The Week Ahead - 8/24/25

A comprehensive look at the upcoming week for US economics, equities and fixed income

If you're a new reader or maybe one who doesn’t make it to the end feel free to take a second to subscribe now. It’s free!

Or please take a moment to invite others who might be interested to check it out.

Also please note that I do often add to or tweak items after first publishing, so it’s always safest to read it from the website where it will have any updates.

As a reminder, some things I leave in from prior weeks for reference purposes, because it’s in-between updates, it provides background information, etc.. Anything not updated this week is in italics. As always apologize for typos, errors, etc., as there’s a lot here, and I don’t really have time to do a thorough double-check.

For new subscribers, this is a relatively long post. The intent is to cover the same areas each week. Sometimes the various areas are more interesting, sometimes less, but it’s easier just to go through them all, so you can expect this format (with things in the same places) each week.

The main sections are intended to cover 1) what’s upcoming next week, 2) what the Fed and rates are up to, 3) what’s going on with earnings (which along with valuations are the most important determinants to stock prices over the long term), 4) what’s going on with the economy (both because of its impact on our daily lives (I am a business investor in my “real” job) but also because it impacts earnings), 5) valuations, 6) breadth (which gets into sector/style performance), 7) positioning/flows (this is the most important determinant to asset price changes in the short term), 8) sentiment (really only matters at extremes though), 9) seasonality (gives you an idea of what normally happens), 10) “Final Thoughts” (remember you get what you pay for there, and it’s the last thing I do so it often is a bit rushed), and 11) my portfolio (to be transparent about where my money is in the market (but note first it is most definitely not intended as financial advice, and second as I mentioned earlier my main job (and investing assets) are in private industries (RE & venture capital)) so my portfolio is built with that in mind (i.e., it’s not how I pay the day-to-day bills)).

The Week Ahead

Note the next Week Ahead will go out on Monday Sept 1st (Labor Day in the US). Also note there will not be daily updates Wednesday and Thursday (and probably Friday) as I’m competing at the IBJJF World Master Jiu-Jitsu Championships in Las Vegas later this week.

Next week is the week before Labor Day in the US meaning a last chance to wrap in a long weekend summer vacation before things pick back up (which typically results in lower volumes this week and more choppy trading). That's especially likely for this pre-Labor Day week, as it doesn't end in a jobs report, which happens about half the time (although it does end with the personal income and spending report with core PCE prices (the Fed’s favorite inflation metric)). As we have a pretty good idea of what the PCE prices number will come out at (estimated at +0.3% m/m and 2.9% y/y, the quickest in five months), a lot of the focus will be on the spending side, as we’ll get real (price adjusted) spending numbers to see how much of the spending growth we’ve seen in reports has just been a rise in prices. We’ll also get inflation adjusted economy-wide details on incomes as well in the report.

Otherwise it's a lighter week for US economic data, but we’ll also get the first revision to 2Q GDP along with July new and pending home sales, durable goods orders, Chicago National Activity Index, June repeat home price indices, and Aug Conf Bd and UMich final consumer confidence/sentiment reports in addition to the normal weekly reports led by jobless claims.

In terms of the Fed, there should be a number of speakers (although they will also likely be taking advantage of the vacation calendar), but after Powell, we’re mostly just marking time until the August NFP report Sept 5th. On the calendar currently are Gov Waller and regional Fed Presidents Logan, Barkin and Williams (just Waller and Williams are voters this year). Remember this doesn't include press interviews.

Treasury auctions will pick back up with 2, 5, & 7yrs Tues, Wed, Thurs.

Earnings reports pick up this week, with 6% of the SPX reporting by earnings weight, mostly though because of one company, Nvidia NVDA, which reports Wednesday. But we still do have 16 other SPX components reporting with two others >$100bn in market cap in CRWD & CRM. (I think WSM might report this week also).

Washington will get one last week of relative calm with Congress still on recess, but there’s always something coming out of the White House (e.g., just see the calls for Lisa Cook’s resignation or surprise furniture tariffs as examples). In that regard, the "de minimis" exemption on tariff imports is scheduled to end Friday and the 50% levy on India is set to become effective on Wednesday.

Ex-US highlights are GDP from Canada and India, CPI from Tokyo (leading indicator for Japan), Germany, France, and Spain, German IFO business climate and unemployment, Japan’s jobless rate, and China industrial profits among other reports. We’ll also get policy decisions in Poland, Hungary, South Korea and the Philippines among others.

Canada

Canada’s second-quarter GDP figures on Friday could show the negative effects of the trade war with the US — just as Ottawa extends a tariff olive branch to President Donald Trump. Bloomberg Economics sees output falling amid a worsening trade balance and destocking of inventories. The median estimate is for a 0.7% decline.

Asia

It’s a big week for central banks and major data releases that will provide a first look at activity at the start of the year’s second half. The Reserve Bank of Australia on Tuesday releases minutes from its August policy meeting, when officials cut interest rates for the third time in the current cycle. The Bank of Korea is set to hold rates at 2.5% on Thursday, while the Philippines is likely to cut its overnight borrowing rate by 25 basis points to the lowest level in three years.

Other major releases include second-quarter GDP for India, where activity likely slowed to a 6.6% pace. China will report industrial profits for July after the prior month’s contraction. Inflation figures from Japan — including July producer prices for services and Tokyo CPI — will show whether price growth may nudge the Bank of Japan toward cutting rates. Japan’s jobless rate likely stayed at 2.5%. Trade and industrial production data across the region will provide a snapshot of conditions before higher US tariffs kicked in. It begins with Thailand’s trade activity on Monday, which is likely to show a slowdown from the breakneck pace of recent months. Singapore and Taiwan report industrial production on Tuesday.

Hong Kong releases July trade figures, which have been running hot lately in the major transshipment hub. Data Thursday is likely to show India’s industrial production increased in July. Capping the week, South Korea releases industrial production, which is seen easing from June but accelerating on the year. Japan’s equivalent activity likely declined for the fourth time this year. The Philippines also reports trade figures on Friday. Australia releases consumer prices for July, which are likely to show a pickup, while New Zealand has retail sales and business confidence reports on the agenda.

Europe, Middle East, Africa

Germany’s Ifo indicator will kick off the week with color on how businesses are reacting to Europe’s trade pact with the US. Despite many investors souring on the deal, which locked in tariffs of 15% on most goods, private-sector activity unexpectedly picked up in August as a three-year slump in manufacturing neared an end. Ifo’s expectations index is expected to be a little weaker, with analysts predicting a pullback to 90.5 from 90.7.

An account of the European Central Bank’s July policy meeting is due on Thursday and will likely highlight the increasingly tricky path to another rate cut. In her first comments since the trade accord with President Donald Trump was reached, ECB chief Christine Lagarde said the levies were only a little worse than the base case, and far less damaging than the scenario that her economists had drawn up. Barring major jolts to the economy, policymakers see little reason to lower borrowing costs when they meet in September, people familiar with the matter have told Bloomberg. Friday brings inflation numbers from Germany, France and Spain, the first since tariffs rose. While fears of a persistent undershoot in consumer-price gains appear to have waned of late, the French reading is seen remaining below the ECB’s 2% target, at 0.9%. German and Spanish inflation is seen ticking up.

Beyond Europe, Nigeria publishes GDP on Monday and Egypt sets interest rates on Thursday, with analysts expecting a cut to 23% from 24%. The same day will also see Zambia report inflation. Consumer-price figures are due on Friday from Uganda and Kenya, while Angola will provide an update on its economy’s performance.

Latin America

Brazil posts mid-August inflation data and Tuesday’s month-on-month print may have declined. A negative monthly reading would push the annual rate down below 5% from mid-July’s 5.30% reading. Messaging by Banco Central do Brasil has been consistent: wait until next year for any policy easing. Inflation in Brazil has been above target since late 2020 save for a single month in mid-2023. Analysts surveyed by BCB don’t see it back to target before 2029.

Attention then shifts to Mexico where Banco de Mexico on Friday will post its quarterly inflation report. Mexico watchers will be keen for policymakers’ take on the much slower-than-expected bi-weekly inflation data and downwardly revised second-quarter output data. Unpredictable US tariff policies cloud the country’s outlook, posing both upside and downside risks for Latin America’s No. 2 economy.

In Brazil, the government reports a number of debt metrics, which remain a concern for investors in the lead up to 2026 elections. Moody’s Ratings in June said it’s “difficult” to see improvements before then. From Chile, six separate data releases are on tap, highlighted by copper production and unemployment. Job growth has been stagnant as the jobless rate held at 8.9% in June. Mexico, Colombia and Brazil all report July labor market data in the coming week, with the headline readings expected to be at or near record lows.

DB’s day-by-day calendar for the week.

BoA cheat sheets for this week. Note they are doing the next two weeks but I’ve tried to limit it to just what’s this week.

And here’s calendars of 2025 major central bank meetings.

Market Drivers

So let’s go through the list of items that I think are most important to the direction of equity markets:

Fed/Bonds

As noted previously this was one of the sections that had grown unwieldy, so I’ve really pared it down. Given I provide daily updates on Fed expectations, Fedspeak, and analyst thoughts on the Fed, it’s duplicative (and time consuming) to regather it all, so, again, I encourage you to look at those (the daily posts) for updates. I will just give more of a quick summary.

I’ve taken out the background information from how we got to where we were from the start of the year through the end of March, but if you’re interested you can find that in this section from the March 23rd update.

And I had left in the background from March until now as I had said it was “still relevant in terms of ‘how we got here,’ and it reflects the continued slow evolution of the Fed away from worries about tariff impacts on inflation towards the need for rate cuts (remembering that absent those tariff worries the Fed would already be cutting at this point).” But I had “[a]t some point the hawks will become less hawkish and then I’ll reset all of this…. Powell this week could seal the pivot, but remains to be seen.”

Well that’s exactly what Powell did, so if you’d like that background, you can find it at the August 17th update.

As a reminder, going into Powell’s appearance Friday morning I had said

while Powell might not be ready for a cut, things are moving in a way that he will likely be forced along….if things progress as they have been, there will likely be more than just the two dissents in September (particularly if the Senate can jam through Stephen Miran’s nomination as the replacement Governor for Kugler), which I don’t think Powell has any stomach for, and, dissents aside, the chorus calling for cuts grows and at some point Powell needs to appease them. So while the market odds may be a bit high at 90% for a September cut, I think it’s far more likely than not, and based on Michelle Bowman Saturday calling for two more this year after that, I think at least two cuts (which has been my base case all year) continues to seem quite reasonable.

And Powell being no dummy saw that same writing on the wall saying "downside risks to employment are rising. And if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment,” and "with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance."

That clearly opens the door wide for a Sept cut, although I thought the comments were much less certain than most commentators who seem to think that Sept is a “done deal”. First, he noted that “it does not appear that the slowdown in job growth has opened up a large margin of slack in the labor market.” Further while did note that "GDP growth has slowed notably in the first half of this year,” his messaging on inflation remained little changed:

"The effects of tariffs on consumer prices are now clearly visible. We expect those effects to accumulate over coming months, with high uncertainty about timing and amounts... A reasonable base case is that the effects will be relatively short lived—a one-time shift in the price level... It is also possible, however, that the upward pressure on prices from tariffs could spur a more lasting inflation dynamic, and that is a risk to be assessed and managed... we cannot take the stability of inflation expectations for granted. Come what may, we will not allow a one-time increase in the price level to become an ongoing inflation problem."

