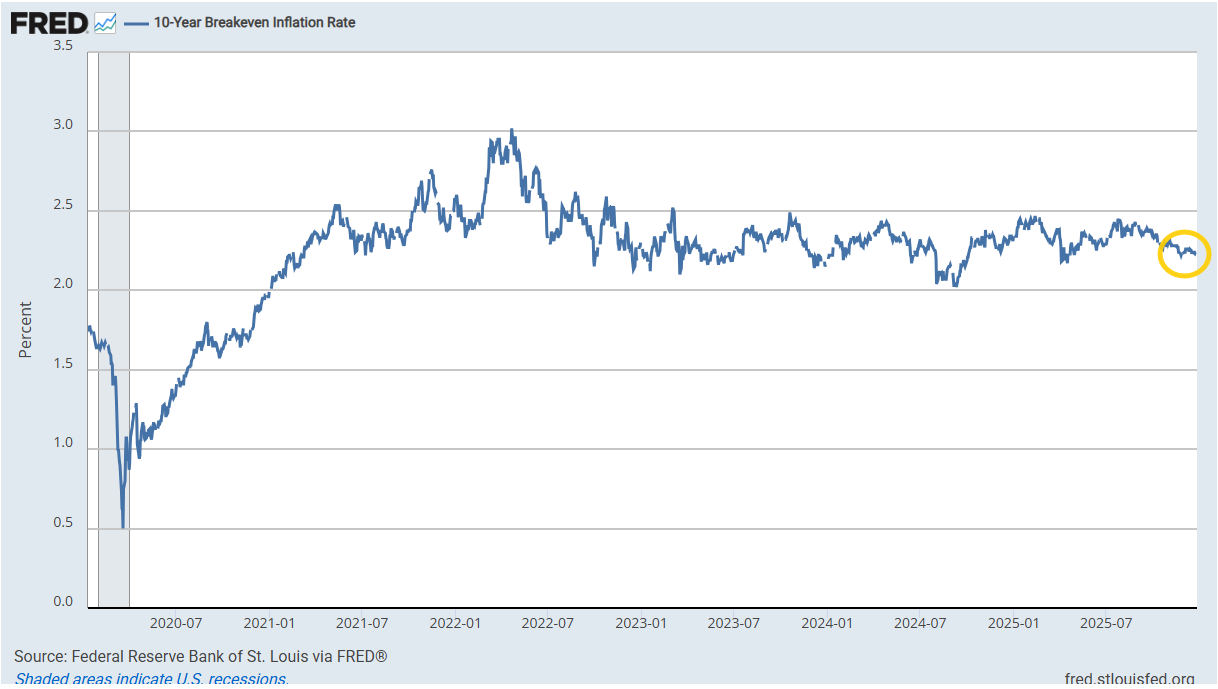

The 10-yr breakeven inflation rate edged back to 2.23% as of Friday, in its post-2022 range.

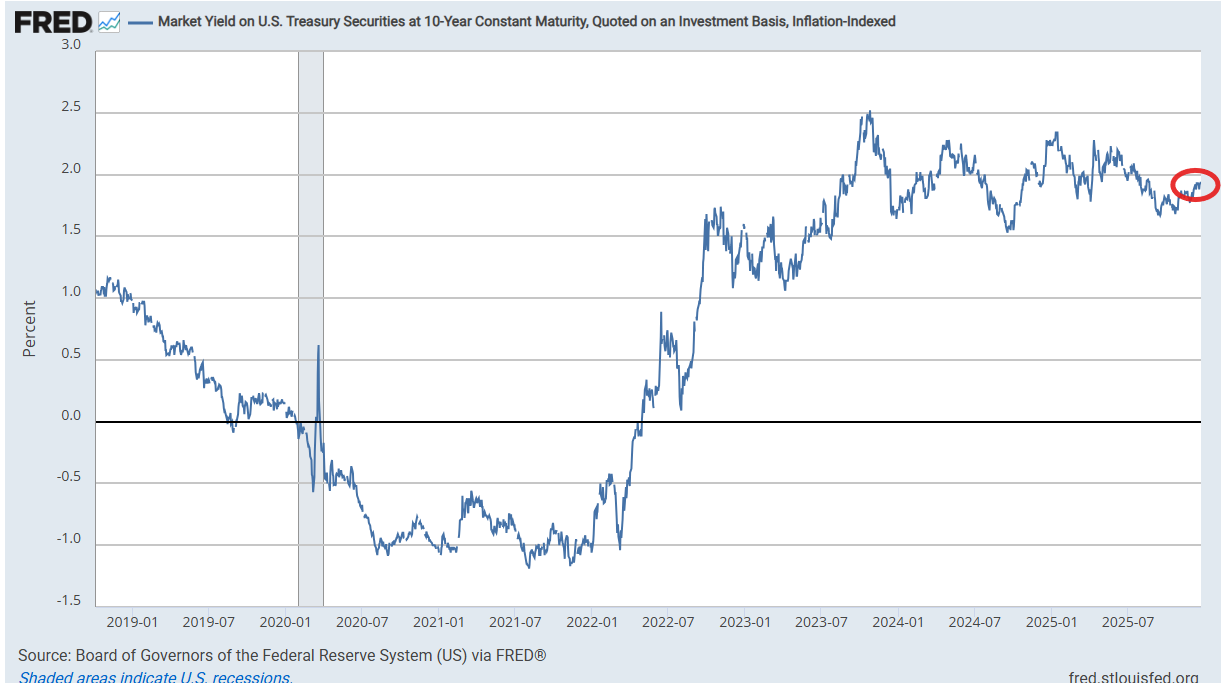

10yr rate real rates edged up to 1.94% last week the highest since mid-Aug, but overall remaining in their range since Aug 2023. They are still well below the 2.34% in mid-Jan (which was the highest since Oct ‘23 (and before that 2007)), but also still well above the 2012-2020 peak of 1.12%.

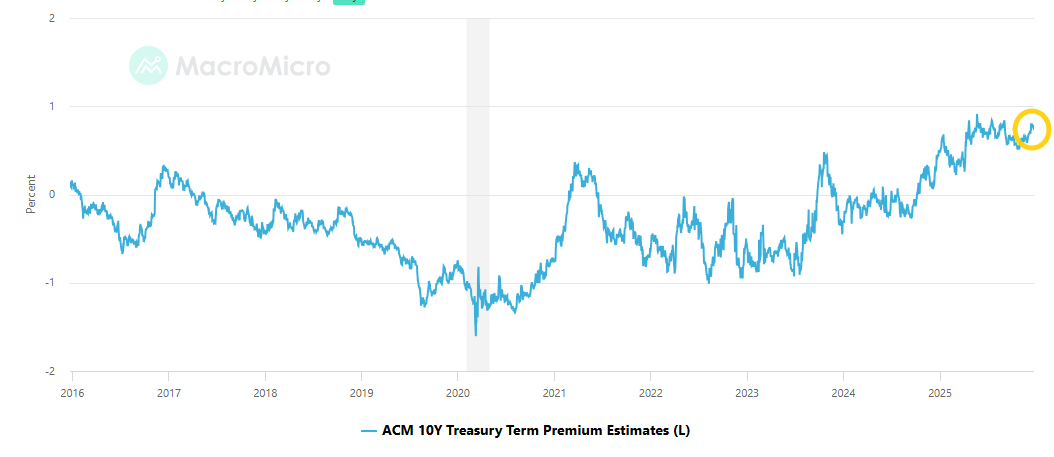

The ACM model of the 10yr #UST term premium (which is solely based on interest rates so has no “external anchor” to help explain why short-term rates may be moving (such as Fed policy expectations)), little changed at +0.73% remaining below the +0.80% from two weeks ago which was the highest since Sept 2nd, but up from +0.51% Oct 28th (which was the least since April).

The high of the year was +0.91% on May 21st (which was the highest since July 2014). This is up +0.21% since the Oct Fed meeting.

As mentioned above, the ACM model has a weakness in that it looks only at rates with no “anchor” to the external environment. The Kim-Wright model addresses that by adding in an expectations layer (from Blue Chip forecasters) of the expected path of short-term rates. TradingView has started carrying that, so I am going to likely switch over to that (or at least note both). Unlike the ACM model, the post-pandemic peak was in Jan at 0.80%, and the overall current level is lower at 0.56%. The overall message is similar though in that pre-pandemic you have to go back to 2013 to find comparable levels.

The extended discussion on term premium (what it is, why it’s important, etc.), can be found in this section in the Feb 4th Week Ahead.

Not much relief for small businesses or HELOC borrowers as the real prime rate (inflation adjusted using core PCE) was little changed at 4.56% in Sept and less than a half point from the 4.92% in April which was the highest since October. While over a percent below the 5.9% high June 2024, which was the highest since Sep 2007, it remains more than double the 10yr pre-pandemic avg. [this gets updated the next time we get a PCE report]

The FOMC’s median long run projection for the endpoint of the Fed Funds rate (the “neutral rate”) continued to remain at 3.0% in Sept. The average of the dots did edge up another tenth to 3.13% but even at 3% it is the highest since Sep 2018 (but also well below levels prior to that). [This gets updated after the Jan FOMC]

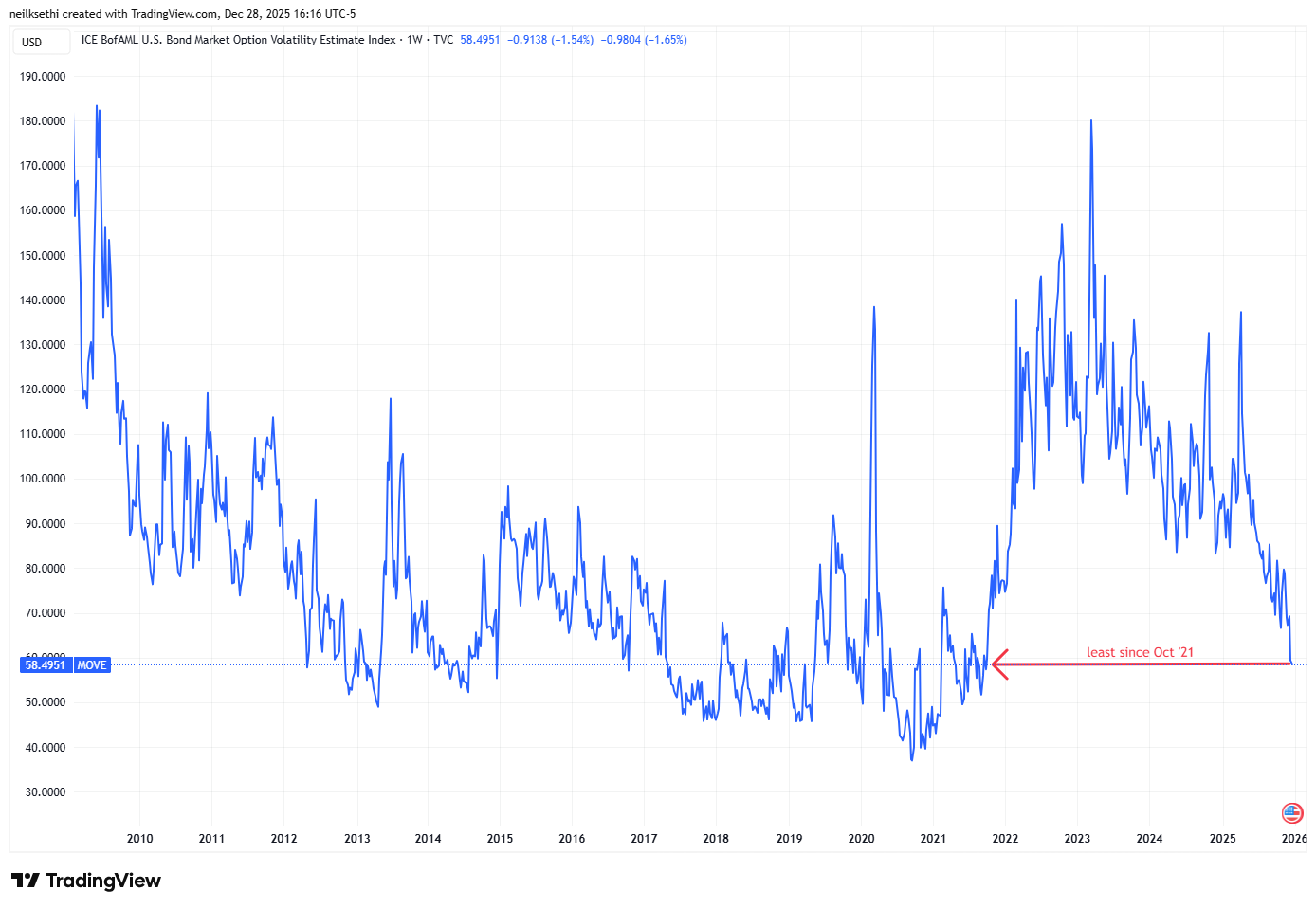

The MOVE index of expected 30-day Treasury note/bond volatility continued to fall back, now down to 58.50 from 69.41 the prior week, remaining the least since Oct ‘21.

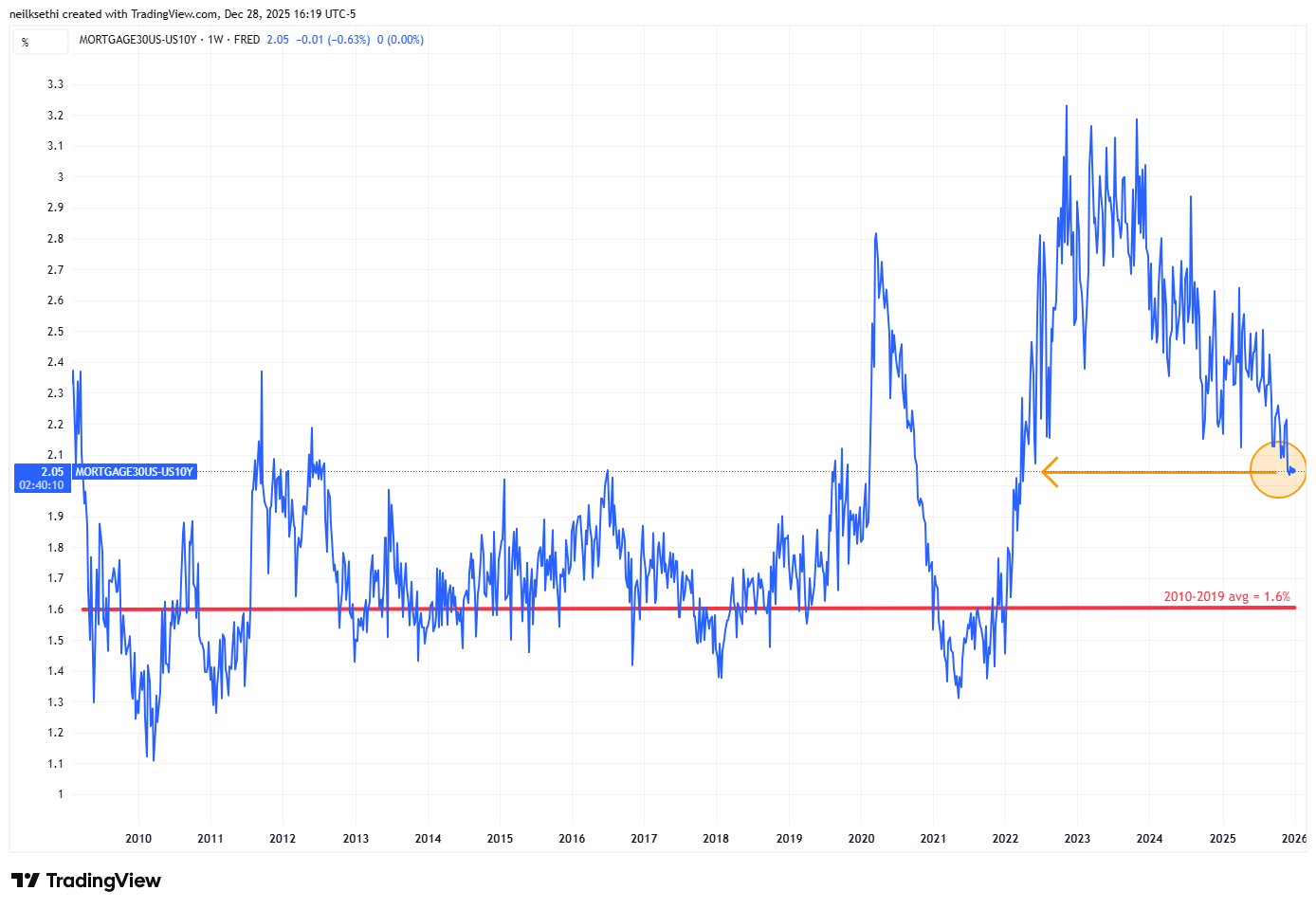

With the continued subdued Treasury volatility, mortgage spreads remained at 2.05%, around the least since March 2022 (when they were surging higher from 1.29% in March 2021 to the 3.1%, the peak in June 2023 as the Fed tightened rates).

They’ve now fallen under the peaks from the 2010-20219 period, but still some room (~50bps) for them to fall to get to the 2010-2020 avg level of ~1.6%.

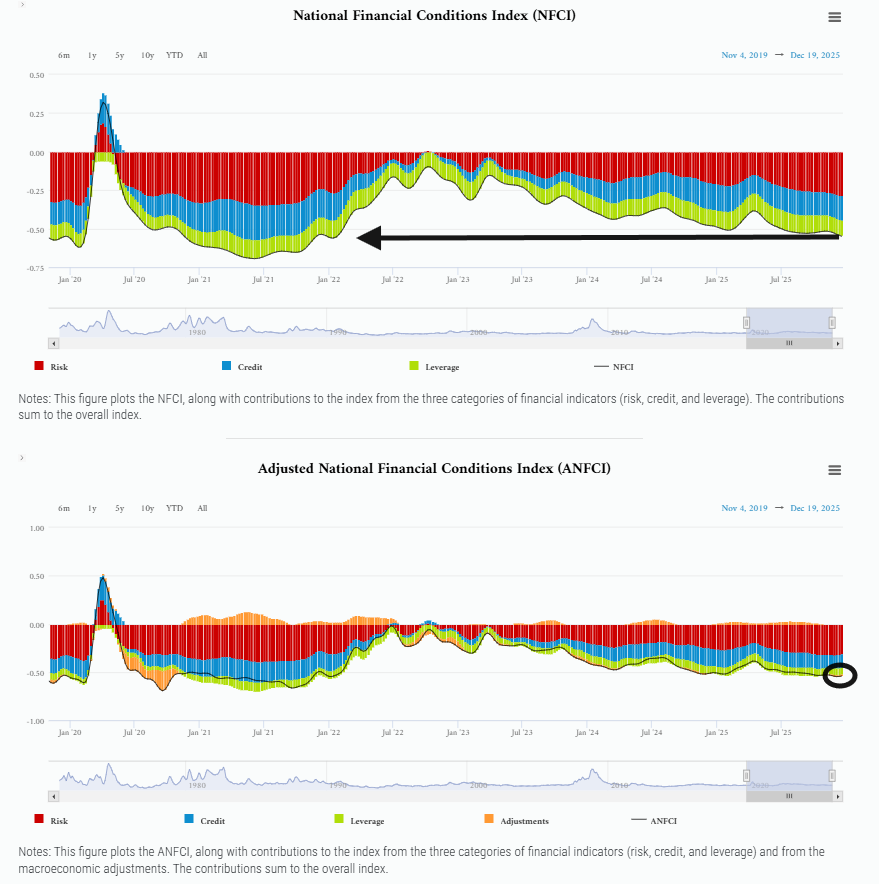

The Chicago Fed National Financial Conditions Index and its adjusted counterpart saw the former edge lower to the joint least (loosest) since Jan ‘22 while the latter edged up for the first time in two months from the least (loosest) since Nov ‘21 (but note this is often revised lower).

Both of these indexes are very comprehensive, each w/105 indicators. The “adjusted” version attempts to remove the correlation between the various indicators due to broad changes in economic conditions which also impact other areas (so as to not double count them).

https://www.chicagofed.org/research/data/nfci/current-data

Goldman’s US Financial Conditions Index edged higher but remained around the loosest since 2022.