"In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside—a challenging situation. When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate. Our policy rate is now 100 basis points closer to neutral than it was a year ago, and the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance. Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance."

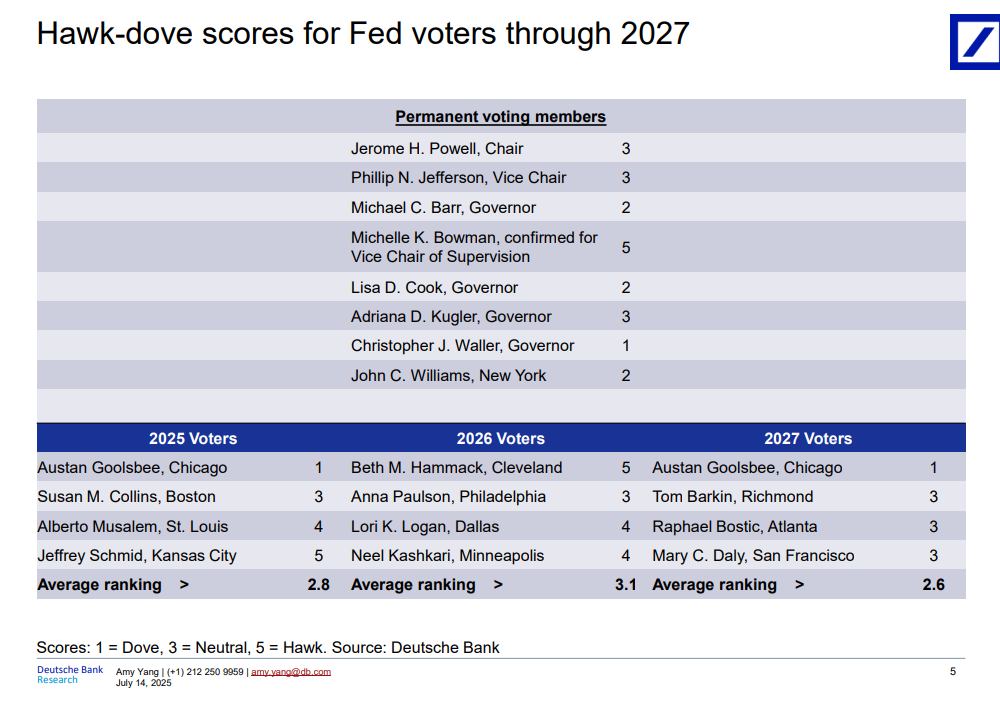

To me that sounds like someone who is open to a cut, but not convinced. And neither are a number of other Fed members. Hammack is a definite no, but she’s not a voter, and neither are Bostic or Collins who would also likely be no’s. But Schmid doesn’t sound like he wants to cut, and Goolsbee is clearly on the fence as is Gov Cook (who is a whole different story we will need to talk about, as her position on the Fed is quite tenuous, and her removal would give Pres Trump a fourth appointment amongst the seven Governors).

But that said, if Miran is appointed in time to vote, or if another Fed member is ready to join Waller and Bowman in dissenting from a cut, Powell will convince the rest of the Fed to go along with at least a Sept cut, but it may very well be a “hawkish cut” meaning no committing to further cuts (i.e., remaining completely data dependent).

Of course all of that depends on the August NFP to be released on Sept 5th (and perhaps a little on the CPI/PPI the following week right before the meeting). If the NFP deteriorates back to what the revised numbers were in May/June (i.e., sub 30k private payrolls) or particularly if unemployment continues to rise (it was very close to rounding to 4.3% in July, then I think it will be a more standard cut with perhaps guidance for further cuts to come (a lot will depend on what Bowman and Waller think as with Miran a lock to be on the committee for October (and perhaps another Trump Governor based on the Cook situation), Powell will very likely bend to the will of three Governors for the remainder of his term to avoid the appearance of discord that three (of seven) governor dissents would create (even as it’s not unusual in other central banks). A cohesive Fed has been a hallmark of Powell’s chairmanship. While I for one would not find such "fracturing” to be a negative, it has not been seen at the Fed in decades and is probably not the way that Powell wants to exit his term.

For now, markets are looking for a Sept and Dec cut.

And despite the increasing chances of Fed rate cuts, the 2/10 curve continues to remain around the +0.5% area at 0.58% unchanged w/w.

As a reminder, historically when the 2/10 curve uninverts following a long period of inversion the economy is either in a recession or within a few months of one. It uninverted in Sept, so I had said this looks officially like a "this time is different" situation.

The 3mos/10yr yield curve (considered a better recession signal than 2/10’s w/the last four recessions on average coming a few months after the curve uninverted (prior to that it generally uninverted after a recession had already started)) like the 2/10 curve has trended sideways the past few months but in its case around the unchanged mark (-0.01% this week), still clearly calling for rate cuts (this is normally closer to 1.25%).

As noted back in February, this (reinverting) is something that it did prior to (or just after) the last two recessions and it also dipped (but didn’t reinvert) in the two recessions prior to that. Not sure if the reinversion “restarts the clock” on the recession watch. If so the longest it went in those previous four instances before recession after reinverting is 6 months (2007).

Also note that in 1989 and 2007 we saw similar periods of a recovery from inversion that stalled at the zero line for long periods of time which turned into recessions after they lifted (but in 1989 it took six months).

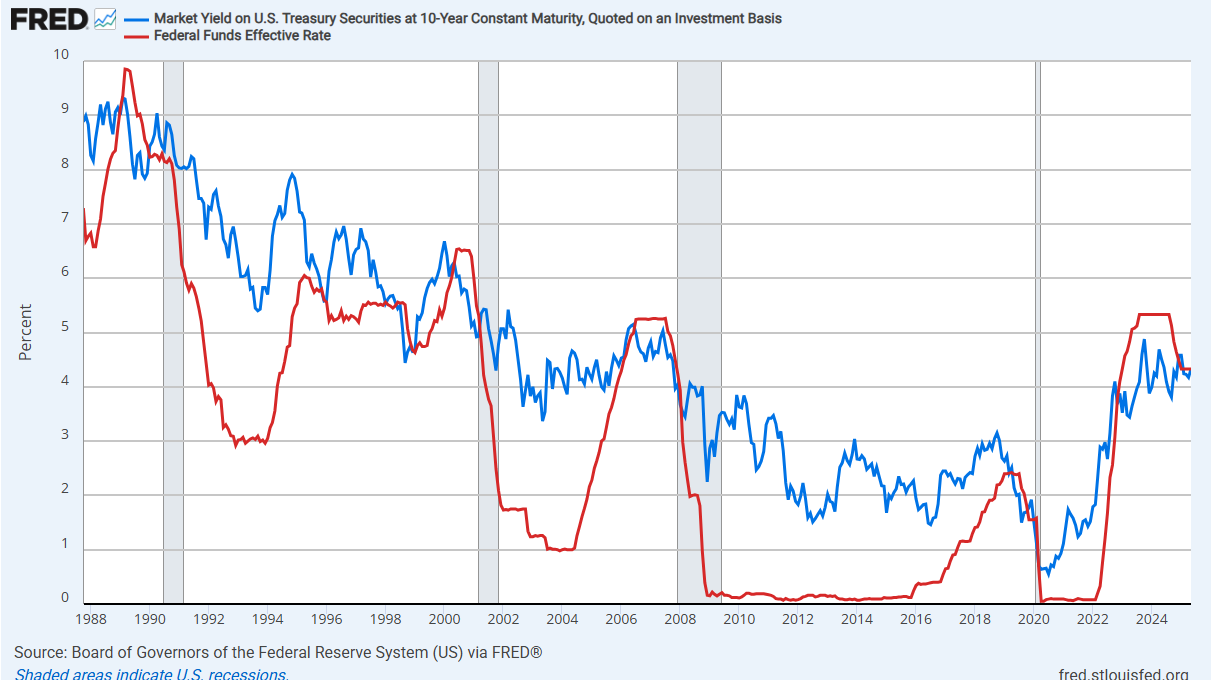

And another way of looking at this, the 10yr Treasury yield continues to fluctuate around the Fed Funds rate, well under the typical spread of around 1-1.25% above, so also for now still calling for rate cuts.

As noted previously when it’s dropped from above to below (as opposed to having the FFR move from below to above) as it did earlier this year, we’ve always seen a rate cut since 1985 although it can take as long as a year.

Long term inflation expectations as measured by the 5-yr, 5-yr forward rate (exp'd inflation starting in 5 yrs over the following 5 yrs), which continues to be referenced here and there by Fed members as evidence for long-term inflation expectations remaining “well anchored,” little changed from last week at 2.34% still down from the 2.41% four weeks ago (which was the joint highest (with October) in a year), and near its 20-yr average, in the middle of the range since mid-2022.

While the 10-yr breakeven rate also remained in its post-2022 range at 2.41%.

10yr real rates edged up to 1.94% on Thursday but remained around the lows of the year (1.83% Apr 4th), well under the 2.34% mid-Jan peak (which was the highest since Oct ‘23 (and before that 2007)), but also still well above the 2012-2020 peak of 1.12%.

While backing into 10yr real rates using 5-yr, 5-yr forward inflation expectations (subtracted from the 10yr nominal yield) saw them edge up to 1.99% from 1.89% (the least since Oct two weeks ago (this series has consistently been a bit higher)). These are even further below its Jan peak (2.45%) but are also nearly four times the 2013-2020 average of around 0.5%.

Short-term real yields (Fed Funds - core PCE) fell back to 1.54% in June from 1.57% in May (revised from 1.65%) and from 1.75% in Apr which was the highest since October, remaining well under the 2.70% last June, which was the highest since 2007, but above the local low of 1.38% in February. [this gets updated end of month]

Not much relief for small businesses or HELOC borrowers as the real prime rate (inflation adjusted using core PCE) was little changed at 4.71% from 4.74% in May (revised from 4.82%) and 4.92% in Apr. While over a percent below the 5.9% high last June, which was the highest since Sep 2007, it remains more than double the 10yr pre-pandemic avg. [this gets updated end of month]

A little surprising to some was the FOMC’s median long run projection for the endpoint of the Fed Funds rate (the “neutral rate”) remaining at 3.0%. That said, note the average moved up to 3.11% from 3.02%, and even at 3% it is the highest since Sep 2018 (but also well below levels prior to that). [this will be updated in Sept].

The ACM model of the 10yr UST term premium (which is solely based on interest rates), +0.12% higher w/w through Thursday to +0.76% still -15bps below the peak this year of +0.91% on May 21st which was the highest since July 2014.

The extended discussion on term premium (what it is, why it’s important, etc.), can be found in this section in the Feb 4th Week Ahead.

The MOVE index of expected 30-day Treasury note/bond volatility remains just above the least since Jan ‘22.

And with expected Treasury volatility remaining subdued, 30yr mortgage spreads through Thursday fell to 2.26%, the least since June 2022, edging under the 2.27-2.5% range since last September, well under the 2024 peak of 2.73% and the 37-yr high of 3.1% in June ‘23. But they are still around +50bps above the 2010-2020 avg level.

Chicago Fed National Financial Conditions Index and its adjusted counterpart (the latter attempts to remove the correlation between the various indicators due to broad changes in economic conditions), both of which are very comprehensive, each w/105 indicators, in the week through Aug 15th continued on their 16-week decline to the least (loosest) since Jan ‘22.

https://www.chicagofed.org/research/data/nfci/current-data

Goldman says their financial conditions indicator remains near its recent lows.

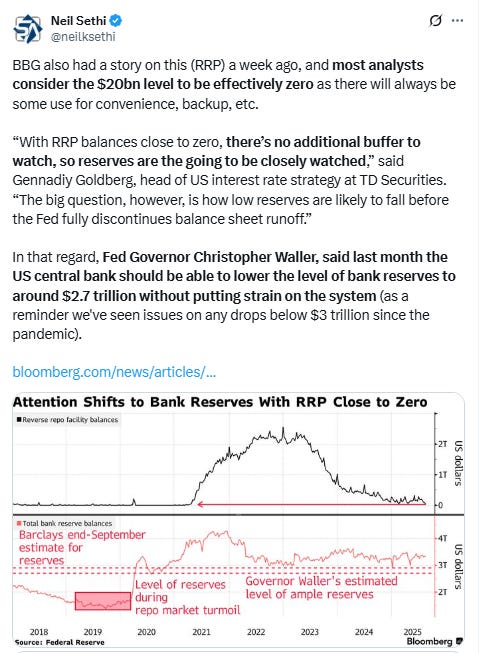

Turning to RRP, some background:

As the Fed continues to drain liquidity from the system via QT (although much more slowly now), I think it’s important to watch for stresses which give an early warning signal that they are perhaps going to far as they did in 2018 which led to a near bear market. One area I am monitoring is reverse repos (which is an overnight secured place institutions (mostly money markets and banks) can park excess funds to accrue some interest, designed by the Fed originally to keep excess liquidity from pulling down rates too much in other short term markets and provide a “risk free” place to park short-term funds). RRP grew rapidly in 2021 & 2022 as money was pumped into the system and needed a home, but since May ‘23 has been steadily drained down by the Fed’s QT program and higher bond issuance with banks discouraged by regulatory rules from taking up the increased Treasury supply.

In particular, the continued sizeable issuance of T-bills (<1 yr duration) of around $800bn/month (accentuated by the $60bn in balance sheet runoff (meaning the Fed has reduced its buying of maturing Treasuries by that amount which the private market has to fill)) drained ~$1.75 trillion from RRP in the year through March 1st. From then until early July RRP levels had remained relatively stable in the $375-$500bn range, but then resumed their decline (in fits and starts (seeing spikes at most month-ends but then coming down to hit new lows), with the lowest level hit Apr 16th at $54bn, the least since Apr ‘21.

As noted in previous weeks, since then RRP had rebuilt somewhat as with the Treasury up against the debt ceiling they have had to stop issuing new Treasuries only refinancing maturing ones which had taken away a source of investment for money markets and other buyers who have had to turn to the RRP in part despite the lower and with the Fed slashing QT. With the debt ceiling now raised, and with the administration apparently looking to increase T-Bill issuance this is an area that will need monitoring, although some on the Fed think this can be drained to zero without any collateral damage.

As you know if you read my RRP updates, I’ve been waiting (seemingly endlessly) for RRP to drop to the near zero levels several analysts have predicated and many at the Fed feel is appropriate, and this week we got the closest since 2021. As I noted at the start of July, with the debt ceiling raised, the Treasury is in the process of refilling the TGA (Treasury bank account) which was drawn down as they could not issue above the previous limit, which will mean around $500bn (perhaps more) in extra T-Bill issuance over July and August, similar to 2023.

Markets had no issues with the TGA rebuild in 2023, but in part that was due to RRP funding around $800bn of that, and that's not possible this time around with RRP starting at around $200bn. And since the start of August, we’ve seen RRP steadily falling as low as $22bn this week, effectively at zero (there will likely be some amount of RRP usage just for convenience). This is now something to keep an eye on as it means there is very little cushion, and so may begin to impact bank reserves which in turn would likely put pressures on funding markets.

In that regard, here is what BoA said earlier this year:

We expect a debt limit resolution in late July/August, which would imply a large TGA rebuild from near $0 following the resolution.... At that time we expect the Fed’s 'dashboard' of money market & liquidity indicators will clearly shift from green, past yellow, and towards red. We continue to believe UST repo is the single best indicator for flagging when QT should end."

And in August BoA updated their RRP estimates now seeing it fall to zero by the end of August. This will, as I indicated, in their opinion mean pressures on bank reserves (which could perhaps see a restart of QE):

Assuming stable auction sizes, this would imply ON RRP near $0 by mid-August. The risk to this view is that as we approach an ON RRP of $0, some of the cash remains sticky and we start to see a smaller beta. We strongly suspect Fed ON RRP will be near zero by late August / early September. Once ON RRP is drained, other cash sources will be required to keep bills & SOFR in check; this will likely see SOFR rise above IORB headed into September as bank cash may be required to support funding markets.

ON RRP at zero should therefore allow for clearer signs of upward pressure on money market rates. We continue to forecast the Fed will end QT in Dec ’25 with risk skewed to earlier if funding pressures rise significantly. Following the end of QT, we forecast the Fed will begin to reinvest all prepaid and maturing MBS into T-bills in the secondary market. We also expect the Fed will have to start growing their UST holdings to offset growth in non-reserve Fed liabilities to keep reserves steady as a % of GDP. For non-reserve Fed liabilities, we assume growth roughly equal to GDP. We expect this will result in the Fed buying roughly $350b-$500b per year in T-bills.

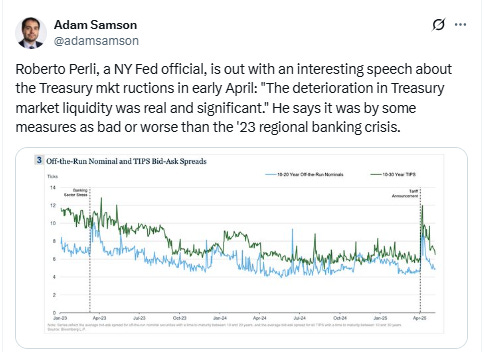

And per the above discussion, as I have noted since I started talking about RRP, it is to me most important in its shielding of bank reserves. The $3tn mark has been a line in the sand the past couple of years, catalyzing the indigestion in the credit markets in March ‘23 (SVB, etc.) and April (Robert Perli, head of the SOMA desk of the NY Fed confirmed we did see stresses).

For now though, they remain fairly comfortably above at $3.3tn although that is down from $3.6tn Apr 10th (the highs of the year). I will continue to watch reserves closely as an early warning signal for potential stresses in funding markets, particularly that $3tn level (which, BoA (table above) sees being challenged as early as Sept).

For background on various estimates of when reserves will be “too low” see the Feb 4th Week Ahead.

Getting back to rates, I said back in April 2024 that 2-year Treasuries were a good buy at 5%, and as I noted once the Fed started its cutting cycle thereafter the ship has likely sailed on seeing those yields anytime soon (meaning years). In terms of 10yr’s I had advised then grabbing some at 4.7% (which I subsequently sold on the drop under 3.75% as posted here in September) but at the time that level seemed like something we wouldn’t see anytime soon, but we got back there in January (and I added some as posted here), and it seemed like we might be headed much higher until Treas Sec Bessent noted the administration’s focus on keeping the 10yr yield low (and perhaps more importantly committing to the auction schedule set up by Sec Yellen for the foreseeable future (and perhaps even reducing longer term supply as he has noted in subsequent interviews and through the increase to the Fed’s buyback program), which has exerted downward pressure on 10yr yields). I sold that new, small position on the dip under 4% in April, and I have been waiting on us revisiting that 4.7 - 5% area to reload. BMO’s excellent rates strategist Ian Lyngan said this week he’s continuing to look for 3.85% by the end of this year and 3.3% by the end of next year, and he doubts we’ll see 5%. I will continue to watch for a pop up to rebuy.

For now though we continue to see range bound action in the 10yr UST in my “2025 likely trading range of between 4 and 5%.” While they left that range in early April (for one day), other than that we’ve been solidly in it, which I expect to continue for now.

For all the old “final hike” and “first cut” materials, you can reference the Feb 4th blog post.

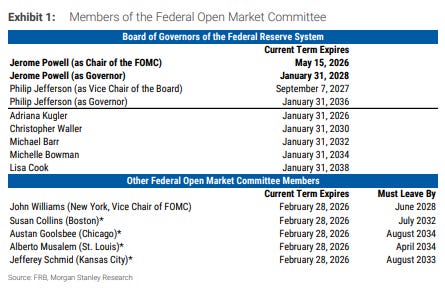

This is the most recent FOMC hawk/dove chart, and it just show you how much has changed in just a couple of months. Goolsbee is now a 3-4 as is Cook. Daly is closer to a 2, and Kugler is now gone and Miran will be a 1. Kashkari’s probably a 2-3.

And here’s one that goes over current term expirations.

Earnings

As a reminder, I have removed most of the background material, which you can get in the Feb 4th blog post. You can reference this post from 12/1/24 for stats on 3Q, this post from 3/9/25 for stats on 4Q, and this post from 6/1/25 for stats on 1Q 25.

Given we’ve had 90% of the SPX reporting prior to the start of this last week, Factset is on break until Aug 29th (post-NVDA earnings which are Aug 27th). I’ll do a final update for 2Q after that. I will continue though to put any earnings analysis (which they keep coming in) at the end of the section.

Through Thursday we’ve had 90% of SPX earnings in for Q2 (really just waiting on NVDA) according to Factset. The beat rate has remained elevated at 81%, in line with the “low bar” I (and many others) mentioned ahead of the earnings season, above 1Q’s 76%, the 5-yr avg of 78% and 10-yr avg of 75%, and those beats are coming in now +8.4% above estimates (up from +6.1% two weeks ago) now above the +8.3% in 1Q and the 10-yr avg of 6.9%, but below the 5-yr avg of 9.1%.

As a reminder, coming into the season we’d seen a larger than normal drawdown in expectations since the start of the quarter (April 1st), now to 4.8% y/y according to Factset from 9.3% as of the start of the quarter, -larger than the 5 & 10-year averages (-3.0% & 3.1%).

The result of the overall earnings beat rates has been earnings estimates for Q2 have now pushed to +11.8%, +1.5% w/w, and up from 4.9% at the start of the quarter (Apr 1st), and down now just two tenths from the +12% to start the year. It will be the 9th consecutive quarter of positive earnings and third consecutive quarter of double-digit y/y growth.