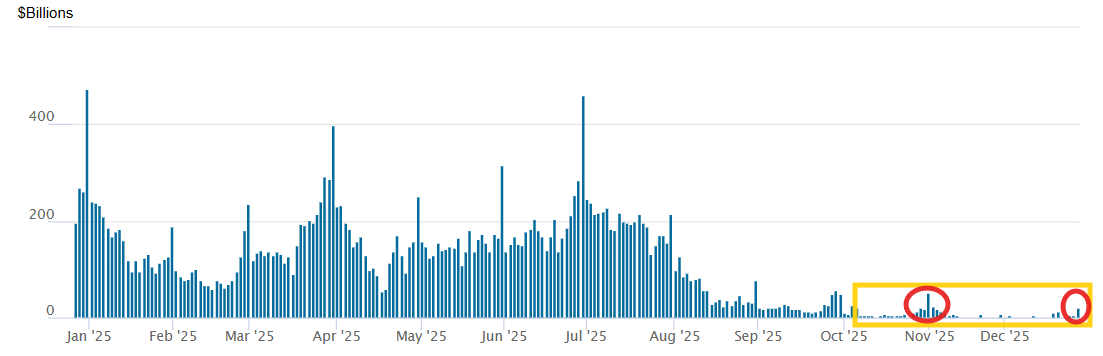

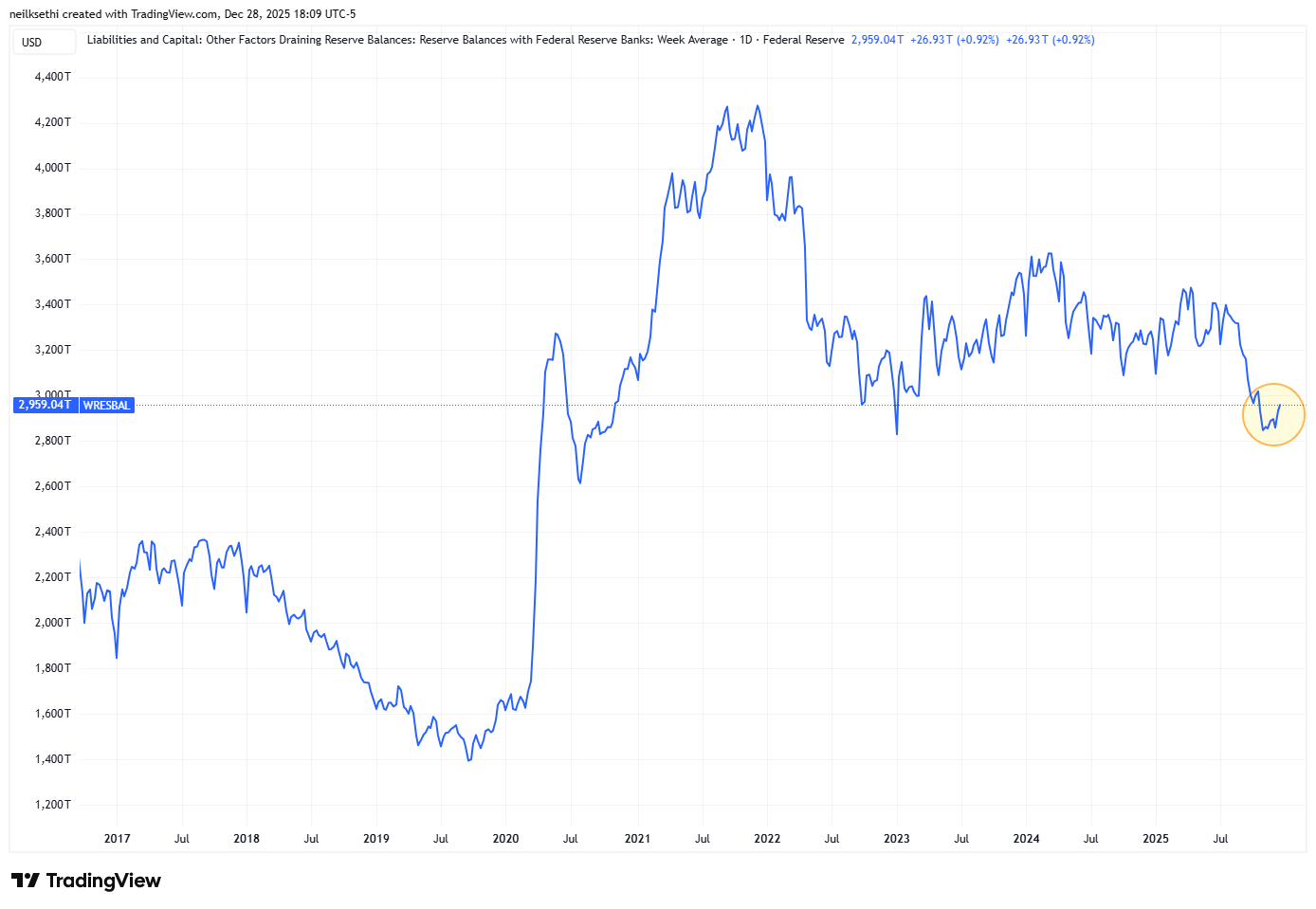

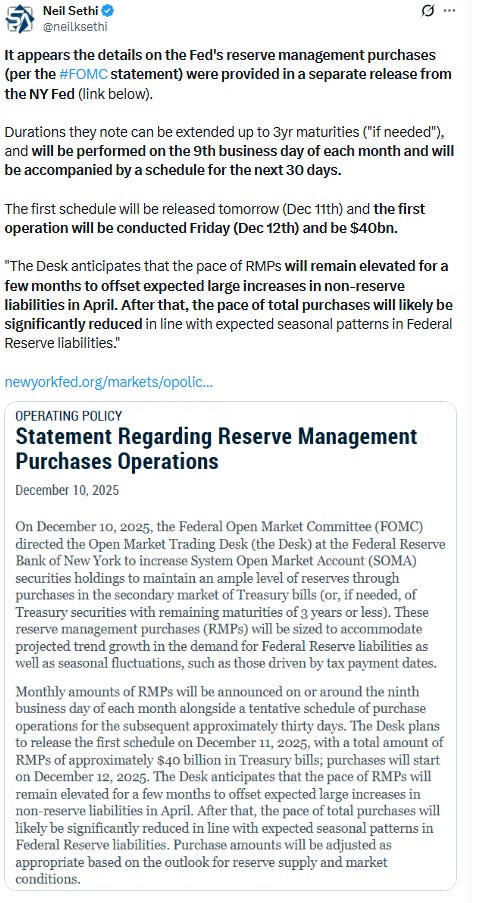

As you know if you read my RRP updates (Reverse Repurchase Program where financial institutions can park money overnight which sets a “floor” under funding markets (as you wouldn’t lend to anyone else at a rate less than you can lend to the Fed risk free)) RRP levels in mid-August finally dropped to the “near zero” levels I had been waiting (seemingly endlessly). As I noted last week, they will likely continue moving higher into month/year-end as is normal (see Nov) as banks “paint their books” for regulatory purposes, they are effectively at zero, which is in part what forced the Fed to start the reserve management purchases (they drying up of this liquidity source).

As a reminder, now that RRP levels have drained to minimum levels, attention turns to bank reserves as discussed below.

Bank reserves, which fell as low as $2.82tn as of the end of October, which was the least since Oct 2020 and down from $3.6tn Apr 10th (the highs of the year) under my “danger zone” level of sub-$2.9tn, as of Wednesday moved up to $2.96tn (+$30bn w/w), a two-month high, as we now have the start of reserve management purchases of $40bn a month (for the time being) added to the end of QT (as of Dec 1st).

This is a level Fed members have generally indicated they are comfortable with.

Getting back to rates,

I said back in April 2024 that 2-year Treasuries were a good buy at 5%, and as I noted once the Fed started its cutting cycle thereafter the ship has likely sailed on seeing those yields anytime soon (meaning years). I still have some 2yr’s but have been selling on big dips in yields, not really getting a chance to reload as they never seem to be at a level that makes sense, although most analysts think they’re going lower from here.

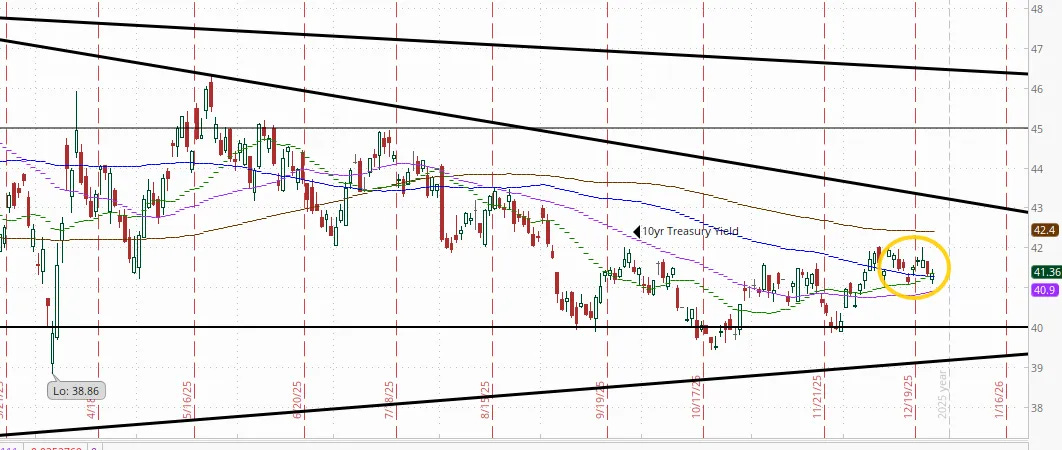

In terms of 10yr’s I had advised then grabbing some at 4.7% (which I subsequently sold on the drop under 3.75% as posted here in September) but at the time that level seemed like something we wouldn’t see anytime soon, but we got back there in January (and I added some as posted here), and it seemed like we might be headed much higher until Treas Sec Bessent noted the administration’s focus on keeping the 10yr yield low (and perhaps more importantly committing to the auction schedule set up by Sec Yellen for the foreseeable future (and perhaps even reducing longer term supply as he has noted in subsequent interviews and through the increase to the Fed’s buyback program), which has exerted downward pressure on 10yr yields). I sold that new, small position on the dip under 4% in April, and I had been waiting on us revisiting that 4.7 - 5% area to reload.

But as noted in late Sept, it is looking less and less likely that I will get that trip back up to the 4.7% area to add to my 10yr holdings any time soon. I had been thinking that 4.3-4.5% is potentially in the cards, but even that seems like too much despite all of the worries about deficits, etc. We have gotten to 4.2% but no further. As I also noted four weeks ago, BMO’s excellent rates strategist Ian Lyngan has said he’s continuing to look for 3.85% by the end of this year (probably not going to happen) and 3.5% by the end of next year, and he doubts we’ll see even 4.5% which so far has been the case. TD, another good rates shop is similarly looking for 3.5% next year.

So “[o]verall the 10yr yield continues to hold the bottom of of my 2025 likely trading range of between 4 and 5%. It’s broken that level a few times, but it’s held each time outside of a [few days]. We’ll see if that level can continue hold and/or if yields can get any traction to the upside or downside.” I will likely set a 2026 range of more like 3.5 to 4.5% (maybe a bit wider on the downside).

For all the old “final hike” and “first cut” materials, you can reference the Feb 4th blog post.

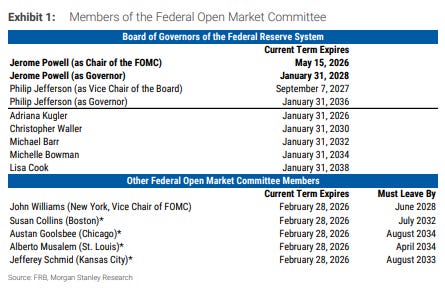

BoA finally updated their Dove-Hawk chart. Logan I think is as hawkish as Schmid, and I’m not sure I’d characterize Goolsbee as Hawkish, more Centrist, but otherwise seems about right.

And JPM added that gives you 2026 voters. I have some quibbles. The ends are fair but there really should be a distinction b/w Miran and the rest. No way is Barr dovish (and he proved that with a speech not long after I first wrote that). He’s now proven himself to be with the Bostic/Kashkari Fed Presidents. Also, not sure about Cook (she seems to vote with Powell). I think Paulson though should be with Williams and Daly (and she proved that with a speech on Dec 12th. Collins was fairly hawkish in her last appearance as has been Goolsbee (although he’s tricky, dissenting from the Dec cut but also saying “I’m one of the most optimistic folks about how rates can go down in the coming year.”). Otherwise hard to argue much with the slotting.

And here’s one that goes over current term expirations.

Earnings

As a reminder, I have removed most of the background material, which you can get in the Feb 4th blog post. You can reference this post from 12/1/24 for stats on 3Q, this post from 3/9/25 for stats on 4Q, and this post from 6/1/25 for stats on 1Q 25. And the 9/1/25 post for 2Q 25.

While Q3 earnings will continue to trickle in, they won’t move the needle, so if you want to reference the stats for Q3 you can find them at this post from 11/23/25.

There was no update from Factset this past week, so all of this is left in from last week with just a couple of new posts at the bottom. If you want the charts from last week, here’s the link to last week’s Week Ahead.

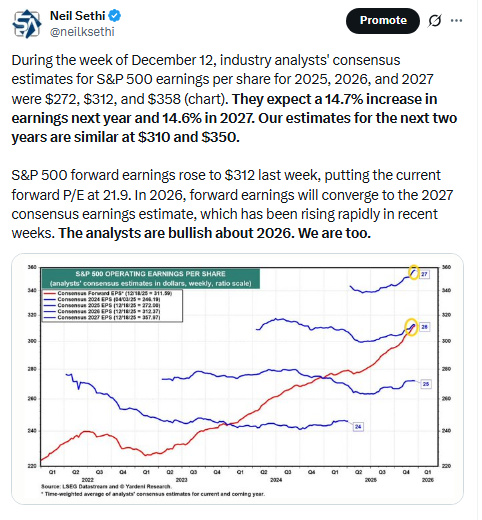

Q4 earnings expectations according to Factset pushed up to +8.3% growth (+0.6% from two weeks ago), which represents a +1.1% increase from Sept 30th.

That’s the second straight quarter we’ve seen earnings estimates for a quarter increase leading into earnings season in contrast to the normal decline we normally see (not to mention that in every non-recession quarter earnings estimates will increase further from here). The past 5 years the decline from the start of a quarter to its end has been -1.6% and 10 years -3.1%

It’s also the first time we’ve seen back-to-back increases in expectations leading into a quarter since 2021.

But notably, that increase is being driven by Tech which is expected to see a huge +25.7% y/y increase. The next highest is Materials at +9.3%. In contrast Industrials and Cons Discr are expected to see negative y/y growth.

And 2025 as whole pushed up two tenths to +12.3%, up from +10.6% at the start of the quarter.

2026 earnings expectations also saw an even bigger increase a bigger +0.5% w/w to an even more robust +15.0% growth (despite the higher 2025 base) with Q1 +13.1%, Q2 +14.6% (+0.8% w/w), Q3 +14.7% (+0.9% w/w) and Q4 +18.1%(!) (+0.7% w/w).

This would be the third year of double-digit growth

Factset notes that only two of the top five contributors to earnings growth for CY 2026 are “Magnificent 7” companies: NVIDIA and Meta Platforms. Overall, analysts expect the “Magnificent 7” companies will report earnings growth of 22.7% for CY 2026, which is slightly above the estimated earnings growth rate of 22.3% for CY 2025. On the other hand, analysts predict the other 493 companies will report earnings growth of 12.5% for CY 2026, which is above the estimated earnings growth rate of 9.4% for CY 2025.

Factset: 2025 earnings expectations continued to climb to $270.96 (+$0.10 w/w), which represents a very healthy growth rate of +12.3% y/y, down just -0.3% since Dec 31st (much less deterioration than normal but around average for non-recessions).

As I have been noting since July BoA’s analysis is that the July 1st number ($264) historically changes by less than 2% by the end of the year absent a major economic event (GFC, Covid, etc.). Still as I’ve noted since then, the top end of the range would be $270 which it is now a little above, but so far their analysis is pretty close, especially as we fell materially below in 3Q.

2026 earnings expectations also continue to edge higher to $309.83 (+$0.53 w/w), representing even stronger 15.0% y/y growth, down just around -0.4% from the start of the year.

In terms of the earnings growth expected for 2025 Factset notes it will be a record. On average over the past 25 yrs there is a -6.3% deterioration from where it starts the year ($275.05) which would equate to $257.72 based on the average deterioration. But Factset pulls out 4 outlier years (2001, 2008, 2009 & 2020) where the overestimation was between 27-43% due to recessions. Excluding those, and assuming no recession, the difference is just -1.1% (which would equate to $272.02 (still a little above where we are now)).

While 4Q earnings estimates are expected to grow the least since Q1 ‘24, revenues are expected to grow +7.6% y/y (almost as much as earnings) which is the most since Q3 ‘22.

Those have also grown now by almost the same amount since the start of earnings season (from +6.4% on Sept 30th).

Q4 profit margins were unchanged at 12.8%, below the previous quarter’s 13.1%, but above the year-ago 12.7% and 5-year average of 12.1%.

Factset: 2025 revenues are now expected to grow +7.0% up +1.4% since Dec 31st (which is unusually high). Just energy is expected to have negative revenue growth (but much less than expected even June 30th).

2026 SPX revenue growth is now expected at +7.2%, up +0.3% w/w with Tech +17.4% and Comm Services +10.4% leading.

In line with the larger than normal increase in earnings expectations, Factset’s compilation of analyst bottom-up SPX price targets for the next 12 months as of Thursday continued to increase for a 26th week to 8,011 which would be +18.2% from Thursday’s close. That’s an ATH +43pts w/w (+453pts the past 7 weeks and +1,328pts the past 27 weeks).

Tech (+26.5% up from +19.8% the prior week) remains the sector seen by analysts with the largest upside (the only sector above the SPX), followed by RE (+18.1% from +17.0%) while Financials remains the sector expected to see the smallest price increase (+9.4% up from +8.3% the prior week) followed by Consumer Staples (+12.3%).

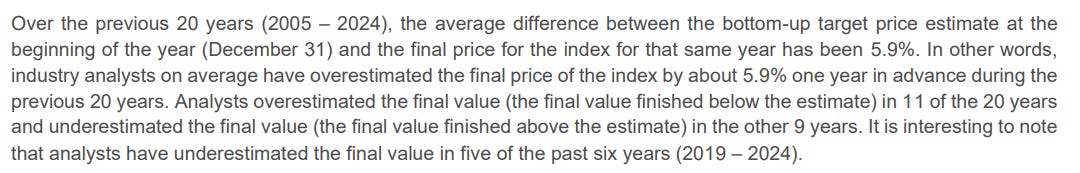

As Factset remind us last week, the last 20 yrs (through 2024) analysts have been on avg +5.9% too high from where they start the year (which was 6,755 coming into 2025) but note they underestimated it five of the past six years (including 2024). They’re currently 2.5% too high.

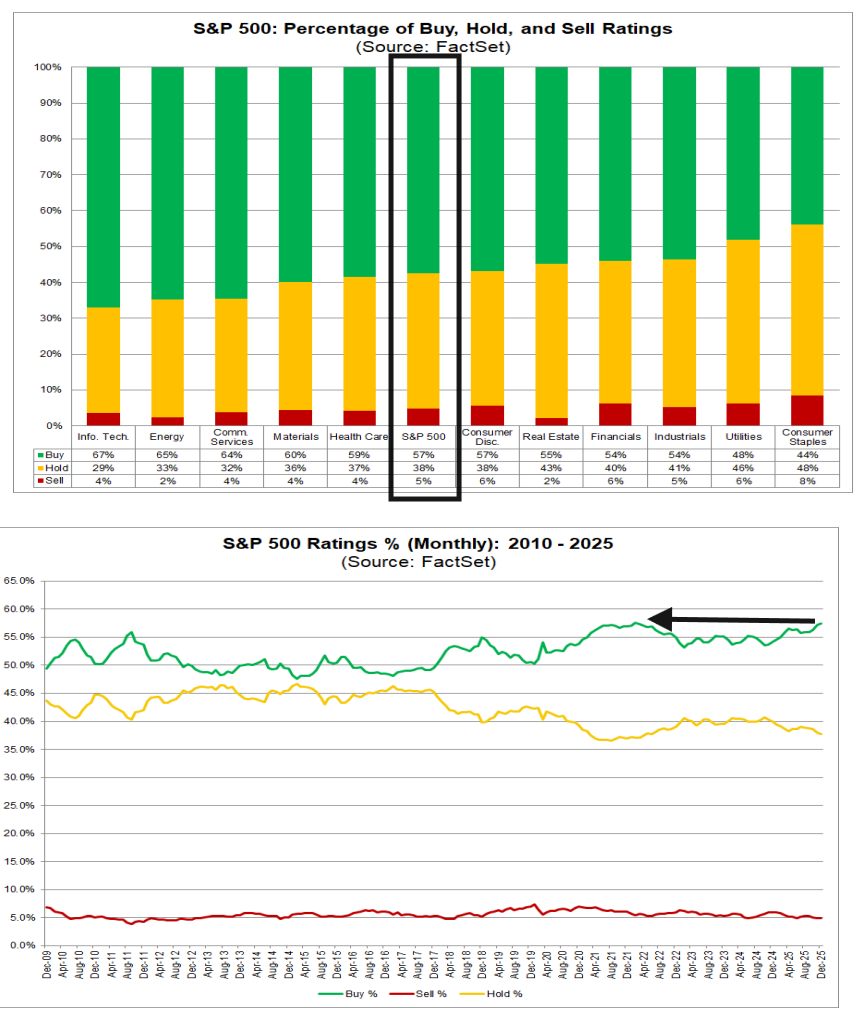

Factset: In terms of analyst ratings, buy and hold ratings continue to dominate with buy ratings at 57.5% (below the highs of the year (59.3%) but up from 53.6% on Oct ‘24) and hold ratings at 37.7%, with sell ratings at 4.8%. While below the highs of the year on a weekly basis, Factset notes if 57.5% is the final percentage of Buy ratings for the month, it will tie the mark with February 2022 (57.5%) for the highest (month-end) percentage of Buy ratings going back to at least 2010.

The Information Technology (67%), Energy (65%), and Communication Services (64%) sectors have the highest percentages of Buy ratings, while Consumer Staples (44%) has the lowest percentage.

Consumer staples also has the most sell ratings at 8% and Hold ratings at 49% (down from 50% two weeks ago, next closest on Hold ratings is Utilities at 45% (up from 43% two weeks ago)).

The percentage of Buy ratings is above its 5-year (month-end) average of 55.1%. The percentage Hold ratings is at its 5-year (month-end) average of 39.0%. The percentage of Sell ratings is below its 5-year (month-end) average of 5.9%.

Factset also notes that two of the three sectors that have recorded the largest price increases since December 31st are also two of the three sectors that had the highest percentages of Buy ratings on December 31st: Communication Services and Information Technology. The other though, Energy, saw the second smallest price gain since then.

Just one of the three sectors that have recorded the smallest price increases since December 31 are also one of the three sectors that had the lowest percentages of Buy ratings on December 31st: Consumer Staples. The others were Utilities and Materials/Industrials.

And some other earnings stuff:

Economy

Over the past 2+ years part of my earnings optimism has been due to the economy holding up better than expected. While earnings only track the economy loosely (and markets look forward 6-12 months), there is a clear positive correlation between the economy and earnings (particularly a weak economy and weak earnings), and there is a very strong correlation between earnings and stock prices (although stock prices (being as noted forward looking) generally fall in advance of a recession and bottom 6-9 months before the end of one). So if you can see a recession coming it is quite helpful, although very difficult (especially ahead of the market). You can reference this Week Ahead (see the Economy section) for a lot of material on how every recession is preceded by talk of a “slowdown” or “soft landing” as close as a month before the start. That report also has the notes about how small caps have shorter debt maturity profiles and more of it (debt).

As long time readers know the beginning of this section hadn’t changed much since I switched to the Week Ahead format in mid-2022, with the indicators to me during that period consistent with solid (which at times has been robust) economic growth, and I have been a broken record that I “certainly do not think we’re on the verge of a recession (although as noted above every recession starts out looking like just some economic softening).”

Since the end of March, though, we’d seen the data soften (it actually stretched back pre-March with 1Q services spending getting a notable markdown in the GDP revisions (as did services exports (tourism, etc.) and construction spending)) with reports since then more mixed, although remaining consistent with an economy running around trend levels (if not a bit above).

While we were deprived of the official data, what we saw during the shutdown “seemed to offer little change in the picture with estimates of layoffs and hires remaining generally low, consumer sentiment remaining weak, but private estimates of spending healthy, reinforced by earnings reports which also indicate a fairly healthy business environment (even if top-heavy) with solid balance sheets and low delinquencies (again though with some cracks in the subprime or leveraged areas and what seems like perhaps some slowing in certain pockets of discretionary spending like restaurants).”

As noted last week we’re finally starting to get some more recent data, highlighted by an update on the labor market with our preeminent report in Nonfarm payrolls (and only two weeks late). That said, that report is best viewed with some skepticism as the collection periods were highly distorted, particularly for the household survey (where the employment rate comes from) which likely influenced things. But regardless the message was similar to what we’d seen from the Sept report which is unemployment continuing to rise but not due to layoffs but instead an increasing labor force (despite the reduced immigration) which is an economic positive. With overall payroll growth remaining subdued (and highly concentrated), new entrants are having trouble finding jobs (the recent college graduation rate fell to the least since Nov ‘20 in Sept).

Importantly, though, the index of aggregate weekly payrolls (one of the key economic measures I follow, as it is basically the take-home pay for all employees) remained healthy (if also slowing). October control group retail sales were also very strong, and CPI fell sharply for November (with even more caveats though than the NFP report). In other reports, flash PMIs decelerated but remained in expansion, jobless claims remained low (historically), while consumer and homebuilder confidence and existing home sales all edged higher but remained near post-pandemic lows.

Overall, I would say, as I have the past several months, the data continues to show an economy remaining in “ok” shape (although a GDP print over 3% is definitely more than “ok” which it seems we are poised to get for 3Q), with some “tiny cracks” as I put it in mid-June.

As I said at the start of September 2024:

without question, the evidence is building that the days of >3% real GDP growth are behind us (although as noted the Atlanta Fed now has a nearly 4-handle for 3Q, and we should be happy to settle into something more around trend (1-3% real (infl adjusted) growth). That though is far from a disaster. The important thing will be to see the softening level out (L-shape) rather than continue to fall turning the “soft landing” into a recession.

Finally, as a reminder, as we turn the page into 2026 we’ll be getting more economic boost from deregulation and the OBBB which should at the very least offset the drag we’re getting from the tariffs and perhaps provide a bigger tailwind than many are expecting. And possibly even boosted by $2k handouts. TBD.

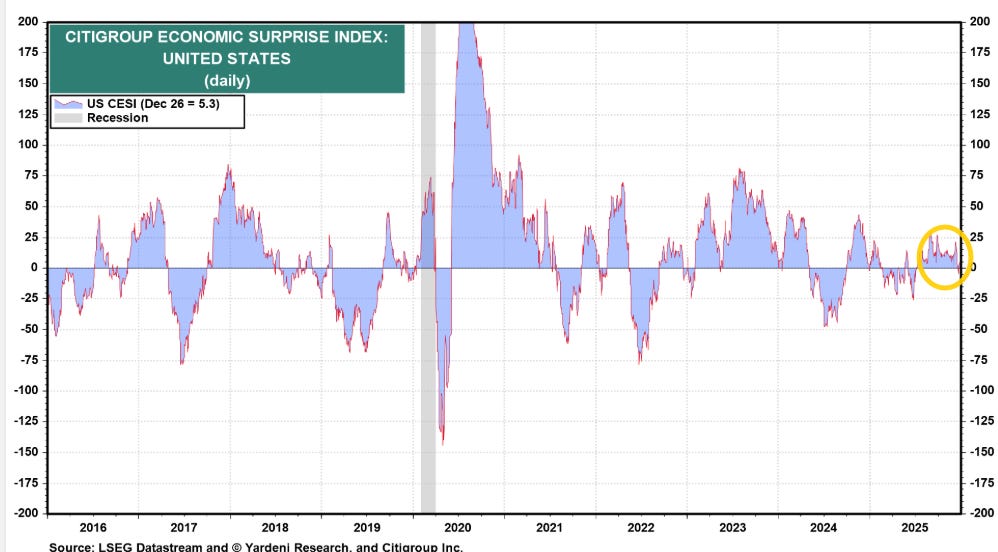

After falling back into negative territory for the first time since July the prior week, the Citi Economic Surprise Index improved to +5.3 from -0.5 but still well below the +21.8 hit two weeks ago, which had been the highest since Sept.

The high of the year was 28.6 Sept 4th and the low of the year was -24.6 in late June. The 2024 high was 47.2 (in Feb) and the low -47.5 (in July).

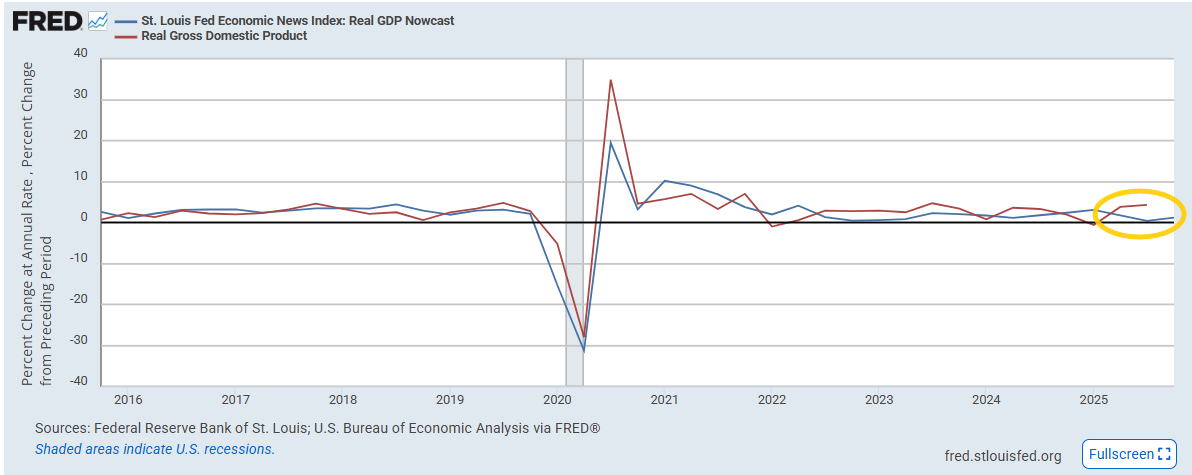

And GDP estimates are for now consistent with a no recession call (again though remembering GDP going into recessions generally doesn’t look like one is coming (it was up around 2% in Q2 & Q3 2008 well after the recession had started)), and while the Q1 number was weak as was expected, we did get the bounceback I was expecting in 2Q coming in at 3.8%, and the range of estimates for Q3 remains fairly wide but increasingly strong going from ~+0.4% from the St. Louis Fed to +3.5% from the Atlanta Fed. We’ll find out who was right this week.

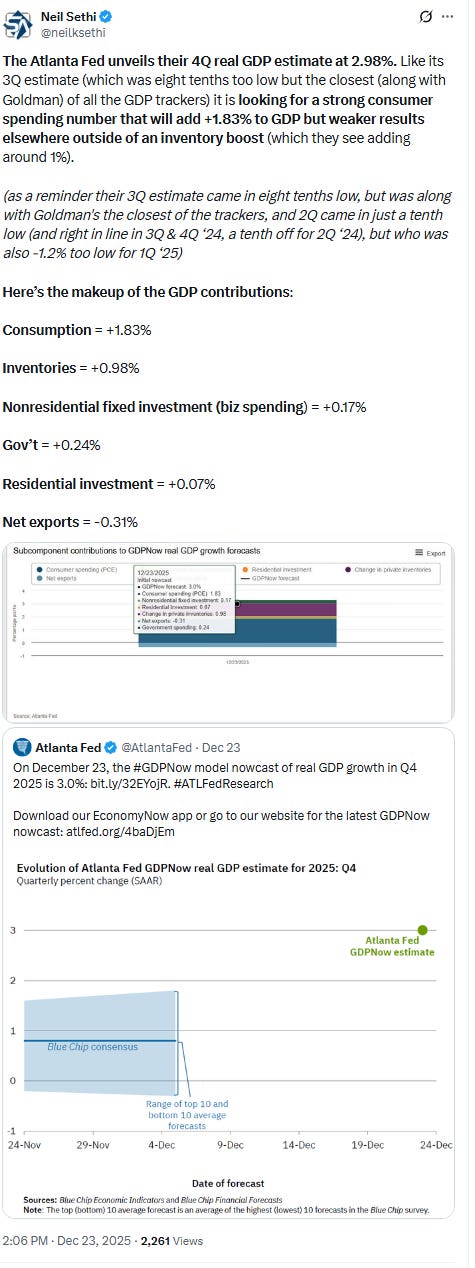

Atlanta Fed initiated their 4Q GDP tracking at +2.98% after having come in the closest for 3Q at +3.48% vs the actual 4.3%. They were right on until a couple of weeks ago (and of course they may end up being right on once the revision comes out).

I had mentioned the NY Fed “locked” its 3Q nowcast on Nov 28th even as we continued to get more data, and perhaps not surprisingly it was further off than many other nowcasts that continued to update at +2.31% (which also didn’t change through the entire month of November) vs the actual first estimate of 4.3%. As a reminder, they were also well under for 2Q at +1.68% vs +3.0% actual first est after being too high for 1Q at +2.6% vs -0.3% (although they were closer in most other quarters)).

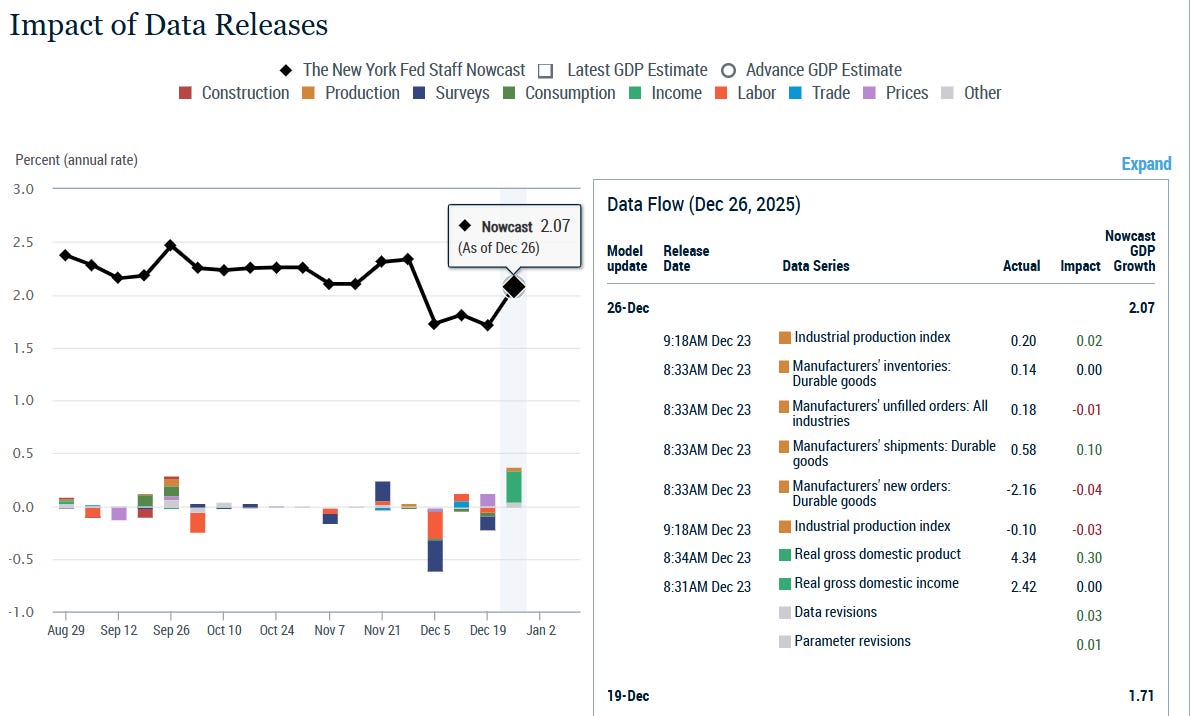

In terms of 4Q their GDP tracker rose +0.36% w/w to +2.07% from the least since they initialed tracking in late August, with most of that “marking to market” following the 3Q result (+0.30%). The Oct durable goods orders was also a small boost while strangely industrial production subtracted even as it beat estimates.

As another reminder, the model is “dynamic” and so adjusts in real time as data evolves) and “parameter revisions” added +0.01%.

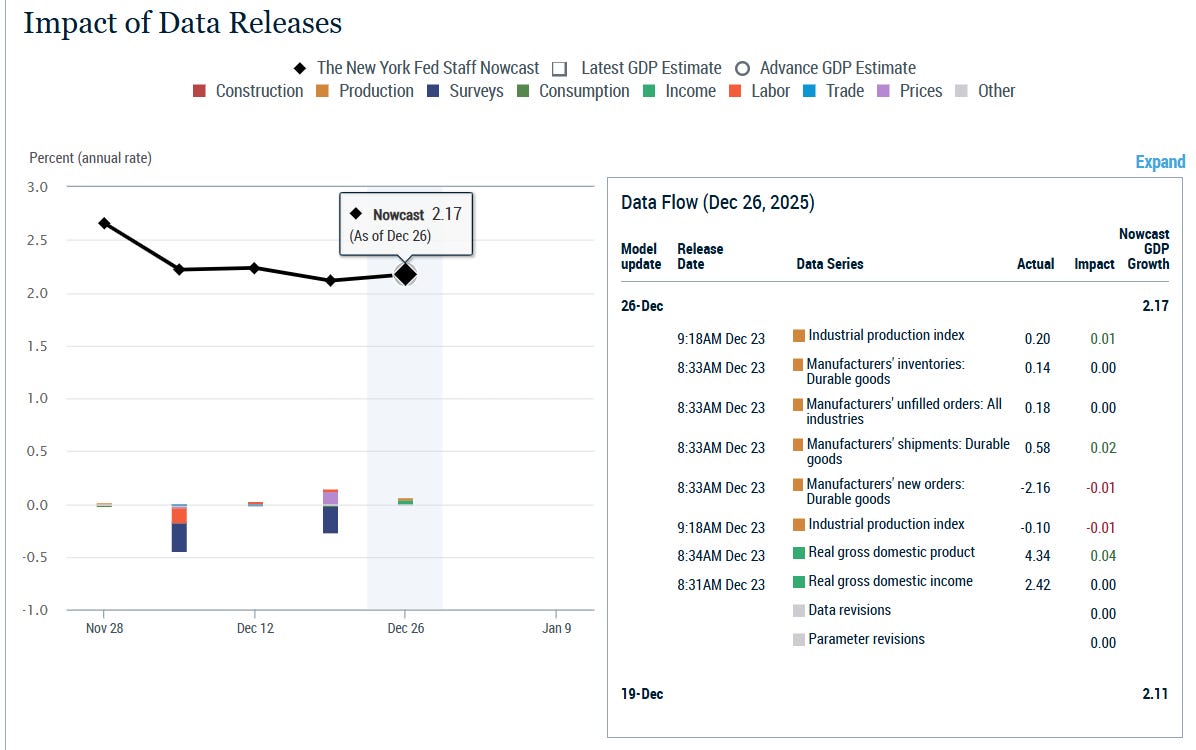

And while most are just starting a 4Q tracker, as noted two weeks ago, the NY Fed is on to 2026, with their Q1 estimate seeing a much smaller +0.06% w/w gain to a still healthy +2.17% as the factors noted had a much smaller impact.

The St. Louis Fed initiated their 4Q GDP tracker this week at +1.18% on Friday.

The St. Louis Fed was a pretty good tracker pre-pandemic, but since Q2 ‘20 it has been much less so. For the just completed 3Q they were by far the lowest of the trackers at +0.42%, nowhere in the vicinity of the 4.3% actual first estimate. They do not give a breakdown of the inputs.

That dismal 3Q performance comes after undershooting 2Q ‘25 by -1.2% and overshooting Q1 ‘25 by +3.7%. It did though do well Q4 (and Q1) ‘24 but otherwise has been at least 1.5% off every quarter since Q2 ‘20, often by much more than that.

No update from BoA this week. They were +3.1% for 3Q, so not that far off.

BoA edges their 3Q GDP tracker to 3.1% as of Thursday on the back of the higher-than-expected net exports and wholesale inventories numbers for Sept. They see final sales coming in at 1.9%.

As a reminder their tracker was eight tenths low for 2Q ‘25 GDP and a tenth high for 1Q vs the 1st estimate, right on for 4Q ‘24 GDP & two tenths high for 3Q ‘24.

Their official forecast is 2.7% for GDP, 2.0% for final sales.

BoA’s 2026 macro estimates see GDP ending 2026 at 2.4% (2027 at 2.1%) with CPI at 2.9% (2.4%) and three more Fed cuts (starting in June) bringing Fed Funds to 3.13% (midpoint).

Goldman also hasn’t released a 4Q tracker yet. They were +3.6% for 3Q, the closest of the trackers. Their official forecast

Goldman on their Q3 GDP tracking has it at +3.6% (quarter-over-quarter annualized) and their Q3 domestic final sales estimate I believe is +2.6% very solid numbers. I didn’t see an update just one sentence in a report:

Goldman’s official forecast for 3Q and 4Q are 3.3 & 1.3% the last I saw but those might have been raised.

Goldman’s preliminary Dec US Current Activity Indicator was initiated at +1.8%, down from 2.0% in Nov, healthy readings around the 2-yr average.

The CAI is their “real-time measure of inflation-adjusted economic momentum using 37 inputs.”

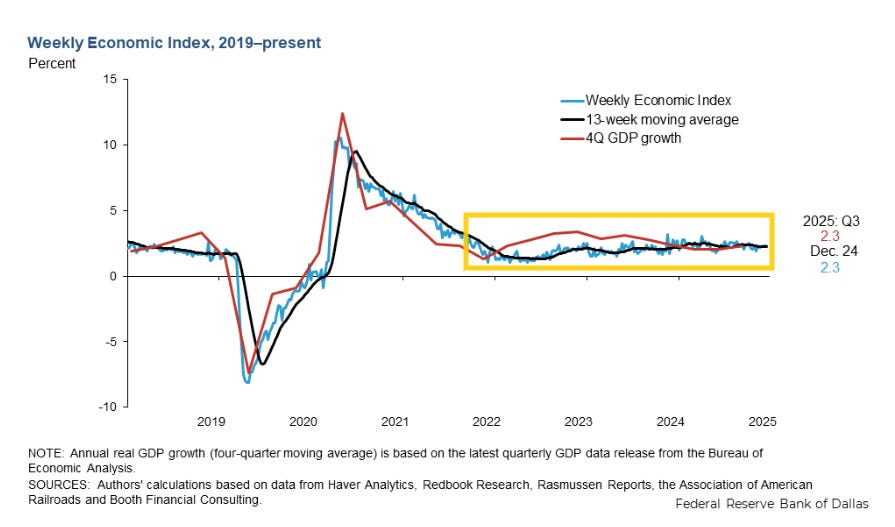

The Weekly Economic Index from the Dallas Fed (scaled as y/y rise for real GDP (so different than most GDP trackers which are Q/Q SAAR) and which uses 10 daily and weekly economic series but runs a week behind other GDP trackers), in the week through Dec 20th edged up +0.01% to 2.32% (after a small revision to the prior week), remaining in the 1.49 - 2.79% range it has occupied since 2022 only poking above a couple times (most recently Apr 5th).

This series has become one of my favorites as it has a high correlation with actual GDP (chart and note the recently released Q3 GDP report showed y/y GDP at 2.33%, right in line with this index) and has consistently indicated no recession and relatively healthy growth since the pandemic (which is what we’ve seen). It was referenced in November by Dallas Fed Pres Laurie Logan as support for her contention that the economy “remains solid”.

Importantly, the 13-wk avg is at 2.26% (still down a bit from the 2.53% reading May 3rd, which was the best since 2022, but still a very healthy reading), continuing to evidence economic momentum that is slightly above trend.

https://www.dallasfed.org/research/wei

Other economy stuff:

Valuations

Like the other sections, I’ll just post current week items regarding the multiple. For the historical stuff, see the Feb 4th blog post.