The +6.9% improvement since the start of the quarter still remains below the 5yr average of +7.7%, but now up from the 10yr avg (+5.6%) and Q1’s +6.1%.

In terms of Q2 revenues, Factset says through Thursday morning a large 81% have beaten, well above Q1’s 64%, the 10yr avg of 64% and the 5-yr avg of 69%, and beats are +2.4% above expectations, the most since Q1 ‘23, and well above the 10-yr avg (1.4%) and 5-yr avg (2.1%).

As a result of the beats, Factset says 6.3% revenue growth is now expected for Q2 (+0.3% w/w), the best since Q3 ‘22, up from 4.2% to start the quarter and 4.7% in Q1. It would be the 19th straight quarter of growth. Only the Energy sector will have a y/y decline in revenue growth in Q2 (but much less than was originally anticipated).

With the tariff backdrop, profit margins are a big focus this earnings season. Currently, though, Factset says expectations are for 12.8% profit margins for Q2 (+0.1% w/w), now above the 12.7% in Q1 and up from the 12.2% a year ago and the 5-year average of 11.8%. It will be the 5th straight quarter with 12%+ profit margins.

Three sectors are reporting a year-over-year increase in their net profit margins in Q2 2025 compared to Q2 2024: Communication Services (15.4% vs. 11.6%), Information Technology (25.4% vs. 24.0%), and Financials (20.0% vs. 18.8%)

On the other hand, six sectors are reporting net profit margins in Q2 2025 that are below their 5-year averages, led by the Energy (7.9% vs. 9.9%) sector.

Factset: It is interesting to note that analysts believe net profit margins for the S&P 500 will be improve in the second-half of 2025. As of today, the estimated net profit margins for Q3 2025 and Q4 2025 are 12.7% and 12.8%, respectively

While Q2 earnings expectations saw a big boost to +10.3% growth, Factset saw a decrease to Q3 while Q4 remained unchanged, not enough to outweigh the increase to Q2:

-Q3 fell to +7.2% (-0.4% w/w),

-Q4 remained at +7.0%.

2025 as a whole a very solid +10.3%, +0.4% w/w.

With 2025 quarter-by-quarter earnings expectations seeing a notable improvement (due to Q2) so did overall 2025 earnings expectations which Factset says improved for a third week from the least since the start of their tracking to $267.48 (+$1.82 w/w, now up $3.52 the past 4 weeks, but still -$6.78 since Dec 31st).

That represents a very healthy growth rate of +10.3% for 2025 earnings (+0.4% w/w), although that’s still down from 12.6% Dec 31st (which is typical).

As a reminder, BoA’s analysis is that the July 1st number ($264) will change by less than 2% by the end of the year absent a major economic event (GFC, Covid, etc.). Still that could see it end at around $270 which would be double digit earnings growth.

In terms of the earnings growth exp’d for 2025 Factset notes it will be a record, although also notes that there is on average over the past 25 yrs a -6.3% deterioration from where it starts the year ($275.05) w/analysts overestimating in 17 of those yrs (which would equate to $257.72 based on the average deterioration). But it should be noted that average includes 4 outlier years (2001, 2008, 2009 & 2020) where the overestimation was b/w 27-43% due to recessions. Excluding those, the difference is just -1.1% (which would equate to $272.02 (above where we are now)).

As I noted at the start of the earnings season, final earnings for Q2 are very likely going to be materially higher than the +5% at the start of the quarter. Factset notes that on average over the past 1, 5 & 10 yrs companies have beaten earnings expectations by 6.3%, 9.1% & 6.9% respectively resulting in “inflation” to the earnings estimates on average by 4.6%, 8.1% & 5.6% respectively over where they stood as of the start of the quarter (in this case June 30th which was 4.9%). That would mean if we get the average improvement earnings should come in at +9.5%, 13.0%, or 10.5% respectively.

Actual earnings by the end of the quarter have not surpassed expectations at the start of the quarter in only 3 of the past 42 quarters (Q1 ‘20, Q3 ‘22, and Q4 ‘22 are the only exceptions according to Factset).

Factset: 2025 revenues are now expected to grow +5.8%, +0.2% w/w and now up +0.1% since Dec 31st (a bit unusual), and +0.3% since the start of the quarter (April 1st).

Energy is the only sector expected to have negative revenue growth (although that’s been cut by over two-thirds since the start of the year).

The changes to 2025 earnings expectations (now at +10.3% y/y growth had been matched by 2026 expectations which remained near +14% all year, but those are starting to slip falling to +13.3%, -0.5% w/w and now down -0.4% since Dec 31st.

In terms of how markets are handling earnings beats & misses for 2Q, as noted in previous weeks “it seems they’re well aware of the low bar for beating,” as Factset says we continue to see beats rewarded less than typical looking at the two days before to two days after a report with just a +0.4% reaction vs the 5-yr average of +1.0%, while misses are being punished over 2x more than average at -5.5% (the worst in at least five years (BoA says it is the worst since 2000) vs the 5-yr avg of -2.3%.

Factset’s analysis of analyst bottom-up SPX price targets for the next 12 months as of Thursday continued to increase for an 11th week (following a 10 week string of decreases (the longest period of softening since 2022)) +86pts w/w to 7,148 (a new ATH and +621 pts the past 11 weeks) which would be +12.7% from Thursday's close.

Health Care (+20.4% up from 15.4% two weeks ago) remains the sector having the largest upside seen by analysts followed Energy (+18.4%), while Utilities (+6.5%) remain the sector expected to see the smallest price increase (Staples now second at +9.3%).

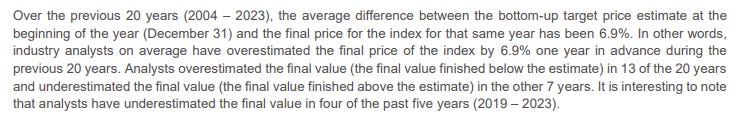

As a reminder the last 20 yrs (through 2024) they have been on avg +6.3% too high from where they start the year (which was 6,755), but note they underestimated it five of the past six years (including 2024).

Factset: In terms of analyst ratings, buy and hold ratings continue to dominate although the former continue to slip -0.2% w/w and -0.6% the past 2 weeks to 55.7% with hold ratings increasing to 39.2% (buy ratings are still up from 53.6% on Oct ‘24), while sell ratings fell to 5.1%.

The Energy (66%), Technology (64%), and Communication Services (63%) sectors have the highest percentages of Buy ratings, while Consumer Staples (40%) has the lowest percentage. Utilities, Staples, and Financials lead sell ratings at 7%.

The Consumer Staples (53%) sector also has the highest percentage of Hold ratings.

“The percentage of Buy ratings is above its 5-year (month-end) average of 55.1%. The percentage Hold ratings is below its 5-year (month-end) average of 39.0%. The percentage of Sell ratings is also below its 5-year (month-end) average of 5.9%.”

And some other earnings stuff:

Economy

Over the past 2+ years part of my earnings optimism has been due to the economy holding up better than expected. While earnings only track the economy loosely (and markets look forward 6-12 months), there is a clear positive correlation between the economy and earnings (particularly a weak economy and weak earnings), and there is a very strong correlation between earnings and stock prices (although stock prices (being as noted forward looking) generally fall in advance of a recession and bottom 6-9 months before the end of one). So if you can see a recession coming it is quite helpful, although very difficult (especially ahead of the market). You can reference this Week Ahead (see the Economy section) for a lot of material on how every recession is preceded by talk of a “slowdown” or “soft landing” as close as a month before the start. That report also has the notes about how small caps have shorter debt maturity profiles and more of it (debt).

The intro will remain unchanged for the time being as it serves as introductory material:

As long time readers know the beginning of this section hadn’t changed much until this year since I switched to the Week Ahead format in mid-2022, with the indicators to me during that period consistent with solid (which at times has been robust) economic growth, and I have been a broken record that I “certainly do not think we’re on the verge of a recession (although as noted above every recession starts out looking like just some economic softening).”

Since the end of March though, we’d seen the data soften (it actually stretched back pre-March with 1Q services spending getting a notable markdown in the GDP revisions (as did services exports (tourism, etc.) and construction spending)) and data since then has continued to remain mixed. This week was light on data but it continued the theme. The most important data point as far as the market was concerned was the very strong flash PMIs, but remember nobody will care what they said once the ISM version comes out in two weeks. Still, they seem inconsistent with a weak economy. Similarly the coincident indicators (which are an excellent real-time look at economic strength) moved to a new all-time high, and housing starts came in much better than expected. Jobless claims edged higher but remained in recent ranges lowe historically. Building permits, existing home sales, and homebuilder confidence were weak.

So, overall, I would say, as I have the past few months, the data continues overall to show an economy remaining in “ok” shape, with those “tiny cracks” as I put it in mid-June. For now though the general message remains the same as it has been the past several months:

Hopefully we don’t get much further softening and perhaps we can rebound as we start to (fingers crossed) get past the tariff uncertainty. The good news is the important services sector has so far held up which is keeping overall employment and wages up [but as noted previously we have seen some cracks growing in the services sector and employment]. That last item is perhaps the most important indicator to watch (real wage growth). That softened in July. Importantly, productivity growth rebounded. Productivity is incredibly important in allowing the economy to expand with less labor supply and without triggering inflation. Still, for now, I continue to feel that any softening does not appear to be morphing into a recession.

And as I said at the start of September:

without question, the evidence is building that the days of >3% real GDP growth are behind us, and we should be happy to settle into something more around trend (1-3% real (infl adjusted) growth). That though is far from a disaster. The important thing will be to see the softening level out (L-shape) rather than continue to fall turning the “soft landing” into a recession.

And looking more specifically at the biggest current risk to economic growth, the tariff policies and uncertainty they’re creating until finalized, as I mentioned Apr 20th,

I am now less concerned than I was the week the reciprocal tariffs were first unveiled given we’ve seen a clear acceptance by the administration that they likely overreached and are now dialing things back (including now China) with continued positive noises coming out of the White House regarding “deals”, etc. As I also noted we saw that there is a definite pain threshold for the administration which means to the extent things start to look shaky, we seem to have a “Trump put”, although there are perhaps longer term ramifications that we’ll only see months/years down the road in terms of the global view of the US as an investment destination which may have impacts on the cost of capital here. That’s beyond the scope of this note, though, and as I said following the unveiling of the reciprocal tariffs when I noted I didn’t want to forecast a recession despite the numerous calls for one because “I am not an economic forecaster, so I will just continue to follow the data…. I think it’s too early to draw any strong conclusions,” that remains the case. For now, I don’t see any strong signs of a recession.

And on tariff policies as I said in July “it looks like we’re starting to coalesce around a 15% tariff rate for most major trading partners with higher tariffs on countries outside the top 5, and an even higher tariff rate on China which is yet to be finalized (I’d guess it will end up in the 30-40% range but perhaps lower). So the overall tariff number looks like it will be in the 18% range. The jury is still out on what that means in terms of prices, trade flows, etc., so I’m not making any predictions. I’ll just note that so far we haven’t seen the dire results many had predicted (but again it may take months before things finally settle out). Goods imports represent just 9% of US GDP after all.”