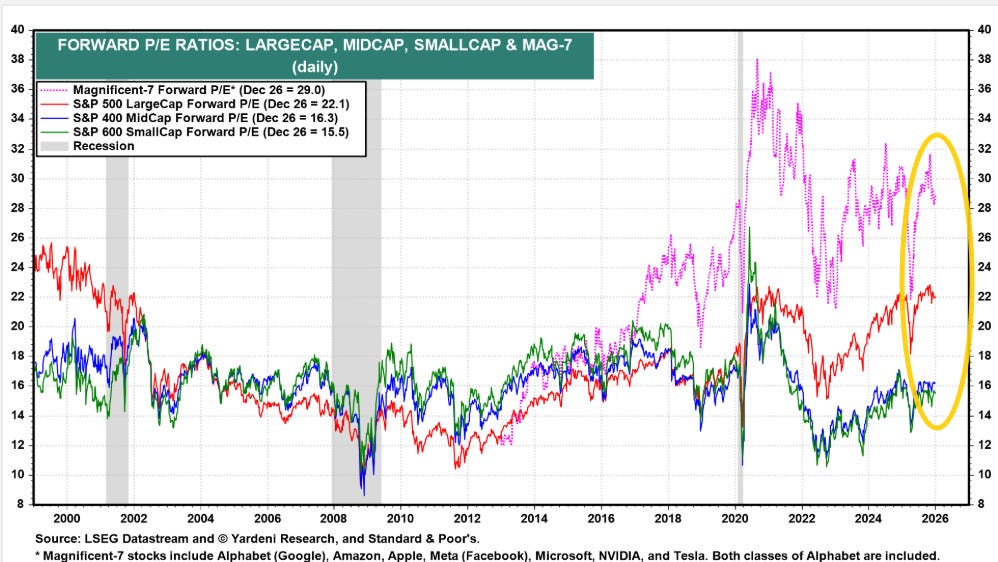

With equity indices moving higher last week, P/E’s mostly did as well outside of the smallest caps:

-The SPX forward P/E (red line) pushed up to 22.1, (+0.2pts w/w, -1.5pts from the highest since 2001 on Yardeni’s model (which is a bit lower than most others (presumably due to the forward earnings calculation and earnings data source))).

-Mid-caps’ (blue, S&P 400) moved for the first time in four weeks +0.1pt to 16.3 (-0.8pts from the highest since early-’21 (17.1)).

-Small caps’ (green, S&P 600 so higher quality than the Russell 2000) edged back to 15.5 (-0.1pts w/w, -1.6pts from the highest since early-’21 (17.1)).

-Mag-7 (purple) saw the biggest move to 29.0 from 28.2 the prior week which was just off the least since Aug (-1.9pts from the highest since 2024 (30.9)).

https://yardeni.com/charts/stock-market-p-e-ratios/

Other valuation stuff:

Breadth

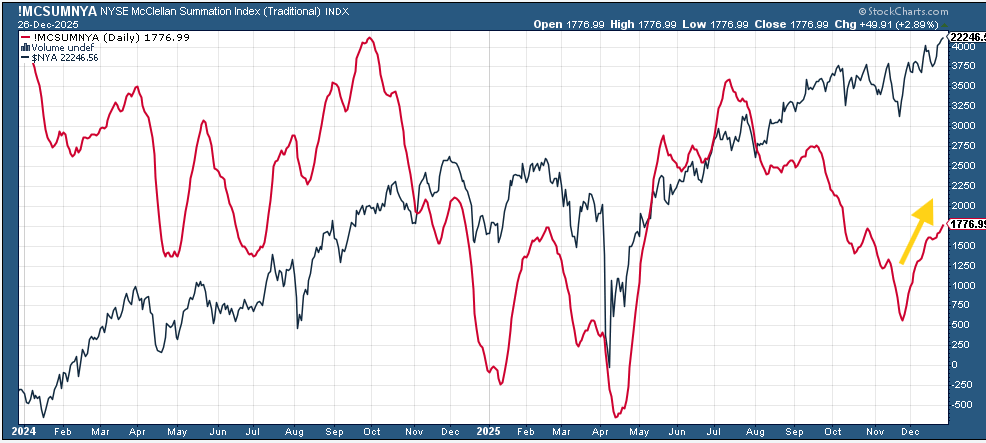

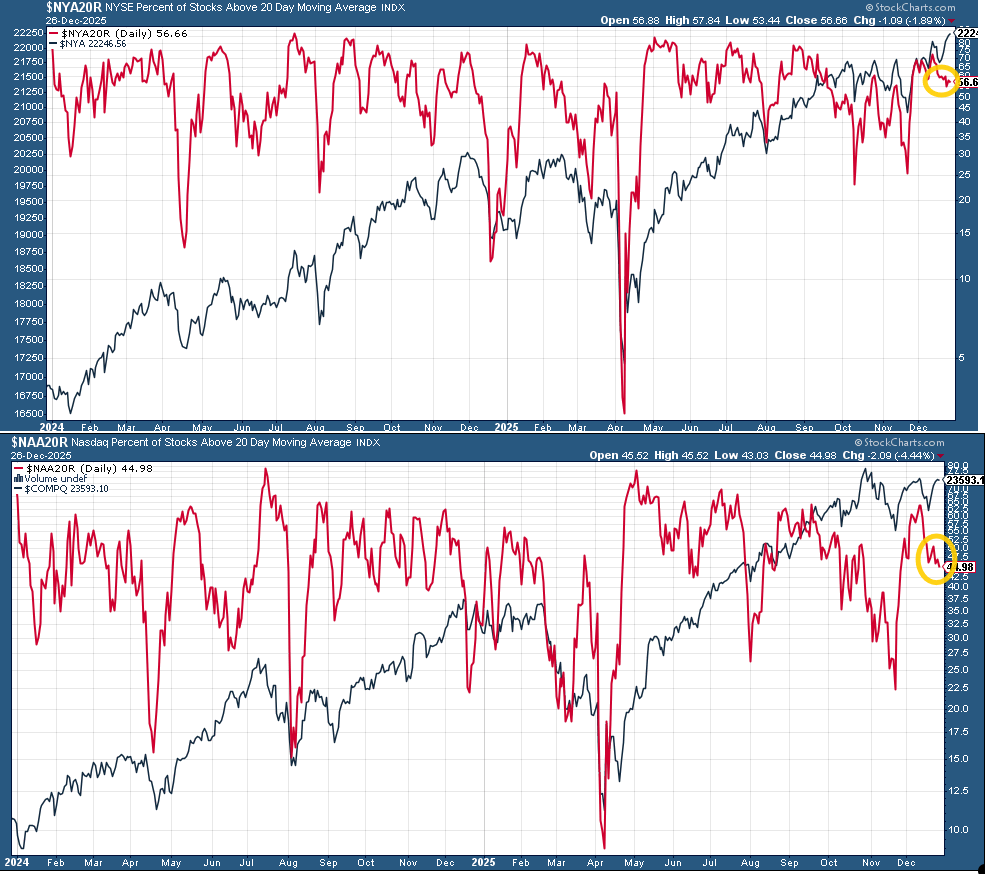

The NYSE McClellan Summation Index (red line, a longer-term breadth indicator (”what the avg stock is doing”)) resumed its move higher from the lowest since April five weeks ago, still though just back to early Oct levels.

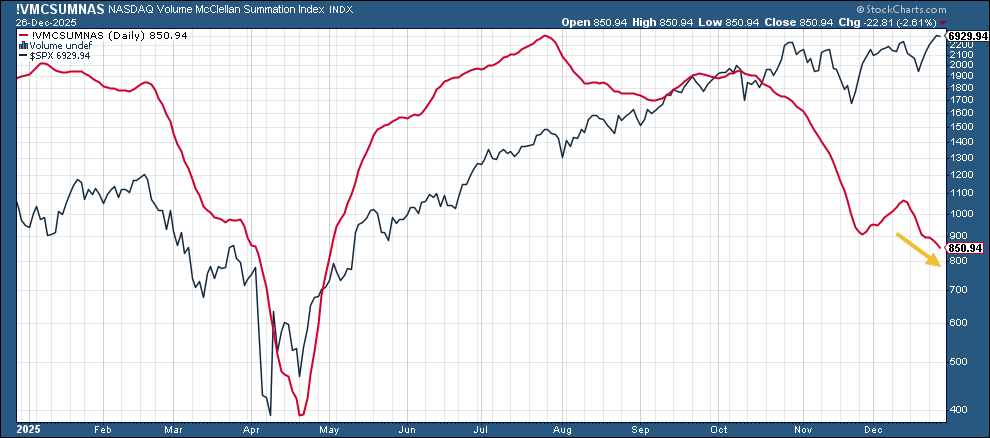

The Nasdaq volume-based version (red line, favored by Helene Meisler for this index) though continued lower for a second week and is the least since April.

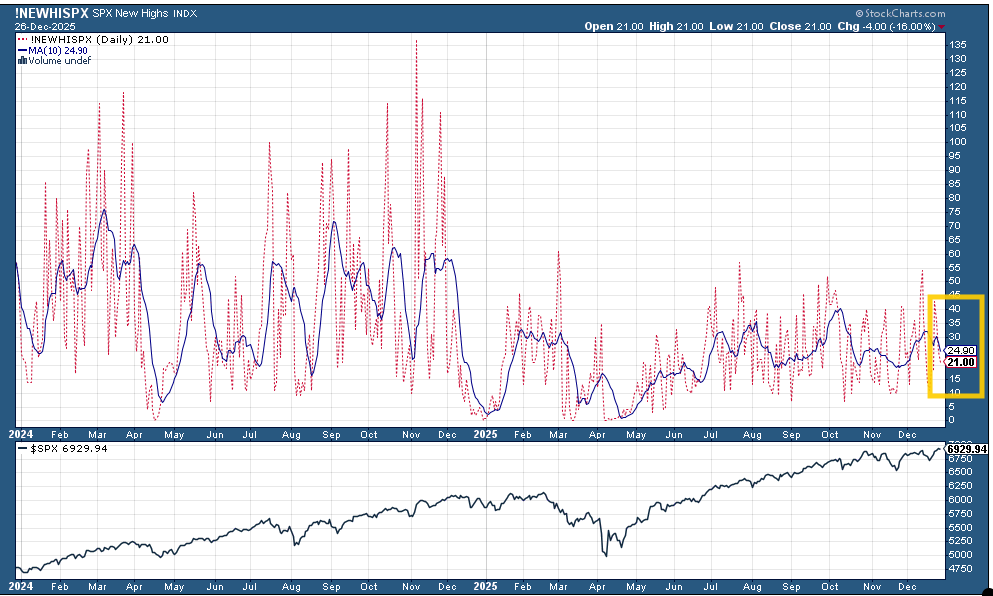

Despite hitting an ATH this week, SPX new 52-wk highs (red line) only got to 43 (on Monday and fell the rest of the week) ending Friday at just 21. That’s well below the 54 hit two weeks ago (which was the best since July), the 2025 peak of 61 in March, and the 2024 high of 137. The low was 0 in April.

The 10-DMA (blue line) also moved lower for a second week. It’s at 25. The 2025 high was 40 in October (and the 2024 peak was 76).

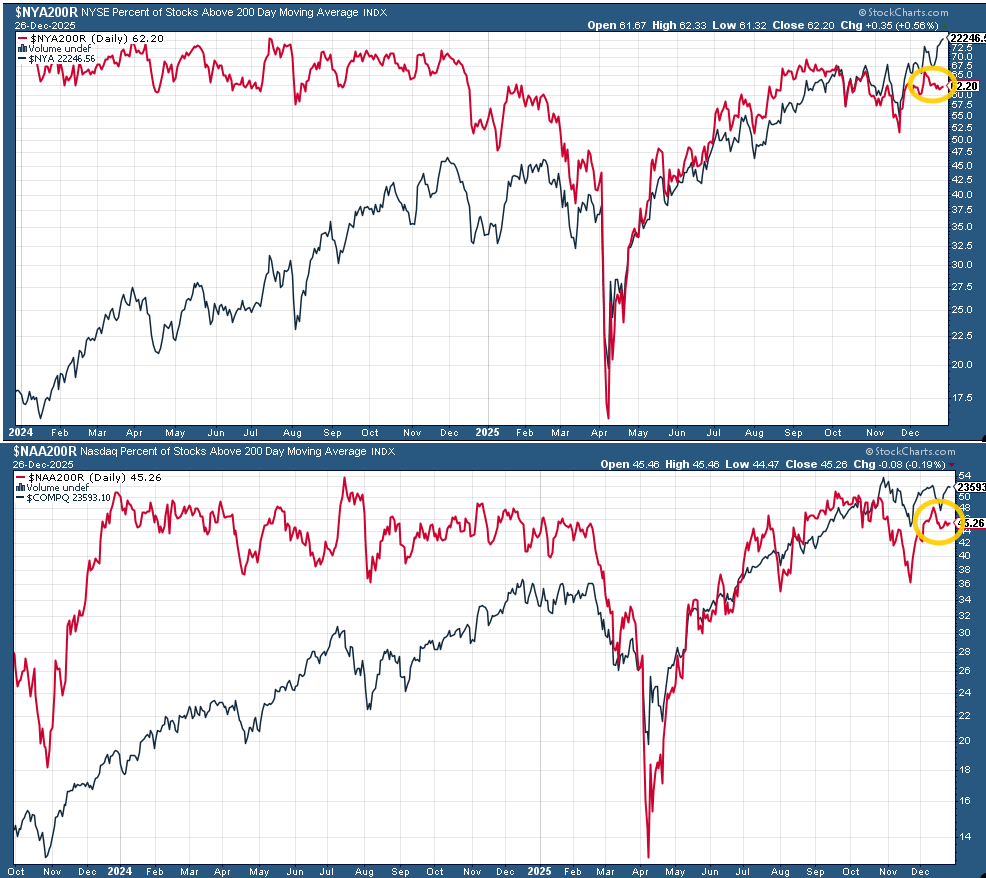

In addition to the SPX, the NYSE Composite made an ATH this week, but the % of stocks over 200-DMAs (red lines), a gauge of stocks in longer term uptrends, didn’t follow little changed w/w not even at the highs of the month. Nasdaq a similar story (although that index didn’t make a new high last week).

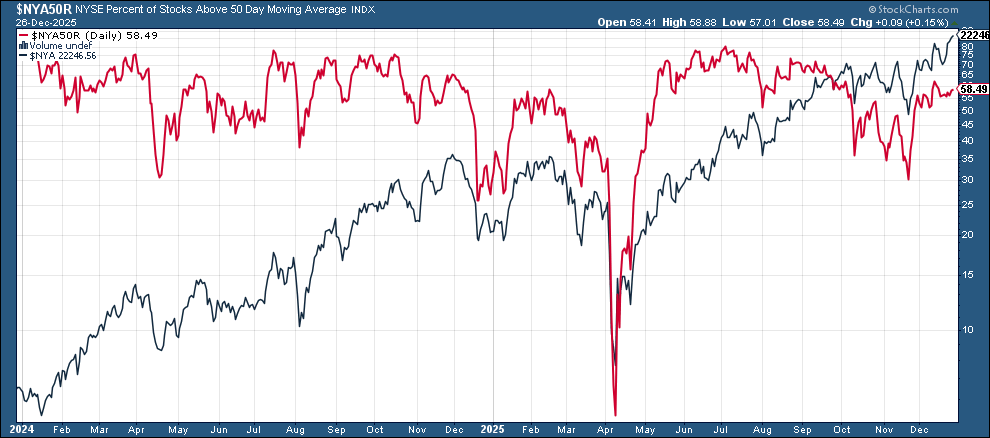

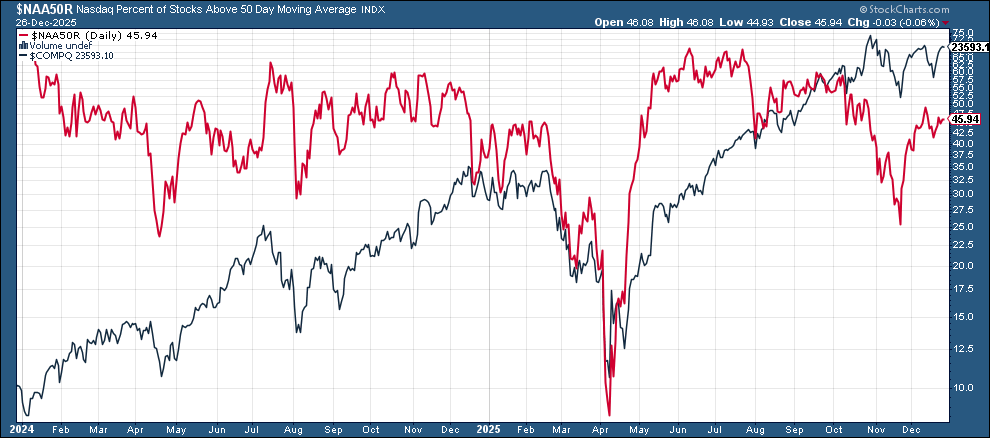

% of stocks above 50-DMAs (red lines), a gauge of stocks in medium-term uptrends a similar story with both (esp the Nasdaq) further off the highs of the year.

And shortening the lookback to % of stocks above 20-DMAs (red lines, indicative of equities in shorter-term uptrends) doesn’t help, as those actually fell back to the lowest in a month.

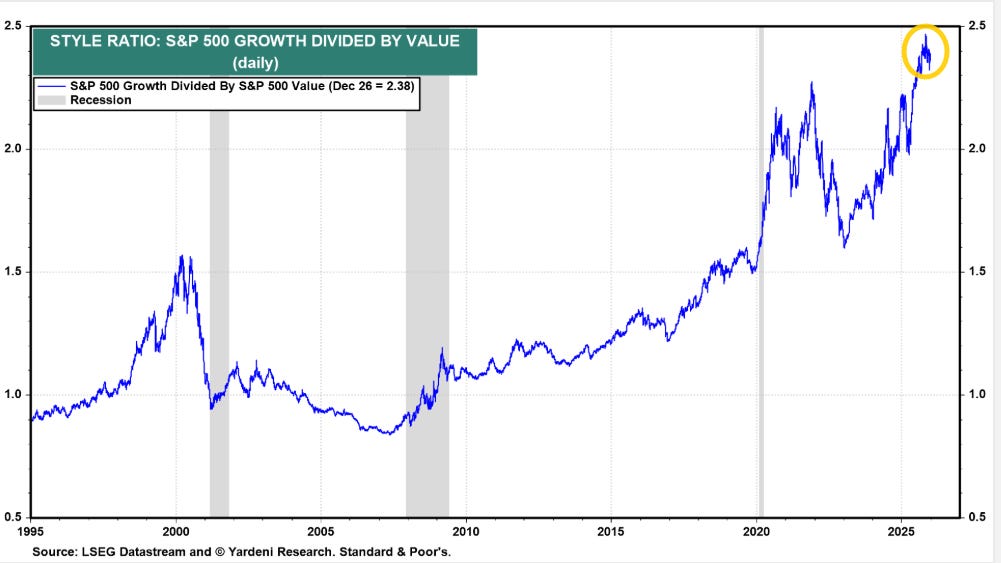

SPX growth/value edged higher for a second week to 2.38 after hitting a 3-mth low at 2.35 three weeks ago, still down from the highest since 1995 (2.44) the first week in Nov, but still up from around 2.0 to start the year.

https://yardeni.com/charts/growth-vs-value/

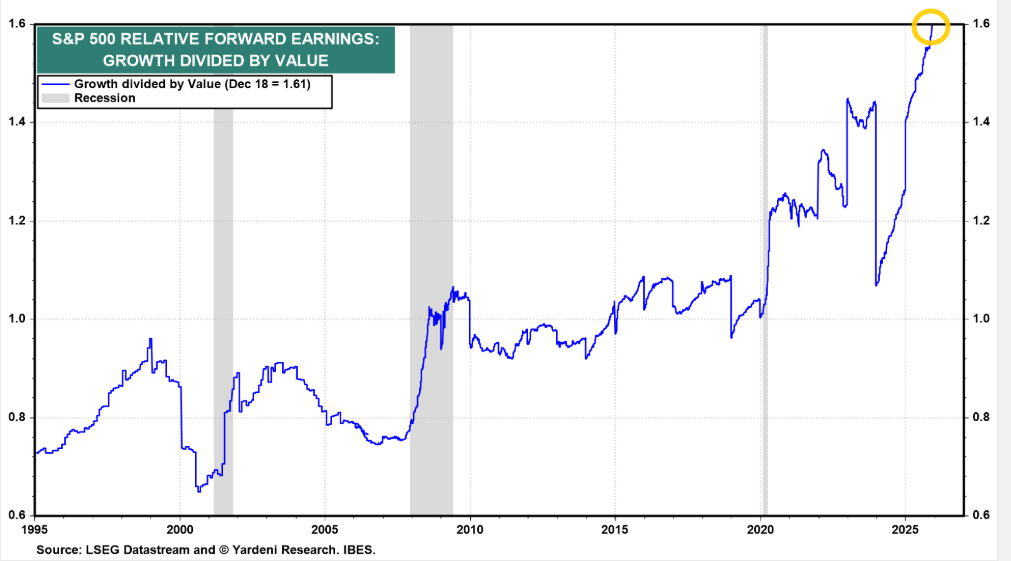

Even as the relative forward earnings of growth vs value continues to move to new highs (1.61), one week lagged (now actually off the chart).

Equal-weighted SPX vs cap weighted ratio fell back for a second week after clearing its downtrend line from April, remaining not far from the least since 2003

IWM:SPY (small caps to large caps) continued lower after last week being turned away from its downtrend line from the start of 2024.

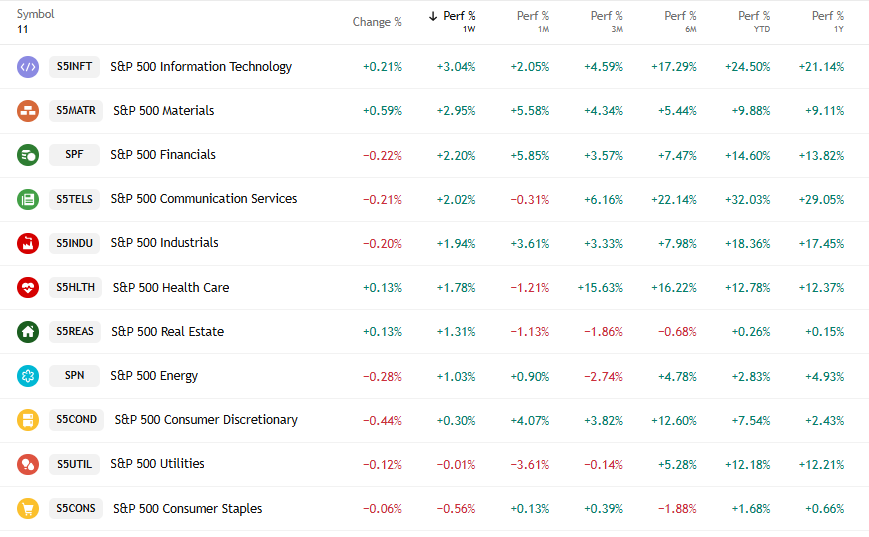

I couldn’t find a scorecard for just last week, so these are the SPX sector returns over the past 5 sessions (include Friday):

SPX sector breadth improved last week to 9 of 11 sectors higher (up from 4 the prior week and 6 the week before that, the best since all 11 the week before that) and one (Utilities) was down just -0.01% (and the other (Staples) just -0.6%).

8 sectors up more than 1% (after none the prior week and 4 the prior two weeks) led by Tech +3.0% (but note a lot of that was the prior Friday, excluding that it was just +1.4%).

Stock-by-stock chart from @FINVIZ_com similarly includes Friday (and so similarly would be much less strong if that was excluded for the top names) which in turn resulted in big weeks for many Tech and Financials and lots of green in many other sectors. Weaker sectors were Utilities, Staples, and Consumer Discr ex-Amazon and travel.

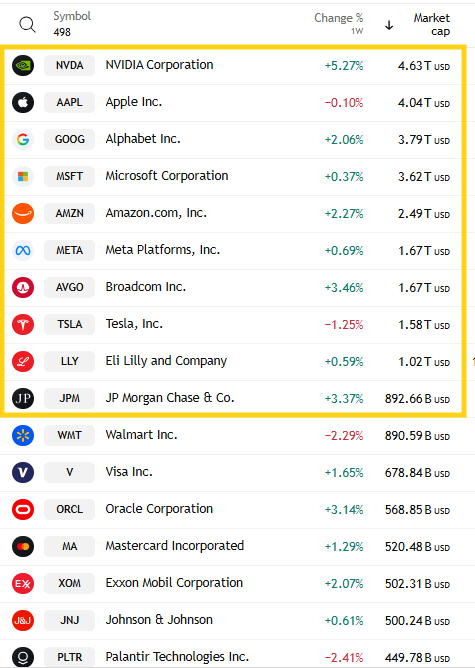

Looking at the top 10 stocks by market cap, just two were lower (vs three the previous week and seven the week before that) led to the downside by TSLA -1.25% (it would have been WMT -2.3% but as noted in the daily updates that has fallen out of the top 10 replaced by JPM). Leading to the upside was NVDA +5.3%. AVGO, AMZN, GOOG were also up over +2%.

Freeport McMoRan FCX the top performer on the SPX over that period at +7.9%.

15 stocks up over +4%, down from 33 the prior week and 80 the week before that. Five of those were >$100bn in market cap in MU (again), MRK, NVDA, C, NEM (in descending order of percentage gains),

On the other side Moderna MRNA -7.7% led decliners.

Just 3 SPX components were down -4% or more (down from 50 and 35 the prior two weeks), and none were >$100bn in market cap. Closest was PEP -3%.

Other breadth stuff:

Flows/Positioning

No Flow Show report this week.

EPFR FICC flows in the week through Wed saw a continuation of the prior week with continued buying of Commodities and Gold/Silver (which finished second and third in inflows (after second and first the prior week, the third week of finishing in the top 3 (after two weeks of outflows which broke a streak of nine weeks of finishing first and second (or second and first))).

EM debt moved to the top of inflows (with 0.6% of AUM) but otherwise it was almost identical (in ranking) with Corp HY and IG following (although just +0.1% ).

Treasuries a very modest inflow, but TIPS, cash (biggest outflow since Apr), and bank loans all saw outflows (and in that order).

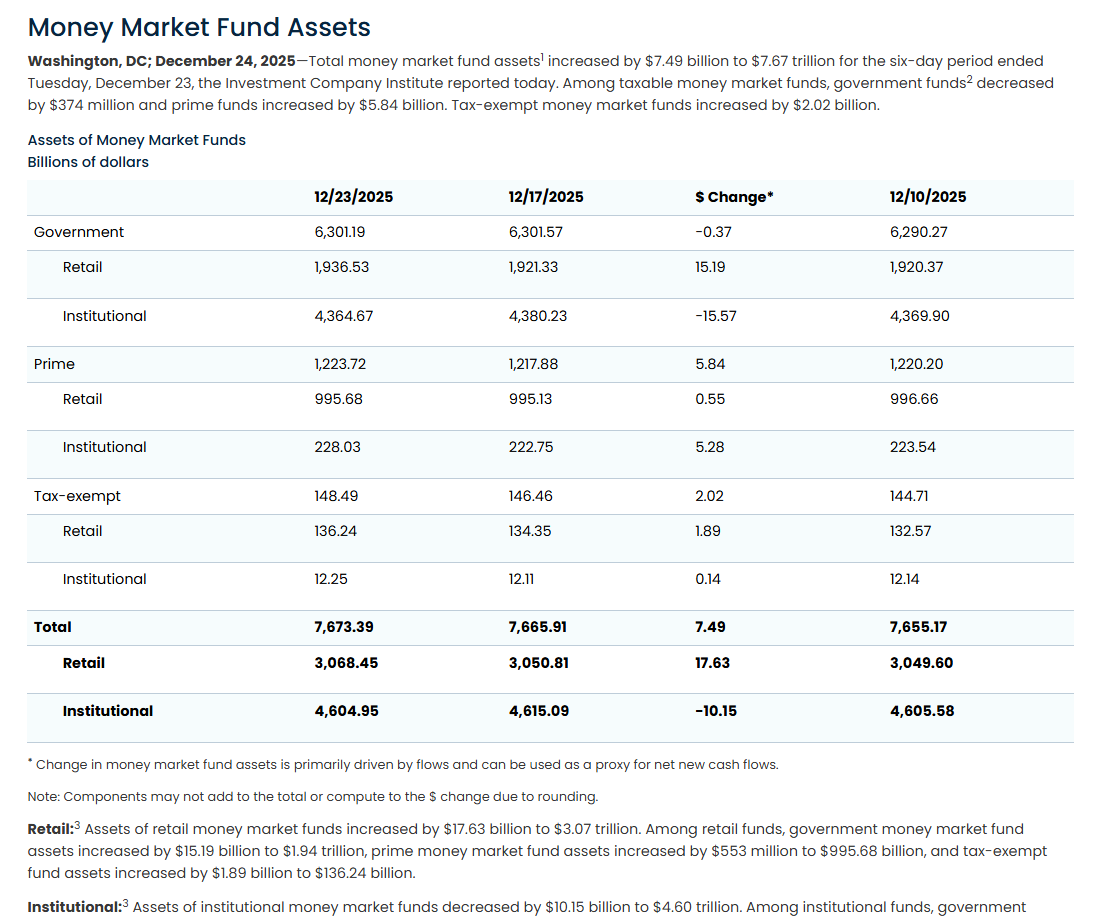

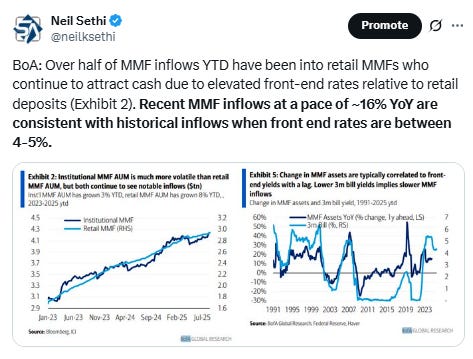

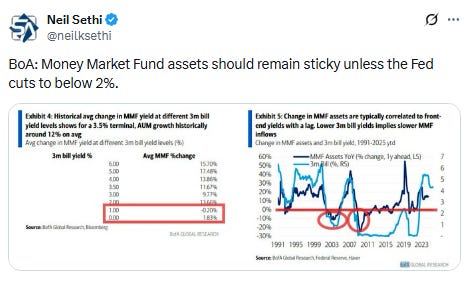

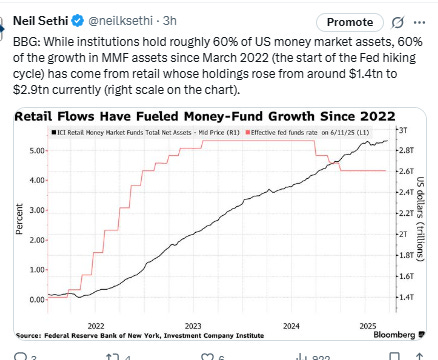

ICI data on money market flows saw a +$7.5bn inflow in the week through Dec 24th which brought their five week total to +$151.7bn.

But in a change from previous weeks, Institutions (who hold ~60% of MMF assets) shed -$10.2bn, the first decline in 6 weeks, dropping their total inflows over the past 15 weeks to +$396.9bn. Retail in contrast added a hefty +$17.6bn, the most since Sept 8th (now +$101.5bn the past 15 weeks).

Total MMF assets at a record $7.67tn.

https://www.ici.org/research/stats/mmf

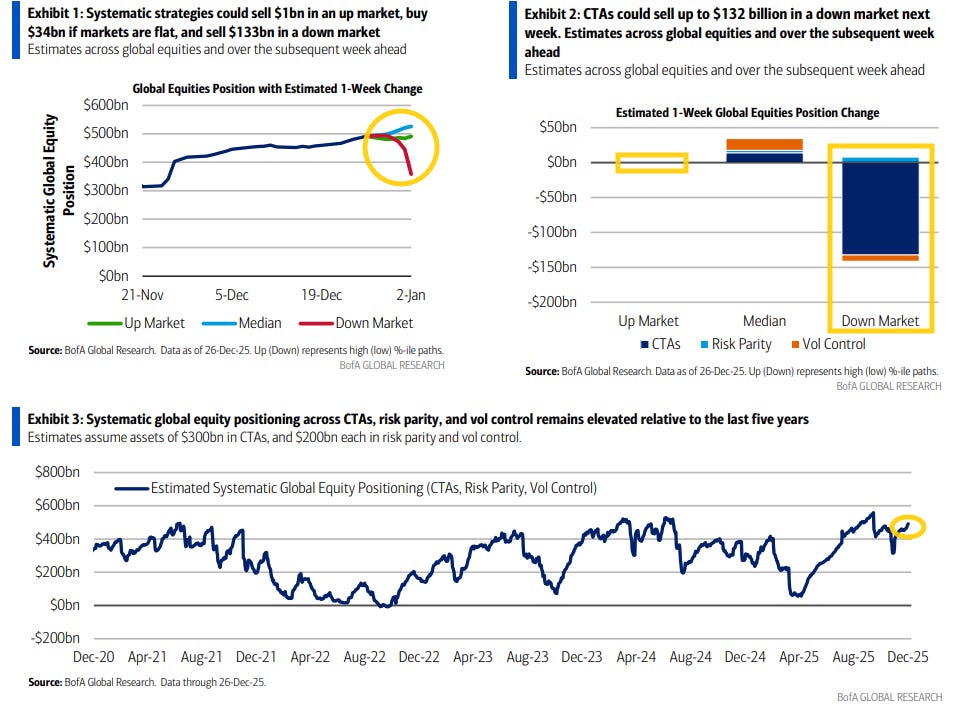

BoA again this week doesn’t provide any written commentary regarding their estimates on consolidated systematic positioning but the charts show we took another leg up in the rebound in positioning from the levels from late Nov, not quite back to the levels seen in Sept (which were the highs of the year), but the highest since then.

And like the last three weeks we remain with an unbalanced outlook similar to what we had seen until mid-Nov with much less scope for buying then selling:

BoA estimates a combined +$34bn of buying in a flat market (up from +$32bn the previous week but +$10bn the week previous to that) with buying driven by vol targeters and CTAs,

just +$1bn of buying in an “up” market (down from +$8bn the prior week but up from -$21bn of selling week before that (but down from +$75bn of buying at the lows in Nov (”up market” defined as 97.5 %ile price path or ~+3.5% similar to Goldman)), and

-$133bn selling in a “down” market, up from -$106bn the prior week and -$115bn the week before that (”down market” defined as the 2.5 %ile price path or ~-2.9% (different than Goldman who uses --4.5%)).

CTAs dominate the selling in a down market (due to both increased volatility but more importantly breaking sell triggers) representing -$132bn of the -$133bn in combined estimated selling (with vol control the rest offset by some very small risk parity buying (in that regard they have again risk parity modeled as a small buyer in all price paths)).

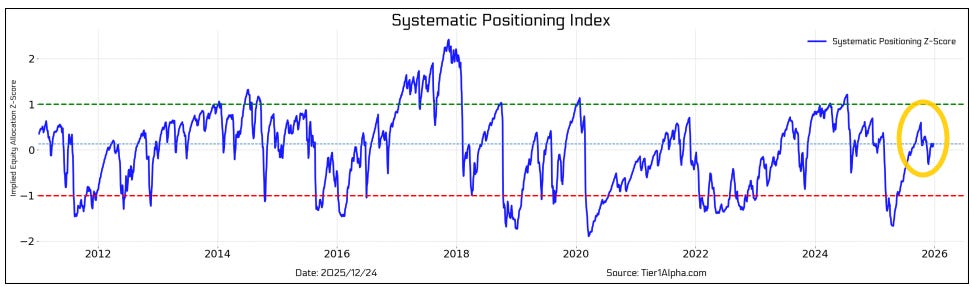

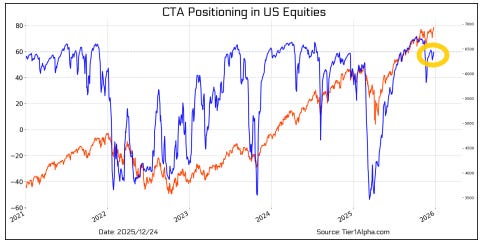

Tier1Alpha models less of a rebound in overall systematic positioning not yet to the levels of late Oct and just above the average net length to 2011.

Didn’t get the DB Flows report this week, so

DB also sees systematic positioning a little more full remaining at the 78th %ile net length to 2011.

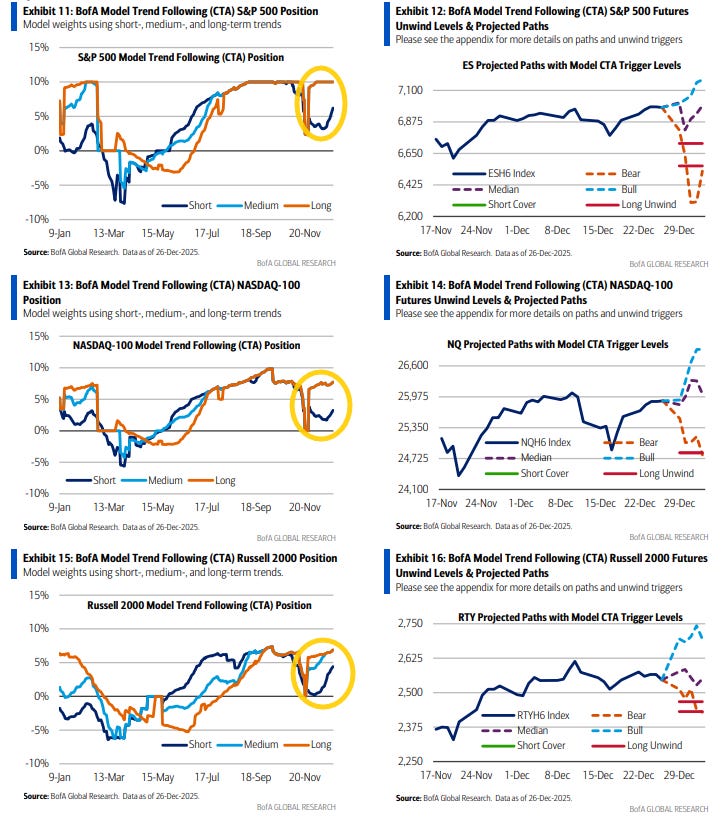

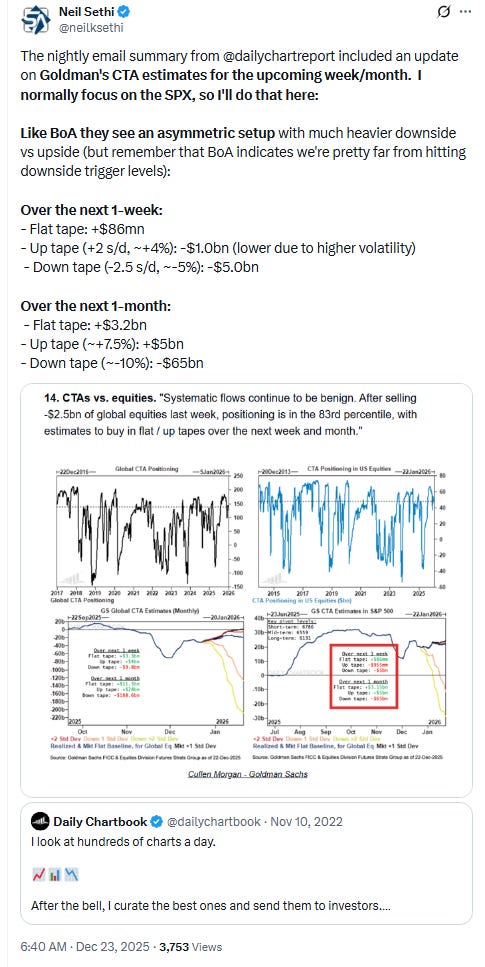

Looking more specifically at CTA (systematic trend follower) positioning in the US indices, BoA says:

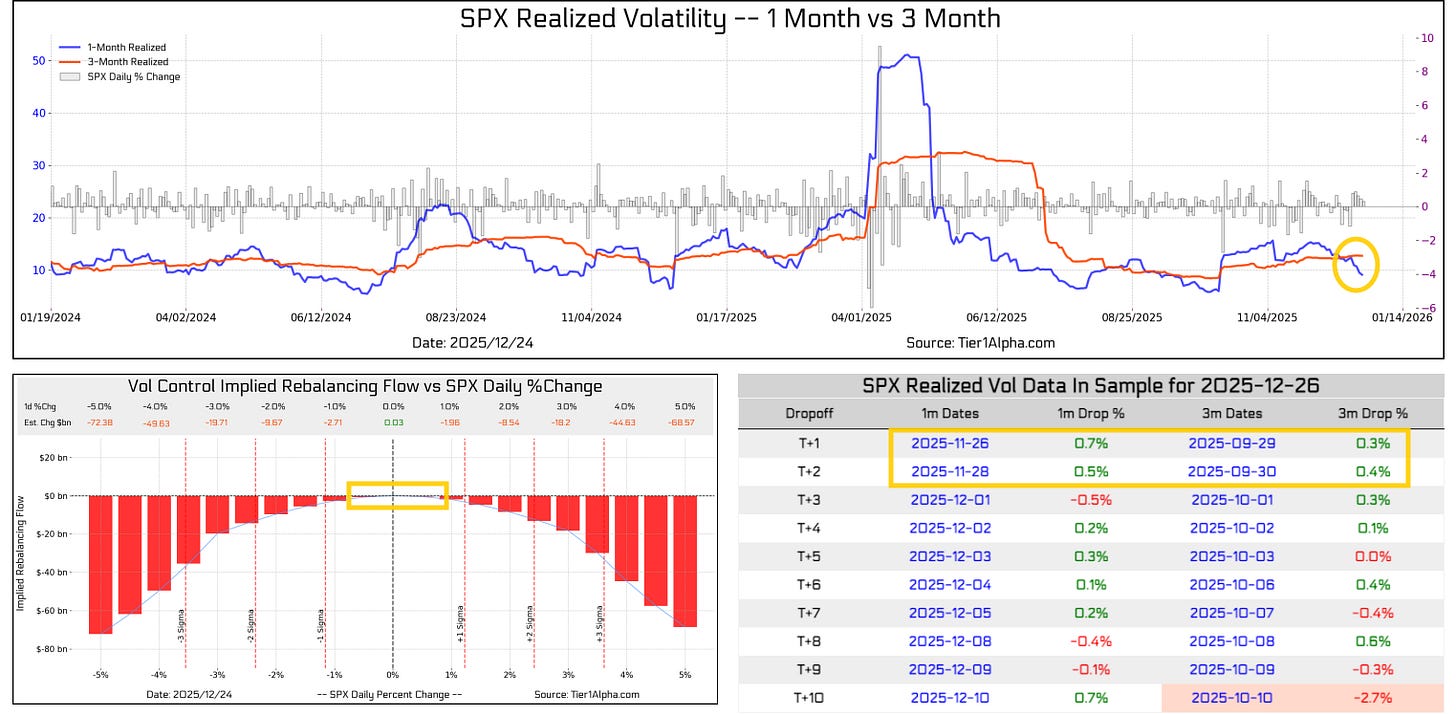

“CTAs with medium- to long-term trend signals remain stretched long across US equities. Short-term models, however, could still have room to add exposure. CTA long equity positioning could still increase as realized volatility declines, as it did [last] week. Volatility could potentially continue falling next week into the new year. Heading into the final week of the year, near-term risk of forced selling remains limited unless markets experience a sharper drawdown.”