Finally, as a reminder, we’re likely to start getting some level of economic boost from deregulation and the OBBB which should at the very least offset the drag we’re getting from the tariffs and restarting of student loan payments and perhaps provide a bigger boost than many are expecting.

And the Citi Economic Surprise Index found the data last week overall better than expected up +8.1w/w to 15, the highest since Feb 3rd.

The highs of the year were 22.8 in mid-Jan, the low was -24.6 in late June. The 2024 high was 47.2 (in Feb) and the low -47.5 (in July).

And GDP estimates are for now consistent with a no recession call (again though remembering GDP going into recessions generally doesn’t look like one is coming (it was up around 2% in Q2 & Q3 2008 well after the recession had started)), and while the Q1 number was weak as was expected, we did get the bounceback I was expecting in 2Q coming in at 3.0% (we’ll get an update on that this week) although as noted there was some weakness under the hood in terms of overall economic consumption. We’re just starting to get Q3 tracking data, and like we often see early in the quarter, the range of estimates are fairly wide going from +0.3% from the St. Louis Fed to +2.3% from the Atlanta Fed, although most are in the 1.5-2.5% range.

3Q GDP estimate from the Atlanta Fed (as a reminder their 2Q estimate came in just a tenth low (and was right in line in its 3Q & 4Q ‘24 first est’s (and just a tenth off for 2Q ‘24), but who was also -1.2% too low for 1Q ‘25) dropped nearly three tenths to +2.26% from +2.54% on Friday despite the housing starts data coming in much stronger than expected I guess on the weak permits.

“After this morning’s housing starts release from the US Census Bureau, the nowcast of third-quarter real residential investment growth decreased from 1.1 percent to -5.9 percent.”

Here's the makeup of the GDP contributions (and changes from the prior reading Aug 15th): Consumption = +1.52% (unch) Inventories = +0.74% (unch) Nonresidential fixed investment (biz spending) = +0.37% (unch) Gov't = +0.24% (unch) Residential investment = -0.24% (-0.28%) Net exports = -0.36% (unch)

NY Fed’s 3Q GDP Nowcast (as a reminder, they were well under for 2Q at +1.68% vs +3.0% actual first est after being too high for 1Q at +2.6% vs -0.3% (although they were closer in most other quarters)) edged down -0.05pp to +2.01% as the weak Philadelphia Fed manufacturing outlook and building permits offset better than expected housing starts.

As a reminder, the model is “dynamic” and so adjusts in real time as data evolves), but no “parameter revisions” this week.

The St. Louis Fed's GDP tracker (which has had a mixed track record the past few years, often undershooting actual GDP since Q2 ‘22 (including for 2Q ‘25 when it was -1.2% goo low) but was right on in Q1 & Q4 '24, but then way too high at +3.07%(!) for Q1 ‘25), sees their 3Q GDP tracker remain well below other trackers but at least now in positive territory at +0.37% from -0.30%. They do not give a breakdown of the inputs.

BoA hasn’t initiated their 3Q tracker yet (they said it would start this week but then they didn’t put out an economic report).

BoA (who as a reminder was eight tenths low for 2Q ‘25 GDP and a tenth high for 1Q GDP vs the 1st estimate, right on for 4Q ‘24 GDP & two tenths high for 3Q), left their 2Q GDP tracker at 2.2% as of Thursday, but I’d imagine it will see a healthy cut Friday after it incorporates the weak NFP and ISM manufacturing index.

Goldman boosted their tracker to 1.5% this week.

And Goldman's US Current Activity Indicator (their real-time measure of economic momentum using 37 inputs) for August stands at +1.9% (vs. +2.0% in July (the highest since Jan)).

The Weekly Econ Index from the Dallas Fed (scaled as y/y rise for GDP (so different than most GDP trackers which are Q/Q SAAR) which uses 10 daily and weekly economic series and runs a week behind other GDP trackers), in the week through Aug 16th edged +0.04% to 2.54% moving closer to the 2.63% July 5th which was the best since April, and remaining towards the top of the 1.49 - 2.79% range it has occupied for almost all of the past 3+ yrs, only poking above a couple times (most recently Apr 5th).

This series has consistently indicated no recession since the pandemic. The 13-wk avg rose to 2.28% (moving closer to the 2.53% reading May 3rd, which was the best since 2022), continuing to evidence overall economic momentum that is a little above trend.

https://www.dallasfed.org/research/wei

Other economy stuff:

Valuations

Like the other sections, I’ll just post current week items regarding the multiple. For the historical stuff, see the Feb 4th blog post.

Forward P/E ratios were mixed moving in line with stock prices (higher prices push up P/Es without a commensurate increase in earnings expectations):

-The SPX forward P/E is 22.2 (unch w/w (-0.2pts from the highest since 2021 on Yardeni’s model)).

-Mid-caps' (S&P 400) is 16.3 (+0.4pts w/w, -0.8pts from the highest since early-’21 (17.1)).

-Small caps' (S&P 600 so higher quality than the Russell 2000) is 15.7 (+0.5pts w/w, -1.4pts from the highest since early-’21 (17.1)).

-Yardeni's “Megacap-8” (adds NFLX) P/E is 29.2 -0.3pts w/w, -2.3 pts from the 31.5 it hit in 1H 2024 (which was the highest since Jan ‘22)). It was ~31 at the December peak of the Mag-7 index.

https://yardeni.com/charts/stock-market-p-e-ratios/

Other valuation stuff:

Breadth

While the NYSE Composite index is just under ATH’s the NYSE McClellan Summation Index (red line, "what the avg stock is doing") remains near 2-mth lows.

The Nasdaq volume-based version (red line, favored by Helene Meisler) has moved with price to new highs.

SPX new 52-wk highs increased to 38 Friday, near the highs of the month, but well off the 57 they hit in July, but the 10-DMA remains around the lowest since June after hitting the highest levels of the year at the start of the month.

% of stocks over 200-DMAs (red line) now at the highs of the year on the NYSE & Nasdaq but not yet to the 2024 highs.

% of stocks above 50-DMAs (red lines) though not yet to the highs of the year (which though are also around the 2024 highs) with the Nasdaq further away.

% of stocks above 20-DMAs (red lines) a similar story

SPX growth/value edged further off record highs since 1995 (now to 2.31 from 2.36 (record) two weeks ago).

https://yardeni.com/charts/growth-vs-value/

Equal-weighted SPX vs cap weighted ratio edged higher for a second week from the least since 2003, but so far just another bounce in what has been a bear market for this indicator since the start of 2023.

IWM:SPY (small caps to large caps) ratio a similar story with the two-week bounce taking it to the highest since March from the 25 year lows hit in April. The bear market for this indicator though started March 2021.

SPX sector breadth very solid last week with just Tech and Comm Services lower, the former the only sector down more than -1%. Seven sectors up more than 1% led by cyclicals (Energy, RE, Materials, Financials all up over 2%).

Stock-by-stock chart from @FINVIZ_com for last week consistent with a lot of green but pockets of red and in many of the biggest names. 7 of the 10 largest stocks in the SPX were lower with META, AVGO, and WMT all down more than -3%.

Top performer on the SPX last week was DAY at +30.9% followed by the prior week’s top performer PSKY up +16.6% (after +30.5% the previous week). In total there were 4 stocks up over 10% (down from 12 and 10 the prior two weeks), and ~100 (the same as the last 2 weeks) up over 4% (vs 16 three weeks ago). The largest was Exxon (XOM) which is still the 16th largest component of the SPX.

On the other side Palantir PLTR -10.4% led decliners, the only stock down -10% or more (down from two the prior week, 12 the week before that and 36 the week before that), and just 7 SPX components down -4% or more (after 12 the prior week, 45 the week before that and ~200 the week before that). Interestingly though of those seven, five were >$100bn in market cap (PLTR, INTU, AMD, ORCL, AVGO (in order of percentage losses). DELL was another at $89bn and CSX is $64bn, , while META was just under -4% at -3.9%

Other breadth stuff:

Flows/Positioning

Flows from BoA’s Flow Show report:

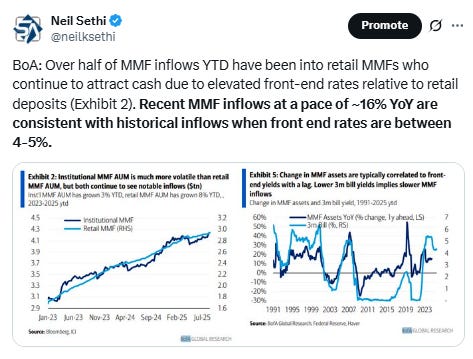

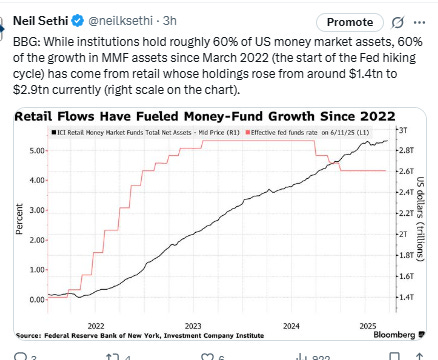

ICI data on money market flows saw a +$3.75bn inflow in the week through Aug 21st, in line with the +$1.3bn EPFR saw. The inflow was all from retail (+$8.1bn) as institutions (who hold ~60% of MMF assets) withdrew -$4.3bn.

Total MMF assets now at $7.19tn an ATH.

https://www.ici.org/research/stats/mmf

Looking at CTA (systematic trend follower) positioning in the US indices, first as noted earlier this year BoA has updated their reporting to now providing detail on bullish, flat, and bearish price paths (which are based on price trend vs moving averages), and also adds in short, medium, and long term price trends.

With that backdrop BoA says:

“Trend follower equity positioning was little changed this week with our model indicating that CTAs are still stretched long S&P 500 and NASDAQ-100. Positioning will continue to move inversely to changes in volatility. Russell 2000 longs are smaller with limited moves expected in the coming week”

So BoA sees CTAs for a third week as unlikely to add to equity longs for the SPX and NDX absent realized volatility continuing to move back towards June/July levels (which were historically low). But now on the RUT they also see limited scope for upside, although I have a feeling this was prepared in advance of Friday’s gains as I’d have to think that CTA’s will be adding to that index following its strong move higher. All though have "significant" unwind potential on a sustained downtrend given the relatively full positioning, but there is a good amount of breathing room (3-4%).

Currently they see initial sell triggers at 6260, 22919, and 2287 for the SPX, NDX, and RUT.

Tier1Alpha’s model also sees CTA positioning in US equities as the highest this year. They note: CTA strategies are near max long US equities, and given the modest deterioration in trend this week, could turn into more aggressive sellers on a larger enough downside move. Combined, these funds would create a significant headwind for equities, and when coupled with negative gamma, could set the stage for the next systematic sell-off.

And Citadel’s Scott Rubner on Tuesday noted: We estimate trend followers are now near fully exposed heading into late August. Our model indicates they are no longer adding at current levels – suggesting limited incremental upside.

BoA on gamma positioning:

"As equities fell from then all-time highs in February earlier this year, SPX gamma collapsed from >$10bn down to 0 and remained largely dormant for several months. However, in recent weeks SPX gamma has sporadically begun to show signs of life. For example, SPX gamma climbed to +$5.7bn on 04-Aug the highest level (at the time) since February. Even more notable, on Monday of this week (18-Aug) SPX gamma breached +$9.1bn. Though this material level did not persist. The remainder of the week SPX gamma gradually declined and ended Thursday at a meager +$2.4bn (45th 1y %ile)."

So BoA, like Tier1Alpha who I update on frequently during the week, sees gamma as fairly low although not negative which means it doesn’t provide much dampening impact on volatility but also isn't an accelerant. And also similar to Tier1Alpha their model sees it increasing on a rally up to the 6525 area meaning it will dampen upside volatility and doesn’t turn negative (accelerating upside) until 6600.

In contrast it falls on a decline in the SPX providing less cushion though stays mildly positive until 6200 at which point it turns into an accelerant to further downside.

And as always, remember these levels adjust as prices move, so unless it is a sharp, sudden move you have to take that into account.

BoA’s estimate of risk parity positioning (whose AUM is thought to be as big as CTAs & vol control combined ($500bn-$1tn)) saw a pause in the recent reallocations over the past several weeks although equity and commodity allocations remain high and their (leveraged) overweight to bonds low historically. #oott

Citadel’s Rubner sees risk parity equity exposure as closer to the 3yr average: Risk Parity strategies – driven by lower cross-asset volatility – now hold equity exposure near their 3-year average of 25% exposure.

And as highlighted previously we’re past the point of dropping big moves from the realized volatility lookbacks, but BOA still saw vol control (volatility targeting fund) exposure move to new local highs (highest since March).

Which is similar to what Rubner models.

Tier 1 Alpha’s blended estimate of vol control positioning edged off the highs of the year but remains near the highest since Jan 2020.

In that regard, they noted on Friday: For the first time since Q2, we are growing more concerned about systematic positioning, particularly within the vol control space. Earlier this week, the 1-month realized volatility broke slightly higher than the 3-month realized volatility, which is a key structural signal we monitor as an early warning for potential systematic deleveraging.

In fact, realized vol levels coming off such a low base, it wouldn't take that much volatility to trigger a wave of mechanical selling, with a mere ~2% move in SPX causing up to ~$35B in net selling requirements.

And just a reminder for volatility funds, moves in either direction count the same, so Friday’s +1.5% up day they modeled to see around $30bn of SPX selling from vol control on Monday.

BoA in their estimate sees -2.2% in vol control AUM coming off Monday (which is typically end of day).

Looking at the upcoming week, it continues to be a difficult lift for 1-mth lookback with the largest move just 0.4%. It’s again better though for the 3-mth mostly because we’ll drop a 2.0% day but the average of the other three days is 0.57%. And don’t forget these lookbacks are not just for vol control, but CTAs and risk parity rely on lower volatility in terms of positioning as well.

Although Tier1Alpha continues to model overall systematic positioning at just above the 0 z-score (the mean since 2011), so not hugely extended.

And Scott Rubner has a similar warning: Systematic strategy (CTA/Trend, Vol-Control, Risk Parity) demand is near maximum equity levels. Systematic positioning remains elevated → watch for volatility moves, as flows skew moves to the downside.

I like to look at the impact of moves in leveraged ETFs on the overall market as a barometer of risk appetite (the greater the impact, the more investors have in these ETFs which I think of as “higher risk”), and while both dipped last week to the least since June, they recovered with the SPX little changed w/w remaining just off the highs of the year, while the NDX is a little further off the highs.

Remember, this is a “constant negative gamma” source as Charlie McElligott put it in a Oddlots appearance (meaning that there is double/triple buying pressure from them as they rebalance each day). BoA estimates while they’re just 4% of end of day flows for the SPX, they’re 30% for the NDX in the last 5 minutes.

And the two largest single stock ETF’s $TSLA and $NVDA went in different directions this week with TSLA’s AUM +$537mn to $8.0bn, while NVDA lost -$132mn (after -$370mn the prior week) to $6.20bn.

3rd place $MSTR also lost -$50mn after -$333mn the prior week to $2.2bn.

And after buybacks ended 2024 at a record, and started 2025 even better, they have by and large remained below seasonal averages since April.

And some other notes on positioning:

Sentiment

Sentiment (which I treat separately from positioning) is one of those things that is generally positive for equities when its above average but not extreme (“it takes bulls to have a bull market”, etc.), although it can stay at extreme levels for longer than people think, so really it’s most helpful when it’s at extreme lows (“washed out”). We got close to washed out levels in April before steadily recovering much of that until 6 weeks ago (when I said we were “getting to” euphoric). Since then things have been more mixed on the sentiment front, certainly not euphoric.

AAII bulls (those who see higher stock prices in 6 mths) increased for only the 2nd time in seven weeks but very marginally to 30.8% from 29.9% (which was the least since May 8th), below the long-term historic average of 37.5% for a 3rd week while bears (who see lower stock prices in 6 mths) edged down to 44.8% from 46.2% (the highest since that same week), remaining above the long-term average of 31.0% for the 38th time in 40 weeks.

Those who are neutral edged to 24.4% from 24.0% but remained below the long-run average of 31.5% for the 57th time in 59 weeks.

https://www.aaii.com/sentimentsurvey

In the special question this week AAII asked “How would you describe the updated earnings guidance given by companies during the second-quarter 2025 earnings season?”

40.2% said companies’ forward earnings guidance had been approximately what they expected, while a little more than a third (34.6%) said guidance has been better than they expected. Only 4.3% said future guidance has been worse than they had expected.

NAAIM (investment managers) exposure index (which "represents the average exposure to US Equity markets reported by our members" and which ranges from -200% (2x short) to +200% (2x long)) was already moving higher this week pushing up to 98.15% just below the highs of the year (99.3 July 2nd). The 4-wk avg (89.2) also moved higher.

https://naaim.org/programs/naaim-exposure-index/

The 10-DMA of the equity put/call ratio (black/red line), little changed this week although edging on Friday to 2-week low, in the middle of the range of this year.

When it’s increasing it normally equates to a consolidation in equities and increase in volatility and vice versa.

Goldman’s US Equity Sentiment Indicator which combines nine measures of institutional, foreign, and retail investor positioning, not updated this week remaining in negative territory at -0.5 as of Friday. The indicator has still not registered a positive reading since February.

The CNN Fear & Greed Index fell back to 60.6 from 64.5 a week ago still up from the recent low of 49.8 on Aug 1st, a 3-mth low, staying in “Greed”. Again this week no indicators in Fear or Extreme Fear after four three weeks ago:

Extreme Greed = None

Greed = stock price strength (net new 52-week highs); market momentum (SPX vs 125-DMA); junk bond demand; put/call options (5-day put/call options) (from Extreme Greed)

Neutral = market volatility (VIX & its 50-DMA); stock price breadth (McClellan Volume Summation Index) (from Greed); safe haven demand (20-day difference in stock/bond returns) (from Greed)

Fear = None

Extreme Fear = None

https://www.cnn.com/markets/fear-and-greed

BofA’s Bull & Bear Indicator (a global metric), edged down -0.1pt to 6.0 ("Neutral") now down -0.4pts the past four weeks from the “highest since [the] Nov ‘24 election”, although still well above the 3.2 it hit at the start of the year which was what would now be a 1-yr low “on DM equity outflows, bad global equity breadth, and bearish hedge fund positions, offset by low FMS cash level.”

Still, three of the six components remain “V Bullish” vs just one that is “V Bearish” (HF positioning). The other two are Neutral.

Helene Meisler's weekly poll alternates for a fifth week, back to bullish with 64% voting next 100pts higher on the SPX, up from 45.3% last week (which was looking good until Friday), the most bullish since the record 73% on Apr 13th. That was a down week but from there we rocketed higher.

The high of the year was 72.9% voting higher Apr 13th (a record) and the low was 33.2% on May 17th (also a record).

Helene Meisler’s traveling so no ChartFest this week.

It normally includes Citi’s Panic/Euphoria Index which fell almost to the zero line at the end of April but then has moved back into Euphoria where it remains.

As a reminder, “[h]istorically...euphoria levels generate a better than 80% of stock probabilities being lower one year later.” In that regard, it first entered euphoria in late March 2024 (when the SPX was around 5200) and then reentered in late October (around 5800). This time (July) the SPX is at 6200.

We didn’t get to 5200 by late March of this year, but we got closer than I would have thought at 5500.

We crossed over 5800 mid-May and haven’t looked back. Seems a stretch at this point to see us under there by October.

That would make it 0-for-2. We’ll see how it does this time (would need to be under 6200 July 2026).