As a reminder, BoA now looks at bullish, flat, and bearish price paths (which are based on price trend vs moving averages), but also in short, medium, and long term price trends. It appears that similar to the prior two weeks only the shortest haven’t yet brought their positioning back up to the levels from early Nov (with SPX and RUT at the highs of the year, and short-term CTAs are catching up, particularly on the RUT) leaving less room for CTAs to add per the systematic positioning summary, but they also see a good amount of breathing space before any selling would take place.

They don’t therefore provide buy levels (as that is more volatility dependent as they note) but they see the first layer of sell triggers at 6721, 24820, and 2472 on the SPX, NDX, and RUT respectively.

DB sees CTA equity positioning as edging back the 70th %ile to 2010 (from the 71st the prior week) still not far up from a 4-month low (56th %ile) three weeks ago. In terms of the US, long positioning eased to the 51st %ile in the SPX (from the 52nd) stayed at the 52nd for the RUT and fell to the 41st (from the 45th) in the NDX, so seeing more room to expand than BoA models.

Tier1Alpha sees CTA positioning in US equities edging higher last week but remaining off the highs of the year.

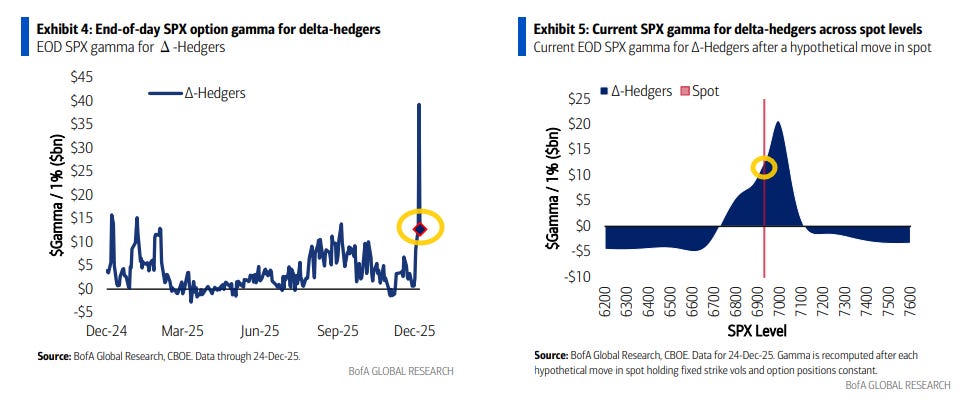

BoA on SPX gamma:

“SPX dealer gamma set a new all-time-high (ATH) on Tuesday with an astounding +$39bn gamma. The previous ATH was +$24bn gamma on 05-Jul-2024. The primary cause of Tuesday’s record gamma was a large SPX 1DTE (Wed 24-Dec expiry) iron condor sold by an end-user (strikes of 6885/6890/6920/6925) with ~80-100k contracts per leg. The S&P ended Wednesday at 6932 so the condor buyer (seller) realized the max gain (loss) of the trade. As of Wednesday, SPX gamma was ~$13bn (97th 1y %ile) which may grow if the S&P climbs into year-end due to a large position in the 31-Dec 7000 options.”

Ah, the power of 0DTE to mess up a chart. Looking past the now irrelevant (but interesting) iron condor trade, we remain in the “highly asymmetric” gamma profile as BoA has described it, which I indicated in prior weeks would likely last through YE given it is built around the JEPI call strike at 7000 which won’t change until the end of the month. And even with the iron condor trade rolling off, we remain at an elevated gamma level this year that will cushion volatility.

BoA models gamma building on moves to that 7000 area (which many believe will act as a “magnet” pulling the SPX towards it) but falling off on declines, although not turning negative until the 6750 level. That setup gives less cushion to declines, especially if one is quick and sharp (which could happen if bad news comes out in this week’s low liquidity environment).

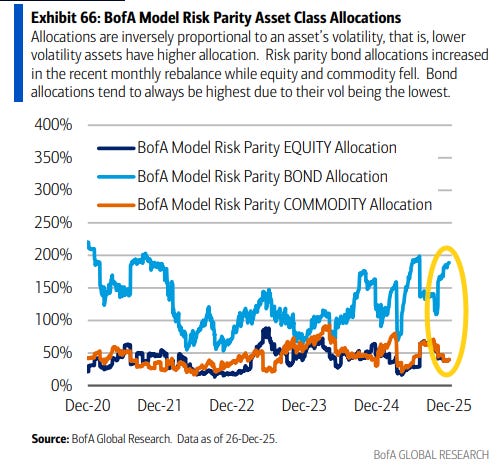

BoA’s estimate of risk parity positioning (which they estimate at around $200bn of AUM at max exposure) saw another week of increase in the leveraged exposure to bonds, nearing the highs of the year, and little change in stock and commodity exposure which are well off the highs.

DB models risk parity funds (est ~$250bn in max AUM) adding to equities although their US allocation “was pared slightly.” They also trimmed commodities for a second week while their allocation to bonds was flat:

overall equity allocation increased again this week (78th percentile from 77th the prior week). While the allocation to the US was pared slightly (76th percentile from 77th), that to other developed markets (71st percentile from 69th) and EM (82nd percentile from 82st) rose modestly. Their allocation to bonds (37th percentile) and inflation-protected notes (69th percentile) stayed flat, while their allocation to commodities (79th percentile from 83rd) was trimmed.

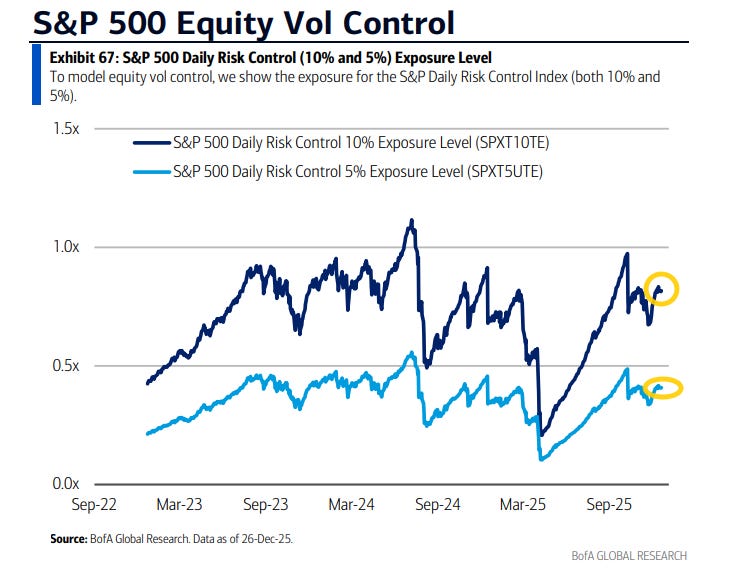

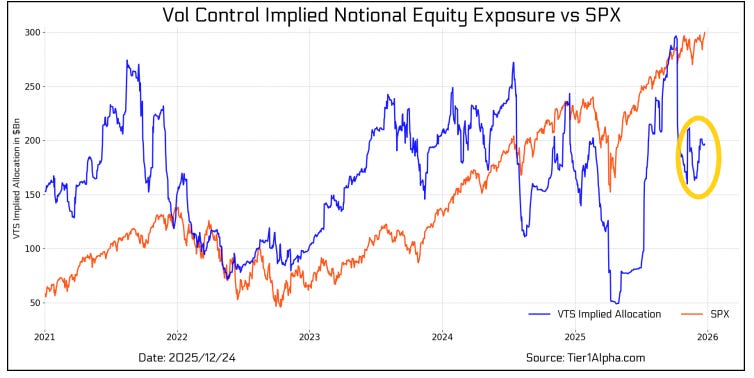

Despite the more subdued volatility of late BoA’s estimate of vol control equity exposure (which they estimate at around $200bn of AUM) was little changed w/w. While still not back to early Nov levels, they are quite full historically.

DB though says vol control funds “slightly reduced their equity allocation this week (97th percentile since 2010 from 99th the prior week). Their sensitivity to market sell-offs rose.” Note that this estimate is well above what BoA and Tier1Alpha estimate and is up sharply from the lowest since May (33rd percentile) three weeks ago.

Tier1Alpha also sees vol control edging back their net length well off the highs of the year.

And they don’t see much scope for buying this week as the most volatile day we’re dropping from the lookbacks is 0.7% (on the 1-month), and on the 3-month which is “the new rebalancing toggle,” as it has moved over the 1-month, the largest is just 0.4%.

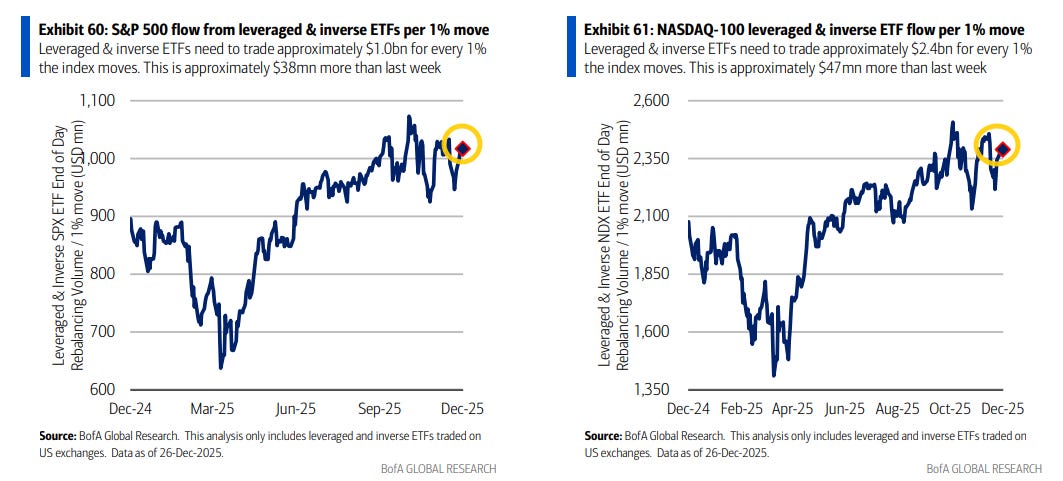

I like to look at the impact of moves in leveraged ETFs on the overall market as a barometer of risk appetite (the greater the impact, the more investors have in these ETFs which I think of as “higher risk”), and both SPX and NDX leveraged ETF AUMs continued their rebound, although both are still a little below the levels from early Nov (and further from the levels in late July). Both though much, much closer to the highs of the year than the lows.

Remember, this is a “constant negative gamma” source as Charlie McElligott put it in a Oddlots appearance (meaning that there is double/triple buying pressure from them as they rebalance each day).

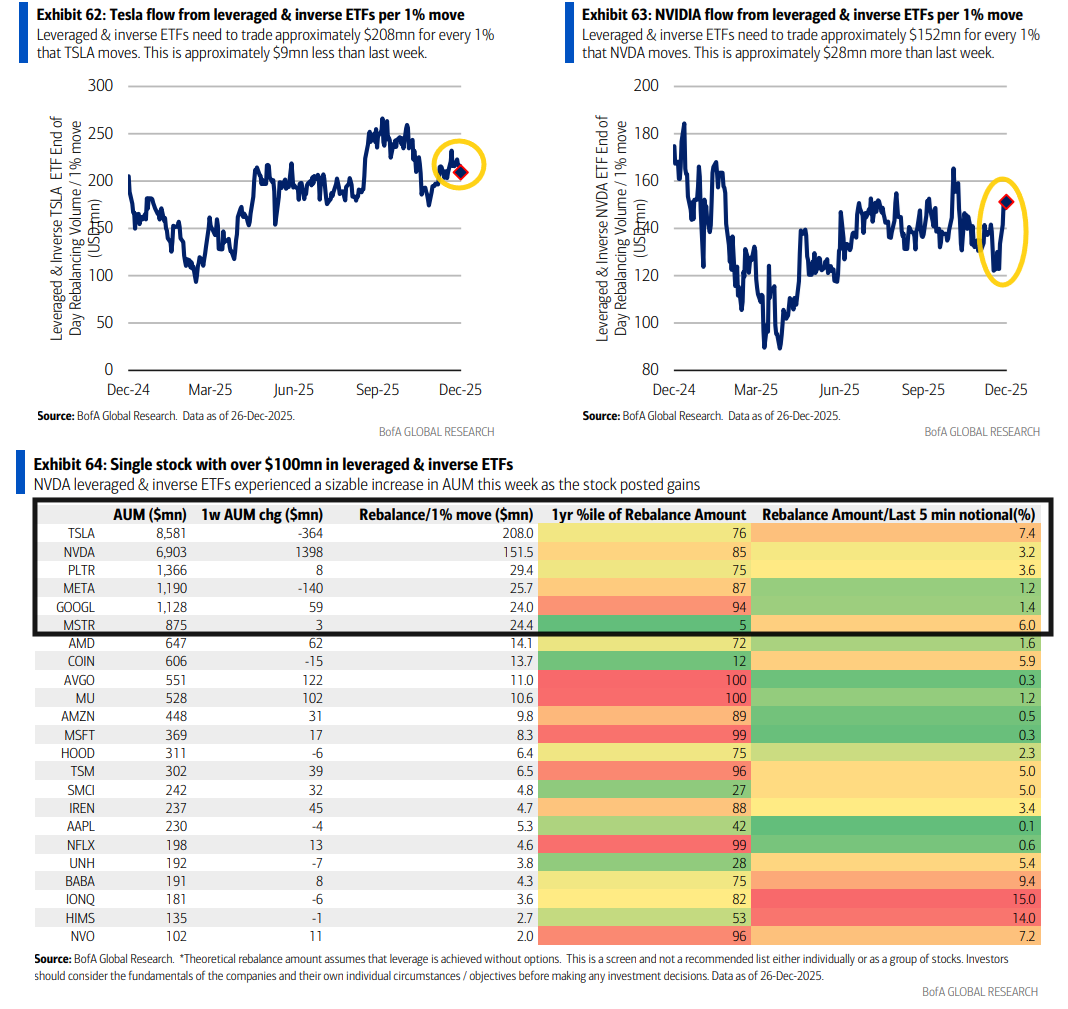

Looking at the two largest single stock ETFs $TSLA and $NVDA, we saw a reflection of recent newsflow as the largest, TSLA ETFs, shed -$0.4bn in AUM after -$0.2bn the prior week (but only after adding +$.1.6bn the two weeks before that) still with a comfortable lead at $8.6bn (which is now a 7.4% rebalance amount daily in the last 5 minutes (down from nearly 30% seven weeks ago)), while NVDA leveraged ETFs jumped to the highest since October +$1.4bn to $6.9bn (3.2% rebalance), from the least since June.

Also $PLTR moved to third place even as it added just +$8mn remaining at $1.4bn, as $META lost -$0.1bn in AUM to $1.2bn. GOOG remained in fourth place ($1.1bn) and MSTR ($0.9bn) in fifth both with marginal changes.

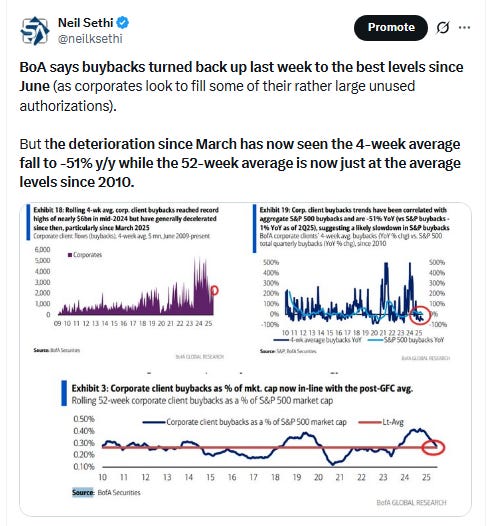

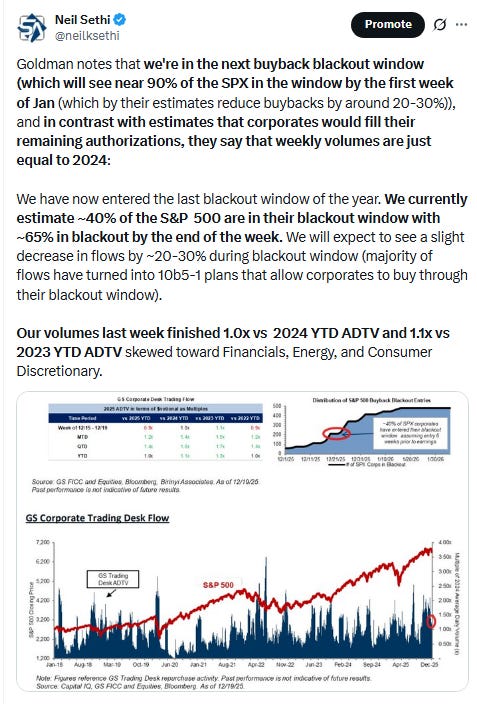

And after buybacks ended 2024 at record levels and started 2025 even better, they had by and large remained below seasonal averages since April until October when they seemed to have picked back up (depending on who you ask), but according to BoA have turned back lower (y/y) of late, currently -54% on a 4-wk avg basis (after having been +1% in 2Q. We are also starting to close the buyback blackout window which will accelerate as we get towards 4Q earnings in January.

And some other notes on positioning:

Sentiment

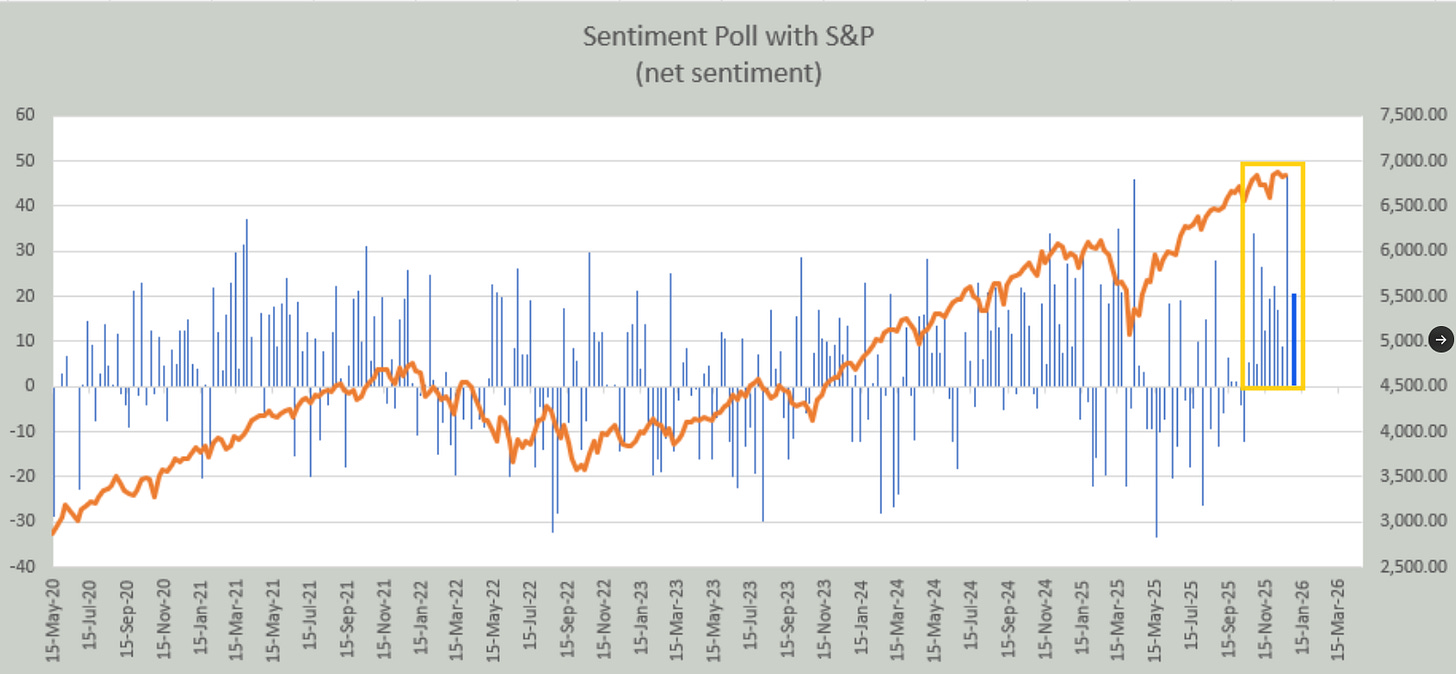

Sentiment (which I treat separately from positioning) is one of those things that is generally positive for equities when its above average but not extreme (“it takes bulls to have a bull market”, etc.), although it can stay at extreme levels for longer than people think, so really it’s most helpful when it’s at extreme lows (“washed out”). We got close to washed out levels in April before steadily recovering much of that through late July (when I said we were “getting to” euphoric).

Since then things had been much more mixed on the sentiment front, before again moving back towards the July levels in later October (and in some cases exceeding them (NAAIM hitting the highest in over a year, and a variety of other metrics like II bulls-bears, BoA Bull/Bear indicator, 10-day put/call ratio, etc., hitting the most frothy levels of the year)). Those all fell back though along with the equity drawdown in November, and a couple hit at or near extremes for the year at the end of November. But like clockwork they rebounded along with the equity recovery although most eased off last week.

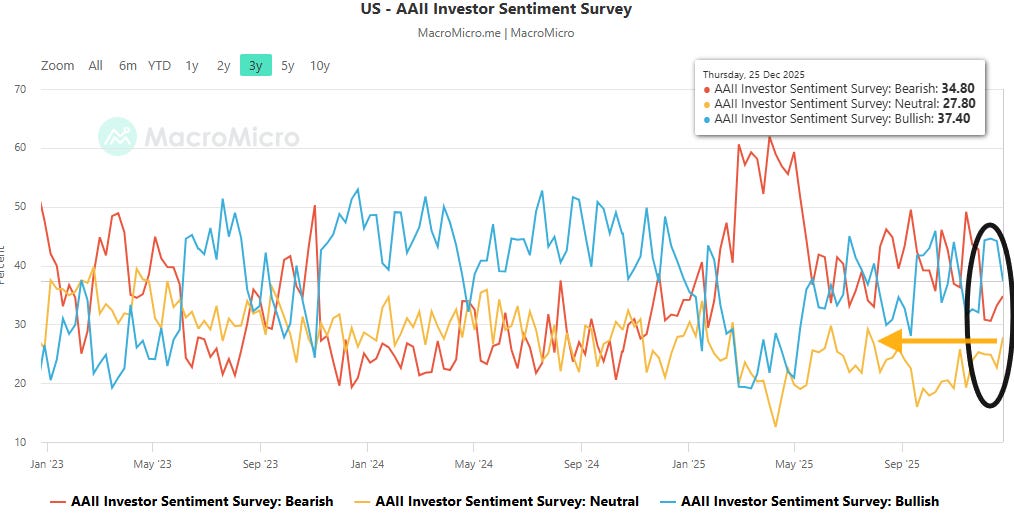

AAII bulls (those who see higher stock prices in 6 mths, blue line) fell back for a second week to 34.8% from 44.1% the prior week (and 44.6% week before that, which was the highest since Oct 8th), but still up a bit from the 32.0% four weeks ago, but back below the long-term historic average of 37.5% for the first time since then (4 weeks ago).

Bulls also remained a little above the level of the bears (who see lower stock prices in 6 mths, red line) who increased for a second week (after falling for four weeks) to 37.4% from 33.2% the prior week and 30.6% the week before, which was the least since Jan 23rd (following the biggest drop since Nov ‘23). Bears remain above the long-term average of 31.0% for a second week and the 51st in 54 (since Dec 12th).

The rest of the bulls went into the neutral camp (yellow line) which increased for the first time in four weeks to 27.8%, the highest since July, from 22.7% the prior week, but still under the long-run average of 31.5% for the 74th week in 76 (since July ‘24).

https://aaii.com/sentimentsurvey

In the special question this week AAII asked “How has the rise of passive investing (index funds/ETFs) affected your investing strategy?”

A majority (52%) said they hadn’t changed their strategy or approach while 29% said they had shifted more into passive.

5.6% said they had gone more active “to differentiate”.

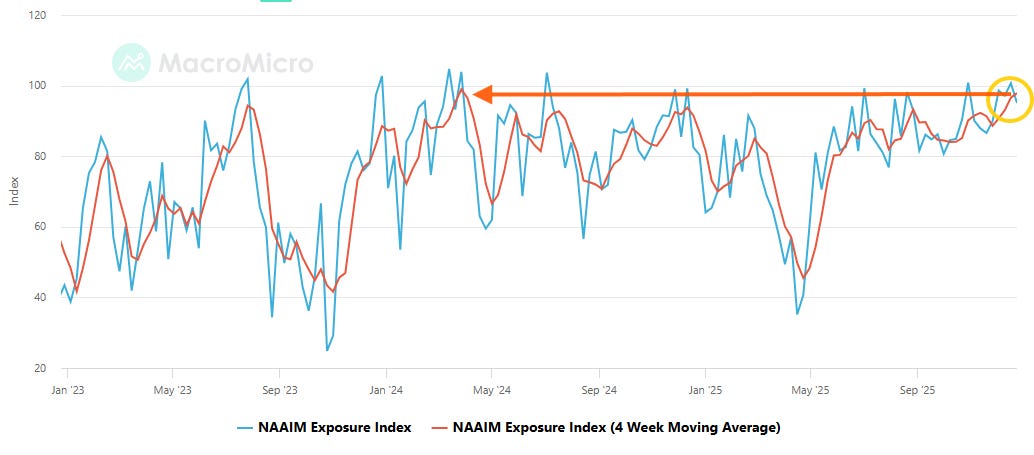

NAAIM (investment managers) exposure index (blue line) fell for the first time in five weeks after exceeding the 100 mark for the second time this year the prior week (which means that the average respondent (investment manager) is levered long equities), down to 95.08% from 100.70% which was just a touch under the 100.83% Oct 29th, which was the highest since July ‘24.

The 4-wk avg (reddish line) though improved to 97.9%, the highest since Mar ‘24 (99.0%).

As a reminder, the index “represents the average exposure to US Equity markets reported by our members” and which ranges from -200% (2x short) to +200% (2x long).

https://naaim.org/programs/naaim-exposure-index/

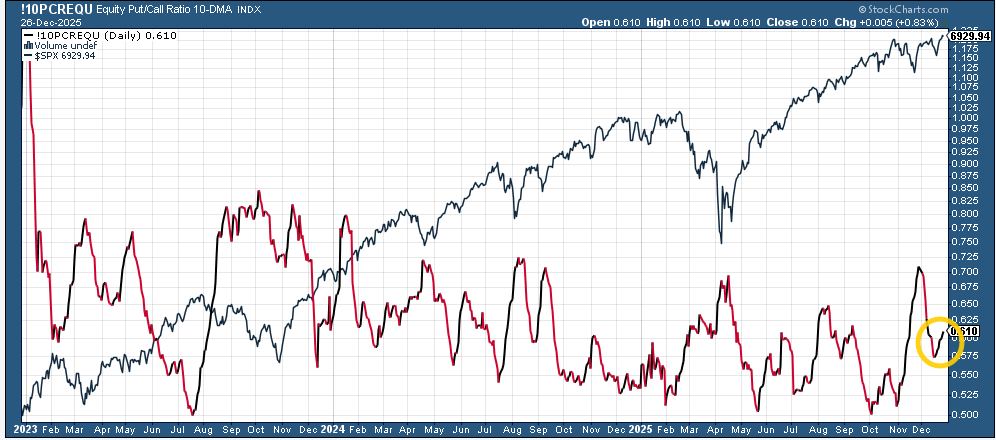

Along with the AAII, NAAIM, etc., surveys softening, the 10-DMA of the equity put/call ratio (black/red line) continued to move higher for a second week to 0.61 from 0.59 a week ago, evidencing some increased demand for downside vs upside protection (although it remains well under the 0.71 in late Nov (the highest in a year)), but it also turned up well before it got to the 0.50 it hit at the start of Oct (which was the joint lowest in three years).

When it’s increasing it normally correlates to a consolidation in equities and increase in volatility and vice versa.

Goldman’s US Equity Sentiment Indicator improved to +1.0 from +0.4, only the fourth time (after one week in October) the indicator has been in positive territory since February, and the highest since then on the cusp of “stretched positioning” which would indicate likely equity weakness in the short term.

The indicator combines “six weekly and three monthly indicators that span [across the more than 80% of the US equity market that is owned by institutional, retail and foreign investors]. Readings of +1.0 or higher have historically signaled stretched equity positioning. Readings of -1.0 or lower have signaled very light positioning and have historically been a statistically significant signal for subsequent S&P 500 performance”.

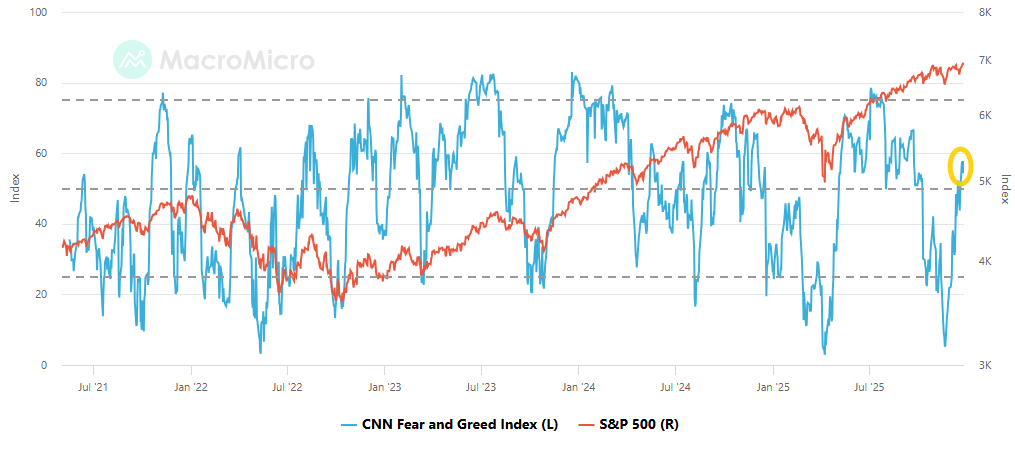

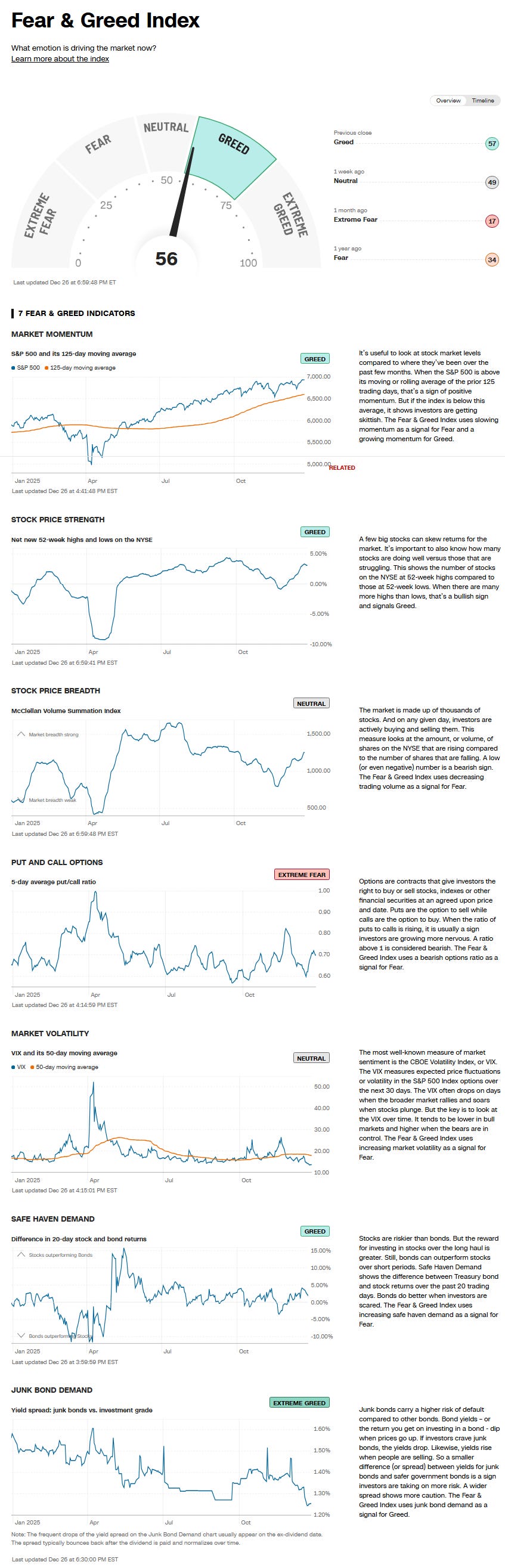

The CNN Fear & Greed Index (blue line) made it to 57.29 Thursday, the highest since Sep 22nd, before edging back to 55.51 Friday, still up from 45.49 the previous Friday at the bottom of “Greed,” a world away from the 6 it hit intraday on Nov 20th.

After having no indicators in Greed/Extreme Greed two weeks ago, we now have four of the seven and just one in Fear/Extreme Fear (vs six in Nov):

Extreme Greed = junk bond demand (from Fear)

Greed = market momentum (SPX vs 125-DMA) (from Fear); stock price strength (net new 52-week highs) (from Neutral); safe haven demand (20-day difference in stock/bond returns) (from Extreme Greed)

Neutral = market volatility (VIX & its 50-DMA); stock price breadth (McClellan Volume Summation Index) (from Fear)

Fear = None

Extreme Fear =put/call options (5-day put/call options)

https://www.cnn.com/markets/fear-and-greed

No Flow Show this week.

The revamped BofA Bull & Bear Indicator rises to 8.5 from 7.9, not yet to the 8.9 on Oct 1st which was “an extreme bullish level last seen in Feb’18 & Feb’20,” but good enough to again trigger the “contrarian sell signal” “on huge inflow to equity ETFs, rising global stock index breadth, hedge funds cutting length in VIX futures”:

“Bull & Bear Indicator >8.0 = extreme bullishness = contrarian sell signal; median decline in global stocks = 2.7% in 2 months following 16 sell signals since 2002 (Chart 19) with 63% hit ratio (Table 1); max drawdowns in 1 month, 2 months, 3 months after sell signal = 4%, 6%, 9% respectively (vs. max upside foregone <2% - see Table 2)”

And we have a post-pandemic record. Helene Meisler’s weekly poll remained bullish for an 11th week, breaking the 10-week streak in early 2021. As I said last week, “like this streak, that streak was after an extended bull run which carried on from there.”

The bullishness did though decelerate from the previous week’s record high of 73.3% to a more sedate 60.4% voting next 100pts higher on the SPX.

While they started the year unusually much more wrong than right (but also after Helene had to start with a new X address which dropped her followers dramatically), they have been much more accurate since the start of October (probably not coincidentally as her follower numbers have grown (although still just around 10% of what they were pre-hack) although they missed last week.

The low of the year was 33.2% on May 17th (also a record).

And the link to Helene Meisler’s always excellent Weekly Chart Fest. [link is from last week, no Chart Fest this week].

It normally includes Citi’s Panic/Euphoria Index which fell almost to the zero line at the end of April, moved higher, softened again in August but never left Euphoria before hitting new 52-week highs five weeks ago before again softening but remaining well into Euphoria.

While the fine print says “[h]istorically...euphoria levels generate a better than 80% probability of stock prices being lower one year later,” it has seen a mixed track since the start of 2024:

-It entered euphoria in late March 2024 (when the SPX was around 5200). We didn’t get to 5200 by late March of this year, but we got closer than I would have thought at 5500 (and we did fall under for one day in April).

-The next entry into Euphoria was in late October 2024 w/the SPX around 5800. The closest we’ve been since the start of October was 6550.

This most recent entry was in July w/SPX at 6200. We’ll see how it does this time (so would need to be under 6200 July 2026).