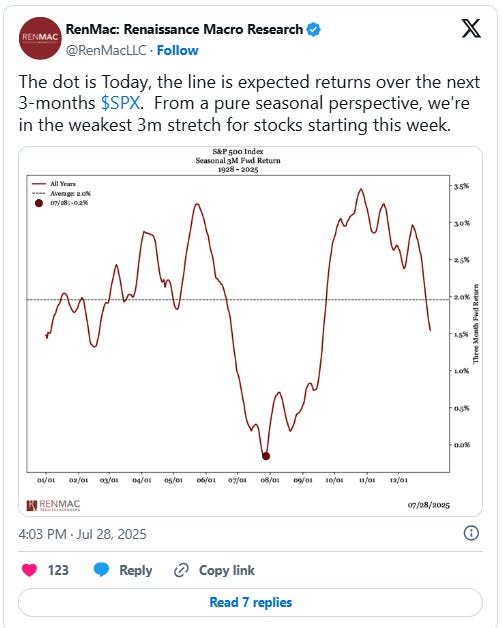

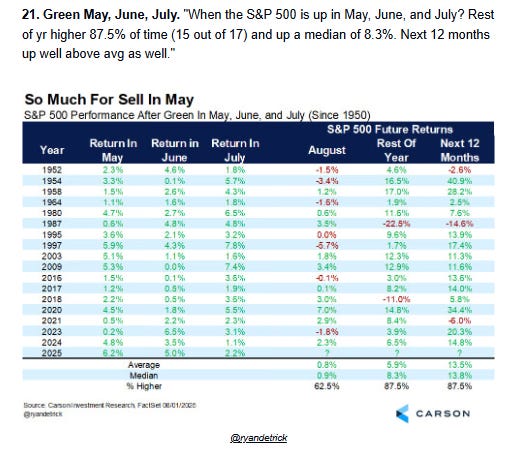

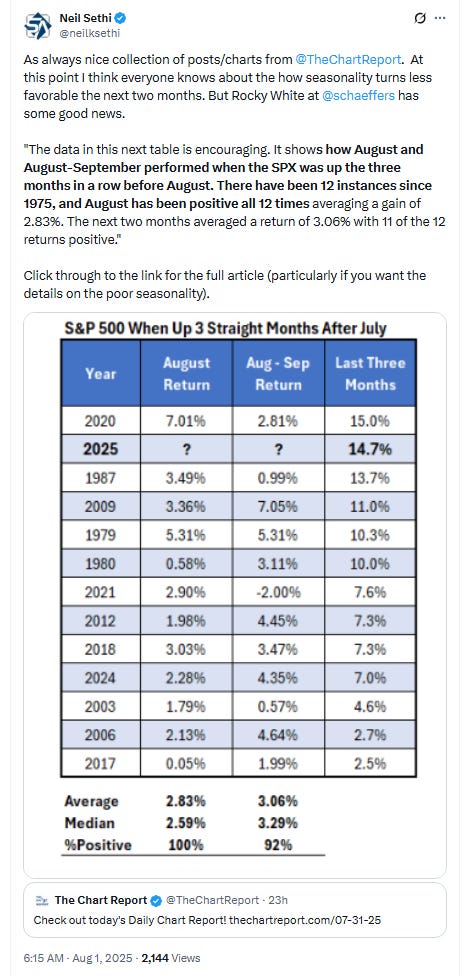

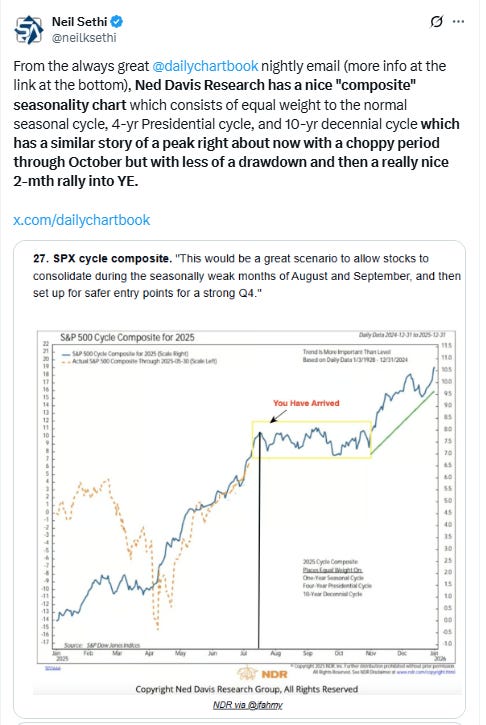

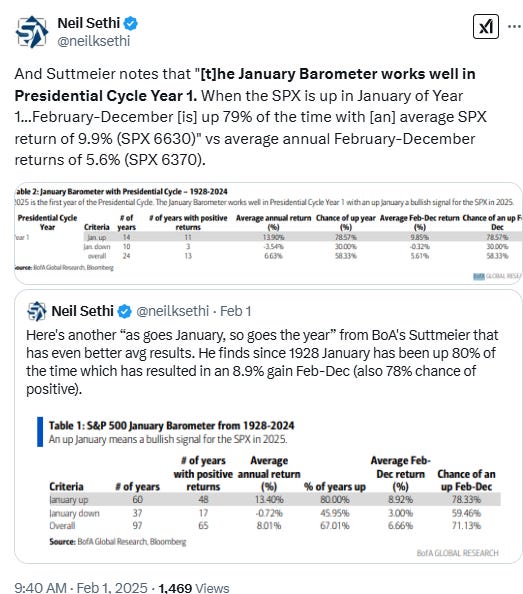

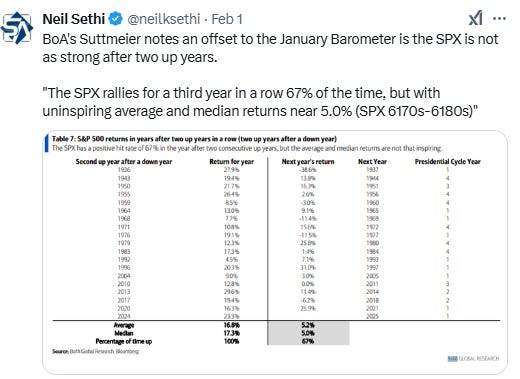

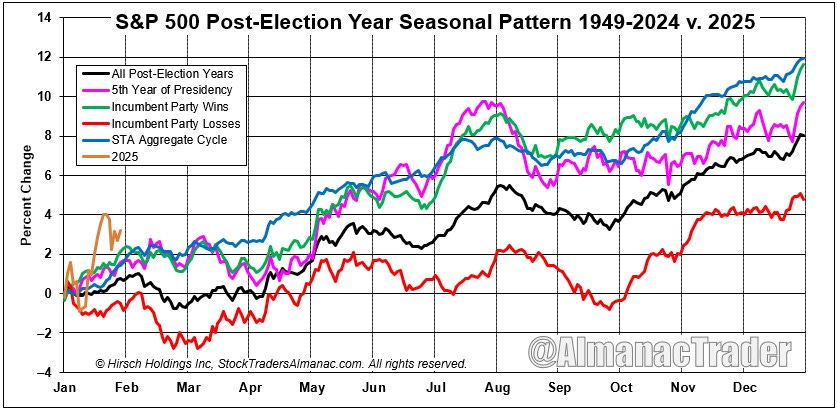

Seasonality

As we move into the second half of August, things improve a bit seasonally:

From Almanac Trader: "Over the last 21 years, the first eight or nine trading days of August have exhibited weakness while mid- and late-month has been somewhat better with the major indexes trading sideways before jumping to close out the month."

And that seasonal pattern of a stronger second half of August in post-election years fits with the median return of all years since 1950 which improves to around +0.5%, smack in the middle of all half-month periods, from +0.1% in the first half.

Although looking since 1928 the story is less rosy with a +0.10% avg return (down from +0.21% for the first half of Aug), the 10th weakest of all 24 halves (and vs +0.25% avg) although the median improves to +0.17% from +0.02%, still though notably worse than since 1950 and the 6th weakest (vs 0.59% median for all periods). And volatility picks up (measured by standard deviation) from the 5th least volatile half-month for the first half of Aug to 3.46% for the second half, still though a little less than the 3.5% median for all periods (and well below the upcoming 4.23% for the first half of Sept which is the 2nd most volatile after the first half of Oct (4.30%)).

And looking at August as a whole, in Pres Yr 1 it is the 4th weakest month of the year with a 1.1% avg return and 50% hit rate. The SPX has generally gone sideways.

As always, though, remember that seasonality is like climate. It gives you an idea of what generally happens, but it is not something to base your decision on whether to bring an umbrella.”

Final Thoughts

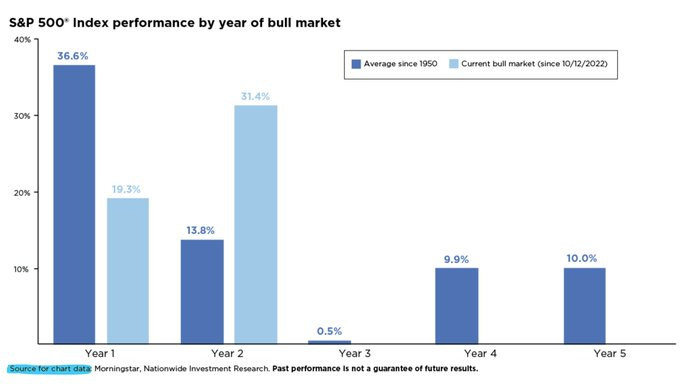

In some background, I noted at the start of the year,

As we turn the page into the new year, we’re presented with a very different backdrop than what we saw for much of 2024 when the Fed was moving from hiking to cutting, bond yields were falling, seasonality was mostly favorable, systematic positioning was mostly a tailwind, political risk was low, valuations had room to grow, liquidity was very robust, the economy was firing on all cylinders, volatility (until early August) was more subdued, earnings were rebounding, etc.

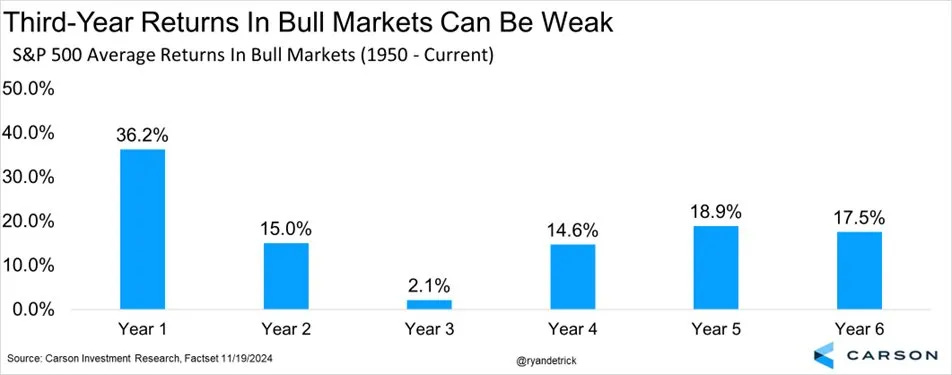

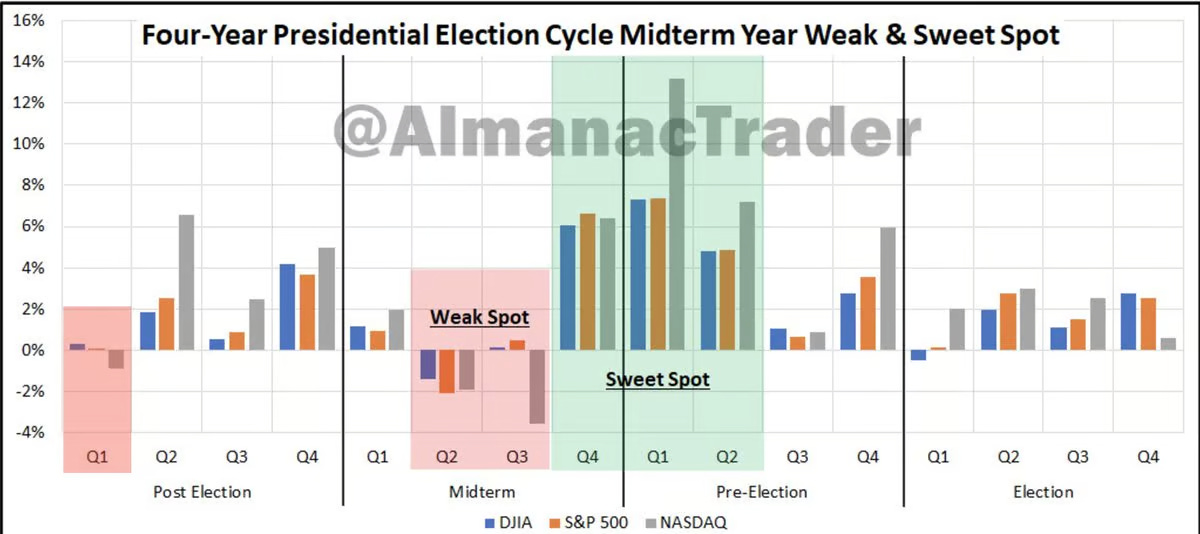

Now we’re in what is historically a more challenging year (1st year of a Presidential term and 3rd year of a bull market following two 20% years) with valuations well above where we started 2024, high expectations (judging from analyst SPX forecasts), higher volatility and political risk…higher bond yields (particularly real yields), a Fed talking more about fewer than more cuts and continuing to drain liquidity that is now hitting levels we’ve run into issues in the past, high earnings expectations, etc.

It doesn’t mean that we can’t have a good or even a great year. Balance sheets remain very solid as does the economy and labor markets (even if slowing), earnings are expected to be very good, buybacks are expected to be a continued tailwind, there’s a lot of scope for the Fed to become less hawkish, the upcoming administration may provide big tailwinds in tax cuts, deregulation, etc., etc. But we need to see at least some of those come through, and disappointments are not going to be welcomed given the set-up, so my expectation is for choppier markets more like we’ve seen since October than what we saw before.

But in mid-April I noted that I thought

the upside is much more favorable than the downside…. The tariff issue remains the overhang over things and until things are finalized it will weigh on market, consumer, and business sentiment, and prevent any sort of truly sustainable rebound. At some point we’ll get to a resolution that will “free” the markets to react more typically to the other fundamental inputs….. Positively, we did see that Trump will, as expected, not push things too far in terms of stress on financial markets as evidenced by his pivot following stresses in the bond market (which weren’t actually all that bad outside of the move in yields (things barely registered on the Fed’s radar))…the good news is we have taken all of the “froth” out of the equity markets, which means we’ll be working from a much less extended base with plenty of “dry powder” from hedge funds, institutions, etc. And while the Fed is on hold for now, they still have a bias to cut, and the economy (and most importantly labor markets) remain for now healthy.

And from there we saw a historic rally fueled by a renewed confidence in Pres Trump’s willingness to change his policies in the face of market distress, the reactivation of the “Fed put” in the event of notable turn for the worse in the labor market, improving earnings expectations, great seasonality, hedge and systematic funds refilling their AUM after having cut it to multi-year lows, etc. But as I noted four weeks ago much of that story has played out. And while we didn’t get a 3-5% pullback as I thought we might, we did get a couple of the 2-3% variety, and, more importantly, we have moved just +1.2% over those four weeks, consistent with the more choppy market I was looking for.

Markets got a shot of adrenaline Friday with Powell opening the door to a Sept rate cut, which I think was a misinterpretation of what Powell was actually saying (I think his remarks were simply acknowledging that rate cuts were a possibility as opposed to a “done deal” as discussed in the Fed section). That said, as also discussed, we have Stephen Miran set to join the board as soon as Sept, and potentially another Fed Governor with Lisa Cook’s situation looking tenuous. That would give Pres Trump three/four Governors who will really dictate policy for the rest of Powell’s term given I don’t think he has any stomach for three Governor dissents.

Given they will almost certainly be pushing for at least a couple of rate cuts, a lowering of policy rates into an economy which may be reaccelerating (if the flash PMIs have any accuracy) is a powerful cocktail as long as Nvidia’s earnings come through reasonably well (and there’s no reason to expect otherwise). The AI investment spending boom has become a key pillar of the economic backdrop. Plus there’s also the stimulus boost from the OBBB and deregulation which will continue to be economic tailwinds.

But as I noted two weeks ago, a consolidation always comes, and “things have gone from stretched to the downside to stretched to the upside on many metrics, all as we enter a difficult seasonal stretch with a President who seems to think that the market at all-time highs means to extend further with current policies (even if markets are betting on the opposite).” In particular, systematic strategies are now heavily invested in equities. When something comes to turn the tide, and again something always comes to turn the tide, there will likely be quite a bit of selling in a compressed time frame, particularly in September which is seasonally the worst month of the year for equities (who have followed the seasonal pattern pretty well this year). Keep that Sept 5th nonfarm payrolls report circled on your calendar (and perhaps the Sept 11th CPI release). Of course the Fed decision Sept 17th could be market moving as well, although as discussed above it seems Powell’s hands are increasingly tied.

But for now, as I said six weeks ago:

we continue to have a “honey badger” economy (unkillable), a Fed that it seems is highly likely to be cutting rates and perhaps significantly at some point this year absent a significant resurgence in inflation, the tailwind of the Trump tax bill (front loaded spending increases, back loaded spending cuts), and an upcoming earnings season which seems from all appearances to be setting up to be any easy beat over beaten down expectations. The recipe for continued gains seems favorable for now, particularly as President Trump has [started to deescalate the trade issues].

That does set up a toxic brew of deal negotiations, a potential government shutdown, a turn to worse seasonality, stretched valuations and positioning, etc., as we move [into September], but for now there’s nothing on the radar that screams problems to me (of course it’s always the punch you don’t see coming right?).

So overall it seems like we’re again back to everyone wanting to buy a selloff that won’t come.

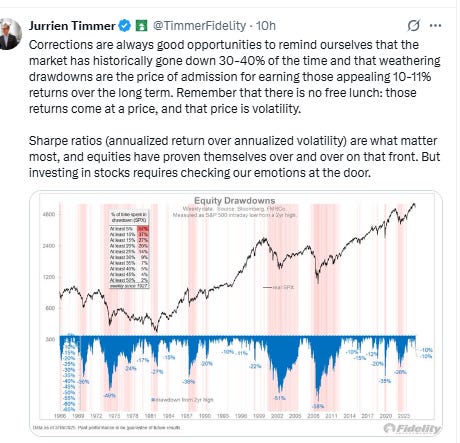

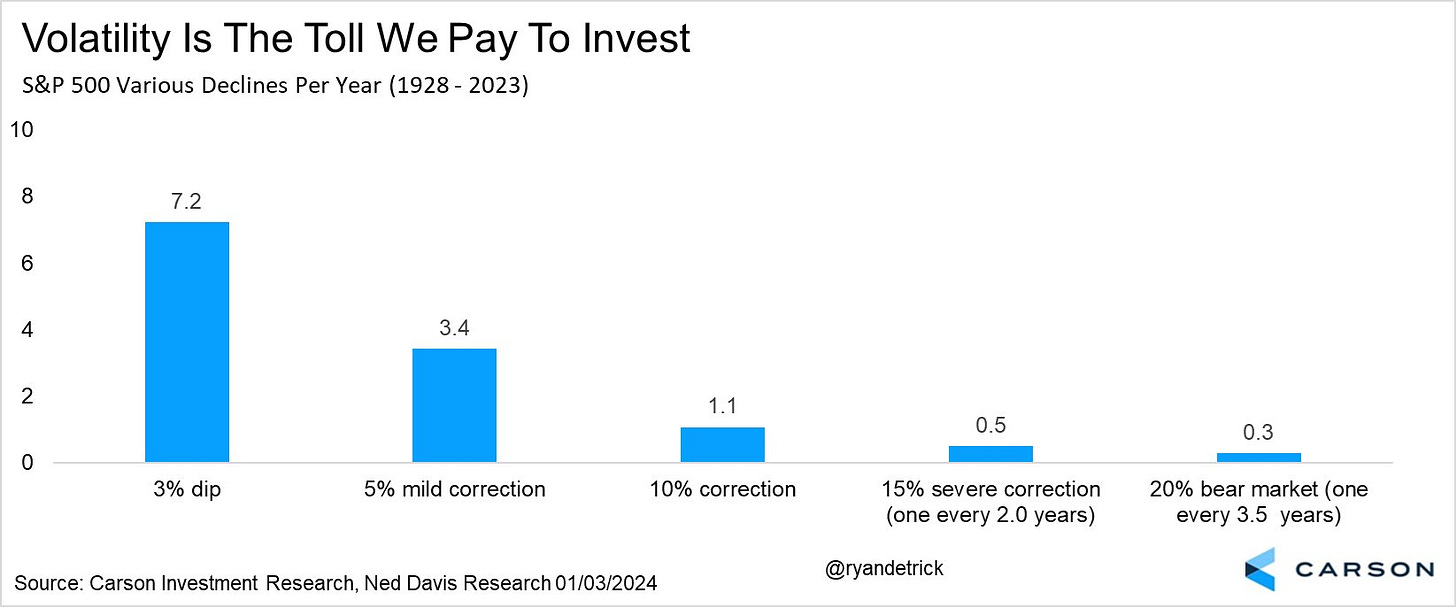

And in the long term, as always just remember pullbacks/corrections/bear markets are just part of the plan.

Portfolio Notes

No significant moves this week. It’s a bull market, though, so despite the high cash position, I continue to sell puts covered by that cash generating good income (as well as calls on many positions, particularly energy) and put money to work in smaller bets after pullbacks/selloffs (such as LLY, UNH, CMG recently).

Cash = 25% (held mostly in SGOV & BOXX (BOXX mimics SGOV but no dividend, all capital appreciation so get long term capital gains if you hold for a year)

Bonds/Fixed Income (mostly short duration like MINT, SHY, ICSH, etc., but also 3% or so in longer term (TLH, TLT)) = 20%

Core equity positions (each 5% or more of portfolio (first 2 around 10% each, total around 25%) Note the core of my portfolio is energy infrastructure, specifically petroleum focused pipelines (weighted towards MLP’s due to the tax advantages). If you want to know more about reasons to own pipeline companies here are a couple of starter articles, but I’m happy to answer questions or steer you in the right direction. https://finance.yahoo.com/news/pipeline-stocks-101-investor-guide-000940473.html; https://www.globalxetfs.com/energy-mlp-insights-u-s-midstream-pipelines-are-still-attractive-and-can-benefit-from-global-catalysts/)

EPD, ET, PAA, BINC

Secondary core positions (each at least 1% of portfolio, less than 5%)

ENB

And the rest of the top 50 (all >0.5%, less than 1%):

GILD (this will likely be called away soon), VNOM, NEM, ARCC, AM, IBIT, HYD, BOND, MPLX, TLH, CMCSA, ING, UUP, CTRA, OWL, GLD, OXY, GSK, RHHBY, FXI, GPN, PFE, URNM, VICI, RRC, SLB, MSFT, SCMB, B, DVN, AMZN, VZ, VOD, GOOGL, BAYRY, BIP, CQP, WBA, ASML, CHWY, T, LLY, NXPI, UNH, GTBIF, MELI, NVO, BLK, STWD, AR, ES, ARES

Note: EPD, ET, MPLX, PAA all issue K-1s (PAGP is the same as PAA but with a 1099).

Reminder: I am generally a long term investor (12+ month horizon) but about 20% of my portfolio is more short term oriented (just looking for a retracement of a big move for example). This is probably a little more given the current environment. I do like to get paid while I wait though so I am a sucker for a good well supported dividend. I also supplement that with selling calls and puts. When I sell a stock, I almost always use a 1-2% trailstop. If you don’t know what that is, you can look it up on investopedia. But that allows me to continue to participate in a move if it just keeps going. Sometimes those don’t sell for days. When I sell calls or puts I go out 30-60 days and look to buy back at half price. Rather than monitor them I just put in a GTC order at the half price mark.

To subscribe to these summaries, click below (it’s free).

To invite others to check it out,