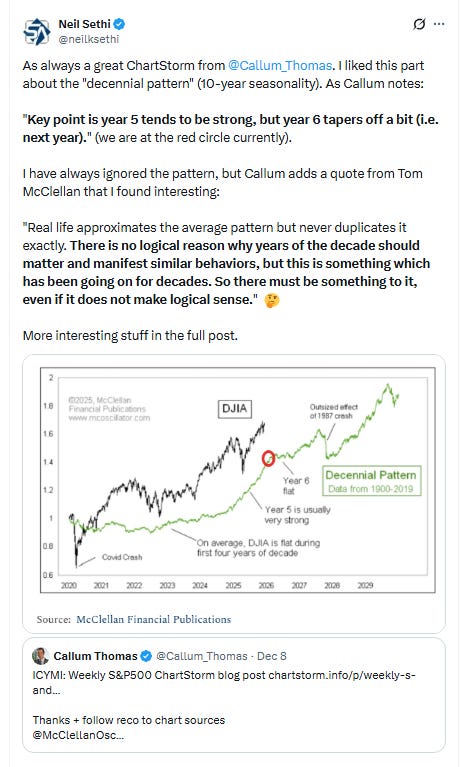

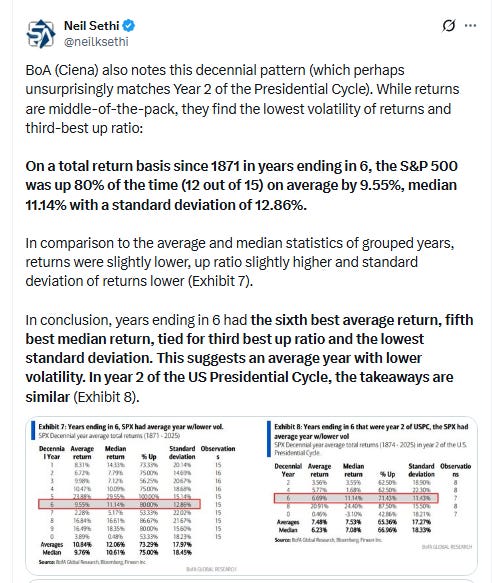

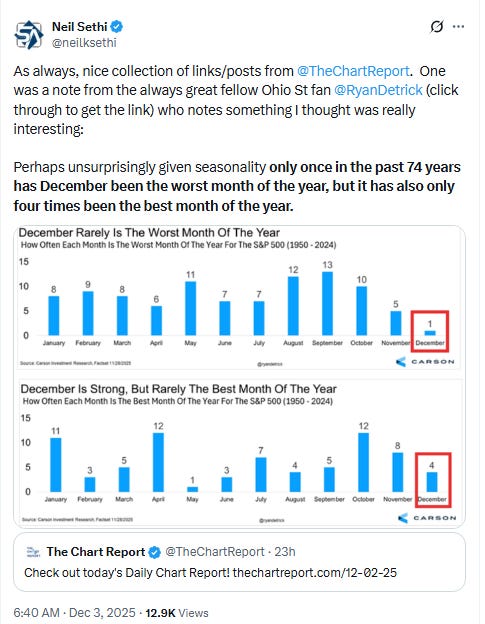

Seasonality

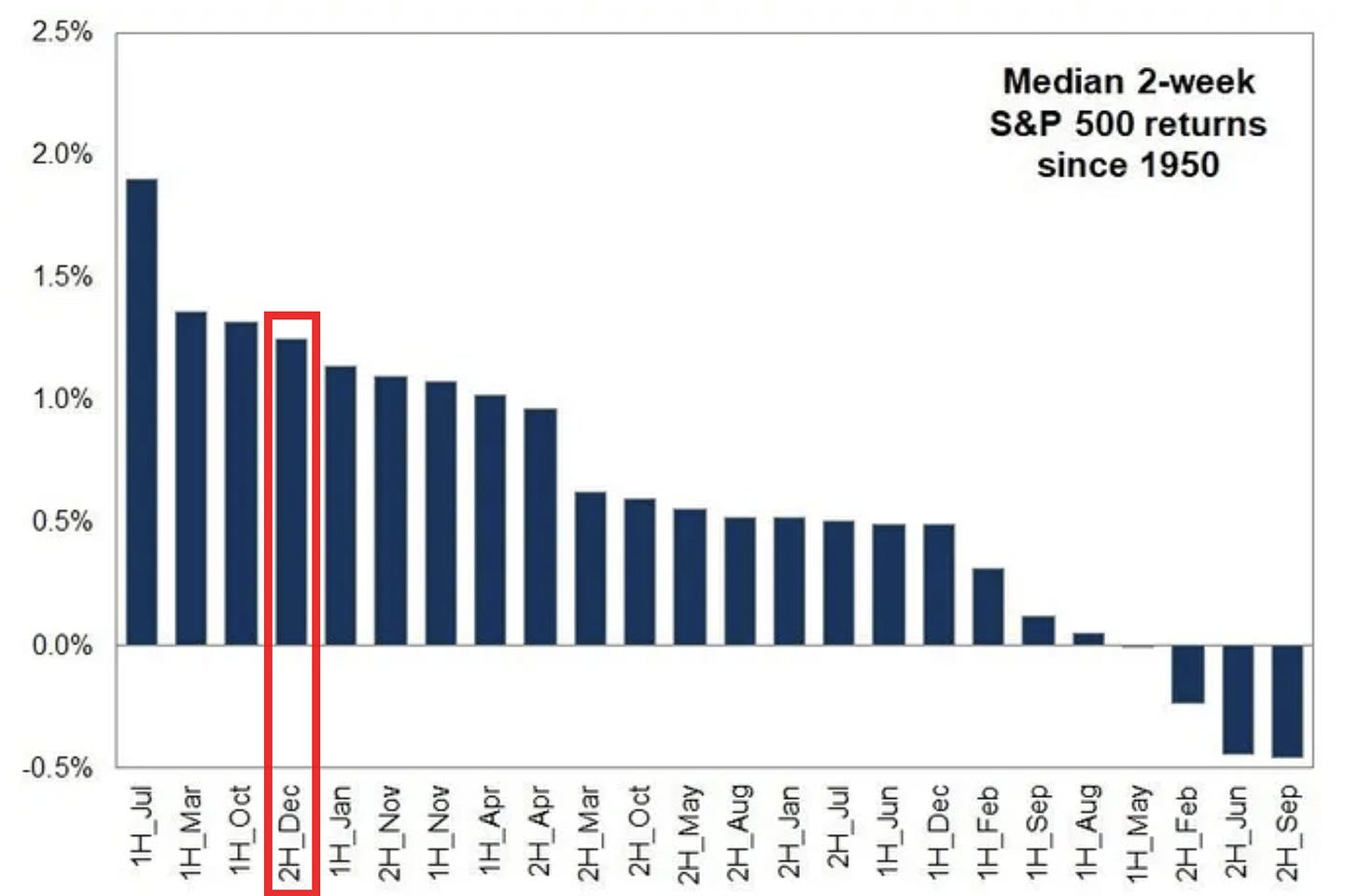

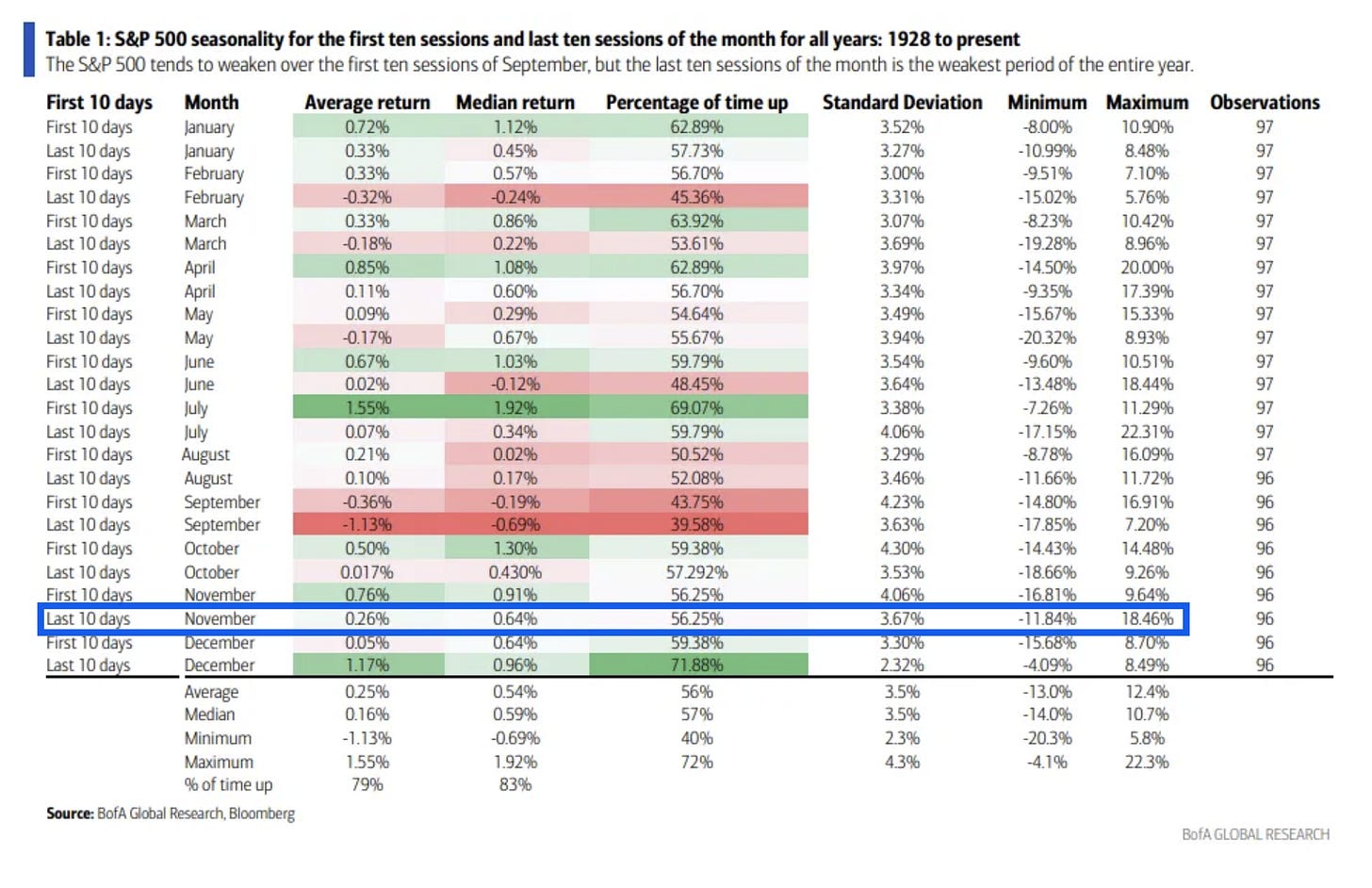

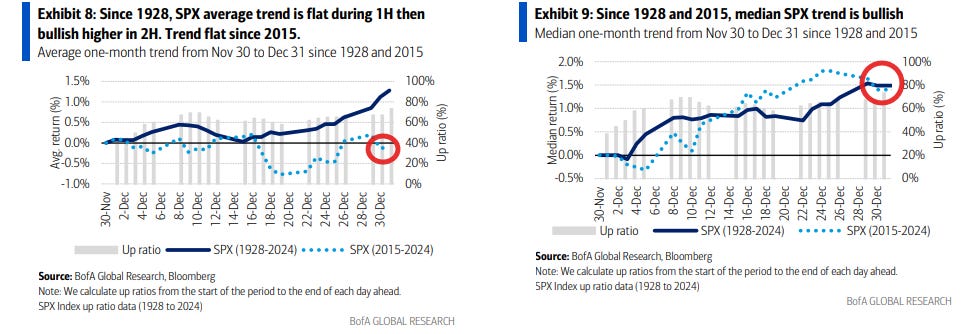

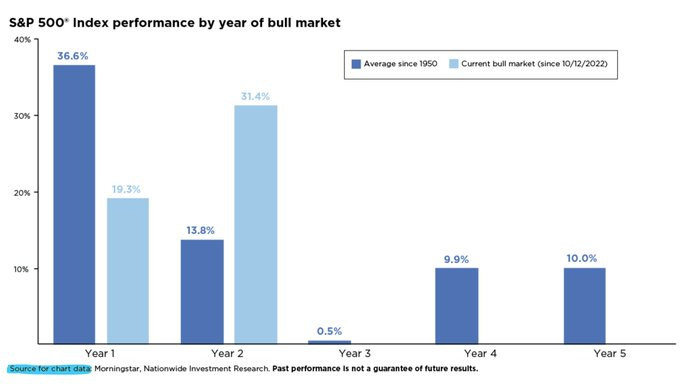

As we move into the second half of December seasonality improves with a median return since 1950 of of +1.3% up from just +0.3% for the first half (which may partially explain the weakness the past couple of weeks which were down slightly), placing it 4th from the top for all monthly halves.

Looking since 1929 the second half of December is similarly relatively strong with an average gain of +1.17% (up from +0.05% in the first half), the 2nd best of all half-months and well above the all-halves average of +0.25%. Median is a touch weaker at +0.96% (up from +0.64% for the first half) which is just 5th best also better than the all-halves median of +0.59%.

But here’s where it really gets good: The second half of December has been positive 71.8% of the time, the best of all halves and vs the 56% average and 57% median for all halves, while the standard deviation (volatility of returns) is just 2.32%, by far the least volatile (the next closest is first half of February at 3.0%, over a percent below the all-halves avg/median of 3.5%.

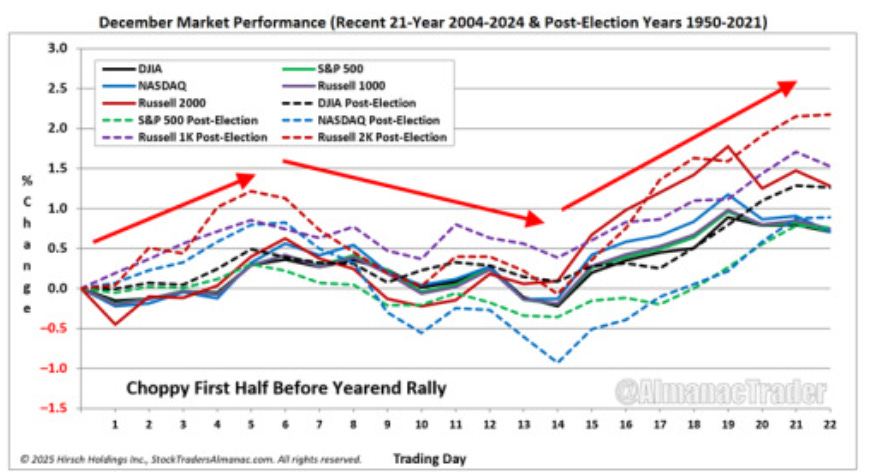

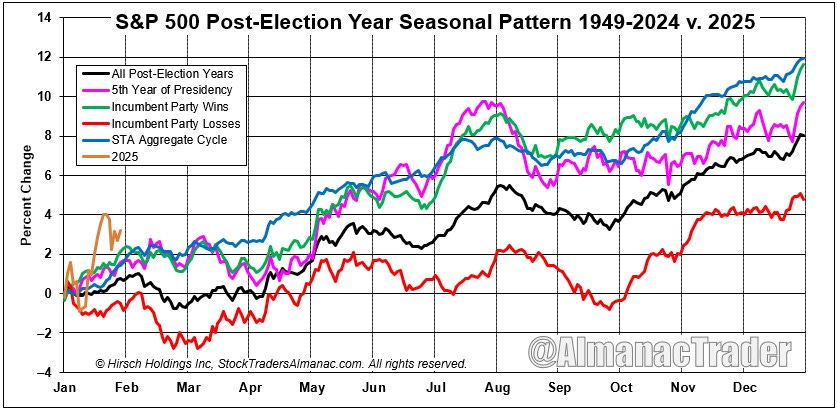

Jeff Hirsch, editor of the Stock Trader’s Almanac, ascribes what is normally a choppy first half of December to “tax-loss selling and year-end portfolio restructuring” as “[a] modest rally through the around the sixth trading day has also fizzled going into mid-month. It is around this point that holiday cheer tends to kick in (and tax-loss selling pressure generally fades) propelling the indexes higher with a pause near month-end. Post-election year Decembers have followed a similar path, but with varying degrees of over- and under-performance.”

But interestingly the average December SPX trend since 2015 sees the index with a slightly negative bias through the month (in part due to the big 2018 drawdown (2015 and 2024 also saw negative Decembers) while the median trend though has been much more favorable.

In Presidential Year 1’s December has been solid but just the 7th best month. Still it’s got an average return of +0.54% and is positive 75% of the time (best among all months). But that average is versus the all-years average of +1.28% in December.

Final Thoughts

As we look to embark on a new year, I’ll be reworking this section. If you want the summary as to “how we got here” in 2025 you can see the Dec 21st Week Ahead in this section.

The most recent part of that summary though remains relevant:

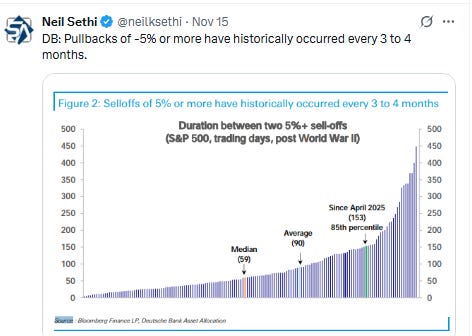

At the start of November it seemed that “concerns about the heavy AI spending, the Fed hawks [feeling] emboldened creating some concerns about rate cuts, rich valuations and very full equity positioning (especially systematic), etc.,” finally coalesced to the point of getting us our long delayed 5% pullback with the absence of any weekend headlines to provide a “stick save”. As I said then, the “good news is the pullback has skimmed off at least the top layer of froth,” meaning we entered the end of November “with valuations, positioning, sentiment, etc., all having moderated to levels that allow for renewed expansion.” And that’s exactly what we saw with one of the best Thanksgiving weeks ever (not that I was expecting that).

Since then things have been more challenging for the cap-weighted index (we’re currently just above the close on Oct 28th) with the AI trade remaining under scrutiny (which I believe is very healthy and will prevent the bubble many are worried about), but even beyond that, the “other 493” (represented by the equal-weighted SPX) are at those levels as well.

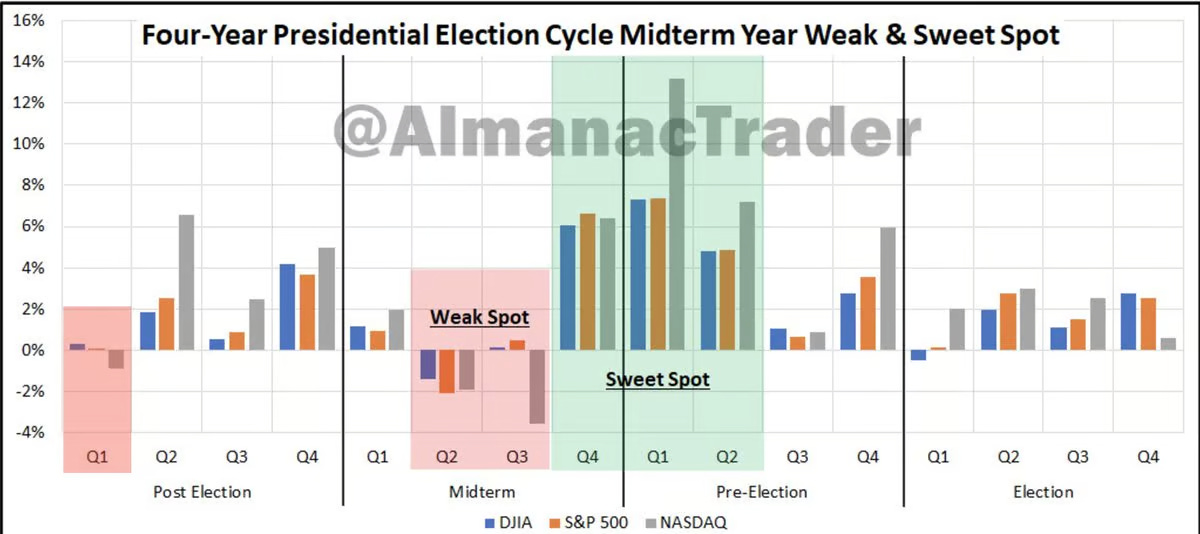

I mentioned five weeks ago things seem overall in favor of the bulls. Earnings expectations remain high (and increasing), seasonality doesn’t get much better (although that’s ending soon), buybacks are flowing (has already though started to slow with Q4 earnings season coming soon), the Fed while not a big tailwind is not a headwind (and there’s no question that the “Fed put” remains alive and well), Pres Trump is unlikely to be a negative catalyst (and likely to be a positive catalyst) through the midterm elections (and partly as a result volatility has receded to the lows of the year which fuels buying from systematic funds), the economy remains in decent shape even if the jobs market has cooled (that 3Q GDP print was something), etc. Sentiment indicators are mixed but the most frothy eased off last week, and the more important positioning indicators indicate a sufficient amount of caution with room for positioning to improve.

As I said several weeks ago, “I continue to believe as I have said for most of the year ‘for now it makes a lot of sense to be comfortably long stocks, with a plan in place for the inevitable 5-10% drawdown.’”

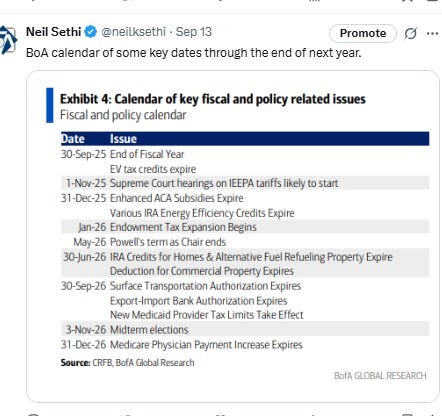

The one fly in the ointment is always something out of Washington (particularly if we get that Supreme Court ruling on the IEEPA tariffs which will definitely be market moving, although I’m thinking a negative ruling has been increasingly socialized so might not be as big of an event as I had thought earlier in the year).

And as I’ve written since August:

The longer term story remains a positive one, and whatever happens between here and the start of November, I’ll likely turn more bullish to close out the year given its historically good track record. The Fed is embarking on a cutting cycle in what does not appear to be a recession (which has almost always resulted in market gains), earnings growth has been strong with revisions) the highest in years, we will continue to get more fiscal tailwinds from the OBBBA as we move into 2026 (as noted in the Economy section), the economy remains healthy with some evidence of acceleration (at least in Q3), corporate buybacks remain solid on pace for a record year (and we’ve exiting the discretionary buyback blackout), and retail continues to want to buy the dip. It’s when we start to see a majority of those flip that I’ll be more concerned.

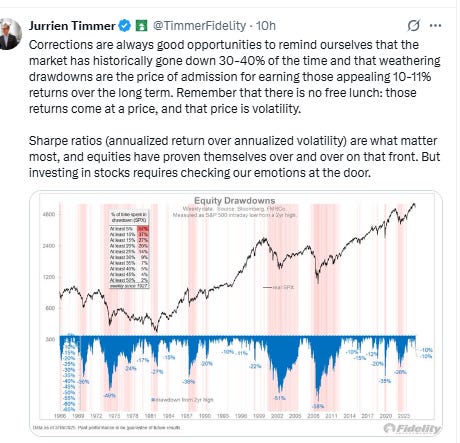

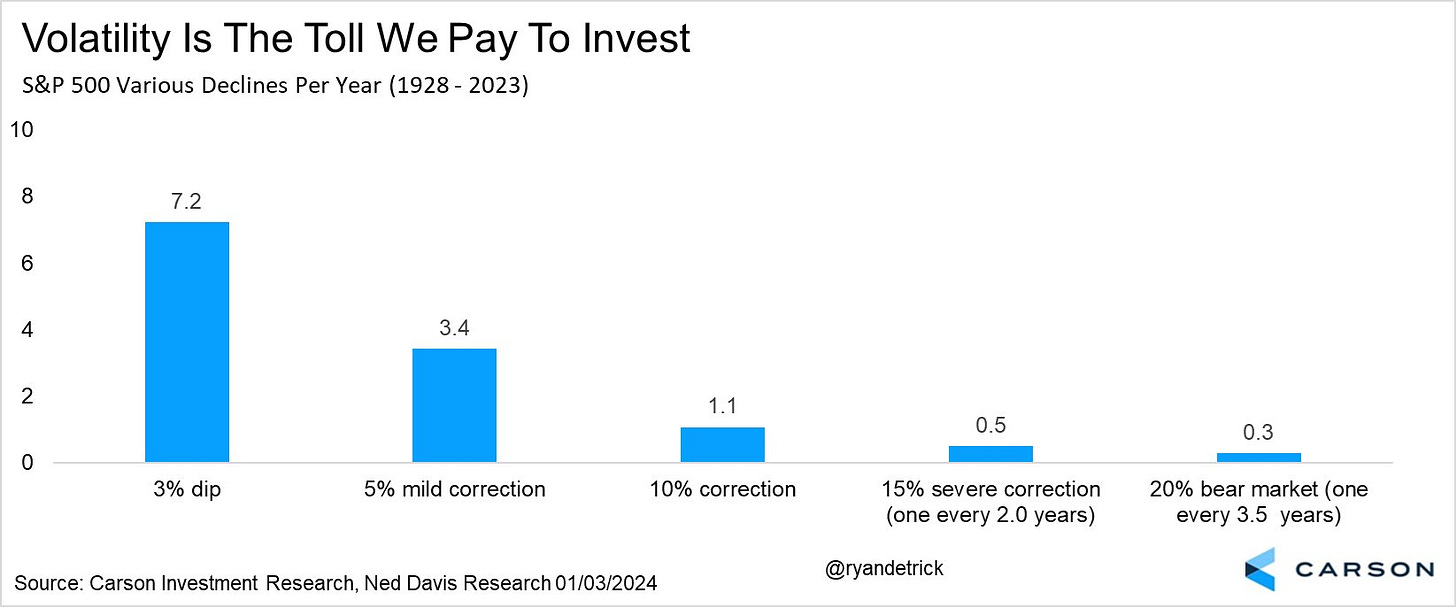

And in the long term, as always, just remember pullbacks/corrections/bear markets are just part of the plan.

Portfolio Notes

I keep running out of time for an update here, but I continue to make incremental moves. I’m working on moving to a more concentrated portfolio that I’ll try to unveil early next year that tried to (finally) put together fundamentals and technicals along with the other areas I write about in this blog.

Also, I should note that I would not necessary recommend such a large position in MLP’s as I have. At this point I have become “trapped” in them as I bought them at much lower levels, and because of the way they are taxed selling them would trigger a large tax bill. I don’t expect much out of them price-wise but they will continue to kick off very good tax-advantaged yields and I will continue to sell out-of-the money calls on them to generate additional income (hard to complain about 15% returns).

Cash = 15% (held mostly in SGOV & BOXX (BOXX mimics SGOV but no dividend, all capital appreciation so get long term capital gains if you hold for a year)

Bonds/Fixed Income (mostly short duration like MINT, SHY, SCHO, ICSH, etc., but also 2% or so in longer term (TLH, TLT)) = 10%

Core equity positions (each 5% or more of portfolio (first 2 around 10% each, total around 25%) Note the core of my portfolio is energy infrastructure, specifically petroleum focused pipelines (weighted towards MLP’s due to the tax advantages). If you want to know more about reasons to own pipeline companies here are a couple of starter articles, but I’m happy to answer questions or steer you in the right direction. https://finance.yahoo.com/news/pipeline-stocks-101-investor-guide-000940473.html; https://www.globalxetfs.com/energy-mlp-insights-u-s-midstream-pipelines-are-still-attractive-and-can-benefit-from-global-catalysts/)

ET, EPD, BINC

Secondary core positions (each at least 1.5% of portfolio, less than 5%)

PAA, ENB, HYD

And the rest of the top 50 (all >0.5%, less than 1.5%):

GILD, XOM, VNOM, URNM, AM, BOND, ARCC, TLH, AMZN, MPLX, TLH, GSK, ING, GLD, BAYRY, RRC, NVDA, OXY, FXI, UUP, AR, DUOL CMCSA, CRM, LULU, BLK, PFE, MRVL, CTRA, MSFT, OWL, BIP, VZ, VICI, GTBIF, RHHBY, SCMB, IBIT, OKE, SLB, TLT, UNJ, PYPL, NKE, CHWY, OBDC, DVN, BEP, STWD, ASML, KWEB, AXP, TDG, IJS, O

Note: EPD, ET, MPLX, PAA all issue K-1s (PAGP is the same as PAA but with a 1099).

Reminder: I am generally a long term investor (12+ month horizon) but about 20% of my portfolio is more short term oriented (just looking for a retracement of a big move for example). This is probably a little more given the current environment. I do like to get paid while I wait though so I am a sucker for a good well supported dividend. I also supplement that with selling calls and puts. When I sell a stock, I almost always use a 1-2% trailstop. If you don’t know what that is, you can look it up on investopedia. But that allows me to continue to participate in a move if it just keeps going. Sometimes those don’t sell for days. When I sell calls or puts I go out 30-60 days and look to buy back at half price. Rather than monitor them I just put in a GTC order at the half price mark.

To subscribe to these summaries, click below (it’s free).

To invite others to check it out,